Why should e-Invoicing really be speeded up?

What could be the reason to send the invoices in the same way?

Is it because the paper invoices have NO future?

Or the high proportion of the exception handling, inaccurate and poor data quality of invoices?

Much of the progress is happening now in the country specific to invoicing processes. The article defines electronic invoicing rules at the country level and provides the country-specific e-invoicing templates that simplify the expansion of global e-invoicing initiatives. The excellent vehicle of automated electronic Invoicing removes obstacles and increases enablers for a wider unified market.

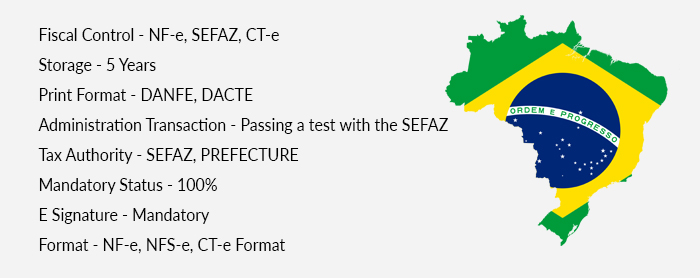

1) Brazil:

All invoices must be submitted to the tax authority, which is reviewed and provisionally approved before any items may be shipped. The invoice receives an authorization code once reviewed, only after that the code is received can the seller ship the items. The goods can be seized by the Government after the prior authorization.

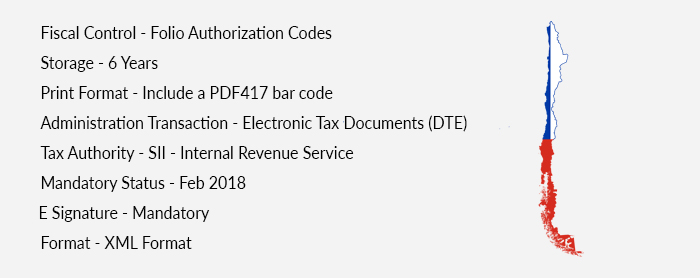

2) Chile:

The electronic Invoicing finally became mandatory back in 2003. According to the recent stats, 97% of the billing is now filed electronically. The annual growth rate of 32% in the use of e-Invoices in the 2017- 2024 period. The expansion of e-Invoicing regulations might only be 12-14% interest per year.

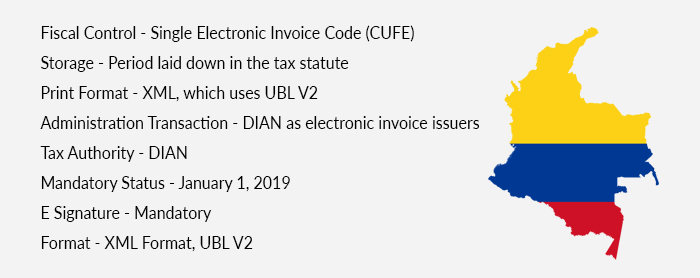

3) Colombia:

Electronic Invoicing in Colombia sees a start of new phase from Jan 1, 2019. The obligation to issue e-Invoices is expected to reach over 8, 00,000 businesses throughout the country for a real increase in the adoption of this technology.

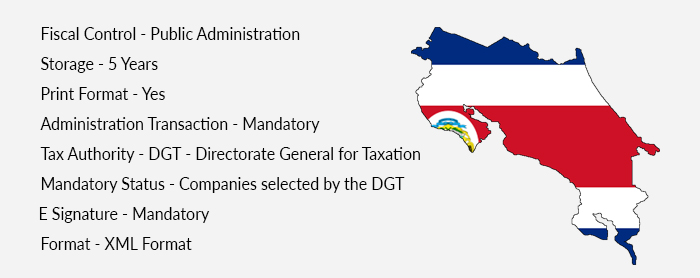

4) Costa Rica

The 8 years of voluntary e-invoicing, Costa Rica has begun its transition to mandatory e-Invoice submissions. As Costa Rica electronic Invoicing continue to expand, companies must have compliance to avoid the rejected tax deductions and credits that accompany compliance errors. Multinational companies need to be proactive and start looking for a solution to avoid any surprises when they are mandated.

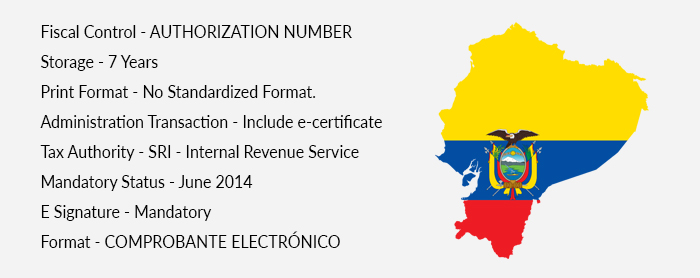

5) Ecuador

The tax administration is SRI. The e-Invoicing mandates require companies to sign their e-Invoices using digital certificates issued by SRI or the authorized entities. Each e-Invoice must be validated online through the SRI platform. The standard format of e-Invoice is XML.

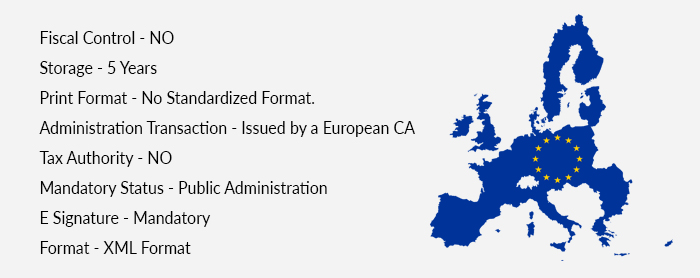

6) European Union

The relative importance of the EU approach to electronic invoicing has somewhat diminished in recent years. The European Union is in the progress of being changed, modernizing end-to-end e-Invoicing solutions.

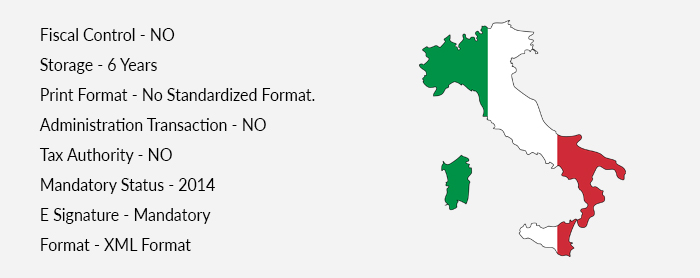

7) Italy

Italy is also quite advanced in the context of e-Invoicing.

Note: B2B e-Invoicing will become mandatory for companies engaged in petrol sales and subcontractors- beginning in July 2018

B2B electronic Invoicing will become mandatory for all companies- Beginning in January 2019

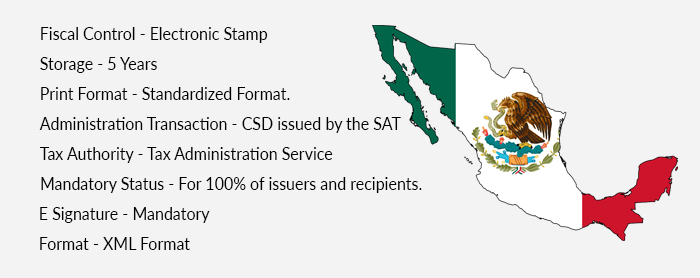

8) Mexico

In 2011, the Mexican companies start issuing “facturas electronics” in their business transactions-transmitted and approved via government services. These standardized electronic invoices and pay slip began January 1, 2014. The real-time audits can be implemented in 2016.

9) Peru

In January 2013, Peru started a pilot project declaring e-Invoicing as mandatory for suppliers to public administration. The electronic invoice in Peru is legal since 2000, mandatory since 2014.

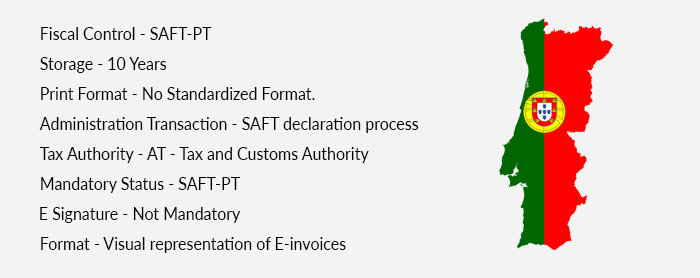

10) Portugal

The change in Portugal e-Invoicing solution adds up the updated version from July 1, 2017. It modifies the SAF-T file for invoices and delivery notes with entry into force on July 1, 2017.

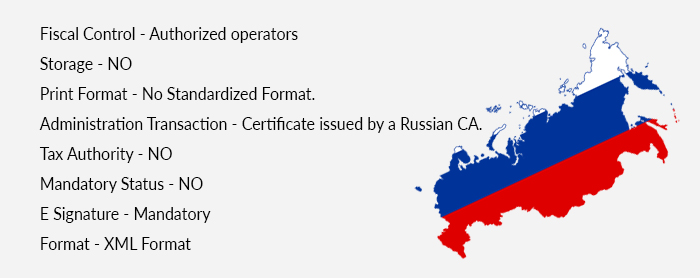

11) Russia

The implementation of Invoicing in Russia brings tremendous efficiencies on airlines and freight forwarders. It helps to speed up the costs, improve efficiency and reduce costs for airlines and shippers on the flight to and from the Russian Federation.

12) Spain

The e-Invoicing trend in Spain provides variations such as automated reporting, invoice numbering requirements, standard audit files and more. The recent survey indicated that the proportion of the PDF invoices was around 3/4th of all electronic invoices. The country provides highest e-Invoicing revenues.

TOGETHER WITH:

E-Invoicing is helping businesses to seamlessly manage the account payable process, improves relationship between buyers and suppliers. The move to e-Invoicing eliminates the invoice fraud, saves cost, and increases control, in addition to easy to access online portals.

INCREASE BUSINESS AGILITY WITH INVOICERA

Invoicera supports modern businesses across the entire purchase to pay process and provides frictionless exchanges between millions of buyers and suppliers. Both buyers and suppliers can track their invoices at any time. Invoicera e-Invoicing solution increases visibility into the whole invoice flow, which at the same time benefits the customers. This is a good example of cost reduction and to keep track of what’s going through the invoicing system- no more uncertainity!