Are you tired of generating manual invoices or following up with clients to get paid on time?

If yes, you are wasting your energy, time, and effort. You can ease the job of creating invoices and can do work of many hours in minutes.

In today’s fast-paced world, where time is of the essence, you must adopt an automated system for invoicing.

It will help maximize efficiency, and boost your business grow. Moreover, you will start receiving invoice payments on time, which will strengthen your company’s finance stream.

Thus, we have come up with detailed information about every aspect of automated invoicing. We will also discuss the benefits of an online software, Invoicera.

Let’s first know a few benefits of automated invoicing. Let’s dive in.

Benefits of Automating Invoicing

According to recent statistics, companies that embrace automated invoicing systems witness a substantial reduction in error rates and invoicing cycle times.

In fact, businesses that implement automation report a decrease of up to 30% in invoicing-related errors and a reduction of up to 40% in overall invoicing time.

- Enhanced Accuracy: Automated invoicing minimizes the chances of human errors, ensuring that every detail is accurately recorded and calculated.

- Effortless Tracking: Keep tabs on the status of your invoices effortlessly. Know when they are sent, received, and paid.

- Faster Payments: Automated invoicing generates and delivers invoices promptly, leading to quicker payment turnaround.

- Time and Cost Savings: Automating the invoicing process frees up a lot of valuable time that you can dedicate to strategic business activities. Additionally, operational costs are reduced as manual labor is minimized.

- Improved Client Relationships: Invoicing automation ensures clients receive their bills consistently and on time, fostering positive business relationships.

- Customization and Branding: Many automation tools, including Invoicera, allow you to customize invoice templates and add your branding elements, maintaining a professional image.

Understanding the Invoicing Automation Landscape

Invoicing automation offers many benefits through technologies like OCR, AI, and blockchain. A few of them are:

- Reduced manual work

- Faster processing times

- Improved accuracy

However, challenges, including initial implementation costs, system integration, and compliance, must be navigated.

Looking ahead, the landscape shows promise with AI advancements, predictive analytics, ecosystem integration, and global standardization shaping the future of invoicing automation for businesses seeking enhanced financial efficiency and competitiveness.

Key Features of Invoicing Automation Software

Have a look at some key features to consider while choosing any automation software:

- Invoice Generation: Automation software can swiftly generate accurate invoices based on predefined templates, reducing the need for manual data entry and minimizing errors.

- Customization: The ability to customize invoice templates to match your brand identity not only maintains a consistent image but also adds a professional touch to your communications.

- Recurring Invoices: For businesses that bill clients regularly, the software can automate the creation and delivery of recurring invoices, saving time and ensuring timely payments.

- Integration: Seamless integration with your existing accounting and CRM systems ensures that invoicing data is synchronized, eliminating the need for duplicate data entry.

- Payment Tracking: Keep track of payments with ease. Automation software can provide real-time updates on invoice status, helping you manage cash flow effectively.

- Late Payment Reminders: Set up automated reminders for clients with overdue payments, promoting prompt settlement and improving your cash flow.

- Data Security: Advanced security features to safeguard sensitive financial data, giving you peace of mind that your information is protected.

- Reporting and Analytics: Access insightful reports and analytics, helping you get insights into your invoicing processes and enabling you to make informed decisions. Plus, invest in enterprise knowledge management automation to simplifiy data handling and keep information organized.

Implementing Invoicing Automation: Step-by-Step Guide

1. Assessment Phase

Begin by assessing your current invoicing processes. Identify pain points, bottlenecks, and areas that can benefit from automation.

2. Research and Selection

Research various invoicing automation software options available in the market. Consider factors such as features, scalability, user-friendliness, and customer support. Choose a solution that aligns with your business needs.

3. Data Migration and Integration

Migrate your existing invoicing data to the new software. Ensure seamless integration with your accounting, CRM, and other relevant systems to maintain data consistency.

4. Configuration and Customization

Configure the software according to your business requirements. Customize invoice templates, payment terms, and any automation workflows you want to implement.

5. Training and Onboarding

Train your team on how to use the new software effectively. Provide comprehensive onboarding to ensure everyone understands the features and benefits.

6. Testing and Quality Assurance

Thoroughly test the software in a controlled environment. Check for any glitches, inaccuracies, or inconsistencies. Address and rectify any issues before proceeding.

7. Go-Live and Monitoring

Once you’re confident in the software’s functionality, launch it for your invoicing processes. Monitor its performance closely during the initial stages and address any hiccups promptly.

Challenges and Pitfalls

Integration Complexity: Integrating an invoicing system with existing software and tools can be complex and time-consuming, leading to potential disruptions.

Data Accuracy: Relying solely on automated processes can sometimes result in inaccuracies, especially if the initial data input needs to be corrected.

Resistance to Change: Employees might be resistant to adopting new systems, leading to a learning curve and potential productivity dips.

Customization Constraints: Some automation solutions may not offer the level of customization needed to accommodate unique invoicing workflows.

Invoicera – Most Powerful Invoicing Software

Among the various invoicing solutions available, Invoicera stands out as a powerful tool that streamlines invoicing processes and offers a range of features:

1. Customizable Templates: Invoicera provides a variety of customizable invoice templates, allowing businesses to maintain a professional image while tailoring invoices to their branding.

2. Recurring Invoices: The software enables the creation of recurring invoices, making it easy to manage subscriptions and regular client billing.

3 Expense Tracking: Invoicera’s expense tracking feature helps businesses keep a close eye on expenses, ensuring accurate and transparent financial reporting.

4. Automated Reminders: Late payments can affect cash flow. Invoicera’s automated reminders help send timely notifications to clients, reducing the chances of delayed payments.

5. Payment Gateways Integration: The software integrates with various gateways, enabling clients to make payments easily and securely online.

Future Trends in Invoicing Automation

As technology continues to advance, the future of invoicing automation holds exciting possibilities:

Artificial intelligence can analyze past invoicing patterns, client behavior, and market trends to predict payment cycles and provide insights into cash flow. It allows businesses to make better financial decisions.

Blockchain’s inherent security and transparency features can be integrated into invoicing processes. It ensures that invoices are tamper-proof and provides a secure audit trail, reducing the risk of fraud and disputes.

Ending Thoughts

As technology is continuously advancing, the potential for automation in invoicing is only set to grow.

From reducing manual data entry to facilitating seamless communication between departments, automated invoicing processes pave the way for enhanced productivity and improved financial management.

Investing in automated invoicing software like Invoicera will reduce all your manual efforts and let you focus on other business aspects.

Frequently Asked Questions

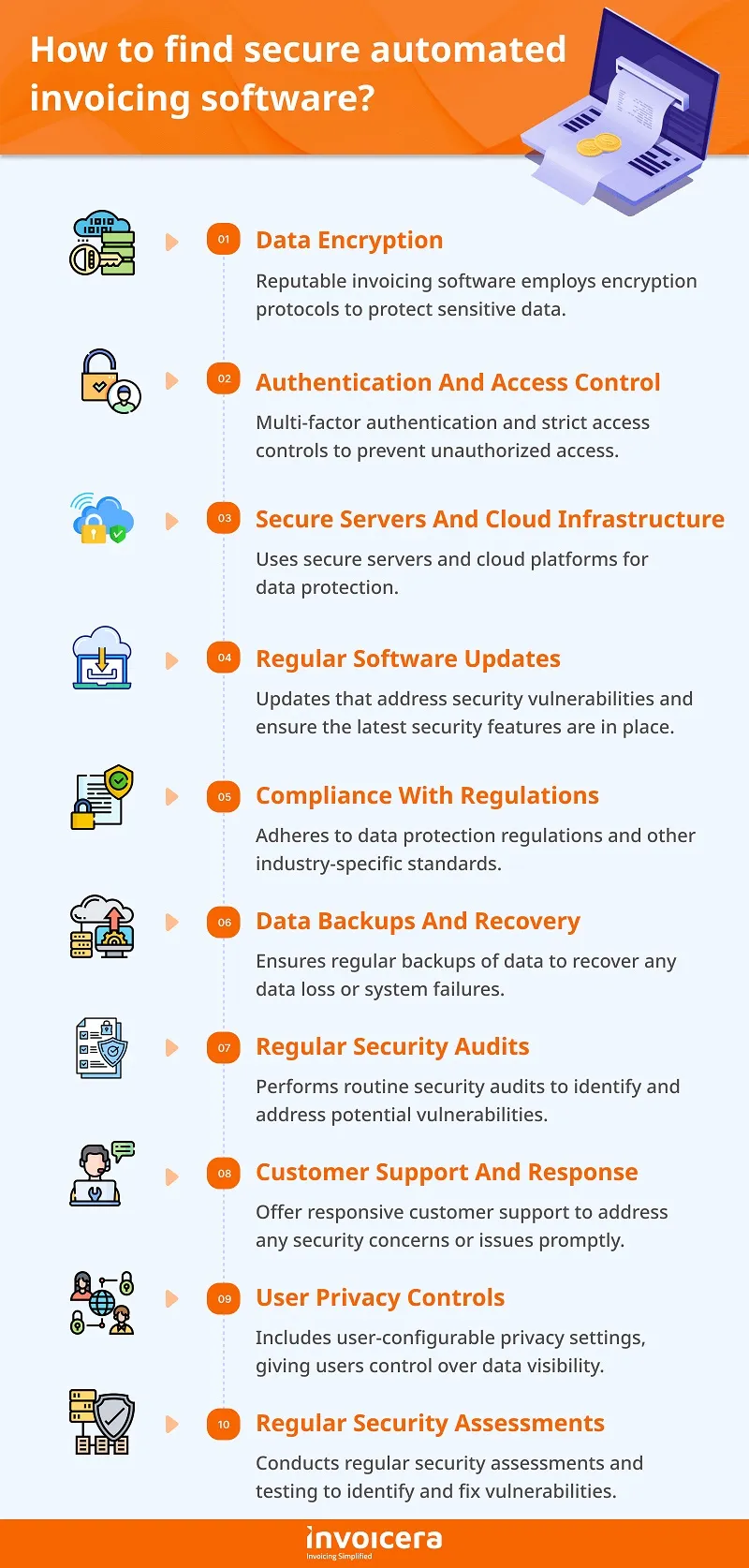

Q1. How secure is an automated invoicing software?

All the renowned automated software in the market are secure. What you need to do is check reviews and security measures before you make a final choice. Invoicera has multiple layers of security and keeps your sensitive data safe.

Q2. Is automated invoicing suitable for small businesses?

Yes, businesses of any size can opt for automated invoicing software. A lot of invoicing platforms are there in the market that offers prices that suit different sizes of businesses and also have plan customization options.

Q3. Will automating invoicing lead to job losses?

While we talk about any automated service, it does not fully replace an employee but will shift their role to use automated software. However, in this case, a company can help upskill an employee to focus on more strategic and value-added tasks that contribute to business growth.