Introduction

Well, you are a CEO and you always have a lot of things to do in your company. You require an efficient system for bills and payments to run your business and you like to get rid of conventional methods. You’re already using Bill.com!

But what if there was another tool that was more productive and efficient? An excellent solution that will help to organize your finances, automate payment processes, and provide you with absolute control over your expenses?

While Bill.com is a popular choice, it’s not the only game in town. This blog explores the potential downsides of Bill.com and offers you an exclusive list of ten Bill.com alternatives that you might have been searching for.

Potential Downsides of Bill.com

Many users have reported a few common pain points, which has resulted in finding alternatives to Bill.com. Below are a few downsides:

1. Smaller Business Focus

While the Bill.com platform is suitable for small companies, it may not offer some additional functionalities that larger enterprises may prefer to have.

2. Payment Processing Delays

There have been instances where payments have passed through Bill.com late, causing frustration and possibly monetary issues.

3. Customer Support Struggles

A few of the users have conveyed displeasure towards their customer support, claiming that they do not respond quickly enough and do not help with the problems encountered.

4. Limited Accounting Functionality

Bill.com is definitely helpful when it comes to tracking bills and payments, but it is not an all-inclusive accounting software. It does not deal with inventory tracking, employee payroll etc.

5. Price Tag

When it comes to pricing strategies, Bill has relatively affordable offers, but sometimes, users may complain that the price is slightly higher compared to other similar services.

It’s important to remember that every business has different needs, so these drawbacks might not be dealbreakers for everyone. However, it’s wise to be aware of these potential challenges before committing to Bill.com.

Top 10 Bill.com Alternatives

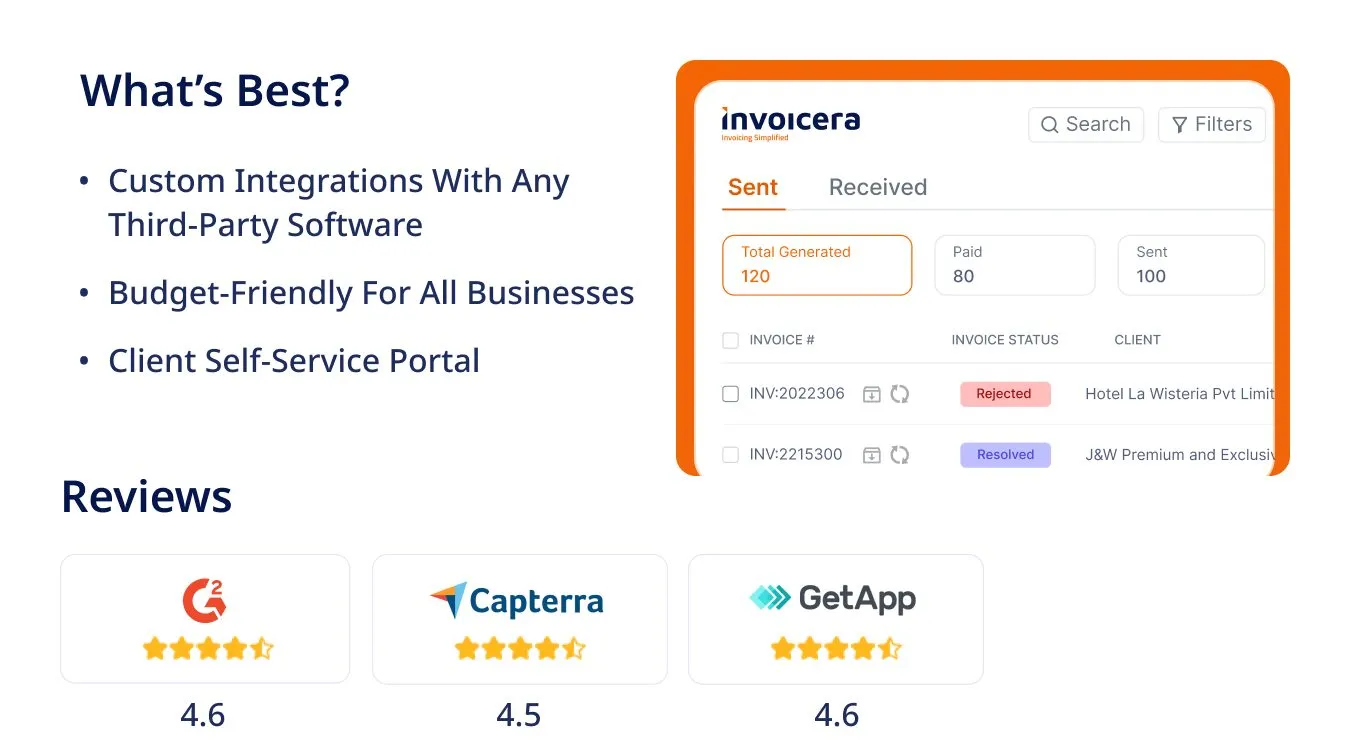

1. Invoicera

Invoicera is a powerful invoicing and billing platform that goes beyond basic invoicing, offering a wide range of features to help businesses manage their finances more efficiently.

Key Features

✅Automated Invoicing: Automate the creation of invoices at fixed intervals and monitor payments in real time.

✅Automated Reminders: Automate the sending of reminders to customers with overdue invoices.

✅Custom Templates: Create professional invoices that are consistent with your brand identity by using templates for invoices.

✅e-Way Bill: Create and track e-Way bills for transportation of goods within India. This feature makes it easier to process and check the Indian tax laws to avoid any legal challenges.

✅Vendor & Purchase Order Management: Store vendor details and enable purchase orders to be tracked easily, which is very useful when it comes to control of expenses.

✅Workflows: Centralize your invoice approval workflows and work with multiple approval steps within your invoicing automation.

✅Invoice Taxation: Automate tax calculations and application to your invoices, guaranteeing compliance with a wide range of tax laws.

✅Client Portal: Your clients are able to access their invoices, make payments, and overall account information in a secure way.

Advantages

- Invoicera’s automation is beneficial for time and cost savings.

- With automated reminders and a user-friendly client portal, you can significantly improve your payment collection rates.

- Invoicera has great security features, such as making backups of data and maintaining an audit trail to secure your information.

Limitations

- The free plan is quite limited, and you will have to upgrade your account to access every feature.

Pricing

Invoicera has different types of price tiers to enable it suit the needs of various businesses. The pricing begins with the Free plan with paid plans starting at $15 to $119 per month based on the features and number of users.

2. Tipalti

If you are looking for a tool that is perfect for global billing and can handle international payments, you should go for Tipalti. This is specifically designed to address automating accounts payable and simplify the management of global suppliers.

Key Features

✅Automated Invoice Processing: One of Tipalti’s features is that it uses artificial intelligence to read through invoices and enter relevant data automatically.

✅Supplier Management: Tipalti also has a supplier portal through which suppliers can input their own data and monitor payment status.

✅Tax Compliance: Tax forms collection, validation and withholding calculations are some of the areas where Tipalti has integrated automation to ease tax compliance.

✅Global Payments: Some of the payment options for the vendors include a wire transfer, ACH payment, domestic payment, foreign payment, payment by check, and payment by card.

✅Automated Workflows: Tipalti streamlines the approval process and payment processing.

Advantages

- Best for global businesses with a focus on compliance

- Flexible pricing plans that suit your needs

Limitations

- Expensive for small businesses with a low volume of payments

- User interface may not be friendly

- Limited customization options

Pricing

Tipalti’s pricing starts at $129 per month, with advanced offerings available for larger businesses.

3. Paycove

Paycove is an all-in-one invoicing CRM that aims to help make quoting, invoicing, and getting paid as easy as possible. Not only is it an invoicing solution, but Paycove is also an accounts receivable management system that includes detailed estimates. With splendid automation and flexibility, Paycove is worth trying out for business with a complex system of payment.

Key Features

✅Estimates & Quotes: With the help of Paycove’s quote builder, you can create accurate and professional quotes with custom pricing structures and automated calculations as well as e-signatures.

✅Invoice Automation: You can create invoices from approved estimates using the easy-to-use, customizable invoice generator.

✅Payment Options: You can provide your customers with multiple payment methods, such as accepting online payments via integrating Stripe, EMI payments, accepting deposits, and customizing payment timelines.

✅Reporting & Analytics: You get real-time insights into your accounts receivable with detailed reports, automated aging reports, and customizable dashboards.

✅Integrations: With Paycove, organizations can easily connect with various business apps such as HubSpot, QuickBooks, and Stripe, thus saving time and effort.

Advantages

- Streamlines billing and payment processes

- Gives you more control over your A/R

- Offers flexible payment options to your customers

- Integrates with popular business tools

- Provides valuable real-time insights

Limitations

- Lacks features like expense management

- Pricing isn’t publicly available

Pricing

Plans start at $99 per month. You need to contact Paycove to get detailed pricing information.

4. Freshbooks

FreshBooks is a leading cloud-based solution for small companies who want to integrate their accounting services. Another advantage is its simplicity and comprehensible navigation, which could be a good replacement for Bill.com. FreshBooks allows invoice tracking, expense management, and time tracking if you work on an hourly basis.

Key Features

✅Invoicing & Quoting: Prepare and dispatch high-quality invoices and quote documents to the clients within a few minutes. You can also design them to have your logo included in the design for a professional appearance.

✅Expense Tracking: Prepare and dispatch high-quality invoices and quote documents to the clients within a few minutes. You can also design them to have your logo included in the design for a professional appearance.

✅Payment Collection: With Freshbooks, you can get your money faster with many different integrated payment gateways for your client’s convenience. You can also use automated messages to remind your clients to make their payments on time.

✅Accounting Reports: You may obtain detailed reports that can help you monitor your business’s financial performance in a better way.

✅Time Tracking: Record your hours and bill for services on an hourly basis. This is particularly beneficial if you operate on an hourly basis for different projects.

Advantages

- Easy to use and navigate, even for beginners

- Comprehensive features for small businesses

- Affordable pricing plans

Limitations

- Limited features for large businesses

Pricing

FreshBooks has several plans for users, and the basic plan starts at $19 per month. You can talk to a FreshBooks specialist, who can assist you in selecting the best plan for your enterprise.

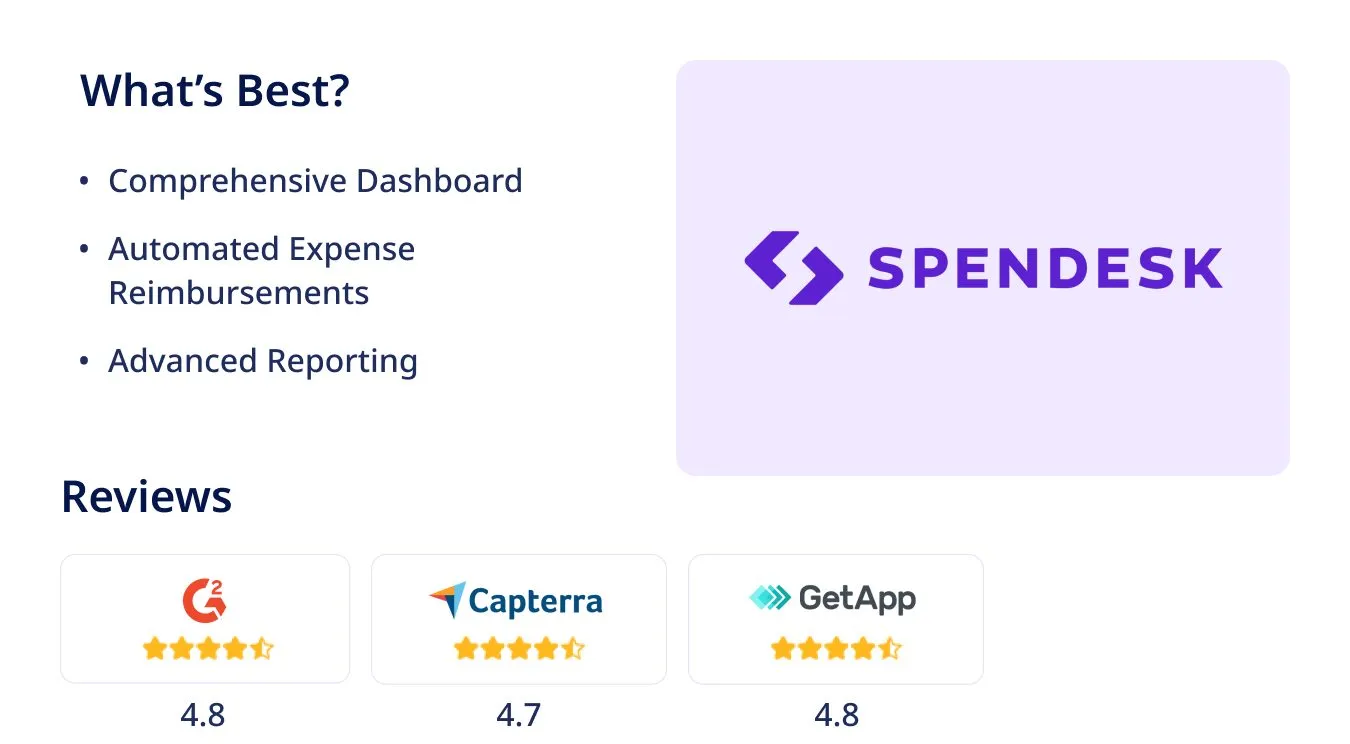

5. Spendesk

Spendesk might be a good choice if you want a tool to help control your business costs and are looking for something different from Bill.com. It’s a strong system that shows all your spending in one place and helps you manage money better. Spendesk offers:

- Digital cards

- Easy expense paybacks

- Clear reports

It’s like seven tools in one, helping you spend money wisely.

Key Features

✅Virtual Cards: Spendesk lets you make digital cards for your workers, making it easy to track spending and control budgets.

✅Easy Approvals: Spendesk makes the approval process for costs and bills quick, improving workflow and saving time.

✅Cost Claims Handling: Handle cost claims easily with Spendesk. It makes it simpler to send in, approve, and track cost reports.

✅Spend Request Handling: Control spending from the start by managing spend requests, making it easier to stay within budget.

✅Phone App: The Spendesk phone app lets workers take pictures of receipts right away, with quick paybacks.

Advantages

- Easy-to-use user interface

- Integrates and automatically synchronizes transactions and receipts with ERPs and accounting systems.

- Scalable and flexible to support business growth

- Replaces multiple accounting and spend management tools and processes with a single solution.

Limitations

- Pricing can be a barrier for some businesses, as it’s based on a customized quote.

Pricing

Spendesk charges a set fee for using the platform and extra costs based on how many times you use it. Contact their team for a price made just for you.

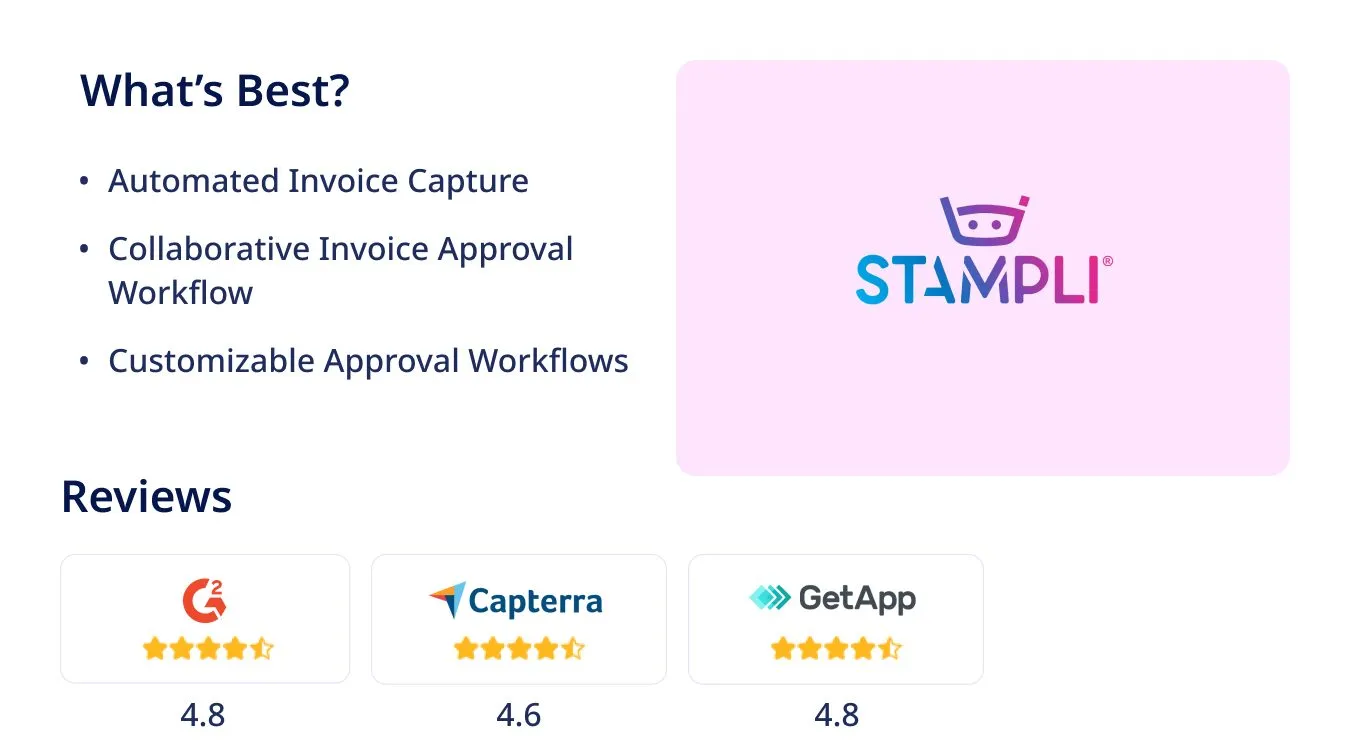

6. Stampli

Stampli is a good choice instead of Bill.com if you want a more advanced bill handling tool with smart computer features. It can help you make bill handling faster, make approvals automatic, and see your money info right away.

Key Features

✅Integrated AP-related Communications: Easily communicate with vendors and employees within the platform.

✅Accounts Payable Automation: You can automate as many of your AP processes as possible, including invoice receipt and payment.

✅AI-powered Workflows: Integrate the use of artificial intelligence and machine learning to enhance the performance of tasks in the AP processes.

✅ERP Integrations: Stampli connects with more than 70 ERPs, including Quickbooks, Sage CCM, Oracle NetSuite, and Workday.

Advantages

- Seamless ERP integrations

- User-friendly dashboard

- Quick and secure invoice payments

- Easy setup and implementation

Limitations

- It may be more expensive compared to some other AP automation solutions.

- While integrations with popular ERP systems are available, some integrations may not be real-time.

Pricing

You need to request a quote to get to know about their pricing tiers.

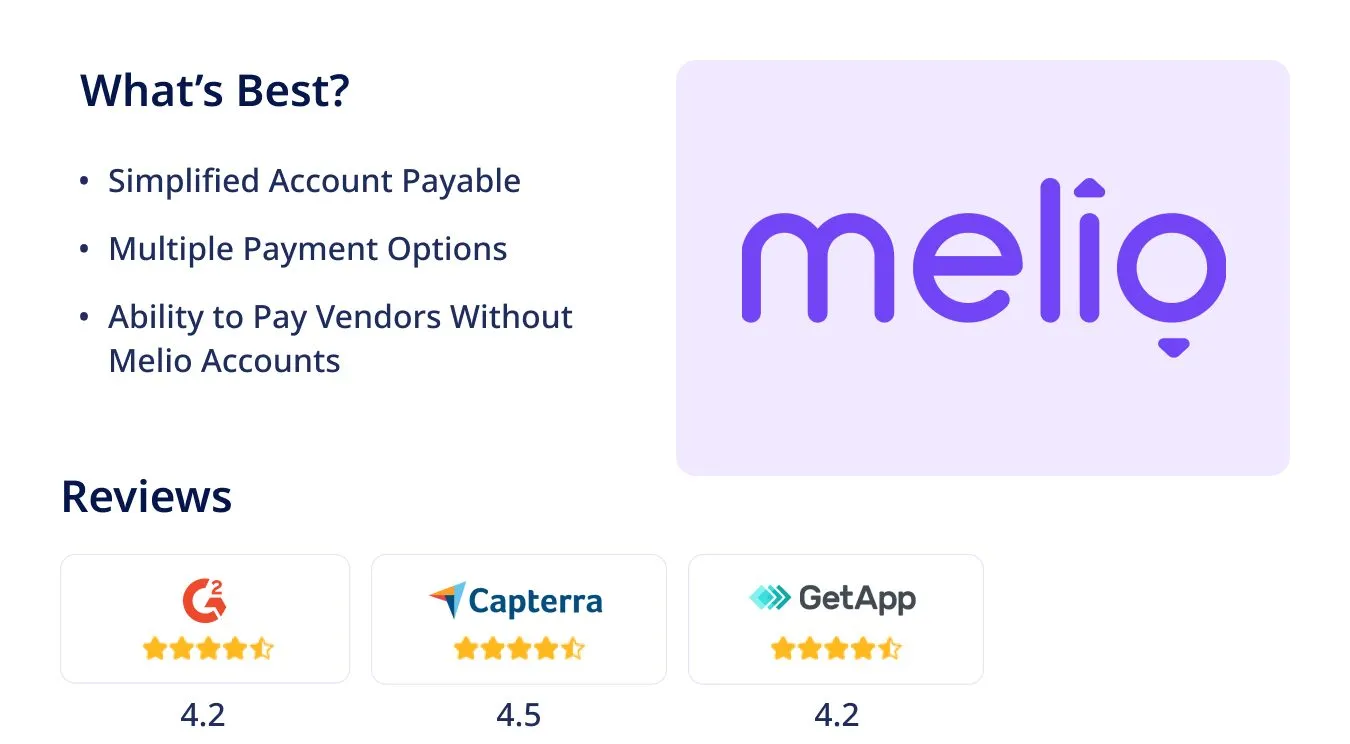

7. Melio

Melio is a good substitute for Bill.com, especially if you are an SMB looking for a cost-effective yet powerful solution to manage your accounts payable and receivable. Melio helps streamline your finances through different payment methods, bill capturing, and the ability to pay your vendors using Melio even if they don’t have a Melio account.

Key Features

✅Vendor Management: Melio helps you keep track of vendor info and payments, helping you stay orderly and pay on time.

✅Bill Management: Melio makes bill capturing automatic, helping you deal with bills easily and track your costs.

✅Payment Collection: Melio makes it easy to get payments from customers by sending and tracking bills, helping you get paid quickly.

✅Accounting Reports: Melio gives you different reports to help you watch your finances and make smart business choices.

Advantages

- Uses AI to automate bill capture, making invoice processing easier

- Convenient and flexible payment methods

- Supports international payments to over 80 countries

- Free for basic services

Limitations

- Features might be insufficient for large or rapidly growing organizations.

Pricing

Melio’s basic services are free, but there are fees for features like transfers and international payments.

- ACH bank transfer and the first two checks per month are free.

- Instant transfers and fast ACH bank transfers incur a 1% fee.

- Fast checks and international payments carry a charge of $20 each.

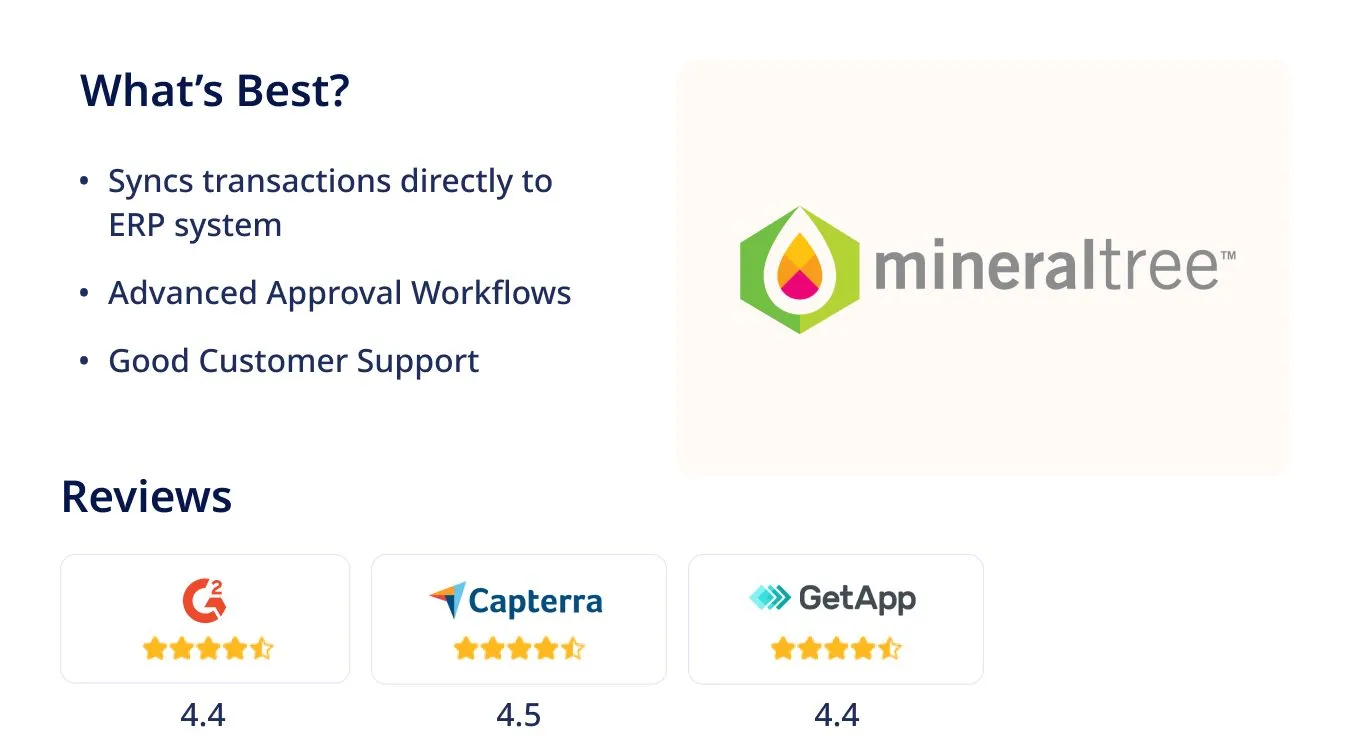

8. Mineral Tree

If you’re looking for a Bill.com alternative that’s all about automating your accounts payable (AP) processes, MineralTree is worth considering. It’s a powerful solution that integrates with a wide range of enterprise resource planning systems, making it a good fit for companies of all sizes.

Key Features

✅Real-Time Dashboards: Get a clear picture of your AP process with real-time dashboards that display key insights like payment mix, cash flow, and overall AP performance.

✅Secure Virtual Cards: MineralTree’s virtual cards provide a more secure way to make payments to vendors. You can pre-load them with specific amounts based on your vendor agreements.

✅Invoice Data Capture: MineralTree simplifies invoice data entry with automated capture capabilities. It uses AI and optical character recognition (OCR) to extract data from invoices and automatically populate fields in your system.

✅Vendor Management: MineralTree helps you manage your vendor relationships effectively. You can create vendor profiles, track payment history, and communicate with vendors through the platform.

✅Reporting and Analytics: Get detailed insights about your AP performance with customizable reports and analytics. You can track key metrics like payment cycle time, invoice volume, and approval times.

Advantages

- Streamlines AP processes

- Improved visibility with Real-time dashboards

- Virtual cards provide a secure way to make payments and help reduce fraud risk.

Limitations

- MineralTree charges licensing fees in addition to transaction fees and fees based on payment and invoice volume.

- Robust features might be overkill for smaller businesses with simpler AP needs.

Pricing

MineralTree’s pricing structure involves a licensing fee, transaction fees, and fees based on the volume of payments and invoices processed. You’ll need to contact them directly for a customized quote.

9. Happay

Happay has been a strong Bill.com competitor since 2012, focusing on making expense management and corporate travel booking easier for businesses of all sizes. It’s a good option if you’re looking to replace outdated systems with a more modern solution.

Key Features

✅Prevention of Duplicate Bills: Upload bills in bulk, and Happay’s AutoMerge feature will consolidate duplicate bills, saving you time and effort.

✅Rich Spend Analytics: Get a deeper understanding of your spending with Happay’s detailed analytics. You can create customized reports to track trends, identify spending patterns, and make informed decisions.

✅Pre-Paid Cards: Happay offers pre-paid cards for employees that can be used for both business and personal expenses, allowing for easy tracking and reporting.

Advantages

- Automates expense capture, reporting, and approval processes

- Makes booking business travel efficient and compliant

- Rich analytics tools help you track spending

Limitations

- Pricing information is not readily available on its website. You’ll need to contact them directly for a quote.

- While Happay integrates with Uber, it might not have as wide a range of integrations with other third-party tools as some competitors.

Pricing

Happay’s pricing is not publicly available. Contact them directly for a quote matching your needs.

10. Mesh Payments

Mesh Payments is a great alternative to Bill.com, especially if you’re looking for a free plan and have a lot of international business. It’s more than just an invoicing and payment solution – Mesh offers a complete spend management suite, including features for travel, SaaS subscriptions, and even procurement.

Key Features

✅Travel Management: Mesh’s travel management features let you control spending, book flights, and hotels, and get real-time visibility into your travel budget.

✅SaaS Spend Management: Mesh helps you manage all your SaaS subscriptions from one place, allowing you to track spending, automate payments, and get insights into your SaaS usage.

✅Expense Management: Mesh’s expense management tool allows you to easily track, categorize, and approve expenses. It helps you reconcile transactions quickly and get real-time insights into your spending.

✅Multi-Subsidiary Workflows: You can manage receipts, categorize expenses, and reconcile transactions across multiple subsidiaries.

✅Virtual Cards: Mesh offers virtual corporate cards that help you control employee spending and track expenses easily.

✅Accounting Automation: Mesh can help you automate your accounting processes, from receipt collection to syncing transactions with your ERP system.

Advantages

- Free Plan perfect for small businesses

- Comprehensive Spend Management

- Global Reach

Limitations

- Enterprise plan pricing is not publicly available.

- Mesh might not be the best choice for businesses that don’t need a full-fledged spend management solution.

Pricing

Mesh offers three plans: Pro, Premium, and Enterprise. The Pro plan is free, while the Premium plan costs $10 per user per month. The pricing for the Enterprise plan is customized based on the business’s specific needs.

Conclusion

As a CEO or founder, finding the right financial management tool is crucial for your business’s success. While Bill.com has been a popular choice, it’s clear that there are many powerful alternatives available.

From Invoicera’s custom integrations to Mesh Payments’ comprehensive spend management suite, each option offers unique features to address different business needs.

When choosing an alternative, consider your company’s size, international presence, and specific requirements. Whether you need advanced invoice automation, global payment capabilities, or robust expense tracking, there’s likely a solution that fits your needs perfectly.

By exploring these alternatives, you can find a tool that not only replaces Bill.com but potentially offers even more value to your business.

Remember, the right financial management solution can save you time, reduce errors, and provide valuable insights into your company’s finances.

Take the time to evaluate these options, and don’t hesitate to request demos or trials before making your decision. With the right tool in place, you’ll be well-equipped to streamline your financial processes and focus on growing your business.

FAQs

Can I migrate my existing data from Bill.com to one of these new platforms?

Most of these alternatives offer data migration services or tools to help you transfer your existing data from Bill.com. The process and ease of migration can vary between platforms. It’s advisable to discuss data migration options with the sales or support team of the alternative you’re considering before making a switch.

What kind of customer support can I expect from these Bill.com alternatives?

Customer support offerings vary among these alternatives, but most provide multiple support channels such as email, phone, and live chat. Some offer dedicated account managers for higher-tier plans. It’s worth noting that several of these alternatives, like Invoicera and Stampli, have received positive reviews for their customer support.

Are there any mobile apps available for these alternatives, and how do they compare to Bill.com’s mobile offering?

Many of these alternatives offer mobile apps for both iOS and Android, allowing you to manage your finances on the go. Apps like Invoicera, FreshBooks, and Spendesk are known for their user-friendly mobile interfaces. While features can vary, most mobile apps allow for basic functions like invoice creation, expense tracking, and payment approvals. We recommend you to view the app store ratings and reviews before you make a final choice.

Invoicera has a rating of 4.8, which makes it a good choice as an alternative to bill.com.