Introduction

The world of Goods and Services Tax (GST) is filled with many challenges that business entities encounter, most especially when issuing invoices.

These challenges often include navigating varying tax rates across states, complying with ever-changing regulations, and managing the complexity of manual invoicing systems.

These hurdles can lead to significant delays in invoicing, increased risk of errors, and higher administrative costs, ultimately impacting business profitability. This is where the concept of automated invoicing comes into play.

It not only makes compliance easier but also minimizes the necessity of tackling invoices to grow the business.

This blog will discuss automated invoicing and how it eliminates some common GST problems. It will also look at the bigger-picture benefits that this brings.

Find out how incorporating e-invoicing into your organization can transform the tools and strategies for GST compliance and financial performance, including real-time invoice tracking and the integration of IRP.

E-Invoicing and GST as a Powerful Duo

E-invoicing is a digital approach to generating, sending, and storing invoices, streamlining the invoicing process and enhancing efficiency. Under the GST system, e-invoicing will involve passing invoices in real time to help businesses meet any legal requirements concerning taxes.

Hence, linking to the Invoice Registration Portal (IRP) is essential to meet the e-invoicing requirements. The IRP is the Receipting Interface Point and all e-invoices have to be sent to the IRP where they are validated and approved before being issued out to the customer.

This integration enables invoices to conform to the GST standards and helps carry out the eventual reporting and tracking.

The government mandate for e-invoicing constitutes the new way of how companies will be handling their invoices. The task is to address issues related to tax evasion, information disclosure, and compliance.

- Streamlined reporting reduces manual entry and errors by automatically generating GST returns based on e-invoice data.

- Businesses can monitor their invoices and payments in real-time, improving cash flow management.

- The IRP ensures that only validated invoices are sent to clients, minimizing the risk of discrepancies.

- Reduced paperwork and administrative tasks lead to lower operational costs for businesses.

Overall, e-invoicing is transforming GST compliance, making it easier for businesses to adhere to tax regulations while benefiting from improved efficiency and transparency.

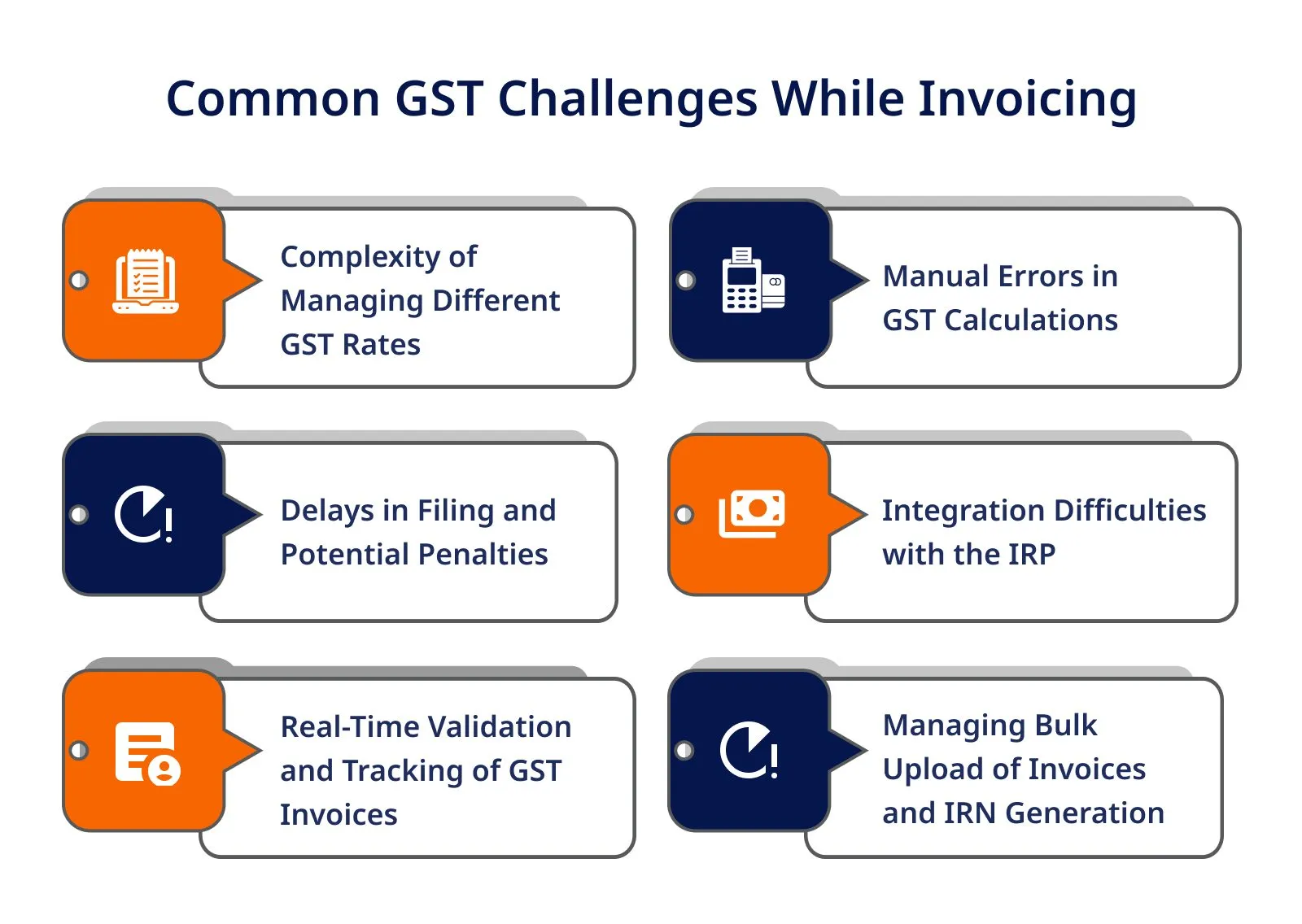

Common GST Challenges While Invoicing

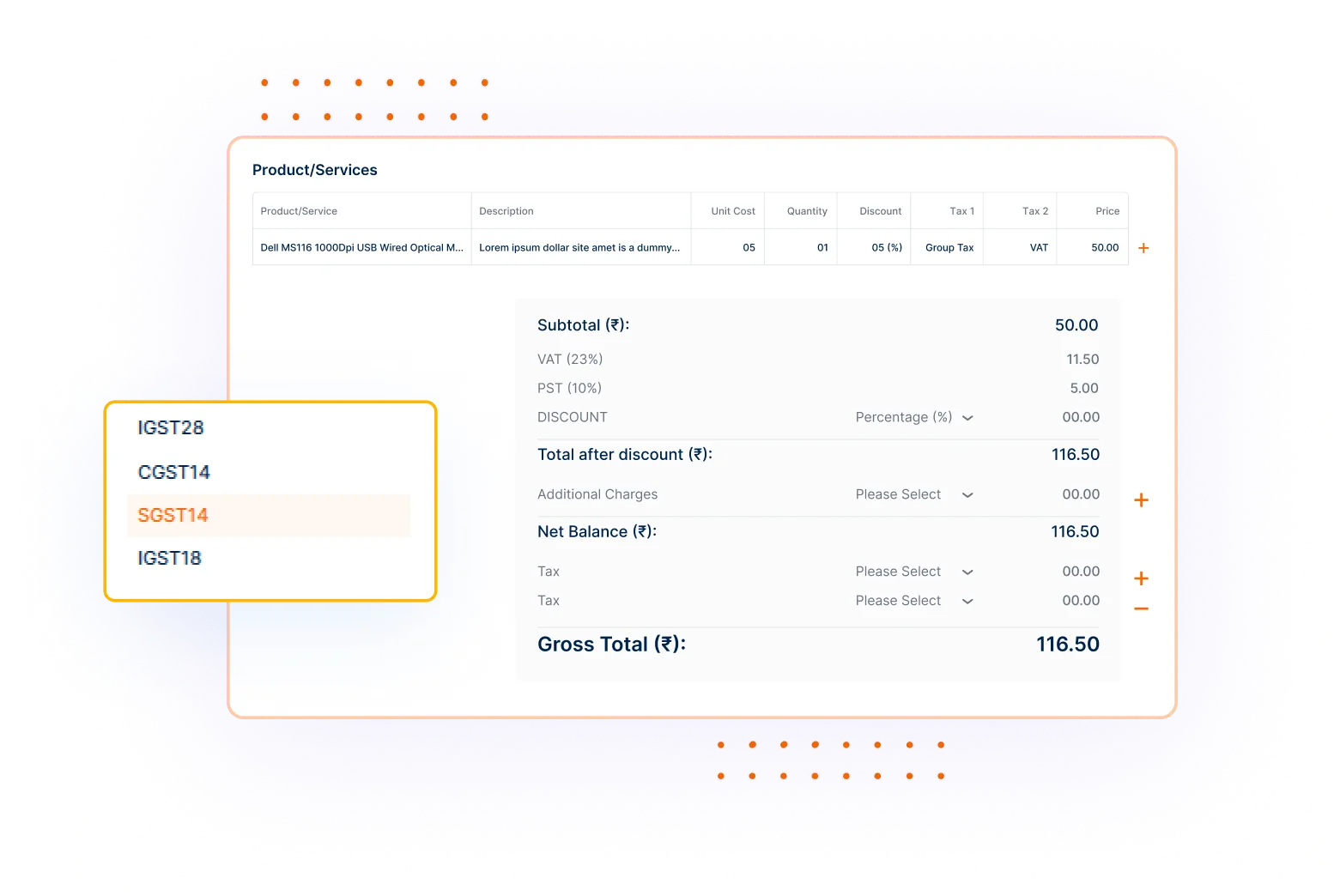

Complexity of Managing Different GST Rates

Navigating various GST rates for different products and services can be overwhelming. This complexity along with the use of tools like an income tax calculator, makes it challenging to ensure that each invoice is correctly calculated, which can lead to compliance issues.

Manual Errors in GST Calculations

Relying on manual processes often results in errors during GST calculations. These mistakes can lead to discrepancies that create compliance problems, potentially resulting in fines or audits.

Delays in Filing and Potential Penalties

Timely GST filing is crucial, but manual invoicing can cause delays. Missing deadlines can result in penalties and increased scrutiny from tax authorities, impacting your business’s financial health.

Integration Difficulties with the IRP

Integrating invoicing systems with the Invoice Registration Portal (IRP) can be complex. Businesses may face challenges in ensuring seamless communication between systems, leading to inefficiencies in invoice processing.

Real-Time Validation and Tracking of GST Invoices

Keeping track of GST invoices and validating them in real-time can be difficult. Without proper tracking, businesses risk losing important information, which can affect compliance and reporting accuracy.

Managing Bulk Uploading & IRN Generation

For high-volume businesses, handling the bulk upload of invoices and generating Invoice Reference Numbers (IRNs) can be a daunting task. This challenge can slow down operations and create backlogs in invoicing processes.

How Automated Invoicing Solves GST Challenges

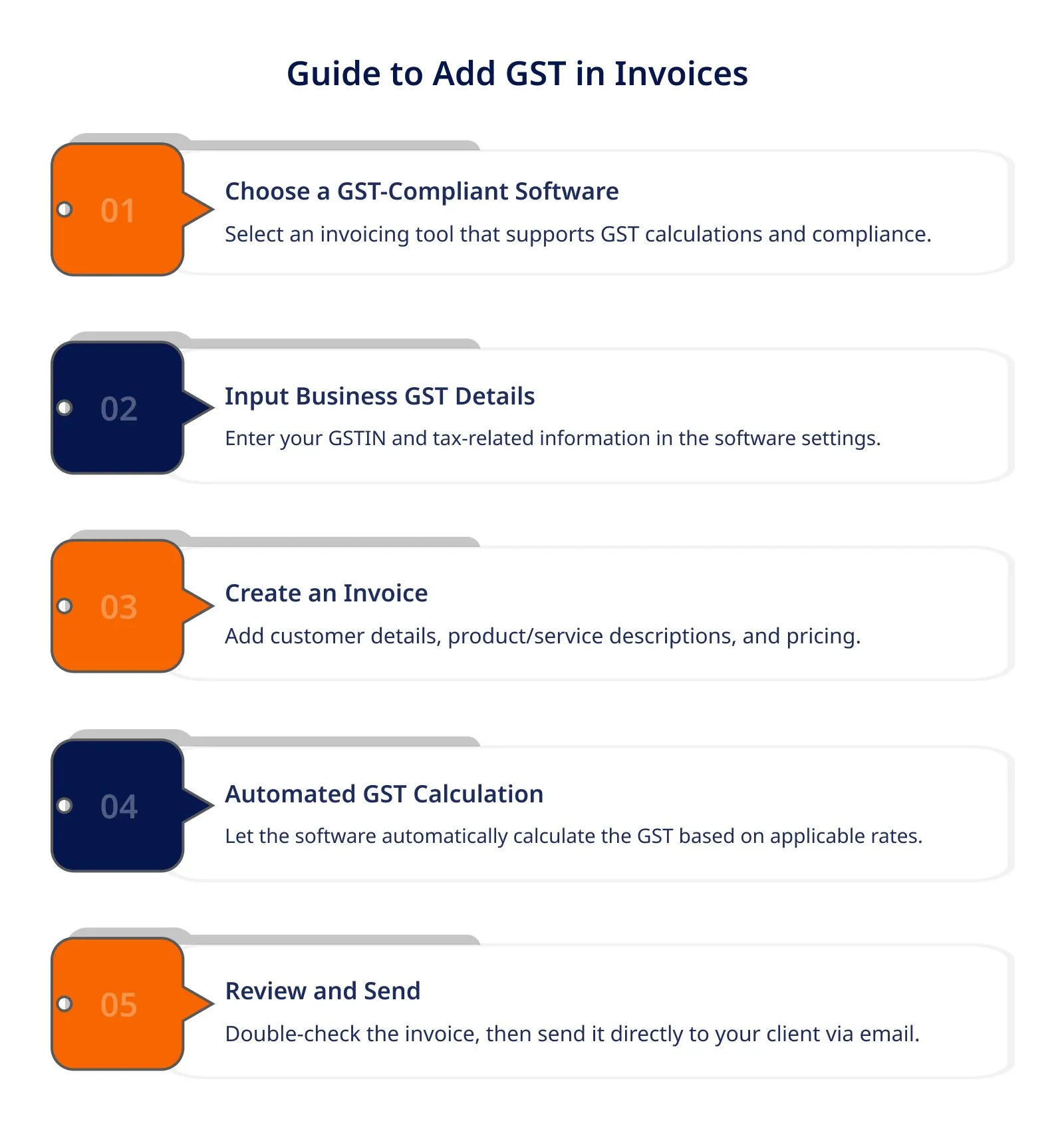

Dealing with GST manually can be tedious and error-prone, but automated invoicing software makes it simple and hassle-free. Here’s how it helps you overcome common GST challenges:

Accurate GST Calculations

No need to worry about manual errors. Automated software ensures precise GST calculations, helping you avoid compliance issues and penalties.

GSTIN Validation

You can easily validate your customers’ GSTIN to ensure the correct details are on your invoices, reducing the risk of mistakes.

Automatic Tax Rate Updates

It helps you stay updated with the latest tax rate changes, automatically adjusting GST percentages as per government regulations.

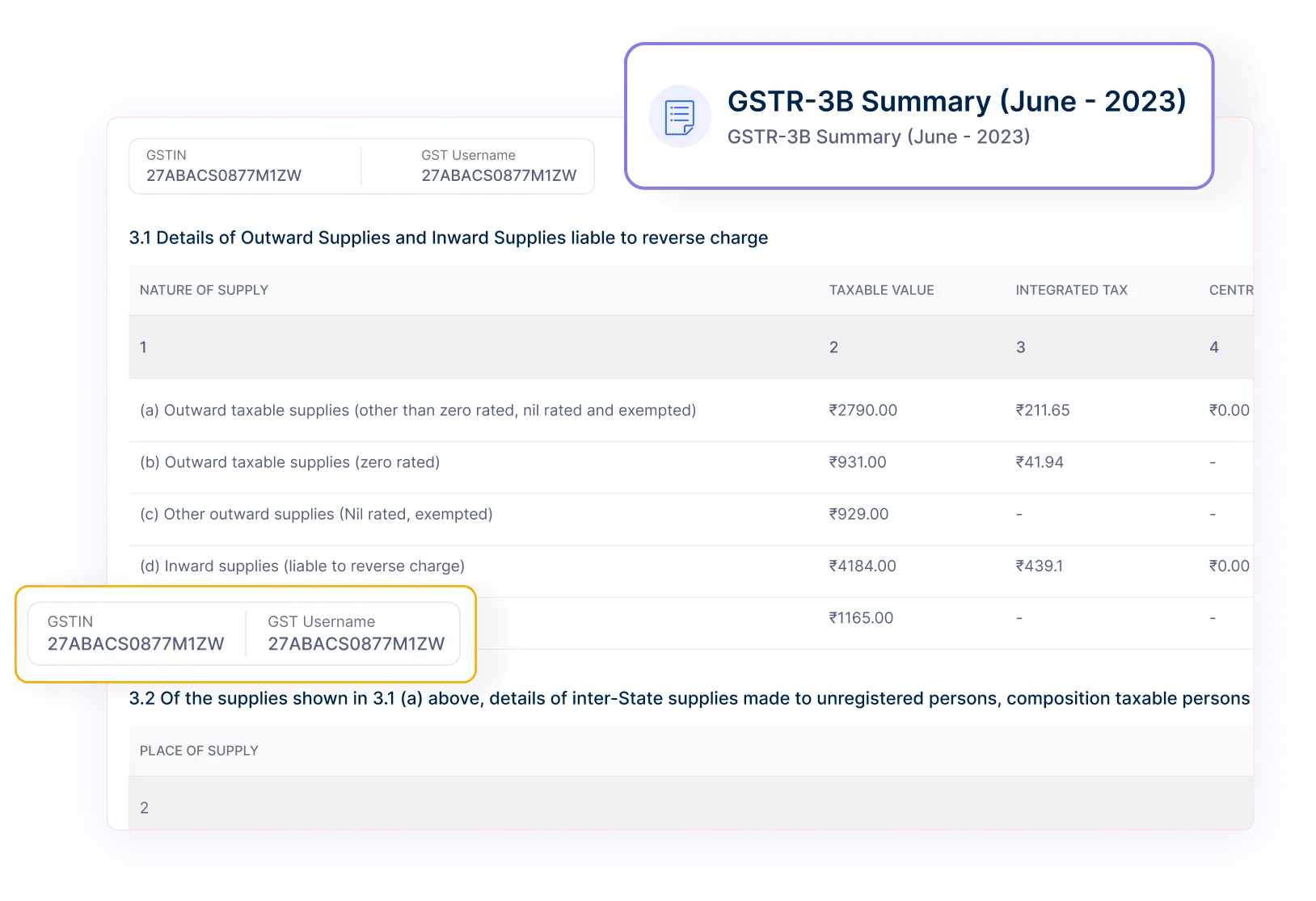

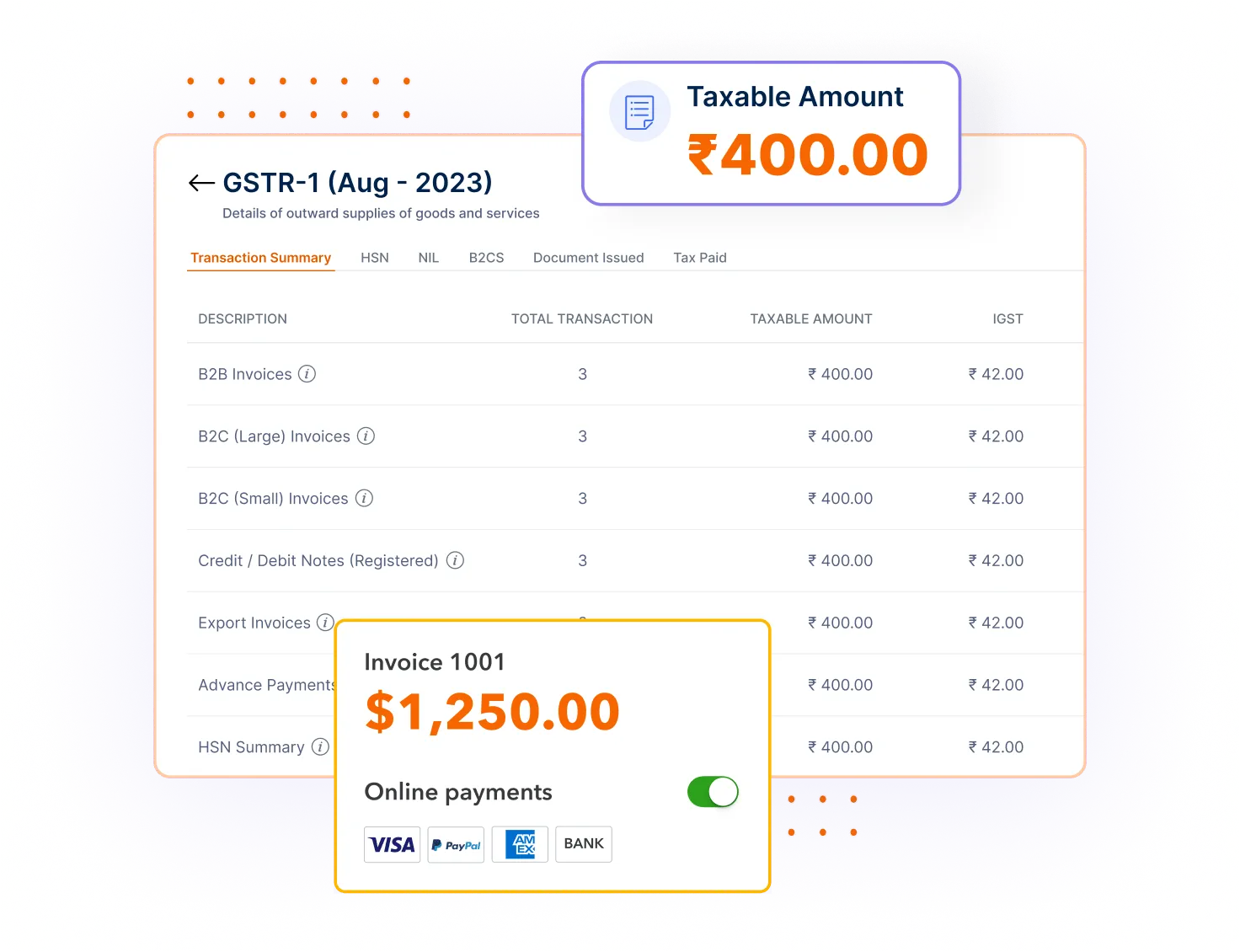

Seamless Reporting

You can generate GST-compliant reports for filing returns in just a few clicks, saving you time and effort.

Effortless Invoice Tracking

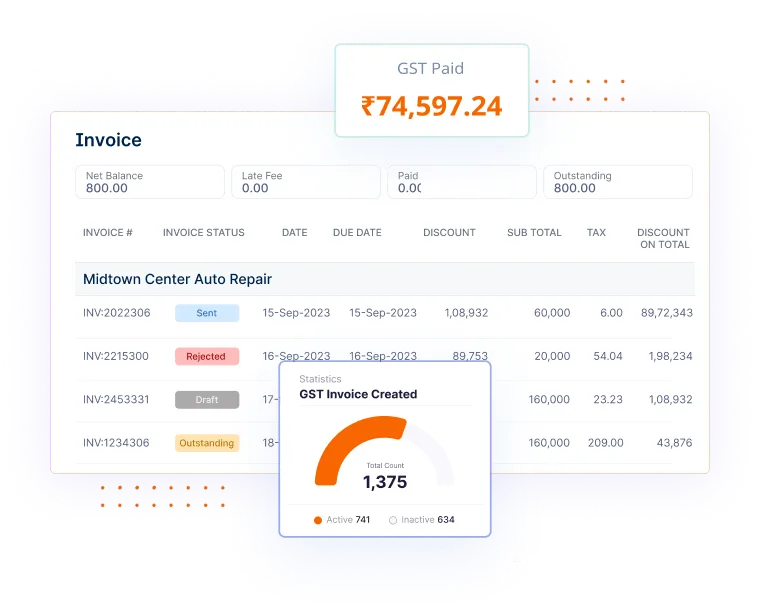

Track paid and unpaid invoices, ensuring that GST on each invoice is accounted for, and preventing cash flow gaps.

Benefits of Using Automated Invoicing for GST

Saves Time

It only takes a few minutes to create and send invoices. With features such as pre-designed templates and recurring invoicing, there will be less time spent on paperwork and more on business. It enables you to concentrate more on the crucial aspects of developing your business.

Reduces Errors

Automation reduces the chances of errors in calculations and data input. Thus, the risk of manual errors in invoices is eliminated, guaranteeing that your invoices are correct and that there is little possibility of compliance complications or delayed payments.

Enhances Cash Flow

Automated invoicing is an efficient way to receive your payments earlier. For due matters you can also set reminder so that you can call or notify your clients to pay their overdue invoices. This strategy is unarguably proactive in enhancing your cash flow since it allows you to have enough cash for the operations.

Improves Compliance

Automated invoicing helps your invoices contain all the necessary GST information so that your organization does not face penalties on taxes. This way, you do not have to worry about the issue of taxes while managing or operating your business.

Provides Insights

Another advantage of automated invoicing is that you get to know the patterns of invoicing with report and analytics data. It can help you know which clients are timely with their payments, understand the revenue patterns, and make strategic decisions for your practice’s growth.

Streamlines Record Keeping

Retrieving past invoices is easy since most automated software keeps all your invoicing records in one place. This kind of organization helps minimize your accounting hassles, and makes it easy to prepare for audit tests or GST return.

How Invoicera Helps in GST Invoicing?

Navigating GST invoicing can often feel like a maze of regulations and paperwork. Luckily, Invoicera is here to make it simpler and more efficient. Let’s break down how this tool can transform GST invoicing for you.

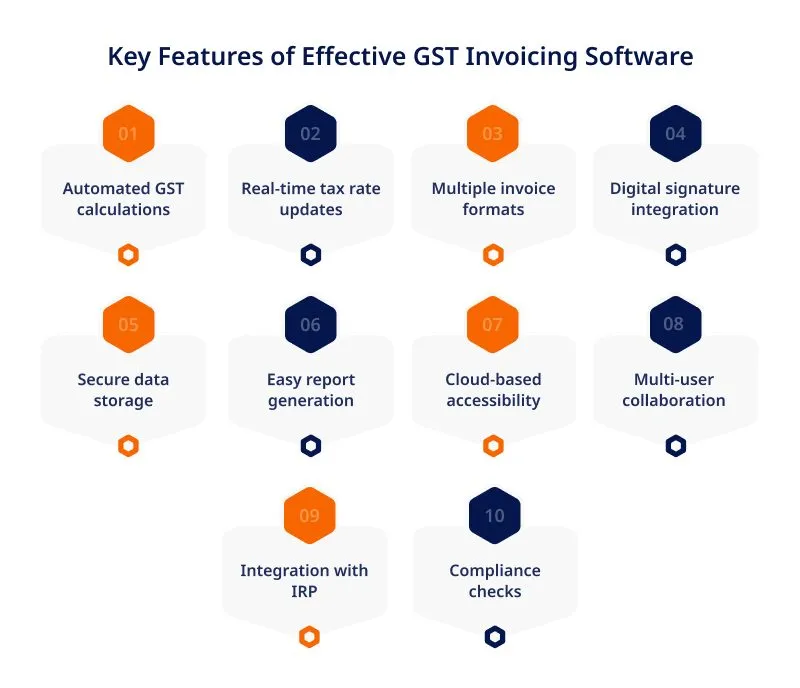

Automated GST Calculations

Seamless IRP Integration

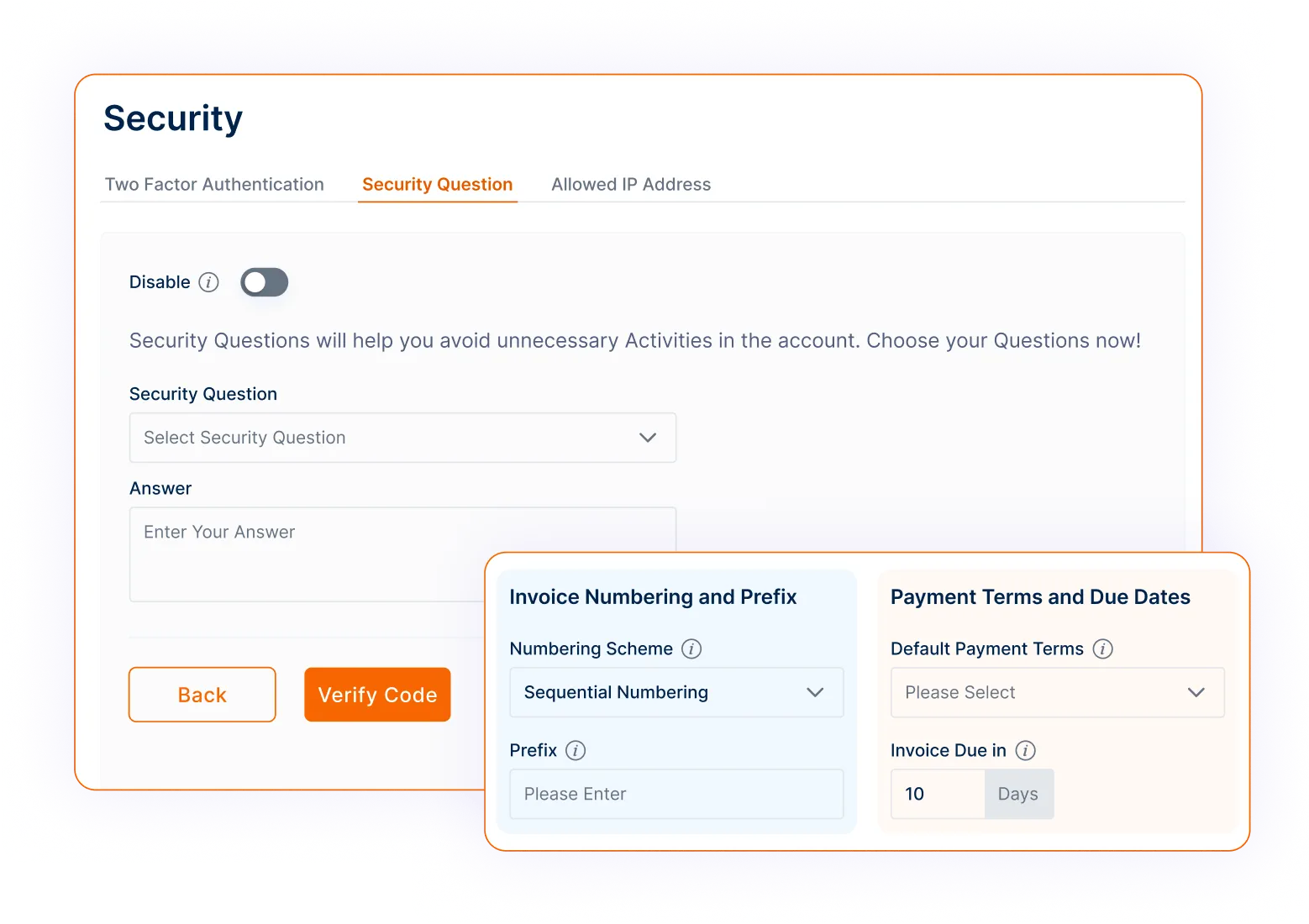

Built-in Security and Validation

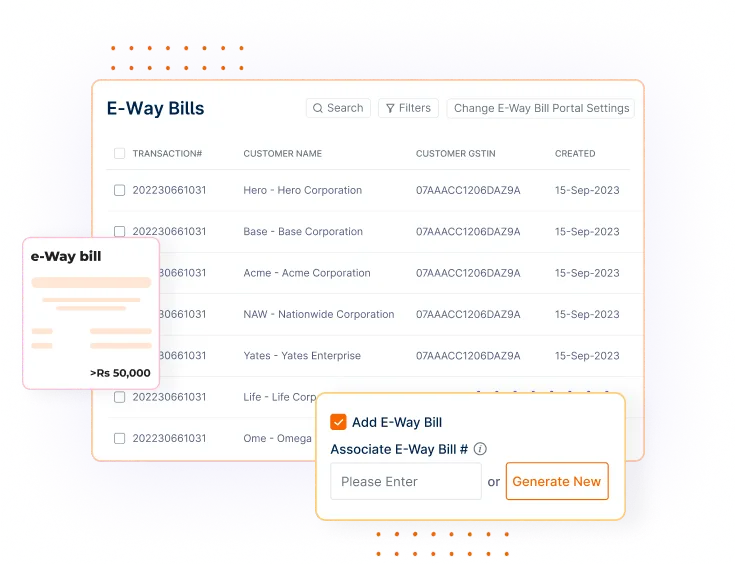

E-Way Bill Generation

Multi-Rate GST Support

Bulk Invoice Generation with GST

GST-Compliant Invoice Templates

Integration with Accounting Software

Data consolidation is essential to make the right entries in your accounts. Invoicera is compatible with most of the used accounting software to ensure that records are well kept and consistent.

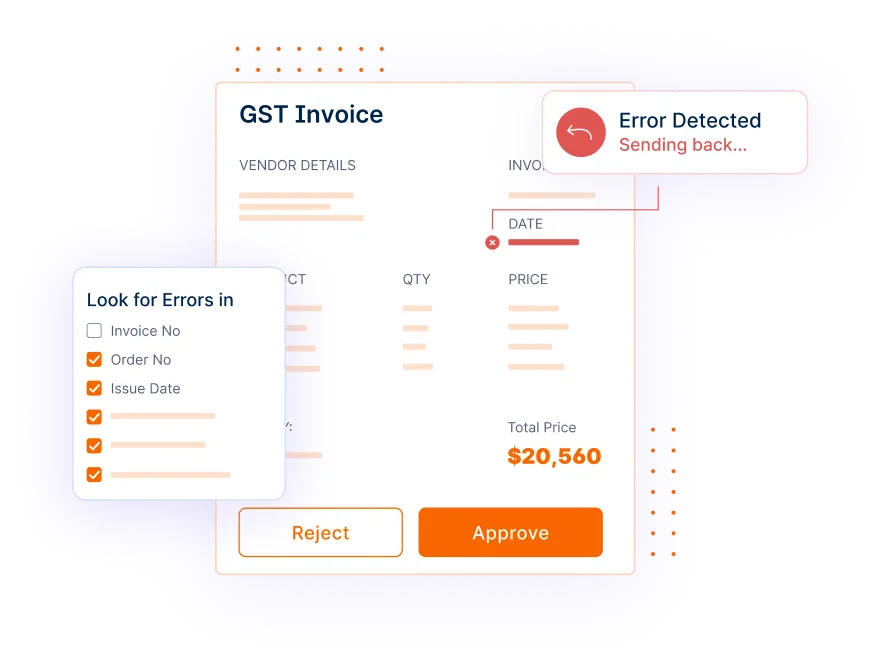

Real-Time Error Detection

One can very easily make mistakes on a GST invoice, which could cost a fortune. It offers real-time error checks, where errors are detected before they turn into issues, and everything is correct and legal on Invoicera.

With the help of a number of integrated facilities, Invoicera aims to minimize the complexities of GST invoicing. From basic arithmetic tasks to the generation of e-way bills and filing returns, this tool has all the features needed to manage GST compliance successfully.

Conclusion

Electronic invoicing and other GST solutions have drastically changed the way that companies approach their invoicing and tax management. That is why, adopting such tools, companies can minimize the amount of errors and time spent on financial processes.

There are several tools on the market that can help overcome these problems, including Invoicera, which provides an extensive list of tools that simplify GST processing.

Since organizations remain in the process of their digital transformation, such solutions are no longer only advantageous — they are becoming a necessity for increasing competitiveness and meeting modern requirements.

FAQs

Ques: How often do GST rates typically change, and how can businesses stay updated?

Ans: GST rates can change periodically. Businesses should regularly check the official GST portal and consider subscribing to government notifications for updates.

Ques:Can I use e-invoicing software for international transactions?

Ans: Yes, many e-invoicing solutions support international transactions, but ensure the software complies with both domestic GST and international tax requirements.

Ques: Can I switch to a different e-invoicing software provider after I’ve started using one?

Ans: Yes, you can switch providers. However, ensure your new software can import historical data and comply with all current GST regulations.

Ques: How does e-invoicing handle situations like returns or credit notes?

Ans: Most e-invoicing systems have features to manage returns and credit notes, ensuring these transactions are properly recorded and reflected in GST calculations.