Introduction

Think about this: You are an accountant! You are back in the office, ready to start your job day! What do you see?

You haven’t received payments for the invoices you generated! And what you see is a list of excuses for not getting timely payments.

It’s not the first day of this happening, it occurs many times. Overdue invoices are frustrating as it affects cash flow of a business.

According to a study by Fundbox, 64% of small businesses struggle with cash flow due to late payments.

So, you find yourself trapped, spending too much time chasing down late payments. What if you could put a stop to those ridiculous excuses? What if you had some stratgies to overcome these late payments without disturbing relationships with your clients?

We have that for you! In this blog post we will cover 12 most common late payment excuses, giving you solutions to tackle them.

Let’s get started with the first step you can make to improve your business cash flow.

Top 12 Excuses For Late Payment

Here are the top 12 most common late payment excuses:

1. Sorry! We forgot to make the payment

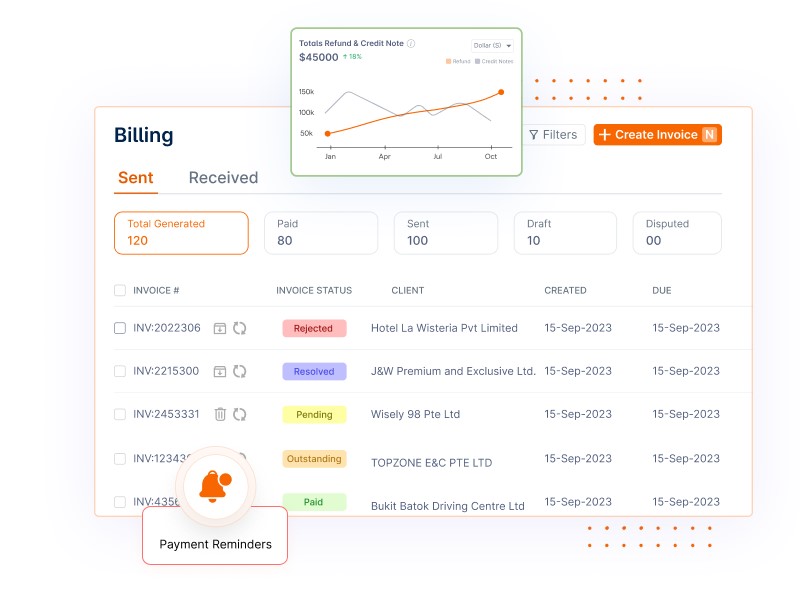

The payment reminder feature in an invoicing software such as Invoicera could also be helpful.

However, this reason is one of the not acceptable reasons for late payments on credit report.

2. We are facing issues with your order

In this situation, you should request more feedback right away. After collecting all the information about the problem, write it down in detail. Then, look into and resolve issues as quickly as possible.

Get a commitment from them to pay the amount as soon as you’ve resolved the issue.

3. We have already paid the invoice

It’s a classic excuse. If your customer says they have already paid an invoice before the due date, first check the payment. Sometimes, there are errors in data entry, or your client can give you wrong information about a bank transfer that has yet to arrive in your account.

Another reason for this excuse could be that they still need to send you the payment and forgot to tell you. This type of late payment may be acceptable if it’s not too often. For this, a tool that tracks every activity of the invoices sent and payments received will be useful.

4. The cheque has been sent

A customer may inform you that they have already paid you if you wait for them to do so for a while. However, if you are working with them for the first time, you have every reason to be cautious of this excuse.

Ask your bank for confirmation or assistance to make sure you have received the payment to avoid this defense.

5. The person responsible for payment has a family emergency

It’s a common trick to pretend that the individual who is supposed to make the payment is away from the office. Ensure you find out who they are and whether anybody else is coming in to fill the position. It’s unrealistic that the firm would be put on hold until this person returns to work.

If no one appears to be available, ask to talk with a senior director.

If there is no other option besides waiting for that individual to return, ask them when you can anticipate the payment and ensure they respond in writing. Contact them again if they do not pay on the promised date.

6. We are switching to a new bank

Moving an account to another bank is not a big task for any business since it only needs to wait a few days. When you wait weeks or months for payment, your lender is simply avoiding paying you.

Depending on your prior knowledge and relationship with the late-paying customer, you can ask for proof that they are changing banks or permission to contact the bank.

7. We’re experiencing cash flow problems

Sometimes, your customers might think how to explain delay in payment. In this, case they give you an excuse about cash flow issues.

If your customer tells you they are running out of cash and won’t be able to pay you on time, ask them when they can repay you.

However, you can ask them to pay you the amount they can afford right now and the rest on any specified date, they state. In this way, you will get your payment in only two installments.

Also, provide the client a copy of your invoice and mention late payment penalties if not paid by the new due date.

8. Claimed bankruptcy

If the business has gone bankrupt, get confirmation and discover who the administrators are. You may contact the officials and show them evidence that the bankrupt firm owes you money.

If the firm is only shutting down yet not bankrupt, you can pursue them in court if you think they have enough assets to cover the debt.

9. Still waiting for the goods to receive

This problem may be resolved with ease. You must keep delivery records safe. If a client claims they have not received the items, you can send them the signed delivery papers electronically to avoid delays.

A company may offer a signature guarantee through an online document management system like Invoicera, which allows you to sign in on any mobile device. These papers are saved on your online account, and you can easily retrieve them anytime from anywhere.

10. We are working on a big project

While it’s possible that your clients are out of money while working on a new project, only accept these justifications once you have proof. However, at least you must know you’ll get paid eventually if your customer offers a valid explanation for the late payment and lets you know when they can pay in full.

11. It was a typo error

If you have made a typo on a bill sent to the client, your customer will tell you about it. If you haven’t received any notifications until after this date, send an email explaining the change and asking them to pay again if they have already done so.

Also, ask for evidence because it’s improbable that you have made a typo in the invoice number.

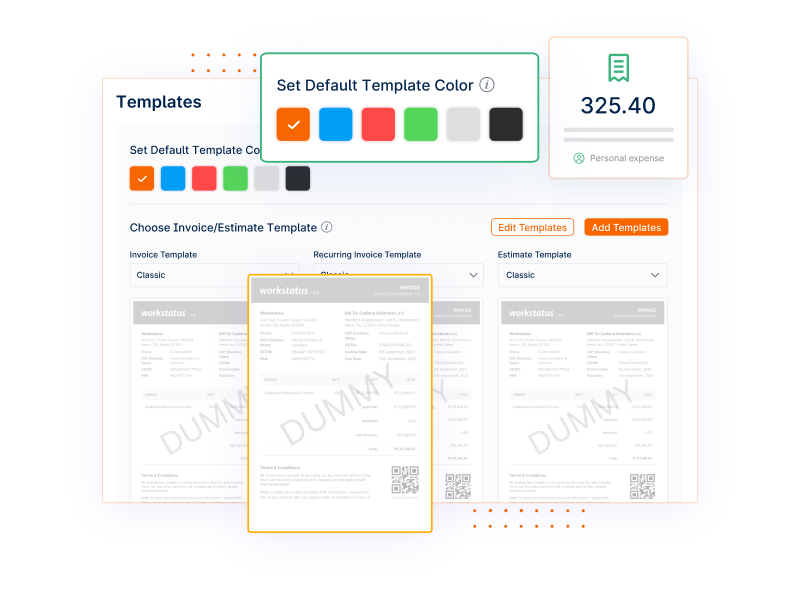

Invoicera has pre-designed templates which could help to get rid of typo errors.

12. We haven’t received the invoice yet

It is the most common tactic to delay payments, as it can absolve the business and make you feel guilty. To avoid this, the invoices must be shared via email for proof.

In case you have emailed the invoices still, you are getting this excuse; you need to check on the address to which the invoice is sent. Or it is clear that the company has forgotten to pay and is only making excuses.

How Can Late Payment Excuses Affect Your Business?

Late payment excuses can have severe effects on your business:

- Cash Flow Constraints: Excuses for late payments can disrupt your cash flow, hindering your ability to meet financial chores and invest in growth opportunities.

- Client Relationships: Consistently delayed payments strain relationships with suppliers, leading to reduced credit terms, limited access to goods/services, and potential disruptions in the supply chain.

- Hampering Productivity: Dealing with excuses demands time and effort from your staff, diverting resources from other essential activities and lowering productivity.

- Reputation Damage: Unacceptable reasons for late payments on credit reports can harm your reputation, breaking trust with stakeholders and affecting your brand image.

How to reply for late payment professionally?

Online invoicing is a widely used practice to overcome late payments. The Internet can alleviate the hassle of sending, receiving, and processing hard copies of paper invoices; it can save on stamp expenses and postage and provide quick turnaround times for both the invoice sender and receiver. These efficiencies mean businesses don’t have to wait days or weeks to get what they’re owed or spend hours hunting down someone in the office before making a payment.

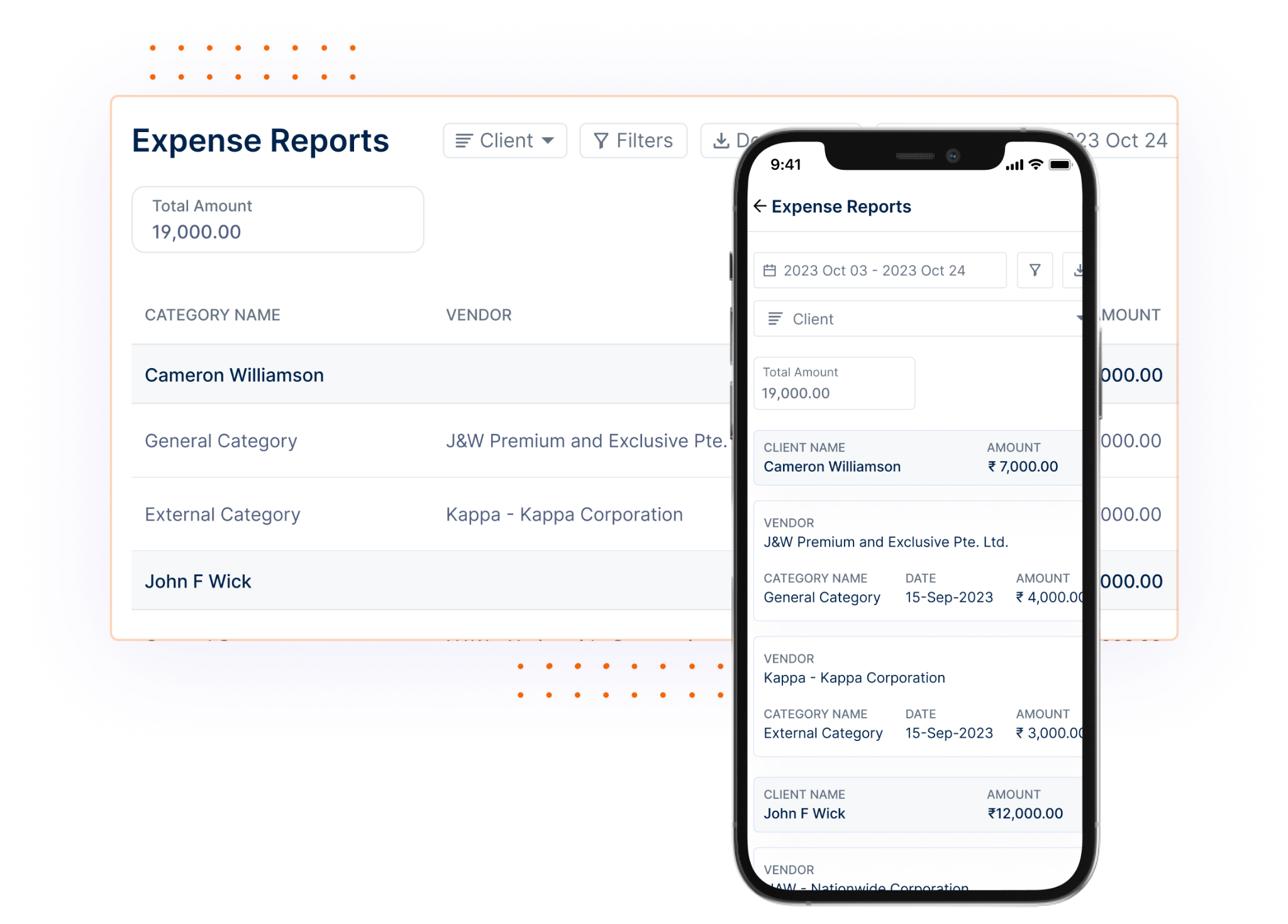

Importantly, billing invoices online makes managing one’s business finances easier by enabling real-time access to collected invoice balances. With these, manually updating spreadsheets with collected payments becomes unnecessary.

Businesses also benefit from increased billing receipts because digital signatures are legally binding on all parties. It means that if a company sends an invoice with a legally binding digital signature, they don’t have to worry about disputed payment matters.

All-in-one solution – Invoicera!

Invoicera helps you deal with all the late payment excuses by automating invoices and payments.

It’s a new and revolutionary cash flow management and invoice system that has successfully streamlined the workflow of most small and medium-sized businesses. The program offers protection against late payments without assuming any risk, allowing companies to put their resources into building their products or service offerings.

Invoicera is made for you to maintain a good relationship with your clients and not break the trust chain.

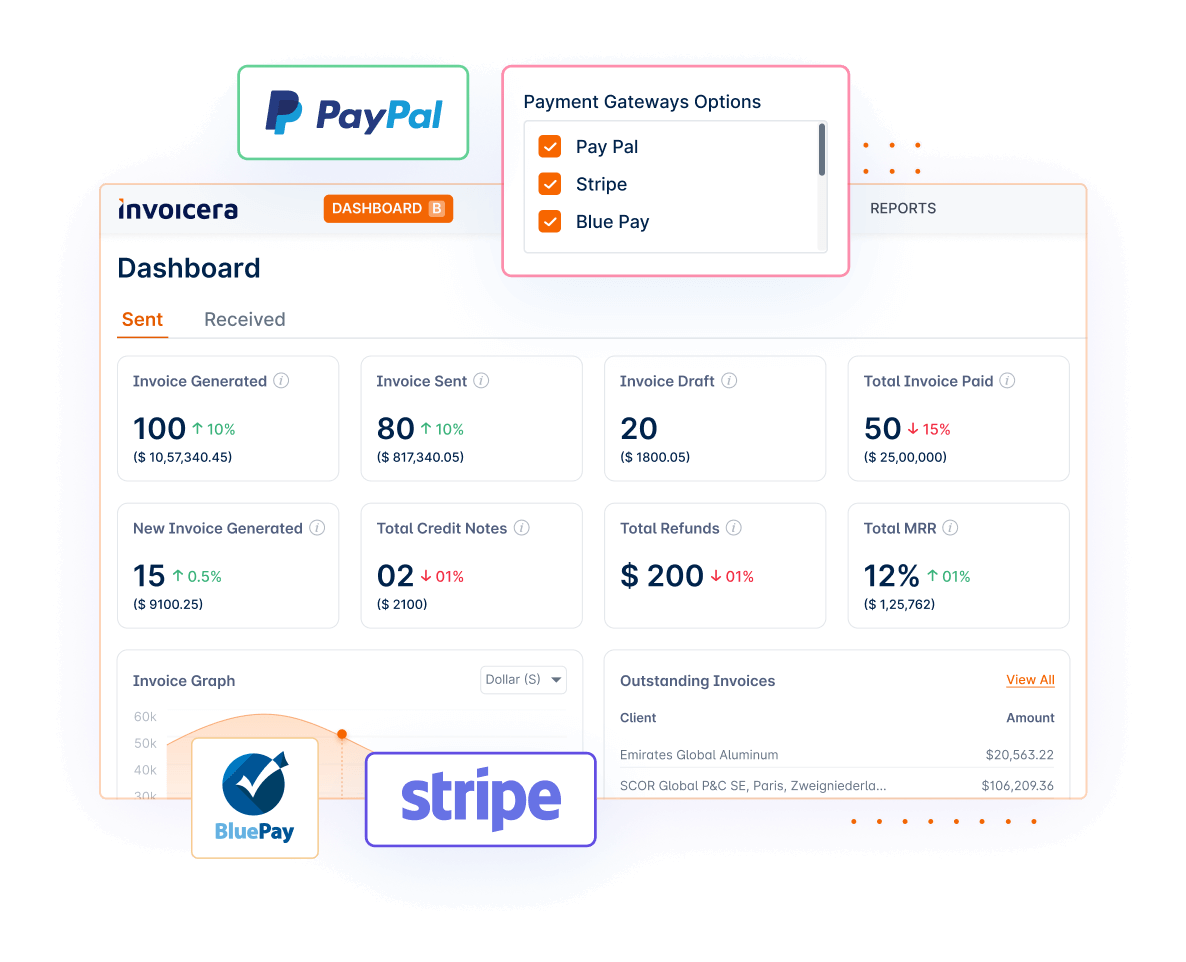

With 14+ integrations with online payment gateways, this tool has really made it possible to accept payments from any available payment option from anywhere in the world. It is fully capable of handling the complex technicalities of financial transactions. It’s quick, simple, and secure when accepting online payments from anywhere.

Sign up today and try the most reliable cash flow management software for free.

Final Thoughts

All the above excuses clearly make sense that manual payments are not easy and organized to manage. Therefore, it might be time to consider a different invoicing software.

Invoicera is an online platform that helps small and medium-sized businesses with all aspects of the invoice process, including creating invoices, automated payment reminders, receiving payments, detailed reports, and invoice approval. Its easy-to-use interface makes complicated tasks like attaching files or calculating taxes easy for anyone in the office – not just accountants!

As well as saving on labor costs by taking care of routine work, Invoicera also has powerful analytics tools to track how successful each invoice was at getting paid on time. With these insights, you’ll know what needs tweaking in future processes too!

Any more excuses you are facing? Tell us in the comment section.

FAQS

Q: What if the payments are delayed using Invoicera also?

The reminder feature never lets you miss any payment. It helps streamline the payment process by sending timely notifications, reducing late payment chances, and improving business cash flow management.

Q: What should I do when there is an excuse, “Approval is pending from higher authorities”?

For any future payments, you can understand the approval process in advance. It would help you to have a clear picture of when you are going to receive the payment. Pre-approvals help facilitate timely payments.

Q: How to explain delay in payment?

When explaining a delay in payment, honesty and transparency are key. Begin by acknowledging the missed deadline and express your commitment to resolving the situation. Clearly state the reason for the delay, whether it’s a financial discrepancy, processing error, or unforeseen circumstances.

Q: Whats a good excuse to ask for money?

Asking for money, especially in personal contexts, requires sensitivity and honesty. A “good” excuse is one that’s genuine and communicates your need effectively. This could be an unexpected financial hardship like medical bills, car repairs, or sudden unemployment.

Q: How do I respond to a late payment email?

Responding to a late payment email involves addressing the issue promptly and professionally. Start by apologizing for the delay and acknowledging any inconvenience caused. Be transparent about the reasons for the late payment, without oversharing personal details.