Introduction

Are you confused about whether to switch to paperless invoicing or not?

You might be facing these issues if you are still using paper invoices:

- Organizing the invoices can be time-consuming.

- Excessive paper usage and waste

- Manual handling leads to delays

- Expenses related to printing, postage, and storage

Businesses worldwide generate a staggering 20 billion paper invoices each year, resulting in a substantial ecological footprint and unnecessary operational costs.

But why choose paper invoicing if you can save time, costs, and more with paperless invoicing?

Thus, this blog will explore the cons of using traditional paper invoices.

We will also discuss the benefits of going paperless and explain digital invoicing is not just a trend but a necessity in the changing business landscape.

Let’s begin.

The Evolution Of Invoicing

The process of invoicing has undergone a significant evolution over the years.

From traditional paper invoices to the modern era of paperless invoicing, the transformation has not only simplified administrative tasks but has also brought about notable improvements in efficiency and sustainability.

The Era of Paper Invoices

In the not-so-distant past, businesses relied heavily on paper invoices for documenting and tracking their financial transactions.

This manual approach involved creating, printing, and mailing paper invoices, making the entire process time-consuming and susceptible to errors.

Paper invoices also posed challenges related to storage, retrieval, and environmental impact.

The Rise of Digital Invoicing

As technology advanced, so did the invoicing landscape. The introduction of digital invoicing marked a turning point in streamlining the billing process.

Digital invoices allowed for the creation and delivery of invoices electronically, reducing the reliance on paper and manual handling.

While this transition improved efficiency, it still necessitated using some paper, such as when clients printed invoices for record-keeping.

Entering Paperless Invoicing

In recent years, paperless invoicing has gained momentum, presenting a revolutionary shift towards a more sustainable and efficient invoicing system.

Paperless invoicing eliminates the need for physical documents, replacing them with electronic formats that can be easily generated, sent, and stored digitally.

Paper Invoicing: Pros And Cons

Paper invoicing has been a longstanding method for billing and record-keeping. While it has served its purpose well over the years, weighing the pros and cons before deciding if it stands up to the advantages of paperless invoicing is essential.

Pros

- Familiarity and Tradition: One of the primary advantages of paper invoicing is its familiarity. Many businesses and clients are accustomed to the traditional paper trail, making it a comfortable and well-established practice.

- Tangible Documentation: Paper invoices give you real, touchable records to put in a file or storage. Some businesses like having a paper copy because it feels secure and lasting.

- Accessibility Without Technology: Unlike digital methods, paper invoices don’t require any technological infrastructure. They can be accessed and reviewed without a computer or internet connection, making them accessible to a broader range of users.

- Personal Touch: Sending a physical invoice can add a personal touch to business transactions. It may be perceived as more thoughtful and considerate, fostering a positive relationship between the business and its clients.

Cons

- Environmental Impact: The most significant drawback of paper invoicing is its environmental impact. The production and disposal of paper lead to deforestation and wastage. As businesses increasingly strive for sustainability, paperless options become more appealing.

- Costs and Inefficiency: Printing, mailing, and storing paper invoices can lead to more money spending. Moreover, the manual handling of paper invoices is prone to errors and inefficiencies, potentially leading to delays and misunderstandings.

- Limited Accessibility: While paper invoices don’t require technology for access, they are limited regarding remote accessibility. In a global and remote business world, the convenience of accessing invoices from anywhere becomes a crucial factor..

- Security Concerns: Physical documents are vulnerable to loss, theft, or damage. This poses a security risk for sensitive financial information. In contrast, paperless invoicing often comes with advanced encryption and security measures to protect digital data.

The Rise Of Paperless Invoicing

The shift towards paperless solutions has become increasingly evident, with electronic invoicing leading the way.

This method replaces traditional paper invoices with digital alternatives, changing how businesses handle their finances.

Let’s delve into the introduction of electronic invoicing solutions and explore the compelling benefits of embracing a paperless invoicing system.

Introduction to Electronic Invoicing Solutions

- Electronic invoicing, often called e-invoicing, is a contemporary approach to handling billing processes without needing physical paperwork.

- It involves digitally creating, transmitting, and receiving invoices, streamlining the invoicing cycle.

- One of the key elements of electronic invoicing is using secure online platforms or specialized software.

- This enables businesses to generate invoices electronically and transmit them directly to clients or trading partners.

- Unlike traditional paper methods, e-invoicing leverages technology to automate and simplify the invoicing workflow.

The decision to transition from paper to electronic invoicing brings many advantages for businesses of all sizes.

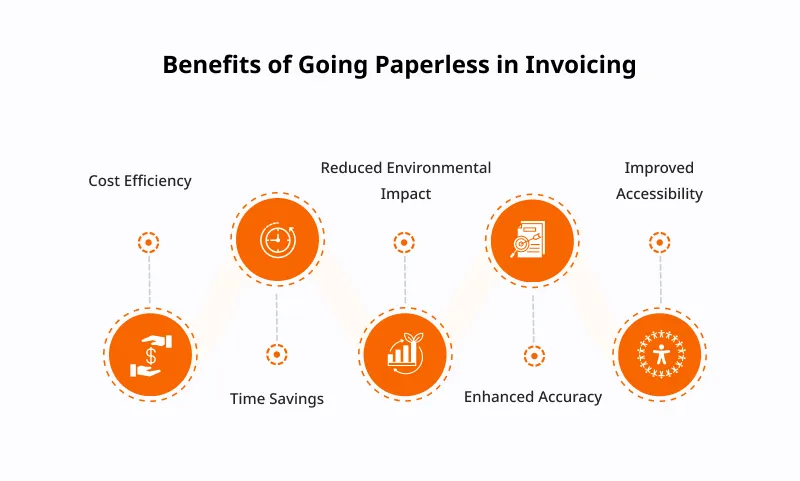

Here are some noteworthy benefits:

- Cost Efficiency: Going paperless eliminates the need for physical materials, postage, and manual processing. This results in cost savings for businesses, allowing resources to be allocated more efficiently.

- Time Savings: eInvoicing makes invoicing process faster by significantly reducing a lot of time spent on manual tasks. Transactions become faster, leading to improved cash flow and more streamlined financial operations.

- Reduced Environmental Impact: Embracing paperless invoicing aligns with environmentally conscious practices. By reducing reliance on paper, businesses contribute to a greener and more sustainable planet, positively impacting the environment.

- Enhanced Accuracy: Automation reduces the chance of errors associated with manual data entry. Electronic systems provide greater accuracy in invoicing, reducing the risk of discrepancies and enhancing overall financial integrity.

- Improved Accessibility: Digital invoices are easily accessible from anywhere at any time. This enhances collaboration between businesses and clients, fostering a more efficient and responsive invoicing ecosystem.

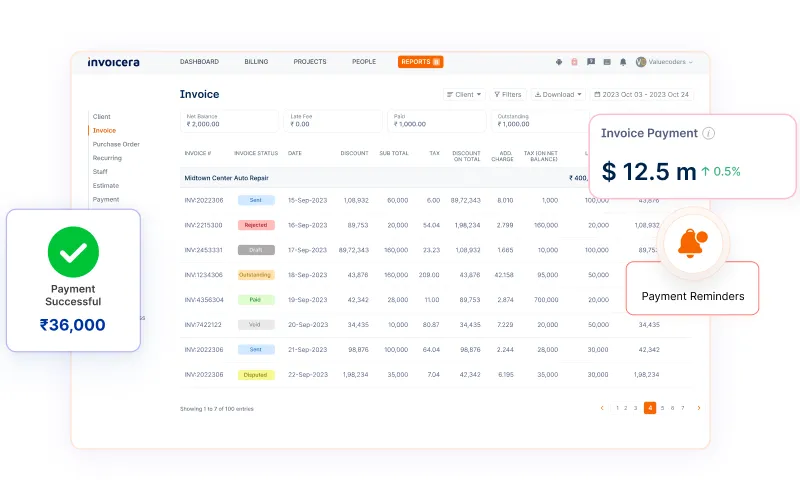

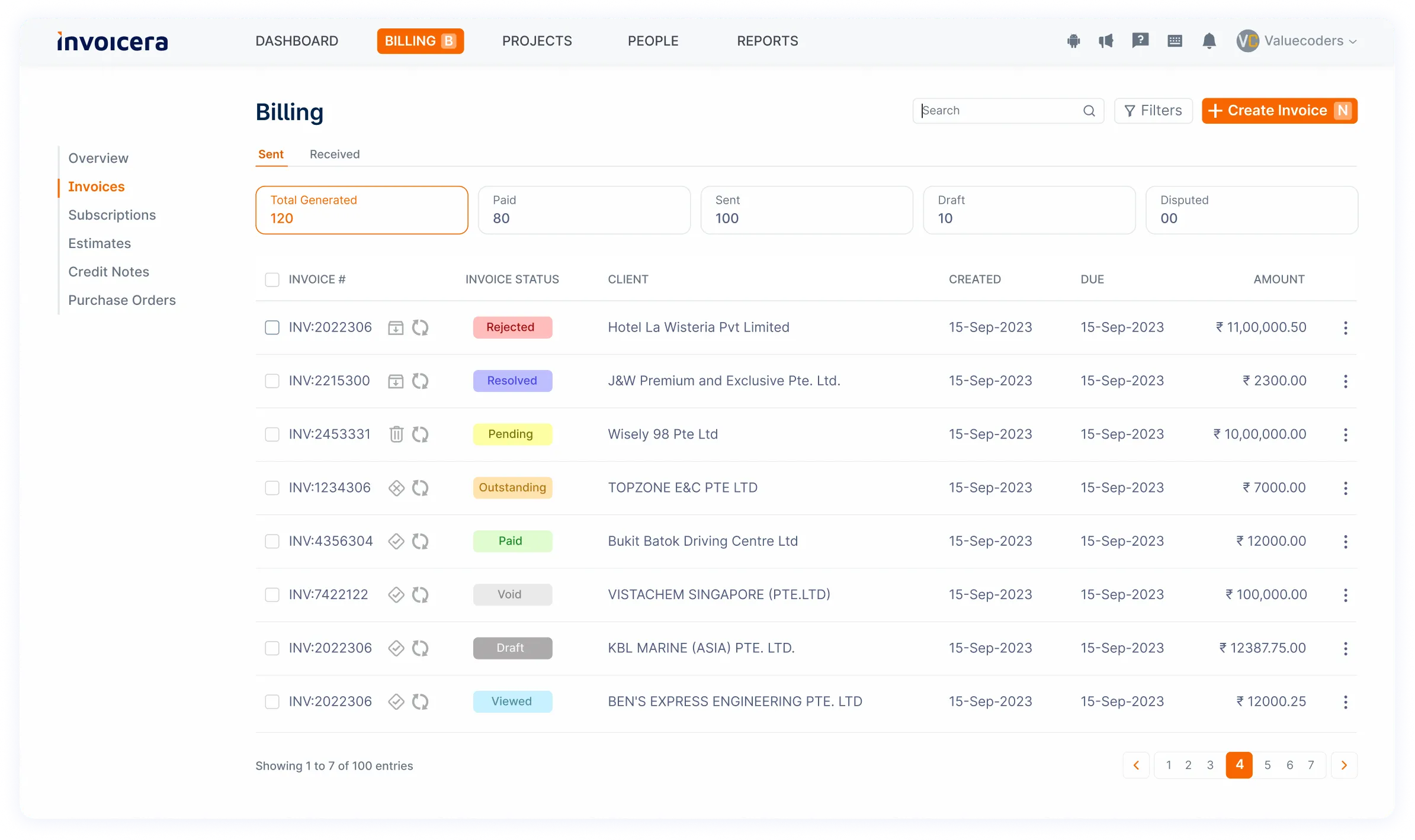

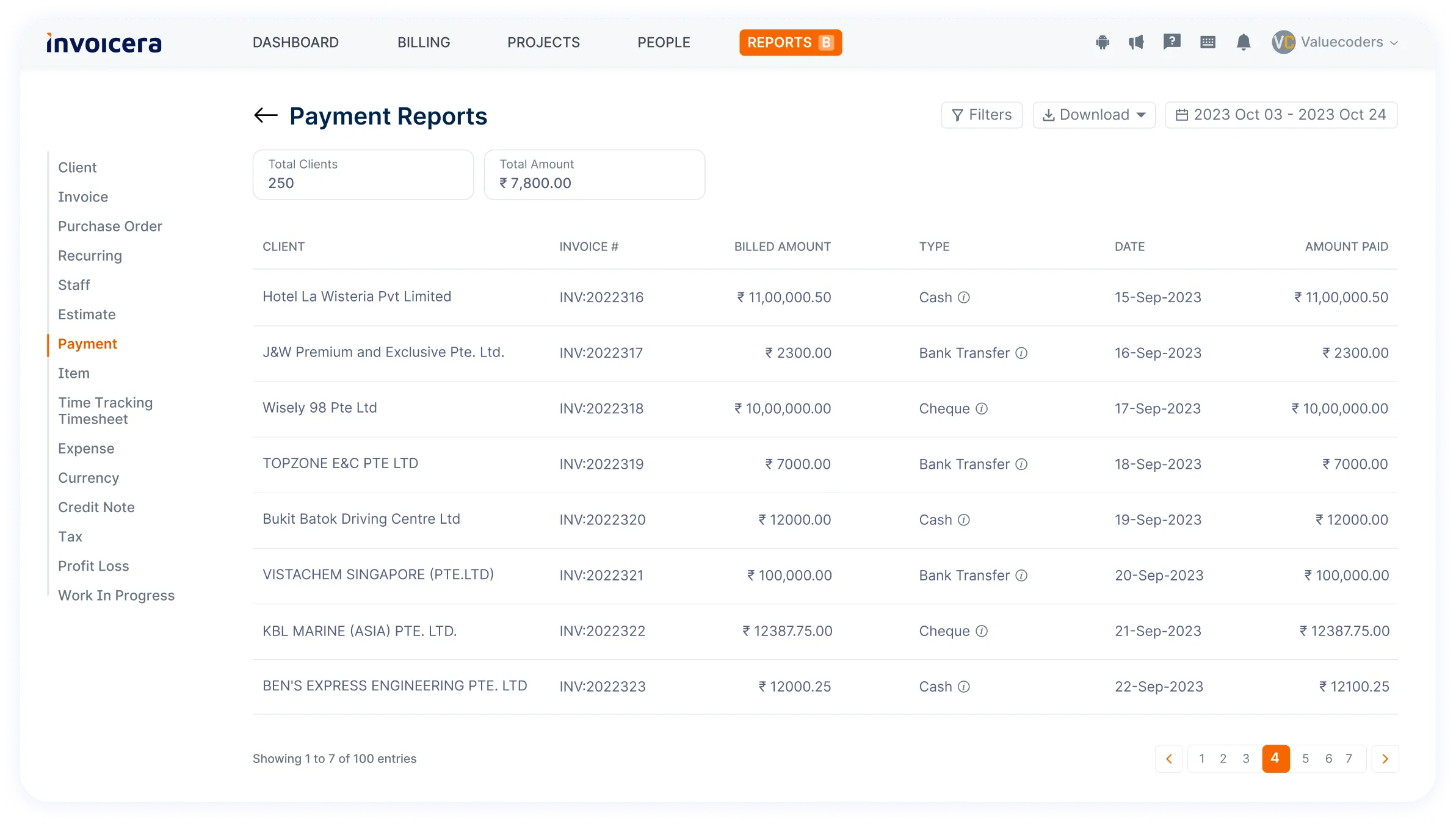

Invoicera: A Leading Paperless Invoicing Solution

Invoicera is an online invoicing software specially designed to make billing easier for different sizes of business.

As a cloud-based solution, Invoicera eliminates the need for traditional paper invoices, offering a more efficient and eco-friendly alternative. The platform is known for its easy-to-navigate interface and a range of features that benefit diverse business needs across various industries.

The platform’s accessibility from anywhere with an internet connection ensures flexibility, enabling businesses to stay on top of their invoicing tasks regardless of their location.

Features

1. Customizable Invoices:

Invoicera empowers users with the ability to create professional and personalized invoices that reflect their brand identity.

With customizable templates, businesses can ensure that their invoices convey a professional image while meeting their specific requirements.

2. Automated Invoicing:

One of the standout features of Invoicera is its automation capabilities. Businesses can set up recurring invoices, reducing the manual effort required for repetitive invoicing tasks.

It saves a lot of time and reduces the chances of errors, ensuring accuracy in invoicing processes.

3. Online Payment Integration:

Invoicera facilitates seamless online payment processing by integrating with various payment gateways.

This feature expedites the payment collection process and enhances convenience for both businesses and their clients.

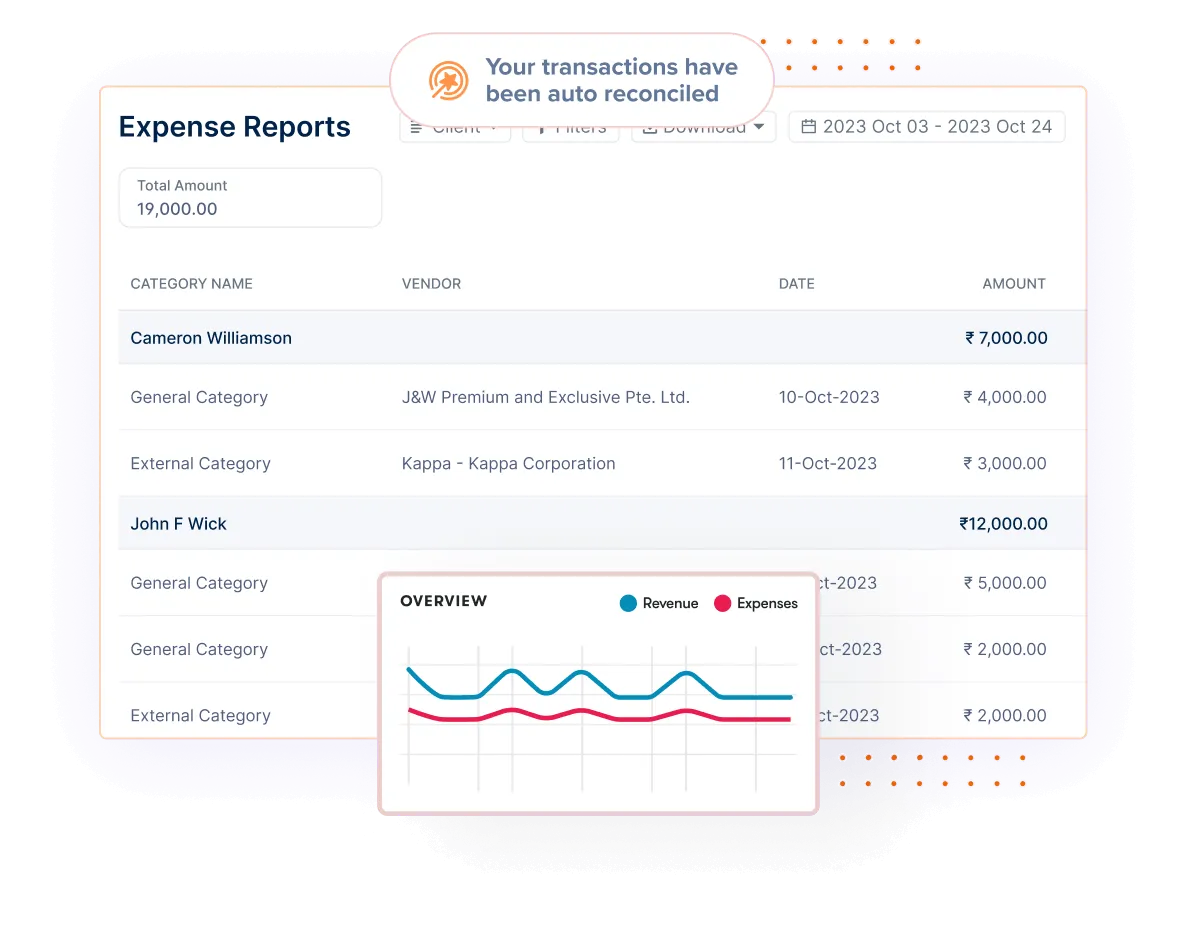

4. Expense Tracking:

Keeping track of expenses is simplified with Invoicera’s integrated expense tracking feature.

Businesses can efficiently monitor and manage expenditures, promoting better financial control and decision-making.

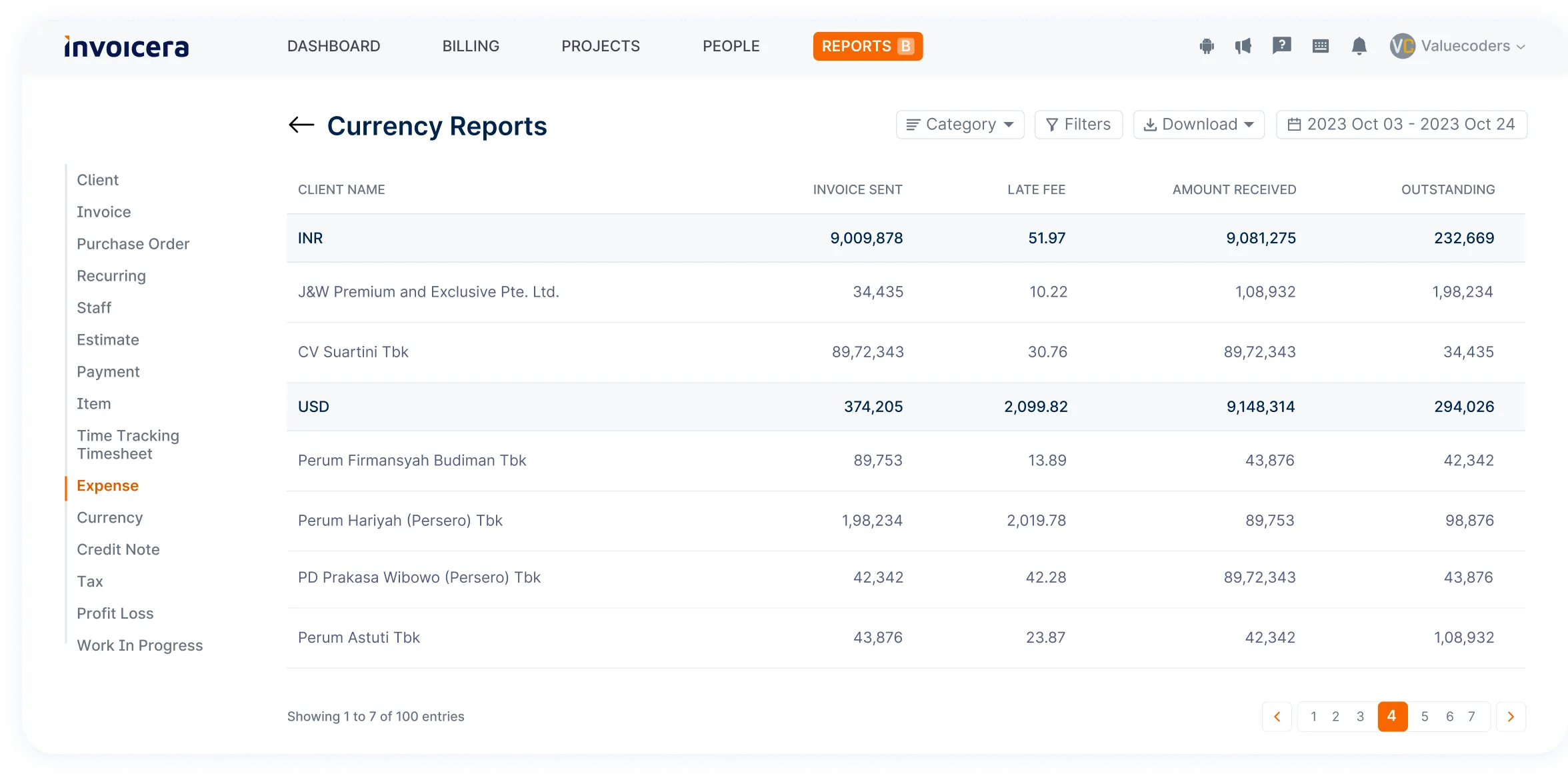

5. Multi-Currency Support:

In an interconnected global business environment, Invoicera recognizes the importance of supporting multiple currencies.

This feature enables businesses to transact internationally and cater to a diverse clientele without complications.

Transitioning To Paperless Invoicing: Tips and Best Practices

Many companies are switching from traditional paper invoicing to the more streamlined and eco-friendly method. This transition helps reduce environmental impact and brings about efficiency and cost savings.

If you’re considering the move to paperless invoicing, here are some tips and best practices to ensure a smooth transition:

1. Choose the Right Software

Selecting the right invoicing software is crucial for a successful transition. Go for a solution that matches your business needs, offers user-friendly features, and gives a secure platform to store and manage electronic invoices.

2. Train Your Team

A successful transition requires the cooperation of your team. Provide comprehensive training on the new paperless invoicing system to ensure everyone understands how to use the software effectively. Feel free to raise any concerns or questions to ease the adoption process.

3. Establish Clear Processes

Define and document the new invoicing processes. Clearly outline the steps from creating invoices to approving and processing payments. This helps in minimizing errors and ensuring a consistent workflow across the organization.

4. Implement Digital Signatures

Consider incorporating digital signatures into your paperless invoicing system. It provides an extra level of security and authenticity to your invoices, making them legally binding and reducing the risk of fraud.

5. Go Mobile

Opt for a paperless invoicing solution that offers mobile accessibility. This enables your team to manage invoices on the go, enhancing flexibility and responsiveness. Mobile access is especially beneficial for businesses with remote or traveling employees.

Pro Tip: Invoicera offers you a mobile app for both iOS and Android devices.

6. Automate Invoice Reminders

Leverage the automation capabilities of your invoicing software to set up reminders for due payments. This helps minimize delays and ensures that your clients are promptly reminded of upcoming or overdue invoices.

7. Backup and Security Measures

Implement robust backup procedures to safeguard your electronic invoices. Additionally, prioritize cybersecurity by using secure and encrypted platforms to protect sensitive financial information. Keep your security protocols up to date to stay ahead of possible threats.

8. Encourage Client Adoption

Communicate the benefits of paperless invoicing to your clients and encourage them to adopt electronic invoicing methods. Highlight the efficiency, speed, and environmental advantages that can improve client relationships.

9. Monitor and Evaluate

Regularly monitor the performance of your paperless invoicing system. Get feedback from your team members & clients and identify the areas you can improve. Continuous evaluation allows you to refine processes and optimize efficiency over time.

10. Stay Compliant

Ensure that your paperless invoicing practices comply with relevant laws and regulations. Stay informed about any legal requirements regarding electronic transactions and adjust your processes as needed.

Challenges And Solutions In Paperless Invoicing

While the benefits are substantial, it’s essential to acknowledge and address the challenges businesses may encounter during this shift.

This section will explore common challenges in paperless invoicing and present practical solutions focusing on the Invoicera platform.

Common Challenges

- Resistance to Change: Businesses often resist introducing new processes. Due to unfamiliarity, employees may be accustomed to traditional methods and might resist adopting paperless invoicing.

- Security Concerns: Security is paramount when dealing with sensitive financial information. Some businesses fear data breaches or unauthorized access to their electronic invoices.

- Integration Issues: Ensuring seamless integration of paperless invoicing with existing accounting systems and workflows can be a significant challenge for businesses.

- Client Adoption: Convincing clients to accept and adapt to electronic invoices can be challenging. Some clients may prefer traditional paper invoices or be skeptical about the security of digital transactions.

Practical Solutions and Tips

- Employee Training: Invest in comprehensive training programs to address resistance to change. Educate employees on the benefits of paperless invoicing and provide hands-on training sessions, ensuring a smooth transition.

- Robust Security Measures: Choose a paperless invoicing platform, such as Invoicera, that prioritizes security. Use encryption, ensure secure user logins, and conduct regular security checks to protect sensitive information.

- Seamless Integration: Opt for invoicing solutions that easily integrate with popular accounting software. Invoicera, for instance, provides seamless integration with platforms like QuickBooks and Xero, minimizing disruption to existing workflows.

- Client-Friendly Features: Make the transition easier for clients using invoicing platforms with client-friendly features. Invoicera allows clients to view and pay invoices online, track payment status, and easily download digital copies, providing a user-friendly experience.

- Clear Communication: Encourage clients to adopt paperless invoicing. Clearly articulate the benefits, such as reduced environmental impact, faster processing, and enhanced convenience. Address any concerns they may have about security and data integrity.

- Invoicera’s Automation Features: Leverage Invoicera’s automation features to streamline invoicing processes. Save time and work smarter by automating repeat invoices, payment reminders, and late fee notifications.

Future Trends In Invoicing

- The future of invoicing is marked by a shift towards digital solutions, bringing efficiency and eco-consciousness to the forefront.

- Key trends include:

– Blockchain for secure transactions, AI automation for streamlined processes, Mobile solutions for on-the-go invoicing

- Enhanced data security, eco-friendly initiatives, and collaborative platforms are also on the rise.

- Businesses are expected to integrate regulatory compliance features and focus on personalized customer experiences, ensuring a smooth and efficient transition to a paperless invoicing landscape.

Conclusion

In conclusion, the shift to paperless invoicing offers businesses a more efficient, cost-effective, and environmentally friendly alternative to traditional paper invoices.

The streamlined process reduces errors, enhances productivity, and saves on paper, printing, and postage expenses. While the transition may pose initial challenges, the long-term benefits of embracing digital invoicing are undeniable.

It not only aligns with sustainable practices but also positions businesses for a more technologically advanced future.

Consider exploring solutions like Invoicera to facilitate a seamless and effective transition to paperless invoicing.

FAQs

What if my clients prefer traditional paper invoices?

Communicate the benefits of paperless invoicing to your clients, emphasizing efficiency and environmental responsibility. Many businesses today appreciate the convenience of digital transactions, and providing both options during the transition period can help ease the shift.

Is it hard to use a paperless invoicing platform like Invoicera?

Not at all. While there might be a slight learning curve initially, modern platforms like Invoicera are designed to be user-friendly. Tutorials and customer support are available to help you navigate the system easily.

What if there’s a technical issue with the invoicing platform?

No worries. Reputable platforms like Invoicera have customer support teams to assist with technical issues. Choose a provider with reliable support and maintenance for quick problem resolution.