If you are doing business in Canada and the EU, you may be required to collect two sets of taxes on most of your invoices and estimates. While this may seem like a complicated procedure, Invoicera make these calculations extremely simple. With our new feature to handle GST/PST in invoices and estimates, Invoicera is able to calculate both simple and compound taxes in dual tax fields.

Invoicing with ‘Normal Tax’

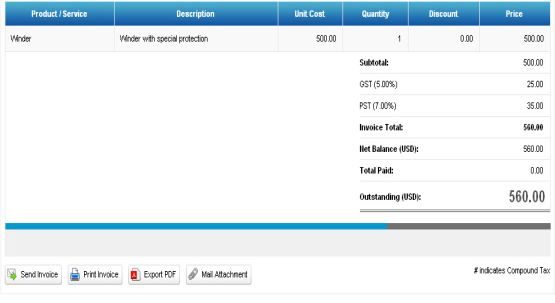

While invoicing with normal tax, both federal and provincial taxes are applied separately on the invoice subtotal. For e.g. in the below invoice GST = 5% & PST = 7%, the percentages of both the taxes will be calculated separately on the subtotal. The invoice subtotal in the invoice is $500. Therefore:

Tax 1 (GST) = 5% of $500 = $25

Tax 2 (PST) = 7% of $500 = $35

And the total invoice amount will be $560 ($500 + $25 + $35)

Invoicing with ‘Stacked or Compound Tax’

While invoicing with compound tax, the compound tax is calculated as a percentage of subtotal + Tax 1. In other words, provincial tax is applied on the sum of invoice subtotal and federal tax. For e.g. in the invoice below GST = 5%, PST = 7% and the invoice subtotal = $500. In this case, PST will be calculated as below:

Tax 1 (GST) = 5% of $500 = $25

Tax 2 (PST) = 7% X (Subtotal + Tax 1) = 7% X ($500 + $25) = $36.75

And, therefore, the invoice total amount will be $ 561.75 ($500 + $25 + $36.75)

Invoicing with IRPF option also supported

If you are selling to a Spanish business you will have to indicate the level of IRPF that should be withheld by the customer. The amount for IRPF is essentially withheld by your customer and paid to the tax office by them on your behalf.

For example, if you have done €1000 of work your invoice will say something like:

• Net total €1000

• IVA 16% (VAT for Spain) €160

• IRPF at 7% €70

You will be paid €1000+160-70 = €1090. This implies, with Invoicera you will be able to have negative taxation amount required for IRPF.