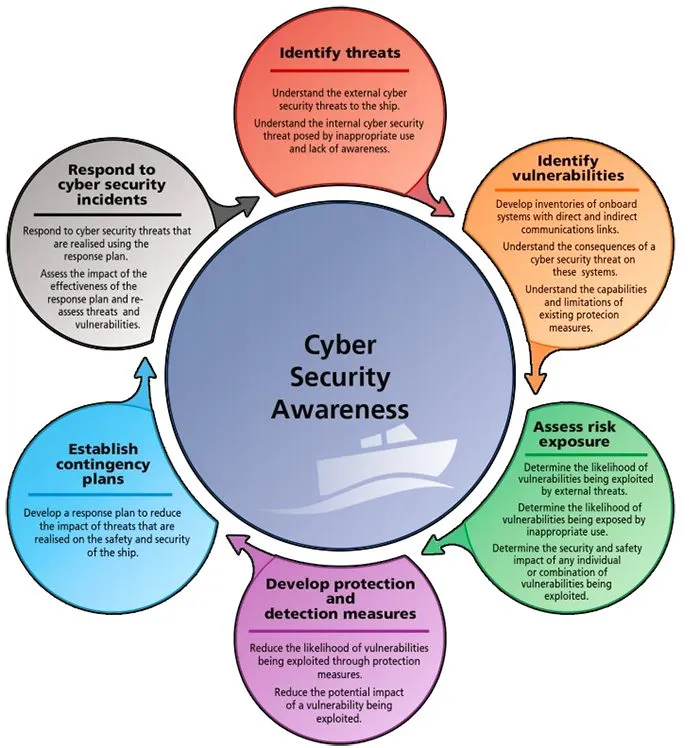

More than one-third of financial professionals proved the growing risks of fraud and cyber-attacks.

Heading into 2017, corporate treasury and finance professionals cite protecting assets, securing transactions and cybersecurity as top priorities. According to the recent survey of 350 financial professionals have heightened awareness of the growing risks of fraud and cyber attacks.

The transition to electronic receivables and payables can improve organizational efficiency and reduce costs in financial departments, but these moves do create additional organizational risks. There are numerous benefits to automating processes, companies need to work with a trusted partner that will provide tools and insights to help them to protect their transactions, data and company assets.

Also view : Accounts Payable Process Improvement Ideas

The transition to electronic payments today leads to 17% of the respondents have paper free receivables that changes to 69% in the near future.

According to the recent stats:

- – 47% of the respondents said that 1 to 2 years required to move most receivables from paper to electronic

- – 20% of the respondents said around 3 to 4 years to move receivables from paper to electronic.

Approximately two-fifths (42 %) of respondents believe that the biggest barrier to adopting paperless receivables is internal resistance to change the organization with the content process.

Other barriers include:

- – The lengthy transition time and required IT resources – 24%

- – Antiquated company infrastructures – 18%

- – The expense of implementation – 8%

The professionals have additional concerns including:

- – 30% of the strict regulatory environment

- – 20% of the organization adapt to faster payments

- – 15% impending interest rate hikes

In the next year, organizations plan to invest in cyber and fraud security protections (31%) and faster and integrated accounts payable capabilities (26%).

Invoicera offers unlimited features for secure, easy and fast invoicing process.

Here comes the comprehensive list of online payment gateways that integrate with Invoicera.

- – Integration with International Payment Gateways (Forte, PayGate, SagePay, Eway, Ogone, BluePay, Network, 2checkout)

- – Integration with US/Canada Payment Gateways (Alipay, FirstData, Psigate, Beanstream, Moneris)

- – Integration with Indian Payment Gateways (Razorpay, Paydollar, Citrus, PayU India)

Therefore automation of receivables is worth the investment saving companies both time and money for a long haul.

Interested: Try For Free