Introduction

Accounting, essential for managing finances, has traditionally relied on hourly rates or fixed fees. But a transformation is taking place in the accounting world—enter value-based pricing.

Imagine this: Instead of just tracking hours, accountants are basing their fees on the value they bring. This shift will change how accountants charge and revolutionize the client experience.

“Value-based pricing isn’t just about getting what you’re worth. It’s about delivering value far beyond what you’re paid.” – Ron Baker

Consider this:

While 80% of accounting firms stick to hourly rates, a whopping 90% of clients prefer other options.

There’s a massive gap! Clients want a pricing model that truly reflects the value they get.

Value-based pricing breaks away from the norm, promising benefits for both accountants and their clients. But is this shift just a trend or a lasting revolution?

In this exploration, we’ll dive deep into value-based pricing in accounting, uncovering its advantages and challenges and how tools like Invoicera are shaping this new billing era.

Accountants, get ready—we’re entering a world where value takes the spotlight.

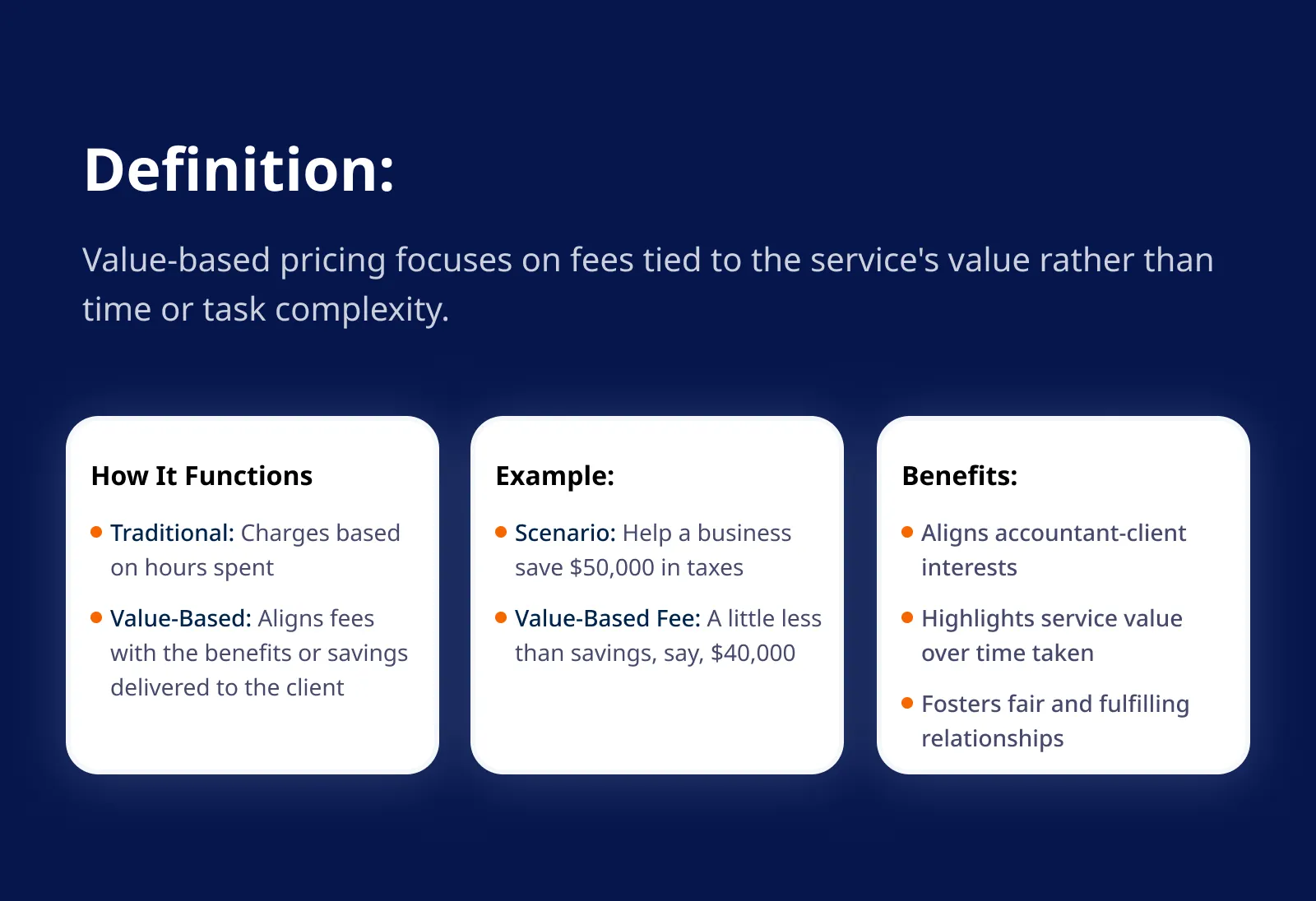

What Is Value-Based Pricing?

Value-based pricing in accounting fundamentally revolves around assigning fees based on the value of the services provided rather than the time spent or the complexity of the task.

It’s like paying for the worth of a service, much like you pay for a gourmet meal at a restaurant rather than the ingredients separately.

How It Works:

Let’s say you’re an accountant helping clients optimize their tax strategy.

With traditional hourly billing, you might charge based on the hours spent researching and implementing the strategy.

However, with value-based pricing, you’d assess the potential tax savings or benefits generated for the client and charge a fee aligned with that value.

Example:

Imagine you help a small business save $50,000 in taxes by restructuring its financials.

With value-based pricing, your fee could be a percentage of those savings, ensuring the client pays for the value they receive, not just the time you put in.

Key Points:

- Focus On Outcome: Value-based pricing centers on the impact or benefit delivered to the client rather than the hours worked.

- Mutual Benefit: Both you and the client are vested in achieving the best possible outcome.

- Transparent Value: Clients see precisely what they’re paying for—tangible results and expertise directly benefiting their bottom line.

Value-based pricing, therefore, aligns the interests of accountants with those of their clients, emphasizing the value of the service rather than the time taken, ultimately leading to a more equitable and rewarding relationship.

How Value-Based Pricing Benefits Accountants?

Transitioning to a value-based pricing model can revolutionize how accountants operate, offering many advantages beyond traditional billing methods.

A. Increased Profitability And Revenue Potential

With value-based pricing, accountants can break free from the constraints of hourly billing or fixed fees. Rather than being restricted by time constraints, they can dedicate their efforts to providing outstanding value to their clients.

This shift often results in increased profitability as accountants are rewarded for the expertise and efficiency they bring to the table.

When clients perceive the value received outweighs the cost, they’re often willing to pay higher fees, thereby boosting revenue potential.

B. Enhanced Client Relationships And Trust

Value-based pricing fosters deeper trust and collaboration between accountants and their clients.

By transparently aligning prices with the value delivered, accountants demonstrate their commitment to the client’s success.

This approach builds trust and strengthens relationships, as clients appreciate the clarity and fairness of a pricing structure directly linked to the value they receive. Accountants become partners in their clients’ growth rather than mere service providers.

C. Flexibility And Scalability In Service Offerings

One of the key advantages of this value-based pricing is its flexibility in tailoring services to meet individual client needs.

Accountants can customize their offerings based on their specific value to each client, leading to more personalized and impactful solutions.

Moreover, as businesses evolve, so can the services provided. This scalability allows accountants to adapt their offerings to changing client requirements, ensuring a continued alignment between value delivered and pricing.

How Value-Based Pricing Benefit Clients?

Value-based pricing isn’t just advantageous for accountants; it’s a win-win for clients, too.

Here’s how:

1. Cost-Effectiveness And Value Proposition

Using value-based pricing ensures clients get optimal value for their investment. Instead of paying for hours clocked or a fixed service fee, they’re billed based on the value they receive.

This means they avoid overpaying for routine tasks that might take less time but hold significant importance for their specific requirements.

They’re investing in outcomes and solutions, ensuring every dollar spent yields measurable value.

2. Tailored Services And Solutions For Specific Needs

In business, especially in accounting, a one-size-fits-all approach falls short. Value-based pricing empowers accountants to create customized solutions tailored precisely to each client’s distinct needs.

Whether it’s offering specialized advice, devising strategic plans, or tackling intricate financial

challenges, clients receive services designed to directly address their unique pain points.

This personalized approach nurtures stronger client-accountant relationships grounded in trust and satisfaction.

3. Predictable Pricing And Reduced Uncertainty

Say goodbye to unexpected invoices causing budget surprises. Value-based pricing offers clients cost predictability.

They have a clear upfront understanding of what they’ll pay for the services they require. This transparency avoids uncertainties, enabling clients to plan their finances effectively without worrying about hidden fees or unforeseen expenses.

It establishes a transparent comprehension of services and associated costs, creating a more seamless and confident client experience.

How To Implement Value-Based Pricing?

Switching to value-based pricing in accounting means moving from conventional billing methods to a more client-focused and value-oriented approach. Here’s a thorough walkthrough on making this switch:

1. Grasping Client Requirements: Begin by fully understanding your client’s needs, challenges, and goals. Engage in conversations to delve deep into the value they seek from your services.

2. Identify Value Metrics: Determine the specific metrics representing your clients’ value. This could be time savings, improved financial insights, risk reduction, or any other measurable outcome tied to your services.

3. Service Packaging: Restructure your services into packages that align with the identified value metrics. Develop clear, transparent packages that showcase the value clients will receive at different price points.

4. Value Assessment: Conduct assessments or consultations with clients to assess the potential value they could gain from your services. This could involve analyzing their current situation and estimating the impact of your expertise.

5. Set Pricing Strategies: Establish pricing strategies based on the value offered rather than the hours spent. Calculate pricing tiers linked to each package’s value, ensuring it’s competitive and justifiable.

6. Communicate Value Proposition: Articulate the value proposition clearly to your clients. Pay attention to the benefits and outcomes they can expect from each package, reinforcing the value they’ll receive.

7. Transitioning Clients: Transition existing clients to the new pricing model by explaining the rationale behind the change. Showcase how the new model aligns with their goals and offers more tailored and beneficial solutions.

8. Monitor And Adjust: Consistently assess the efficiency of your value-based pricing approach. Collect client feedback and adjust packages or pricing to suit their evolving needs better.

9. Educate Staff: Ensure your team understands the shift in pricing strategy. Train them to communicate the value-based approach effectively and empower them to address client queries regarding the new model. Moreover, leverage mentor-mentee matching to pair new hires with experienced colleagues and provide them with personalized guidance.

10. Use Technology For Efficiency: Leverage accounting software like Invoicera to streamline invoicing, billing, and monitoring of value-based pricing models. These tools can automate processes, making managing and adjusting pricing structures easier.

11. Maintain Transparency: Maintain transparent communication throughout the process. Be open about how prices are determined based on the value delivered, fostering trust and long-term client relationships.

12. Measure Success: Establish metrics to measure how well your value-based pricing strategy works. This could include client satisfaction, revenue growth, or the number of clients opting for higher-tier services.

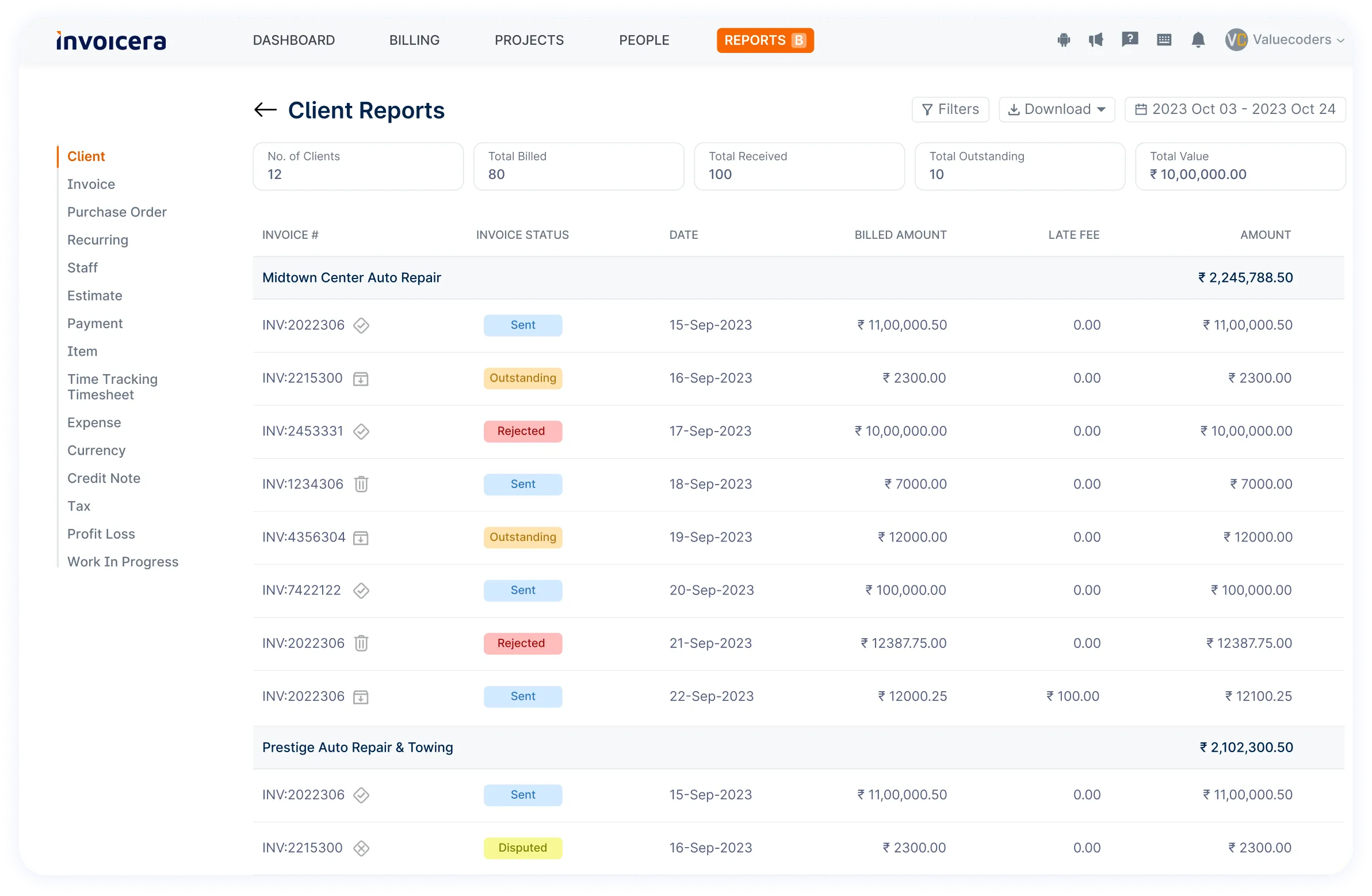

How Invoicing Software Helps In Value-Based Pricing?

Invoicera is more than just an invoicing software; it’s a robust tool designed to assist accountants in seamlessly transitioning to value-based pricing models. Here’s how it helps:

- Customized Invoicing: Invoicera allows accountants to create customized invoices tailored to the services provided. With value-based pricing, where services and their worth vary, personalizing invoices is crucial. Accountants can easily include detailed service descriptions and pricing in a clear and understandable format for clients.

- Flexible Pricing Structures: Value-based pricing often involves different pricing structures for various services. Invoicera enables accountants to set up and manage these diverse pricing models effortlessly. Whether project-based, milestone-based, or outcome-based pricing, the software accommodates these variations seamlessly.

- Transparent Billing: Transparency is key in value-based pricing. Invoicera facilitates transparent billing by providing detailed service breakdowns and associated costs. Clients appreciate this clarity, leading to better trust and understanding between accountants and their clients.

- Time Tracking And Reporting: Invoicera offers robust time-tracking features that allow accountants to accurately track the time spent on different tasks for various clients.

This data is invaluable when determining the value of services and setting fair prices based on the effort invested.

- Automated Reminders And Notifications: Value-based pricing often involves billing based on milestones or outcomes. Invoicera’s automated reminders and notifications ensure that accountants never miss billing opportunities.They can promptly send invoices upon reaching milestones or achieving pre-defined outcomes, ensuring timely and accurate billing.

- Client Collaboration And Feedback: Invoicera provides a platform for efficient communication and collaboration between accountants and their clients.

This open channel allows for feedback on services provided, ensuring that the value delivered aligns with client expectations.

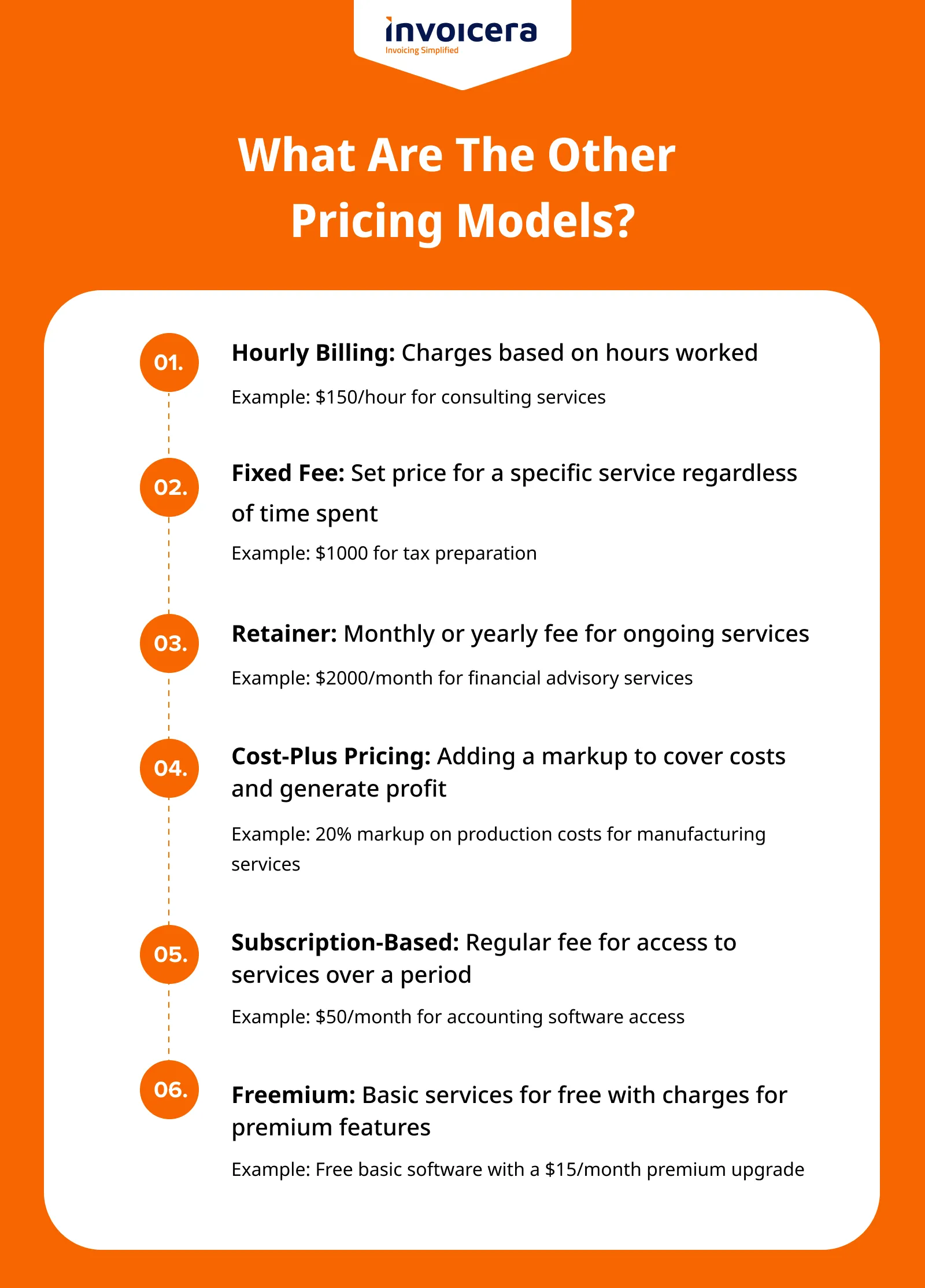

Value-Based Pricing vs. Traditional Billing

| Value-Based Pricing | Traditional Billing |

| Focuses on the value | Relies on hourly rates or fixed fees |

| Delivers services based on the perceived worth to the client | Charges for time spent on tasks |

| Tailored pricing based on client needs and benefits received | Standardized pricing for services |

| Encourages collaboration and understanding between accountant and client for mutual benefit | May lead to conflicts over billable hours |

| Flexibility in pricing structures | Limited flexibility and potential for unexpected costs |

| Emphasizes outcomes and results | Focuses on hours worked rather than outcomes |

| Enhances client satisfaction due to transparency and value for money | May result in client dissatisfaction due to unexpected charges |

| Rewards efficiency and expertise | May not fully reflect the value of expertise or efficient work |

| Aligns pricing with client success and satisfaction | Billing based on time spent, regardless of client outcome |

Challenges Of Traditional Billing Models

1. Challenge: Limitations Of Hourly Billing Or Fixed Fees

Hourly billing’s rigidity ties cost solely to time spent, potentially misrepresenting the service’s actual value. Fixed fees might not accurately reflect the service’s worth, leading to client concerns about overpayment or underutilization.

Solution: Invoicera addresses these limitations by introducing a more adaptable and transparent billing model. It facilitates the shift towards value-based pricing, where the cost aligns more accurately with the value clients receive. This approach ensures fairness in billing, enhancing client satisfaction.

2. Challenge: Client Dissatisfaction And Potential Conflicts

Traditional billing models often cause dissatisfaction, as clients may perceive unfair charges or inadequate service representation within fixed fee structures. This dissatisfaction can strain relationships and lead to conflicts and disputes.

Solution: Invoicera’s solution lies in fostering transparency and trust through value-based pricing. By enabling accountants to assess and charge based on the true value of services, Invoicera promotes fairer billing practices.

This transparent approach minimizes conflicts, strengthens relationships, and boosts client confidence in the accounting services provided.

3. Challenge: Lack Of Flexibility In Billing Structures

Hourly billing and fixed fees lack the adaptability to accommodate varying complexities or efficiencies in tasks. This lack of flexibility can result in overcharging or undervaluing the services rendered.

Solution: Invoicera’s platform allows accountants to implement a more nuanced billing structure based on the delivered value.

It permits adjustments that align better with the intricacies and actual worth of services, ensuring clients pay for the value received, not just the time spent.

4. Challenge: Unclear Representation Of Service Value

Clients often struggle to understand how hourly rates or fixed fees equate to the value they receive. This ambiguity in demonstrating service value can lead to client skepticism and dissatisfaction.

Solution: Invoicera’s value-based pricing model provides clarity by directly correlating the cost with the specific value clients derive from the services.

It enables accountants to communicate the worth of their services more explicitly, enhancing client understanding and satisfaction with the billed amounts.

Tips To Switch To A Value-Based Pricing Model

- Collaborate With Clients

Involve your clients in the pricing conversation. Seek their input and understand their perception of value. Collaborative discussions can lead to a better understanding of their needs and help tailor your pricing accordingly.

- Emphasize Results And ROI

Highlight the measurable results clients can expect from your services. Showcase how your expertise directly contributes to their return on investment (ROI) and long-term financial gains, reinforcing the value proposition.

- Offer Tiered Pricing Options

Present clients with tiered pricing options that cater to different budget levels or service needs. This approach provides flexibility and lets clients choose a package that best matches their requirements.

- Incorporate Performance Metrics

Introduce performance metrics tied to your pricing. Clearly define benchmarks and track the impact of your services on achieving these metrics. This demonstrates accountability and further justifies your pricing structure based on tangible outcomes.

- Provide Value-Added Services

Consider including additional value-added services beyond standard accounting tasks. Offer strategic advice, financial planning insights, or specialized consultations that enhance the overall value proposition for clients.

By incorporating these strategies, you can refine your approach to value-based pricing, making it more adaptable, client-centric, and reflective of the holistic value your firm brings to the table.

Conclusion

In the ever-changing accounting world, embracing value-based pricing isn’t a passing trend – it’s a smart move benefiting both accountants and clients. Unlike traditional models, this approach offers transparency and flexibility, aligning costs with the actual value of services.

Accountants gain higher profits and better connections by valuing their services accurately. Shifting to this model allows them to tailor solutions, understand client needs, and deliver more impactful results.

For clients, it means peace of mind. They get no more surprises in fees; they get custom services that address their unique needs, leading to a more satisfying partnership.

In a nutshell, value-based pricing is a win-win. It amps up service quality, strengthens client bonds, and propels accounting firms toward a future where value, not just time, drives success.

FAQs

Is embracing value-based pricing a tough transition?

Shifting to value-based pricing might pose challenges involving client conversations and internal adjustments. However, with careful planning, effective communication, and tools like Invoicera, this shift can be seamless and beneficial for accountants and clients.

Can value-based pricing cause pricing conflicts with clients?

There’s a possibility, especially during the initial phase. However, transparent communication regarding the advantages and value provided often resolves conflicts. Setting clear expectations is crucial to reducing disputes.

Is value-based pricing for every accounting firm?

Not necessarily. It varies based on the client base, services offered, and defining service value. While beneficial, some firms face challenges due to existing structures or difficulties measuring service value. However, adaptable firms can greatly improve relationships and profitability by aligning services closely with client value.