Effective management of cash resources is one of the most critical success factors in any organization. For many companies, managing accounts receivable (AR) and accounts payable (AP) is a constant challenge, with delayed payments, manual errors, and lack of real-time visibility causing significant disruptions.

A study by Atradius revealed that 48% of B2B invoices in the U.S. are paid late, impacting the financial health of businesses.

Organizations have started adopting automation as the right solution to overcome these challenges. Using the specialized accounts receivable and accounts payable software can help to make these processes faster and more accurate.

Data collected from PYMNTS shows that 90% of companies that have adopted AP automation claim to have saved up to five days in invoice processing.

This blog will highlight:

- Potential AR and AP management issues.

- The aspects to consider when selecting a software application.

- 13 top AR and AP software solutions.

Challenges in Managing AR and AP

Managing AR and AP can be a complex and time-consuming task for businesses, often leading to several key challenges:

- Delayed Payments: Delays can cause heavy cash flow problems. Data from Dun & Bradstreet reveal that 93 percent of companies receive late payments and this impacts their ability to reinvest or to meet operational expenses.

- Manual Errors: Traditional AR and AP processes involve manual data entry, which is prone to human errors. Subtle errors in invoicing or payment records can lead to petty disparity, which ultimately puts pressure on the client or vendor.

- Lack of Integration: AR and AP often lack efficient integration with other applications, such as ERP or CRM tools; this leads to data silos and insufficient insight into financial performance.

- Inefficient Reporting: Delay and inaccuracy in preparing reports can become a barrier for a business to manage its receivables, payables, and/or cash flow status, which hence affects decision-making and planning.

- Difficulty in Cash Flow Forecasting: Estimating cash receipts and payments is difficult where AR and AP cycles are not well-organized or are not fully automated, which can result in poor cash flow estimates.

- Security Risks: Lack of controls and automation create fraud or data leakage risks, especially damaging financial data.

13 Best Accounts Receivable and Payable Software

1. Melio

“Best for Payment Flexibility”

Melio is an easy-to-use AP automation platform tailored for small companies that struggle with manual processes and require an intuitive platform for their payment and supply chain management processes.

It allows the business to pay through ACH, credit card, or even paper checks if it’s the only mode acceptable by the vendor.

Key Features

- Supports ACH, credit cards, and checks for payment flexibility

- Schedule and manage timely bill payments

- Track custom payment requests across devices

- Create branded invoices with logos, colors, and payment links

- Seamless integration with QuickBooks, Xero, and other platforms

Pricing

Melio offers free ACH transfers, while credit card payments have a 2.9% fee. International payments are charged a flat $20 per transaction, making it a cost-effective solution for small businesses.

2. Airbase

“Best Feature: Customizable approval workflows”

Airbase is a SaaS-based accounts payable automation tool that allows businesses to optimize their spending. It is a centralized tool for tracking and processing all non-employees cost, such as accounts payable, corporate cards and expense report.

Airbase synchronizes seamlessly with a range of financial solutions, enhancing spend management and providing real-time transparency and oversight into the company’s finances.

Key Features

- Automated invoice processing with OCR technology

- Batch approvals for streamlined workflows

- Real-time spend tracking

- Powerful reporting tools

- Customizable approval workflows for spending controls

- Integration with accounting tools like , Xero, Sage Intacct, and Oracle Netsuite

PricingQuickBooks

Airbase offers three quote-based plans, which are tailored to different business sizes:

- Standard (up to 200 employees)

- Premium (up to 500 employees)

- Enterprise (up to 5,000 employees)

3. Stampli

“Best Feature: AI-powered invoice management”

Stampli is an accounts payable automation software that provides complete automation of AP with the help of AI and ML. As an artificial intelligence company, it facilitates organizations in automating the processing of invoices, thereby increasing efficiency and minimizing human error.

Stampli offers real-time visibility of business processes associated with AP, which makes it ideal for organizations that want to integrate better control of accounts payable activities with existing financial procedures.

Key Features

- AI-powered invoice capture and GL coding with Billy the Bot

- Real-time transaction tracking with audit-ready histories

- Integrates with 70+ ERP systems, including QuickBooks Desktop

- Centralized AP communication and document workflows

- Advanced payables reporting for cash flow insights

Pricing

Pricing is not provided publicly. Businesses can request a quote or schedule a demo directly from Stampli’s website to learn more about pricing plans.

4. Invoicera

“Best Feature: Custom integration with third-party tools.”

Invoicera is a robust invoicing and billing software solution for businesses to enhance and ease accounts receivables and payables’ functionalities.

Through its dashboard, Invoicera provides easy-to-navigate features that help users track invoices, manage payments, and communicate with clients or vendors. It is particularly effective in enhancing cash flow consistency and improving client satisfaction.

Key Features

- Centralized Invoice Tracking: Maintain all the records of all the payables and receivables invoices in a single convenient location for better control.

- Automated Payment Reminders: Create automatic alerts for receivables so you won’t have to guess when to chase payments again.

- Real-Time Payment Tracking: Gain real-time knowledge of processed and received payments and insights into available cash flows.

- Client Management: Effortlessly manage multiple clients while providing personalized service, enhancing client relationships and satisfaction.

- Custom Purchase Orders: Create and submit purchase order documents that reflect your business requirements and compile necessary documents to include with the POs regularly.

- Easy Vendor Approvals: Enable vendors to confirm and endorse or reject the purchase orders made by various departments through the portal.

- Conversion of Purchase Orders: Automate the creation of invoices from approved purchase orders, thereby reducing the time it takes to prepare the invoices.

- Comprehensive Reporting: Generate detailed accounting reports that provide insights into financial transactions, budgeting, and overall business performance.

- Flexible Payment Options: Provide clients with more than 14 payment options that facilitate easy transactions completed worldwide without interruption to cash flow.

Pricing

Pricing plans start from $15/month.

5. Quickbooks

“Best Feature: Integrated Invoicing Tools”

Intuit QuickBooks is an enterprise resource planner designed for micro, small, and medium-sized enterprises. It is used to ensure proper management of the AP and AR by providing functionalities such as invoicing, bill payments, and tracking of all the expenses as well as generating financial reports.

QuickBooks currently has over 650 third-party integrations with applications such as PayPal, Stripe, and Shopify and provides flexible performance and simple navigation for businesses of all sizes.

Key Features

- Bill payments and invoicing with integrated payment options

- Expense tracking with synced payment accounts

- Financial reporting with A/R aging and automated payment reminders

- Automated tax calculations with access to tax experts

Pricing

- Simple Start: $30/month

- Essentials: $60/month

- Plus: $90/month

- Advanced: $200/month

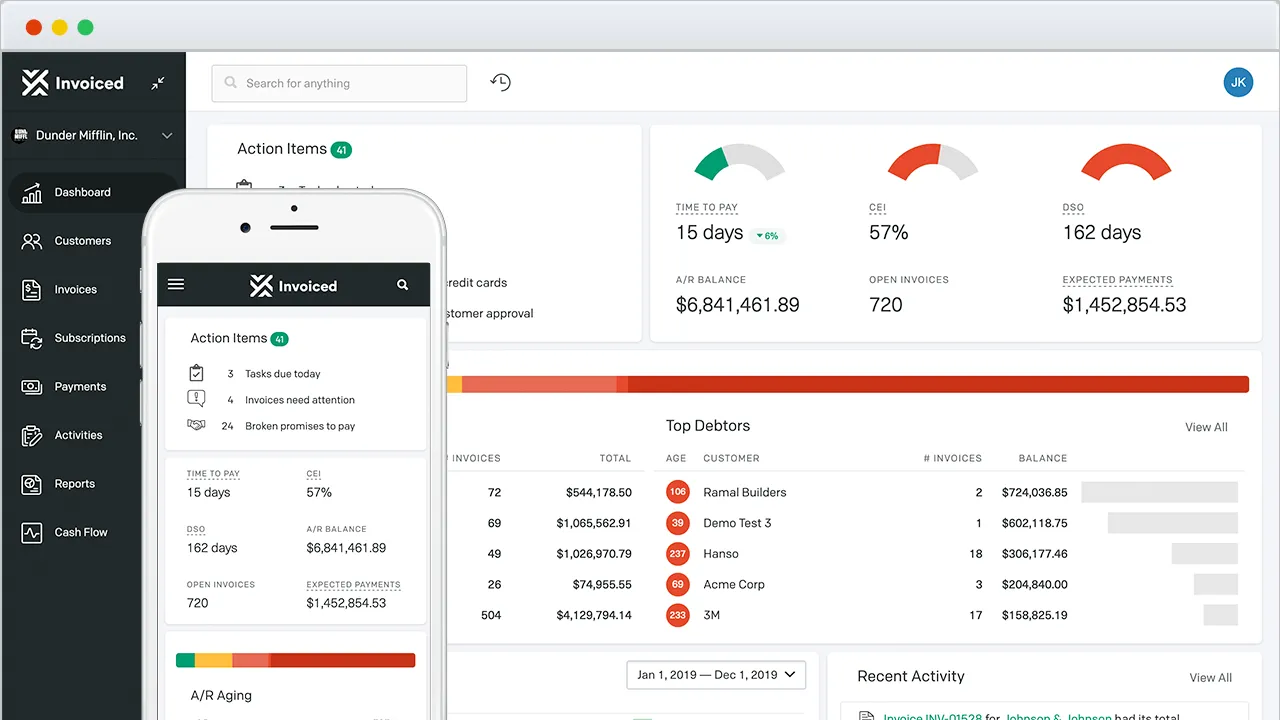

6. Invoiced

“Best in Automated Receivables Recovery”

What sets it apart is that Invoiced is specifically an accounts receivable automation platform meant for invoicing that looks to lessen a business’s time-to-cash levels.

Invoiced is equipped with advanced functionalities for receivables management; intelligent workflow as well as compatibility with QuickBooks and Xero. This platform aids B2B organisations to recover unpaid amounts more efficiently, hence improving cash flow and shortening payment duration.

Key Features

- Centralized system for Customer Management

- Flexible payment plans for customers

- API Access to integrate and customize their accounts receivable processes

Pricing

Available on request

7. Freshbooks

“Best Feature: User-friendly interface”

FreshBooks is a highly rated cloud-based accounting software that is created for small businesses and self-employed personalities. It makes AP and AR management less complicated by providing features that enable users to easily process invoices and payments regardless of the complexity of the accounts.

Thanks to its easy-to-navigate interface, FreshBooks is well-loved for business scalability, particularly for single-operation businesses that require simple, single-solution financial management.

Key Features

- Easy invoicing creation and sending

- AP automation for reducing manual work

- Real-time expense tracking

- Built-in time tracking for accurate billing

- Client project management tools

- Integrates with over 100 apps like Stripe and Zapier

Pricing

- Lite: $7.60/month

- Plus: $13.20/month

- Premium: $24/month

- Select: Custom pricing based on specific business needs

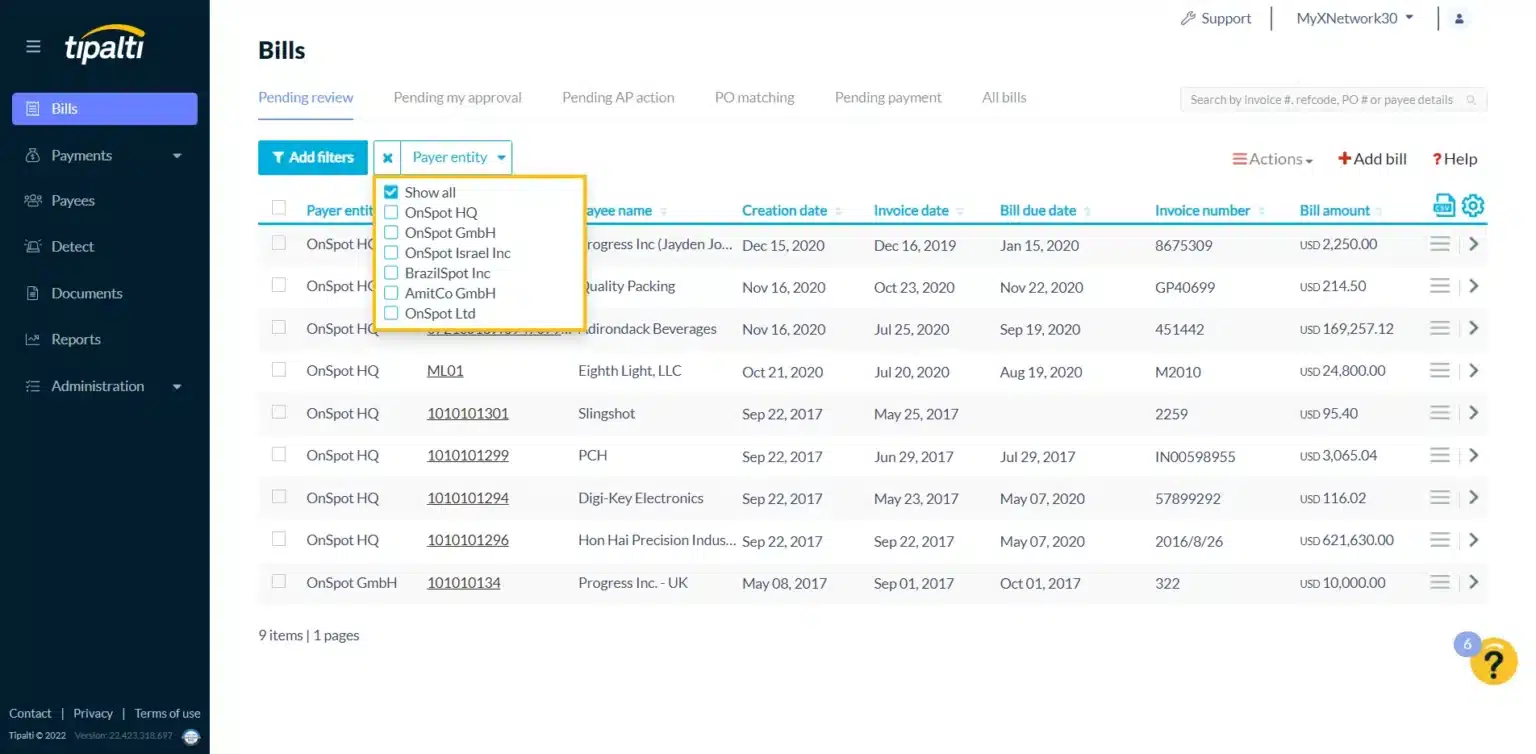

8. Tipalti

“Best in Global Payments”

Tipalti is an integrated accounts payable software solution which can streamline AP operations with features that include invoice processing and global payments. It increases the time of payments approvals, does not entail data rekeying and allows making payments in more than 190 countries in local currency.

Tipalti optimizes global payments by having strong tax compliance and offering functionalities for multiple legal entities. Thus, it is most suitable for eCommerce, affiliates, and companies with remote workers or contractors overseas.

Key Features

- End-to-End AP automation

- Global payments & multi-currency support

- Tax compliance

- Invoice scanning with OCR

- ERP integrations

- Fraud detection & security

Pricing

- Tipalti Express: Starts at $149 per month per user.

- Tipalti Advanced: Available with custom pricing based on business needs.

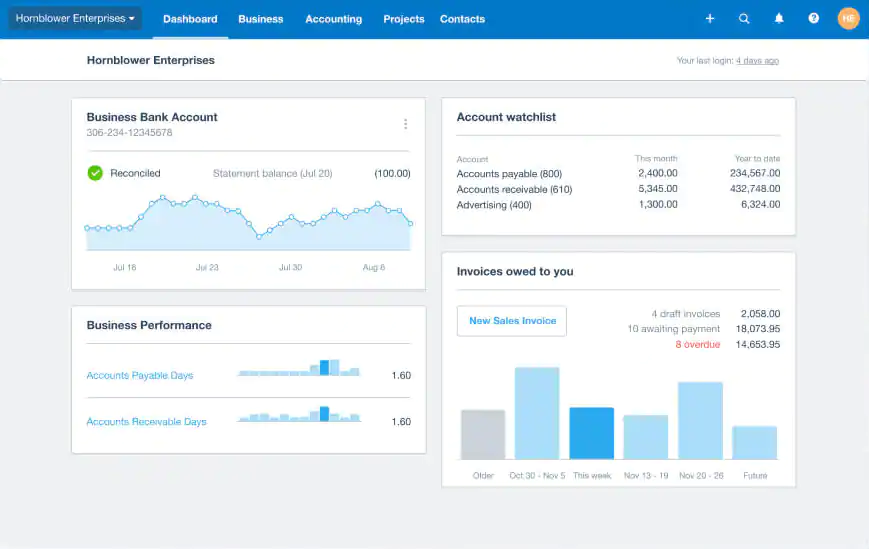

9. Xero

“Best in third party Integrations”

Xero is an online software firm that deals with accounting solutions for business entities that are small or developing. It streamlines key functions like invoicing, bill payments, and tracking expenses in a structured and streamlined manner, which makes it ideal for any firm in need of accounting solutions to enhance its AP & AR.

Its simple-to-navigate interface, along with third-party application compatibility, permits organizations to adapt financial management solutions in a very effective way.

Key Features

- Easy invoice creation and tracking

- Automatic payment reminders

- Multi-bill payment processing

- Real-time financial reporting

- Integration with over 1,000 third-party apps like Stripe, PayPal, and Square

- Mobile app for managing payments and bills on the go

Pricing

- Early: $3.75/month

- Growing: $10.50/month

- Established: $19.50/month

10. Nanonets

“Best Feature: End-to-End AP Management”

Nanonets is an intelligent AI-driven automation platform designed to streamline various business processes, with Accounts Payable (AP) automation being one of its standout features. It offers two distinct solutions: one that automates and enhances existing AP workflows and another that provides an end-to-end AP management system. This flexibility makes Nanonets ideal for businesses looking to fully automate their accounts payable process in a scalable and customizable way.

Key Features

- AI-powered AP automation that handles supplier communication, invoice processing, and financial close.

- Instantly scan, approve, and pay invoices from anywhere in the world, reducing manual workload by up to 10x.

- Seamless integration with any ERP system through customizable export mappings.

- Real-time visibility into spend management and control over financial processes.

Pricing

- Starter Plan: $49/user/month

- Pro Plan: $69/user/month

- Plus Plan: $99/user/month

11. Bill

“Best in Automated approval workflows”

Bill (formerly Bill.com) is a leading financial automation software designed to streamline both accounts payable (AP) and accounts receivable (AR) processes. Known for its intuitive interface, Bill simplifies bill payments and automates invoicing, making it an ideal choice for small businesses, freelancers, and growing companies looking to digitize their financial operations.

Key Features

- Automated bill approvals and workflows

- Digital invoicing and ACH payments

- Real-time tracking of accounts

- Fraud protection

- Seamless integration with QuickBooks, Xero, Sage Intacct, and NetSuite

Pricing

- Essentials plan (AP): $45/user/month

- Team plan (AP): $55/user/month

- Corporate plan (AP & AR): $79/user/month

- Enterprise plan (AP & AR): Custom pricing

Best For

Freelancers, small businesses, and independent accountants seek a straightforward solution to automate bill payments and manage invoicing effectively.

12. MineralTree

“Best Feature – Two-way ERP sync”

MineralTree is a cloud-based solution designed to streamline and automate the Invoice-to-Pay process, making supplier payments efficient, scalable, and secure.

It helps businesses manage a high volume of invoices without increasing staffing needs, optimizing both payment workflows and operational efficiency.

By automating the accounts payable (AP) process, MineralTree reduces B2B payment costs, enhances financial transparency, and minimizes the risk of fraud.

MineralTree’s standout feature is its real-time visibility into AP health and its ability to seamlessly integrate with hundreds of accounting systems via two-way ERP sync. This ensures that all transactions, approvals, and payments are automatically updated, making the AP process faster and more reliable.

Key Features

- Two-Way ERP Sync with popular accounting systems

- Payment Optimization reduces B2B payment costs

- Enhanced Security minimizes fraud risks

- Bank Reconciliation simplifies invoice matching

- Invoice Processing flags duplicates and enables electronic approvals

Pricing

The vendor does not disclose pricing; businesses can request a demo via the MineralTree website to explore its features further.

13. Sage Intacct

“Best Feature – Real-time financial dashboard”

Sage Intacct is a leading cloud-based financial management solution designed for businesses that need more than basic accounts payable functionality.

Particularly well-suited for industries like construction, engineering, and professional services, Sage Intacct excels in managing project-based financial operations and complex job cost management. It automates workflows to improve accuracy, compliance, and overall efficiency.

Key Features

- Automated invoicing for streamlined creation, customization, and scheduling

- Advanced reporting with real-time financial insights and comprehensive analytics

- Project costing for tracking expenses in industries with intricate job costing needs

- Integration with leading accounting platforms like QuickBooks, Xero, and major ERP systems

- Compliance and security with automated workflows to ensure regulatory adherence

Pricing

Custom pricing is available upon request and tailored to the specific needs of each business.

Choosing The Right Software For Business

When choosing the right AR and AP software for your business, there are several critical features to consider to ensure smooth and efficient financial management:

- Automation of Invoicing & Payments: Look for software that can automatically generate and send invoices and track payments. Automation reduces the risk of errors and ensures timely invoicing and payments, which improves cash flow.

- Integration with Other Systems: Your AR and AP software should integrate seamlessly with existing financial tools like ERP and CRM systems. This ensures a unified data flow and real-time visibility into your company’s economic status.

- Advanced Reporting & Analytics: The software should offer robust reporting features, allowing you to monitor outstanding invoices, overdue payments, and overall cash flow. Advanced analytics can help predict trends and support better decision-making.

- Customizable Workflows: You must be able to customize workflows to match your business processes. This could include setting up payment approval chains or creating specific invoicing templates tailored to your industry.

- Multi-Currency and Global Payment Support: If your business operates internationally, multi-currency support and the ability to handle global payments efficiently are essential features to look for.

- Security & Compliance Features: Ensure the software includes advanced security protocols like encryption, two-factor authentication, and fraud detection. Compliance with financial regulations such as GDPR, SOX, or ISO standards is crucial to avoid legal risks.

- User-Friendly Interface: A clean, intuitive interface makes it easier for users to navigate and use the software effectively, reducing the learning curve and boosting productivity.

By choosing AR and AP software with these key features, businesses can reduce manual errors, accelerate payment processes, and improve financial transparency.

Future Trends in AR/AP Software

AI and Automation: Increased use of AI will enhance automation, reduce manual tasks, and predict payment behaviors for improved accuracy and efficiency.

Real-Time Payments: AR/AP software will support real-time payments, speed up transactions, and improve cash flow management.

Blockchain for Security: Blockchain technology will enhance transparency and reduce fraud, making payment processes more secure.

Mobile-First Approach: Future AR/AP platforms will offer better mobile access, enabling users to manage finances on the go.

Sustainability: Eco-friendly features like paperless invoicing and digital records will support greener financial operations.

Conclusion

The proper Accounts Receivable and Accounts Payable (AR/AP) software is crucial for efficient financial management and healthy cash flow. These tools enhance operational efficiency, save time, and reduce costs by addressing common challenges like delayed payments, manual errors, and inefficient reporting.

Integrating AR/AP software with existing systems will be key for businesses to stay competitive as automation trends evolve.

Select a solution that fits your business size, industry, and specific needs to ensure long-term financial health.

FAQs

Ques. How long does it typically take to implement and transition to a new AR/AP software system?

Ans. Implementation timelines vary based on business size, typically ranging from 2-4 weeks for small businesses to 8-12 weeks for large enterprises.

The process includes initial setup, data migration, staff training, and testing phases. Most vendors provide dedicated implementation specialists and support throughout the transition. Most solutions offer a phased rollout option to minimize business disruption.

Ques. How do these software solutions handle data backup and recovery in case of system failures or technical issues?

Ans. Modern AR/AP solutions like Invoicera employ automatic daily backups, real-time data replication, and multiple server locations to ensure data safety and business continuity.

Most cloud-based providers maintain a 99.9% uptime guarantee and offer point-in-time recovery options in case of system failures.

Ques. Can these AR/AP software solutions handle both domestic and international tax regulations, especially for businesses operating in multiple countries?

Ans. Yes, most advanced AR/AP solutions offer built-in compliance with major tax regulations across different countries, including automatic tax rate calculations and regular updates to reflect changes in tax laws.

These systems typically provide multi-currency support and country-specific invoice formats to ensure compliance with local regulations.