Introduction

Stuck sending invoices by hand, chasing late payments, and drowning in paperwork? Traditional invoicing methods can slow you down and limit your business growth. But what if there was a better way?

This post discusses useful invoicing features that can simplify your processes, boost efficiency, and unlock new revenue streams. We’ll dive into time-saving automation, data-driven insights, and advanced client management tools to help you take control of your finances and achieve success. Get ready to streamline invoicing, save time, and watch your business soar.

Efficiency & Time-Saving Features

Invoice Automation

Invoice automation software eliminates this error-prone process, saving businesses valuable time and resources.

A recent Ardent Partners study found that manual invoice processing costs companies an average of $10.18 per invoice and takes 10.9 days to complete.

Automation can significantly reduce these costs and processing times, allowing your team to focus on more strategic tasks.

Mobile App Access

Modern invoicing software comes with intuitive mobile apps, transforming your smartphone or tablet into a powerful business tool. Mobile invoicing offers benefits such as managing invoices, tracking expenses on the go, and even sending instant invoices while you’re out and about. This unparalleled flexibility keeps you responsive to client needs, builds trust, and streamlines every step of the invoicing process.

Multiple Payment Options

Especially when combined with solid point-of-sale systems, a sound invoicing system can revolutionize company efficiency. Fortunately, the best POS systems provide your customers several choices, like real-time tracking, automated reminders, and multiple payment ways beyond simple invoicing. These tools improve consumer happiness by smoothing transactions and increasing transparency, simplifying payment procedures.

Including the best POS systems may also give you an essential understanding of sales trends, guiding your company’s actions. Modern invoicing and reporting tools let companies maximize cash flow control and, more accurately, project financial expansion.Imagine accepting credit cards, ACH transfers, and even mobile wallets—all seamlessly integrated into your invoicing workflow. This convenience speeds up processing, gets you paid faster, and improves your cash flow, eliminating the wait for snail-mail checks and late payment headaches.

Recurring Invoices & Subscriptions

Simplify billing for regular clients with recurring invoices and subscriptions. This minimizes errors, increases revenue predictability, and strengthens client relationships. A 2023 report by Recurly found that subscription businesses experience a 31% annual recurring revenue growth rate on average, compared to just 5% for non-subscription businesses.

Expense Tracking & Integration

Modern invoicing software integrates seamlessly with expense management tools, letting you capture and categorize expenses directly at the source on your phone or computer. No more manual data entry or lost receipts. This streamlined process reduces errors, saves time, and gives clear visibility into your spending patterns.

Growth & Revenue Enhancement Features

Beyond efficiency, modern invoicing software unlocks powerful tools to propel your business toward growth and increased revenue. Here’s how:

Professional & Customizable Invoices

Don’t settle for generic templates! Craft unique invoices that showcase your brand personality with logos, colors, and custom messages. Nearly nine out of ten consumers prioritize authenticity when choosing brands.

Stand out from the competition, impress clients with a professional touch, and build stronger relationships with personalized invoices that reflect your unique identity.

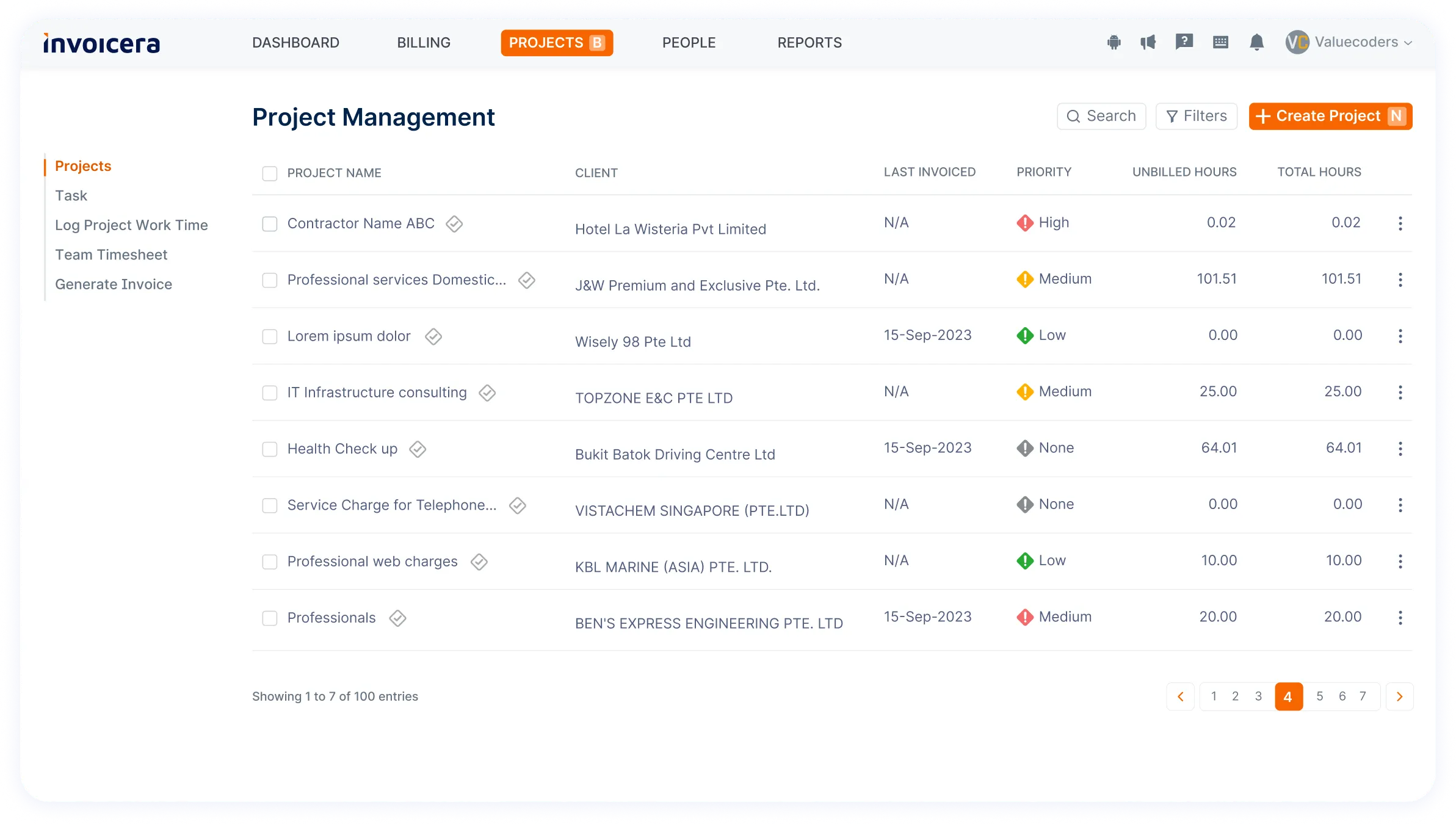

Project Management & Tracking

Modern software seamlessly links invoices to projects, ensuring transparent and accurate billing. No more chasing down details or estimating hours – everything is connected and clear for you and your clients.

This unified view offers benefits such as getting paid what you deserve, boosting communication and trust, and enhancing project efficiency. The Project Management Institute’s Pulse of the Profession 2023 study found that having a unified view can allow a 21% increase in profitability.

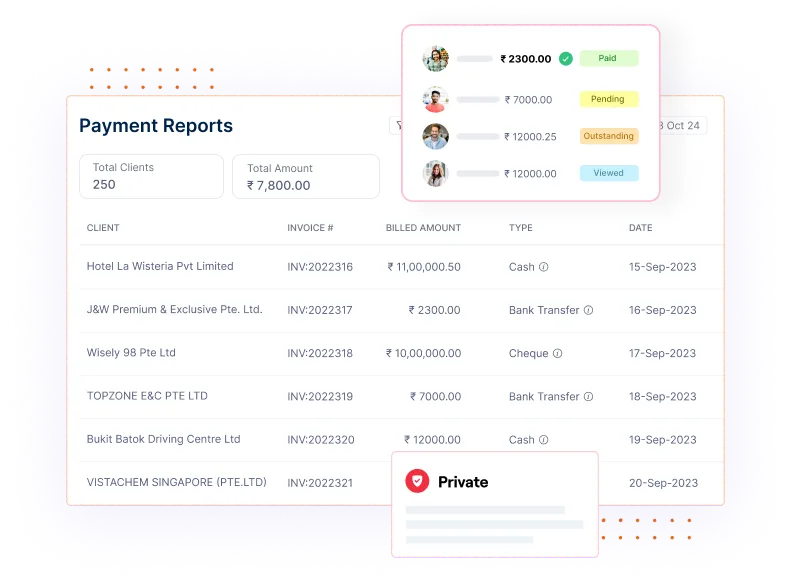

Advanced Reporting & Analytics

Advanced reports and analytics unlock hidden insights about payment patterns, invoice performance, and client behavior. Imagine analyzing which payment methods lead to faster processing, which invoice formats convert best, and which clients consistently pay late.

This valuable intelligence allows you to pinpoint areas for improvement, optimize your invoicing process for maximum efficiency, and make data-driven decisions that propel your business forward.

Upsell & Cross-Sell Opportunities

Turn clients into loyal customers with personalized recommendations based on their purchase history and preferences. A 2022 study by McKinsey & Company revealed that companies with effective cross-selling strategies experience a 15-25% increase in revenue.

Recommend additional services, increase average order value, and boost your revenue potential with data-driven upsell and cross-sell suggestions.

Quotes & Proposals Management

Modern invoicing software lets you convert proposals into professional invoices with a single click. Imagine closing deals faster, reducing errors, and shortening the sales cycle – all by eliminating the manual leap from proposal to invoice.

This seamless workflow keeps the momentum rolling, removes friction from the sales process, and helps you secure more clients, one click at a time.

Client Management & Communication Features

Beyond streamlining your processes, modern invoicing software fosters strong client relationships and smooth communication, paving the way for long-term success. Here’s how:

Client Portal & Self-Service

Empower your clients with a secure online portal where they can access invoices, statements, and payment options anytime, anywhere. No more phone calls or emails about lost invoices!

81% of consumers crave more self-service options, as the 2022 Digital-First Customer Experience Report revealed. Self-service enhances client satisfaction by allowing them to manage their accounts on their terms. Moreover, you can integrate SAP CPQ solutions with self-invoicing software to boost sales and billing processes.

Invoice & Payment Notifications

Modern invoicing software sends automatic reminders for overdue invoices, keeping your cash flow smooth and your clients informed. Imagine gentle email nudges, SMS alerts, or even push notifications discreetly reminding clients about outstanding payments.

This proactive approach boosts communication, prevents delays, and keeps everyone on the same page, ensuring timely or faster payments and happier clients.

Personalized Invoicing & Branding

Tailor invoices to specific client types or projects with custom formats, messages, and branding elements. This shows attention to detail, builds trust, and enhances brand loyalty. A 2022 study by Marq (formerly Lucidpress) found that personalized marketing materials generate 60% higher response rates, translating to stronger client relationships and more repeat business.

Integration with CRM & Communication Tools

Modern invoicing software integrates seamlessly with your CRM, giving you a complete picture of each client. Imagine all invoice data flowing effortlessly into your CRM, creating a unified hub for interactions.

This boosts communication efficiency, lets you personalize interactions based on individual needs and behavior, and even tailor sales and marketer efforts for maximum impact.

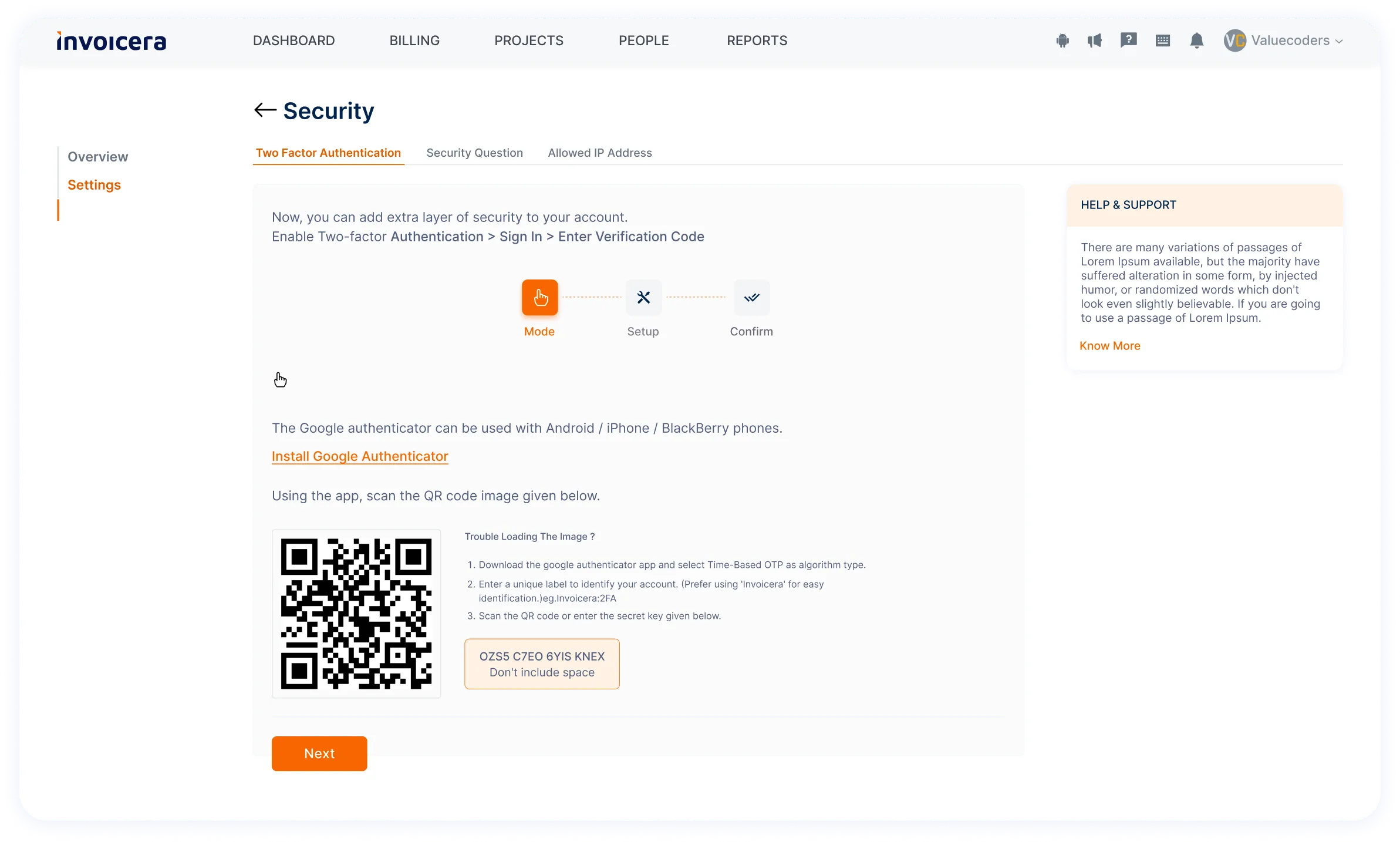

Security & Compliance Features

Modern invoicing software goes beyond convenience and efficiency, prioritizing the security of your sensitive financial data and ensuring your business meets all necessary regulations. Here’s how:

Data Encryption & Security

Rest assured, your invoicing software employs robust data encryption and security measures that meet or exceed industry standards. Think bank-level protection, safeguarding your clients’ financial information, and building trust.

A 2023 Ponemon Institute study revealed that 78% of customers consider data security a major factor when choosing a business to work with.

Audit Trails & Documentation

Every invoice, payment, and modification gets automatically documented and securely stored, creating a comprehensive audit trail. This ensures accurate reporting, facilitates external audits, and provides a clear record of your financial activities for peace of mind.

Compliance with Tax & Regulatory Requirements

Generate invoices that automatically comply with relevant tax regulations and reporting requirements. This eliminates the risk of penalties and fines, simplifying compliance and ensuring your business operates legally.

A 2022 survey by Wolters Kluwer found that 65% of businesses experience reduced stress and improved efficiency with automated compliance features.

Simplify & Succeed With Invoicera

Invoicera, a modern and comprehensive invoicing software, aligns with the key features discussed in the blog to enhance your invoicing processes and contribute to business growth.

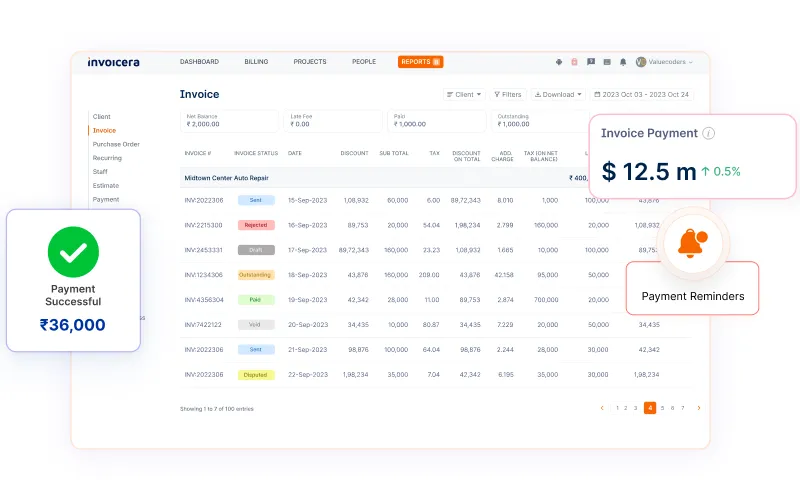

Invoice Automation

Invoicera takes the hassle out of invoicing with its automation features, removing the need for manual and error-prone processes. By automating the creation and delivery of invoices, businesses can save precious time and resources, ultimately reducing the average processing time per invoice.

Mobile App Access

Invoicera’s user-friendly mobile app turns your smartphone or tablet into a versatile business tool. Manage your invoices, track expenses, and send instant invoices on the go. This flexibility ensures you can promptly respond to client needs, enhancing responsiveness.

Multiple Payment Options

Invoicera integrates a variety of payment options seamlessly into its invoicing system. Whether it’s credit cards, ACH transfers, or mobile wallets, this diversity accelerates processing, leading to faster payments and an improved cash flow, perfectly aligning with the flexibility demanded by the modern business landscape.

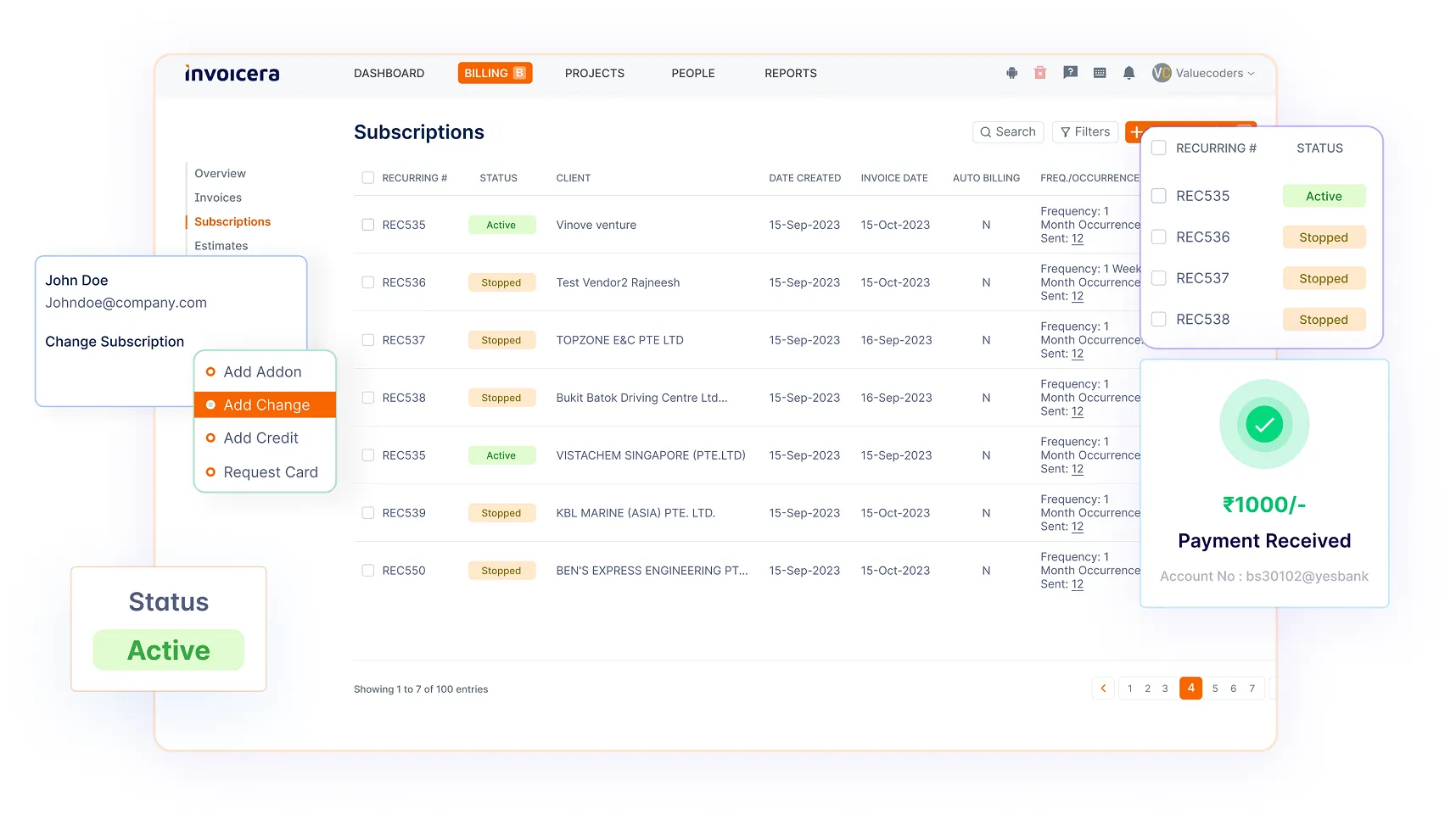

Recurring Invoices & Subscriptions

For regular clients, Invoicera simplifies billing through recurring invoices and subscription features. This reduces errors and enhances revenue predictability, fostering stronger and more enduring client relationships, echoing the advantages highlighted in the blog.

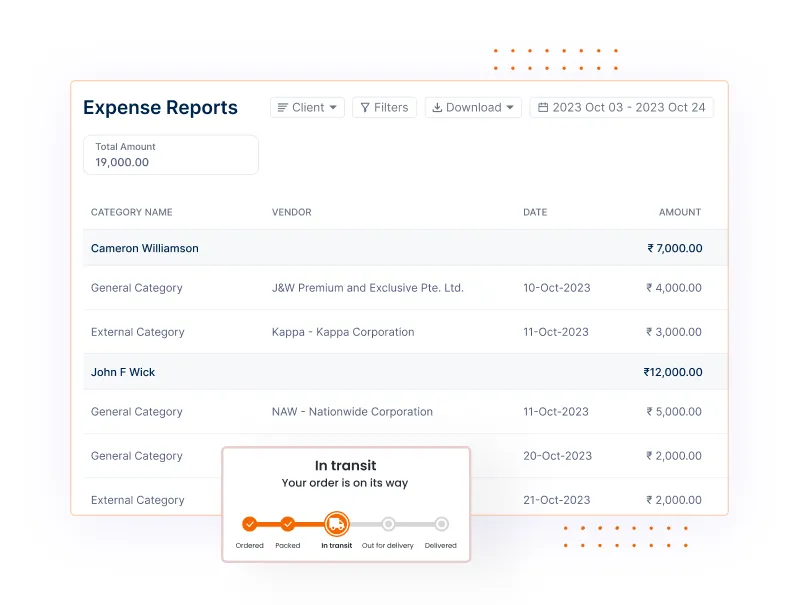

Expense Tracking & Integration

Invoicera effortlessly integrates with expense management tools, letting users capture and categorize expenses directly. Say goodbye to manual data entry and errors. This streamlined process offers a clear view of spending patterns, addressing the points discussed in the article.

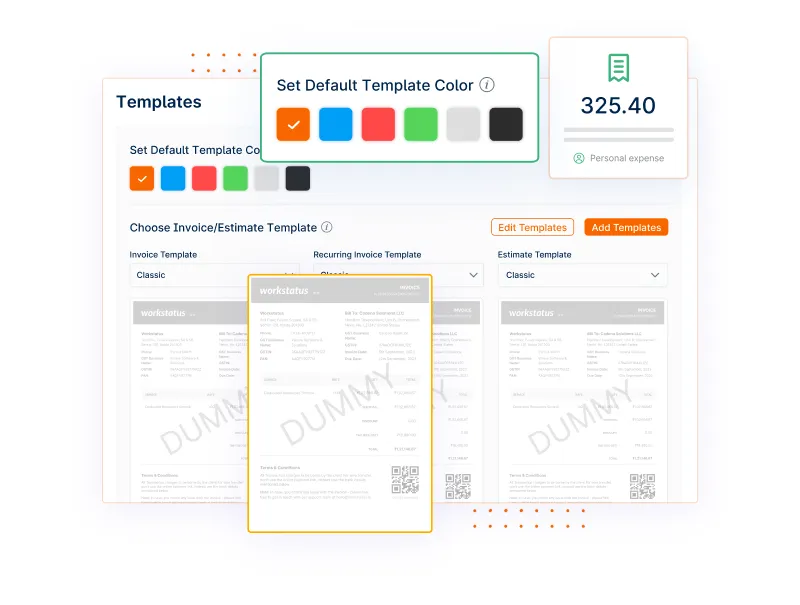

Professional & Customizable Invoices

Invoicera empowers users to create professional and customizable invoices, infusing brand elements like logos and colors. Craft unique invoices that reflect your brand personality, setting you apart from generic templates and building more meaningful client relationships.

Project Management & Tracking

Invoicera seamlessly connects invoices to projects, ensuring transparent and accurate billing. This unified view corresponds with the benefits of efficient project management mentioned in the blog, ultimately contributing to increased profitability.

Advanced Reporting & Analytics

Invoicera provides advanced reporting and analytics, unlocking valuable insights into payment patterns, invoice performance, and client behavior. Users can analyze this data to optimize the invoicing process, aligning perfectly with the blog’s emphasis on data-driven decision-making.

Security & Compliance Features

Invoicera places a premium on the security of sensitive financial data, employing robust encryption and security measures that meet or exceed industry standards. Additionally, it offers audit trails and automated documentation to ensure compliance with tax and regulatory requirements, giving you peace of mind.

Click Your Way to Success: Unleash the Data-Driven Revenue Engine in Your Invoices

We’ve demonstrated that modern invoicing software is more than just automation—it’s a growth engine for your business. Streamline processes, build stronger client relationships, and unlock data-driven insights to optimize revenue.

Consider your unique needs and choose the software that empowers you. Start by implementing core features like mobile access and automated payments, then explore advanced tools for project tracking, personalized branding, and data-driven analysis.

Take control of your invoicing, unlock your business potential, and achieve success that’s clear in every invoice.

FAQs:

How can automated invoicing benefit any business?

Automated invoicing saves time by eliminating manual data entry and reduces errors, resulting in faster processing and improved cash flow.

What are the advantages of offering multiple payment options to clients?

Providing diverse payment options, such as credit cards and mobile wallets, enhances convenience for clients, accelerates payment processing, and boosts cash flow for your business.

How can personalized branding on invoices impact client relationships?

Personalized invoice branding adds a professional touch, fosters brand loyalty, and strengthens client relationships by showcasing attention to detail and authenticity.