Do you spend endless hours managing stacks of paper invoices and chasing payments?

If so, you’re not alone.

According to the “Working Capital Playbook” a PYMNTS and YayPay collaboration, 93% of companies face late payments from customers, which impacts their cash flow and overall financial health.

Thus, there is a need for a more streamlined and efficient invoicing process, which is evident.

Nowadays, E-Invoicing software has come to rise due to many reasons.

This post will talk about online invoicing and the top 5 e-Invoicing software solutions that will help manage your business finances better.

Join us as we delve into the world of digital invoicing.

What Is E-Invoicing?

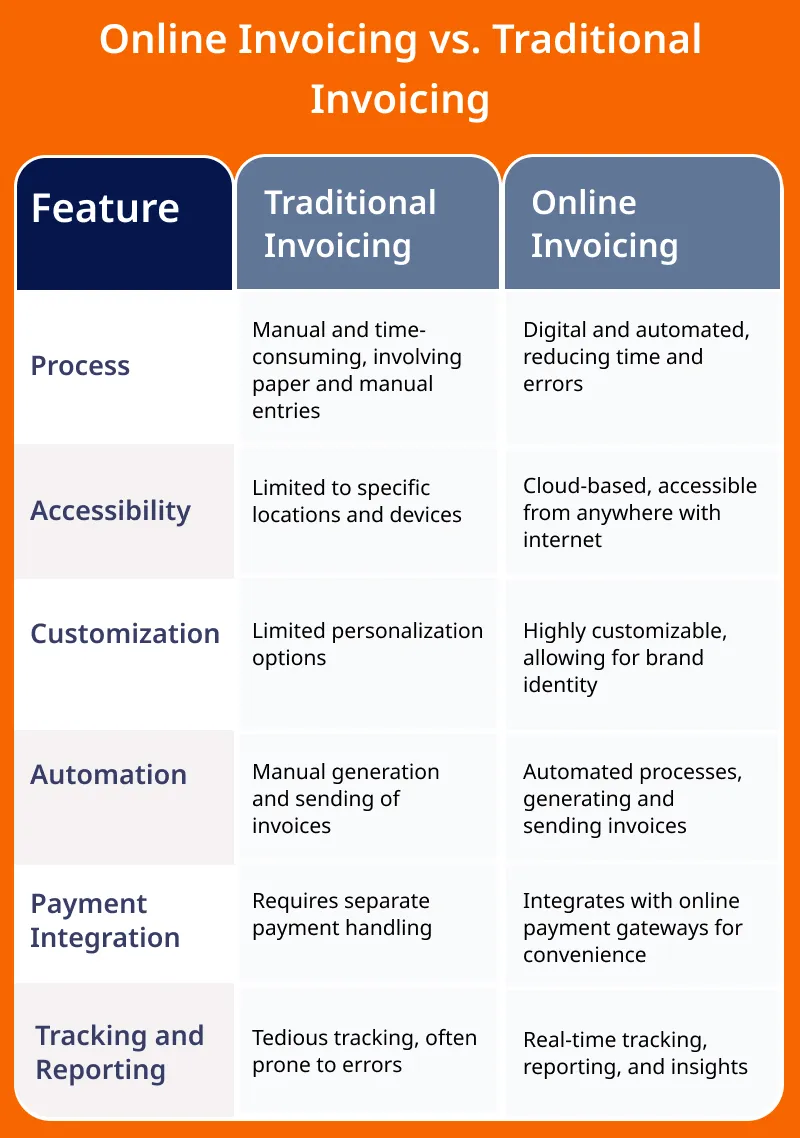

E-Invoicing, or electronic invoicing, is a digital method of creating, sending, and receiving invoices between businesses. It replaces traditional paper-based invoicing with electronic formats, facilitating a more efficient and streamlined process.

E-Invoicing typically involves the use of specialized software or platforms that enable businesses to generate and transmit invoices electronically, leading to:

- Faster processing

- Reduced errors

- Timely payments

This modern approach enhances transparency, lowers costs, and contributes to a more eco-friendly and sustainable invoicing system.

What Is An E-Invoicing Software?

In the world of business, where everyone wants to save time and money, e-Invoicing software emerges as a digital savior, transforming the way invoices are created, sent, and managed.

Simply put, e-Invoicing software is a digital tool that helps businesses generate, distribute, and track their invoices electronically.

Must-Have Features of E-invoicing Software

1. User-Friendly Interface

Online invoicing software typically should have an easy-to-use interface, making it accessible for businesses of all sizes. You don’t need to be a tech whiz to navigate through the platform.

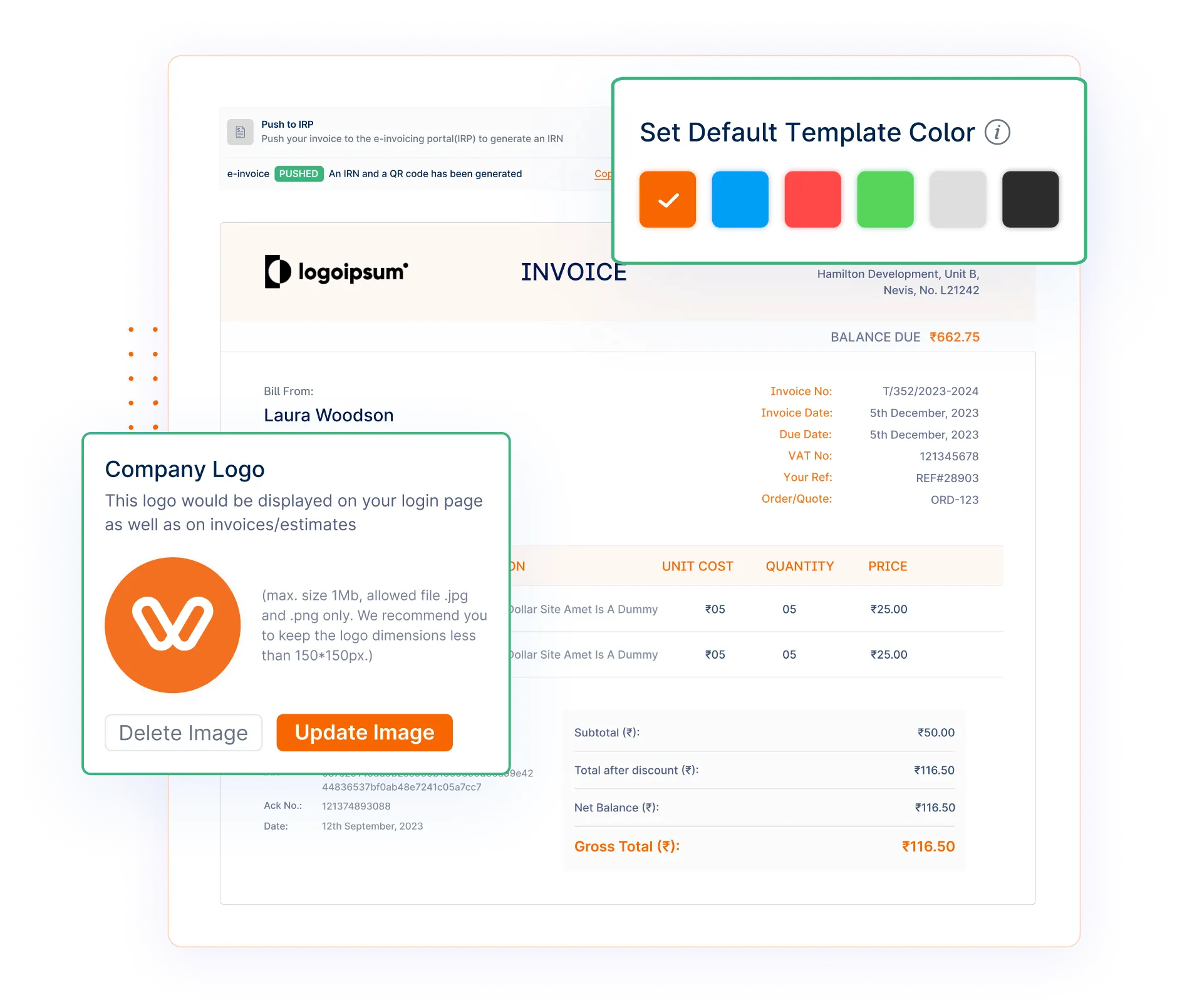

2. Customization Options

One size doesn’t fit all in business, and online invoicing software understands that. These tools must allow you to customize your invoices. Look for options to add:

- Your company logo

- Brand colors

- Personalized messages

3. Automated Invoicing

Online invoicing software automates the invoicing process, saving you a lot of time and minimizing the risk of errors. Once set up, the system must be able to generate invoices automatically based on predefined parameters.

4. Cloud-Based Accessibility

With a cloud-based online invoicing software, you can create, send, and track invoices anytime from anywhere with an internet connection.

This accessibility is especially handy for businesses with remote teams or frequent travelers. You must look for a cloud-based software.

5. Payment Integration

Integration with online payment gateways is a standout feature. This allows your clients to conveniently settle their invoices online, reducing the time it takes for you to receive payments.

It’s makes payment convenient for your clients.

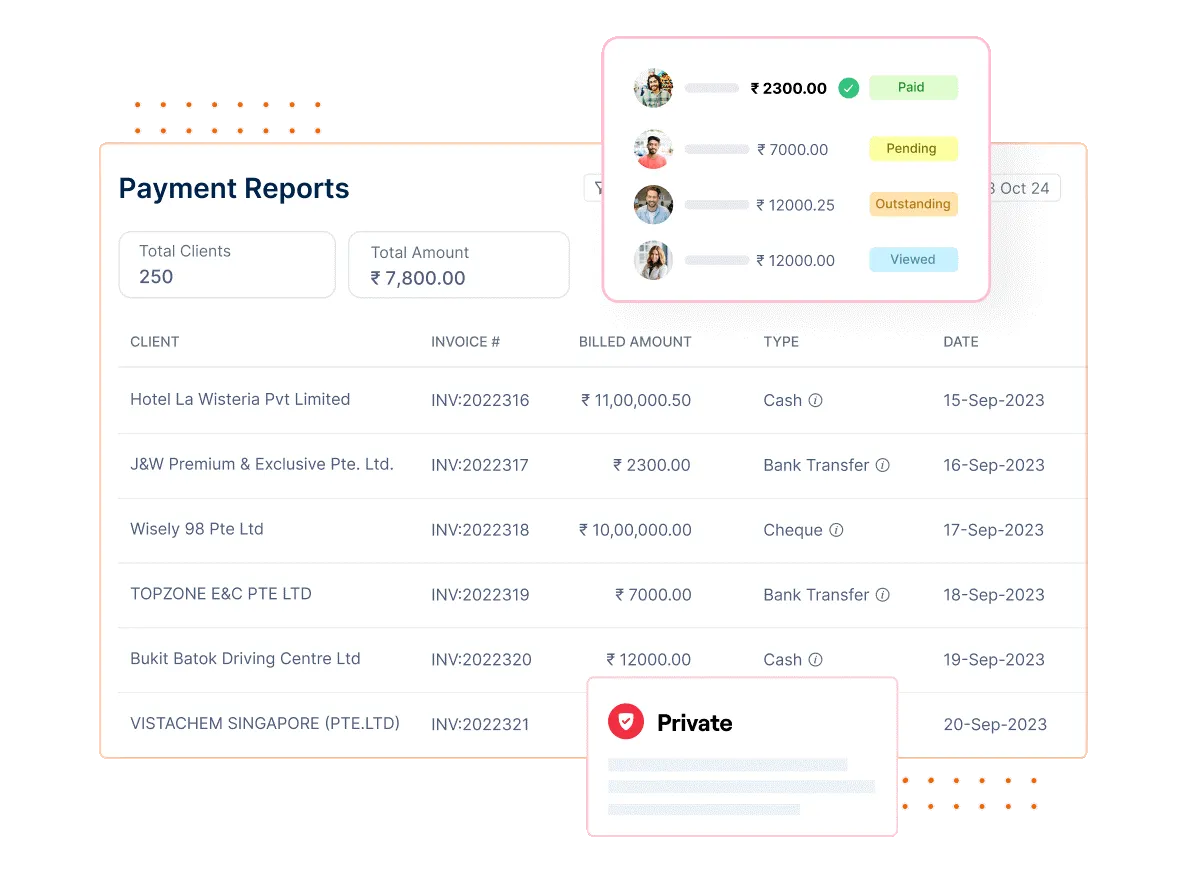

6. Tracking and Reporting

Keep a close eye on your financial health with online invoicing software’s tracking and reporting capabilities.

It should allow you to

- Monitor which invoices are paid, overdue, or pending

- Generate reports

- Get insights into your business’s financial performance

- Grow with your increasing needs

Top 5 E-Invoicing Software Solutions for 2024

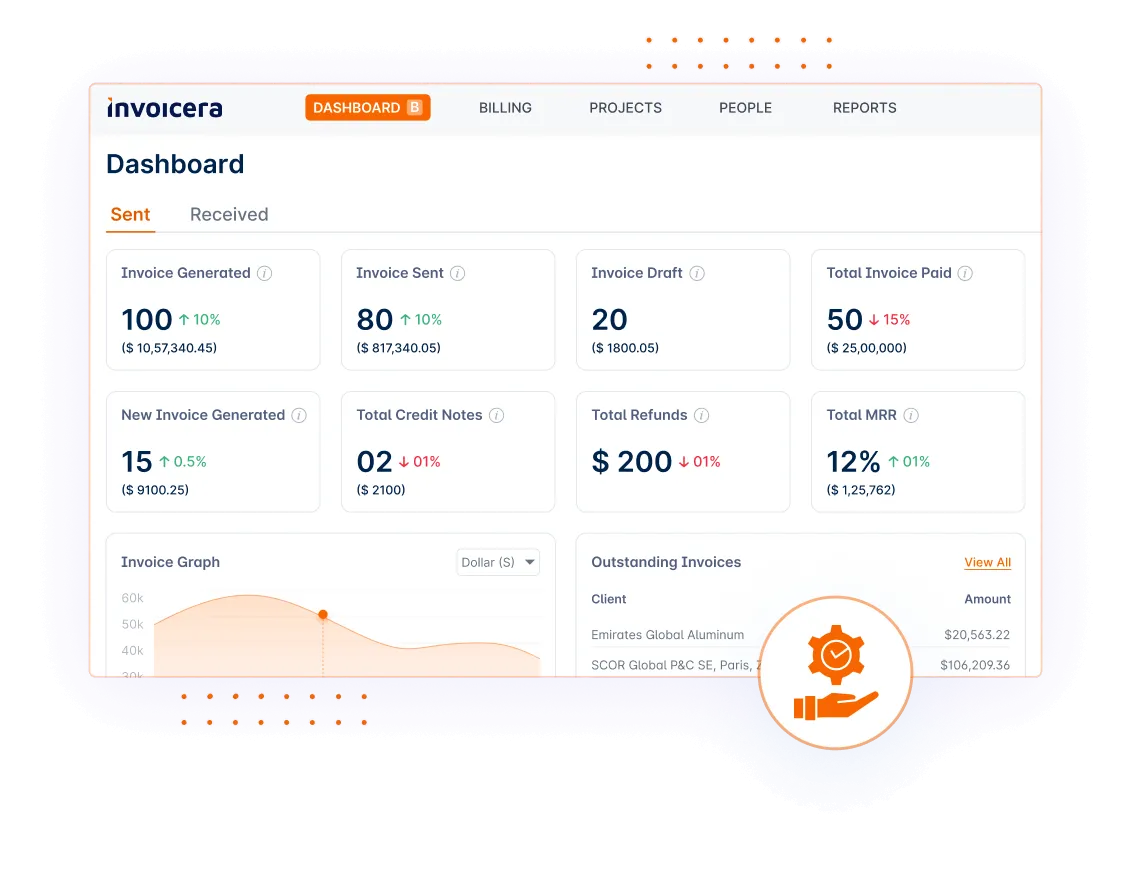

1. Invoicera

Invoicera is not just your average invoicing software; it’s a digital ally that simplifies your billing woes and empowers your business with efficiency. At its core, Invoicera is an online invoicing and billing platform designed to make the invoicing process smoother, faster, and hassle-free.

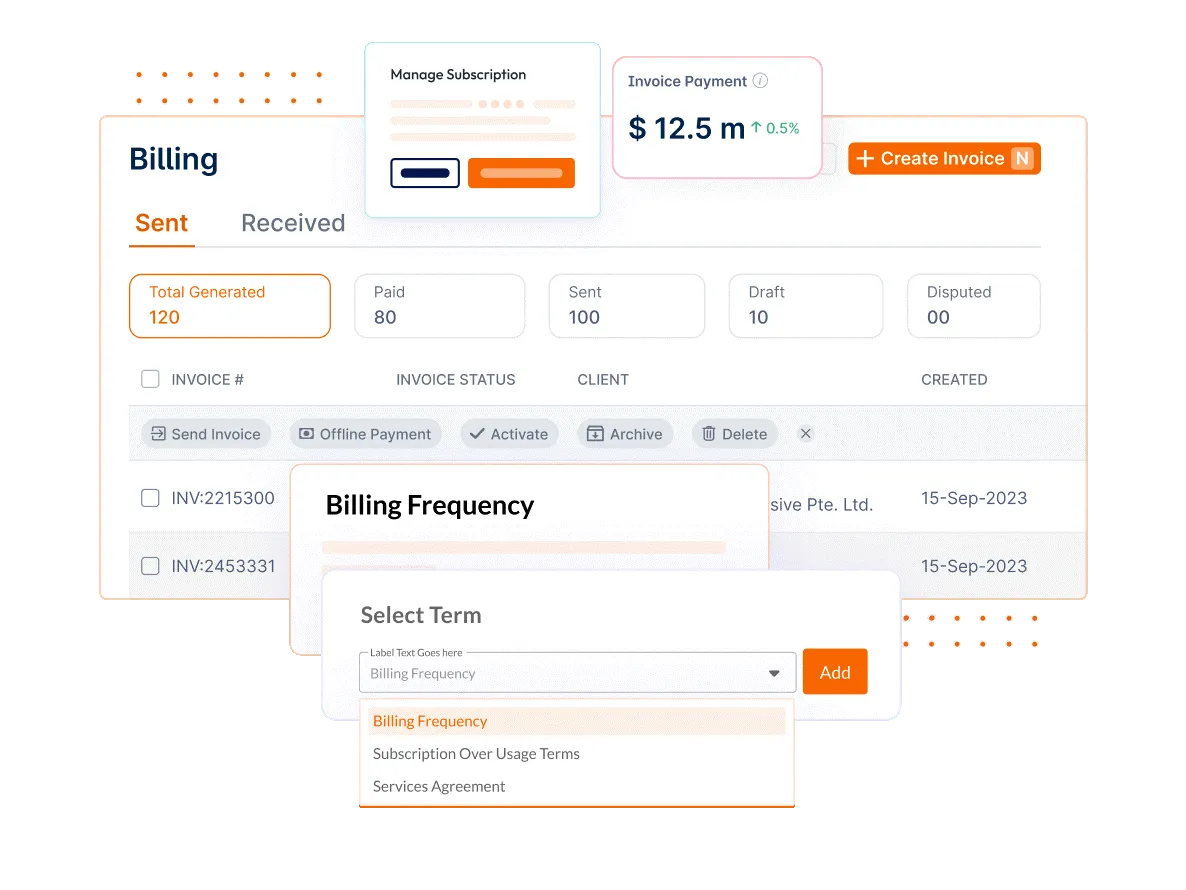

Key Features and Benefits

Standout Feature

Invoicera provides custom integrations with any third-party software upon request, helping businesses to sync data from their existing software. This flexibility helps

- Automate workflow

- Improve processing time

- Reduce manual data entry

- Eliminate errors

✔ User-Friendly Interface

Invoicera boasts an intuitive design, ensuring that even those new to digital invoicing can navigate effortlessly. No need for technical skills – it’s designed for everyone.

✔ Automation Magic

With Invoicera, you can automate repetitive invoicing tasks for subscriptions, save time, and reduce human errors.

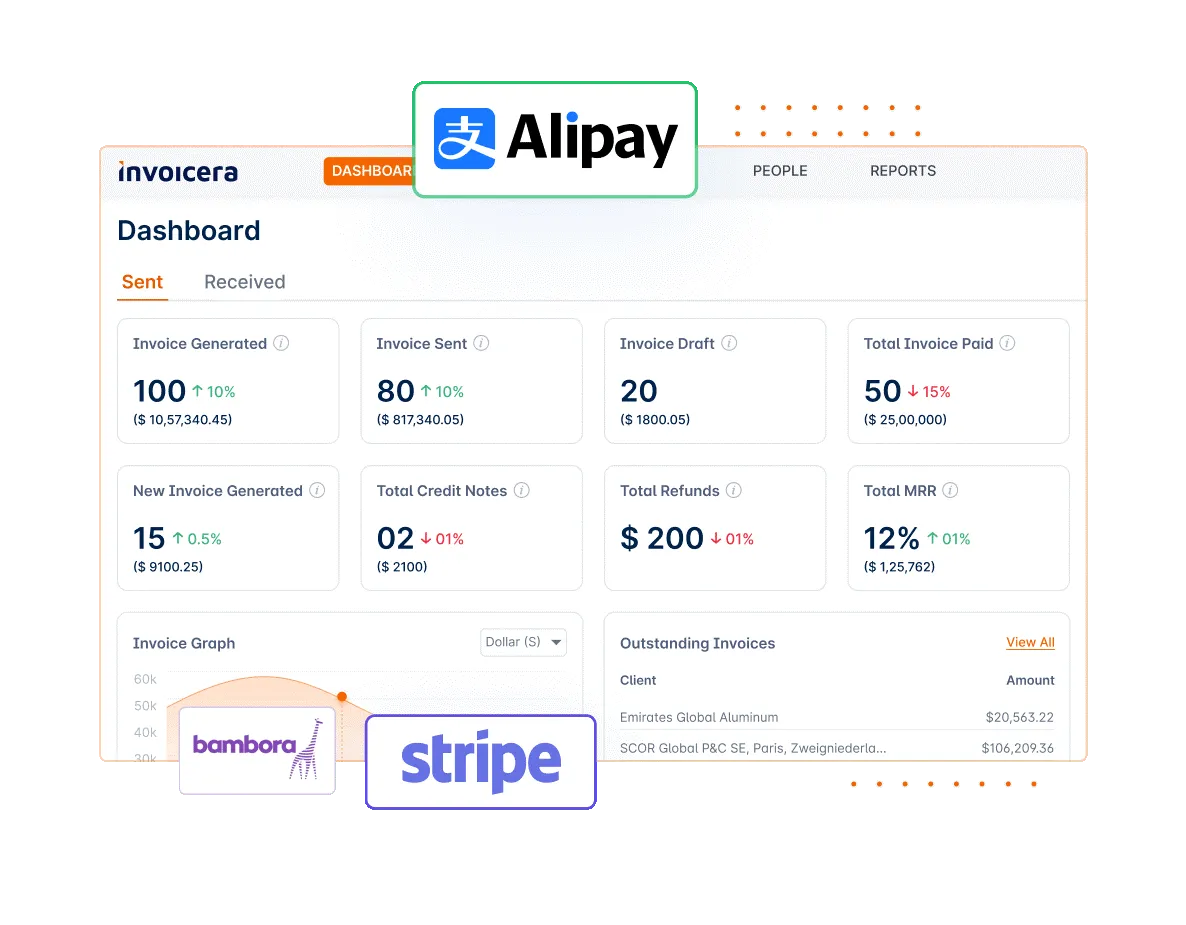

✔ Online Payment Integration

By integrating 14+ online payment gateways, you can speed up your payment cycle. It will help you get paid faster with the convenience of online transactions. Also, it will make it easier for your clients and customers to pay you.

Your clients can also pay you through credit/debit cards, bank transfers and checks.

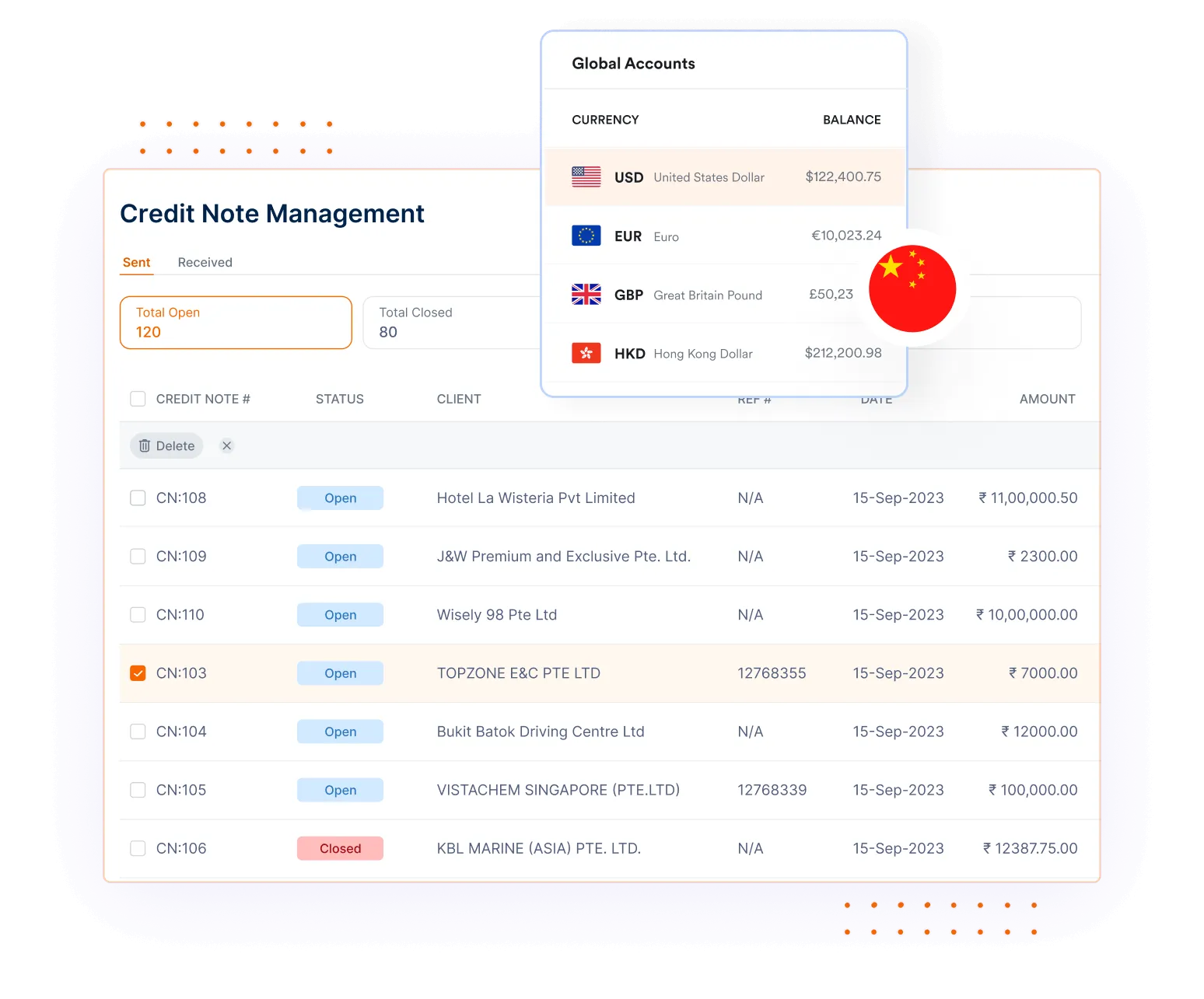

✔ Credit Notes for Discrepancies

With Invoicera, you can easily manage invoice discrepancies and refunds, if any. It lets you create credit notes to adjust invoices for returned products or billing errors.

It boosts customer satisfaction and also helps you keep accurate financial records.

✔ Customization at Your Fingertips

You can tailor your invoices to match your brand identity. Invoicera allows you to customize templates, ensuring a professional and consistent look for all your billing documents.

✔ Real-Time Tracking

You can keep a close eye on your finances with real-time tracking of invoices and payments. It lets you stay in the loop and make better decisions for the financial well-being of your business.

Pros And Cons

| Pros | Cons |

| ● Easy to import expense files

● Handle multiple businesses ● Offers 14+ payment gateways

|

● Advanced features are in the paid version |

Pricing

While Invoicera offers a free plan, its premium plans are competitively priced, ensuring businesses get value for their money.

It starts with an affordable plan of just $15/month that can easily match your business budget. Get a free demo!

2. Wave

Wave is a free invoicing tool that packs a punch. It’s designed for small businesses and freelancers, offering features like invoicing, accounting, and receipt scanning, all without breaking the bank.

Key Features and Benefits

✔ Create Estimates: Generate personalized invoices, estimates, and receipts swiftly.

✔ Payment Reminders: Send automatic payment reminders for timely payments.

✔ Payment Options: Accelerate payments by accepting credit cards, often settled within two days.

✔ Expense Management: Keep tabs on income, expenses, and receipts through scanning tools and bank connections.

Pros And Cons

| Pros | Cons |

|

|

Pricing

Wave pricing for a standard plan starts at $16/month.

3. Freshbooks

FreshBooks is like your organized virtual assistant. It streamlines invoicing and helps you keep track of expenses effortlessly. It’s user-friendly and perfect for freelancers looking for a hassle-free invoicing experience.

Key Features and Benefits

✔ Effortless Customization: Easily tailor invoices using automated recurring options for swift modifications.

✔ Real-time Client Interaction Tracking: Say updated with live tracking of client interactions related to invoices.

✔ Automatic Payment Reminders: Set up automatic reminders and fees for late payments, ensuring prompt settlements.

✔ Seamless Online Credit Card Payments: Accept credit card payments online hassle-free, ensuring smooth transactions.

✔ Professional Estimate Generation: Create and send professional estimates promptly to potential clients.

✔ Intuitive Business Insights: Gain valuable business insights through intuitive reports and dashboards.

Pros And Cons

| Pros | Cons |

|

|

Pricing

Freshbooks offers premium features in the plan that costs $19/month.

4. Zoho Invoice

Zoho is your go-to option for a suite of business tools, and its invoicing feature is no exception. It’s intuitive, customizable, and seamlessly integrates with other Zoho apps, making your invoicing process smoother.

Key Features and Benefits

✔ Streamlined Invoicing Process: Generate polished invoices, automate recurring billing, and easily accept online payments.

✔ Unified Expense Management: Organize and bill expenses to clients seamlessly within a unified platform.

✔ Bank Integration: Link Zoho Books to your bank for live cash flow updates and instant transaction categorization.

✔ Comprehensive Financial Insights: Access insightful financial reports (P&L, Balance Sheet, Cash Flow Statement) for better financial management.

✔ Efficient Inventory Tracking: Implement inventory tracking to oversee stock movements efficiently.

Pros And Cons

| Pros | Cons |

|

|

Pricing

Zoho Books offers its standard plan at $15/month, along with a free trial.

5. Xero

Xero is your cloud-based accounting wizard. It’s user-friendly and offers a number of features beyond invoicing, like bank reconciliation and expense tracking, making it a favorite among many freelancers and small businesses.

Key Features and Benefits

✔ Recurring Billing Solution: Schedule recurring invoices for convenience.

✔ Reminders To Avoid Late Payments: Automate payment reminders to speed up customer payments through tailored emails.

✔ Various Payment Options: Accept online payments via debit/credit cards or PayPal directly from the invoice for improved cash flow.

✔ Mobile Invoicing: After job completion, generate and send invoices instantly from your phone or tablet.

Pros And Cons

| Pros | Cons |

| ● Competitvely-priced plans

● Free 30-day trial ● Unlimited users and clients |

● Quotes and invoices are limited to 20/month on the starter plan

● A little difficult to use |

Pricing

Xero offers its standard plan at $11.5/month.

How Invoicera Stands Out in the Market

In a sea of invoicing solutions, Invoicera stands out for its commitment to simplicity and effectiveness.

Here’s what sets it apart:

Comprehensive Solution

Invoicera goes beyond basic invoicing. It offers numerous features, including expense management, time tracking, and robust reporting tools, making it an all-in-one solution for your business needs.

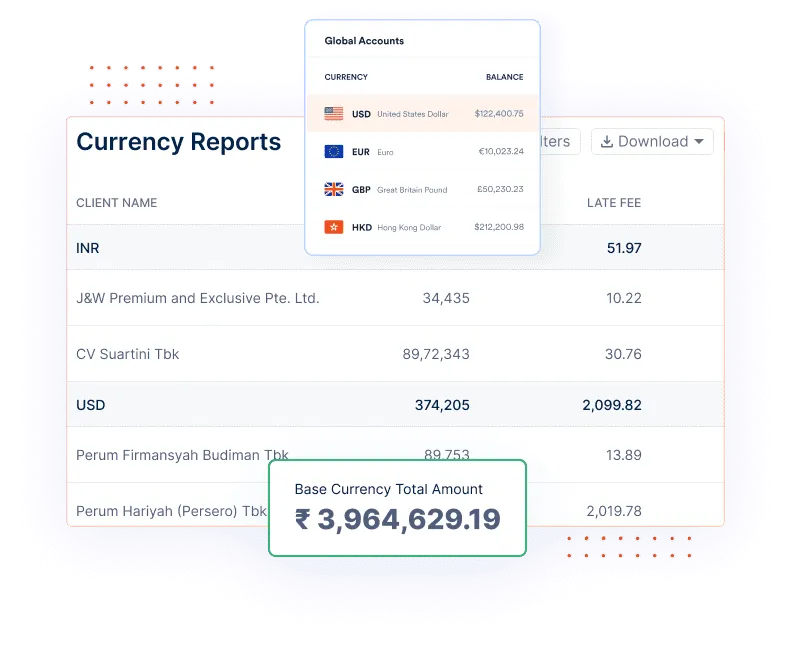

Global Reach

With 125+ currencies and 15+ languages support, Invoicera is not confined by borders. It caters to businesses on a global scale, ensuring that you can manage your invoicing needs seamlessly, no matter where you operate.

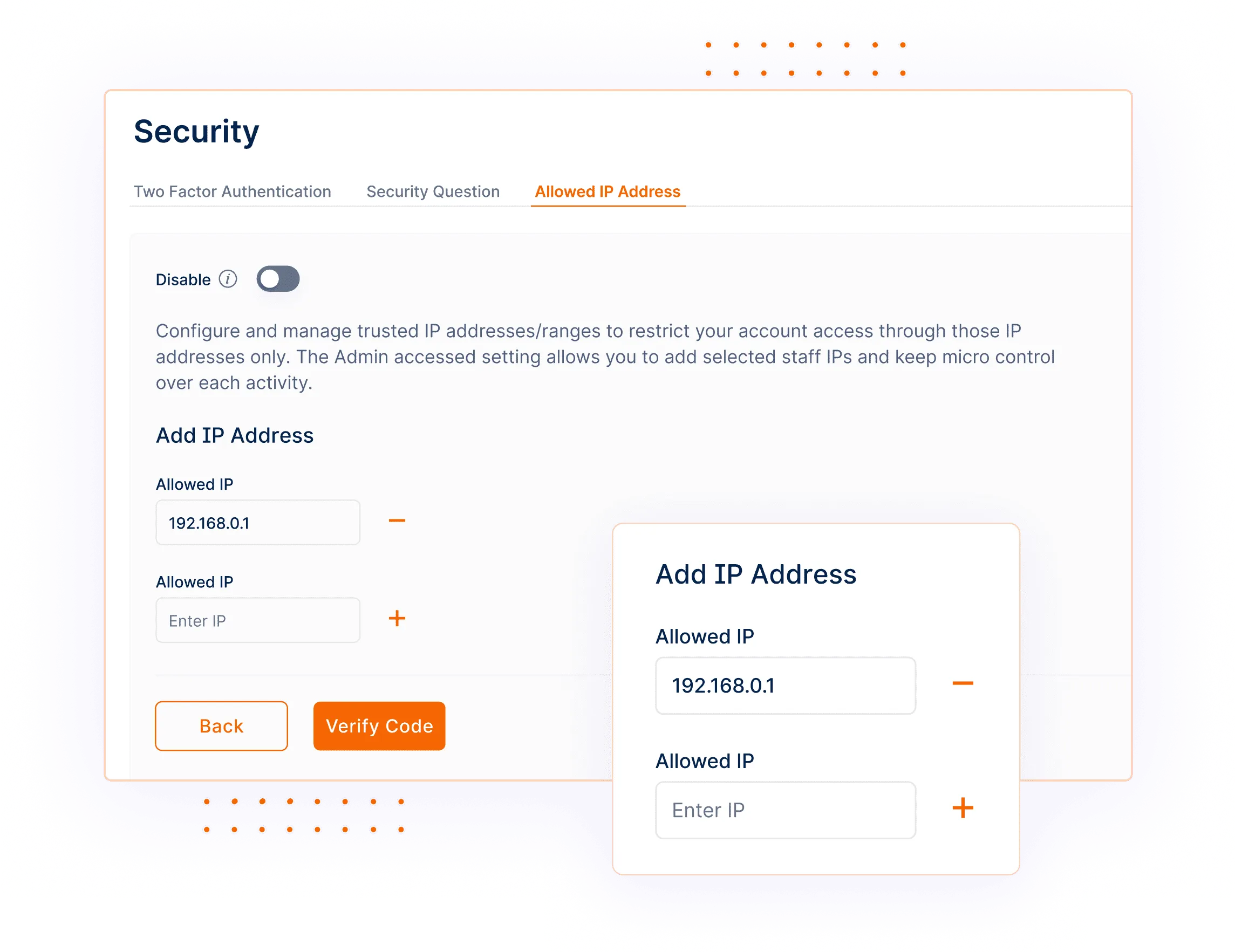

Security First

Invoicera prioritizes the security of your financial data. Benefit from secure transactions and data protection features, giving you peace of mind as you handle your business finances digitally.

How To Make The Right Choice?

Choosing the right invoicing software can significantly impact your business efficiency and client relationships.

Here are key pointers to consider when selecting the ideal invoicing software:

1. Business Needs Assessment

- Identify Requirements: Pinpoint your specific needs. Are you focused on basic invoicing, or do you require additional features like expense tracking, project management, or recurring billing?

- Scalability: Consider your business’s growth trajectory. Will the software accommodate expansion and increasing invoicing demands?

2. Feature Suitability

- Customization: Look for software that allows you to personalize invoices, reports, and templates to reflect your brand.

- Automation: Check for automation capabilities, such as recurring invoices, payment reminders, and integration with payment gateways, to streamline processes.

3. User-Friendly Interface

- Ease of Use: Choose software that you and your team can navigate effortlessly. A user-friendly interface could save you time and reduce the learning curve.

- Accessibility: Ensure it’s accessible across devices and platforms for flexibility in managing invoices on the go.

4. Integration and Compatibility

- Integration Potential: Consider software that integrates with your existing tools, like accounting software or CRM systems, to ensure seamless workflow.

- Compatibility: Ensure compatibility with various file formats and compatibility with different browsers or operating systems.

5. Security and Support

- Data Security: Verify the software’s security measures to protect sensitive financial information and client data.

- Support Services: Check for available customer support, including responsiveness, available channels, and helpful resources like tutorials or FAQs.

6. Cost and Value

- Pricing Structure: Understand the pricing model – whether it’s a subscription-based model, one-time purchase, or tiered plan. Compare it with the value and features offered.

- Return on Investment: Evaluate the potential benefits against the cost to ensure you’re getting a good return on investment.

Why Does Your Business Need E-Invoicing Software?

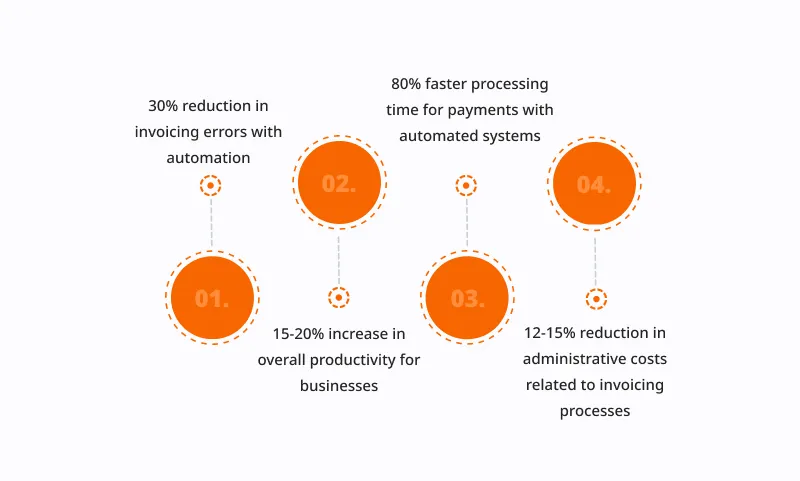

1. Automation and Time Efficiency

Time is money, and wasting it on manual tasks can be a real drain on resources.

Automation takes charge, generating invoices promptly and freeing up your time for more important aspects of your business.

Online invoicing significantly reduces this risk, ensuring that your invoices are accurate every time.

Automation streamlines the entire invoicing process, from creation to delivery.

2. Faster Payment Processing

With online invoicing software, you can link your invoices directly to online payment gateways.

Online payments can speed up the process. This rapid turnaround not only improves cash flow but also lessens the stress in practice management software associated with waiting for payments.

3. Improved Financial Management

Online invoicing software provides instant updates on the status of your invoices. You can check which invoices are paid, pending, or overdue without the need for manual checks.

Real-time tracking helps you identify overdue invoices promptly, minimizing the risk of late fees and improving your bottom line.

4. Enhanced Client Relationships

Online invoicing software allows you to add your company logo, choose brand colors, and customize the layout of your invoices.

The Invoice generator also helps in swift invoice generation and delivery, contributing to a positive client experience.

5. Scalability and Adaptability for Business Growth

As your business blossoms, the number of clients, projects, and transactions might increase. Online invoicing software grows with you, effortlessly handling the rising volume of invoicing needs.

With the expansion of the business toolkit, online invoicing software seamlessly integrates with other tools like accounting software and project management systems.

Conclusion

Remember, it’s not just about finding any software but the one that fits your needs.

Don’t rush this decision. Take your time to compare options, consider what your business truly needs, and weigh the pros and cons.

Ultimately, the right software will make invoicing easier, help you get paid faster, and keep your financial information safe.

So, take a deep breath, trust your research, and make that choice.

Your business will thank you for it.

FAQs

Q. How long does it take to set up and start using new invoicing software?

Ans. The setup time varies. Many invoicing tools offer quick setup guides or tutorials to help you get started quickly. Typically, depending on customization needs, it can range from a few minutes to a couple of hours.

Q. Can I access my invoicing data from different devices or locations?

Ans. Many online invoicing tools like Invoicera offer cloud-based solutions, allowing access from anywhere with an internet connection. Ensure the software you choose supports multi-device access if that’s important for your business.

Q. What happens if the software doesn’t meet my needs after I’ve started using it?

Ans. Many software providers offer trial periods or money-back guarantees. It’s advisable to take advantage of these offers to test the software thoroughly before committing.

Q. How often does the software receive updates or improvements?

Ans. Frequent updates can indicate a software’s commitment to improvement. Check the software’s release notes or update history to gauge how often they enhance their product.