Introduction

Running a small business always comes with unique challenges, but managing finances shouldn’t be one of them.

The right invoicing software can make this job easy by streamlining your billing process and improving your cash flow.

As per FMI report, the invoice processing software market saw revenues of $22 billion in 2022, with projections estimating it will reach $25.3 billion by 2033.

This growth underscores the rising demand for effective invoicing solutions, highlighting the benefits they bring to businesses.

But what sets the best invoicing software apart?

It’s more than just creating invoices; it’s about offering customized solutions that align with your business needs and enhance your brand’s professionalism.

This guide explores the top 10 automated invoicing software for small businesses, showing you how they can accelerate payments, improve accuracy, and help you scale.

Let’s get started by first knowing how this software can benefit you.

How Does Invoicing Software Benefit Small Businesses?

The benefits are discussed below:

1. Accelerated Payment Process

Invoicing software speeds up the payment process by automating the invoicing tasks. You can get prompt payments by sending timely invoices which in turn boosts your cash flow.

2. Environment-friendly

The transition to digital invoicing helps reduce the environmental impact and improve overall organizational efficiency. When you go paperless, you can easily manage and store records through an online invoicing system. It also saves the stationery budget.

3. Enhanced Accuracy and Precision

It minimizes the risk of errors in your invoicing. Invoicing software performs complex calculations accurately, mitigating the chances of miscalculations or inaccuracies. This instills confidence in clients and contributes to a more professional image.

4. More Time for Important Tasks

You can automate repetitive tasks like generating invoicing, sending payment reminders, and more. It will help you reclaim your valuable time. This newfound efficiency can be redirected towards strategic business activities, fostering growth and development.

5. Professional-looking Branded Invoices

An invoicing software helps you to add your brand colors, logo, etc. It can help you impress your clients. It also provides customizable templates that project a professional image, enhancing the overall perception of your business.

6. Streamlined Financial Management

Integration capabilities within accounting tools give you a detailed view of your financial landscape. Invoicing software acts as a financial compass, aiding in:

- Budgeting

- Forecasting

- Maintaining financial stability

Top Small Business Invoicing Software Solutions In 2024

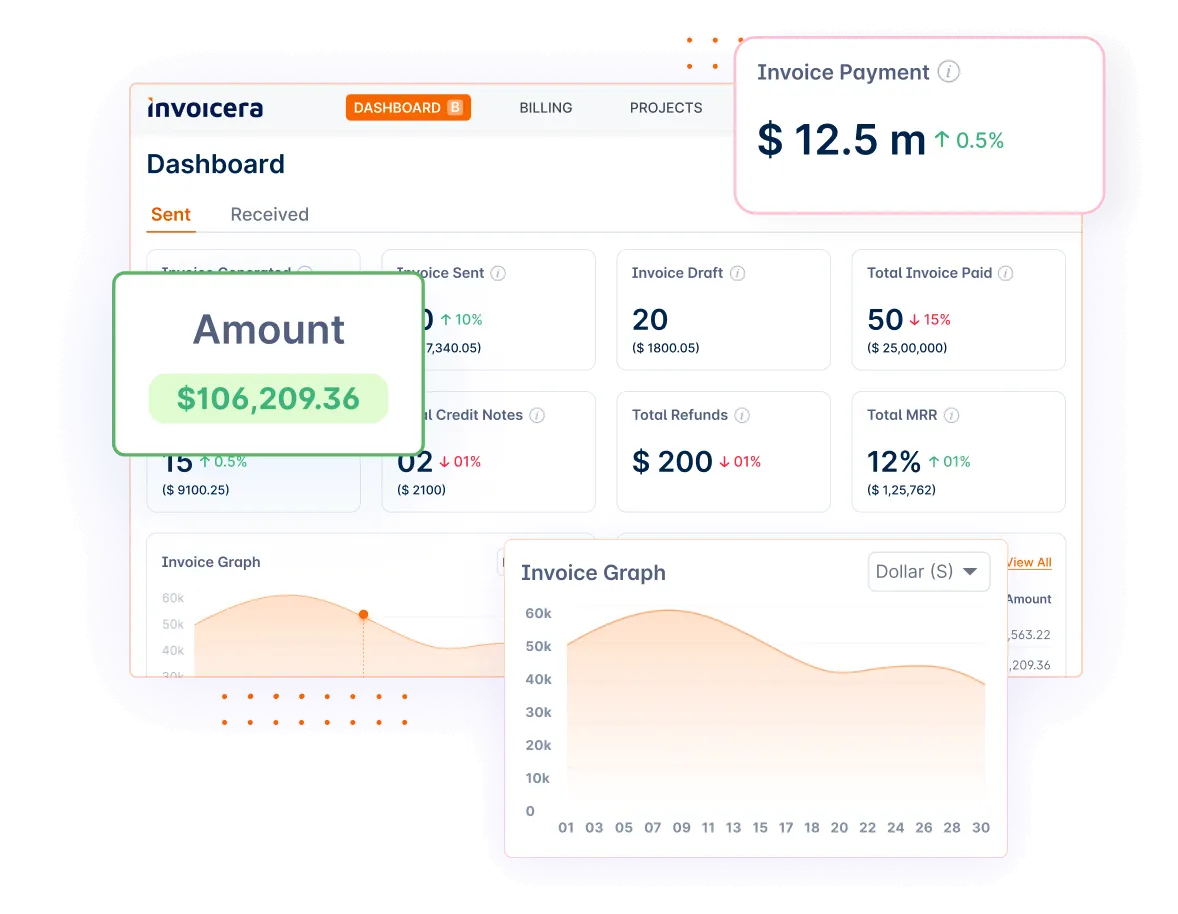

1. Invoicera

Invoicera comes on first number on the list as an invoicing software for every business size. Small bsuiensses looking for a software that is rich in invoicing features can go for Invoicera.

It offers:

- User-friendly interface

- Customizable invoice templates for your brand image

- Automated recurring invoices

- Automated payment reminders

- Invoice approval workflow

- 14+ integrated payment gateways

It excels in automation and helps businesses save time and resources resulting in increased productivity.

The platform’s stringent security measures that ensure the safe handling of sensitive financial data. This makes Invoicera a reliable choice for more than 4 million users worldwide.

Invoicera pricing starts at $19/month for the basic plan. You can also get custom pricing by talking to our salesperson.

2. Freshbooks

Freshbooks is another small business invoicing software on the list. It focuses on simplicity and efficiency.

Its tailored solutions include:

- User-friendly invoicing features

- Time-tracking capabilities

- Expense management

Freshbooks offers a user-friendly interface that is quite easy to use for anyone. It can be an employee, accountant, or other person involved in the accounting process.

It integrates with many business tools and boosts employee productivity with an all-in-one solution. In this way, you can also save time and resources.

The pricing plans for a small business with employees are:

- Premium – starts at $18/month

- Custom plan on request

3. Zoho Invoice

Zoho Invoice is for all business sizes and offers powerful features that meet the different needs of every business.

It comes with customizable templates to create invoices that match your brand image.

Moreover, it integrates with other Zoho apps, which provides a tailored and productive experience for businesses.

Its scalability ensures businesses can adapt and grow, making it a versatile choice for all.

Zoho Books offers a range of pricing:

- Standard at $15/month

- Professional at $40/month

- Premium at $60/month

4. Xero

Next comes Xero!

It is a cloud-based invoicing solution that offers features beyond your expectations.

It offers:

- Comprehensive invoicing features

- Customizable templates to design with brand identity

- Real-time financial tracking

- Integration capabilities with third-party tools

It is an invaluable tool that can be really helpful for small businesses.

This platform is committed to keeping your data secure and compliant. It adds an extra security layer to all the data so that businesses are free from theft of sensitive financial information.

Xero offers multiple pricing options:

- Starts at a flat rate of $7.25 per month – Limited plan

- ‘Standard’ plan is priced at $11.50 per month

- ‘Premium’ plan, which goes best for small businesses, is available for $15.50 per month.

5. Invoice2go

The fifth on the list is Invoice2go.

It offers the below features:

- Perfect for mobile businesses – you can create and send invoices on the go

- Pre-designed and custom invoice templates – you can easily match them with your brand image

- Payment-tracking – you can always stay on top of your finances

Its pricing for unlimited invoices starts at $39.9/month, and the free trial is for 14 days.

6. Tipalti

Tipalti offers a comprehensive platform for global payment and financial operations.

Its tailored solution:

- Streamlines accounts payable processes

- Ensures compliance

- Provides better experience for businesses dealing international payments

Tipalti offers pricing plans starting at $129 per month.

7. Wave

Wave stands out for its commitment to simplicity and affordability.

It exactly matches the needs of a small business. It offers a suite of financial tools, which includes invoicing and accounting.

It makes financial management accessible and efficient for entrepreneurs without compromising on features.

Wave offers pricing at:

- $0 for the starter plan

- $16/month for the pro plan

8. Scoro

Scoro comes next and offers invoicing solutions to SMEs and large enterprises. It also offers project management solutions.

Its integrated approach combines invoicing, collaboration tools, and reporting, providing a centralized hub for businesses seeking comprehensive solutions.

Scoro’s pricing begins at $26 per user per month.

9. Chargebee

Chargebee specializes in subscription billing solutions, tailoring its services to businesses relying on recurring revenue models.

It streamlines subscription management, invoicing, and revenue recognition, offering a customized approach for businesses in the subscription economy.

Chargebee’s pricing model starts at $249 per month.

10. Maxio

Maxio focuses on empowering small businesses with efficient financial solutions.

Tailored to meet the unique needs of entrepreneurs, Maxio offers tools for invoicing, expense tracking, and financial reporting, providing a user-friendly interface that simplifies financial management for startups and small enterprises.

Maxio pricing is determined by the trailing twelve-month billing volume, and users have the flexibility to include or exclude modules as required.

The subscription for Maxio starts at $599/month.

A Closer Look at Invoicera

Invoicera stands out as a comprehensive invoicing solution, offering tailored features designed to meet the unique needs of your business. Here’s a glimpse into the customized solutions it provides:

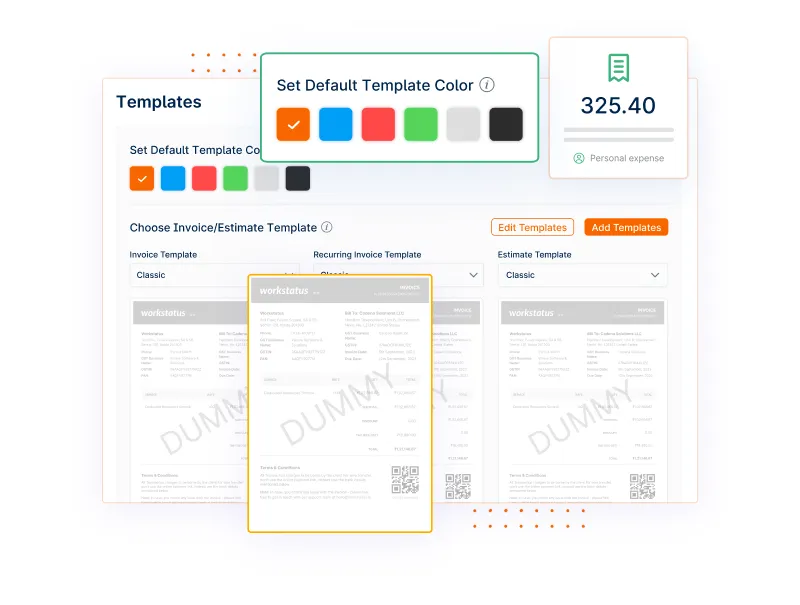

1. You can customize invoices

Invoicera allows you to go beyond the cookie-cutter approach. Craft professional and personalized invoices that align with your brand identity.

Add your logo, choose color schemes, and tailor the layout to leave a lasting impression on your clients.

2. It helps you create a custom workflow

No two businesses operate exactly the same way. Invoicera understands this and offers a customizable workflow feature.

Tailor the invoicing process to match your business dynamics, ensuring that the software aligns seamlessly with your existing practices.

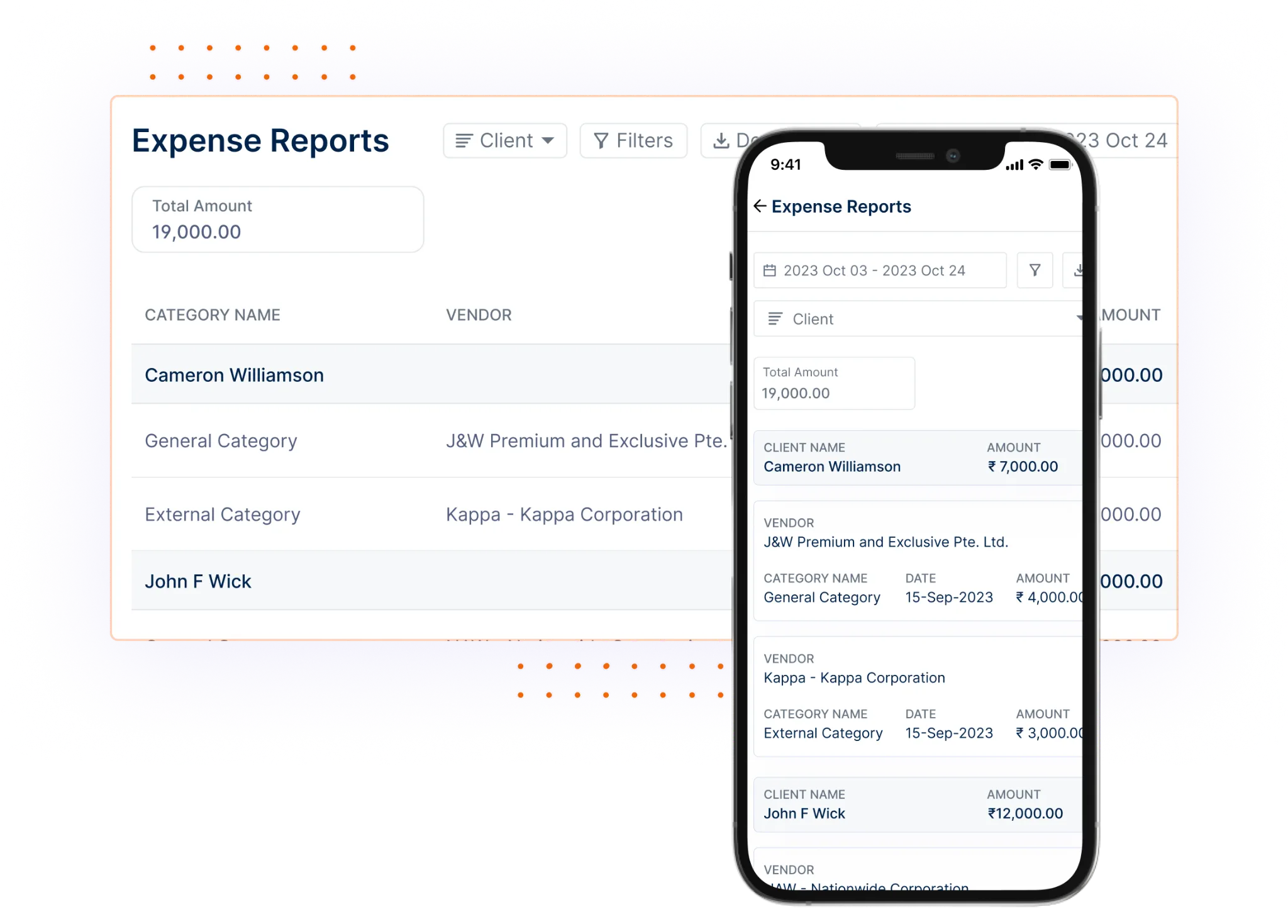

3. You can easily tailor your expense reports

Invoicera empowers you to take control of your expenses. Generate detailed and customizable expense reports that suit your specific reporting needs.

Capture, categorize, and analyze expenses with precision, providing you with a clear understanding of your financial landscape.

4. You can easily get custom integrations with third-party software

Recognizing the diverse software ecosystem that businesses operate in, Invoicera offers custom integrations on request.

Seamlessly connect Invoicera with your preferred third-party tools like Quickbooks, ensuring a cohesive and integrated business environment. This tailored approach enhances efficiency and data coherence across your business systems.

With Invoicera’s commitment to customization, you’re not just getting an invoicing tool; you’re getting a tailored solution that adapts to the unique contours of your business, providing a personalized and efficient experience.

Pricing Model

While Invoicera offers a free plan, its premium plans are competitively priced, ensuring businesses get value for their money.

- The ‘Starter’ plan is for startups or small businesses at $15/Month (Billed annually).

- Small and medium-sized businesses can choose a ‘Business’ plan at $39/Month (Billed annually).

- The most famous ‘Enterprise’ plan costs $79/Month (Billed annually).

- The ‘Infinite’ plan offers everything unlimited at $119/Month (Billed annually).

How To Choose The Right Invoicing Software

Choosing the right invoicing software for your business involves considering a few important things:

✔ Must Fit Your Business Needs

Before picking invoicing software, understand how your business handles billing. Choose software that specifically meets your needs, avoiding extra features that you might not use.

✔ Should Create Professional-Looking Invoices

Make sure your invoices not only have all the necessary details but also look good. Your invoices represent your business, so they should be clear and well-designed to create a positive impression.

✔ Security Must Be High

Pick invoicing software with a good reputation for keeping your financial information safe. Security is crucial because a breach could lead to losses and harm your business’s reputation.

✔ Good Customer Support Is Necessary

Since software can have issues, go for invoicing software with reliable customer support. They should be easy to reach and helpful in resolving any problems. Look for additional support resources like guides and tutorials to make things easier.

Key Takeaways

- Small businesses, stressed by late payments, seek invoicing software for timely payments and brand-aligned customization.

- The blog discussed the top 2024 solutions emphasizing efficiency and personalization.

- It highlighted the benefits and key features of the software tailored to specific business needs.

- Invoicera stands out with customization, workflow flexibility, and integrated solutions.

- Pricing caters to diverse businesses, supported by positive user ratings.

- The guide also discussed choosing software based on business needs, professionalism, security, and reliable support for a transformative invoicing experience.

FAQs

Q. Can I access my invoicing data from different devices or locations?

Ans. Many online invoicing tools like Invoicera offer cloud-based solutions, allowing access from anywhere with an internet connection. Ensure the software you choose supports multi-device access if that’s important for your business.

Q. What happens if the software doesn’t meet my needs after I’ve started using it?

Ans. Many software providers offer trial periods or money-back guarantees. It’s advisable to take advantage of these offers to test the software thoroughly before committing.

Q. How often does the software receive updates or improvements?

Ans. Frequent updates can indicate a software’s commitment to improvement. Check the software’s release notes or update history to gauge how often they enhance their product.