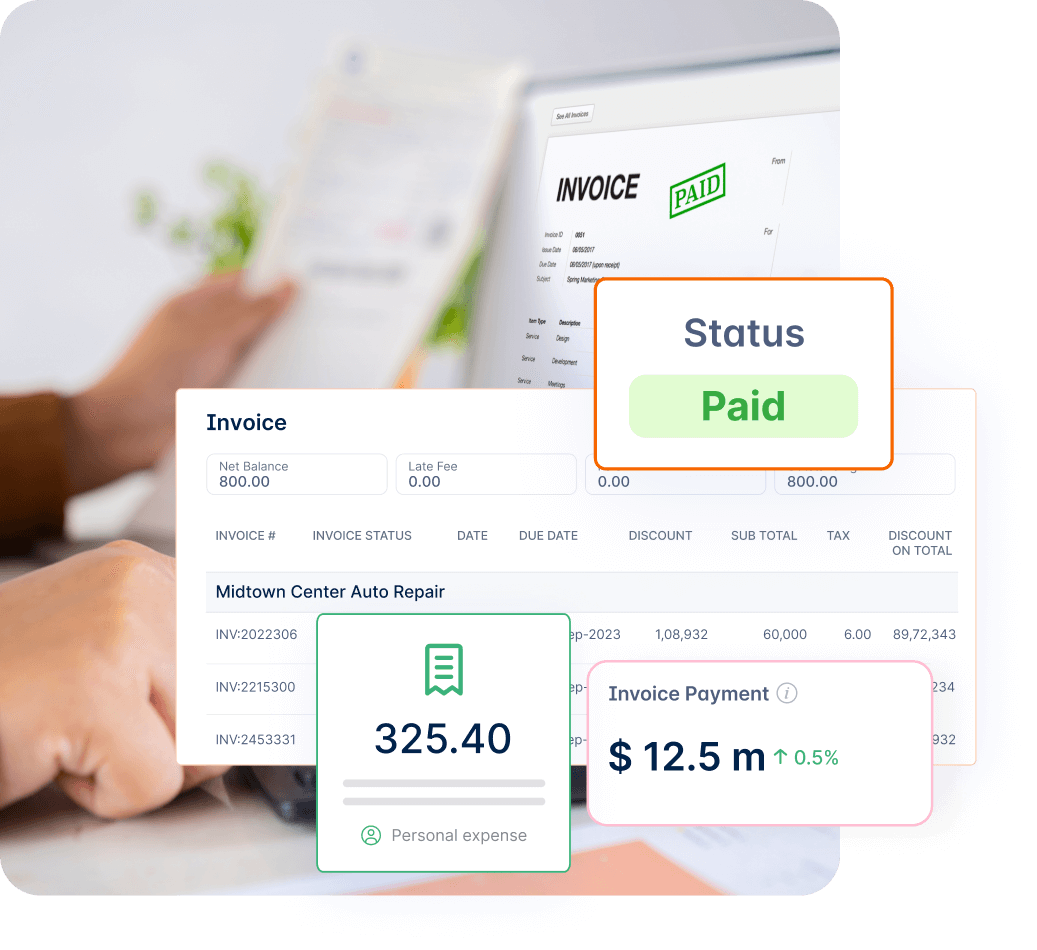

Invoicing

Create invoices effortlessly, get paid faster, and smile bigger!

Explore

Easily file GST returns by entering your GSTIN, username, and starting date. Invoicera automatically compiles all taxable transactions, saving you time and reducing manual efforts.

Associate contacts with their GSTIN, and Invoicera will automatically calculate tax components for all transactions. This streamlines your compliance efforts while ensuring accuracy.

Label items as goods or services by adding HSN/SAC codes to ensure accurate taxation. Easily search for codes within Invoicera’s platform for proper classification.

Create professional invoices that reflect your brand while meeting government mandates.

Design and send invoices that reflect your brand while including essential GSTIN, HSN/SAC codes, and applicable tax rates.

Generate e-way bills instantly with Invoicera, detecting transactions that require an e-way bill based on GST rules.

Ensure better security and transparency by switching to GSTN-authenticated e-invoices for all B2B transactions.

Improve accuracy in filing your GST returns with customizable approval workflows.

Set up approval processes for your GST returns to be reviewed by your admin or accountant, reducing errors.

Access a variety of tax and reconciliation reports to track all your tax activities.

Simplify GSTR-2A and 2B reconciliation processes, ensuring that your input tax credits and transactions match seamlessly.

Generate comprehensive summaries and annual reports for hassle-free tax filing.

Create accurate annual tax summaries with Invoicera’s reporting tools, making tax filing more straightforward.

Monitor input tax credits and reverse charges to maintain accurate records and proper tax reporting.

All-in-one invoicing software to manage & track payments, expenses, bills & more.

Your path to invoicing excellence starts now – take the step that transforms your business landscape.

Go to the Invoicera website. Join the Invoicera community by signing up for an account. Just a few details, and you’re on your way to experiencing the convenience of efficient invoicing.

Tailor your invoicing process by automatically incorporating your company’s GST details, such as GSTIN and payment terms. Easily create professional invoices for your clients, specifying line items, quantities, and applicable GST rates.

Once your invoice is ready, schedule the GST invoice for any date or send it instantly by email. Monitor the status of your invoices, track payments, and easily manage your financial transactions.

Maximize your revenue and drive growth with efficient invoicing.

Discover reliable payment integration gateways, offering diverse payment options tailored to your business needs.

Reach customers worldwide with payment gateways that support multiple currencies.

Ensure every payment is protected with top-tier encryption and compliance standards.

Set up automatic billing schedules to get paid on time regularly. It helps in keeping a steady income flow.

Manage taxes easily. Invoicera helps you ensure you follow tax rules in different countries and keep your financial tasks simple.

Keep your transactions safe using high-tech methods to prevent scams. This helps in protecting private customer information.

Active Subscribers and Counting

Time Savings on Invoice Processing

Seamless Transactions

Reduction in Manual Entry Errors

See how we make a difference.

We’re here whenever you need assistance. If you have any questions beyond what’s covered here, don’t hesitate to reach out.

GST, or Goods and Services Tax, is a comprehensive indirect tax levied on the supply of goods and services in India. It has replaced various indirect taxes like excise duty, service tax, VAT, and others. GST is implemented to simplify the tax structure, streamline compliance, and eliminate tax cascading.

Impact on Invoicing:

Accurate GST invoicing is crucial for several reasons:

A GST-compliant invoice should include the following information:

To set up GST tax rates in Invoicera:

To generate a GST invoice using Invoicera:

Invoicera provides a user-friendly platform that allows you to generate GST & VAT-compliant invoices easily. It automates the process of including required GST & VAT details, ensuring compliance with GST & VAT laws.

A GST invoice should include details like the supplier’s and recipient’s name and address, GSTIN, invoice number, date of issue, description of goods or services, taxable value, applicable GST rates, and more.

A VAT invoice must include specific details to ensure compliance with tax regulations. These include:

Mistakes on a GST & VAT invoice should be corrected through a ‘Credit Note‘ or a ‘Debit Note,’ depending on the nature of the error. You can also edit your invoice even after it is sent.

Yes, Invoicera’s platform is designed to handle different GST & VAT rates for various products and services, making it flexible and compliant with GST & VAT regulations.

Start Risk-Free. No Credit Card Needed. Cancel Anytime.

Seamless integration with your existing software.