Introduction

Are you a business owner who is dealing with the complexities of payment terms, and trying to balance between cash flow and client satisfaction?

Imagine you’ve delivered top-notch products or services, but your invoices are met with delayed payments, impacting your business’s financial health.

Ever wondered how to overcome this situation?

In business transactions, understanding and effectively managing payment terms is crucial.

According to a recent survey by Dun & Bradstreet, 59% of businesses experience late payments, with an average delay of 12 days.

This not only strains relationships but also hampers the operational efficiency of countless enterprises.

Enter Net 30! It’s a widely used payment term that holds both promise and challenge.

This blog post will discuss Net 30, its definition, how it functions, and provide insights into why businesses opt for this arrangement.

To add practical value, we’ll introduce Invoicera, a comprehensive invoicing and billing solution designed to streamline Net 30 transactions.

Let’s get started.

What Is Net 30?

Net 30 is a payment term commonly used in business invoices.

It signifies that your customer has 30 days to pay the invoice from the delivery date of goods or services.

In this arrangement, the seller provides products or services, sends out an invoice, and then patiently waits for the payment within the agreed-upon 30-day period. This helps create a structured and predictable system for both parties involved.

For businesses, Net 30 can act as a balancing act between maintaining a healthy cash flow and offering a reasonable timeframe for customers to settle their bills. Net 30 business accounts can further streamline this process by enabling companies to manage and track their invoicing and payments efficiently. Establishing net 30 accounts also helps build business credit and foster trust with suppliers.

Overall, Net 30 helps manage payment timelines, provides a clear understanding of when funds are expected, promotes transparency, and facilitates smoother financial transactions between businesses.

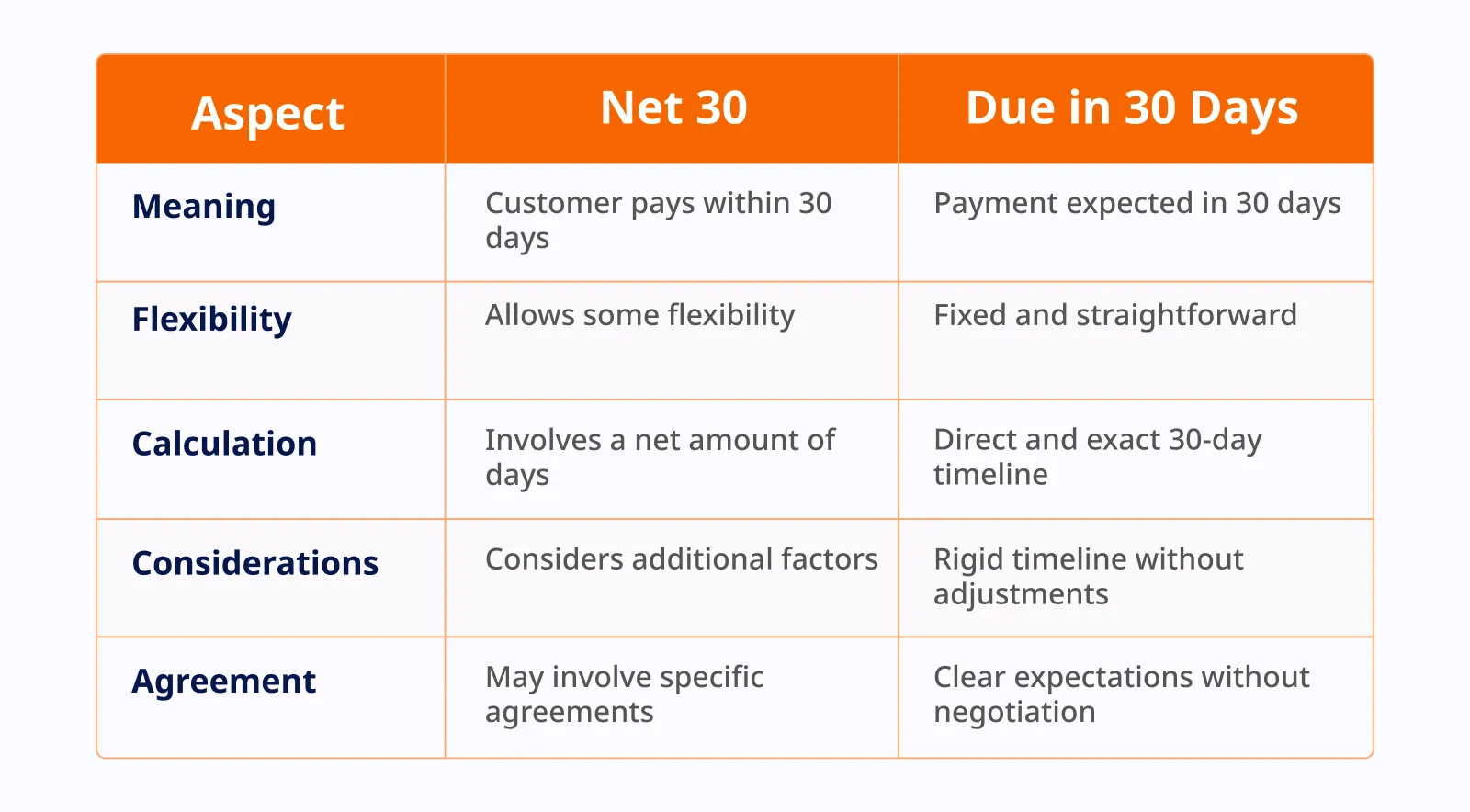

Net 30 vs. Due In 30 Days

The distinction between “Net 30” and “Due in 30 Days” is crucial. “Net 30” grants a 30-day window for payment from the invoice date, allowing some flexibility, particularly concerning factors like shipping or goods receipt.

On the other hand, “Due in 30 Days” is straightforward, demanding payment exactly 30 days after the invoice date without additional calculations.

The choice between them hinges on factors like the nature of the business, agreements with customers, and the desired level of payment schedule flexibility.

Both terms seek to establish a fair and agreed-upon payment timeline, shaping the financial dynamics between businesses and their clients.

What Is 3/10 Net 30?

- The “3” in 3/10 represents a discount percentage offered to the buyer.

- The “10” signifies the number of days the buyer needs to pay to avail the discount.

- “Net 30” says that the full invoice amount is due within 30 days in case the buyer doesn’t take advantage of the early payment discount.

How Does It Work?

Let’s say you have provided goods/services and issued an invoice for $100 with a 3/10 Net 30 term. If the buyer pays money within 10 days after the invoice date, they are eligible for a 3% discount, means they need to pay only 3%, i.e., $97 instead of the full $100 amount. If not, the full $100 is due within 30 days.

Benefits for Both Parties:

- For the Seller: Encourages quicker payments and improves cash flow.

- For the Buyer: Presents an opportunity to save money through early payment.

Considerations:

- Sellers must weigh the benefit of prompt payment against potential revenue loss.

- Buyers need to evaluate whether the offered discount is worth the early payment.

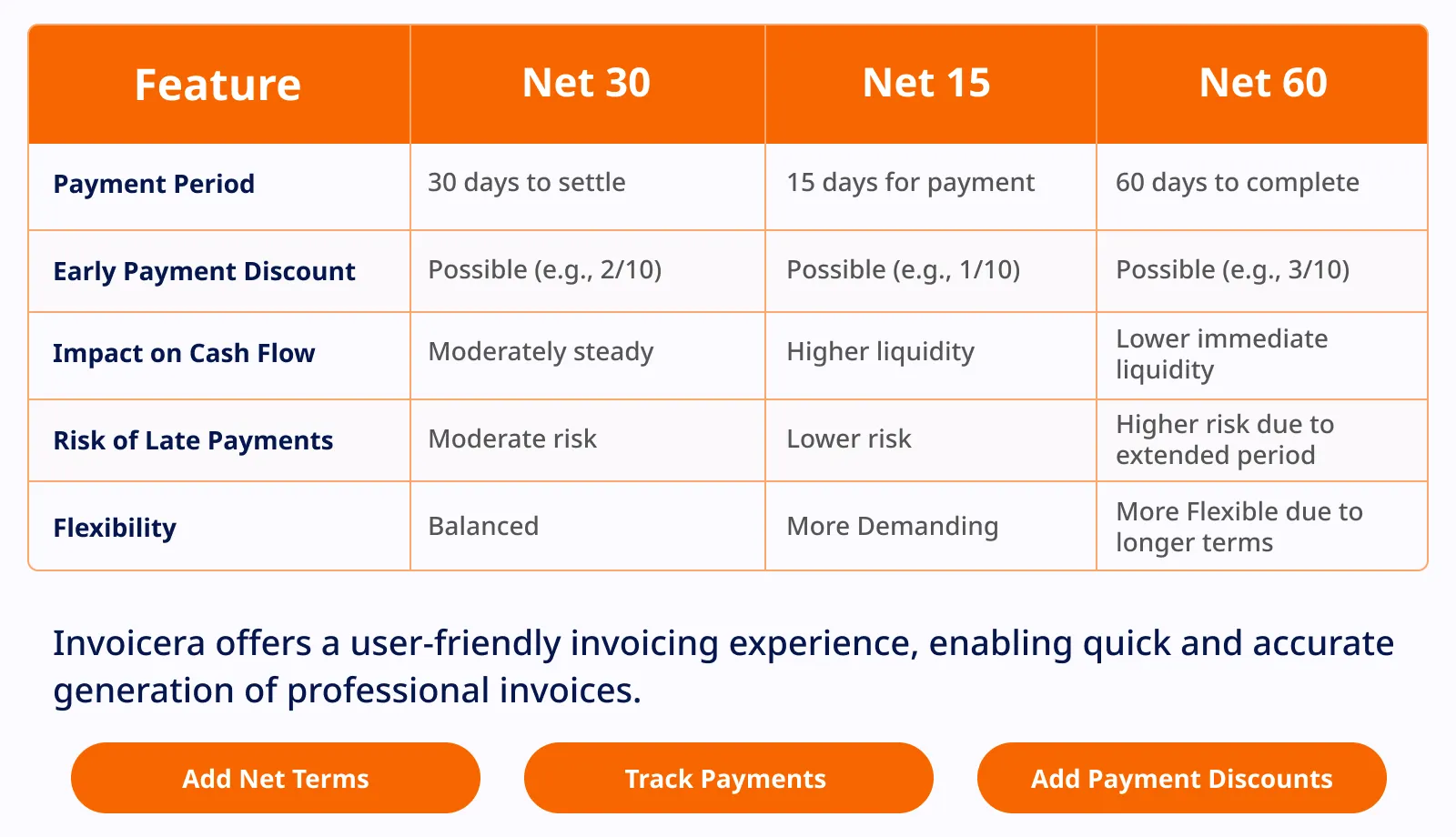

Net 30 vs. Net 15 vs. Net 60

How Does Net 30 Work?

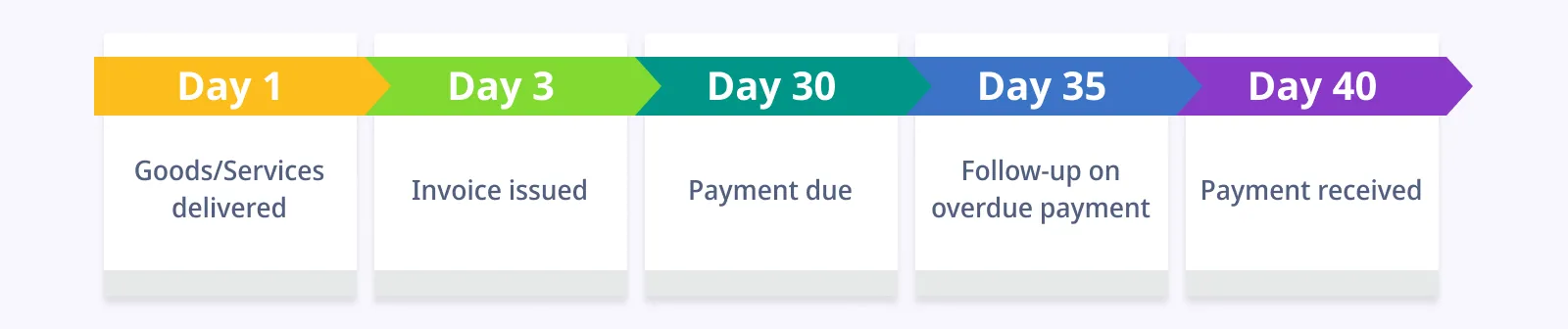

In Net 30, the payment process operates on a simple yet crucial timeline, ensuring a smooth flow of transactions between you and your customers. Let’s break it down step by step:

- Goods/Services Delivered: This marks the beginning of the process. Whether it’s a physical product or a service you’ve provided, this is the stage where your customer receives what they’ve purchased.

- Invoice Issued: Following the delivery, you generate and send an invoice to your customer. The invoice lays out the specifics of the transaction, detailing the products or services rendered, the total amount owed, the payment deadline (typically set at 30 days), and guidance on completing the payment.

- Payment Due: The customer now has a 30-day window from the date of the invoice to make the payment. This period allows them reasonable time to fulfill their financial obligation.

- Payment Received: Ideally, your customer makes the payment on or before the due date. This completes the transaction smoothly. In case of any delay, proactive communication and follow-up are crucial to ensure a timely resolution.

Role of invoices and billing in Net 30 transactions

Invoices and billing serve as the backbone of Net 30 transactions, playing several key roles that contribute to the efficiency and transparency of the payment process:

- Documentation: Invoices are more than just pieces of paper; they serve as formal documentation of the transaction. They itemize the goods or services provided, quantify their costs, and detail any applicable taxes.

- Communication: Invoices are effective communication tools. By specifying payment terms, they ensure that both you and your customer are on the same page regarding when the payment is expected, fostering clarity and understanding.

- Organization: Beyond their communicative role, invoices help keep your financial records organized. Efficient record-keeping is essential for tracking transactions, managing cash flow, and simplifying the overall financial management of your business.

Examples illustrating Net 30 payment timelines

Let’s delve into more detailed examples to provide a comprehensive view:

Example 1: Smooth Transaction

Day 1: Goods/Services delivered

Imagine you run a graphic design business, and you’ve just delivered a set of customized marketing materials to your client.

Day 3: Invoice issued

Promptly, you generate an invoice totaling the cost of the design services, specifying that payment is due in 30 days.

Day 30: Payment due

As the due date arrives, your client, impressed with your work and appreciating the clear payment terms, submits the payment on time.

Day 30: Payment received

The transaction concludes smoothly, and both parties maintain a positive working relationship.

Example 2: Delayed Payments

Day 1: Goods/Services delivered

In another scenario, let’s say you own an online boutique and have shipped a batch of clothing to a retailer.

Day 3: Invoice issued

The invoice is sent promptly, detailing the items, costs, and the 30-day payment window.

Day 30: Payment due

Unfortunately, the payment doesn’t arrive on the due date. Sensing a potential issue, you initiate a friendly follow-up communication to understand the delay.

Day 35: Follow-up on overdue payment

After a brief conversation, it becomes clear that your client faced unexpected cash flow issues. You work together to establish a revised payment plan, extending the deadline by an additional week.

Day 40: Payment received

True to the revised plan, your client submits the payment on the agreed-upon date. While there was a delay, open communication and flexibility helped resolve the situation amicably.

Pros Of Net 30

When it comes to payment terms, Net 30 is a two-sided coin, presenting both advantages and challenges for businesses. Let’s delve into the details with a straightforward yet professional approach.

Flexibility for Clients: Net 30 offers clients more time to settle bills, fostering positive relationships. It shows understanding and flexibility in your business transactions.

Cash Flow Management: Net 30 can save and manage your business’s cash flow. It provides predictability in your revenue, making planning and allocating resources easier.

Competitive Edge: Offering Net 30 can make your business more appealing to clients who appreciate extended payment timelines. It makes your business stand out and can be a big deal for clients when picking a service provider.

Cons Of Net 30

Delayed Payments: The primary drawback of Net 30 is the potential delay in receiving payments, which can strain your finances and disrupt your budget.

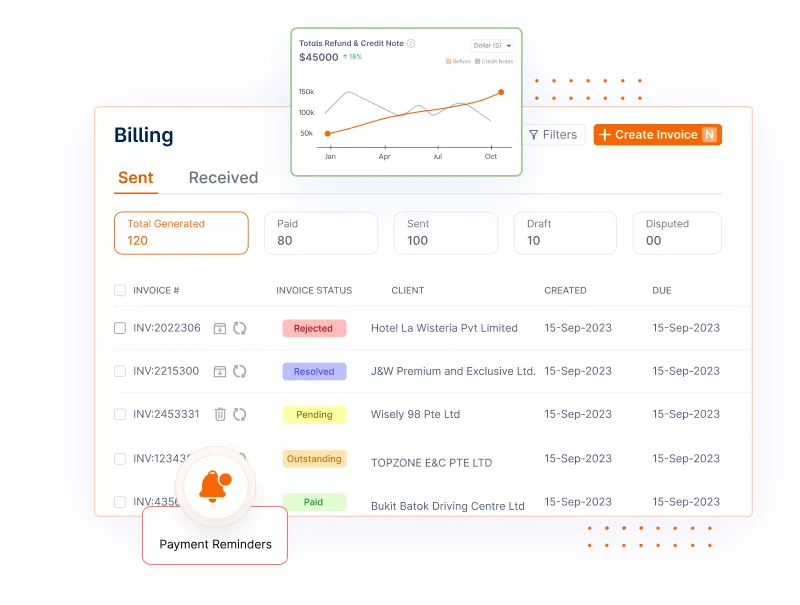

Set up automated reminders with Invoicera to gently nudge clients as the payment deadline approaches. Maintaining consistent communication reduces the risk of delays and encourages timely payments.

Impact on Cash Flow: While Net 30 is beneficial for clients, it can affect your cash flow. You need to handle your finances carefully.

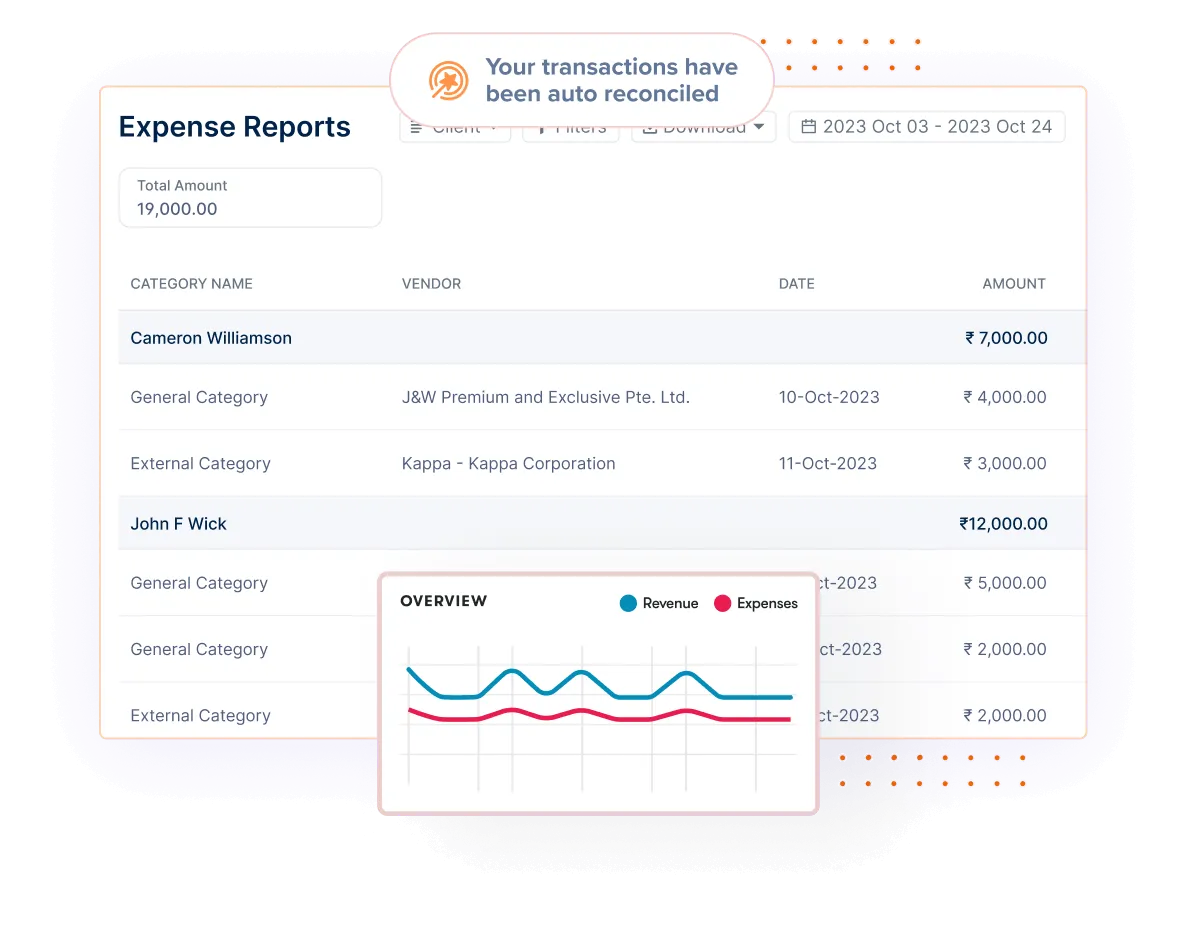

Invoicera’s reporting tools can assist in analyzing your financial data, enabling better cash flow planning. With insights into your income and expenditure patterns, you can navigate the impact on your cash flow more effectively.

Possibility of Non-Payment: Unfortunately, there’s always a risk of clients not paying, creating uncertainty and potential financial losses.

Use Invoicera’s invoice tracking to stay informed about payment statuses. Timely tracking allows you to promptly address non-payment issues, reducing the impact on your business.

Why Do Businesses Use Net 30?

Businesses use Net 30 because it gives a little extra time for customers to pay. It’s like a friendly agreement where they promise to pay within 30 days of getting the products or services.

This can help build good customer relationships, especially if they need more time to gather the money. It also makes the payment process more flexible.

How Net 30 Contributes to Cash Flow Management

Let’s talk about cash flow – the money moving in and out of your business. Net 30 plays a role here. When you use Net 30, you’re giving your customers a deadline for payment, making it easier for you to predict when money will come in. It’s like having a schedule for your income.

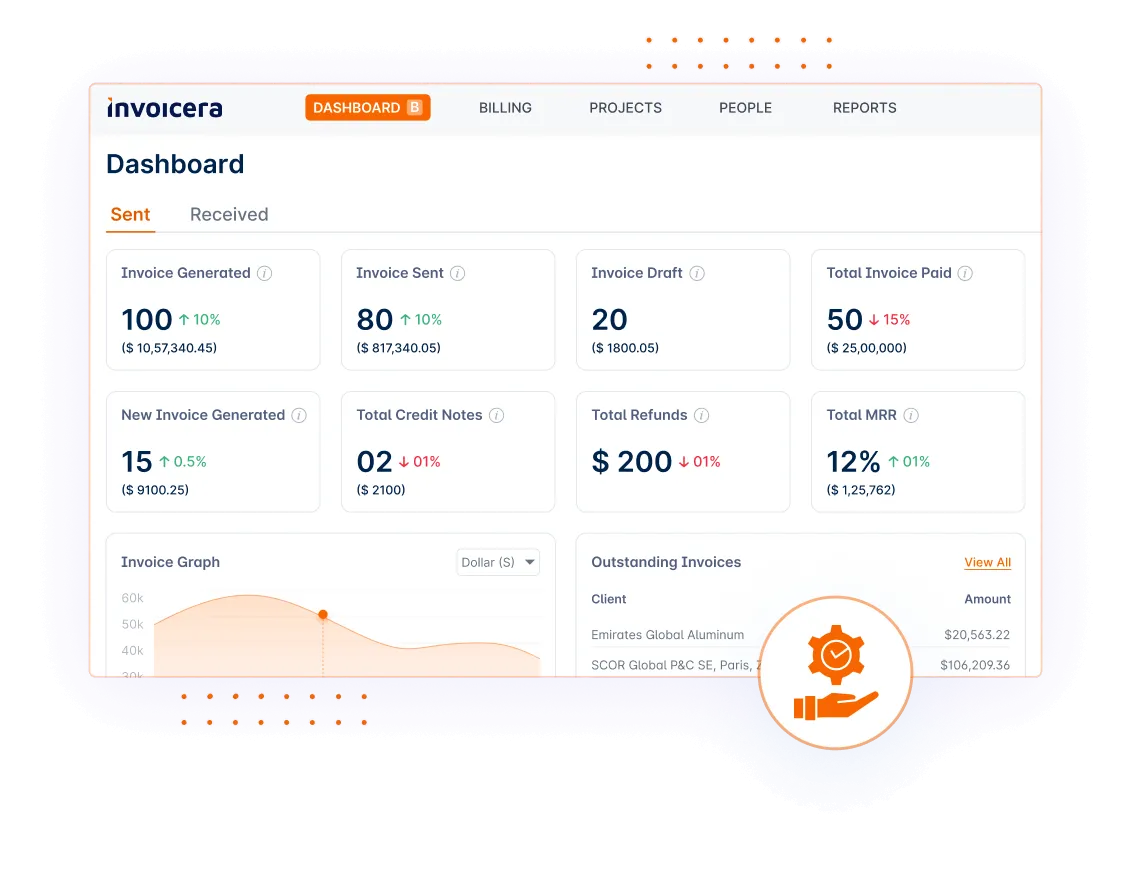

And here’s where Invoicera steps in. Invoicera is a tool that helps you create and manage your invoices smoothly. With Invoicera, you can easily set up Net 30 terms, send out invoices, and keep track of who paid and who needs a gentle reminder.

It makes the whole process organized and less stressful, contributing to better cash flow management for your business.

Manage Net 30 Transactions With Invoicera

Navigating the ins and outs of Net 30 transactions can be a breeze with the help of Invoicera, a user-friendly invoicing and billing solution.

Features of Invoicera in managing Net 30 transactions

Features of Invoicera in managing Net 30 transactions

Here are some key features that make Invoicera an excellent choice for managing Net 30 transactions:

Effortless Invoicing: Invoicera simplifies invoicing, allowing you to easily create and send professional-looking invoices with just a few clicks. This ensures that your Net 30 invoices are clear and detailed, and reach your clients promptly.

Automated Reminders: No more chasing late payments! Invoicera comes with automated reminders, gently nudging your clients as the Net 30 deadline approaches. This feature helps maintain a positive relationship with your clients while ensuring timely payments.

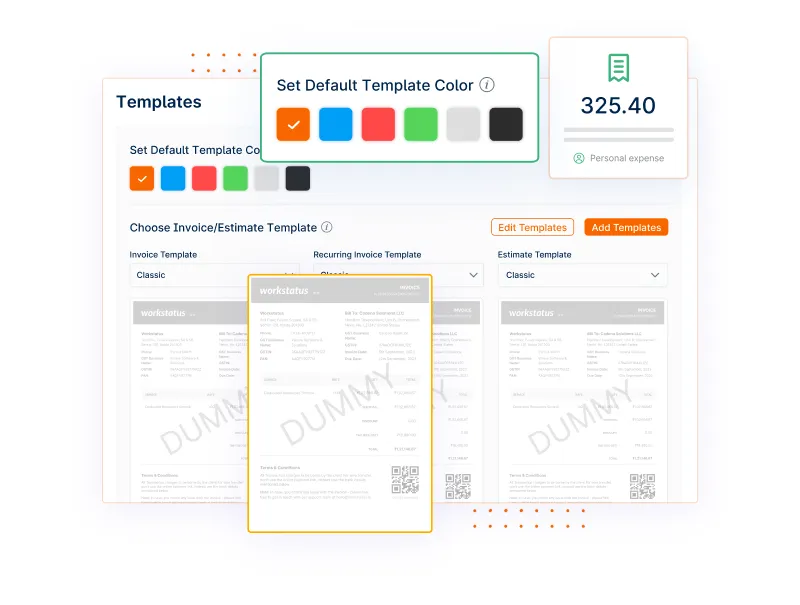

Customizable Templates: Tailor invoices according to your brand and style. Invoicera provides customizable templates, letting you add your logo, brand colors, and personalized messages. This professional touch reinforces your brand and enhances the overall client experience.

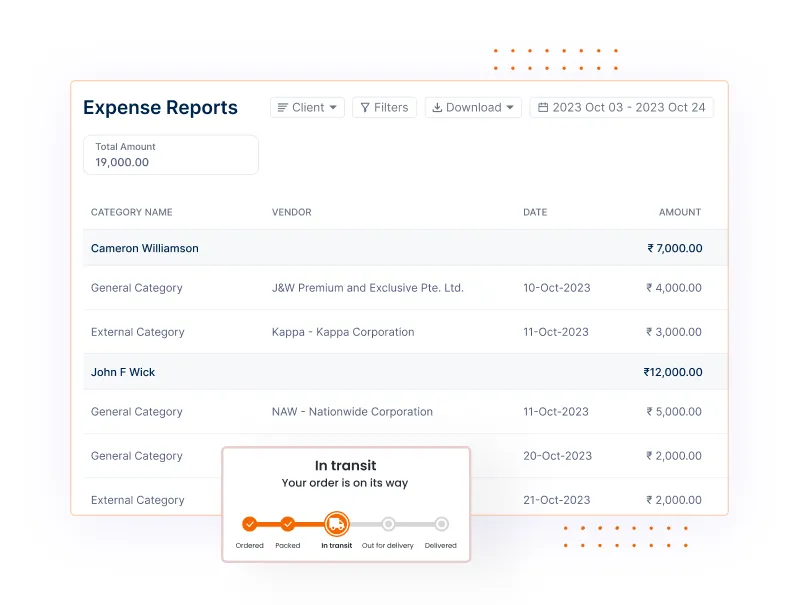

Expense Tracking: Closely track your expenses related to Net 30 transactions. Invoicera offers robust features such as expense tracking, monitoring payments, managing receipts, and maintaining accurate financial records for each transaction.

Real-time Reports: Stay in the loop with real-time reports on your Net 30 transactions. Invoicera provides insights into your financial performance, allowing you to make informed decisions for your business.

Secure Payment Options: Invoicera supports multiple secure payment options, giving your clients flexibility in settling their Net 30 invoices. This convenience can contribute to faster payments and a smoother overall transaction process.

Tips for Effectively Managing Net 30 Transactions

Navigating Net 30 transactions smoothly requires a blend of organization, communication, and strategic thinking. Here are some straightforward tips to help you manage Net 30 agreements effectively:

Clear Communication is Key: Keep your communication crystal clear. Clearly outline payment terms, due dates, and any potential consequences for late payments. This helps avoid misunderstandings and promotes a healthy business relationship.

Send Timely Invoices: Don’t wait! Send your invoices promptly after delivering your products or services. Timely invoicing sets the payment expectations and helps your clients plan accordingly.

Use Invoicing Software: Consider a dedicated invoicing tool, such as Invoicera, to simplify the invoicing process. These tools can automate tasks, reducing the chances of errors and ensuring your invoices are professional and on time.

Offer Incentives for Early Payments: Get timely payments by offering small rewards, such as early payment discounts. It’s a win-win – your clients save a bit, and you get your money faster.

Implement Late Payment Penalties: Clearly state late payment penalties in your terms. While it’s good to be understanding, having consequences for late payments can encourage clients to stick to the agreed-upon timelines.

Regularly Follow Up: Set up a system for regular follow-ups on outstanding payments. Friendly reminders can go a long way in prompting clients to settle their bills on time.

Maintain Accurate Records: Make sure to keep detailed records of all transactions, such as invoices, payments, and any communications. This helps with organization and provides a reference point in case of disputes.

Evaluate and Adjust Terms as Needed: Periodically review your Net 30 terms and assess their effectiveness. If needed, don’t hesitate to make adjustments based on your business’s evolving needs and the feedback received from clients.

Build Strong Client Relationships: Foster positive relationships with your clients. A good brand image can make it easier to discuss payment matters, contributing to a smoother payment process.

Stay Informed About Client’s Payment Habits: Understand your client’s payment habits. If a client consistently pays late, it may be worth reconsidering the terms or having a candid conversation about finding a mutually beneficial solution.

Alternatives To Net 30

There are various payment terms to choose from, each with its own perks. If Net 30 doesn’t quite fit the bill for your business needs, consider these alternative payment terms:

Net 15

Similar to Net 30 but with a shorter payment window. Net 15 might be a suitable alternative if you prefer a quicker turnaround.

Net 60 or Net 90

If you’re willing to give your clients more time, consider extending the payment period to Net 60 or even Net 90. This provides flexibility but requires patience for receiving payments.

Cash on Delivery (COD)

For immediate transactions, COD ensures you get paid once the product or service is delivered. It’s a straightforward way to secure quick payments.

Payment in Advance

To avoid delays altogether, you can opt for payment in advance. This upfront approach can benefit certain businesses, especially for one-time or project-based transactions.

Conclusion

We find that navigating payment terms is a crucial aspect of running a business smoothly. Net 30, with its 30-day payment window, can be a handy tool, offering flexibility for both you and your customers.

Remember, invoices play a vital role in this process, serving as friendly reminders about the who, what, and when of payments. They keep things organized and ensure a clear understanding between you and your customers.

And what about offering discounts? It’s a sweet deal for customers and can speed up payments, but you might get a bit less in return.

Whether you choose Net 30 or other payment terms, the goal is to keep your business running smoothly.

FAQs

What role do invoices play in Net 30 transactions?

When you add Net 30 to your invoices, you tell your customers what to pay, when, and for what. They’re like organized reminders to ensure everyone is on the same page about when the money is due.

Is Net 30 right for my business?

Net 30 is like a tool. It might work if waiting a bit for money is okay for your business and customers. Consider the pros and cons to see if it fits your needs.

Is it beneficial to offer a discount to my customers?

Offering a discount can be like a treat for customers. It might encourage early payments, which is good for cash flow. But you might get a bit less money. It’s a trade-off; decide if quicker payments are worth a small cut.