Introduction

Are you tired of spending endless hours dealing with stacks of paper invoices and chasing payments?

If yes, you’re not alone.

89% of business leaders believe late payments are stopping their business from growing ~ Quickbooks

This shows we really need a simpler and better way to manage invoicing that helps you get paid faster.

Nowadays, online invoicing software has become increasingly popular for various reasons.

This post will delve into online invoicing and introduce the top 10 online invoicing software that can significantly enhance your business’s financial management.

Join us as we explore the digital invoicing.

Importance Of Invoicing Software For Businesses

In the business landscape, time is crucial as there are a lot of competitors. Here’s how invoicing software can help you revolutionize your operations:

1. Saves Your Time And Boosts Productivity

Invoicing software automates the process, allowing you to create, send, and track invoices effortlessly. You can reclaim valuable time to focus on growing your business.

2. Enhances Accuracy By Eliminating Errors

Manual calculations can lead to costly mistakes. Invoicing software ensures accurate calculations, reducing the risk of errors. It helps you maintain a professional image and gain the trust of your clients with precise and error-free invoices.

3. Helps You Stay On Top of Payments

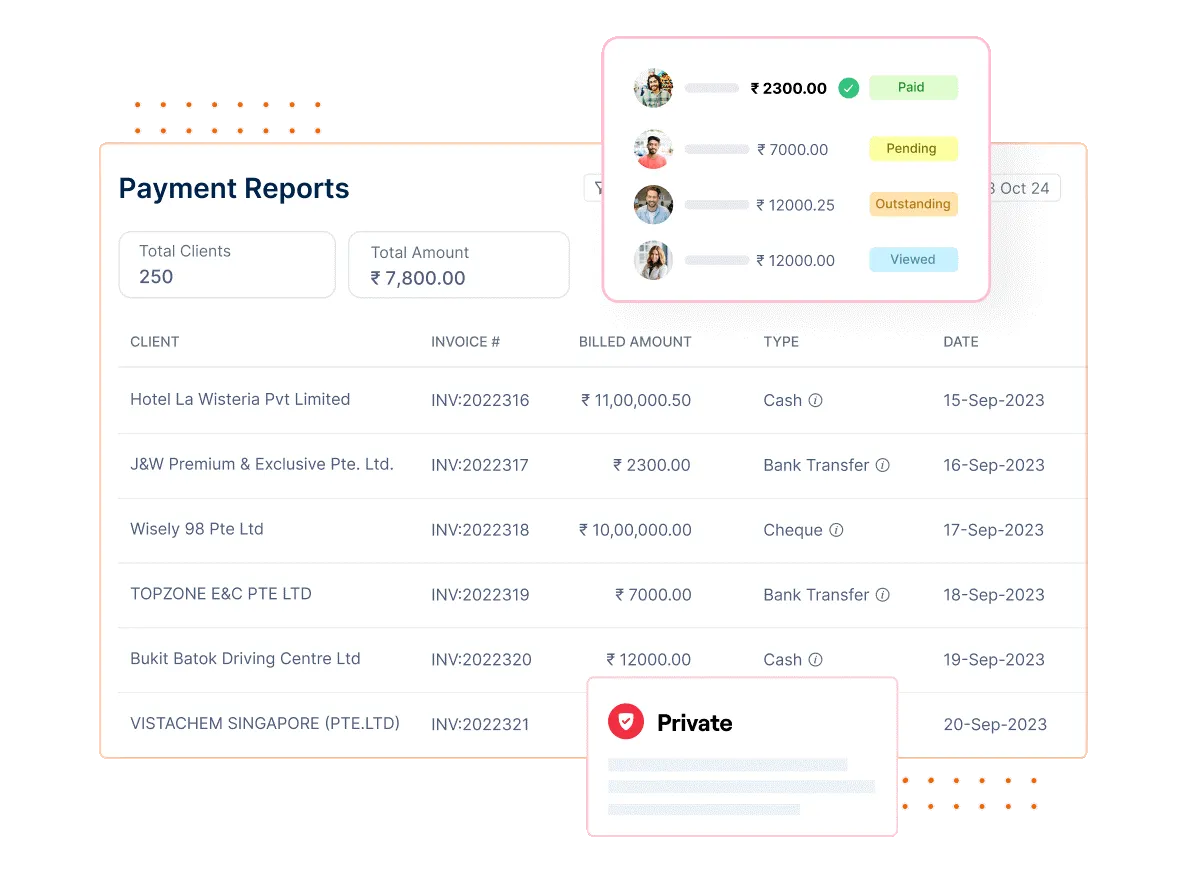

Late payments can disrupt your cash flow. Invoicing software provides real-time updates on payment statuses, helping you stay proactive. Enjoy a healthier financial position by ensuring timely payments and minimizing disruptions.

4. You Can Customize Invoices To Impress Clients

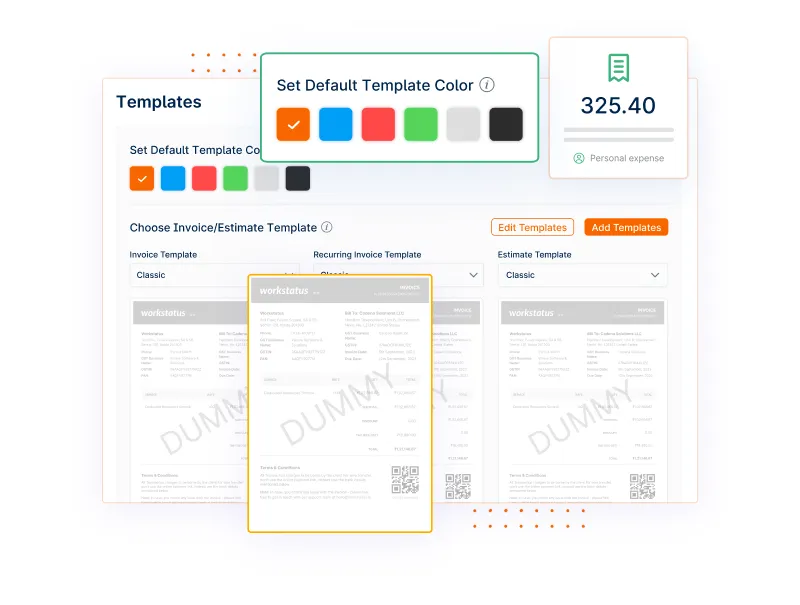

Create customized, professional-looking invoices that reflect your brand identity. Personalized invoices help you impress clients with personalized details and build stronger relationships. Invoicing software allows you to make a lasting impression with every transaction.

5. You Can Access Data Anytime And Anywhere

Invoicing software offers the flexibility to access your financial data from anywhere. It helps you to stay informed and make informed decisions on the go.

6. Streamlines Record-Keeping And Simplifies Tax Compliance

With invoicing software, you can effortlessly maintain organized records. You can simplify tax compliance by having all the necessary information.

7. Helps You To Scale Your Business

As your business expands, so do your invoicing needs. Invoicing software scales with your growth, ensuring your invoicing process remains efficient and adaptable.

How Invoicing Software Works

Invoice software streamlines invoicing by automating repetitive tasks.

An effective invoice software should automatically create a bill, including a list of services or products with their respective costs, and send it directly to the customer.

Initially, an invoice template is set up, and the software adjusts it as needed. The necessary modifications are made using accurate information gathered from the company’s systems and other workflows.

For seamless operations, the invoice software should integrate with other applications within the company, ensuring accurate details about the provided services.

All these processes occur electronically, minimizing the need for interaction between the sales and accounts payable teams.

Top 10 Invoicing Software Of 2024

1. Invoicera

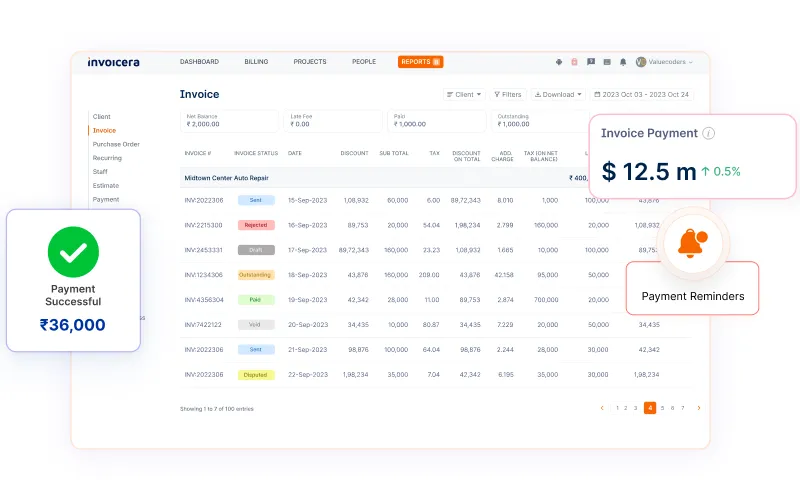

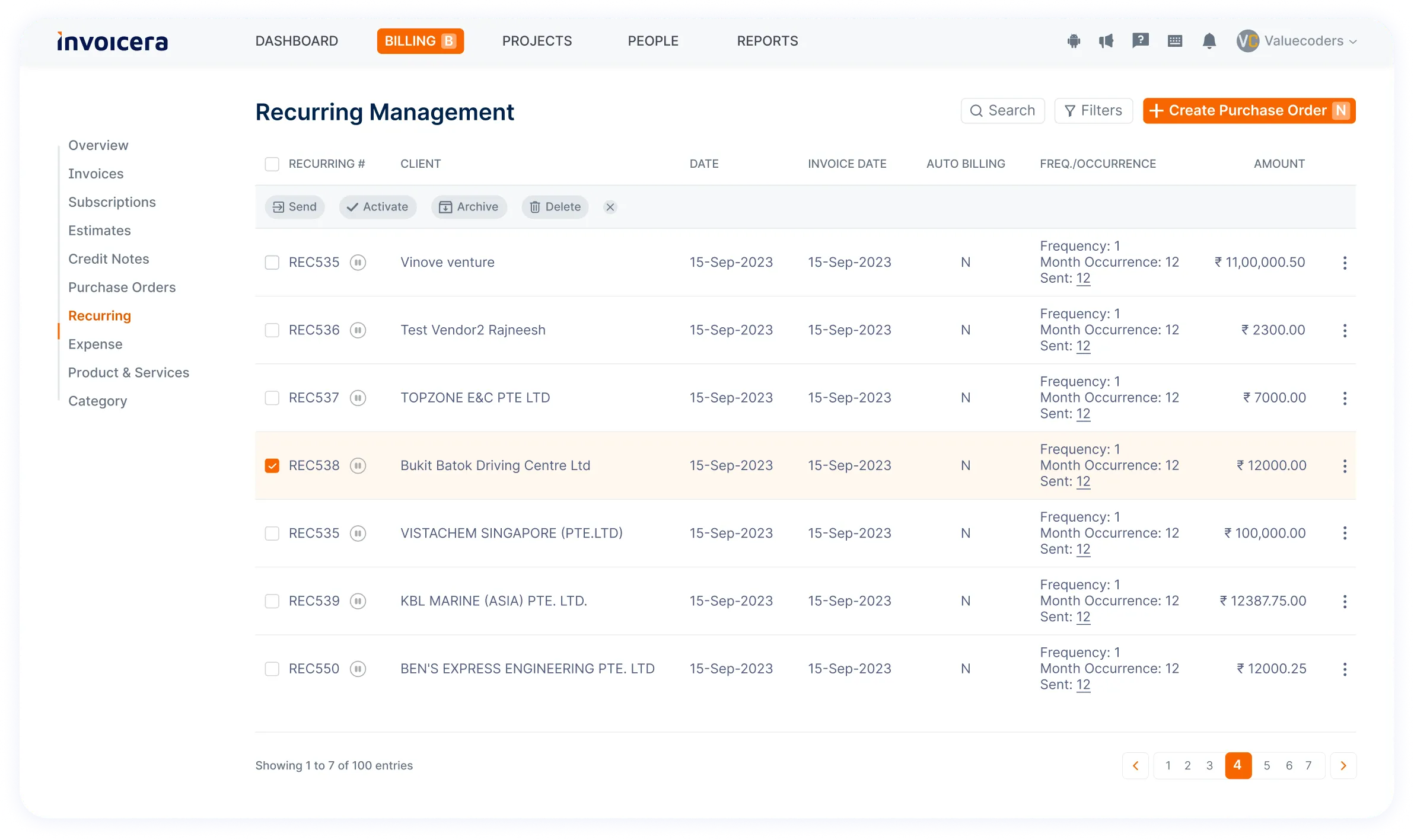

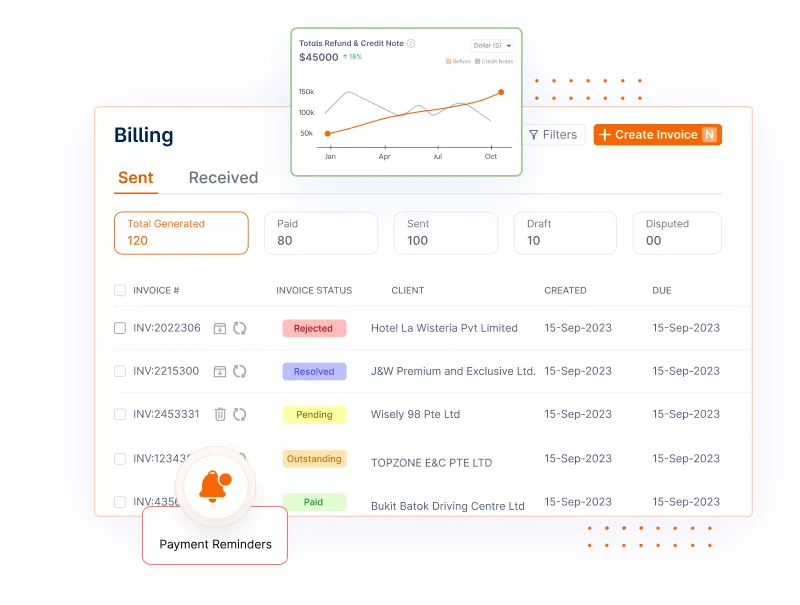

Invoicera is not just your average invoicing software; it’s a digital ally that simplifies your billing woes and empowers your business with efficiency. At its core, Invoicera is an online invoicing and billing platform designed to make the invoicing process smoother, faster, and hassle-free.

Key Features

- User-friendly Interface: Invoicera boasts an intuitive design, ensuring that even those new to digital invoicing can navigate effortlessly. No need for technical skills – it’s designed for everyone.

- Automation Magic: Say goodbye to the tedious task of manual invoicing. With Invoicera, you can automate repetitive invoicing tasks, save time, and reduce human errors.

- Customization at Your Fingertips: Tailor your invoices to match your brand identity. Invoicera allows you to customize templates, ensuring a professional and consistent look for all your billing documents.

- Real-Time Tracking: Keep a close eye on your finances with real-time tracking of invoices and payments. Stay in the loop and make better financial decisions for your business.

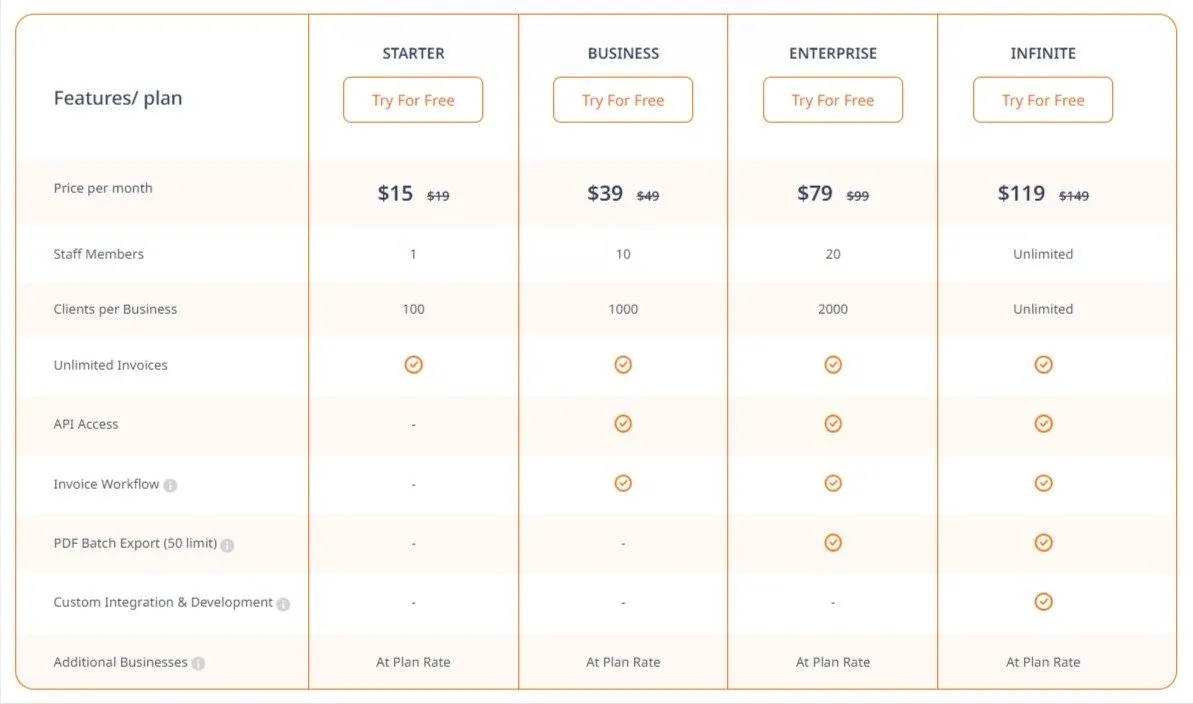

Pricing Model

While Invoicera offers a free plan, its premium plans are competitively priced, ensuring businesses get value for their money.

Invoicera’s pricing starts at $19 per month when billed monthly or $15 per month when billed annually, making it an affordable option.

User Ratings

Capterra: 4.6

2. Sage

Sage stands as a stalwart in the accounting software arena.

Popularly known for its reliability and scalability, Sage streamlines invoicing, inventory management, and financial reporting, providing businesses with the tools they need to thrive.

Key Features

- Easy Invoicing: Generate, modify, and dispatch invoices seamlessly within the software.

- Finance Management: Monitor cash flow by connecting to your bank account and instantly log sales and receipts.

- Collaborative Dashboard: Access impactful reports and dynamic dashboards. Keep tabs on project earnings, costs, and profits.

- Multi-Currency Support: Conduct transactions in diverse currencies.

Pricing Model

Starts at $61/user/year. Free trial for 30 days.

User Ratings

Capterra: 4.1

3. Wave

Wave is a free invoicing tool that packs a punch. It’s designed for small businesses and freelancers, offering features like invoicing, accounting, and receipt scanning, all without breaking the bank.

Key Features

- Create Estimates: Generate personalized invoices, estimates, and receipts swiftly.

- Payment Reminders: Send automatic payment reminders for timely payments.

- Payment Options: Accelerate payments by accepting credit cards, often settled within two days.

- Expense Management: Keep tabs on income, expenses, and receipts through scanning tools and bank connections.

Pricing Model

Wave pricing for the paid plan starts at $16 for a month.

User Ratings

Capterra: 4.5

4. Chargebee

Chargebee specializes in subscription billing management, making it a top choice for businesses operating on subscription models.

Key Features

- Professional Invoices: Create stunning, detailed invoices effortlessly.

- Tax And Compliance: Simplify tax handling with Chargebee.

- Metered Billing: Use built-in metered billing to bill based on usage.

- Multiple Payment Options: Offer diverse payment options like cards, checks, direct debit, and online wallets.

- Recurring Billing Solution: Access subscription management, reporting, and analytics tools as well.

Pricing Model

Starts at $249 per month

User Ratings

Capterra: 4.3

5. Freshbooks

FreshBooks is like your organized virtual assistant. It streamlines invoicing and helps you keep track of expenses effortlessly. It’s user-friendly and perfect for freelancers looking for a hassle-free invoicing experience.

Key Features

- Effortless Customization: Easily tailor invoices using automated recurring options for swift modifications.

- Real-time Client Interaction Tracking: Stay updated with live tracking of client interactions related to invoices.

- Automatic Payment Reminders: Set up automatic reminders and fees for late payments, ensuring prompt settlements.

- Seamless Online Credit Card Payments: Accept credit card payments online hassle-free, ensuring smooth transactions.

- Professional Estimate Generation: Create and send professional estimates promptly to potential clients.

- Intuitive Business Insights: Gain valuable business insights through intuitive reports and dashboards.

Pricing Model

Freshbooks offer its most popular plan at $16.50/month.

User Ratings

Capterra: 4.5

6. Zoho

Zoho is your go-to option for a suite of business tools, and its invoicing feature is no exception. It’s intuitive, customizable, and seamlessly integrates with other Zoho apps, making your invoicing process smoother.

Key Features

- Streamlined Invoicing Process: Generate polished invoices, automate recurring billing, and easily accept online payments.

- Unified Expense Management: Organize and bill expenses to clients seamlessly within a unified platform.

- Bank Integration: Link Zoho Books to your bank for live cash flow updates and instant transaction categorization.

- Comprehensive Financial Insights: Access insightful financial reports (P&L, Balance Sheet, Cash Flow Statement) for better financial management.

- Efficient Inventory Tracking: Implement inventory tracking to oversee stock movements efficiently.

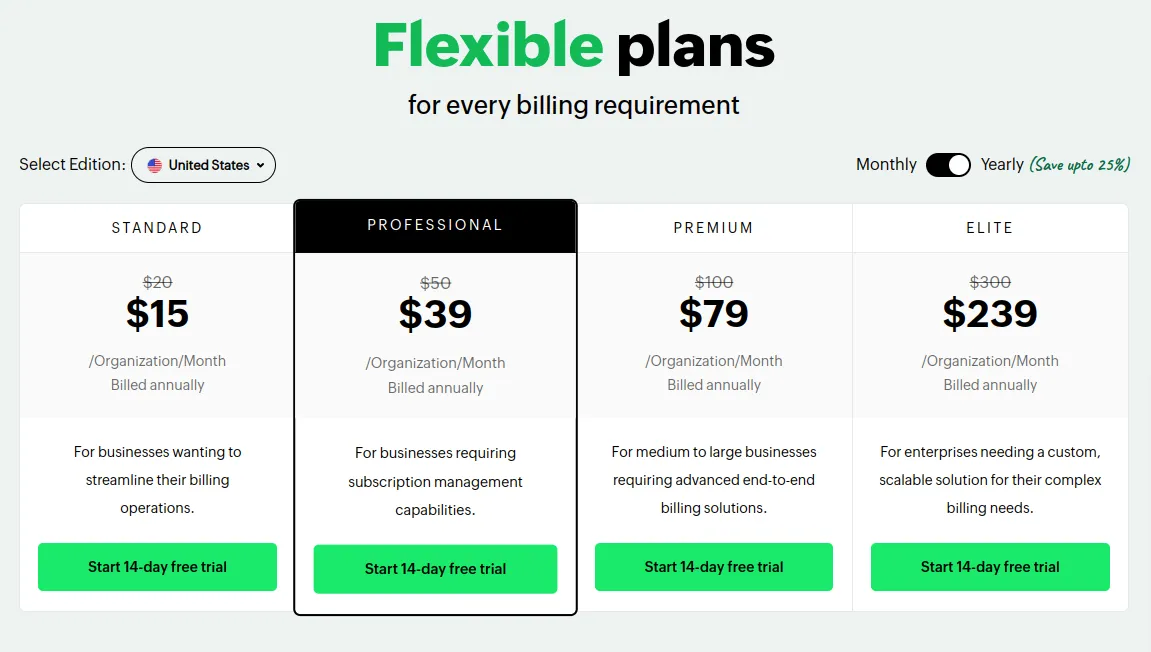

Pricing Model

Zoho Books offers a range of pricing, starting with a free tier for one user and one accountant, Standard at $15/month, Professional at $40/month, and Premium at $60/month, along with a free trial.

User Ratings

Capterra: 4.3

7. Tipalti

Tipalti is designed for global businesses dealing with complex payment processes.

This platform streamlines payment operations, handling everything from supplier onboarding to tax compliance.

Key Features

- Capture billable events automatically

- Create polished invoices and quotes with custom templates

- Track time and invoices

- Monitor payments

Pricing Model

Starts at $129 per month

User Ratings

Capterra: 4.4

8. Xero

Xero is your cloud-based accounting wizard. It’s user-friendly and offers number of features beyond invoicing, like bank reconciliation and expense tracking, making it a favorite among many freelancers and small businesses.

Key Features

- Recurring Billing Solution: Schedule recurring invoices for convenience.

- Reminders To Avoid Late Payments: Automate payment reminders to speed up customer payments through tailored emails.

- Various Payment Options: Accept online payments via debit/credit cards or PayPal directly from the invoice for improved cash flow.

- Mobile Invoicing: After job completion, generate and send invoices instantly from your phone or tablet.

User Ratings

Capterra: 4.4

9. Invoice2go

Key Features

- Tailored Invoices: Customize invoices using various templates to suit your style.

- Invoice Tracking: Track invoices to know exactly when clients view them.

- Automated Payment Reminders: Use payment reminders to save time on chasing unpaid invoices.

- Payments: Accept debit and credit card payments effortlessly.

Pricing Model

Its most popular plan starts at $9.99/month. You can try it for free for 30 days.

User Ratings

Capterra: 4.3

10. Scoro

Scoro offers a unified platform combining project management, time tracking, and invoicing.

Scoro’s real-time dashboards provide a holistic view of project progress and financials, making it a go-to solution for businesses seeking comprehensive project management and invoicing capabilities.

Key Features

- Create personalized sales, prepayment, and credit invoices effortlessly.

- Automate recurring payments for quicker monthly billing.

- Promptly remind overdue payments and ensure timely transactions.

- Gain a comprehensive view of each client’s/project’s profitability.

- Access real-time dashboard insights like sent invoices and monthly revenue estimates.

Pricing Model

Starts at $26/user/month

User Ratings

Capterra: 4.6

Trends In Invoicing Software For 2025

Tips For Choosing The Right Invoicing Software

Choosing the right invoicing software for your business involves considering a few important things:

1. Fits Your Business Needs

Before picking invoicing software, understand how your business handles billing. Choose software that specifically meets your needs, avoiding extra features that you might not use.

2. Professional-Looking Invoices

Make sure your invoices not only have all the necessary details but also look good. Your invoices represent your business, so they should be clear and well-designed to create a positive impression.

3. Security Matters

Pick invoicing software with a good reputation for keeping your financial information safe. Security is crucial because a breach could lead to losses and harm your business’s reputation.

4. Good Customer Support

Since software can have issues, go for invoicing software with reliable customer support. They should be easy to reach and helpful in resolving any problems. Look for additional support resources like guides and tutorials to make things easier.

Common Mistakes To Avoid In Invoicing

Invoicing might not be the most thrilling part of your business, but avoiding common mistakes can save you time, money, and headaches.

Here are some common invoicing mistakes and how Invoicera can rescue you.

1. Forgetting the Basics

Missing crucial details on your invoice can lead to delayed payments. Always double-check your client’s name, contact information, and a clear service or product breakdown.

Invoicera prompts you to fill in all necessary details before sending an invoice, ensuring accuracy and completeness.

2. Timing is Everything

Sending invoices late can disrupt your cash flow. Be prompt – send your invoices as soon as the job is done or the product is delivered.

Invoicera offers automated scheduling, allowing you to set up invoices to be sent out immediately after project completion.

3. Ignoring Payment Terms

Failing to specify payment terms can lead to confusion and delayed payments. Clearly outline due dates and any late payment penalties in your invoice.

Invoicera lets you customize payment terms, making sure both parties are on the same page about when payments are expected.

4. Spreadsheet Struggles

Relying on manual spreadsheets can result in errors and lost invoices. Automation is key to maintaining accuracy and efficiency.

Invoicera streamlines your invoicing process by automating calculations, reducing the chances of manual errors.

5. Neglecting Follow-Ups

Assuming your client will pay promptly without a gentle nudge. Regularly follow up on outstanding invoices to ensure timely payments.

Invoicera offers automated reminders for overdue payments, saving you the hassle of chasing down clients.

Final Words

Remember, it’s not just about finding any software but the one that fits your needs.

Don’t rush this decision. Take your time to compare options, consider what your business truly needs, and weigh the pros and cons.

Ultimately, the right software will make invoicing easier, help you get paid faster, and keep your financial information safe.

So, take a deep breath, trust your research, and make that choice.

Your business will thank you for it.

FAQs

Can I access my invoicing data from different devices or locations?

Many online invoicing tools like Invoicera offer cloud-based solutions, allowing access from anywhere with an internet connection. Ensure the software you choose supports multi-device access if that’s important for your business.

What happens if the software doesn’t meet my needs after I’ve started using it?

Many software providers offer trial periods or money-back guarantees. It’s advisable to take advantage of these offers to test the software thoroughly before committing.

How often does the software receive updates or improvements?

Frequent updates can indicate a software’s commitment to improvement. Check the software’s release notes or update history to gauge how often they enhance their product.