Effective expense management plays a vital role in making any business reach the heights of success. Tracking each and every expense is, however, a long-drawn-out task.

To streamline this process, businesses are embracing automated invoicing, which facilitates efficient expense management while saving valuable time you would have otherwise spent on manual invoicing. Furthermore, this automation significantly reduces the risk of minor invoicing errors, which, if left unnoticed, could transform into substantial financial losses.

In this blog post, we will delve into the significance of invoicing in expense management and explore how your business can harness powerful tools like Invoicera to optimize this crucial aspect.

Understanding Expense Management

In simple words, expense management is optimizing your overall spending while running your business. It involves monitoring, tracking, and analyzing all expenditures, including travel, supplies, utilities, and employee reimbursements.

Businesses that analyze the expenses properly often make sound financial decisions such as budget allocation, investment, resource utilization, and more. It also helps in reducing financial risk while improving profit.

How to Manage Expenses Effectively?

1. Set and adhere to a budget

Going out of your budget eventually leads you into debt. Therefore, establishing a clear budget and defining spending limits becomes necessary for effective expense management. However, we understand that sometimes the expenses go against the budget, but ensure that you adjust them properly into the next budget. It would be helpful for you to remain disciplined with your finances.

2. Utilize expense-tracking software or apps

With the vast tech domain, you will find many software or apps that can streamline expense management. Invoicera is one of them, which has automated features, such as online invoicing, billing & payment in multi-lingual, multi-currency options. You can manage your multiple invoices and clients through one centralized platform.

3. Automate reporting and reimbursement processes

Manual reporting and reimbursement processes are time-consuming and prone to errors. Automating these processes with dedicated software or tools improves efficiency. To ensure accurate, error-free record-keeping and also timely reimbursements, you should give a start to automation.

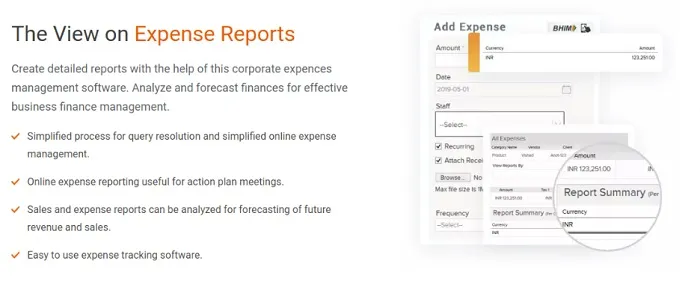

4. Review and analyze expense reports regularly

Keep a check on excessive spending by reviewing reports regularly. Analyze and gain deeper insights into expense data by different categories and departments. You also need to proactively engage with other employees involved to get a better understanding of the expenses.

5. Negotiate for better pricing and cost savings

Do not miss an opportunity to negotiate with your vendors and suppliers. You can ask them for favorable rates if you plan for a long-term contract. Moreover, you can encourage employees to compare prices and make final purchasing decisions.

Why is Invoicing Essential for Managing Expenses?

Let’s understand why invoicing is an essential key in an effective expense management process.

1. Documentation and record keeping

Invoices have details such as vendor information, itemized costs, and dates of transactions. By maintaining well-organized and accurate invoices, businesses can ensure compliance with financial regulations, audits, and tax requirements.

Moreover, invoices act as an important source from where you can have better financial analysis.

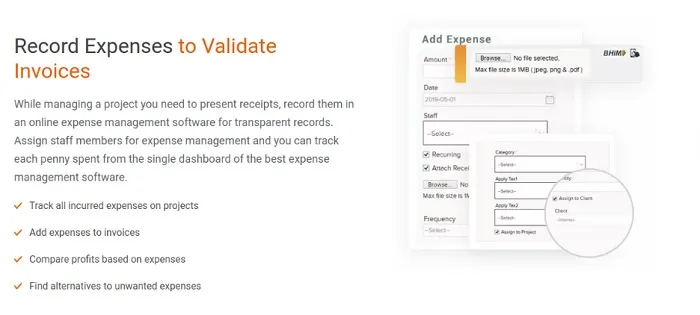

Invoicera records all your expenses on the cloud, accessible anytime and anywhere.

2. Expense tracking and categorization

With expense management tools, you can easily track expenses against budgets and analyze spending patterns. You can also identify where you have overspent, which can help implement cost controls.

Again, Invoicera automates invoices and tracks every payment sent and received.

3. Transparency and Accuracy

Invoices help detect discrepancies, errors, or fraud, ensuring accountability in financial transactions. As a result, these can promote transparency and accuracy in expense management, ultimately helping maintain the integrity of financial operations.

4. Payment Tracking and Accountability

You can refer to invoices and easily track and reconcile payments. In this way, you can avoid any late fees or penalties. Furthermore, Invoices act as evidence, providing information on all the services rendered or products received.

5. Streamlining Expense Management Processes

Overall, invoicing streamlines the expense management process while reducing manual efforts and errors. Integrating invoicing with expense management enables seamless synchronization of expense data and enhances efficiency.

The Future of Invoicing and Expense Management

The future lies in automating invoicing and expense management processes. Despite this, numerous small and medium-sized enterprises depend on a team of employees to manually create invoices.

Suppose you find yourself in the same situation. In that case, it’s essential to realize that you have the opportunity to automate your entire process, resulting in significant savings of both time and money.

Businesses across industries are increasingly harnessing the power of AI to automate manual tasks like data entry and invoice processing, leading to enhanced efficiency and accuracy. So, why not join the ranks of these businesses and reap the benefits of automation?

Invoicera – Embracing Technology for Effective Invoicing

Invoicera goes beyond the basic functionalities, offering advanced tools and functionalities to enhance your invoicing experience. Automating the invoicing process, Invoicera saves valuable time while ensuring accuracy and reliability. It also optimizes cash flow and streamlines the invoicing process, making it seamless and hassle-free.

Conclusion

Invoice and expense management is the backbone of your financial team, providing essential documentation, transparency, and accuracy.

Tools such as Invoicera make it possible for businesses to efficiently manage finances, remove discrepancies, and discover inaccuracies without spending much time.

So, embrace the automated invoicing process and restore your financial stability.

FAQs

Can invoicing improve cash flow management and payment tracking?

Absolutely! Invoicing is vital in cash flow management, ensuring timely invoicing and accurate payment tracking. It helps businesses track outstanding payments, reduce delays, and maintain a healthy cash flow.

Which tool can I use for creating precise invoices?

To create precise and professional invoices, Invoicera is an excellent tool. It has a user-friendly and easy-to-understand interface with numerous templates you can choose according to your organization.

How does invoicing enhance transparency and compliance in expense management?

Invoicing promotes transparency and compliance by providing detailed records of expenses. It ensures accurate documentation, making it easier for businesses to comply with financial regulations, audits, and tax requirements.