Accounting software has become the cornerstone for businesses to streamline operations, track finances, and ensure precision in every transaction.

According to recent studies by Forbes Insights, 88% of businesses credit their growth to adopting advanced accounting software.

For managing finances, there are many options available, but these three products stand out – NetSuite, QuickBooks, and Invoicera.

NetSuite is a cloud-based suite praised for its combined financial, ERP, and e-commerce platform.

QuickBooks is known for its easy-to-use interface, popular among small and medium-sized businesses for smooth financial management.

Meanwhile, Invoicera is versatile, especially liked for its invoicing capabilities for businesses of all sizes.

This blog post talks about the three accounting software in detail, highlighting their features and strengths. By comparing them, we aim to help businesses choose the best accounting solution for their needs.

Join us to learn more about NetSuite, QuickBooks, and Invoicera to find the right financial tools for your business success.

NetSuite

It helps generate accurate, timely reports, giving better control over money matters.

You can see financial info instantly, which helps sort out problems quickly and create reports needed to follow various financial rules like ASC 606, GAAP, SOX, and others.

Features And Capabilities

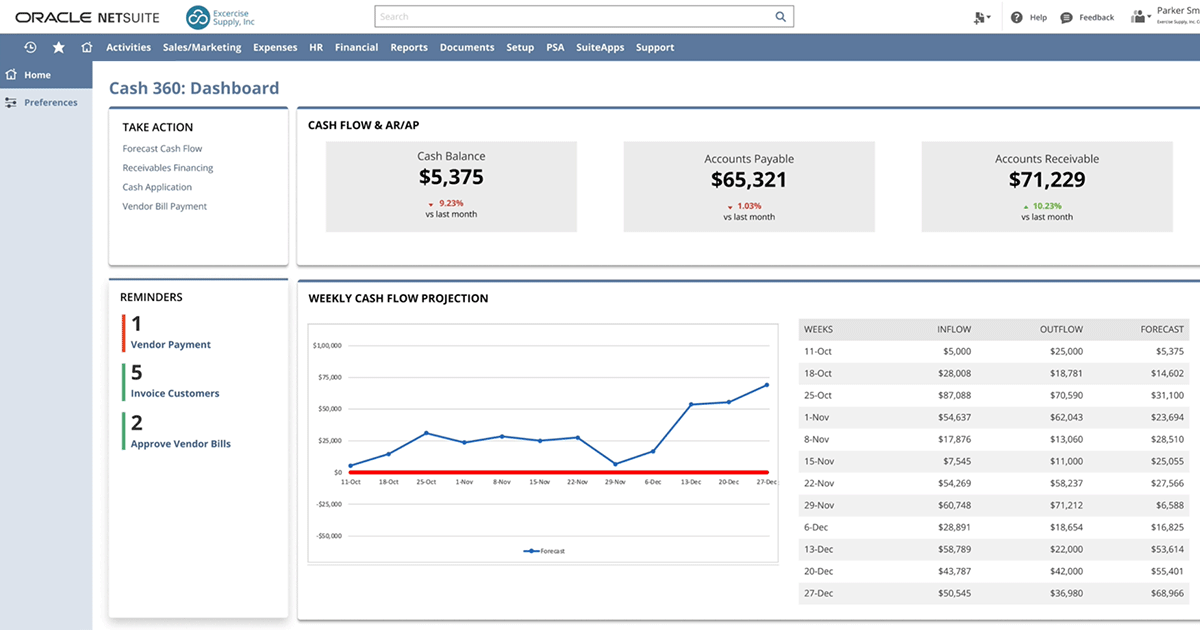

1. Cash Management

Finance teams require clear visibility and reporting tools to improve cash flow, keep an eye on bank accounts, handle available money, and choose wisely.

NetSuite offers a complete picture of how a company’s money moves and cash situation, empowering finance teams to be more strategic than ever.

2. Accounts Receivable

NetSuite makes sending invoices, handling payments, and managing collections easier by doing it all automatically.

This helps you get more money to grow your business faster, reduce the time it takes to get paid, improve customer service, and take advantage of new investment chances quickly.

3. Accounts Payable

By letting NetSuite handle your bill payments automatically, you save time and work faster. Get benefits like avoiding extra fees for paying late and making your money flow better by grabbing discounts for paying early.

Plus, you stay in line with company rules and avoid payment scams with automated checks and approvals.

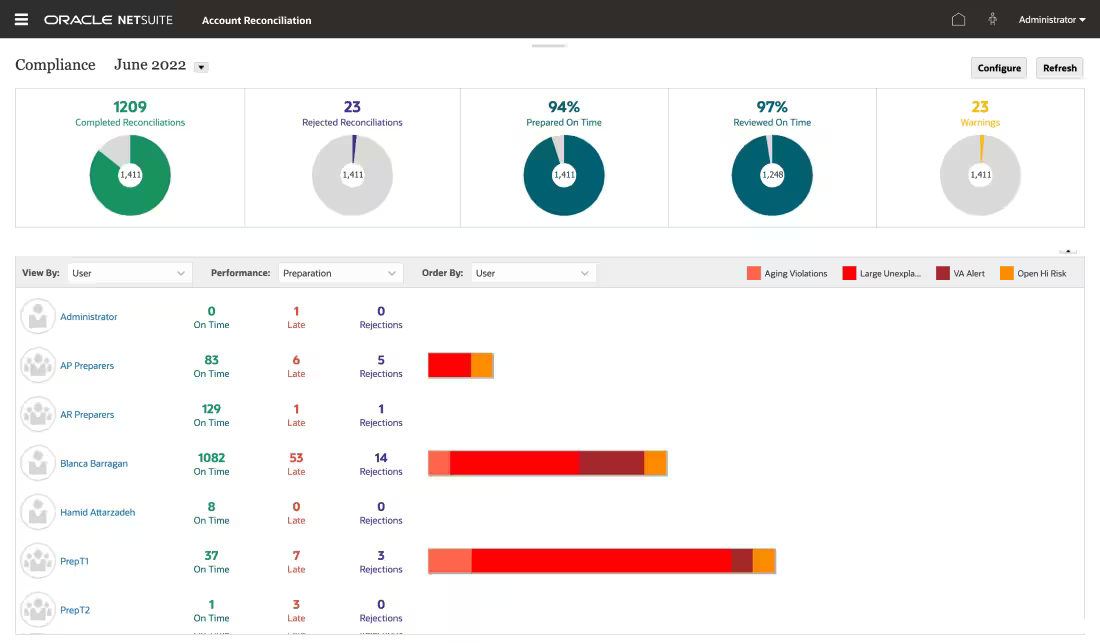

4. Account Reconciliation

Simplify and streamline the matching of accounts payable and receivable in different accounts like bills, payments, inventory, and more.

Control and check the details of each account from one place, comparing balances and keeping track of who’s responsible, who reviews, and when it’s approved.

5. Tax Management

Effectively handles both local and international tax obligations using a straightforward solution. This tool makes detailed reports and instantly breaks down transactions into specific tax details.

NetSuite manages taxes for different branches and supports various tax schedules, covering GST, VAT, consumption, and general sales tax.

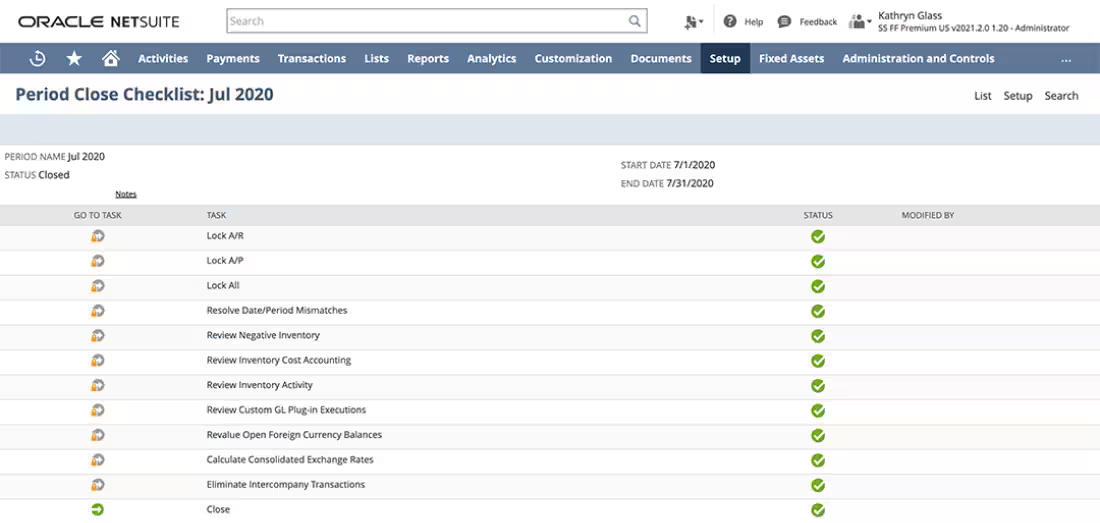

6. Close Management

Speed up the completion of financial tasks by using technology to do things that usually take a lot of time by hand.

This includes recording transactions in journals, making sure accounts match up, comparing differences, and handling transactions between parts of the same company.

7. Fixed Assets Management

NetSuite helps companies handle and oversee everything about items that lose value over time and those that don’t, from when they’re made to when they’re gotten rid of.

Finance teams can ditch the hassle of using spreadsheets and easily keep track of assets in different places using a fixed-asset accounting system that’s all-in-one.

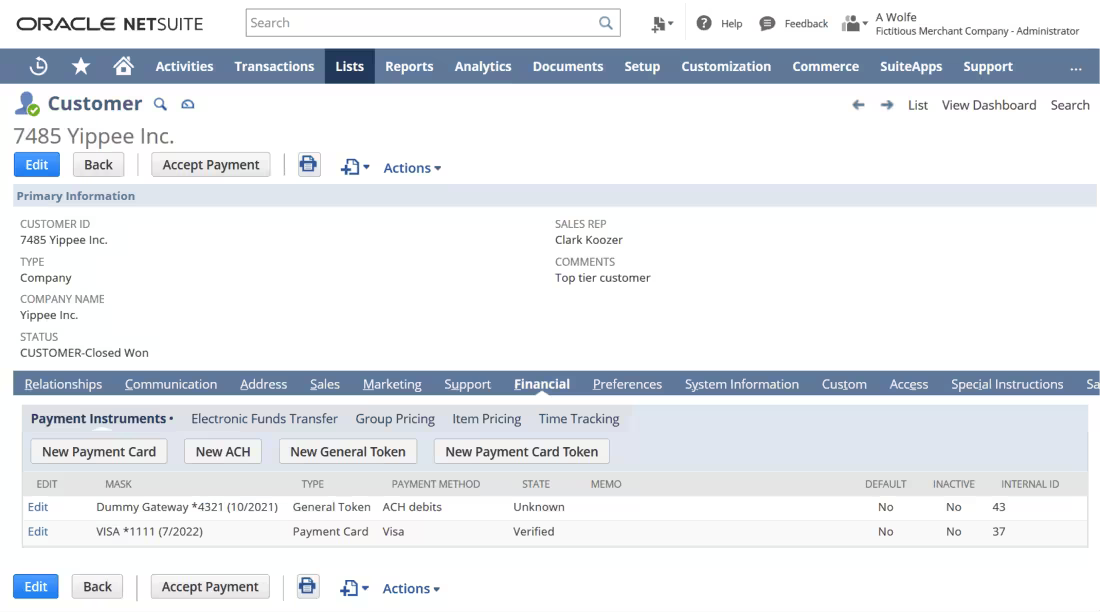

8. Payment Management

If you send bills to customers, charge their credit cards regularly, or take payments online or in-store, NetSuite’s banking and payment tools help you get more payments on time.

They also provide instant financial info to keep track of sales and cut down the time it takes to get paid.

Netsuite Is the Best Choice For

Mid-sized to Large Businesses – NetSuite accounting software is ideal for mid-sized to large businesses seeking a comprehensive, all-in-one solution.

Unified Platform – Its robust capabilities cater to enterprises looking for integrated financial management, including ERP, CRM, e-commerce, and more, all on a unified platform.

Companies Working in Complex Environments – NetSuite’s scalability, customization options, and advanced functionalities suit companies experiencing rapid growth or operating in complex business environments.

Pricing And Subscription Options

Base Package:

- Starts with a monthly fee covering ERP and CRM.

- SuiteSuccess packages cater to specific industries with pre-set roles, workflows, and reports.

User Licenses:

- Self-service for limited access, sold in packs.

- Full user licenses for standard access to all features

Add-On Modules:

- Additional modules for specific business needs.

Service Tier Upgrade:

- Different service levels based on user count and system requirements.

Pros And Cons

| Pros | Cons |

|

● Perfect Fit for Any Business Size: NetSuite works for small, medium, and big companies, helping them grow smoothly. ● Powerful Money Management: It’s excellent at handling finances and keeping your money in check. ● Easy Integration: NetSuite is designed to work with other tools and systems you use efficiently. ● Tailored to Your Way of Working: You can adjust NetSuite to match your business’s operations precisely. |

● Fluctuating Pricing: Subscription pricing can change over time ● Paid Support: Basic support is limited, and additional support comes at an extra cost. ● Customizing reports can be challenging: NetSuite’s reporting tools limit easy customization, restricting the creation of custom data sources and complex reports without technical expertise.

|

QuickBooks

Features And Capabilities

1. Cloud Accounting

You can reach your account, handle your business, and stay organized no matter where you are, whether on your computer, phone, or tablet.

By using QuickBooks, which stores your financial information online, you can keep an eye on sales, make invoices, and stay updated on your business performance whenever you need to.

QuickBooks’ cloud accounting tool lets your bookkeeper, accountant, or team members access and work with your data in real-time online.

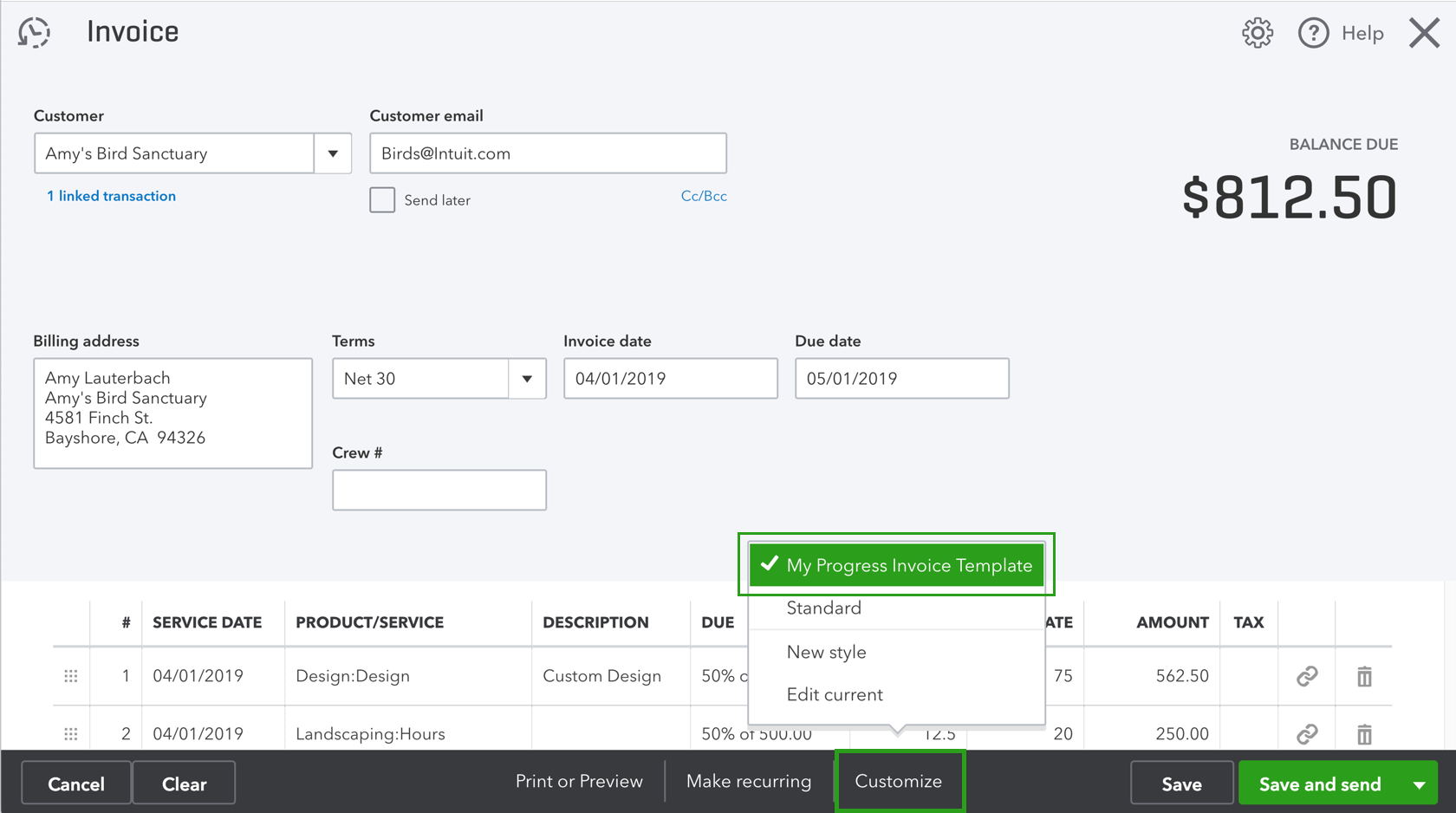

2. Invoicing

Effortlessly craft professional-looking invoices, sales receipts, and estimates within minutes.

Tailor these invoices to your brand’s identity by adding your company logo, choosing colors representing your brand, and including essential contact information.

Simplify generating GST-compliant invoices by selecting built-in data fields designed to meet GST requirements.

When you use QuickBooks Online Software, your bank statements and transactions update automatically. Just link your bank accounts to QuickBooks.

You can also easily add receipts and notes to your transactions.

2. Accounting Reports

Immediately view how well your business is doing using reports and dashboards you can change to fit your needs.

Get current reports, like your balance sheet, profit & loss, and cash flow statement.

Easily spot all invoices that have yet to be paid or are late so you can follow up on getting paid.

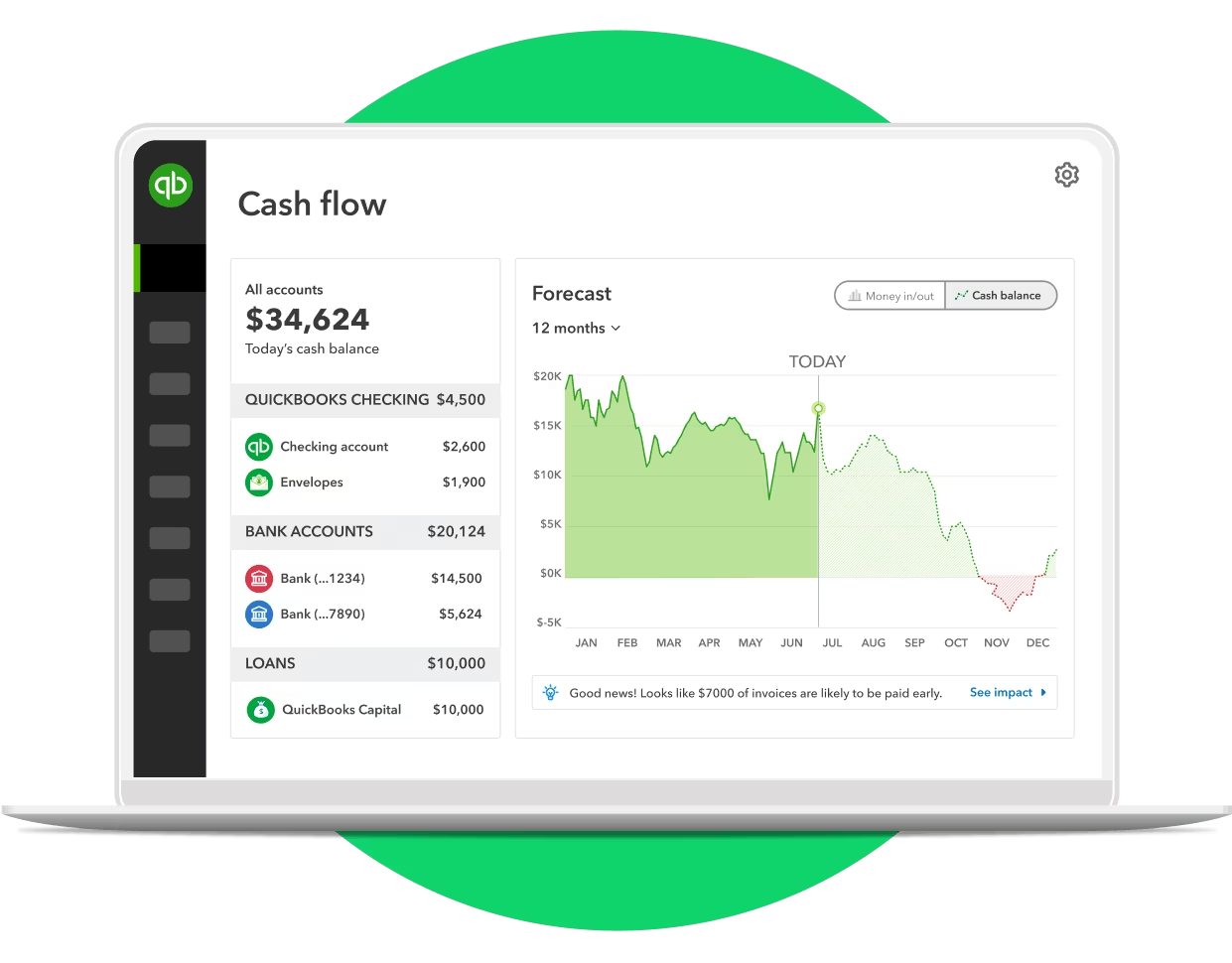

3. Cash Flow Management

In QuickBooks, handling your money flow becomes easy. You can quickly put in the bills you get from people you buy stuff from and pay them at the right time.

You can also make regular payments, saving time and always paying what you owe without any problems.

4. Time Tracking

Keeping track of time becomes easier with QuickBooks’ easy-to-use features. You can easily record how long employees work and keep track of hours spent on projects for clients or by specific team members.

QuickBooks smoothly combines these records. It even does the math for you, automatically adding billable hours to your invoices. This saves you the trouble of having to do calculations by hand.

5. Multiple Users

Using QuickBooks makes it super simple to have many people using it. Using different roles and permissions, you can easily control who gets to see what.

Inviting them to see your books is easy if you’re working with an accountant, making teamwork smooth.

6. Free Unlimited Support

One great thing about QuickBooks is that it gives you free, unlimited help whenever needed. If you ever need assistance, QuickBooks offers a lot of support, giving you answers and information to help manage your business better.

Having this kind of support ready to use can make a difference when facing any problems that come up.

Quickbooks Is the Best Choice For

- Entrepreneurs and Startups: Its user-friendly interface and accessible features suit those new to accounting software, helping them manage finances efficiently.

- Freelancers and Self-Employed Individuals: QuickBooks simplifies invoicing, expense tracking, and tax preparation, making it a go-to option for those managing their finances.

- Small to Medium-Sized Businesses: Its scalability allows businesses to grow without switching to a different platform, offering tools for inventory management, payroll, and more.

- Non-Accountants: QuickBooks caters to users who aren’t accounting experts, providing guidance, support, and easy-to-understand functionalities that don’t require an accounting background.

- Companies Requiring Collaboration: Its multiple-user access and collaborative features suit businesses working with accountants, teams, or remote collaborators.

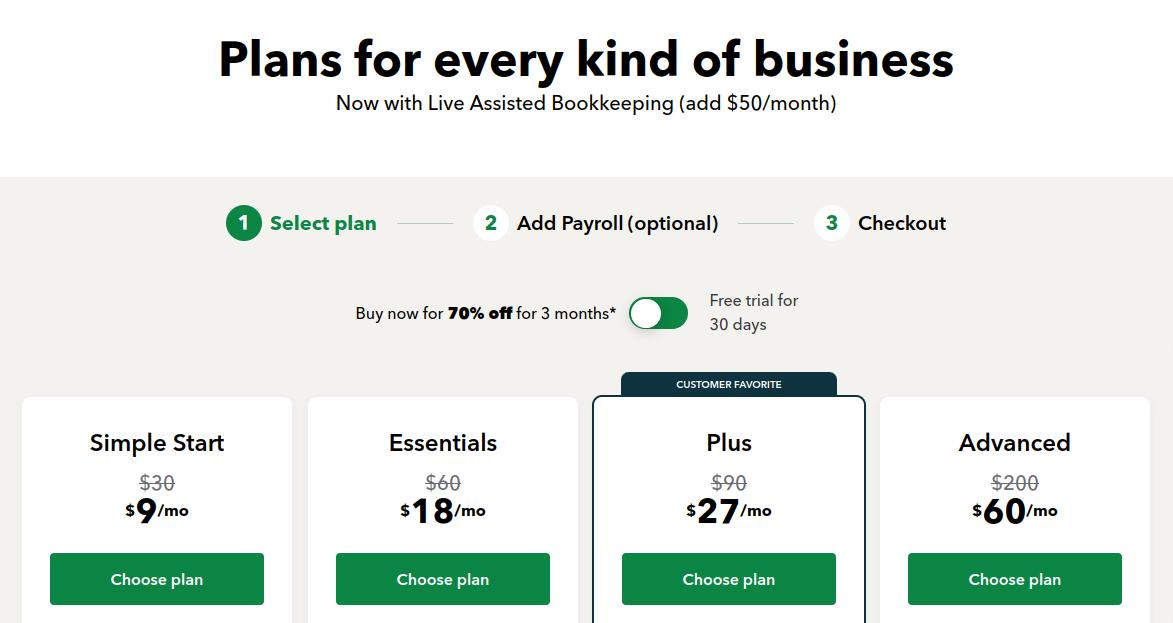

Pricing And Subscription Options

- Simple Start: This plan usually starts at around $9 per month. It’s ideal for small businesses and offers essential features like tracking income and expenses, invoicing, and basic reporting.

- Essentials: Priced at approximately $18 per month, this plan includes additional features such as bill management, time tracking, and more robust reporting options.

- Plus: Around $27 per month, this plan extends the capabilities further, offering inventory tracking, project profitability analysis, and advanced features.

- Advanced: The QuickBooks Advanced plan, priced at $60 per month, offers an extensive suite of features tailored for growing businesses.

Pros And Cons

| Pros | Cons |

|

|

Invoicera

Features And Capabilities

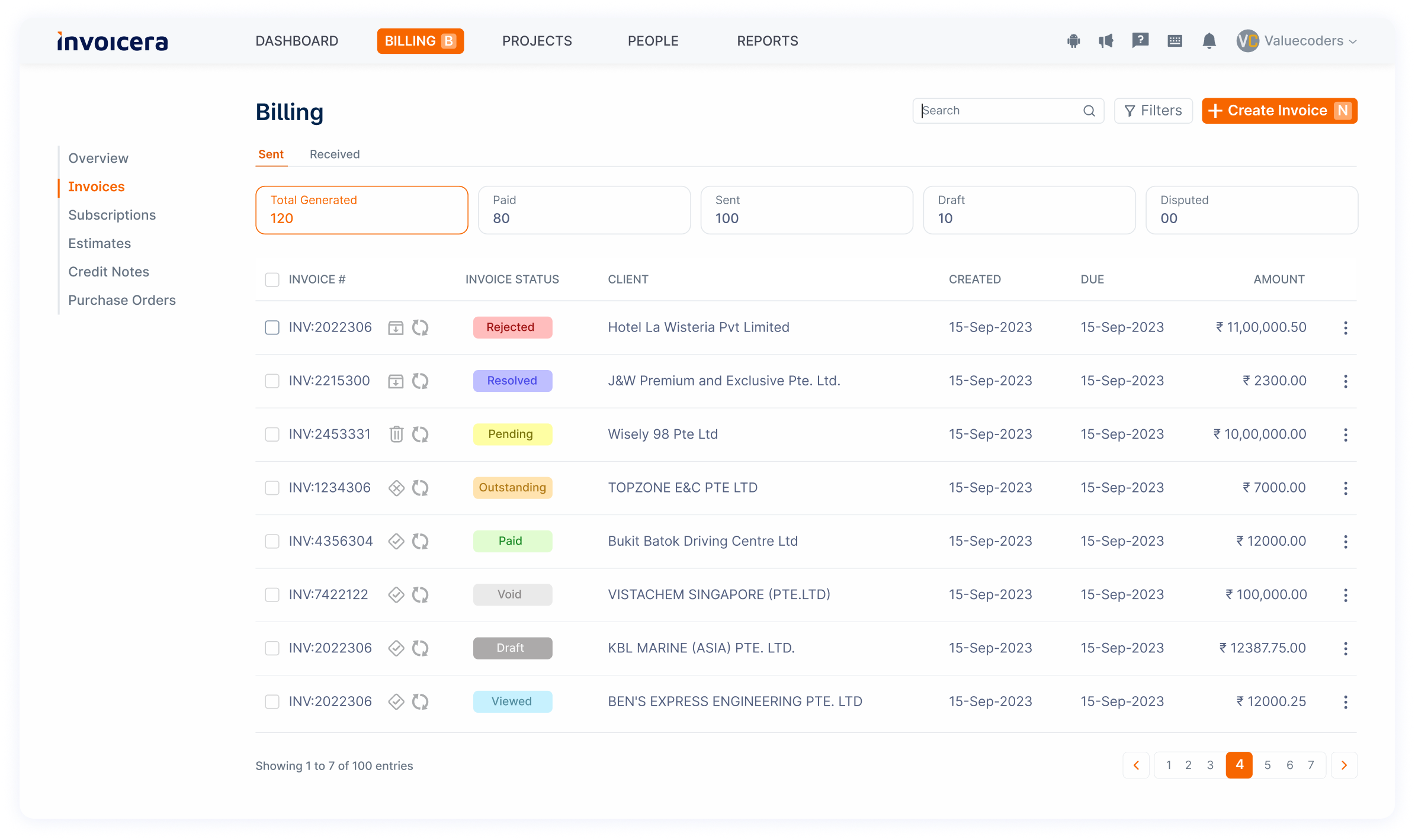

1. Online Invoicing

Elevate your invoicing game with Invoicera’s personalized templates. Stand out by tailoring your invoices to match your brand’s vibe. It’s like giving your invoices a makeover—professional and uniquely yours.

- Reflect your brand identity with custom templates

- Include detailed line items for transparent billing

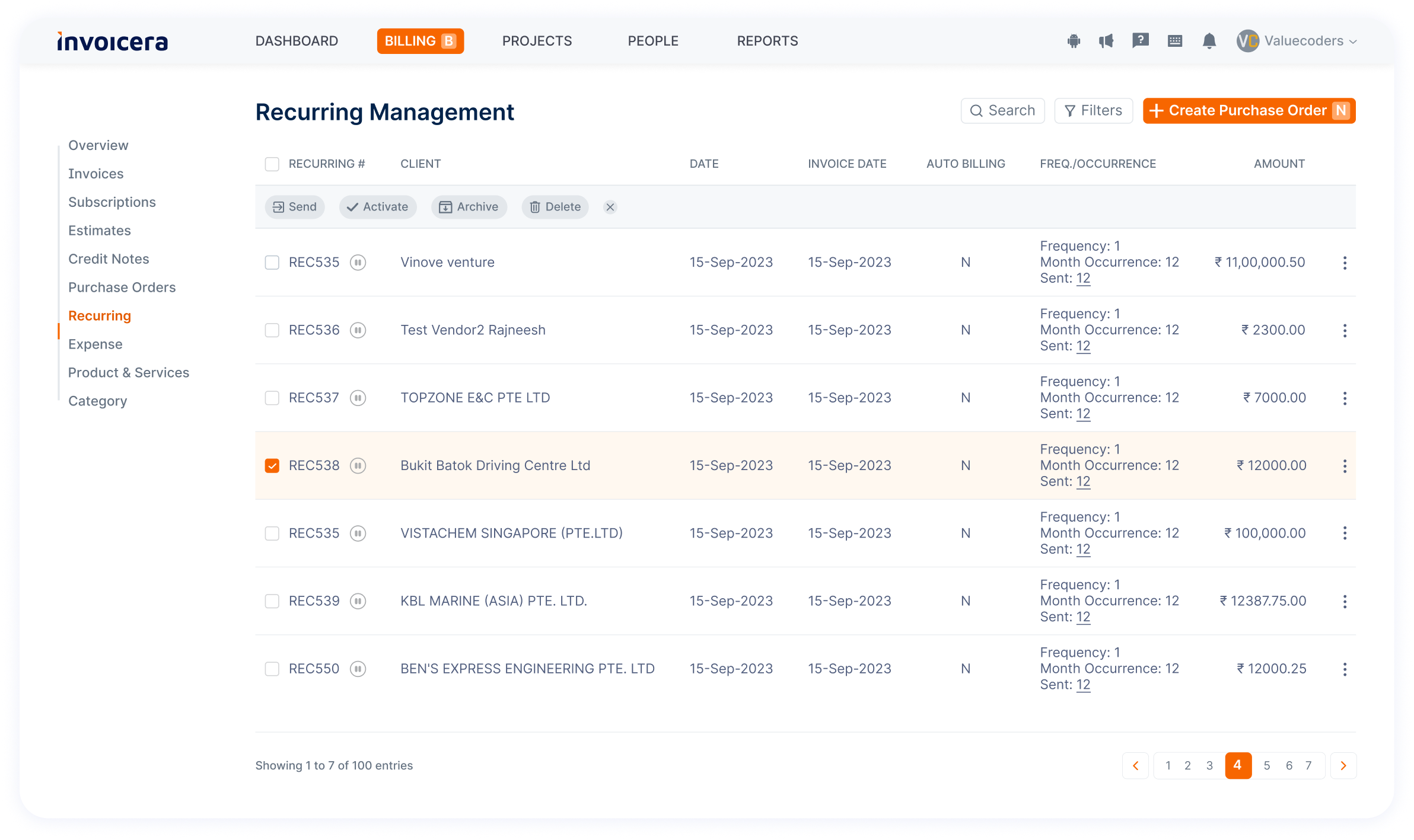

2. Recurring Billing

Say goodbye to repetitive invoicing tasks. Invoicera takes the hassle out of billing cycles by automating those recurring invoices. Set it and forget it – let Invoicera handle the billing while you focus on what you do best.

- Set up automated schedules for invoicing convenience

- Eliminate manual generation of recurring invoices

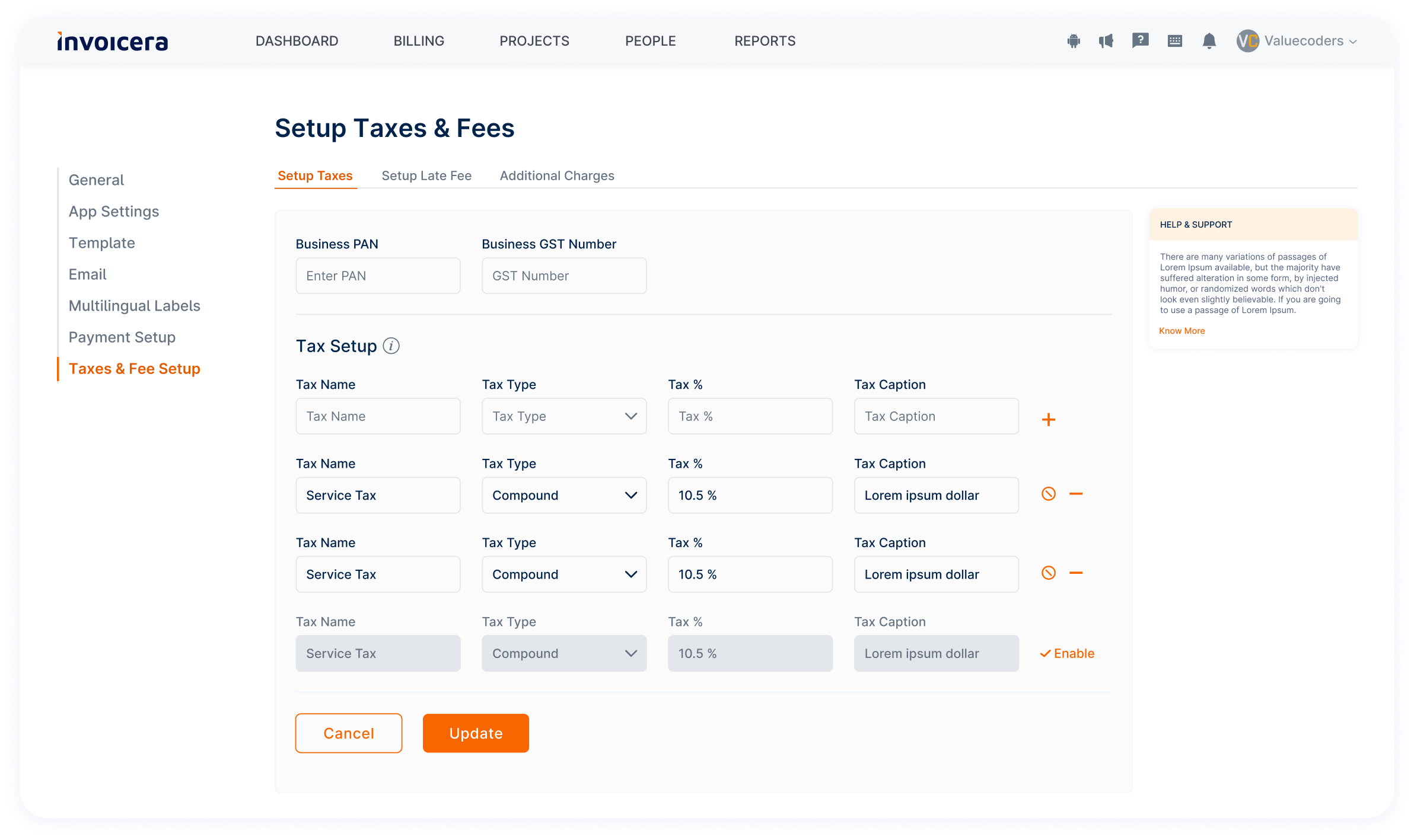

3. GST Invoicing

Keep your invoicing on the right side of regulations. With Invoicera, know that your invoices meet Goods and Services Tax (GST) requirements. Compliance is made easy so that you can invoice worry-free.

- Automated and accurate tax calculations for GST compliance

- Easy invoicing while adhering to GST requirements

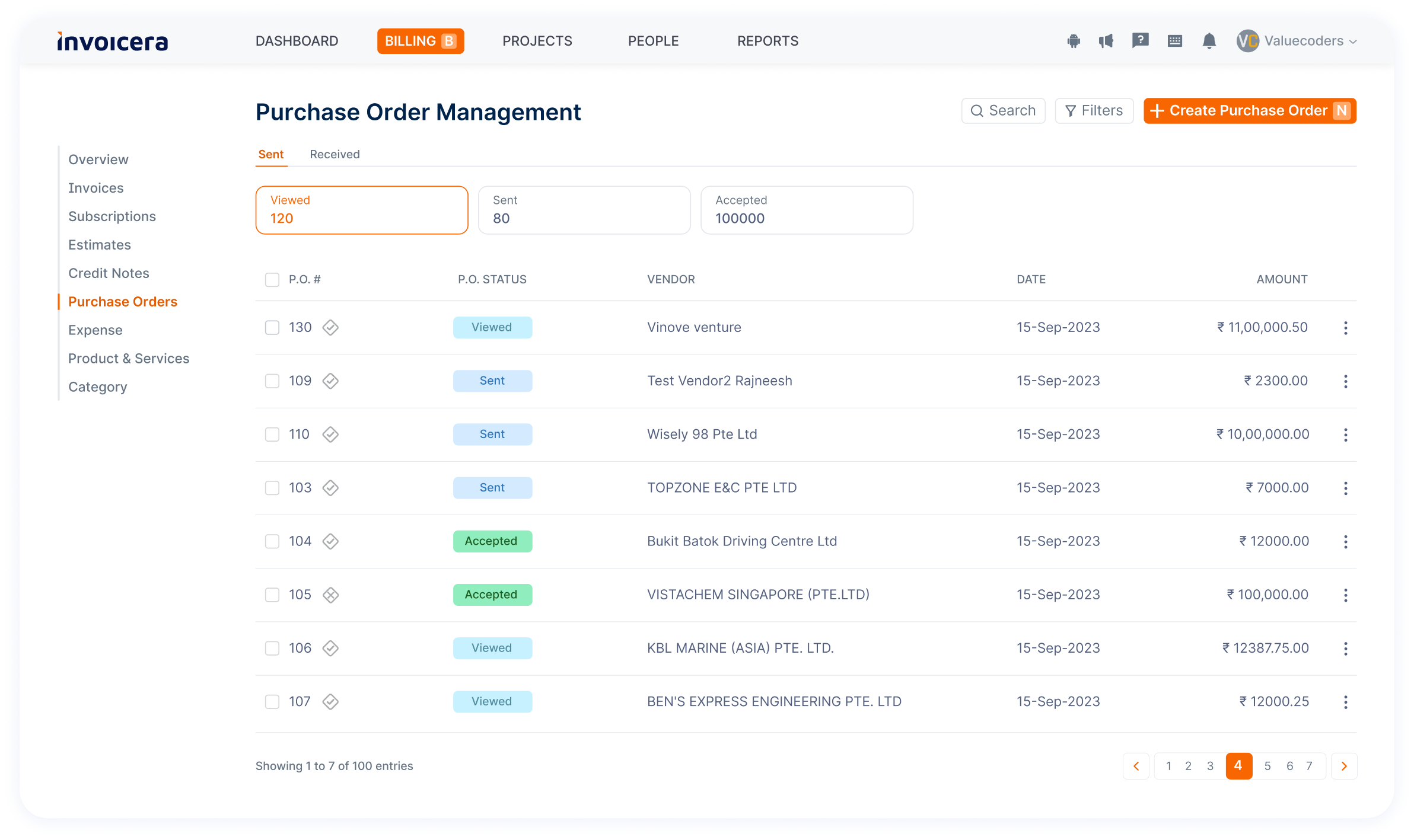

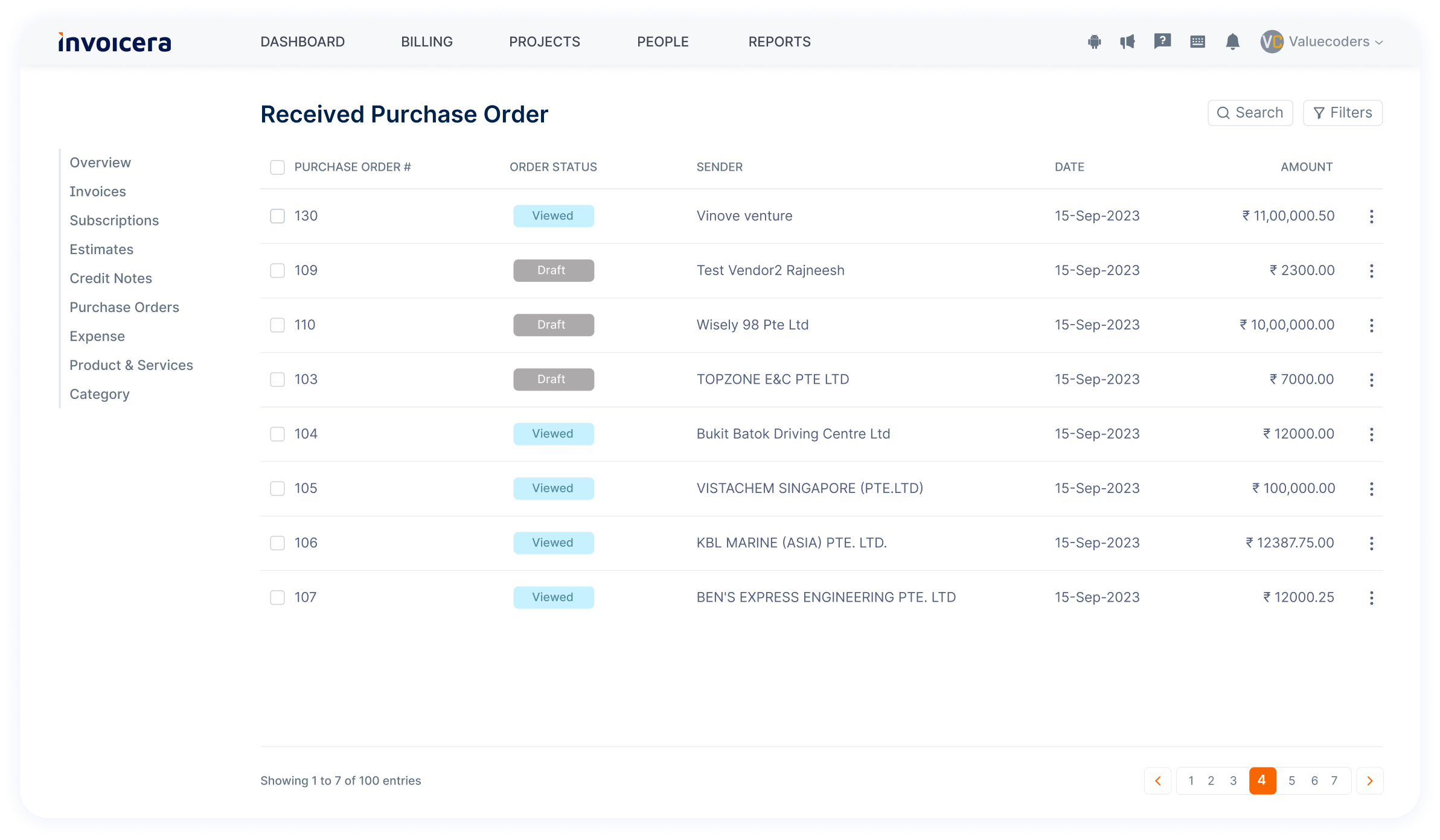

4. Estimates & Purchase Orders

Get your project specs crystal clear with Invoicera’s estimates and purchase orders. Outline project details, set expectations, and seal the deal—no more confusion, just clear-cut communication.

- Communicate cost expectations for future work

- Outline procurement details for smoother transactions

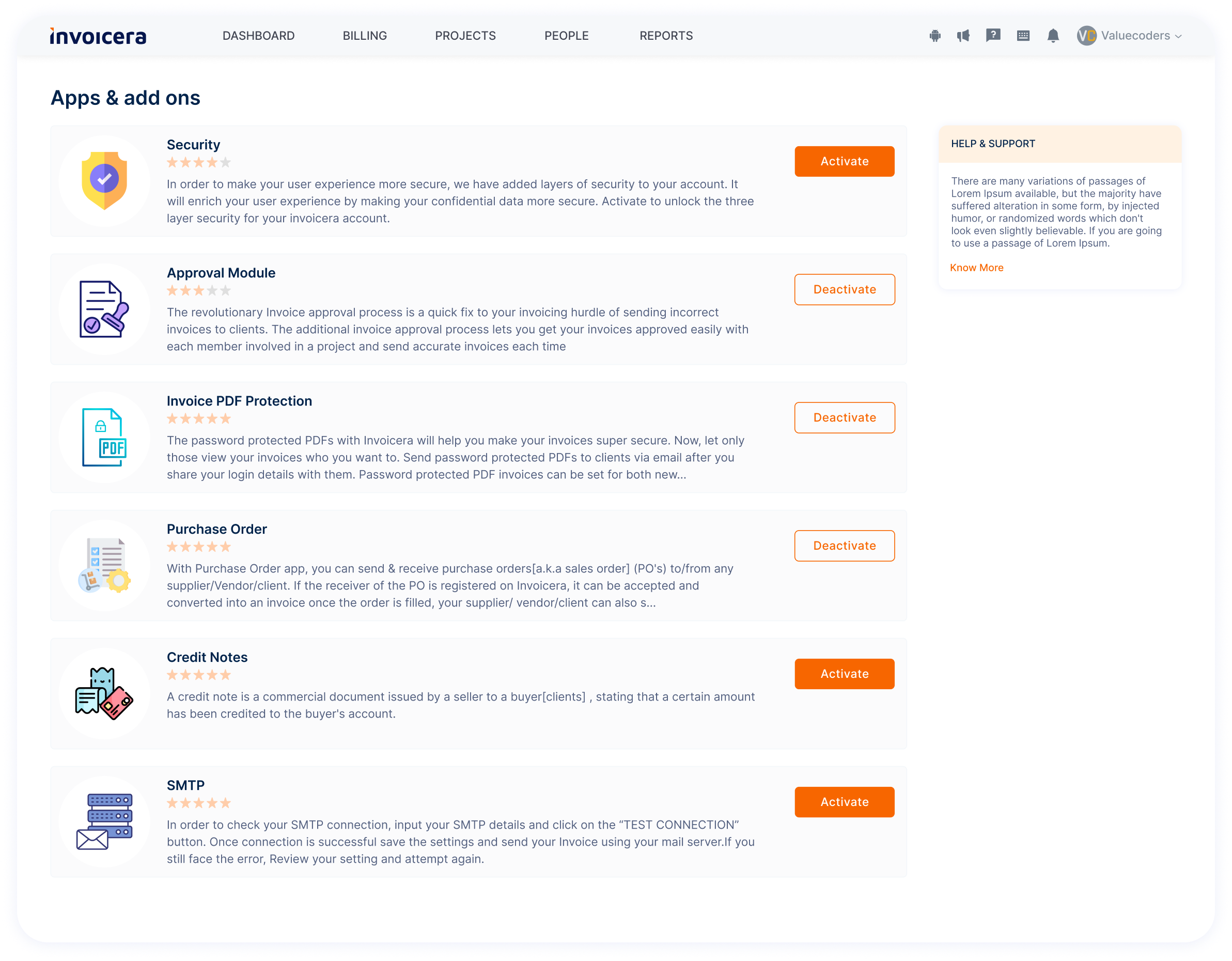

5. Integration With 3rd Party Systems

Invoicera plays well with others! Integrate effortlessly with your favorite apps and tools. It’s like connecting the dots—smooth workflows, all in one place.

- Streamline workflows with CRM or accounting software integration

- Ensure data consistency across integrated platforms

6. Client Portal

Step up your client game with Invoicera’s secure client portal. Impress clients by providing a private space to view invoices and project details and communicate securely. It’s like rolling out the red carpet for your clients—professional, secure, and impressive.

- Provide clients access to invoices and project details

- Foster transparency and facilitate direct communication

7. AR & AP Management

Simplify handling money coming in and going out. Invoicera helps you effortlessly track who owes you money and who you owe, ensuring your financial flow stays smooth.

- Monitor outstanding balances and track incoming/outgoing payments

- Simplify financial processes for efficient management

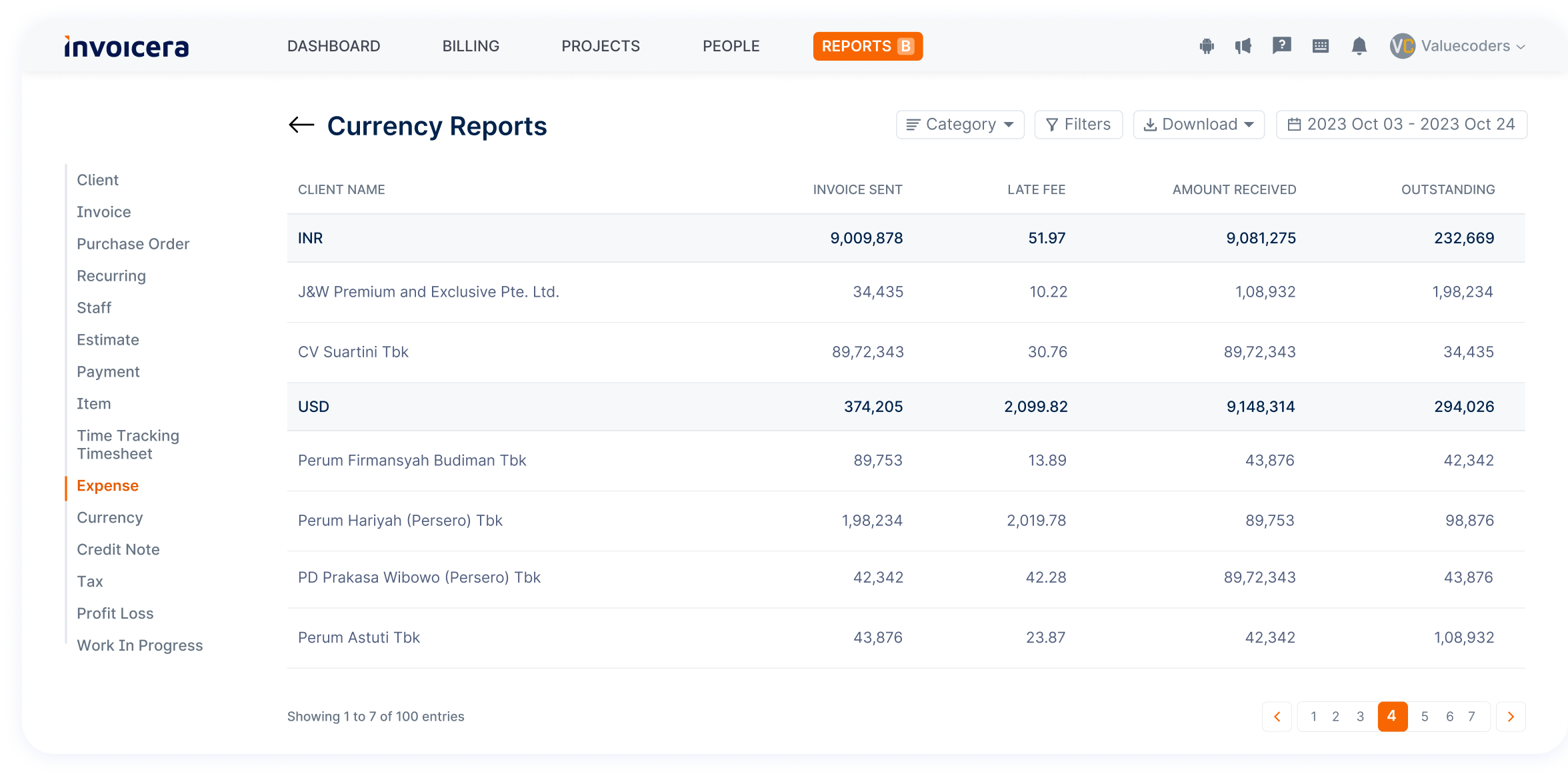

8. Multi-currency & Multi-lingual Support

With Invoicera, you’re not limited by borders or languages. Go global and do business in 15+ languages and currencies, making transactions with international clients a breeze.

- Simplify transactions by accommodating diverse currencies

- Communicate effectively with clients worldwide in their language

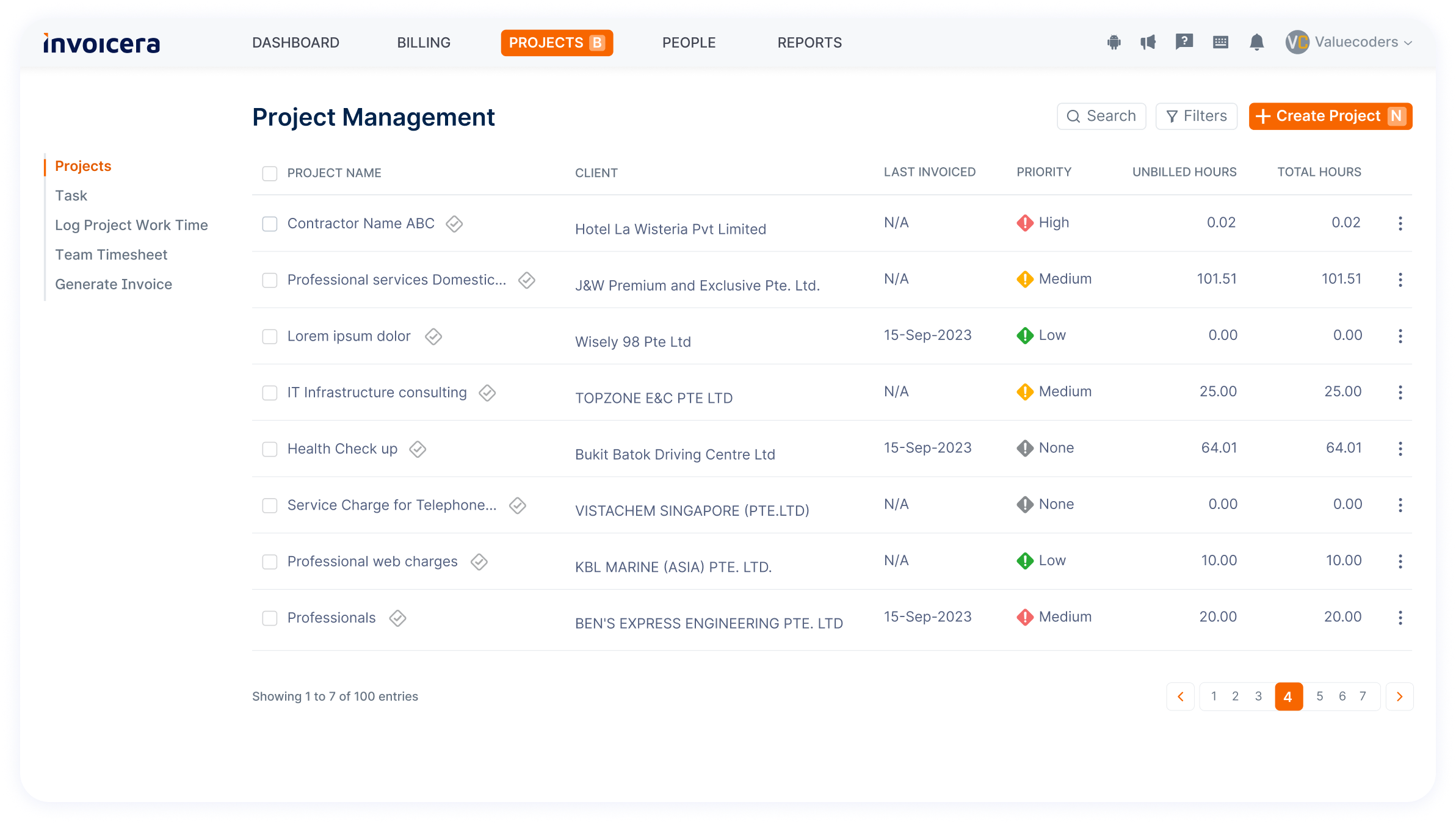

9. Projects & Tasks

Keep all your projects organized in one place. Invoicera lets you manage projects and tasks efficiently, so you never miss a deadline and can keep your team’s work on track.

- Track project progress and allocate resources efficiently

- Ensure timely completion of tasks for successful project delivery

10. Time Tracking

Never miss a minute! Invoicera’s time-tracking feature helps you keep precise records of billable hours spent on projects or services, ensuring you get paid for every second of your hard work.

- Associate tracked hours with clients or specific projects

- Convert tracked time seamlessly into invoiced hours

11. Online Payments

Make paying easy for your clients. Invoicera allows you to offer various secure and hassle-free online payment methods, giving your clients flexibility and convenience.

- Facilitate faster payments through 14+ integrated gateways

- Provide clients with multiple secure payment choices

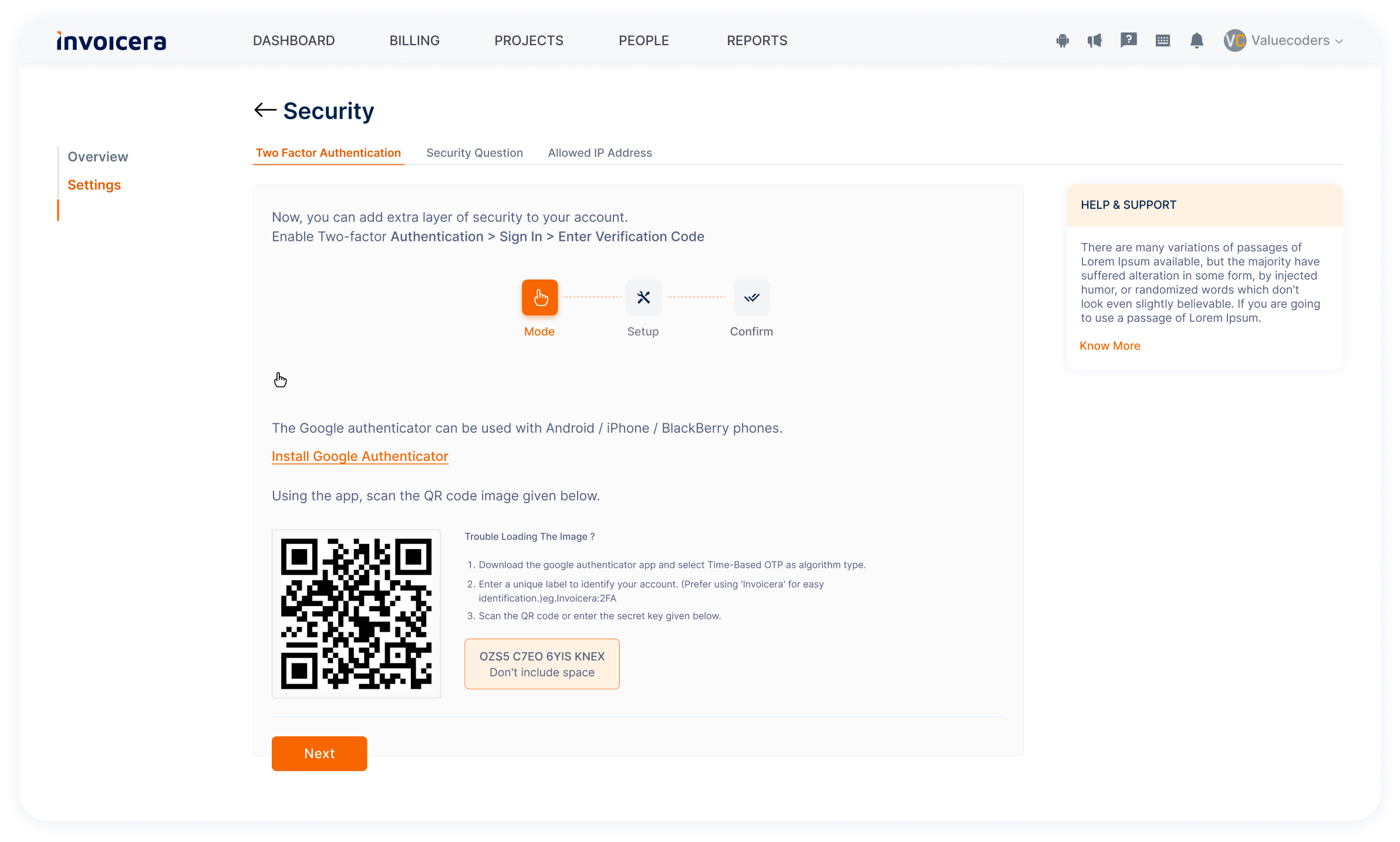

12. Data Security & Backups

Your data’s safety is our priority. Invoicera implements top-notch security measures to protect your sensitive financial information, providing peace of mind and reliability.

- Regular backups safeguard against potential data loss

- Implement security protocols for sensitive financial data protection

Invoicera Is Best Choice For

- Freelancers: Offering customizable invoicing and time tracking features.

- Small Businesses: Providing easy-to-use invoicing with recurring billing options.

- Mid-sized Enterprises: Needing a balance between invoicing and project management tools.

- Businesses Seeking Integration: Offering seamless integration with third-party systems for streamlined workflows.

- Global Operations: Supporting multi-currency and multi-lingual functionalities for businesses working internationally.

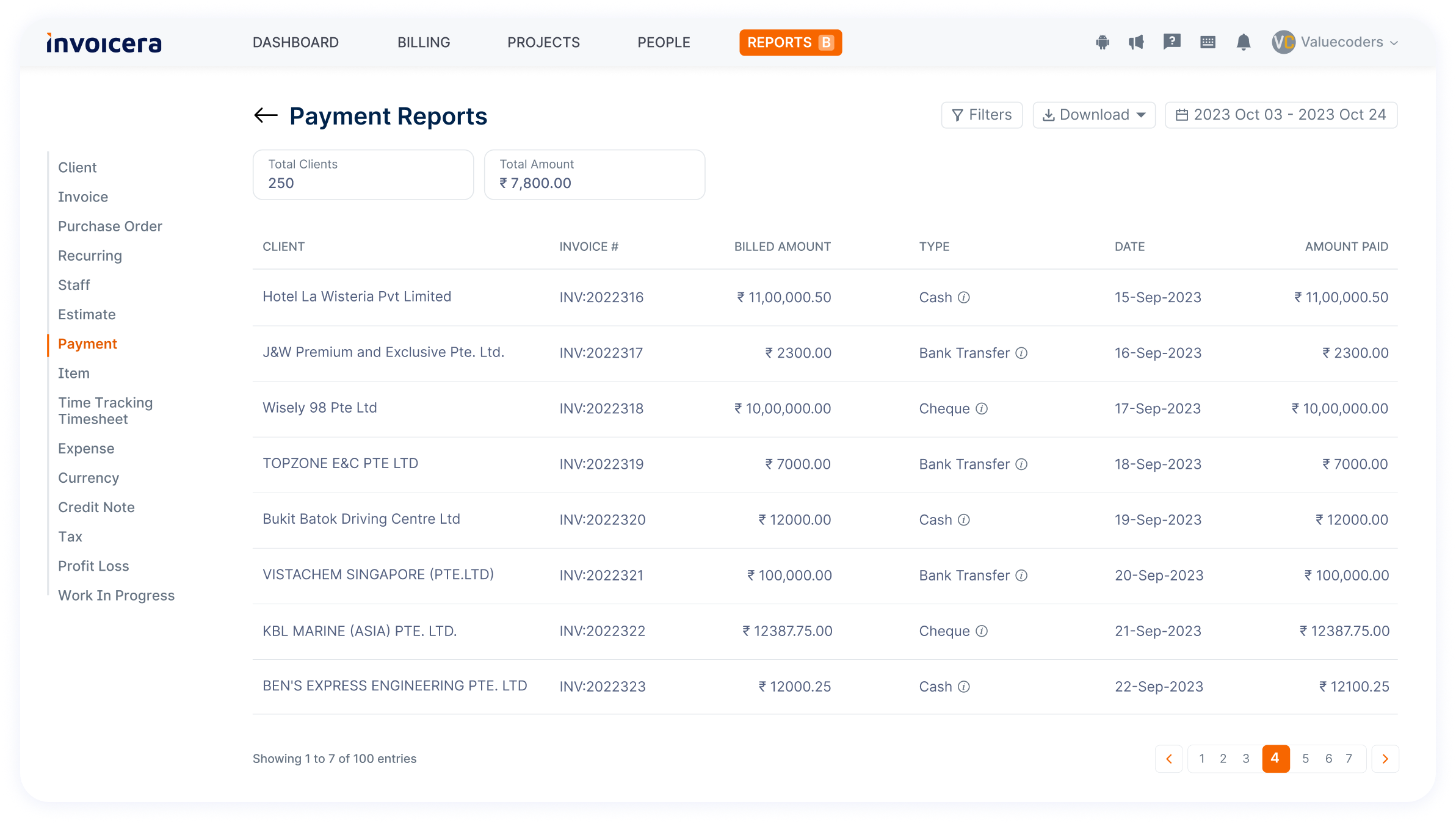

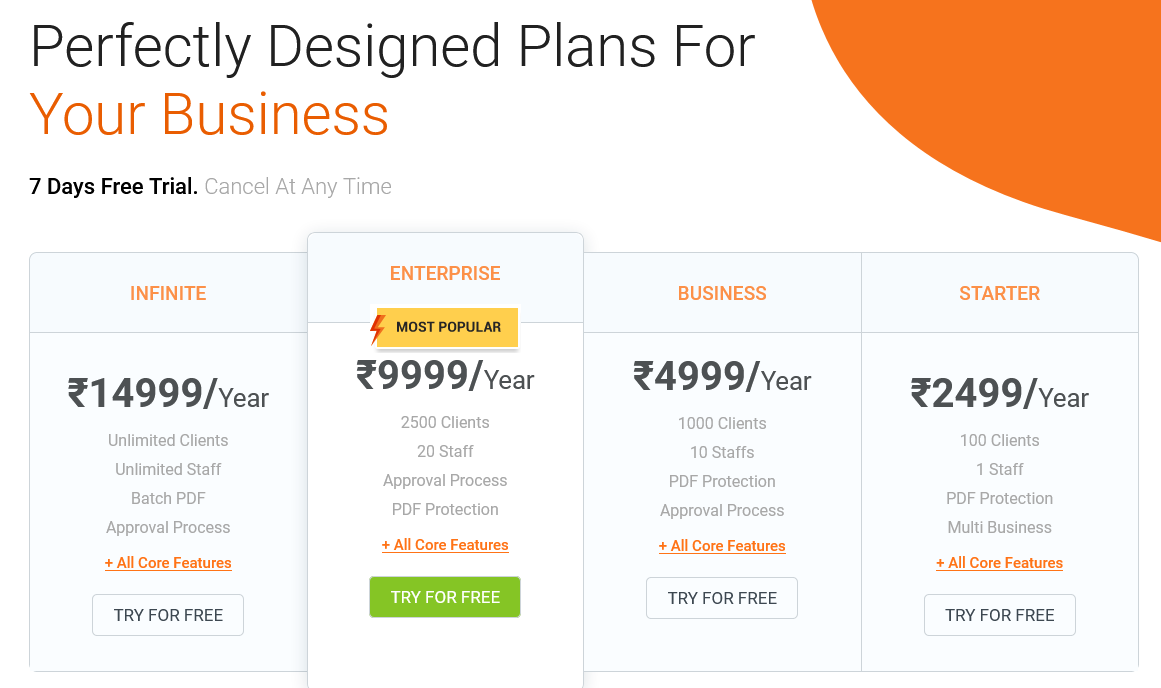

Pricing And Subscription Options

While Invoicera offers a free plan, its premium plans are competitively priced, ensuring businesses get value for their money.

- The ‘Infinite’plan offers everything unlimited at ₹14999/Year.

- The most famous ‘Enterprise’plan costs ₹9999/Year.

- Small and medium-sized businesses can choose a ‘Business’plan at ₹4999/Year.

- The ‘Starter’plan is for startups or small businesses at ₹2499/Year.

Pros And Cons

Pros

- User-Friendly Interface: Its intuitive design makes it easy for beginners and seasoned users.

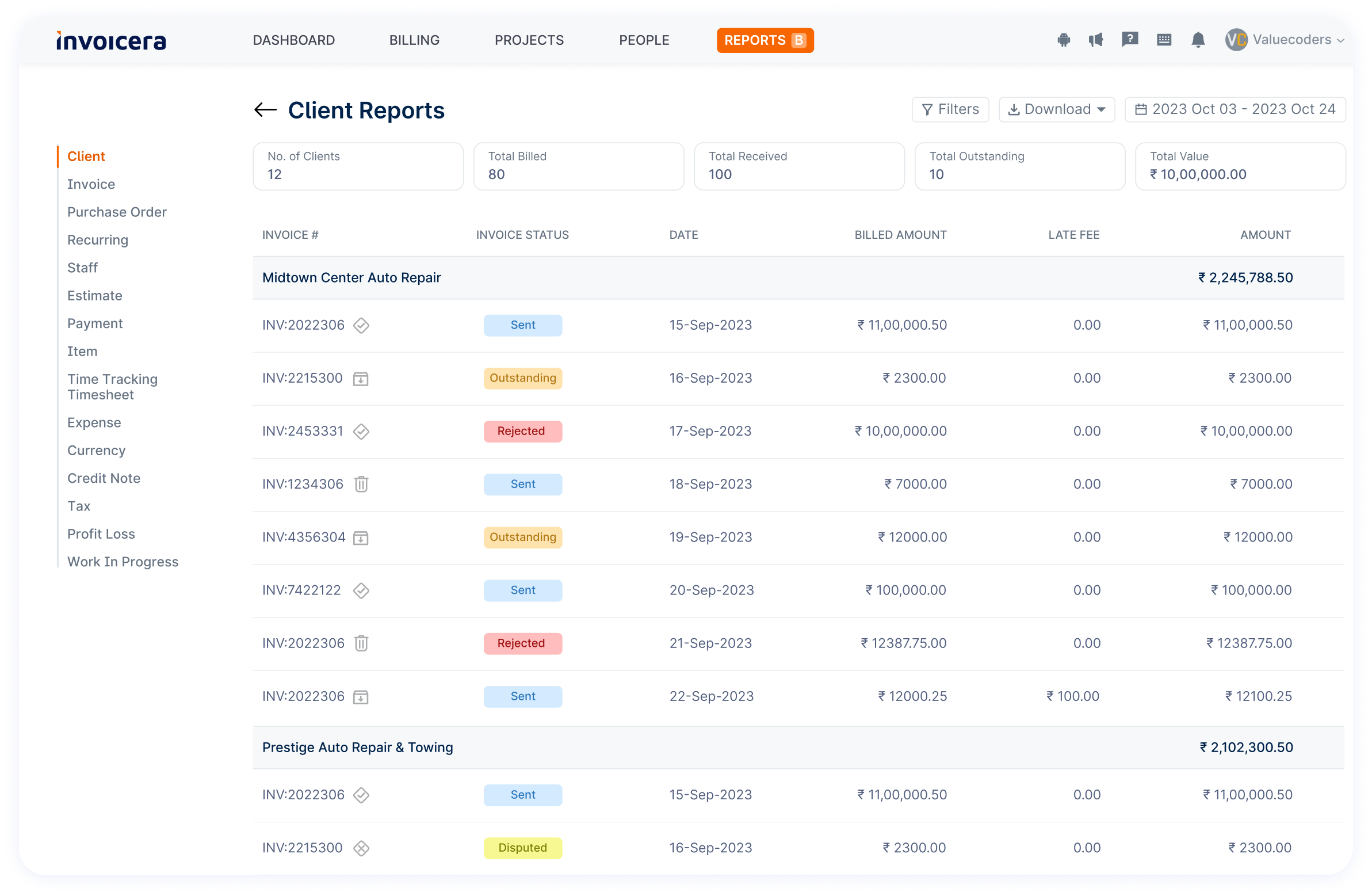

- Comprehensive Reporting: Gain deep insights into your finances through detailed reports.

- Automation Capabilities: Automate recurring invoices and payments, saving time and reducing errors.

Cons

- Customization Limitations: There might be restrictions in certain areas while offering customization.

NetSuite vs. QuickBooks vs. Invoicera

How To Choose The Right Invoicing Tool?

Choosing the right invoicing software can significantly impact your business efficiency and client relationships.

Here are key pointers to consider when selecting the ideal invoicing software:

1. Business Needs Assessment

- Identify Requirements: Pinpoint your specific needs. Are you focused on basic invoicing, or do you require additional features like expense tracking, project management, or recurring billing?

- Scalability: Consider your business’s growth trajectory. Will the software accommodate expansion and increasing invoicing demands?

2. Feature Suitability

- Customization: Look for software that allows you to personalize invoices, reports, and templates to reflect your brand.

- Automation: Check for automation capabilities, such as recurring invoices, payment reminders, and integration with payment gateways, to streamline processes.

3. User-Friendly Interface

- Ease of Use: Choose software that you and your team can navigate effortlessly. A user-friendly interface saves time and reduces the learning curve.

- Accessibility: Ensure it’s accessible across devices and platforms for flexibility in managing invoices on-the-go.

4. Integration and Compatibility

- Integration Potential: Consider software that integrates with your existing tools, like accounting software or CRM systems, to ensure seamless workflow.

- Compatibility: Ensure compatibility with various file formats and compatibility with different browsers or operating systems.

5. Security and Support

- Data Security: Verify the software’s security measures to protect sensitive financial information and client data.

- Support Services: Check for available customer support, including responsiveness, available channels, and helpful resources like tutorials or FAQs.

6. Cost and Value

- Pricing Structure: Understand the pricing model – whether it’s a subscription-based model, one-time purchase, or tiered plan. Compare it with the value and features offered.

- Return on Investment: Evaluate the potential benefits against the cost to ensure you’re getting a good return on investment.

Why Invoicera Is The Best Choice?

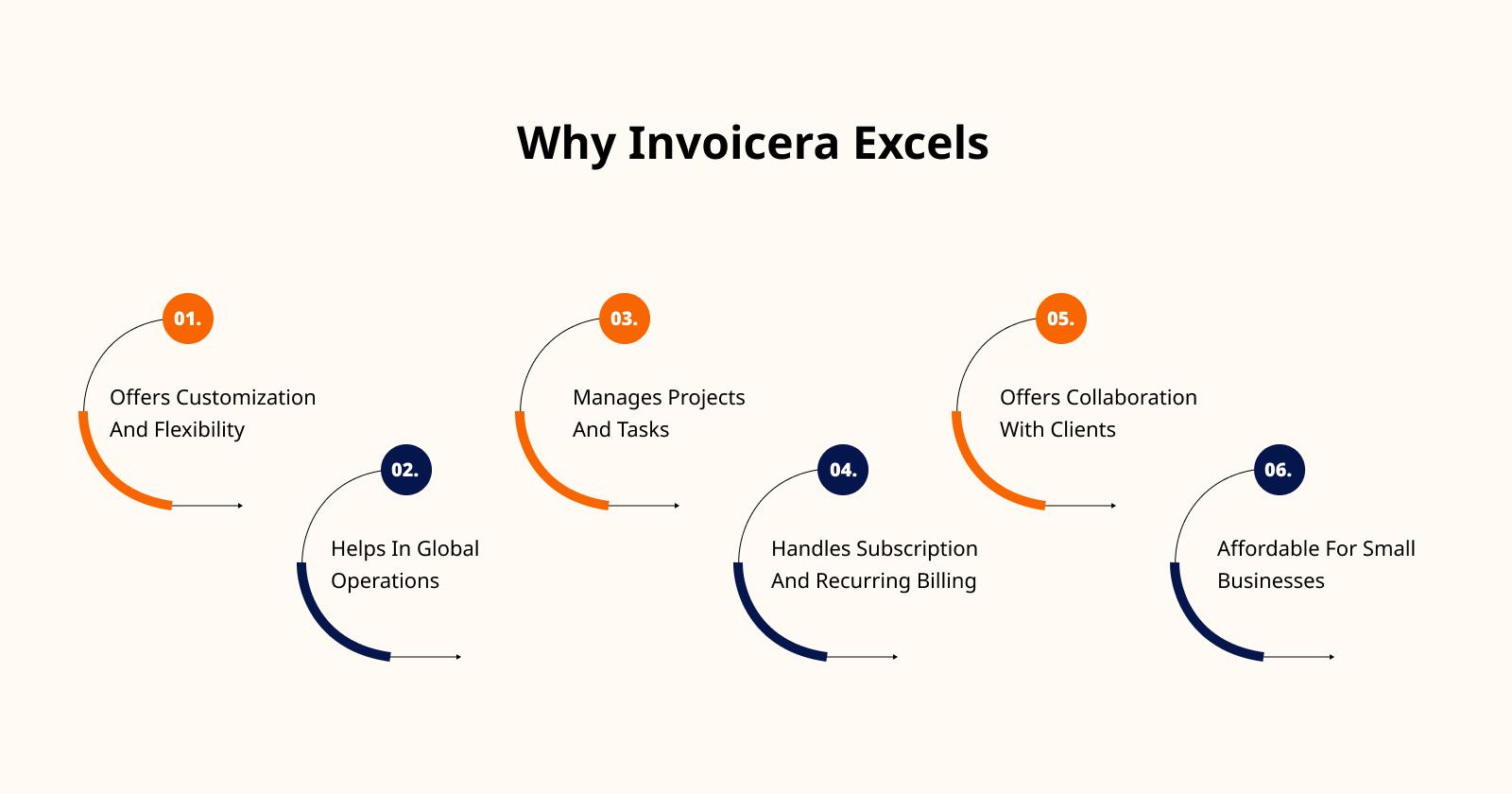

Offers Customization And Flexibility

Invoicera stands out by offering robust customization options, allowing businesses to tailor their invoices, reports, and workflows to match their unique branding and requirements.

Its flexibility enables seamless adaptation to diverse business needs.

Helps In Global Operations

With multi-currency and multilingual support, Invoicera simplifies global operations.

Businesses can effortlessly manage transactions and communicate with clients worldwide, overcoming currency and language barriers.

Manages Projects And Tasks

Invoicera goes beyond invoicing, integrating project and task management features.

It streamlines project workflows, tracks tasks, allocates resources, and converts billable hours into invoices, ensuring comprehensive project management.

Handles Subscription And Recurring Billing

For businesses relying on subscription-based services, Invoicera simplifies billing with automated recurring invoicing.

This feature efficiently manages subscription cycles, ensuring timely billing and reducing administrative burdens.

Offers Collaboration With Clients

Enabling seamless collaboration, Invoicera facilitates client engagement through a client portal.

Clients can access invoices, make payments, and communicate directly, fostering transparency and enhancing relationships.

Affordable For Small Businesses

Invoicera provides cost-effective solutions tailored for small businesses.

Its pricing structure is designed to offer essential features at accessible rates, making it an attractive option for startups and smaller enterprises seeking efficient invoicing and billing solutions.

Conclusion

The choices between NetSuite, QuickBooks, and Invoicera can be a puzzle. Each brings its strengths to the table, catering to different business needs and sizes.

- NetSuite is an all-inclusive solution for larger enterprises, offering a comprehensive suite covering ERP, CRM, and more on a unified platform. It’s a powerhouse for extensive scalability and integration across operations.

- QuickBooks stands out for its user-friendly interface and versatility, making it an excellent choice for small to medium-sized businesses. Its range of plans provides tailored solutions for varying needs, from basic accounting to more advanced features.

- Invoicera, on the other hand, focuses on efficient invoicing and billing solutions. It’s an excellent fit for businesses looking for customization, recurring billing, and project management features without the complexity of larger ERP systems.

As discussed in the criteria above, consider your business needs and budget and compare while making a choice for accounting software.

FAQs

Which software is best for a small business?

Invoicera is the choice of 4M+ users and is more suitable due to its user-friendly interface and affordable pricing plans.

Can these software options handle international transactions?

Yes, NetSuite, QuickBooks, and Invoicera all offer features like multi-currency support, enabling businesses to manage transactions globally.

Do these platforms offer mobile access?

Yes, all three platforms usually provide mobile apps or responsive designs, allowing users to access and manage their accounts on the go.