Looking for cost-effective FreshBooks alternatives?

Although FreshBooks has been a choice for many, it is always better to get software within your budget.

A study has also found that over 40% of small businesses switch their financial software within the first two years.

Thus, many invoicing software options are available in the vast market. We have listed 10 FreshBooks alternatives for you.

These offer features similar to FreshBooks and are also cost-effective.

Whether you’re a budding entrepreneur seeking simplicity or an established business aiming for scalability, these alternatives might be the transformative leap you’ve been searching for.

Let’s get started.

What Is FreshBooks?

FreshBooks is a renowned cloud-based accounting software that simplifies invoicing, expense tracking, and financial management for freelancers, small businesses, and entrepreneurs.

With its user-friendly interface &robust features, FreshBooks has become a go-to solution for many professionals aiming to streamline their financial processes.

“FreshBooks offers intuitive tools that make accounting tasks less daunting, allowing users to focus more on their core business activities.” – Accounting Today

This platform offers functionalities like invoice customization, time tracking, expense categorization, and insightful reporting.

Its accessibility across various devices and integration capabilities with other business tools make it a top choice for managing finances efficiently.

Why Need FreshBooks Alternative?

While FreshBooks is an excellent accounting solution, there are scenarios where exploring alternatives becomes necessary for businesses and individuals seeking specific features, pricing structures, or integration possibilities.

- Diverse Feature Requirements: Sometimes, users may require more advanced features or functionalities that FreshBooks might not entirely cater to. For instance, a need for complex project management tools or inventory tracking might prompt the search for alternatives.

- Cost Considerations: Cost-effectiveness is a critical factor for many businesses. While FreshBooks offers quality services, its pricing structure might not align with everyone’s budget.

- Integration and Scalability: Growing businesses might require software that seamlessly integrates with a broader range of tools or offers scalability options as their operations grow.

- Customer Support and User Experience: Superior customer support and a user-friendly interface are vital for efficient software usage. Some might seek alternatives for better support or a more intuitive experience.

What To Look For In FreshBooks Alternatives?

When exploring alternatives to FreshBooks, it’s essential to consider several key aspects that align with your business needs and requirements:

User-Friendly Interface: Look for invoicing solutions that offer a similar intuitive interface to FreshBooks. Opt for software that simplifies the invoicing process and is easy to navigate for you and your team.

Feature Set: Ensure the alternative invoicing solutions offer a feature set akin to FreshBooks. Seek platforms that cover essential aspects like time tracking, expense management, and customizable invoice templates.

Affordability: Cost-effectiveness is crucial. Compare the pricing structures of various billing software options. Some may offer similar functionalities to FreshBooks at a more budget-friendly rate.

Scalability: Consider your business’s growth potential. A suitable alternative should accommodate your expanding needs, providing scalability without significant disruptions to your workflow.

Integration Capabilities: Look for solutions that integrate seamlessly with your existing tools and software. This ensures a smooth transition without interrupting your current processes.

Customer Support: Assess the customer support provided by these alternatives. Reliable support can be crucial in addressing issues or queries promptly, and minimizing downtime.

Security Measures: Prioritize platforms that guarantee data security and privacy. Look for encryption protocols and compliance with industry standards to safeguard sensitive information.

10 Alternatives To FreshBooks

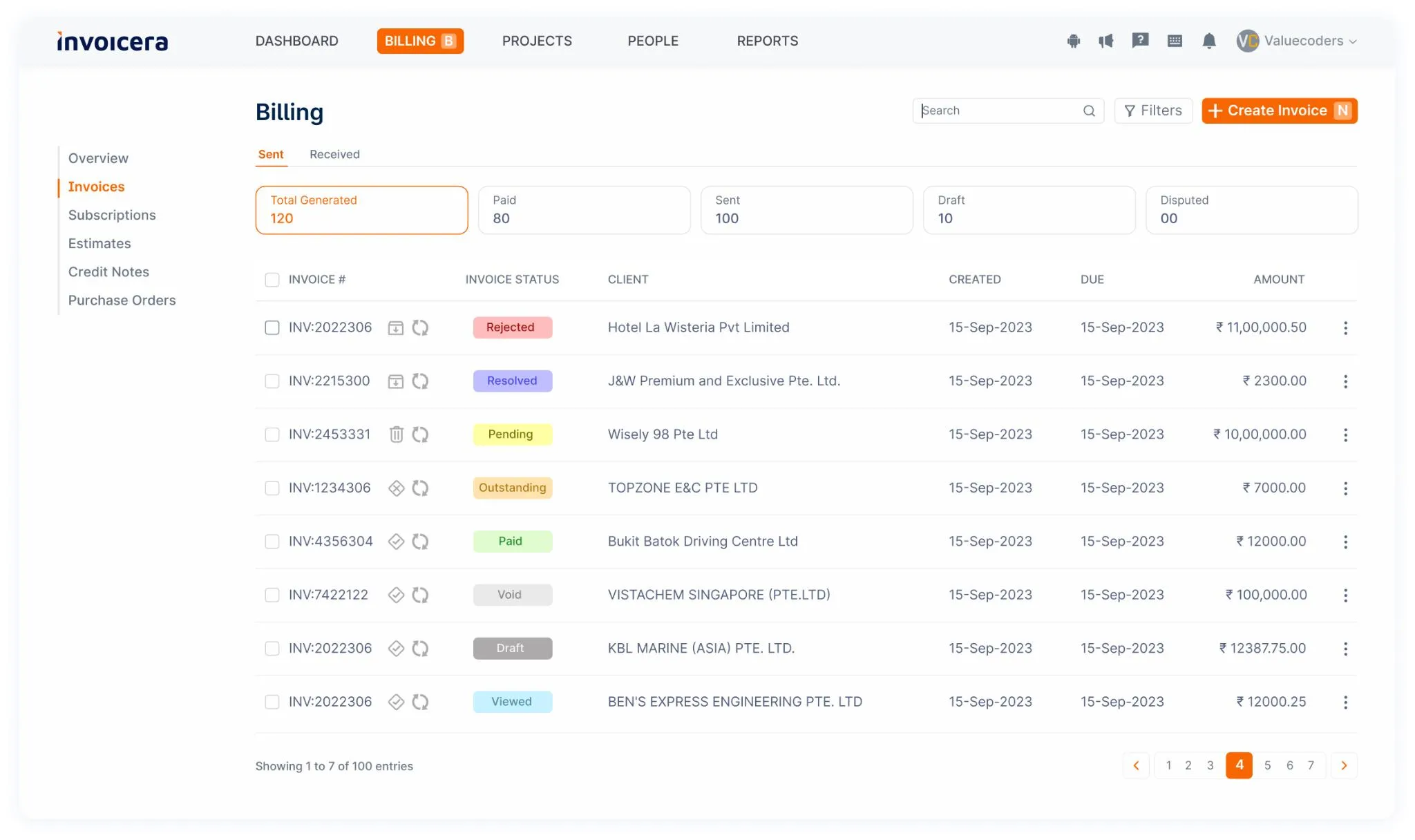

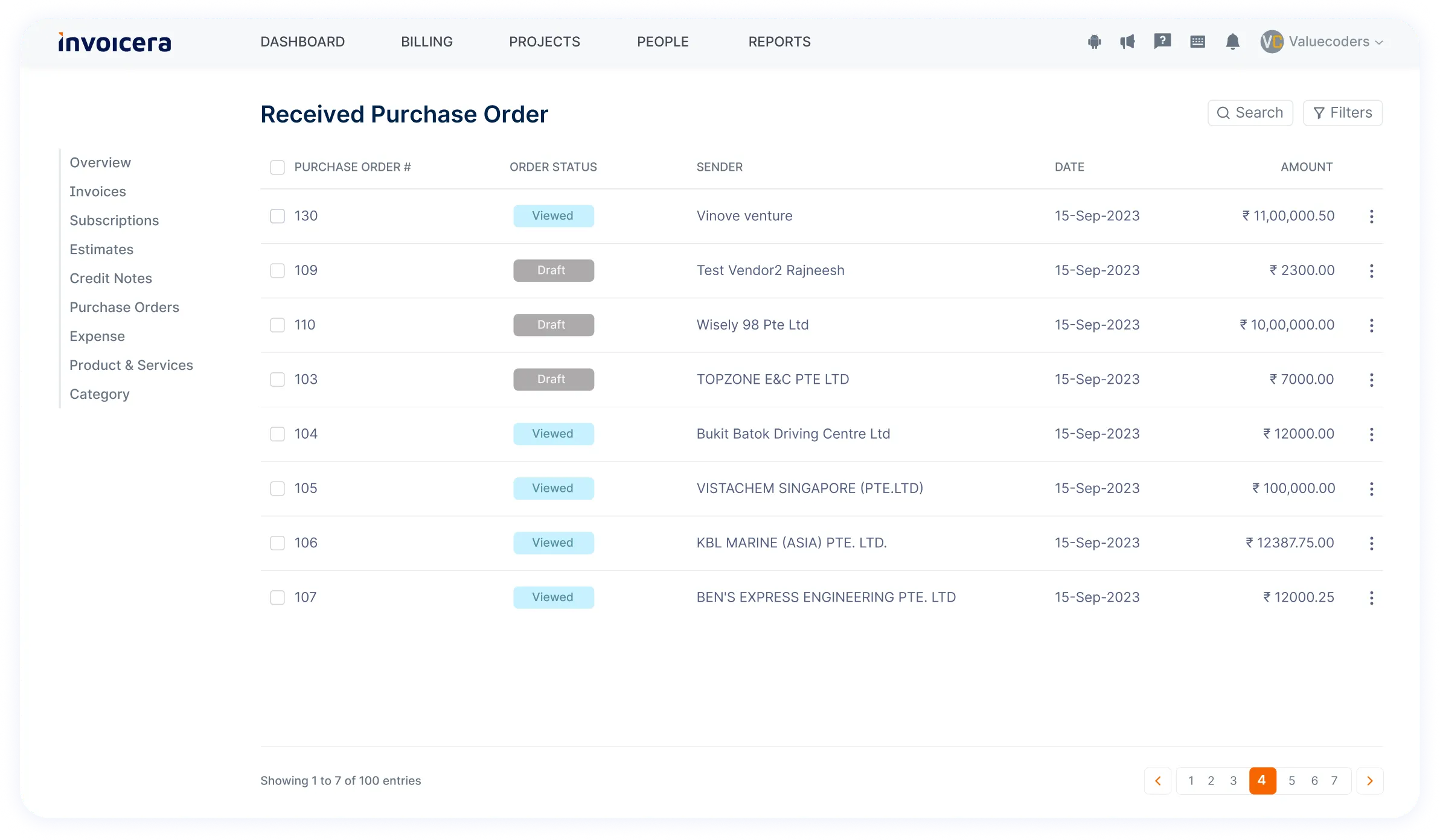

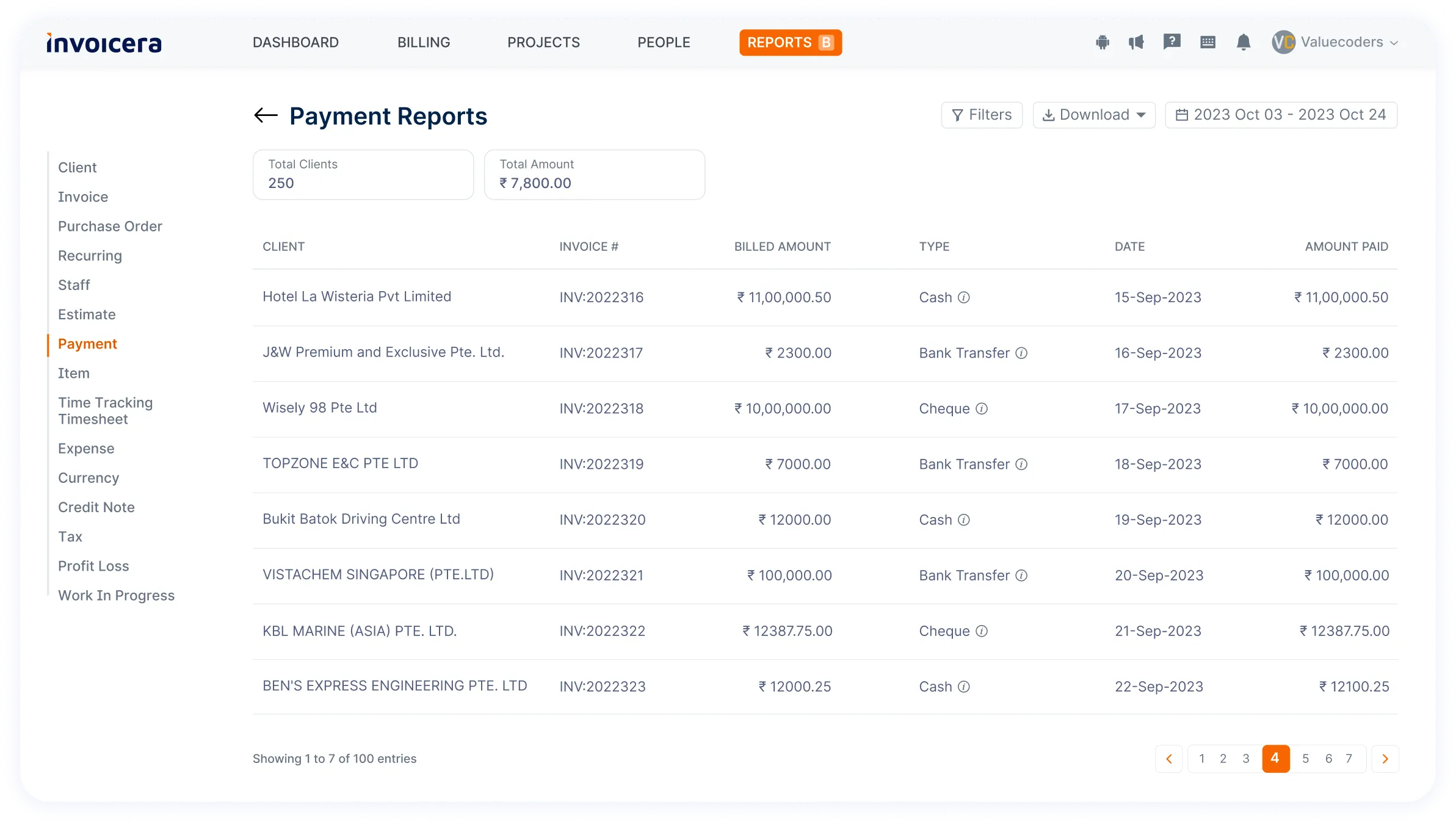

1. Invoicera

Invoicera is a great finance and accounting software option for freelancers and enterprises. It enables faster billing, time tracking, and easy payments.

You can get customizable software solutions according to the scope and size of your business.

Features

- Online Invoicing: Invoicera empowers you to showcase your brand with personalized templates, setting your invoices apart. With detailed line items, it ensures transparent and professional billing, reflecting your brand identity effortlessly.

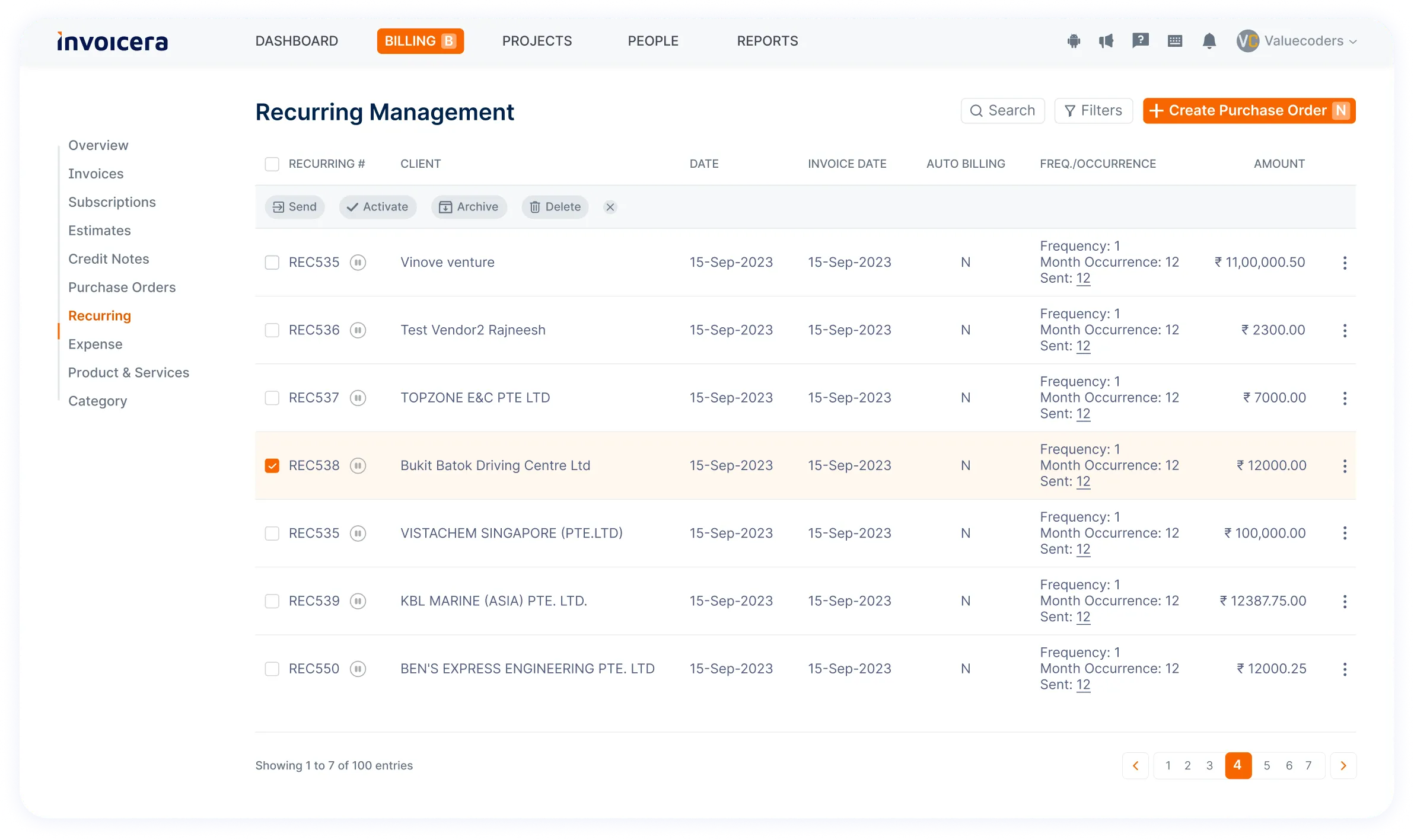

- Recurring Billing: Invoicera streamlines billing with automated recurring invoices. With this tool, you can set schedules and let Invoicera handle the rest while you focus on your strengths.

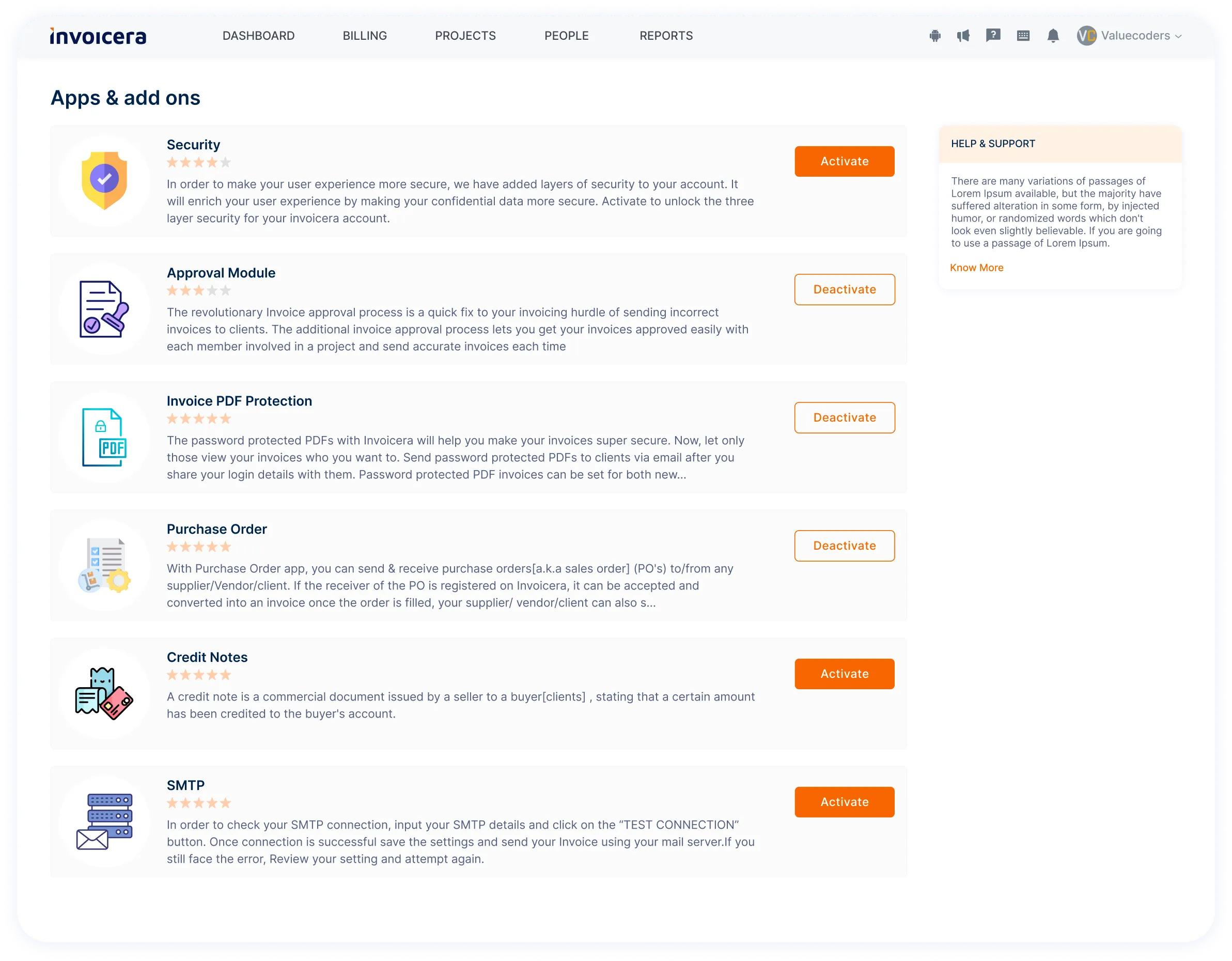

- Integration with 3rd Party Systems: Invoicera simplifies your workflow by seamlessly integrating with your preferred apps and tools. This CRM tool helps in data consistency across the integrated platforms.

- AR & AP Management: Invoicera streamlines managing incoming and outgoing funds, effortlessly tracking owed amounts and payables for a seamless financial flow.

Multi-currency & Multi-lingual Support: With Invoicera, you’re not limited by borders or languages. Go global and do business in 15+ languages and currencies, making transactions with international clients a breeze.

- Online Payments: Invoicera allows you to offer 14+ secure and hassle-free online payment methods, giving your clients flexibility and convenience to pay.

Best For

Medium-sized businesses with an extensive worldwide customer base who require staff management and customizable billing software.

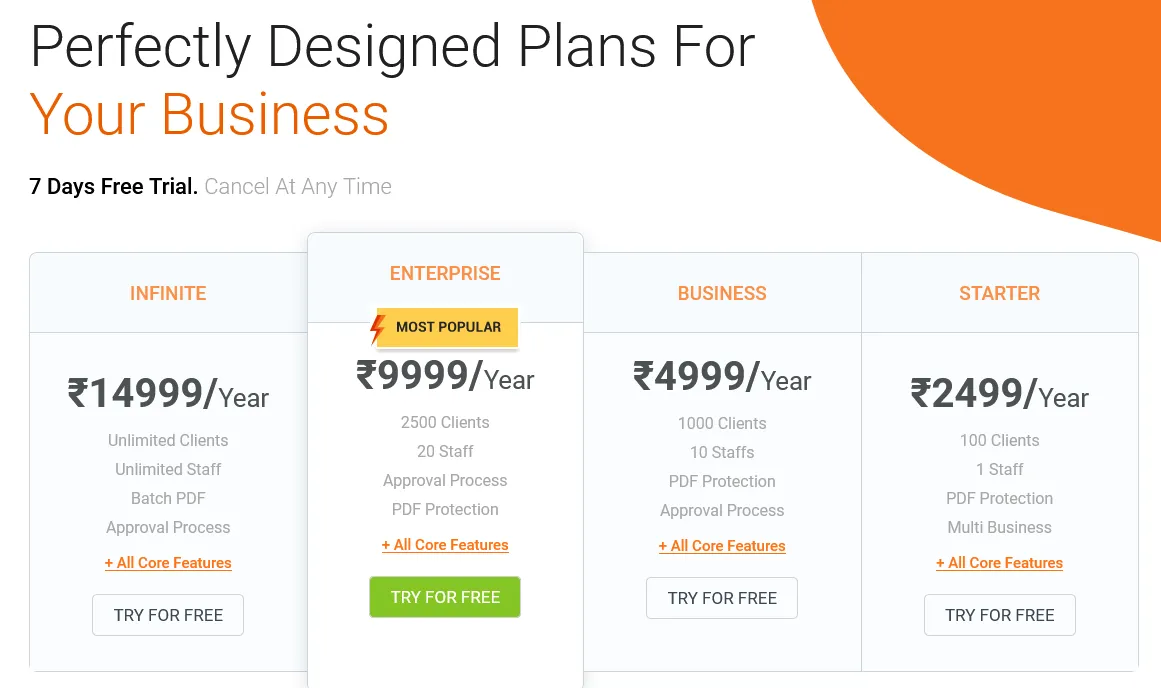

While Invoicera offers a free plan, its premium plans are competitively priced, ensuring businesses get value for their money.

The ‘Infinite’ plan offers everything unlimited at ₹14999/Year.

The most famous ‘Enterprise’ plan costs ₹9999/Year.

Small and medium-sized businesses can choose a ‘Business’ plan at ₹4999/Year.

The ‘Starter’ plan is for startups or small businesses at ₹2499/Year.

| Pros | Cons |

| ● Easy to import expense files

● Handle multiple businesses ● Offers 14+ payment gateways |

● Advanced features are in the paid version |

2. Zoho Books

Zoho Books, an online accounting tool, streamlines workflows for businesses of all sizes. It’s a scalable Freshbooks alternative with robust automation features, encompassing cash flow tracking, invoicing, expense management, and easy accountant collaboration on a free plan for minimal accounting needs.

Features

- Invoicing capabilities for seamless billing

- Creating and managing quotes efficiently

- Customer portal for easy interaction and access

- Tracking and managing expenses effortlessly

- Handling and organizing bills effectively

- Banking integration for financial management

- Project management tools for streamlined workflow

- Inventory tracking and management system

- Managing and tracking sales orders efficiently

- Organizing and managing purchase orders

Best For

Zoho CRM is an excellent entry-level CRM platform that scales with your small business’s growth.

Its free CRM plan is popular among new businesses looking for a free way to track leads and manage contacts easily.

| Pros | Cons |

| ● Expense tracking and inventory management

● Easy-to-navigate interface

|

● New users might face interface difficulties

● Data extraction is not easy ● Customer support is slow to respond |

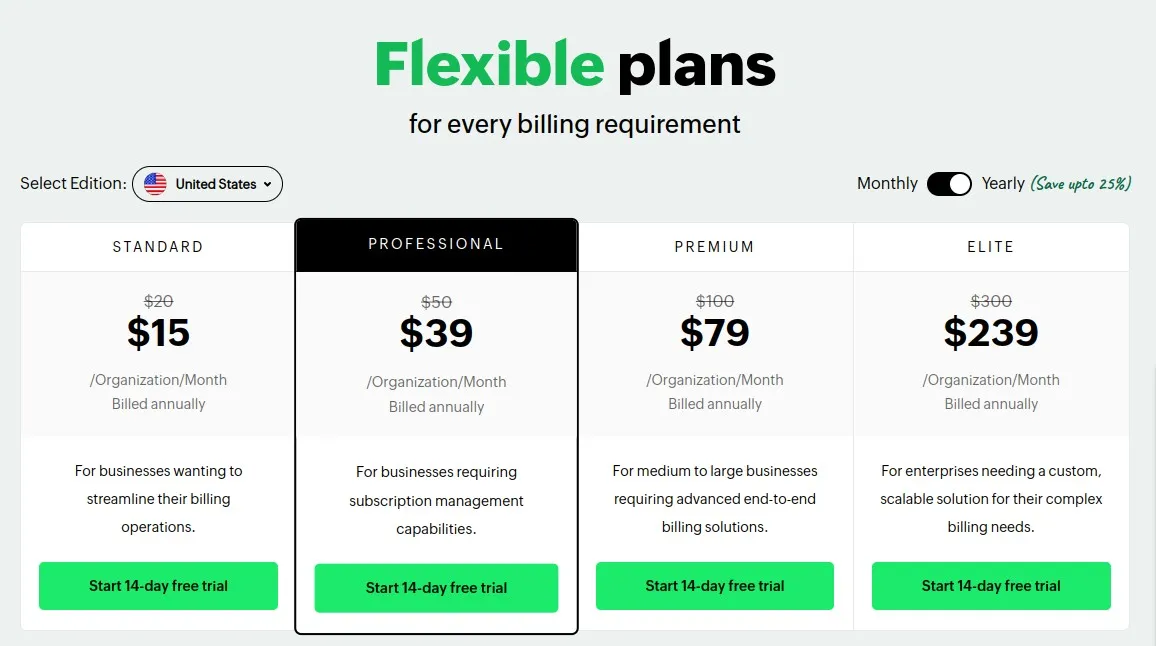

Pricing

Zoho Books offers a range of pricing, starting with a free tier for one user and one accountant, Standard at $15/month, Professional at $39/month, and Premium at $79/month, along with a free trial.

The Elite version comes for $239/month.

3. Wave

Wave, a free accounting software, is popular among small businesses and freelancers as it’s entirely free and earns through transaction fees.

It simplifies digital accounting, offering an invoicing feature for easy creation and sending online invoices using customizable templates.

Best For

Wave is best for newly started businesses looking for free invoicing software for their minimal needs.

Features

- Unlimited collaboration with third-party applications

- Manage accounting with multiple businesses

- Manage income and balance sheets

- Generate reports

| Pros | Cons |

| ● Has a free version

● Best for freelancers and startups

|

● No live or phone support |

Pricing

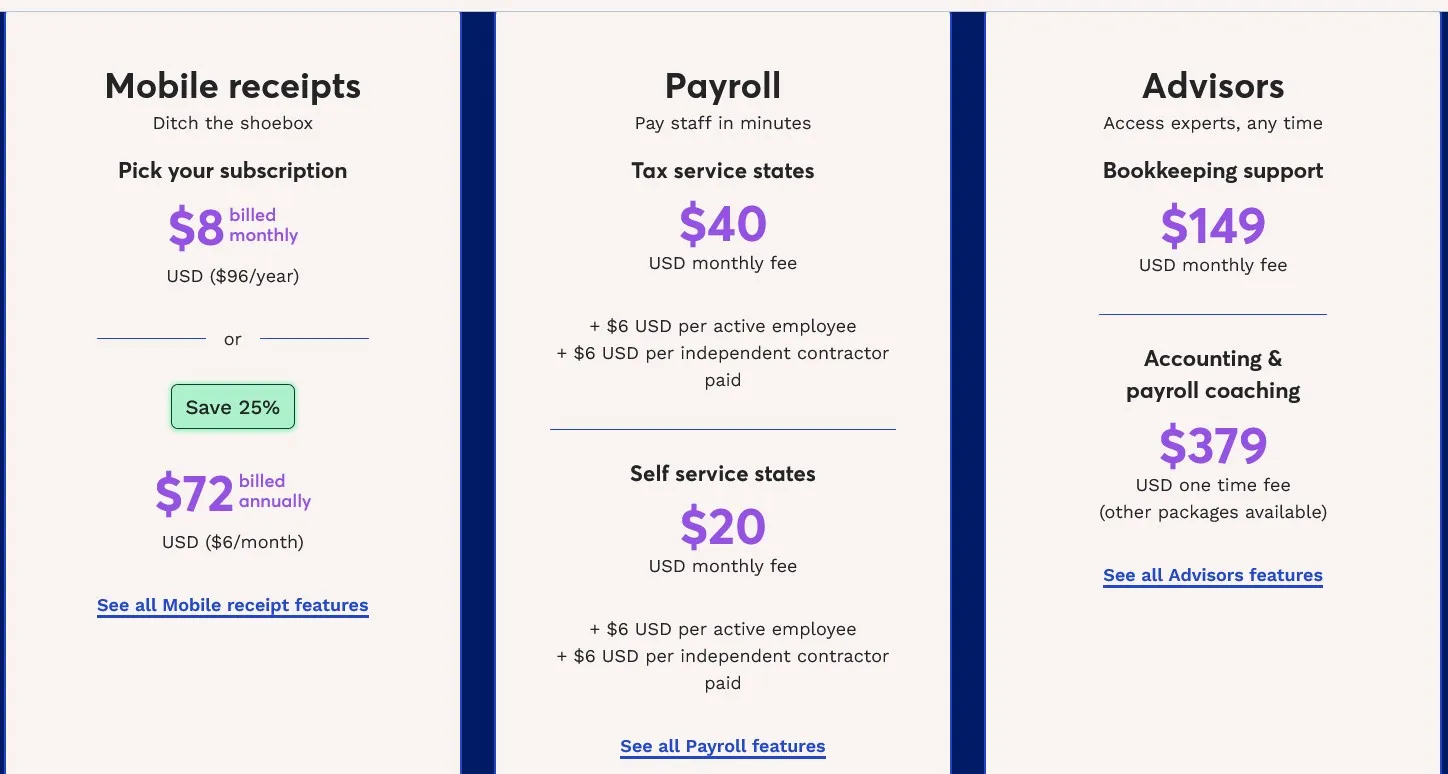

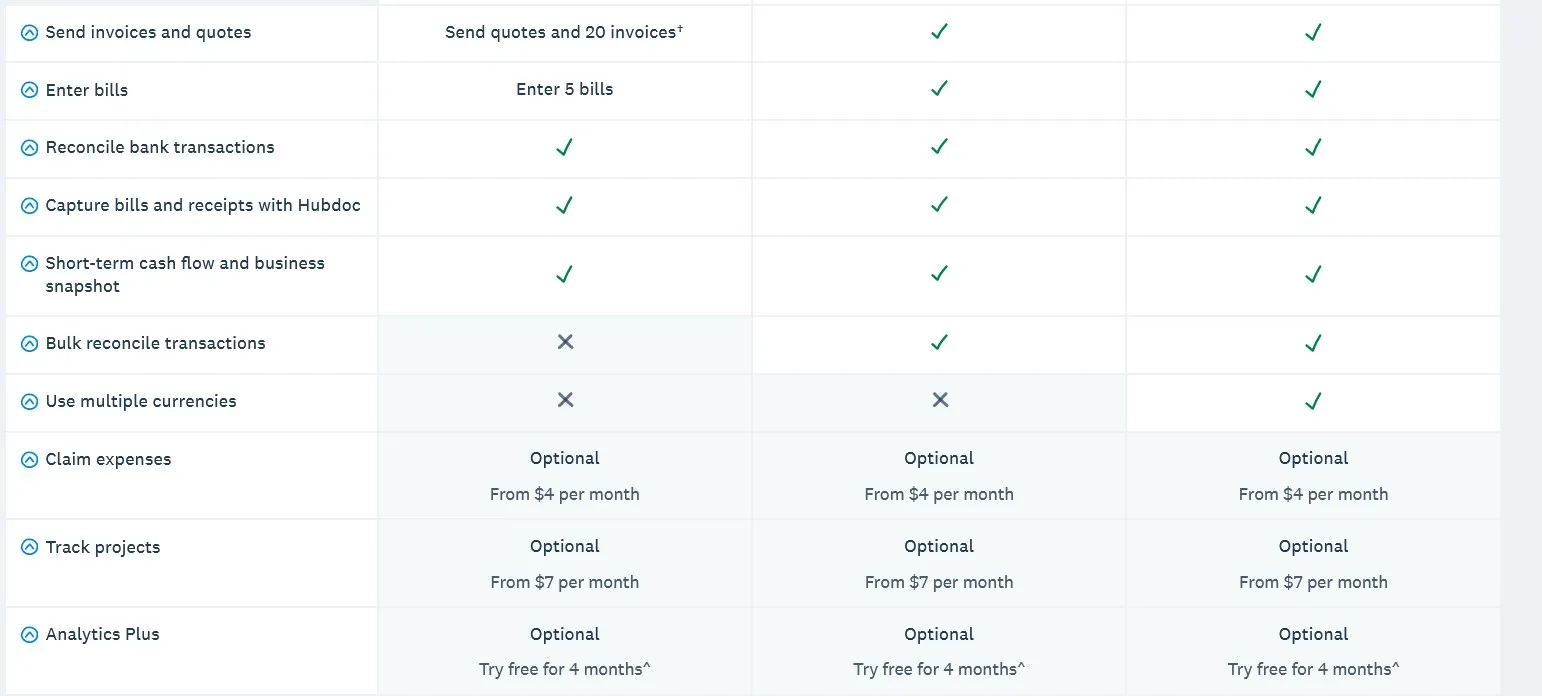

Check out the wave pricing in the images below:

4. Xero

Xero, an accounting tool, serves as an extensive FreshBooks alternative, offering user-friendly features like accounting, inventory management, invoicing, and more, all at an affordable price.

Best For

Suited for small- and medium-sized businesses, Xero is an affordable cloud-based accounting software system that streamlines these processes.

Features

- Pay bills with ease

- Claim and manage expenses

- Connect your bank for seamless transactions

- Keep track of projects

- Store and access files securely

- Generate comprehensive reports

- Manage inventory seamlessly

- Manage and track purchase orders

- Create and manage quotes

- Handle sales tax calculations

| Pros | Cons |

| ● Competitvely-priced plans

● Free 30-day trial ● Unlimited users and clients |

● Quotes and invoices are limited to 20/month on the starter plan

● A little difficult to use |

Pricing

Xero offers a range of pricing options starting at a flat rate of $3.75 per month. Their ‘Early’ plan is priced at $3.75 per month, the ‘Growing’ plan is available for $10.50 per month, and the ‘Established’ plan costs $19.50 per month.

Note: These prices are for the first 3 months as they are offering a 75% discount. Contact their sales team for more information.

5. Hiveage

Hiveage, an online accounting platform, caters to freelancers and small businesses.

It enables project estimates, invoice sending, and tracking of payments and expenses within a unified system.

Best For

Small Businesses

Features

- Tracking expenses by the hour and billing accordingly

- Customized quotes and invoices reflecting your brand

- Detailed financial reports from tracking both expenses and income

- Multiple payment gateway options, including PayPal, Stripe, and international payment integration built-in

| Pros | Cons |

| ● Quick, hassle-free setup

● Easy invoicing and recurring billing ● Multiple online payment processors |

No mobile receipt capture |

Pricing

- This tool offers a free plan for a month with limited features.

Paid plans are:

- Basic – $16/month

- Pro – $25/month

- Plus – $42/month

6. Quickbooks

QuickBooks, a flexible alternative to FreshBooks, caters to small business needs, offering similar functionalities.

It aids in bookkeeping, invoicing, expense tracking, payroll management, check printing, receipt organization, and data import from Excel spreadsheets.

Efficiently perform accounting tasks, automate invoicing, expedite payments with online billing, and maintain precise financial records using QuickBooks, leveraging its bank feeds feature for document management.

Best For

Small and Growing Businesses

Features

- Comprehensive financial tracking and reporting

- Real-time overview of business operations

- Automatic billing

- Compliance management

- Easy transfer of information in and out of the system

- Monitoring and management of expenses

- Handling employee payroll

- Managing and tracking sales tax obligations

- Third-party integrations

| Pros | Cons |

| ● Intuitive and easy to use

● Easily categorizes purchases ● Customizable and also offers valuable add-ons ● Easy integration ● Easy to setup payroll |

● Software updates frequently

● Customer support can be slow to respond ● Expensive for a sole business owner ● No undo button ● Training needed |

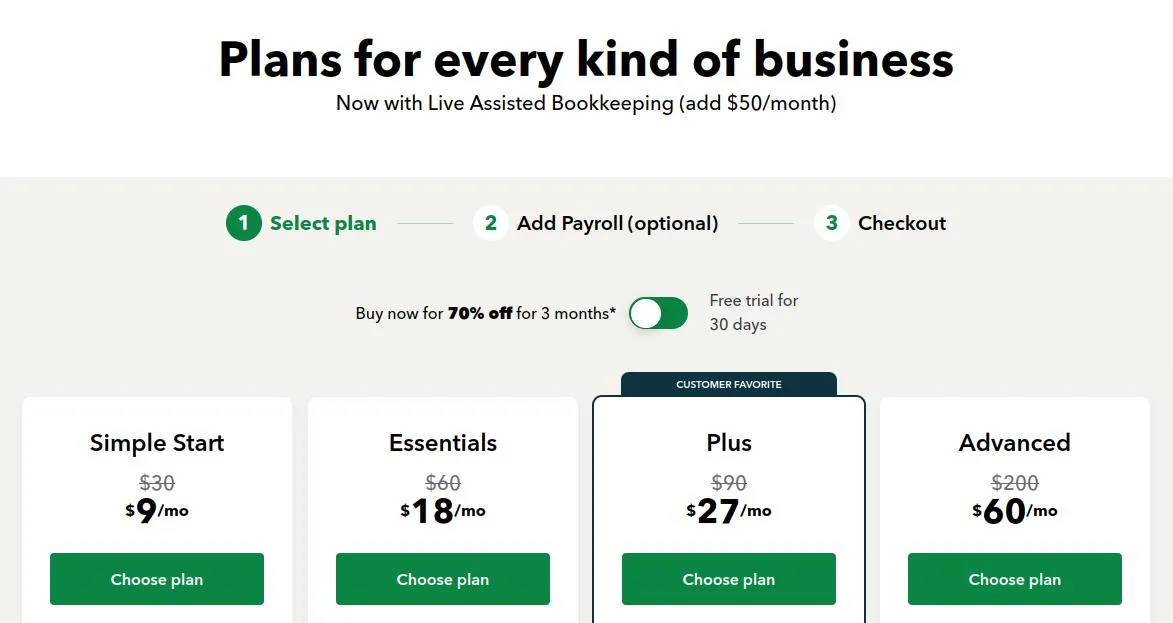

Pricing

QuickBooks offers various plans:

- ‘QuickBooks Simple Start’ is $1per month

- ‘QuickBooks Essentials’ costs $1 per month

- ‘QuickBooks Plus’ is available for $1 per month

Note: These plans are for first three months. After that, they might change; you can contact the sales team for any information.

7. Netsuite

This cloud-based invoicing software scales smoothly for small businesses and larger enterprises, automating processes to free up your time.

NetSuite manages inventory, orders, billing, and finances while providing customizable reports for all roles.

Its ERP module seamlessly integrates with other NetSuite tools, offering scalability and flexibility for your business needs without overspending. NetSuite ensures comprehensive insights for informed decision-making.

Best For

NetSuite is for businesses of all sizes and industries.

Features

- Self-service capabilities

- Comprehensive purchasing, manufacturing, and inventory tools

- Real-time info on inventory and procurement

- Integration with finance and sales

- Live transaction tracking in General Ledger

- Automated invoice and vendor management

- Customizable financial reports

| Pros | Cons |

| ● Works for all businesses

● Easy integration with other tools |

● Subscription pricing can change over time

● Basic support is limited ● Reporting tools limit easy customization |

Pricing

Here is an overview of the packages, but you can contact Netsuite’s sales team to get a quotation.

Base Package:

- Starts with a monthly ERP and CRM fee.

- SuiteSuccess packages cater to specific industries with pre-set roles, workflows, and reports.

User Licenses:

- Self-service for limited access, sold in packs.

- Full user licenses for standard access to all features.

Add-On Modules: Additional modules for specific business needs.

- Service Tier Upgrade: Different service levels based on user count and system requirements.

Concerned About Accessibility And Mobility In Invoicing?

Go For Hassle-Free Invoicing With Invoicera’s Cloud Solution

8. Sage

For robust financial planning, consider Sage Accounting—an extensive tool with features like reporting, expense tracking, and inventory management. This FreshBooks alternative ensures better financial control, offering ease of use and time-saving automation.

Your data remains secure, backed up to prevent loss, and easily integrates with your bank for transaction imports. Sage Accounting elevates your business with professional quotes, invoices, and insightful reports for informed decision-making.

Best For

Small and Medium-sized Enterprises

Features

- Swift, accessible setup on any device

- Simplified automation for time-saving accuracy

- Professional invoicing with automatic tracking for prompt payments

- Stripe integration for diverse payment options

- Real-time intuitive dashboard for financial oversight

| Pros | Cons |

| ● Easy-to-use for non-technical people

● Screen-level security ● Unlimited invoices and clients ● Premium plans are affordable |

● Mixed reviews for learning curve

● No time and mileage tracking |

Pricing

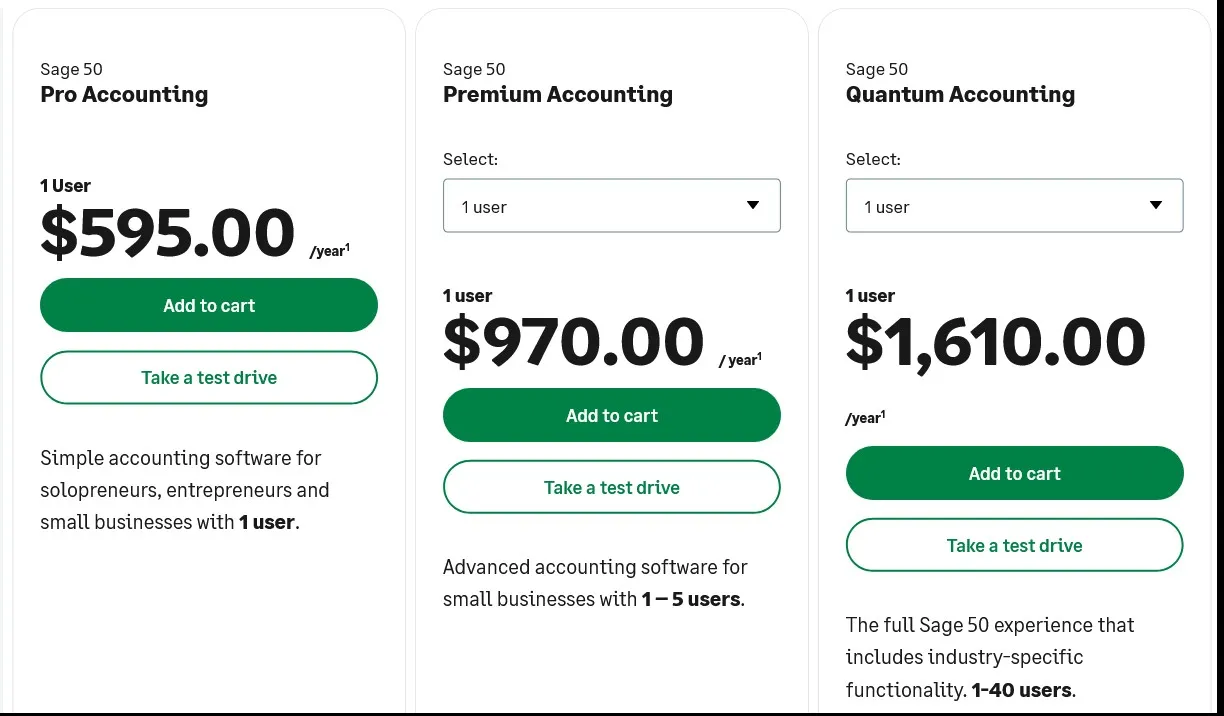

Sage Accounting yearly plans are as:

- Pro Accounting: $596

- Premium Accounting: $970

- Quantum Accounting: $1610

9. ZipBooks

ZipBooks stands as a robust accounting solution tailored for midsize businesses and enterprises, emphasizing streamlined accounting, billing, and comprehensive business insights.

The free version enables unlimited invoicing, basic report viewing, and connection to a single bank account.

Best For

Midsized businesses

Features

- Schedule branded professional invoices

- Automated requests for customer reviews via texts and emails

- Business intelligence for competitive performance insights

- Excellent customer support access

| Pros | Cons |

| ● Easy to get in and start

● Invoicing is easy to set up and track ● Great customer service |

● Need support for alternative payment through ZipBooks |

Pricing

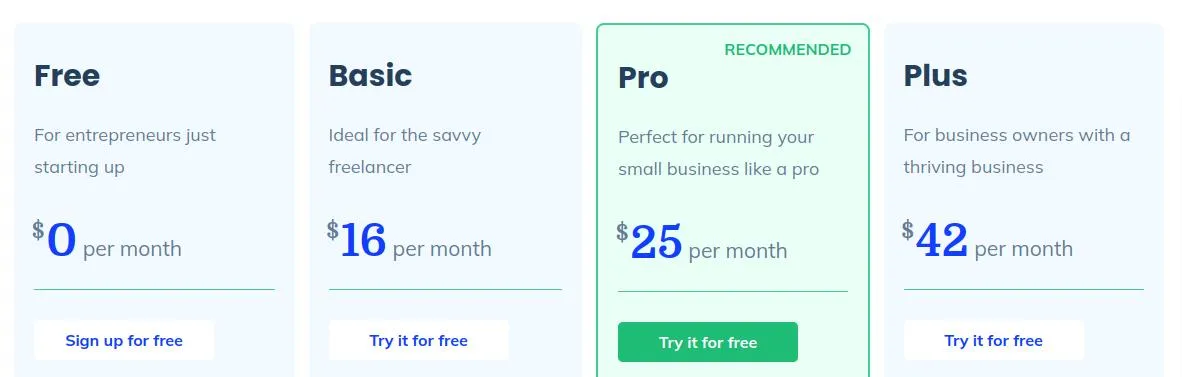

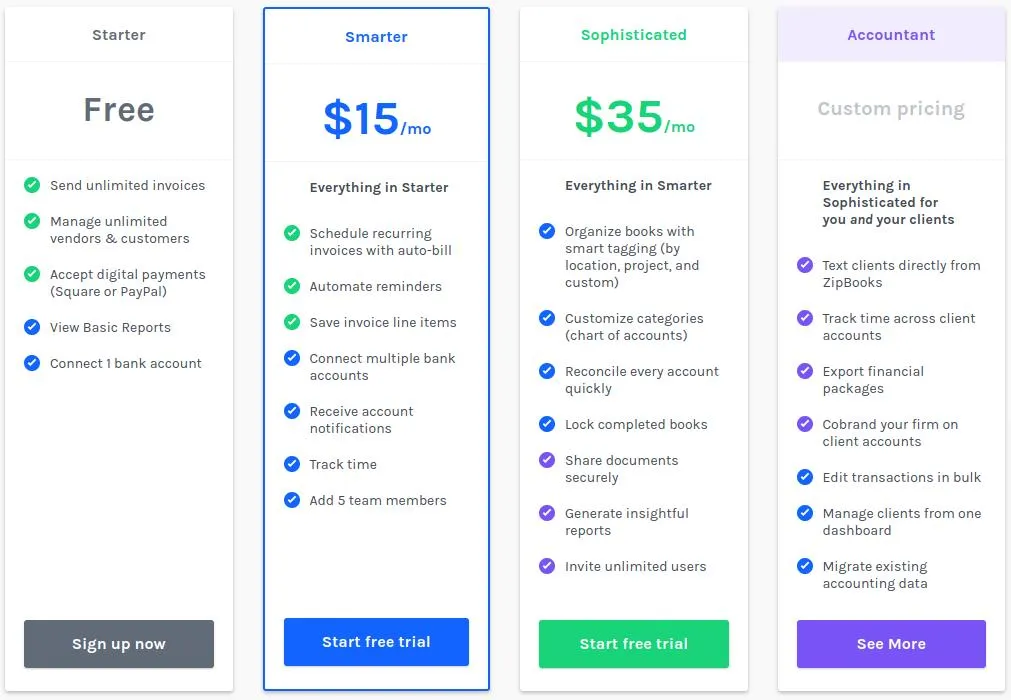

Below are the pricing details in the image:

10. Fiskl

Fiskl, an agile invoicing and accounting tool, empowers small businesses and freelancers to handle finances efficiently. Its user-friendly interface simplifies invoicing, expense tracking, and financial management, providing numerous advantages.

Best For

- Small Businesses: Especially those needing simplified invoicing and expense tracking.

- Freelancers: Offering a convenient platform for managing finances on the go.

- Businesses with International Operations: Given its support for multiple currencies.

- Users Needing Mobile Accessibility: Ideal for those requiring mobile app functionality for financial management.

Features

- Speedily transform quotes into invoices

- Handle finances using a dedicated mobile app

- Effortlessly manage invoices

- Receive international payments

- Automatically track expenses with receipt logs

- Mileage tracking

| Pros | Cons |

| ● User-friendly interface

● Mobile app for managing finances anywhere ● Expense tracking and receipt capture ● Multi-currency support |

● Doesn’t offer payroll management |

Pricing

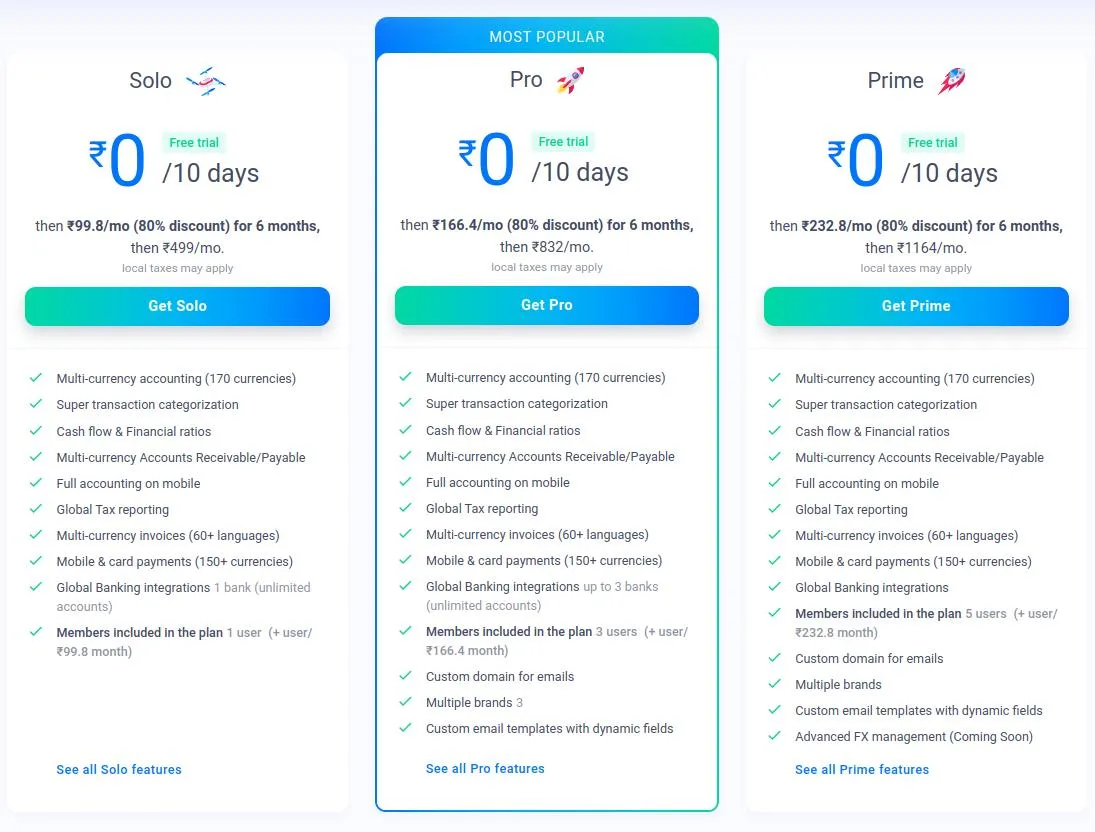

For the first ten days, Fiskl provides a free plan, and paid plans start on the 11th day.

It offers an 80% discount for six months after that, and the plans are as follows:

- Solo: INR 99.8/month

- Pro: INR 166.4/month

- Prime: INR 232.8/month

Why Invoicera Is The Best Alternative?

Offers Customization And Flexibility

Invoicera stands out by offering robust customization options, allowing businesses to tailor their invoices, reports, and workflows to match their unique branding and requirements.

Its flexibility enables seamless adaptation to diverse business needs.

Helps In Global Operations

With multi-currency and multilingual support, Invoicera simplifies global operations.

Businesses can manage transactions and communicate with clients worldwide, overcoming currency and language barriers.

Manages Projects And Tasks

Invoicera goes beyond invoicing, integrating project and task management features.

It streamlines project workflows, tracks tasks, allocates resources, and converts billable hours into invoices, ensuring comprehensive project management.

Handles Subscription And Recurring Billing

For businesses relying on subscription-based services, Invoicera simplifies billing with automated recurring invoicing.

This feature efficiently manages subscription cycles, ensuring timely billing and reducing administrative burdens.

Offers Collaboration With Clients

Enabling seamless collaboration, Invoicera facilitates client engagement through a client portal.

Clients can access invoices, make payments, and communicate directly, fostering transparency and enhancing relationships.

Invoicera provides cost-effective solutions tailored to small businesses.

Its pricing structure is designed to offer essential features at accessible rates, making it an attractive option for startups and smaller enterprises seeking efficient invoicing and billing solutions.

Conclusion:

Looking beyond FreshBooks unveils diverse possibilities, each offering unique features to suit various business preferences and needs.

From streamlined invoicing to robust reporting, these options offer a range of functionalities akin to FreshBooks, ensuring you find the perfect fit for your business.

Remember, the best choice isn’t necessarily the most popular one but the one that best suits your business dynamics and goals.

FAQs:

Are these alternatives easy to set up and use?

Setting up and using these alternatives varies, but many of them offer user-friendly interfaces and intuitive setups. They often come with tutorials and customer support to assist you along the way.

Do these alternatives offer similar features to FreshBooks?

Yes, many of these alternatives offer functionalities similar to FreshBooks, such as invoicing, expense tracking, and reporting. Some might even provide additional features tailored to different business needs.

How cost-effective are these alternatives compared to FreshBooks?

The cost-effectiveness of each alternative varies based on the features included in their pricing plans. Some might offer more affordable plans with comparable functionalities to FreshBooks, making them a budget-friendly choice. You can check the pricing plans of each tool, compare and then make a choice.