Introduction

Many businesses find it difficult to manage their expenses and payments. Too many unpaid bills or Accounts Payable can weigh a company down and eat its profits.

Studies show that almost 62% of a business’s profits can go towards paying off overdue bills that weren’t handled properly. And on average, 48% of businesses make 68% fewer profits because of issues with unattended accounts payable.

You may think you’re doing a good job with accounts payable, but you might also be sailing in the same boat as the above-stated statistics.

But there is a quote that says, “Every problem has a solution.“

There are likely areas where you can improve your payment processes. How to do this?

The good news is that by looking at ways to streamline and optimize your accounts payable system, you can free up more of your revenue to reinvest in growing your business instead of worrying about past-due payments.

So, this blog post will be discussing the common mistakes you are making while managing your AP and the tips to improve them.

Let’s begin by understanding a little about accounts payable.

What Are Accounts Payable?

Accounts Payable means the money a business owes to other people. It covers items such as outstanding bills from suppliers, rent or mortgage payments, loan payments, taxes, utilities, and other expenses the business has not paid yet.

For businesses that buy goods or services for credit rather than paying for them immediately, it results in accounts payable.

It is very important to manage accounts payable accurately. The timely settlement of bills helps maintain good relationships with suppliers and keeps them away from late fees and interest charges. However, if cash is held for too long, it may also be detrimental to the company’s cash flow and profits.

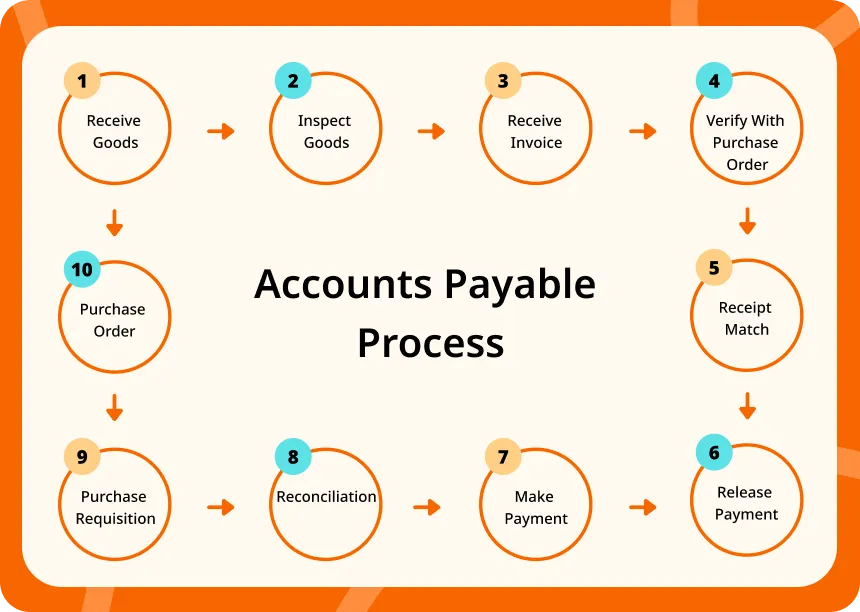

Accounts Payable Process

Receiving Invoices/Bills

Vendors send invoices when they deliver goods or services. His invoices list what the company purchased, the quantities, costs, and due dates for payment. Someone at the company enters these invoices into the accounts payable system.

Verifying Invoices

The company checks the invoice details against purchase orders and receiving documents. Hey, make sure the goods or services were actually received as described on the invoice. The team also identifies any pricing errors or discrepancies.

Coding Invoices

The accounts payable team codes each invoice by expense category, such as supplies, utilities, etc. Roper coding determines which budget the expense will be charged to. Accurate coding is important for accounting and cost tracking.

Invoice Approval

Designated approvers at the company review and approve invoices before payment. The approvers ensure the invoices represent validly authorized expenses. The approval process prevents unauthorized or fraudulent payments.

Payment Scheduling

The approved invoices get scheduled for payment based on the due dates listed. The company may pay some invoices early to capture any discounts offered for early payment. Scheduling payments on time and maintaining good relationships with vendors.

Making the Payment

The company issues payment to the vendor using a method like a check or electronic transfer. Hey, record payment information in the accounts payable system. Once paid, the invoices get closed out and removed from the outstanding accounts payable balances.

Common Mistakes While Managing Accounts Payable

Here are the common mistakes you must be committing unintentionally in your accounts payable management:

- Failing to issue purchase orders.

- Not consciously matching delivered items with contractual terms.

- Lack of visibility into vendor payments

- Lack of operational efficiencies in accounts payable management.

So, how can you improve the accounts payable process? Let’s learn.

7 Accounts Payable Process Improvement Ideas

- Centralize Accounts Payable Management

- Move to Paperless Invoicing

- Automate Approval Workflows

- Strengthen Governance Practices

- Implement Payment Reminders

- Budget Expenses Wisely

- Build a Cash Reserve Strategy

Here are the steps you can follow to improve the accounts payable process:

#Tip 1: Centralize Accounts Payable Process Management

- Eliminate paper invoices and accept only online invoices.

- Integrate into your system invoicing and accounts payable software to eliminate piles of paper and centralize payable management. his simple integration will increase visibility into entire accounts receivable and accounts payable management for your business.

#Tip 2: Take the leap towards paper-less invoicing solutions

- Opt for a centralized scanning solution for vendors who do not supply electronic invoices. His would help to turn images into computer-readable text.

- Perform all the data entries and functions (online & offline) automatically with Invoicera to improve your AP process.

#Tip 3: Streamline workflow with the automation of Approval

- Quickly approve/get approved received invoices to streamline payments. Quick approvals and payments avoid late payments.

- Manage approval assignments, general ledger posting, workflow, Approval, and review or notifications.

#Tip 4: Adopt more robust governance practices

- Organize the functions with a standardized and streamlined accounts payable process.

- Receive accurate payments much more quickly.

————————————————————————————————————————————————————-

Also Read: Top 5 Ways to Effectively Optimize Your Accounts Payable

—————————————————————————————————————————————————————-

#Tip 5: Set up payable reminders

Always take a proactive approach when managing accounts payable. Getting information and tasks is a very common human tendency. Setting up reminders, one can easily take care of bills and take steps towards accounts payable process(AP process) improvement.

Reminders help you anticipate expenses. Se Invoicera will manage invoice due dates and set up alerts that automatically let you know when a due date is approaching.

#Tip 6: Consciously budget your expenses

Proactively creating business budgets can help you improve the AP process and avoid late payments. e your account payables sheet in the dashboard to keep yourself updated about all the bills that you need to pay. Record every penny that needs to be paid, and make sure you don’t spend extra on late payments and fines.

#Tip 7: Strategize to expand your cash reserves

It is not always a happy day for business. You might have to face some slow days, too. On the days when your cash flow is a little too slow, you might need to open your bags of cash reserve and keep your AP process on track.

Manage Accounts Payable With Invoicera

Invoicera encompasses everything you need to handle accounts payable, from centralizing the payments process to improving financial control.

Centralized Management: Invoicera keeps your accounts payable records in one place. Through this software, you can track, manage, and view invoices from all your vendors, which greatly decreases the chances of missed payments or duplication of entry.

Automated Workflows: Automate the approval process for invoices and expenses, allowing a smooth workflow. It often helps to reduce bottlenecks and increase quicker pay cycles, thus allowing you to have good relationships with suppliers.

Paperless Invoicing: Save green with paperless invoicing. Through the online platform of Invoicera, you are able to create, send, and receive electronic invoices, cutting down paperwork and, hence, administrative costs.

Improved Accuracy: You can cut down mistakes in invoice processing with built-in validation and automatic calculation. This feature guarantees that your accounts payable data is reliable, as this will eliminate errors and possible financial problems.

Payment Reminders: Invoicera notifies your clients gently on due dates with automatic payment reminders. This way, you can receive payments on time.

Robust Reporting: Receive in-depth reports of your accounts payable transactions. Voice gives you a glimpse into your spending patterns by analyzing your financial moves and helping you make better decisions.

Managing accounts with Invoicera helps you increase efficacy, lower costs, and gain better command over your company finances. It is the key instrument for any organization seeking to simplify its accounting operations and maintain financial stability.

In The End

Out of cluttered clouds, your mind is now free to think about the best possible ways for you to manage accounts payables. Invoicera, with its artificial intelligence, ensures smoother Accounts payable management and tracking. Here is a quick sneak peek into how Invoicera, the accounts payable management software, makes management easy:

- Eliminate excessive data entry into accounts payable process improvement (AP process).

- View the progress of invoices with an easy reduction of time.

- It provides centralized access to invoice data.

- Get faster automation of approvals.

- Match with the relevant documents.

- Avail 24*7 customer service for a convenient solution online.

FAQs

How do I know if my accounts payable process needs improvement?

There are some signs your process needs improvement. Are you paying bills late often? Do you have many unpaid invoices piling up? Are your records a mess? So, you need to improve. Are you paying high late fees? Are your vendors unhappy? These are also signs you need to make changes.

How can I implement paperless invoicing in my business?

To go paperless, first switch to digital invoices. It is an invoicing system like Invoicera. Through it, you create, send, and receive invoices electronically. Your vendors can send invoices digitally, too. If you get any paper invoices, you can scan them into the system.

What should I look for in an accounts payable management software?

Look for software that manages everything in one place. It should automate tasks for you. Needs paperless invoicing. Ok, for good reporting and payment reminders. The software must connect to your other systems. It should be easy to use. Invoicera has all these good features.