Introduction

Welcome to the world of financial operations, where the gears of business growth turn!

Have you ever thought about why financial operations play the most significant role in business growth?

We’ll tell you!

There are some famous words of renowned investor Warren Buffett,

“Accounting is the language of business.”

And indeed, it is!

Effective financial operations serve as the compass guiding your business toward success.

According to recent studies by McKinsey & Company, businesses that strategically manage their financial operations are 20% more likely to experience rapid growth than those that don’t.

From budgeting to cash flow management, these operations are crucial for business expansion.

In simple terms, efficient financial operations pave the way for steady and sustainable growth, enabling your business to thrive in today’s competitive landscape.

Let’s get to know more about them.

What Exactly Are Financial Operations?

Financial operations are how a company manages its money.

It’s not just about counting dollars and cents. It’s about planning, paying bills, handling invoices, and making smart choices about where to spend and save.

Take Invoicera, for example. It’s a tool that helps manage invoices, ensuring businesses get paid on time and keep track of money coming in.

But financial operations cover more than just invoices. They’re about budgets, expenses, and understanding where the money goes.

Consider financial operations as a business’s GPS, revealing successes, areas for savings, and paths for future investments.

Essentially, they form the backbone of a business. Excelling in these operations unleashes a business’s potential, fostering growth and leading to success.

How Do Financial Operations Drive Business Success?

Financial operations cover a bunch of things. They manage cash flow, monitor expenses, ensure timely bill payments, and allocate funds to foster business growth.

When these operations are top-notch, magic happens—they pave the way for business success.

- First off, they help in making smart decisions. They give a clear picture of what’s working and what’s not. This helps businesses make informed choices on where to invest and save.

- Then there’s the efficiency factor. When financial operations are well-managed, everything runs like clockwork. Bills get paid on time, reducing stress and keeping vendors happy.

- Plus, it helps in predicting future needs. Ever heard the phrase “cash is king”?

Having a good handle on financial operations means you’re prepared for whatever the future throws your way.

- Moreover, good financial operations also help build trust. Whether with investors, lenders, or customers, showing that you’ve got a handle on your finances makes others more willing to do business with you.

- And let’s not forget growth. Smooth-running financial operations offer businesses the freedom of time and resources. This enables them to concentrate on expansion—opening new locations, launching products, or increasing staff.

Essentially, they offer clarity, efficiency, and trust, paving the way for growth.

Dynamics Of Effective Financial Operations

Core components

In business, effective financial operations serve as the backbone for sustainable growth. But what exactly comprises these operations?

- Budgeting and Planning: It includes defining financial targets, crafting budgets, and planning for immediate and future goals. Think of it as sketching a map before starting a trip—it guides the way toward achieving success.

- Cash Flow Management: Monitoring the cash flow of the business is crucial. It ensures enough to cover expenses, investments, and future growth plans.

- Risk Management: Every business faces risks, be it market fluctuations, unforeseen expenses, or operational challenges. Managing these risks involves identifying, assessing, and mitigating them to protect the business’s financial health.

- Efficient Resource Allocation: Making smart decisions about where to allocate funds is key. Whether investing in technology, hiring new talent, or expanding to new markets, wise resource allocation fuels growth.

Connection between financial operations and growth

They rely on each other for success!

When these operations are well-maintained—when budgets are adhered to, cash flows are smooth, risks are managed, and resources are used wisely—it helps in business expansion.

Proper financial operations ensure stability and provide the fuel to take calculated risks and explore new opportunities.

Effective financial operations are the strategic framework that powers a business toward its goals, allowing it to thrive and evolve in a competitive landscape.

How Technology Streamlines Financial Operations?

Nowadays, technology is super important for growing, especially in financial operations. New tools and automated solutions have changed how businesses handle finances.

This makes things run smoother and opens up huge opportunities for growth.

A. Automation And Its Impact On Operational Efficiency

Automation stands tall as a game-changer in streamlining financial operations. Platforms like Invoicera have emerged as lifesavers for businesses, offering seamless invoicing, expense tracking, and payment processing automation. Businesses can reduce human error, save time, and allocate resources more efficiently by automating repetitive tasks, such as generating invoices or tracking expenses.

Automation’s influence extends far beyond time-saving. It significantly boosts accuracy, minimizing errors common in manual data entry.

This promotes dependability and empowers businesses to make informed decisions using precise, current financial data.

Tools For Enhanced Financial Management

Efficient financial management is very important for any successful business. Leveraging the right tools can transform how you handle finances, streamline processes, and set the stage for remarkable growth.

Here are three top-notch tools that can revolutionize your financial management:

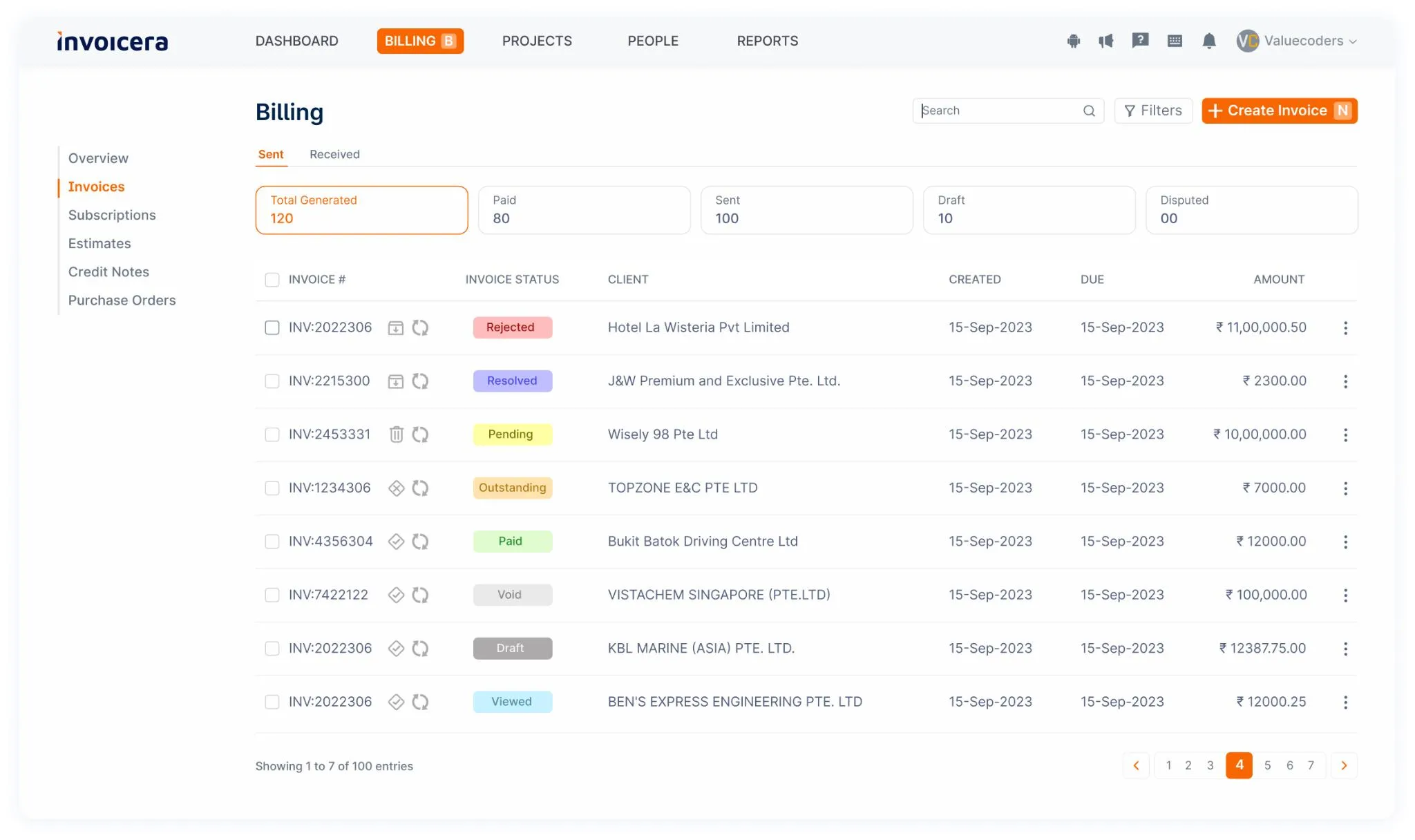

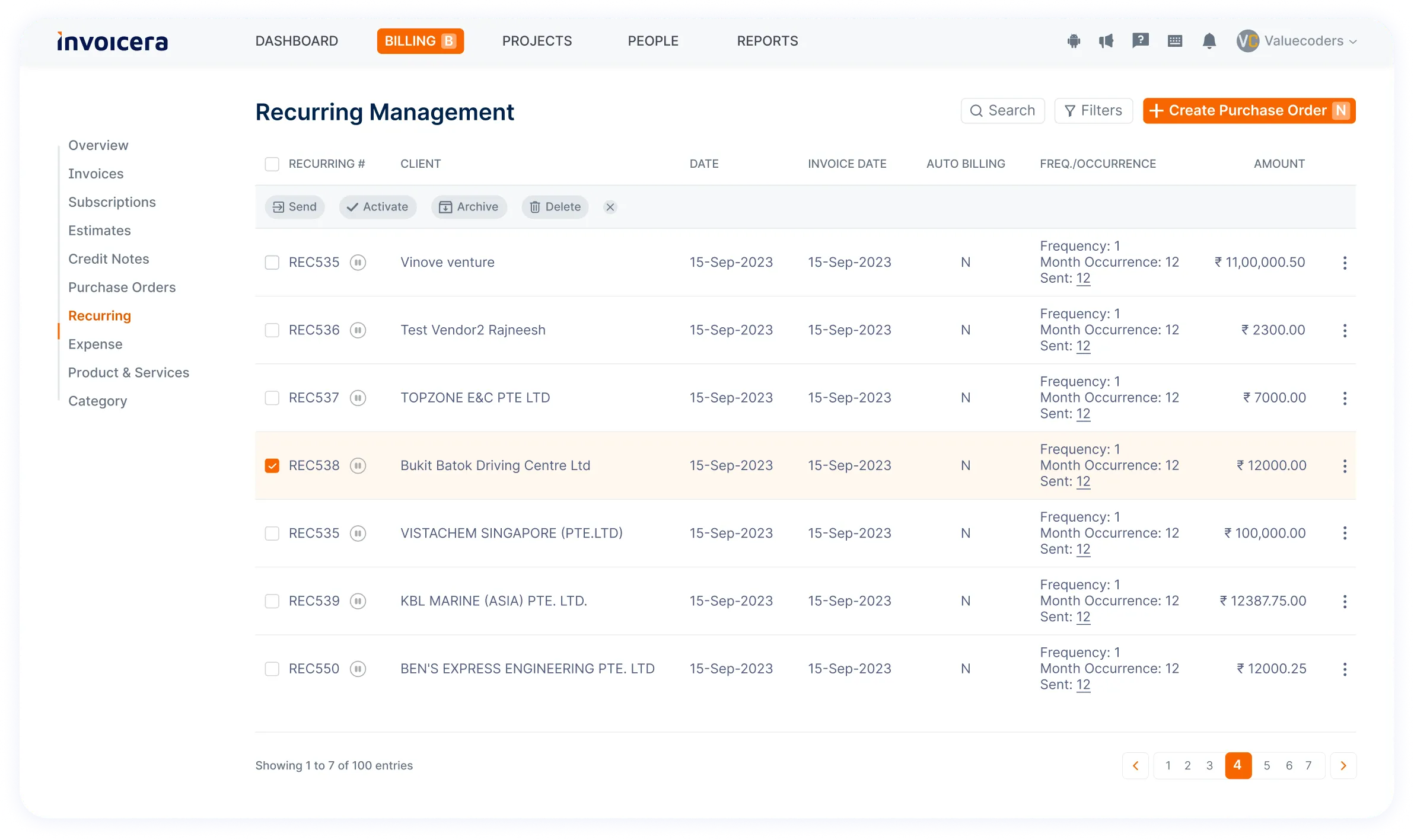

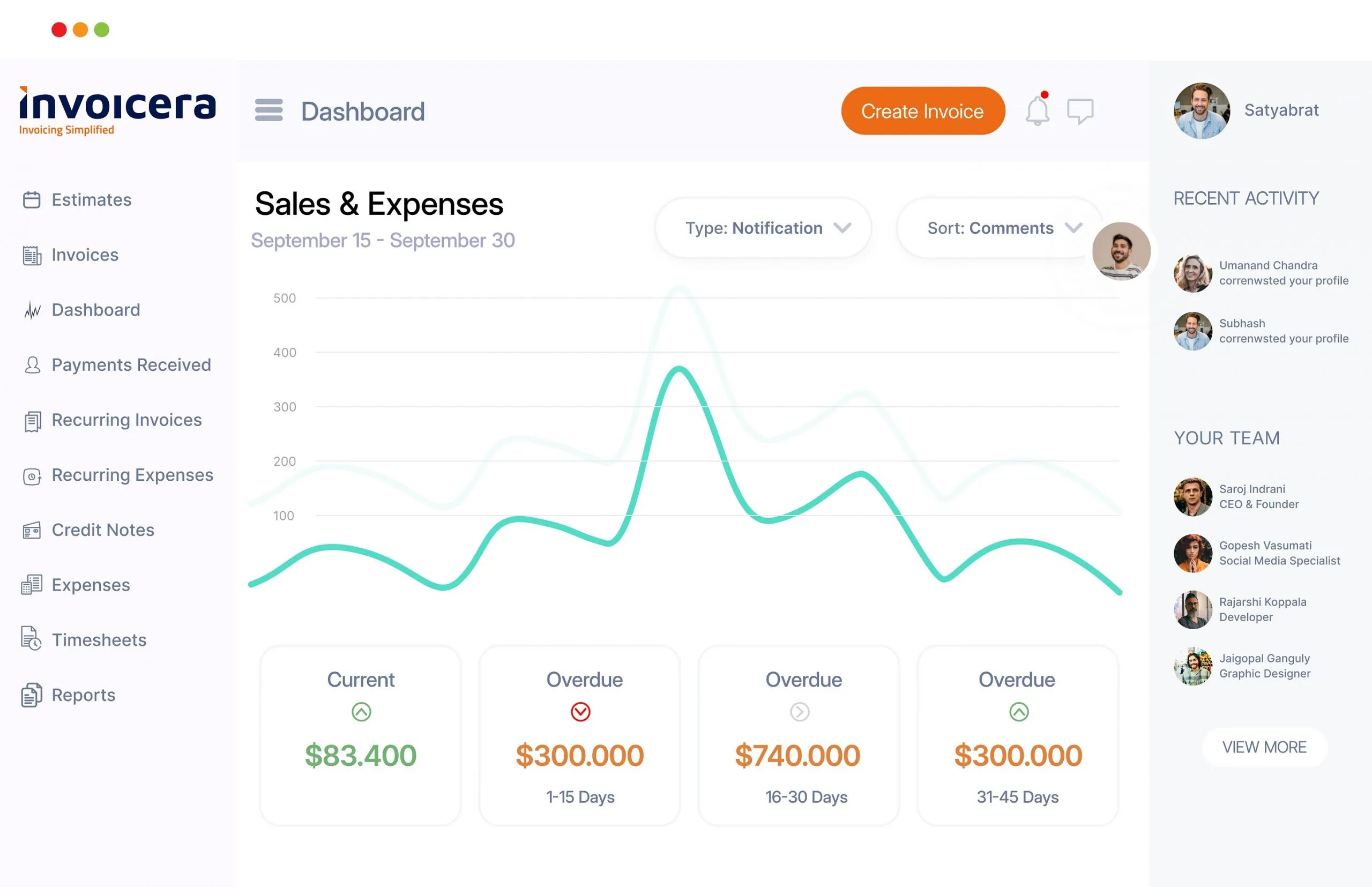

1. Invoicera

Invoicera is a comprehensive platform offering automation for invoicing, expense tracking, and payment processing.

Its robust features encompass:

- Customized Invoicing: Tailor invoices to reflect your brand and business specifics, adding professionalism to your financial transactions.

- Expense Tracking: Track expenses effortlessly, categorize them, and generate insightful reports for better financial analysis.

- Payment Gateway Integration: Seamlessly integrate 14+ payment gateways, allowing clients to pay invoices securely and conveniently.

- Recurring Billing: Set up recurring billing schedules, saving time on repetitive invoicing tasks for regular clients or services.

2. QuickBooks

QuickBooks is a powerhouse in financial management, offering a suite of features including

- Accounting Tools: Manage income and expenses and track financial health with comprehensive accounting tools.

- Invoicing and Payments: Create and share professional invoices and receive payments online, streamlining invoicing.

- Expense Tracking: Capture and categorize expenses for accurate financial reporting and tax preparation.

- Financial Reporting: Generate insightful reports to assess business performance and make informed decisions.

3. Xero

Renowned for its cloud-based accounting software, Xero simplifies financial management with features such as:

- Bank Reconciliation: Automatically import and categorize bank transactions, simplifying reconciliation processes.

- Invoicing: Create and send professional invoices, monitor their status, and get paid faster.

- Expense Claims: Streamline expense claims for better control and visibility over reimbursable expenses.

- Financial Reporting: Access customizable financial reports to gain insights into business performance.

Integrating these tools into your financial operations empowers you with efficiency, accuracy, and insights that can drive significant business growth.

How Important Are Reports In Financial Operations?

Reports are invaluable for your business finances. They gather all the important numbers, trends, and insights into one place, giving you a clear picture of the ins and outs of your business money.

Firstly, reports act as a reality check. They show you the cold, hard facts about your financial health. Whether a profit and loss statement or a cash flow analysis, these reports reveal what’s working and what needs attention.

For instance, they might highlight areas where you’re spending too much or your revenues are booming. This knowledge helps you make smarter decisions to grow your business.

Moreover, reports help in forecasting and planning. You can predict future financial scenarios by analyzing past trends showcased in these reports.

Want to expand your product line or open a new branch?

Reports guide these decisions by providing data-driven insights. They let you estimate how much capital you’ll need and make it easier to set realistic goals.

Reports also play a crucial role in communicating with stakeholders. Whether it’s investors, lenders, or even internal departments, they provide a common language. They present a comprehensive overview of your financial performance, fostering trust and confidence in your business.

Real-time reporting is a game-changer. With updated financial reports, you can make quick, informed decisions. You’ll instantly know if a marketing campaign is working or a cost-saving strategy is paying off. This agility is essential for staying competitive and finding new opportunities.

Thus, reports in financial operations aren’t just numbers on paper or screens. They are the backbone of informed decision-making.

What Are The Challenges In Financial Operations?

There are a lot of issues while managing a business’s finances.

Here are a few challenges discussed and solutions on how Invoicera can resolve them.

- Inefficient Invoicing Systems: Manual invoicing processes can be time-consuming and prone to errors, leading to delayed payments and cash flow disruptions. An automated invoicing solution like Invoicera can streamline this process, ensuring accurate and timely invoices.

- Cash Flow Management: Maintaining a robust cash flow is critical for business operations. Challenges arise when there are delays in receiving payments or when expenses exceed revenue. Invoicera offers features like automated payment reminders and real-time tracking, aiding in better cash flow management.

- Compliance and Regulations: Staying compliant with ever-changing financial regulations can be daunting. Invoicera stays updated with the latest compliance standards, effortlessly helping businesses adhere to legal requirements.

- Manual Data Entry and Errors: Human errors in data entry can lead to inaccuracies in financial records, causing discrepancies in reports. Invoicera’s automation capabilities reduce manual intervention, minimizing the chances of errors and ensuring data accuracy.

- Lack of Financial Visibility: Without clear insights into financial data, making informed decisions becomes challenging. Invoicera provides detailed financial reports and analytics, offering businesses a detailed view of their financial health.

Businesses Excelled With Strong Financial Operations

Apple Inc.:

- Apple is celebrated for its robust financial operations, significant cash reserves, and efficient capital management.

- As of the latest data, Apple’s market capitalization stands at $3.06 trillion, reflecting a 31.26% increase over the past year.

Walmart:

- Walmart handles its money smartly, running a huge retail empire while saving money and managing deliveries quickly.

- In the latest fiscal year, Walmart’s net revenue surpassed $407.17 billion, reflecting its ability to navigate complex market dynamics and generate substantial income.

Amazon:

- Amazon’s financial operations are characterized by strategic investments in innovation, infrastructure, and diverse business ventures.

- As of the latest revenue figure, Amazon’s market value stands at $1.53 trillion, marking a 59.27% increase in its market worth within a year.

Microsoft:

- Microsoft grows steadily by wisely managing resources and being financially disciplined.

- As per the latest data, Microsoft’s net worth stands at $2759.6 billion, solidifying its position as a leading global technology provider.

Future Trends Of Financial Operations

Let’s delve into the exciting trends shaping the landscape of financial operations and what the future holds for this crucial aspect of business growth.

Emerging Technologies And Trends Shaping Financial Operations

- Automation Revolution: Expect to see a surge in automated processes. Artificial Intelligence (AI) and Machine Learning (ML) are streamlining repetitive tasks like data entry, reducing errors, and freeing up valuable human resources for strategic decision-making.

- Blockchain Integration: The rise of blockchain technology is revolutionizing transactional transparency and security. It’s set to transform how financial data is stored, accessed, and protected.

- Predictive Analytics: Advanced data analytics tools help forecast trends, identify risks, and offer valuable insights for smarter financial decision-making.

- Cloud-Based Solutions: Cloud technology is becoming the go-to choice for financial operations. It offers scalability, accessibility, and cost-efficiency, allowing businesses to adapt quickly to changing demands.

- Cybersecurity Measures: As digital platforms become more essential, strong cybersecurity measures are crucial. Expect a continued focus on fortifying financial systems against cyber threats.

Predictions For The Future Role Of Financial Operations

- Strategic Partnering: Financial operations will evolve from a purely transactional role to a strategic partnership with other business functions. It will actively contribute insights for operational efficiency and growth strategies.

- Real-Time Decision-Making: Faster data processing and analytics enable businesses to make real-time financial decisions, enhancing agility and responsiveness.

- Customization and Personalization: Tailored financial solutions will become more prevalent, catering to specific business needs and goals rather than one-size-fits-all approaches.

- Regulatory Adaptability: As regulations evolve, financial operations must adapt swiftly. Expect to focus on compliance and stay updated about regulatory changes to ensure business continuity.

- Sustainability Integration: Financial operations will increasingly align with sustainability goals, with metrics and KPIs reflecting environmental, social, and governance (ESG) considerations.

Conclusion

Growing your business can be tough, but smart money moves can greatly help. We’ve talked about how to handle money well—like budgeting smartly and making good investments—can boost your business. These aren’t just numbers; they keep your business growing and strong.

Remember, there’s no one-size-fits-all for making money work for your business. You’ve got to adjust these money strategies to fit your own goals.

Keep learning about money trends and new tech. Stay flexible and ask for help when you need it.

Start today! Small steps, like tweaking budgets or checking out new investments, can make a big difference. Let’s make your business not just grow but thrive in today’s changing world.

FAQs

What are the risks of poor financial management on business growth?

Poor financial management can affect your business growth. It might cause money troubles, more debts, missing chances to grow, and even getting into legal problems.

How can small businesses leverage financial operations for growth?

Small businesses can start by focusing on fundamental financial practices such as maintaining accurate records, managing cash flow, and seeking guidance from financial experts or mentors.

Additionally, adopting scalable financial management tools like Invoicera and strategies tailored to their size and needs can pave the way for sustainable growth.

What’s the connection between financial operations and long-term business success?

Financial operations form the foundation for long-term business success. They ensure stability, facilitate informed decision-making, attract investors, and create growth opportunities when effectively managed. Consistent attention to financial operations is key to sustaining success over a long period.