Introduction

Keeping up with payment changes is super important!

In 2024, the way accountants handle transactions will change a lot.

- What’s causing these changes?

- And how will they affect what accountants do every day?

Experts say 2024 will see big changes in how payments work. According to a top financial analyst – ‘Digital banking is changing how we pay’.

Stats show a massive 75% increase in mobile payments compared to last year, an example of how people are changing their way of paying money.

With technologies like blockchain and contactless payments becoming popular, accountants will have a new role in ensuring payment safety and speed.

Join us as we explore the top three payment trends that will shape the landscape for accountants in 2024 and beyond.

What Are Payments Trends?

Payment trends indicate the changing ways and developments in handling and processing financial transactions.

These trends encompass various aspects, including the methods used for making payments, the technologies involved, and the shifts in consumer behavior and payment preferences.

Staying updated on payment trends allows accountants to adapt their practices and systems to better serve their clients’ needs in an ever-changing financial landscape.

Have a look at the traditional and modern payment processes.

Role Of Payment Trends In Accountancy

The world of accounting is always on the move, especially when it comes to payments. Let’s dive into why keeping up with payment trends is vital for accountants and how it directly affects their work:

Integrating Payment Trends:

“Their Direct Impact On Accounting Practices And Financial Management”

- Tech Changing the Game: Think mobile payments, blockchain, and AI. They don’t just shuffle money around; they change how financial data is handled. When accountants embrace these trends, they streamline processes and make fewer mistakes in tracking finances.

- Streamlining Finances: Adopting these new payment methods doesn’t just make accountants look tech-savvy. It’s about making life easier. These trends can cut down on errors, making financial records more accurate. That means smoother audits and better financial decisions.

Why Accountants Need To Stay Updated:

“Enhancing Client Services And Operational Efficiency”

- Client Expectations: Clients want payments to be smooth and easy. By staying informed about payment trends, accountants can meet these expectations and provide top-notch service. It’s not just about being up-to-date; it’s about offering better experiences.

- Efficiency Boost: These new payment technologies can run things like clockwork internally. They speed up invoicing, improve cash flow through a business, and make financial management a breeze.

Benefits Of Embracing Payment Trends

Embracing these advancements is about unlocking a world of benefits that can transform how you handle finances.

Here are three key advantages of embracing payment trends in 2024:

1. Enhanced Efficiency

Embracing new payment methods streamlines your accounting processes. Say goodbye to manual data entries and tedious reconciliations. Modern payment systems automate these tasks, saving you time and reducing errors.

By speeding up transactions and making workflows smoother, you’ll have more resources to concentrate on strategic financial planning and interacting with clients.

2. Improved Security

Security is a top-most priority in the financial world. New payment trends come equipped with advanced security measures, protecting sensitive financial information from cyber threats and fraud.

From encryption technologies to multi-factor authentication, these offer robust layers of defense, giving you and your clients peace of mind when conducting transactions.

3. Enhanced Client Experience

Clients appreciate convenience and flexibility. Modern payment methods cater to these expectations, offering clients diverse options to settle invoices or manage their finances seamlessly.

Whether mobile payments, digital wallets, or innovative platforms, providing these choices enhances client satisfaction and strengthens your professional relationship.

Top Three Accounting Payment Trends

1. Automation And AI Integration

In 2024, the accounting landscape is rapidly evolving with automation and AI technology integration. These advancements streamline processes, reduce errors, and enhance accountants’ efficiency.

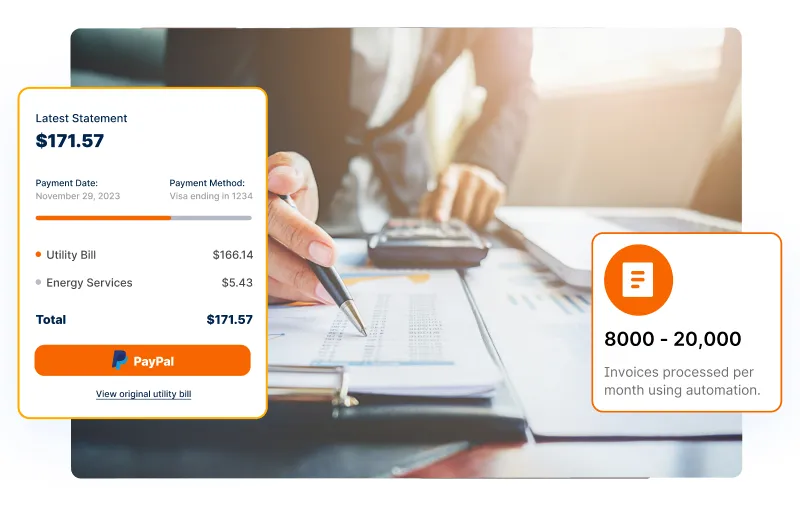

This includes automated invoicing, transaction categorization, and even predictive analytics for cash flow management.

Automation tools expedite routine tasks and allow accountants to focus on higher-value activities such as strategic financial planning and analysis.

AI-powered systems learn from historical data, making them increasingly accurate in predicting cash flow patterns and identifying potential financial risks.

2. Cloud-Based Accounting Solutions

The shift towards cloud-based accounting solutions continues to be a prominent trend in 2024.

Cloud-based solutions offer real-time access to your financial data from anywhere, enabling collaboration among team members and clients. This accessibility primarily benefits remote work setups, fostering seamless communication and enhancing client-accountant relationships.

Furthermore, these platforms often integrate with various payment systems, allowing for secure and swift transactions.

They also provide scalability, allowing firms to adapt quickly to changing business needs without the hassle of extensive IT infrastructure updates.

3. Emphasis On Data Security

With the rising use of digital payment methods and cloud-based systems, the focus on data security has become paramount.

Cyber risks continue to evolve, making it crucial for accountants to invest in robust security measures.

Accounting firms are implementing encryption protocols, multi-factor authentication, and regular security audits to safeguard sensitive financial information.

Moreover, compliance with industry regulations such as GDPR and CCPA is becoming standard practice to protect client data.

What Other Trends Are Shaping Accounting?

Several other key trends will be reshaping the accounting profession in 2024.

Let’s delve into some pivotal shifts accountants should keep on their radar.

Blockchain Technology

Blockchain’s influence on accounting continues to expand. It’s changing how financial info is recorded and checked with its transparent system and decentralized setup. As per a report by Social Capital Markets, blockchain’s market size increased by 51.4% in the last year alone.

Remote Workforce-Based Accounting

The traditional office setup has given way to a more flexible approach, allowing accountants to work remotely. The pandemic accelerated this trend, prompting firms to adopt remote-friendly technologies and practices.

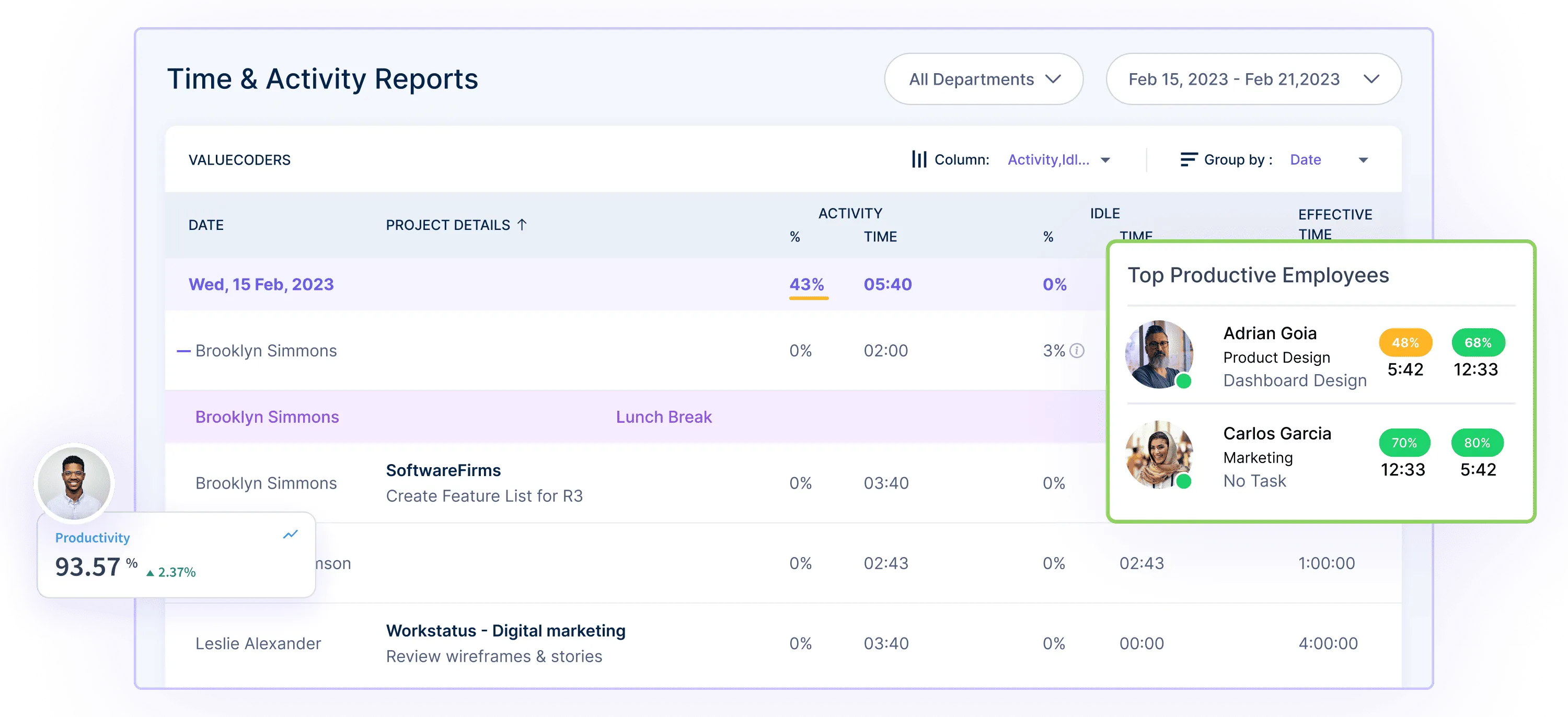

Tools like Workstatus are crucial in supporting this transition by enabling seamless task management and tracking for remote teams.

Changes In Tax Policy

Tax policies are rapidly changing, demanding swift adaptation from accountants.

The 2022 Consolidated Appropriations Act, spanning 6,000 pages, introduced complexities just before the tax season, alongside various changes like tax extenders and simplified PPP loan processes.

Staying updated on these shifts, from assessing tax liabilities to navigating trade policies, is crucial for accountants.

Additionally, two other noteworthy trends are gaining momentum:

Outsourcing

Many accounting firms are leveraging outsourcing to streamline operations and reduce costs.

Virtual Card Payments

The surge in virtual card payments is evident, with Accenture’s study revealing that 75% of finance leaders are either considering or have integrated these solutions.

This trend offers heightened security and efficiency. For accounts payable teams, the advantages are vast:

- Secure, traceable transactions

- Reduced payment processing costs

- Potential revenue from rebates

- Elimination of paper check hassles

- Enhanced management of invoices and cash flow

As the accounting landscape evolves, professionals must remain vigilant and adaptable. Embracing these trends will ensure staying competitive and foster innovation and efficiency within the industry.

Challenges While Adopting New Trends

Adopting new payment trends can be a game-changer for accountants, but it has hurdles. Embracing innovation in the financial landscape can bring about significant challenges that professionals must navigate effectively.

#1 Challenge: Security Concerns: Protecting Sensitive Data

One of the foremost challenges in implementing new payment methods revolves around security. As payment technologies evolve, so do cybercriminals’ tactics.

Statistics from the Federal Trade Commission (FTC) indicate a massive rise in reported identity theft and financial fraud incidents over the past few years. This escalation underscores the critical need for robust security measures when adopting new payment technologies.

Accountants must ensure their systems are fortified against potential breaches, adhere to stringent security protocols, and stay updated with the latest encryption standards.

It’s an ongoing battle that demands continuous vigilance and investment in cutting-edge security measures.

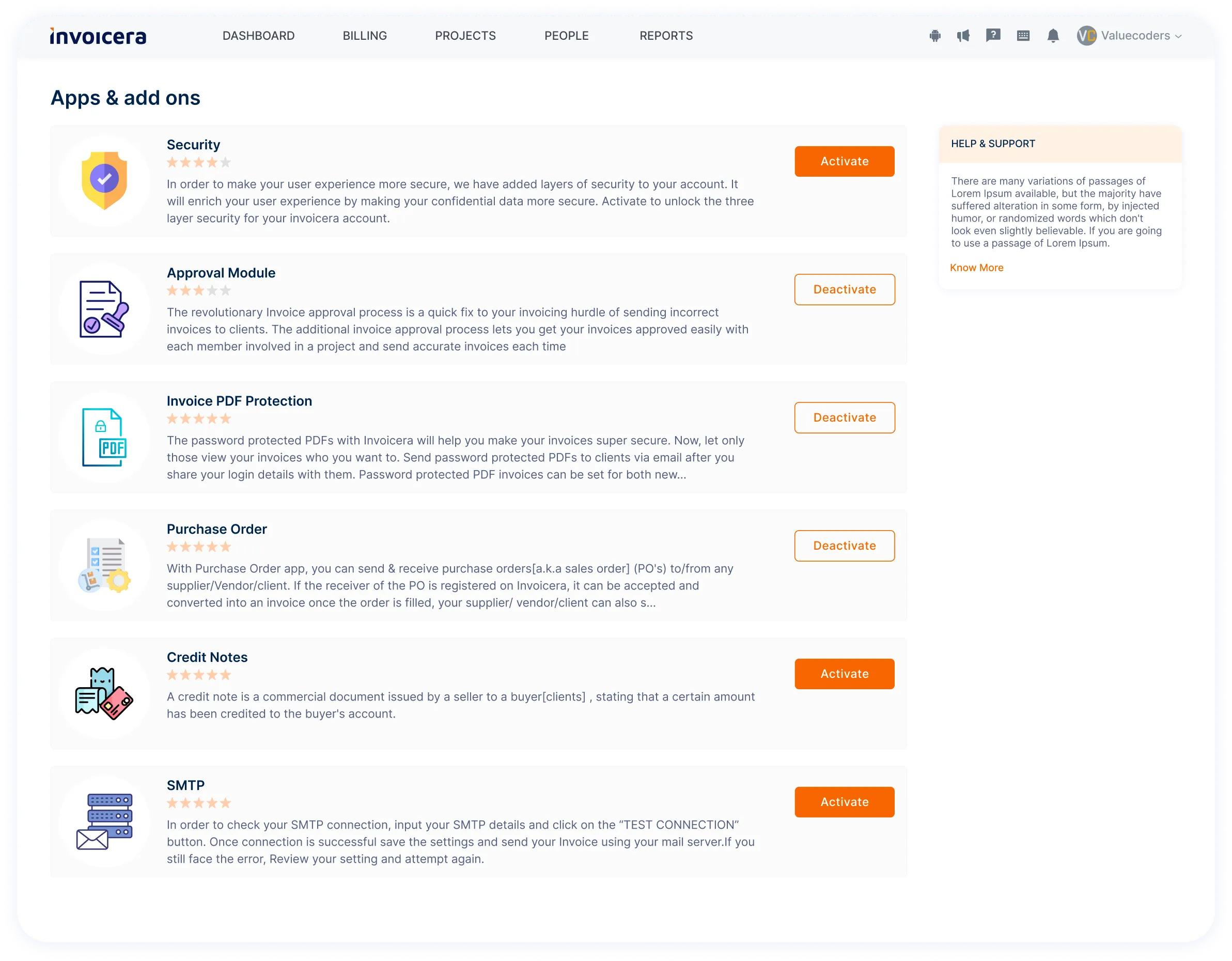

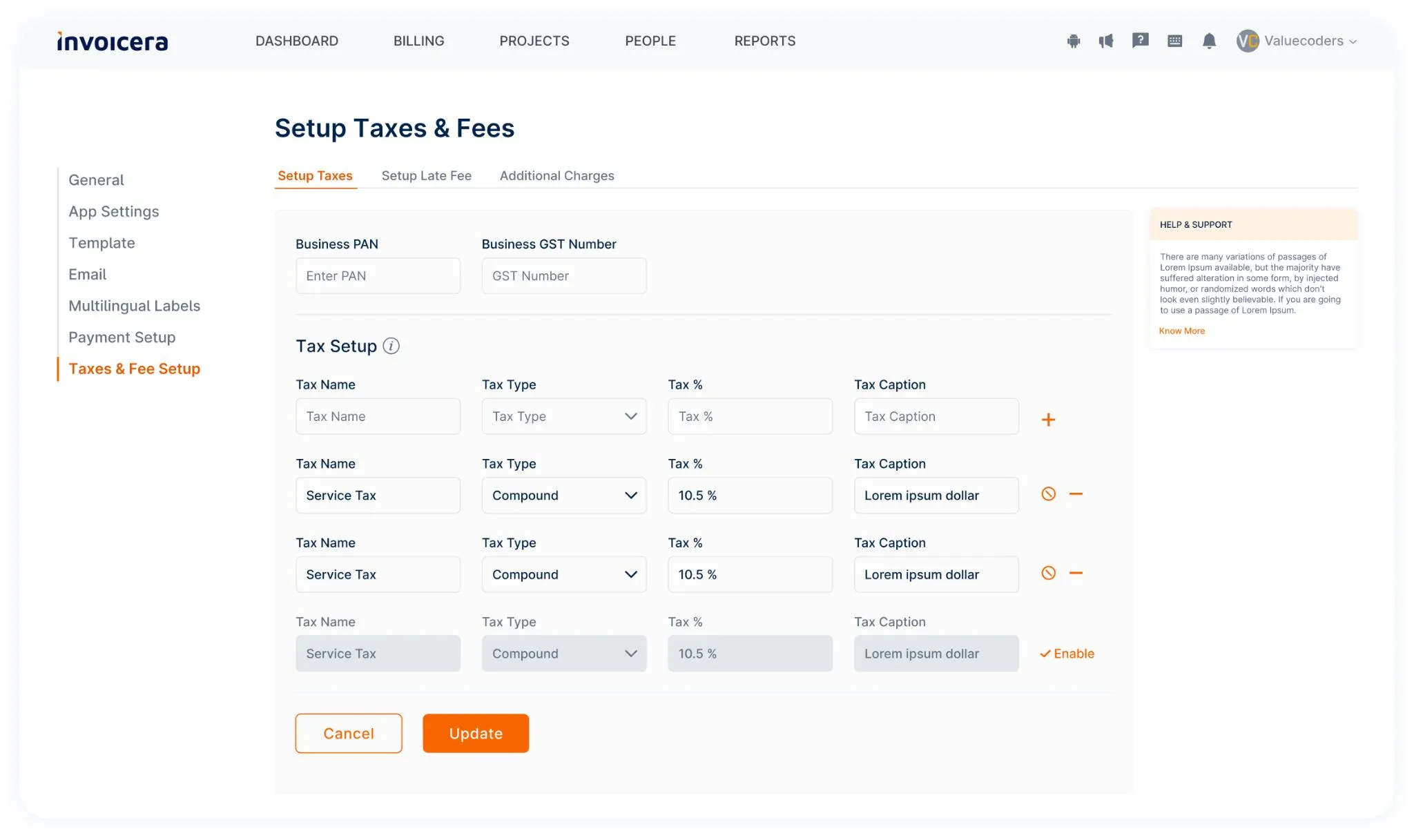

Invoicera employs advanced security measures to safeguard sensitive financial data. It offers robust encryption protocols and complies with industry-standard security practices, including SSL encryption for data transmission and secure servers to store confidential information.

Additionally, it provides two-factor authentication, ensuring an extra layer of protection against unauthorized access.

#2 Challenge: Integration Challenges: Bridging the Gap between Old and New Systems

Integrating new payment trends with existing accounting systems can present a significant hurdle. Many firms still rely on legacy systems that might not seamlessly sync with modern payment methods.

This disparity can lead to inefficiencies, errors in data reconciliation, and operational disruptions.

Accountants must invest time and resources into ensuring compatibility between their legacy systems and emerging payment technologies.

This might involve deploying middleware solutions or engaging with specialized vendors to facilitate smoother integration, reducing the risk of disruption to day-to-day operations.

Invoicera is designed to integrate seamlessly with various accounting software and legacy systems. Its flexible APIs and integration capabilities allow for smooth synchronization with existing systems, ensuring minimal disruption when adopting new payment trends.

Invoicera’s user-friendly interface simplifies importing/exporting data, making it easier for accountants to maintain consistency across platforms.

#3 Challenge: Regulatory Compliance: Navigating Complex Legal Frameworks

Many regulations and compliance standards govern the financial landscape. Adopting new payment trends requires accountants to navigate these complex legal frameworks to ensure adherence to regulatory requirements.

Staying compliant demands a comprehensive understanding of evolving regulations, necessitating continuous education, and training for accounting professionals.

Firms must allocate resources to ensure their teams remain abreast of regulatory changes and implement necessary adjustments to stay compliant while adopting new payment methods.

Invoicera assists accountants in staying compliant with changing regulations by providing customizable templates and features that adhere to legal requirements.

It offers tax compliance features specific to different regions, keeping track of tax rates and enabling the generation of compliant invoices. Additionally, Invoicera regularly updates its platform to align with evolving regulatory standards, aiding accountants in staying current with legal frameworks.

Is Accounting Education And Training Needed?

Yes, it’s super important!

Rules Keep Changing: Accounting is more than just numbers now. Rules change a lot, so accountants need to stay updated. Learning more helps them handle these changes better.

Technology Advances: Computers and fancy tech like AI and blockchain are changing accounting. Accountants need to learn how to use these tools well, so they must keep learning new stuff.

Different Fields, Different Skills: Every industry has its unique financial intricacies. Learning more about specific sectors helps accountants give better advice and help.

Let’s Summarize

As the financial landscape evolves, accountants face a transformative shift. 2024 brings three pivotal payment trends to reshape transaction management and client engagement. With digital currencies, AI-integrated payments, and a focus on sustainable practices, accountants step into an era of innovation.

Adopting these trends isn’t just beneficial; it’s essential for competitiveness and client value. Embrace these changes to streamline processes, enhance accuracy, and build stronger client connections through pioneering payment methods.

Stay ahead. Utilize these trends to optimize internal operations and provide clients with a progressive approach that meets their evolving needs.

FAQs

How critical is cybersecurity in the context of payment processes for accountants?

Cybersecurity is critical. With rising digitization, safeguarding client data and financial info is vital. Accountants must adopt robust measures to protect against cyber threats and ensure secure payment channels.

How can accountants ensure compliance while adapting to new payment technologies?

Staying compliant is critical. Accountants must track regulatory updates, work with compliance experts, and use software that ensures adherence to financial regulations while adopting new payment tech to stay compliant.

What role do client preferences play in shaping payment trends for accountants?

Client preferences are pivotal. Today’s clients seek flexible, secure, and convenient payment options. Accountants need diverse payment methods, personalized experiences, and transparent transactions to effectively meet these preferences.