Introduction

The process of invoicing is very important for any business as it promotes adequate compensation for services provided.

Many businesses rely on Microsoft Excel for invoicing due to its ease of access, but this is becoming less effective owing to progressive technology.

As businesses grow and evolve, there is a need for a better and more sophisticated invoicing solution. That’s where we get introduced to invoicing applications and software. They not only automate but simplify routine tasks, hence upscaling productivity.

Automating invoicing can save businesses up to 10 minutes per invoice – The Economic Times

So readers, ahead in the blog, we’ll be throwing light on the following:

- How can using Excel for invoicing be disadvantageous?

- Why is invoicing software better?

- How the transition can enhance your business?

Whether you are a freelancer or self-employed, belong to an SMB or a big company, it is crucial to be aware of changes that will make invoicing more sustainable in the future.

Why Excel Is Becoming Outdated for Invoicing

As firms operate in a dynamic environment characterized by intense competition, it is evident that using Excel to issue invoices is outdated. Although it was highly effective in the past, the following drawbacks make it inefficient in the current ever-evolving business environment.:

- Prone to Human Error

The greatest disadvantage of using Excel for billing is that manual intervention may lead to many mistakes. Sometimes, manual data entry may result in miscalculation, wrong amount or misplaced data.

These can lead to discrepancies in financial outcomes and erode client trust, making business lose both their time and money.

- Lack of Automation

Excel in particular does not have extra features that can automate invoicing process. All these activities ranging from invoice creation to preparation and dispatch of reminders are done manually, a process that tends to be time-consuming and attracts delays.

Without automation, businesses often struggle to keep up with invoicing timelines, leading to cash flow issues.

- Limited Scalability

As businesses grow, their invoicing needs become more complex. Excel can quickly become cumbersome, struggling to handle a growing volume of invoices and clients.

This limited scalability can lead to inefficiencies, as users may find themselves overwhelmed by managing numerous spreadsheets and files.

Why Choose Invoicing Software Over Excel?

Switching to dedicated invoicing software offers numerous advantages that can significantly improve your invoicing processes. These tools not only streamline operations but also enhance accuracy, enabling businesses to focus on growth and better serve their clients.

Faster Workflow With Automation

Many invoicing softwares perform tasks such as the creation of invoices, reminders on the due dates, and tracking of payments. This automation aids in sorting and processing invoices more effectively, freeing up business teams to engage in other growth strategies.

Real-time Reporting and Analytics

Through invoicing software, the company receives immediate and comprehensive information on financial performance. Real-time reporting and analytics are useful in decision making, recognizing trends and observing cash flow that helps in better financial management.

Accuracy in Calculations

Invoicing software ensures precise calculations, significantly reducing the risk of errors associated with manual entry. This accuracy not only helps maintain financial integrity but also builds trust with clients by delivering correct invoices on time.

Advanced Features You Can’t Find in Excel

Invoicing software offers innovative features that set it apart from Excel, enhancing the overall user experience and improving business efficiency. These functionalities address the unique needs of modern businesses and provide solutions that traditional spreadsheets simply cannot match.

Integration Capabilities

Most invoicing software solutions easily sync with third-party apps & other business software solutions. This includes accounting software, payment gateways, and CRM. Such integration enhances productivity and the flow of data from one system to another, thereby decreasing the time and energy required to input the same data in both systems.

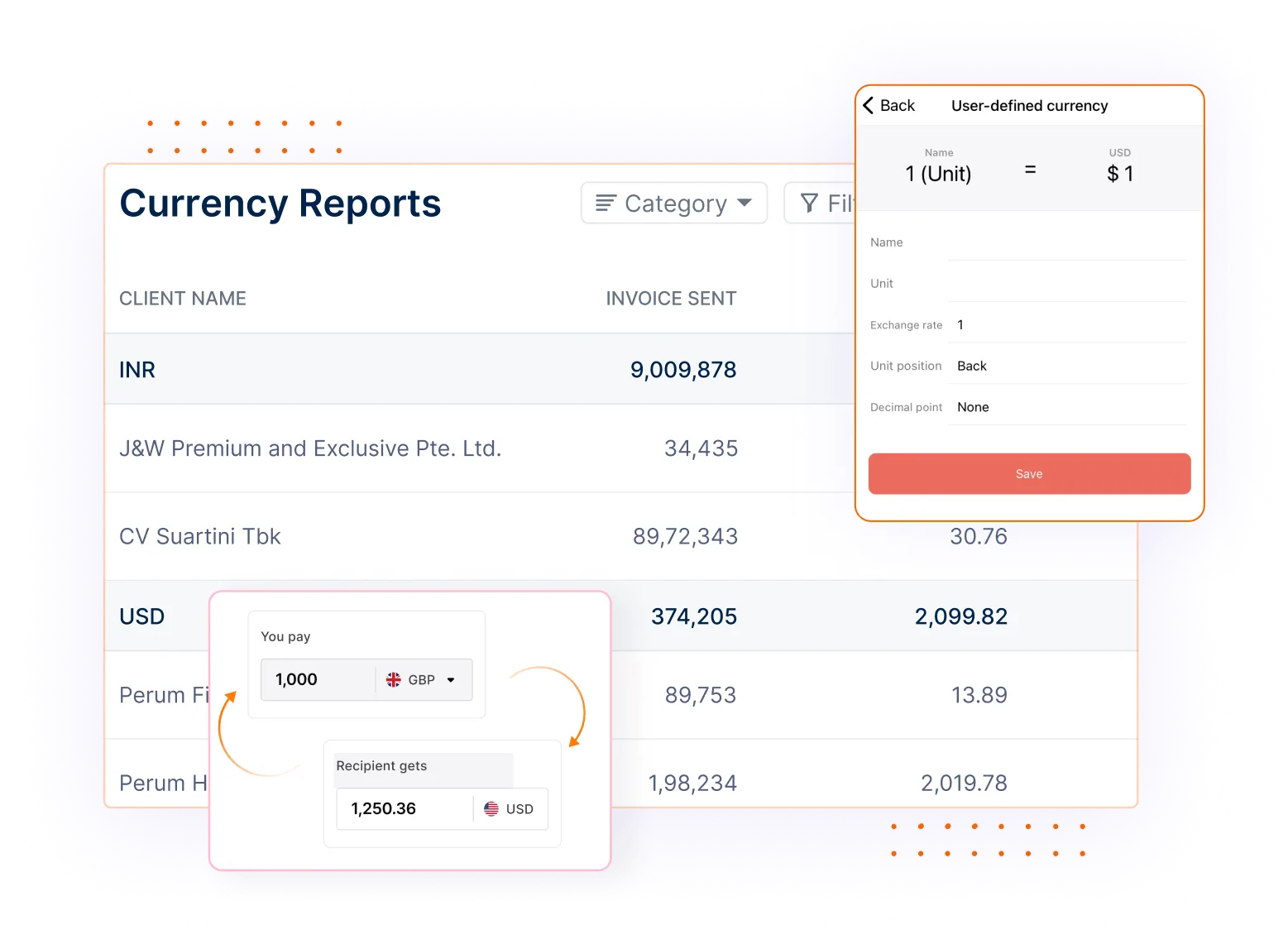

Multi-Currency and Language Support

Invoicing software can make international transactions and it allows a business to send invoices in different currency and language. This capability helps to serve international customers, to deal with invoicing matters more easily, and to meet the peculiarities of various areas.

Customization and Branding

Invoicing software allows businesses to personalize their invoices to reflect their brand identity. Customization options, such as adding logos, adjusting color schemes, and modifying templates, enhance professionalism and customer engagement, making a lasting impression on clients.

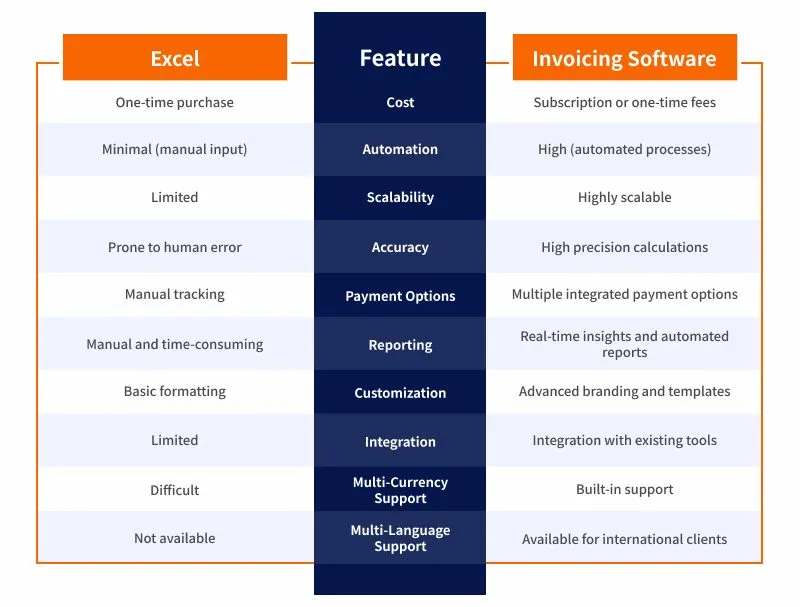

Excel Vs. Invoicing Software: Addressing Common Myths and Misconceptions

Many misconceptions surround the use of invoicing software compared to Excel, which can hinder businesses from making informed decisions. By debunking these myths with clear examples, we can better understand the true value of dedicated invoicing solutions.

Myth 1: “Excel is Free, Invoicing Software is Expensive”

While Excel may have no upfront cost, its hidden expenses can accumulate quickly. Mistakes from manual entries, inefficiencies in processing, and the time lost resolving errors can far exceed the investment in dedicated invoicing software.

Ultimately, the right software can save money by streamlining operations and reducing costly errors.

Myth 2: “Excel is Easier and More Convenient”

Although Excel might appear straightforward at first glance, its limitations in automation and scalability often lead to increased hassle. Specialized invoicing software simplifies complex tasks, automates repetitive processes, and accommodates growing business needs—making it a more convenient long-term solution despite any initial learning curve.

Myth 3: “We Don’t Need Advanced Features”

Even the small enterprises can derive much advantage from the higher order features like automation and analytics. These capabilities enhance operations through time saving on various processes, offering insights on decision making for the betterment of the business.

These features, if underestimated, may make businesses underperform, making advanced features a necessity for business growth.

Transitioning from Excel to Invoicing Software

Switching from Microsoft Excel to unique invoicing software is necessary to increase efficiency, reliability, and professionalism. The transition should be well-planned to remain stress-free.

- Assess Your Business Needs

Based on particular invoicing necessities, assess the software which fits into functional needs of the business. You have to consider parameters like the number of invoices processed, accepted modes of payment and compatibility with existing applications.

- Shortlisting the Best Invoicing Software

Look for the best invoicing software that would suit your needs and that of your enterprise financially. Use the search to find reviews, feature comparisons, and demos so that you can choose the right tool for your company.

- Data Migration and Setup

Any data transferred from Excel to the new invoicing system should be done carefully to avoid transfer of incorrect or incomplete information. Develop a map and validation framework for helping avoid data transfer screw-ups that may occur when migrating.

- Training and Onboarding

Educate the staff on the use of the new software in order to benefit from it as much as possible. The design of onboarding must enhance a smooth learning process and avoid any discomfort during the overall process.

How Invoicera Helped In Automating

Most companies which have tried moving from the manual method using Excel spreadsheets to professional invoicing software have recorded impressive gains.

Through these specialized tools, they have been able to work as per their requirements, cut down on unnecessary errors, and improve on their productivity so much that they can now concentrate on expansion and innovation.

Studies have shown that invoice automation software removes the possibility of human error while lowering manual work by about 80%.

The Invoicing Transformation By Invoicera

Client Background

A thriving digital agency realized that relying on Excel sheets was holding them back. They considered it wise to change to Invoicera in order to serve their purpose of invoicing and management.

Challenges Faced

This agency encountered several challenges, including implementing dynamic pricing, a big client list, recurring billing, and monthly billing reports.

Solutions Implemented

- Client Management: Invoicera introduced sections for dynamic pricing and monthly fees, making it easy to customize client billing.

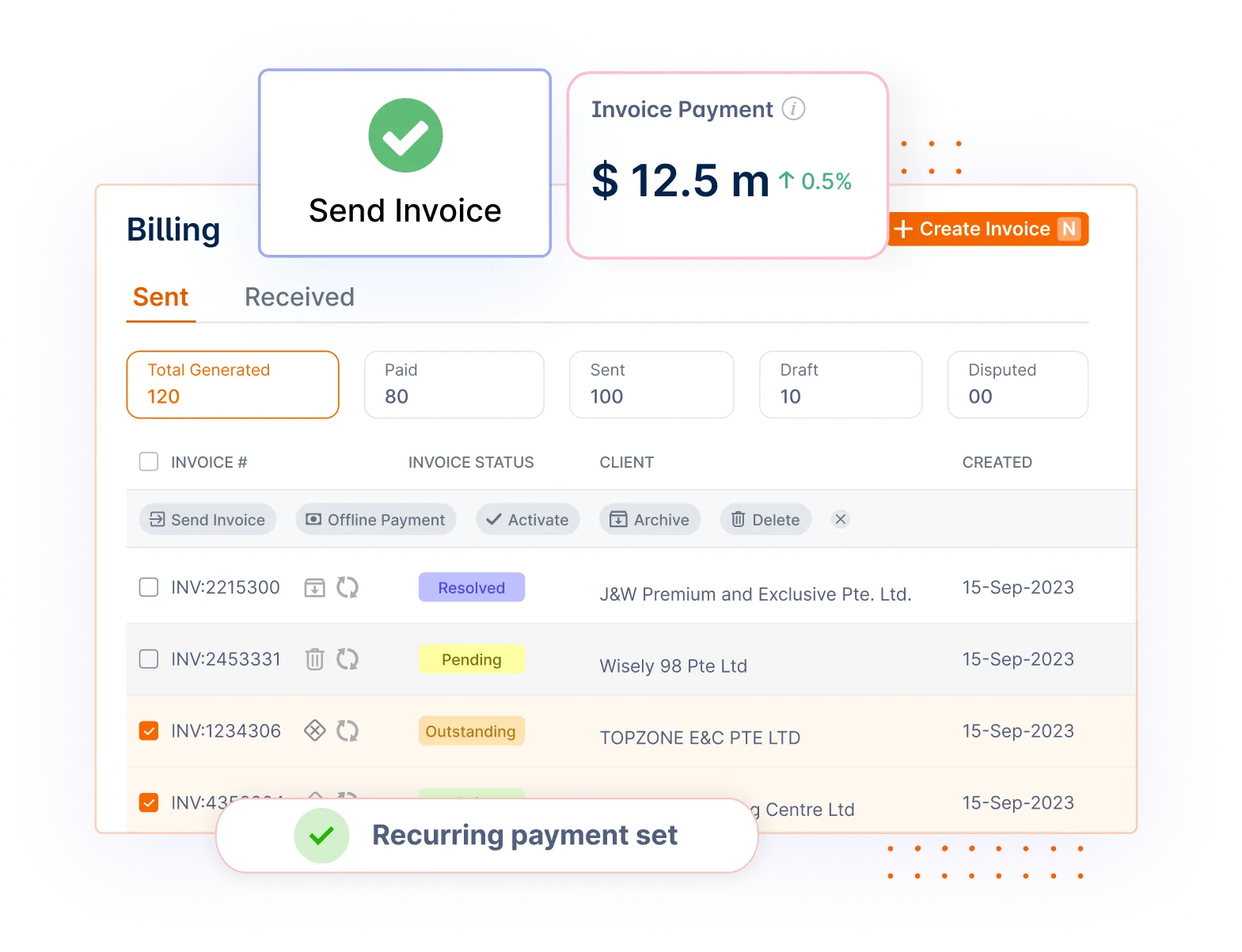

- Invoice Management: A centralized dashboard was created, allowing the team to automate invoice generation effortlessly.

- Staff Management: With the ability to add staff members and assign relevant permissions, overseeing tasks became a breeze.

- Report Management: Customized reports for accounts receivable (AR), accounts payable (AP), and other key metrics were developed to provide valuable insights.

Results Achieved

The transition to Invoicera significantly enhanced efficiency in managing clients, invoices, and staff. Automated invoicing processes led to more accurate financial reporting and less time spent on administrative tasks.

Overall Impact

By moving away from Excel, the agency not only strengthened its cash flow management but also reduced administrative burdens, allowing them to focus on what they do best—creativity and growth. With Invoicera, they found a partner that empowered their business to thrive!

How Invoicera Excels Over Excel

Invoicera is a superior choice for invoicing compared to Excel, thanks to its robust features and dedicated focus on enhancing invoicing efficiency. Invoicera does not only contain standard features of spreadsheets.

It also has specific features that enhance invoicing, and accountability and contribute to the development and success of a business.

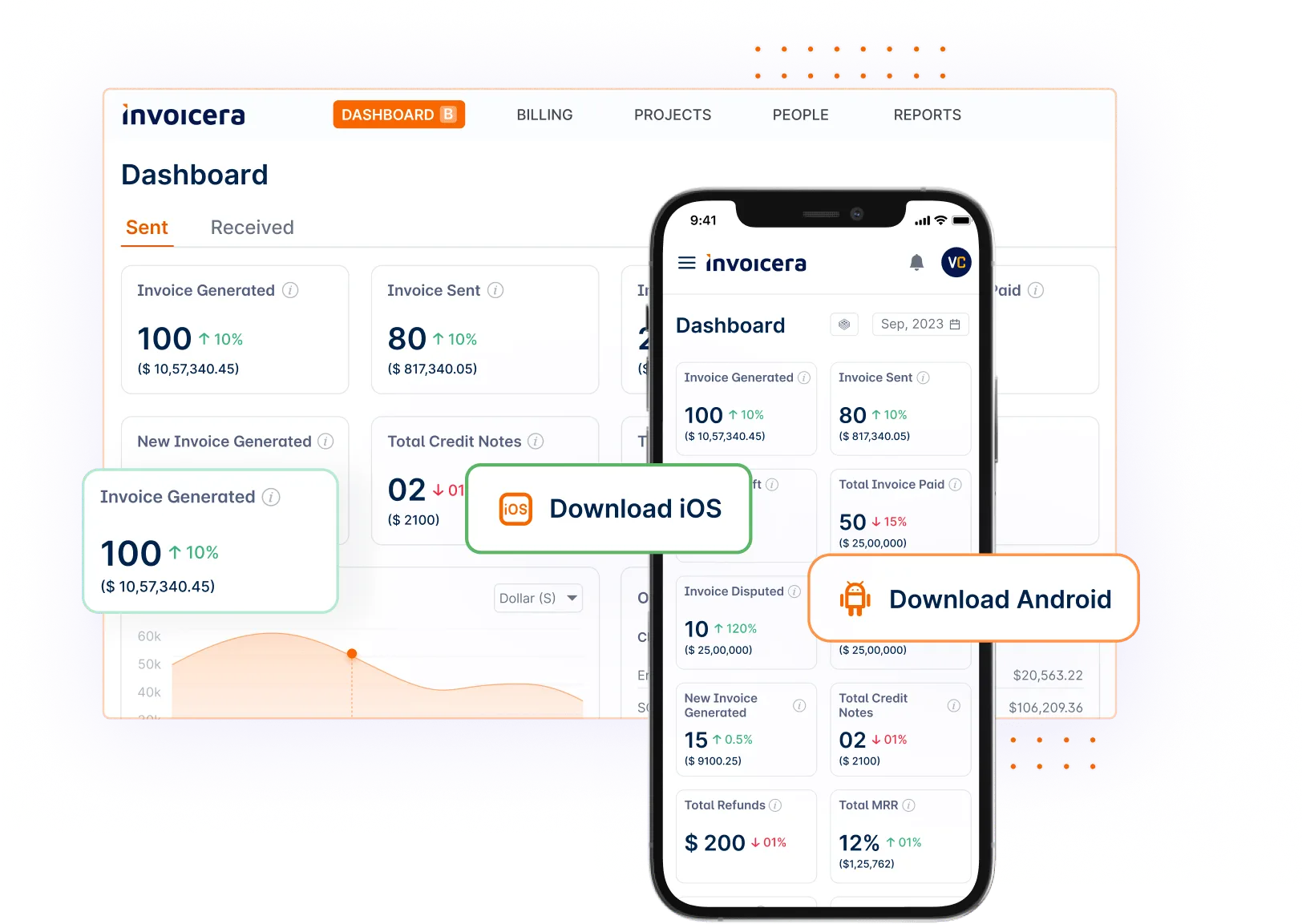

The platform is designed in a way that would ensure that all the users are able to access and manage their invoicing effortlessly. It cuts the learning process in a way that a user can easily learn and master the features.

Key Features

- Automation: Invoicera automates repetitive tasks, such as invoice generation and reminders, allowing businesses to save time and minimize errors, freeing up resources for more strategic activities.

- Mobile Access: What’s more? The mobile compatibility allows users to work with invoices at any time and respond to them promptly irrespective of the place they are located.

- Multi-Currency Support: With Invoicera, adopting multiple currency transactions is relatively easy, mainly when dealing with international clients.

- Recurring Billing: The software simplifies recurring billing with automated cycles, ensuring clients are billed accurately and on time, which enhances cash flow.

- Customizable Templates: Companies can easily design unique invoice forms that are unique to their organization. Thus, making the interaction with their clients more professional.

- Real-time Analytics: Real-time reporting and analysis features help organizations monitor progress, review outcomes, and make important business decisions.

Integrations

Invoicera’s ability to connect with other business applications is a key advantage, allowing for a more cohesive operational flow. By integrating with payment gateways, accounting software, and project management systems, businesses can synchronize their processes, reduce manual entry, and enhance data accuracy. This interconnected approach fosters greater efficiency and productivity across various functions.

Conclusion

Leveraging invoicing software like Invoicera can significantly enhance your operational efficiency. Transitioning from Excel to specialized tools streamlines invoicing processes, automates repetitive tasks, and provides real-time reporting, allowing for better decision-making.

With advanced features like dynamic pricing and customizable reports, your business can not only improve accuracy but save valuable time, enabling you to focus on growth and creativity. Investing in invoicing software is a step toward future-proofing your business in an increasingly competitive environment.

Have you experienced any invoicing challenges with Excel? We’d love to hear your thoughts in the comments!

FAQs

Ques: How difficult is it to migrate data from Excel to invoicing software?

Ans: Migrating data from Excel to invoicing software is generally straightforward. Most invoicing solutions offer import tools that facilitate the transfer of your existing data. Additionally, customer support is usually available to assist you throughout the migration process, ensuring a smooth transition.

Ques: Is invoicing software suitable for freelancers?

Ans: Absolutely! Invoicing software can greatly benefit freelancers by automating the invoicing process, tracking expenses, and providing professional-looking invoices. These tools help freelancers manage their finances more efficiently, allowing them to focus on delivering quality work to their clients.

Ques: What security features should I look for in invoicing software?

Ans: When selecting invoicing software, consider security features such as data encryption, secure payment gateways, two-factor authentication, and regular backups. These aspects are crucial for protecting sensitive financial information and ensuring that your data remains safe and secure.