Getting paid on time is essential for any business to streamline cash flow, but unfortunately, it doesn’t always happen.

This is where invoice dunning comes in.

Invoice dunning is the process of sending reminders to clients who have outstanding invoices in order to encourage them to make payments.

However, manual invoice dunning can lead to potential problems such as:

- Risk of damaging client relationships

- Time-consuming and resource-intensive process

- Negative impact on cash flow and revenue

- Potential for legal disputes and collection actions

To overcome these issues, you can automate the invoicing process with tools like Invoicera.

What is the Purpose of Invoice Dunning?

Invoice dunning encourages timely payment and minimizes the negative impact of late payments on your cash flow and revenue.

You can use a combination of automated reminders and personalized messages to maintain positive relationships with clients while ensuring they make the payment on time.

Ultimately, invoice dunning aims to support a healthy financial position for the organization by reducing the risk of bad debt and improving cash flow.

Types of Invoice Dunning

There are several types of invoice dunning that businesses can use to encourage timely payment from customers:

-

Reminder emails

These are simple, automated emails that remind customers of their outstanding invoices and provide a deadline for payment.

-

Late payment notices

More formal notices indicate that the invoice is overdue and may include additional fees or consequences for non-payment.

-

Phone calls

A more personal approach, like a phone call, can be used to discuss the invoice and provide payment options. Understanding what is a 3 way call can enhance the effectiveness of phone conversations by involving multiple parties simultaneously.

-

Payment plans

If a customer struggles to pay the total invoice amount, businesses may offer a payment plan to help them gradually pay off the debt.

-

Legal action

At last, you can take legal action against clients unwilling to pay their invoices.

By using these types of invoice dunning, companies can tailor their approach to each customer’s specific needs and preferences while ensuring they receive payment promptly.

How to Set Up Invoice Dunning in Your Online Invoicing Software?

To set up invoice dunning in your online invoicing software, follow these steps:

-

Choose the right software

Make sure your invoicing software has built-in invoice dunning features or integrates with a third-party tool that can handle it.

-

Define your dunning strategy

Determine the timing and frequency of your dunning messages and the consequences for non-payment.

-

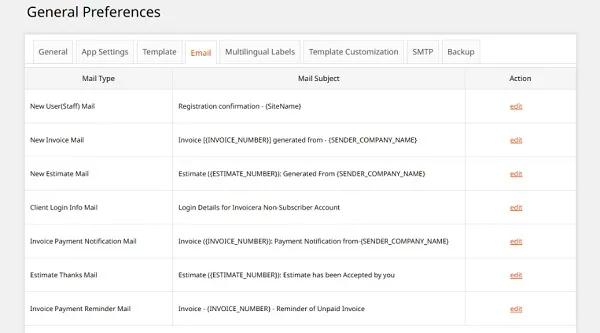

Create your dunning templates

Design the content of your dunning messages, including the subject line, body text, and call-to-action phrase.

-

Set up your dunning schedule

Set up your software to automatically send dunning messages according to your chosen frequency and timing.

-

Customize your dunning messages

Personalize your dunning messages by including the customer’s name, invoice details, and other relevant information.

-

Monitor your dunning effectiveness

Keep track of your dunning messages and their effectiveness in encouraging timely payment, and adjust your strategy as needed.

The above steps will help you ensure that your online invoicing software is set up to manage invoice dunning and improve your cash flow effectively.

What to Keep in Mind While Creating Invoice Dunning Messages?

Read the infographics to learn some tips for creating invoice dunning messages.

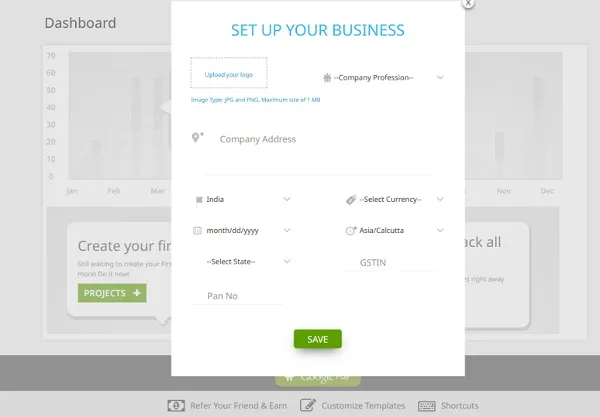

Getting Started with Invoicera

-

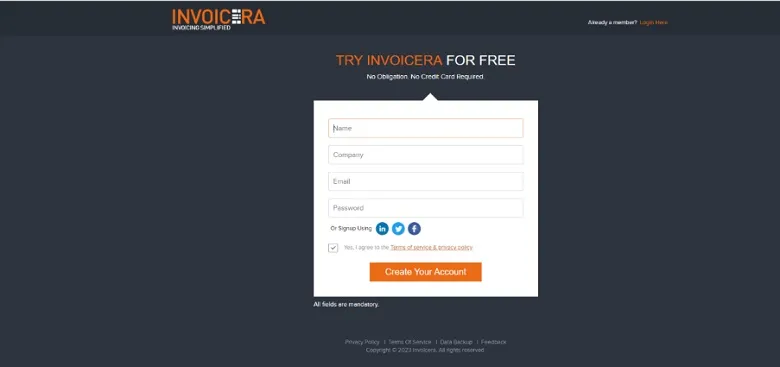

Sign up for an account

To start with Invoicera, visit the website and sign up for an account.

-

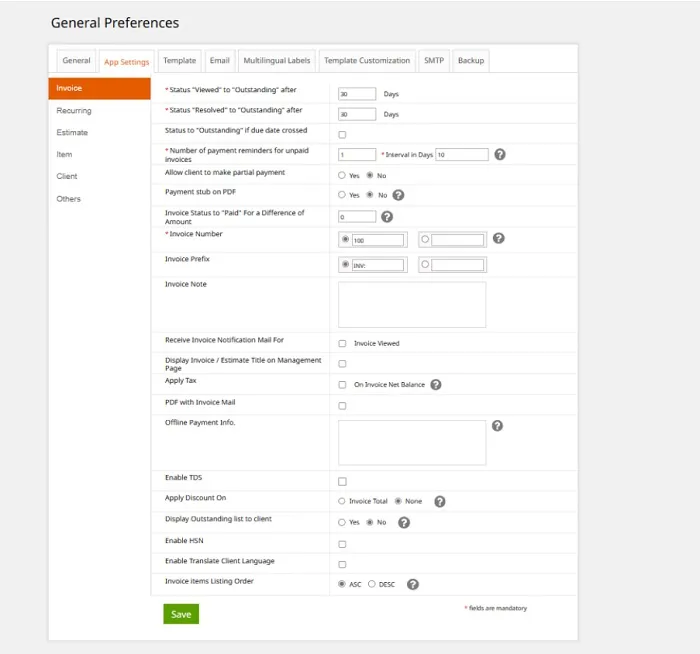

Customize your settings

After creating your account, you can customize your settings to fit your business needs. It includes:

- Setting up payment gateways

- Add business

- Basecamp

- Configuring tax rates

- Invite people

-

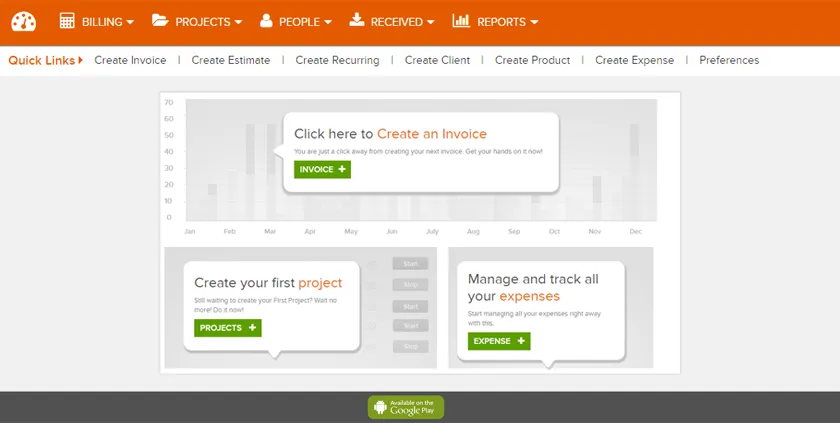

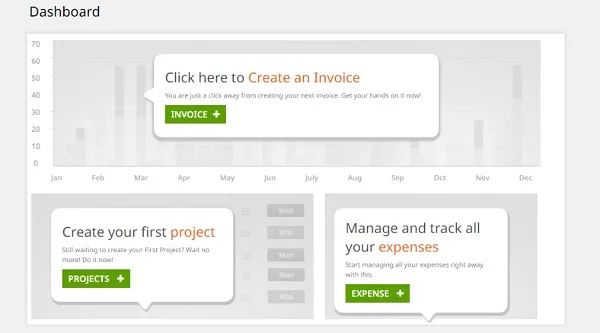

Create your first invoice

-

Send the invoice

Once you’ve created the invoice, you can email it to your client or download a PDF copy to send via post.

Don’t let unpaid invoices pile up

Let Invoicera help you manage invoice dunning process and get paid on time

-

Track payments and expenses

Invoicera lets you track payments and expenses to quickly see which invoices are outstanding and which expenses you need to account for.

-

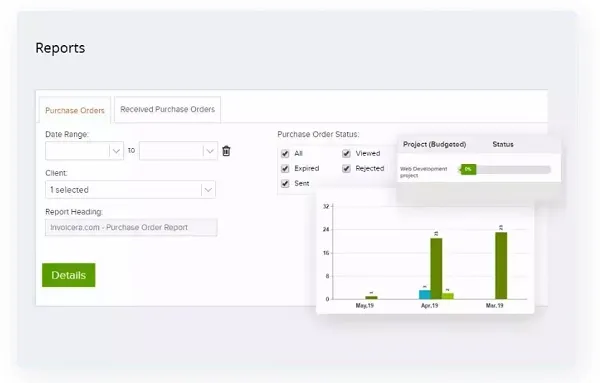

Generate reports

With Invoicera, you can generate a variety of reports, including:

- Profit and Loss

- Expense reports

- Tax reports

It makes it easy to keep track of your business finances and file your taxes.

Invoicera can help you streamline your invoicing and accounting processes, whether you’re a freelancer or a small business owner.

Strategies for dealing with difficult or non-responsive clients

Dealing with difficult or non-responsive clients can be challenging.

However, by staying professional and following these strategies, you can increase your chances of getting paid on time and maintaining a positive relationship with your clients.

-

Communicate clearly

Make sure your communication with the client is clear and concise.

Explain the situation, the consequences of not paying on time, and the steps you’ll take if the payment is not received.

-

Stay professional

Despite any frustration you may feel, it’s essential to remain professional and polite in your communications.

Avoid using aggressive or threatening language that could damage your relationship with the client.

-

Offer a payment plan

If the client is experiencing financial difficulties, consider offering a payment plan that allows them to pay off the outstanding balance in installments.

It shows flexibility and can help maintain a positive relationship with the client.

-

Consider a third-party collection agency

If the client continues to be non-responsive, consider enlisting the help of a third-party collection agency.

These agencies can help recover the debt on your behalf but remember that they will charge a fee for their services.

-

Take legal action

At last, consider taking legal action against the client to recover the debt.

This can be an expensive and lengthy process, so it’s essential to consider the potential costs and benefits before pursuing this option.

Bid adieu to late payments

Say hello to improved cash flow with Invoicera

Closing Thoughts

In conclusion, mastering invoice dunning is crucial to manage your business’s finances effectively.

By leveraging online invoicing software like Invoicera, you can streamline your invoicing process, reduce late payments, and ultimately get paid faster.

Don’t let unpaid invoices slow down your growth and success.

Start mastering invoice dunning today!

FAQs

Q: What is invoice dunning?

A: Invoice Dunning is sending reminders to clients who have unpaid invoices to prompt them to make payment.

Q: How many dunning messages should I send?

A: It is generally recommended to send 3-4 dunning messages, spaced out over a period of time, to give clients enough opportunity to make payment.

Q: Can I automate the invoice dunning process?

A: Yes, online invoicing software like Invoicera allows you to set up automated dunning messages for specific intervals, making the process more efficient and effective.