1.3 million people travel for work purposes every day in the U.S. alone.

As the demand for corporate travel continues to rise, the complexity of managing these trips also increases. With hundreds of trips to manage, Travel Businesses find it difficult to manage their billing manually. Even if you are a startup travel company, managing billing, apart from all other booking management tasks, can be a little hectic. Also, it might lead to multiple errors and give your clients a bad experience. If you are also going through these challenges, don’t worry; there’s a way ahead!

In this blog, we will outline how you could make your travel billing process better with automation. Whether you’re struggling with the common issues companies face or simply eager to harness the potential of innovative travel industry invoicing tools such as Invoicera, you’ve come across the right website.

Let’s start the blog and see how automation can upgrade your invoicing experience.

Challenges in Traditional Travel Invoicing

The important thing to know about manual processes is that they have drawbacks that negatively affect business operations and lead to different problems. A few are discussed below that led to the adoption of automated invoicing.

Manual Invoicing Errors and Delays

When entering invoice data manually, there is a high risk of errors, such as entering wrong figures or leaving out vital information. These mistakes may lead to expensive time losses, damaged client relations, and a downfall of your travel business.

Complex Multi-Currency and Cross-Border Billing

Managing different currencies and handling international transactions is one of the biggest worries for any travel business that engages with clients from different countries. While some countries tend to have currency fluctuation, others have unpredictable tax standards and numerous compliance measures, and thus invoicing becomes an activity inviting mistakes.

Time-Consuming Invoice Reconciliation

It is exceedingly challenging to match payments with invoices manually. It takes a lot of time sometimes even days to reconcile the accounts and such exercises pull the team away from more important tasks. From consolidation to reports, various small differences can be overlooked, resulting in incorrect amounts.

Difficulty Tracking Travel Expenses and Allocations

On business trips, there are different expenses, ranging from flight tickets, lodging, and even food to extra expenses. Managing these expenses and making sure that the correct one is assigned to the right invoice becomes cumbersome, especially when using manual tools.

Lack of Real-Time Financial Insights

You cannot obtain actual real-time information on the financial position of your business. The manual ways of issuing invoices lead to proper financial data that prevents fast decision making. Absent this insight, the growth of your business can be hindered, and you may find yourself facing difficulties relating to cash flow.

Conventional travel bills have a host of issues that may hamper your business, escalate costs, and cause unnecessary stress. However, appropriate solutions can mitigate all these challenges.

How Automation Makes Travel Billing Easier?

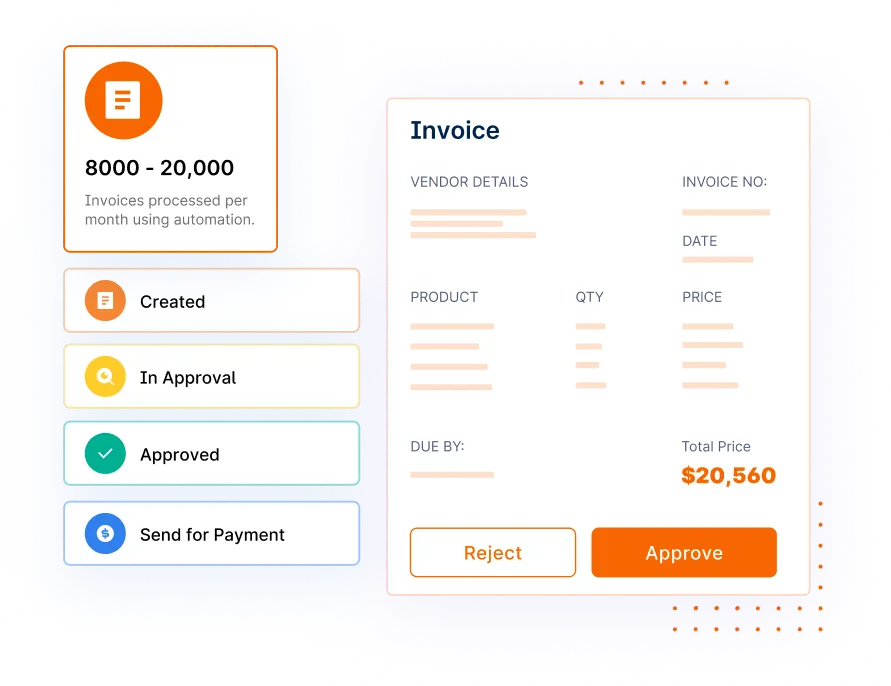

To your surprise, automation is here to adopt a new way of performing your billing and invoicing. There are numerous benefits of invoicing automation for travel businesses. Below are a few discussed:

No Errors. Only Professional Invoices

With automated systems, you are able to generate professional-looking invoices easily. This not only saves you time but also minimizes the chances of mistakes while generating your client’s bills.

Invoicing Software Integrates With Your Accounting Software

Travel billing automation software can integrate with your accounts platform, synchronizing client details, payments, and financials. This integration also saves time entering data and helps the user keep correct records of all financial transactions and avail of detailed reports.

Get 2X Faster Payments From Vendors

Buying travel-related services such as flights, hotels, and other accommodation services from different suppliers can be daunting. Automation allows you to manage vendor payments easily, avoiding late payments. This helps prevent debts or any other penalties that may come with delayed payments.

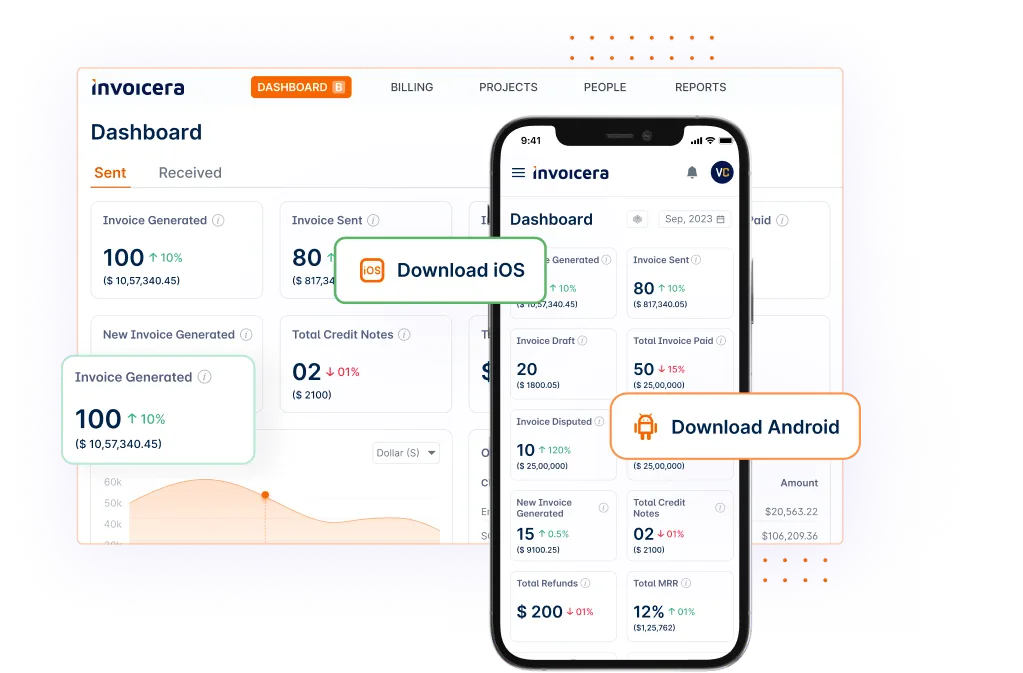

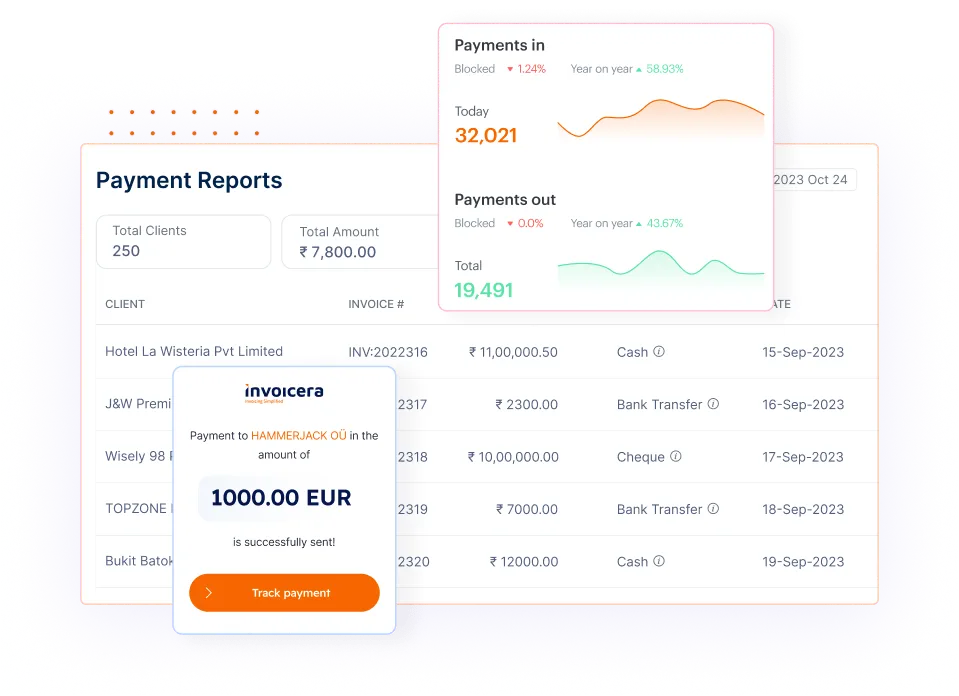

View Your Financial Data In Real Time

Automated billing systems allow you real-time access to your financial information. You can easily check the outstanding invoices, the receivables and payables position, and any errors or missing information, which will help you make the right choices and help you manage your finances better.

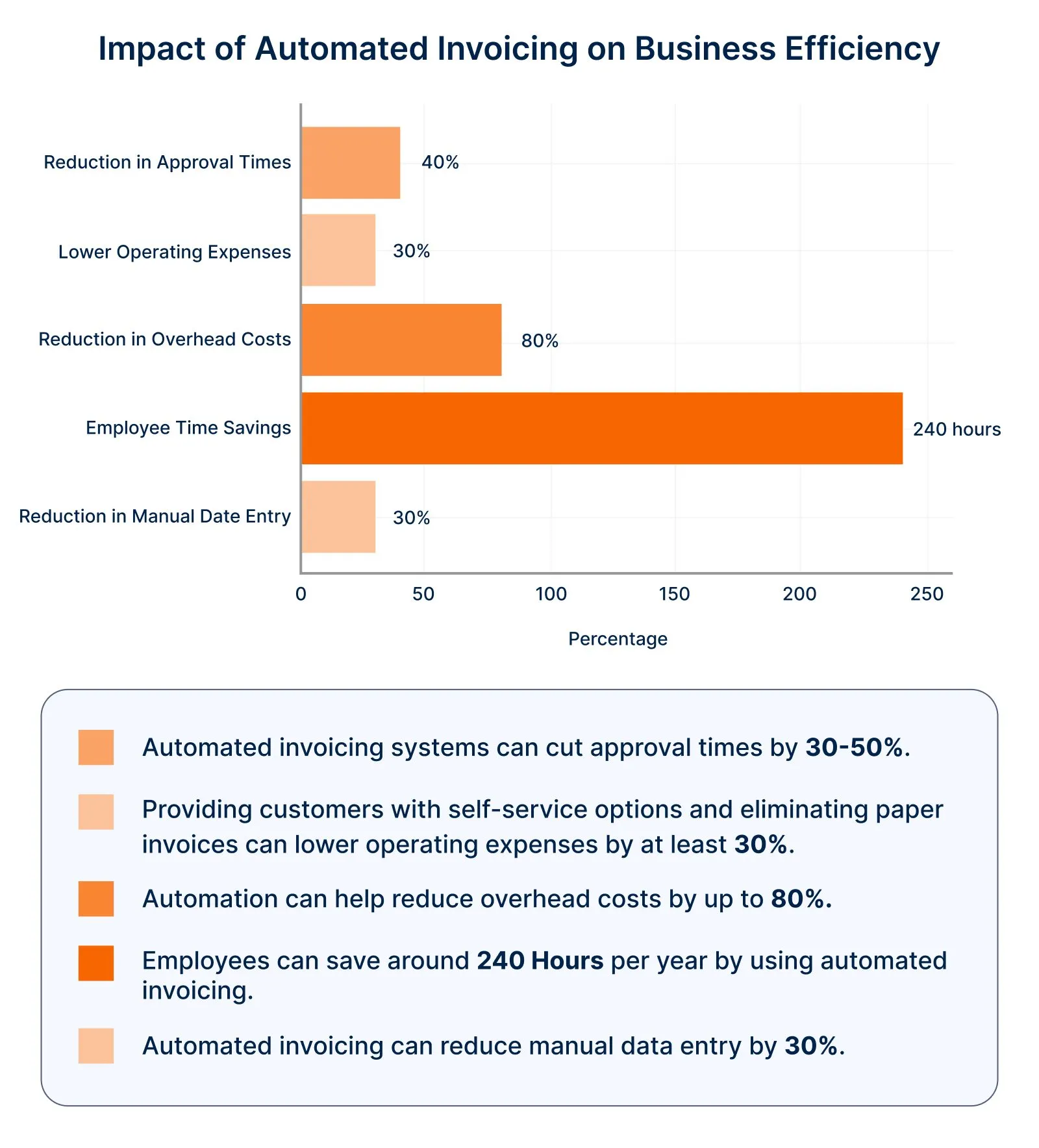

Increases Overall Efficiency To 80%

This means you can save time and resources you would have spent on tedious invoicing processes and other manual activities. This efficiency gives you the opportunity to sharpen customer service, generate new business opportunities, and foster growth.

These were some benefits you receive when using automated invoicing software. So why not give it a try and see how it can transform your business?

How Supplier Invoices Help Monitor Your Business

Another major concern that many tour operators face is placing the exact figure on their earnings for any given tour. This becomes tricky because they usually do not have a complete idea of the costs involved or a means of presenting such costs alongside the income generated from the tour. This is where supplier invoices are helpful, as they contain several critical pieces of information.

Supplier invoices help in evaluating the performance of the business easily. For any tour operator, it is crucial to monitor your income and expenses if your business has started growing.

If supplier invoices are included in the travel system, the income and expenses per tour, group, or reservation can be compared. Such tracking is useful for capturing business results in a detailed manner, which assists in planning ahead.

Also, supplier invoices facilitate the correction of some errors that may go unnoticed, originating from either suppliers or employees.

For example, If a supplier promises a special offer but sends an invoice without it, you can quickly spot the price difference when entering it into the travel system.

Rise of E-Invoices in the Travel Industry

E-invoicing is also revolutionizing the travel industry as it shifts from traditional paper-based billing to electronic billing solutions. This transition is not only making processes more efficient but also making it faster and more accurate to process transactions for travel agencies, hotels, and tour operators.

Furthermore, it increases the speed of invoice processing, which enhances cash flow in business, irrespective of their scale.

Understanding and implementation of tax requirements is another major benefit. It also assists travel businesses in maintaining compliance for record keeping as governments demand electronic records for tax reporting. This is especially the case for the tourism industry since many transactions involve players from various districts.

E-invoicing also improves the transparency of financial operations. Consumers get billing statements that break down expenses and make it easier for business people to account for their expenditures. Such transparency is effective in building trust with customers and, therefore, improving relations with them.

However, it is emphasized that the implementation of paperless invoices contributes to environmental protection. On the positive side, e-invoicing reduces the use of paper, hence minimizes wastage and pollution resulting from the circulation of paper documents.

Invoicera’s e-invoicing lets you create validated invoices for your clients and improves your business credibility.

Using Invoicera For Travel Invoicing

Invoicera makes travel invoicing effortless with these handy features:

Generate Accurate Trip Estimates in Minutes

It helps you create comprehensive estimates, depending on the nature of a particular trip, for one client or a tour group. This feature enables you to map out each of the services that you offer and every cost associated with them, which improves communication and assists you in forming accurate quotes.

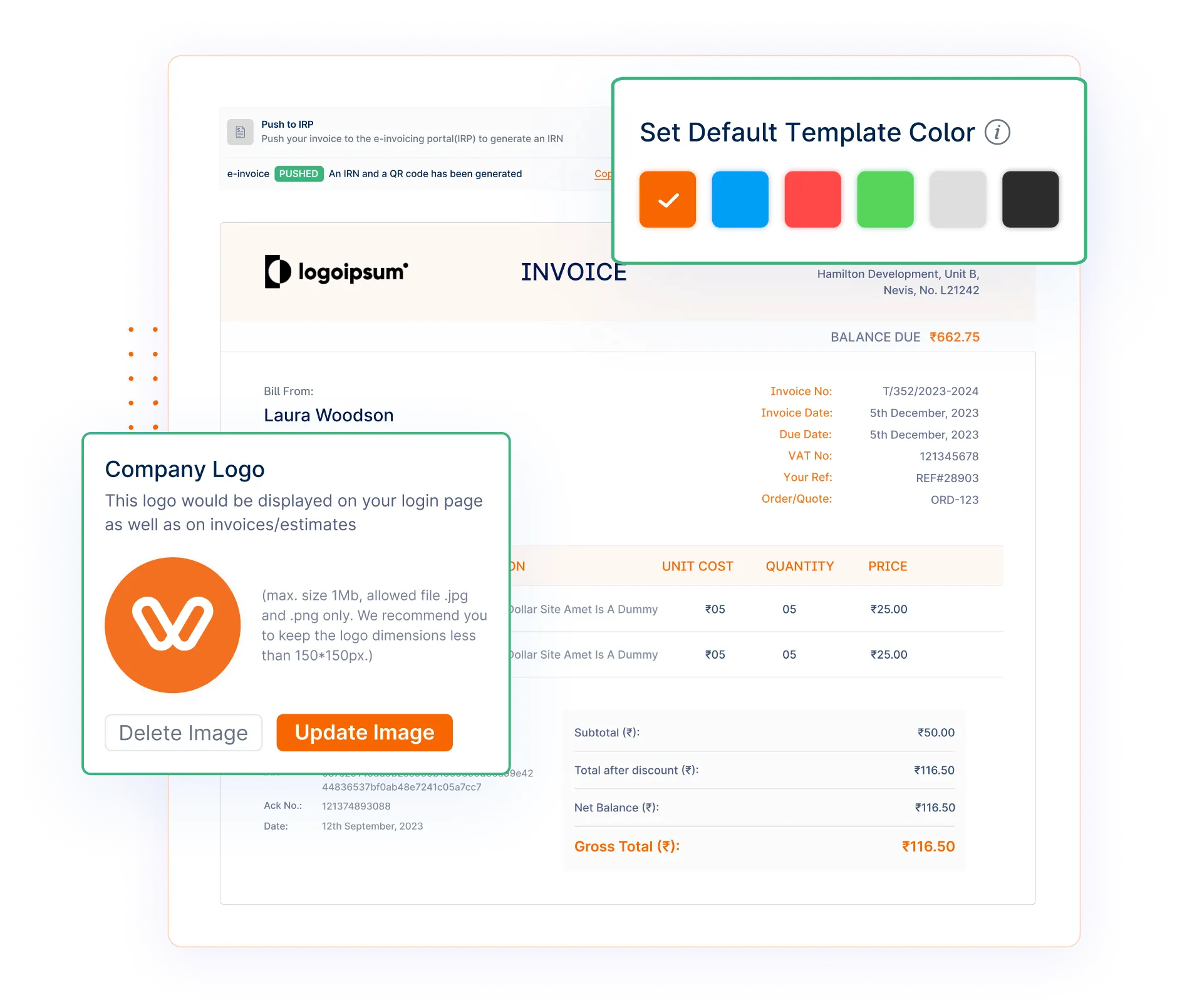

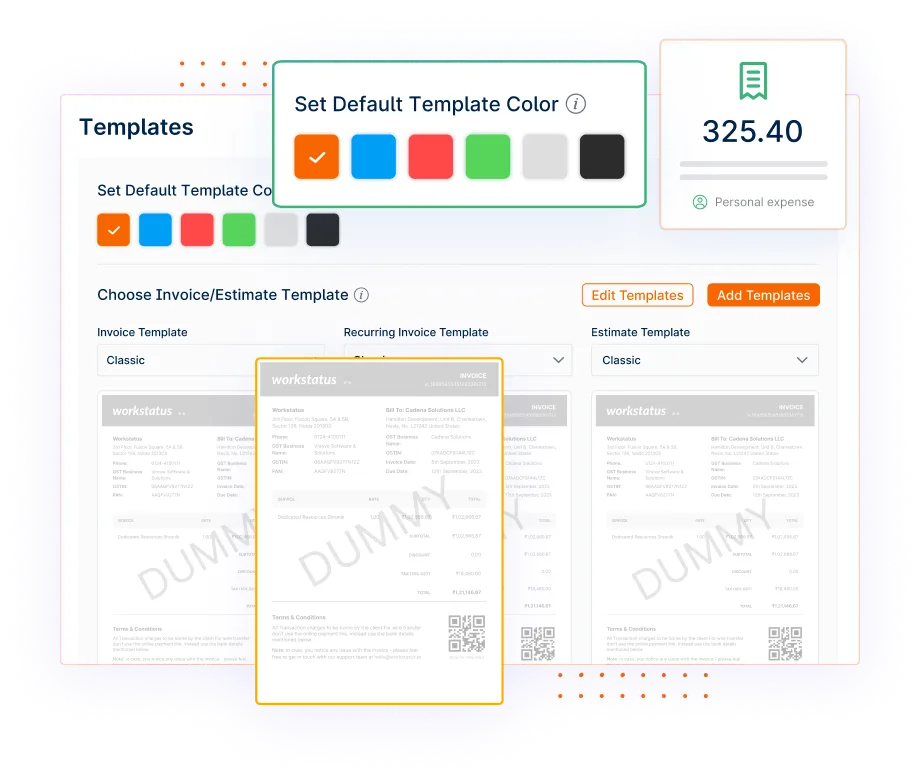

Customized Templates for Your Estimates and Invoices

Select from the wide range of templates available or build one from scratch relevant to your brand. It allows you to perfectly customize your estimates and invoices by adding your logo, colors, and other branding elements.

Convert Estimates to Invoices with One Click

You can reduce your time by converting your estimates to invoices in a single click. This feature is exceptionally helpful! It makes it convenient to update a document and prevents the need to manually write out the same information over again.

Create Professional Invoices

Ensure that the invoices you send out incorporate your brand in some way. You can use your company logo, the company color preference, and the format of your choice in your invoices. Select from various font options to fit the look of your business, and make sure that every invoice you send out looks professional.

Enjoy a User-Friendly Interface

It is, however, a simple and user-friendly interface that does not require the user to have any technical know-how. It also contains certain features that make it easy for the invoicing chores to be executed without much strain.

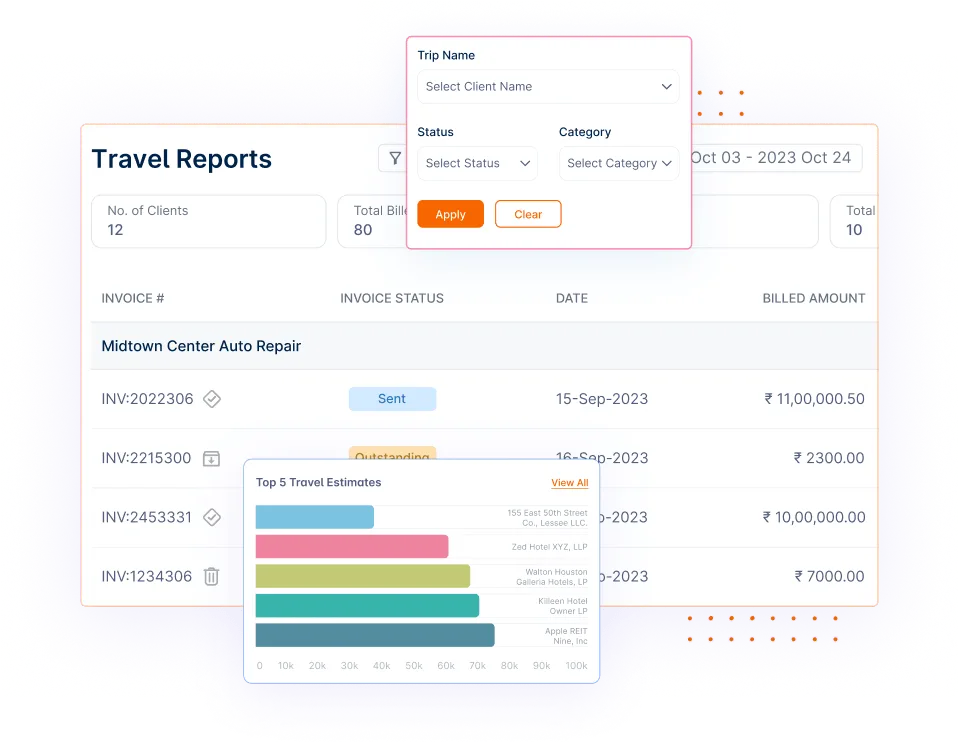

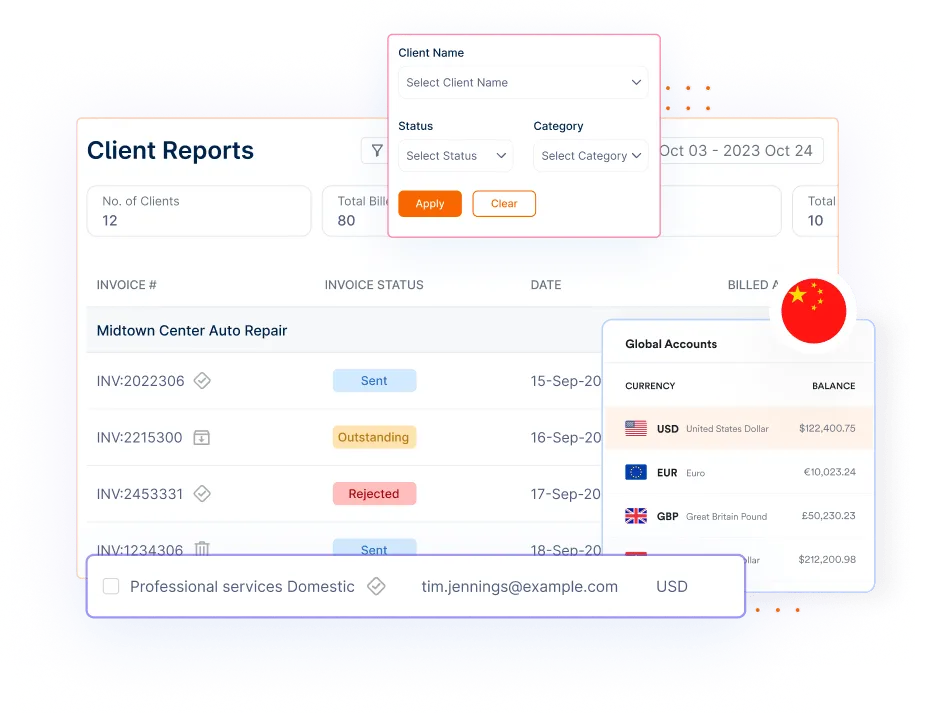

Track Invoice Status and Overdue Payments in Real-Time

Track your invoices and their status in detail. Get notified when a specific client has not made payment for a while. Thus, you will be up to date with your accounts receivables and cash flow.

Manage Your Clients Worldwide

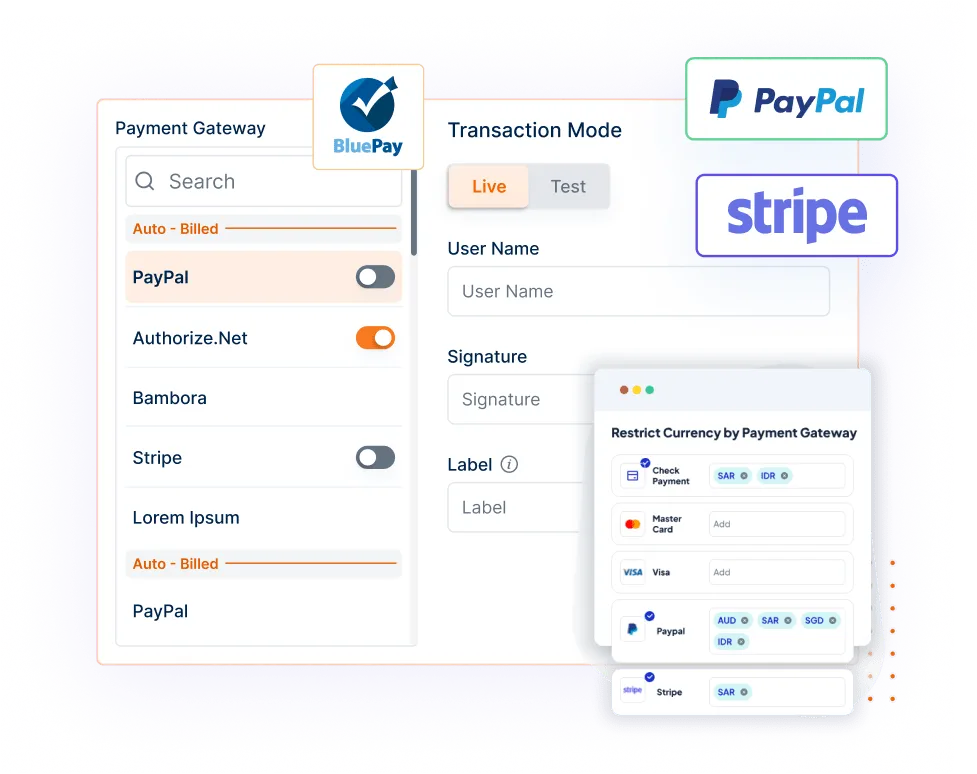

Faster Payments with 14+ Payment Gateways

Provide your clients with diverse, secure payment methods via the most renowned gateways such as PayPal, Stripe, etc. This approach ensures the business receives payment promptly while the customers find it convenient to make payments using their preferred payment method.

Integrate with Your Trip Management Software

Integrate Invoicera with the existing trip management system without any hassle. This integration helps to make billing more efficient in your organization since it does not consume so much time on entry of data.

How Invoicera Automation Helped Businesses?

➡️ A highly subscribed and recommended international travel guide was looking for an invoicing and billing tool to manage its invoices and payments at over a hundred locations. This led to the client’s requirement to have customized invoices with the respective bills per destination, taxes for each destination, and monthly billing for corporate customers.

To address the requirements of the client, Invoicera offered automatic billing, localized billing, tax calculation, subscription billing, payment gateway integration, and daily reporting. This solution also helped optimize the invoicing procedure, allowing for correct destination-based invoices and effective billing for regular contracts with corporate customers.

➡️A worldwide established travel agency faced issues incorporating an invoicing system into the travel software. They required integration in their booking and reservation processes to get better with billing procedures. Fortunately, Invoicera agreed to develop a structured integration between their travel software and the invoicing platform.

This meant that the agency could easily generate invoices from bookings, apply the correct taxes as well as fees, and make payments seamlessly. Owing to this integration, the client was able to cut down his manual work, thereby enhancing the effectiveness of their billing process.

➡️An international travel firm was facing challenges in handling cross-border payment transactions with the previous setup of the invoicing system. They realized they required a system that would accommodate different payment processors, multiple currencies, and multiple languages to address the needs of their clientele.

When they moved to Invoicera, they found that the new tool could support multiple payment gateways and currencies as well as multiple languages. It also enabled the company to handle international payments faster and interact with the customers using their desired language. By transitioning to Invoicera it has made their payment procedures far more efficient and streamlined for their international consumers.

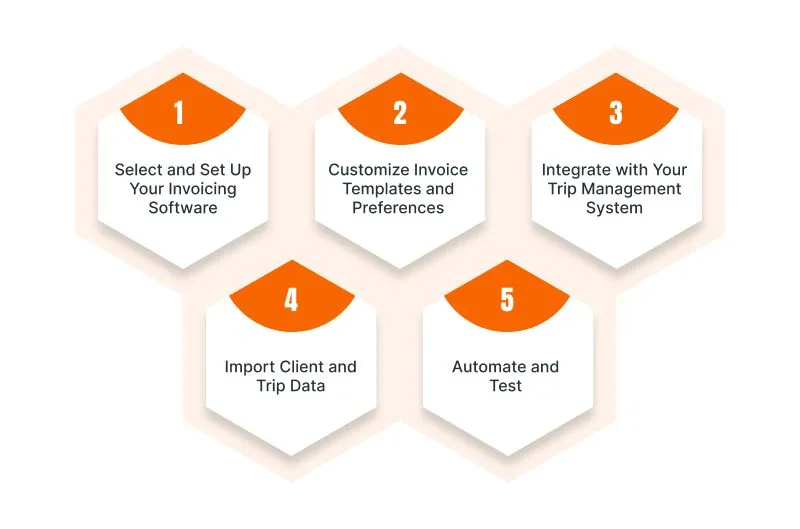

How Can You Start With Invoicing Automation?

1. Select and Set Up Your Invoicing Software

Select the right invoicing software for your travel business. Register, enter your account credentials, and fill in your business information.

2. Customize Invoice Templates and Preferences

Choose or create invoice templates that best represent your business image. Add your logo and colors, and arrange them in any way you would like. Specify the billing terms, payment options, and taxes by your needs.

3. Integrate with Your Trip Management System

Integrate your invoicing system into the existing trip management solution to avoid manual data entry and generate invoices automatically by applying data from bookings.

4. Import Client and Trip Data

Input your current client and trip data into the new system. Make sure that the information is correct and recent enough to support the invoicing procedure.

5. Automate and Test

Create different invoices using automation and test transactions to ensure they meet your desired setting. Modify it as much as necessary and guarantee that everyone in the organization understands how to work with the new platform.

Final Thoughts

Travel sector Invoicing automation is truly revolutionizing by addressing the longstanding challenges of manual billing. For travel businesses, managing invoices manually often means dealing with errors, delays, and the complexities of multi-currency and cross-border transactions.

Automation transforms this process, bringing efficiency, accuracy, and real-time financial insights to the forefront. With solutions like Invoicera, travel companies can streamline their invoicing, minimize mistakes, and speed up payments.

This not only enhances operational efficiency but also provides better service to clients and supports business growth. As the travel industry continues to embrace automation, the benefits of faster, more accurate billing will drive a new era of financial management in travel.

FAQs

Does travel sector invoicing automation meets Compliance Standards?

Invoicing automation systems often include features to help ensure compliance with tax regulations. They can automatically calculate taxes based on the latest rules and regulations, generate compliant invoices, and keep digital records that are easily accessible for audits.

Will I need to change my current accounting software to use invoicing automation?

Most invoicing automation systems, including Invoicera, can easily integrate with your existing accounting software. So, you don’t need to switch your accounting platform; instead, you can enhance your current setup with automated invoicing capabilities.

Can automated invoicing systems handle special pricing or discount structures?

Yes, automated invoicing systems can handle various pricing models and discount structures. You can configure the system to apply specific pricing rules, discounts, and offers, ensuring that your invoices reflect accurate and customized charges for each client or transaction.

How secure is my financial data with automated invoicing?

Automated invoicing systems prioritize security by implementing encryption, secure access controls, and regular data backups. These measures protect your financial data from unauthorized access and ensure that your information remains safe and secure.