Introduction

Are you trying to manage several income sources and finding it tough to keep everything in check?

It’s like handling many moving parts—it can get tricky and overwhelming. Nowadays, it’s pretty common to have more than one source of income.

Studies show that about 45% of working Americans are hustling on the side, and experts think this trend will keep growing.

But how do you monitor all these income streams and ensure they’re doing well?

Let’s dig into some methods and tools that help you keep track of your different income sources without making it a hassle.

Firstly, we’ll discuss a little about an income stream and the benefits of creating multiple income streams.

What Is An Income Stream?

An income stream is a source of revenue or money that an individual or entity receives regularly. It’s essentially where your money comes from. These streams can take various forms, such as salaries, wages, profits from businesses, rental income, dividends from investments, royalties from creative work, or earnings from freelance gigs.

Each income stream typically represents a different source or avenue through which you generate money.

Understanding and categorizing these streams is crucial for effective financial management. By delineating and comprehending your various income sources, you gain clarity on the stability, reliability, and potential growth of your overall financial situation.

This awareness lays the groundwork for effectively managing, tracking, and optimizing these diverse revenue channels.

Benefits Of Multiple Income Streams?

Having multiple income streams offers several key advantages:

- Risk Mitigation: Diversifying income sources divides the risk. Depending solely on single source of income can leave a business exposed to market shifts or challenges specific to its industry. Multiple streams act as a safety net against potential losses in any area.

- Stability in Uncertain Times: Economic downturns or unforeseen events can impact businesses. However, a company can better weather these storms with various income sources. While one stream might see a downturn, others might remain steady or even grow, providing stability during uncertain times.

- Capitalizing on Opportunities: Different income streams can tap into various markets or customer segments. This flexibility allows companies to take advantage of emerging trends or new opportunities in different sectors, potentially maximizing overall revenue.

- Increased Cash Flow: Multiple income streams mean more consistent cash flow. Even if some streams generate revenue at different intervals, collectively, they contribute to a more regular and reliable cash influx, aiding in smoother financial operations.

- Enhanced Financial Planning: Managing multiple income streams demands closer attention to financial metrics and performance indicators. This heightened focus on financial planning and analysis helps make informed decisions, optimize resources, and allocate funds where they’re most needed.

How Do You Track Multiple Income Streams?

1. Understand Your Financial Landscape

To effectively manage multiple income streams, begin by clearly understanding your financial landscape. As a financial manager, this involves taking stock of all revenue sources within the company.

- Inventory your income sources: List and categorize each revenue stream, whether it’s from product sales, service offerings, investments, or any other sources. Having a comprehensive list helps you visualize the entirety of incoming funds.

- Chart your finances: Create a simple but detailed overview or spreadsheet that tracks the income generated from each source. Include dates, amounts, and relevant details to create a clear financial snapshot.

- Identify income variability: Analyze the consistency and predictability of each income source. Some revenue streams might fluctuate seasonally or due to market changes. Recognizing these fluctuations allows you to prepare for lean periods and capitalize on lucrative ones.

2. Tools For Independent Tracking

Effectively handling numerous income sources relies on utilizing the appropriate tools. Below are key tools that can simplify the process of tracking:

- Spreadsheets: Simple yet powerful spreadsheets like Microsoft Excel or Google Sheets offer a versatile way to organize and track various income sources. You can customize columns for different revenue streams, dates, amounts, and any additional details you need to monitor.

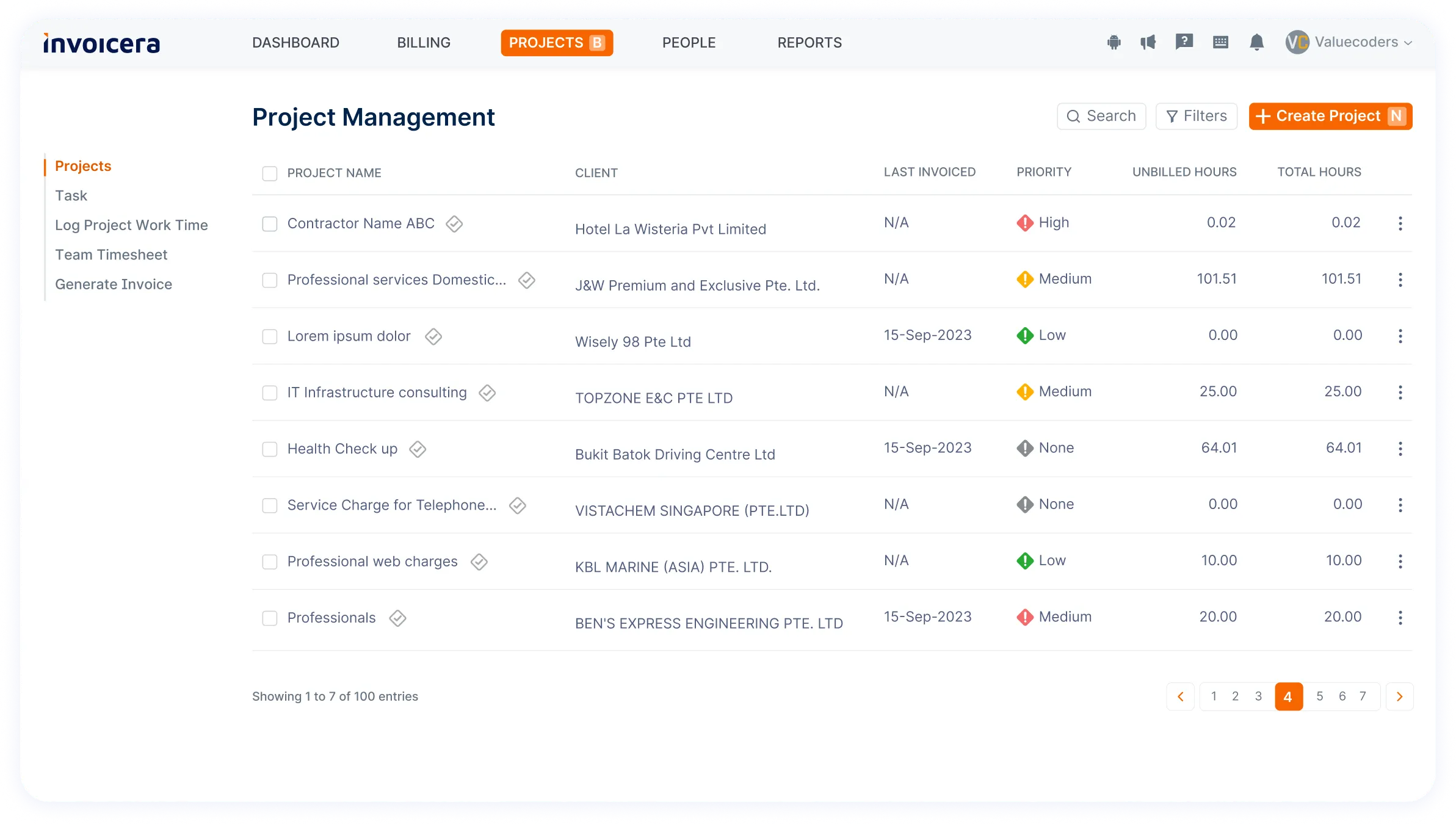

- Project Management Tools: Platforms designed for project management, such as Invoicera, can be repurposed to track income streams. You can create boards or tasks dedicated to each revenue source, set payment deadlines, and monitor progress.

- Accounting Software: Investing in accounting software like Invoicera can automate much of the tracking process. These tools have the capability to connect with your bank accounts, sort your income into categories, create reports, and offer a comprehensive view of your finances.

- Freelance Invoicing Platforms: Platforms specifically tailored for freelancers and small businesses, like Invoicera, streamline the invoicing and payment process. They allow you to create professional invoices, track payments, and manage multiple clients efficiently.

Pro Tip: Invoicera stands out as an intuitive platform that generates customizable invoices and offers robust features for expense management, time tracking, and reporting. Its user-friendly interface simplifies tracking multiple income streams, allowing you to focus more on your business and less on administrative tasks.

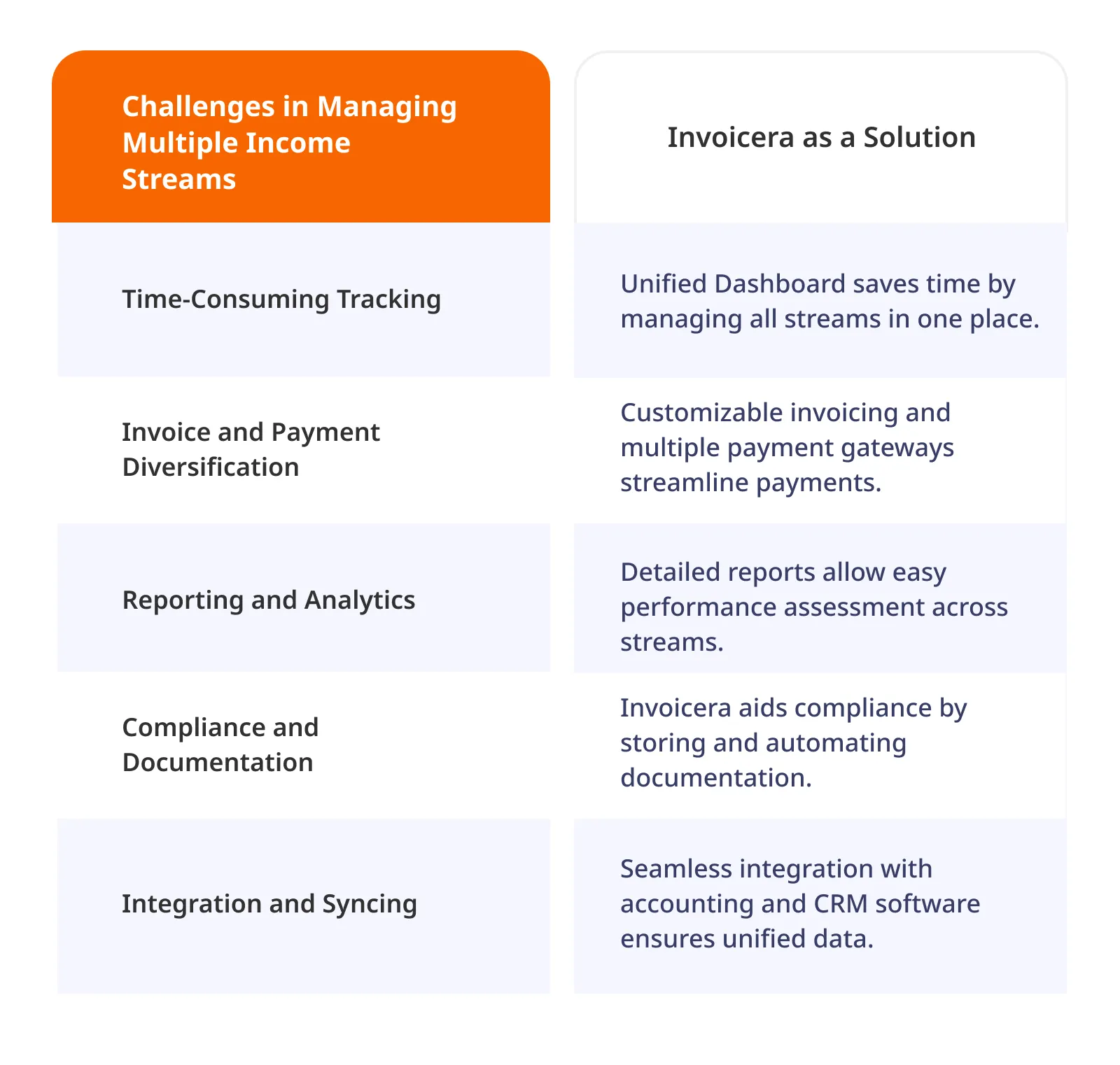

3. Invoicera for Streamlined Tracking

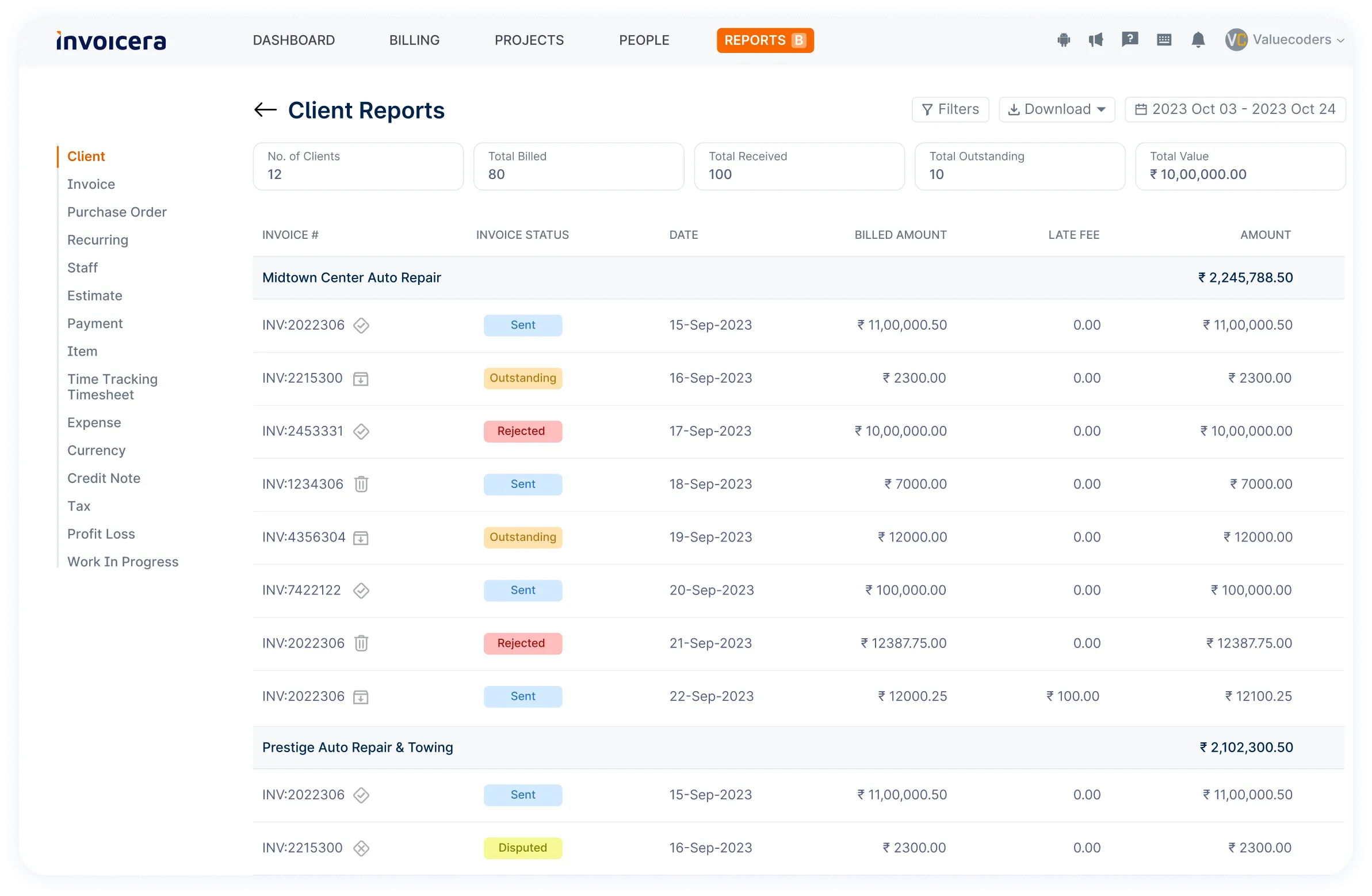

Invoicera provides a dedicated feature to organize and manage various income streams efficiently.

This functionality allows you to segregate and track each revenue source separately, providing a clear overview of your diversified income channels.

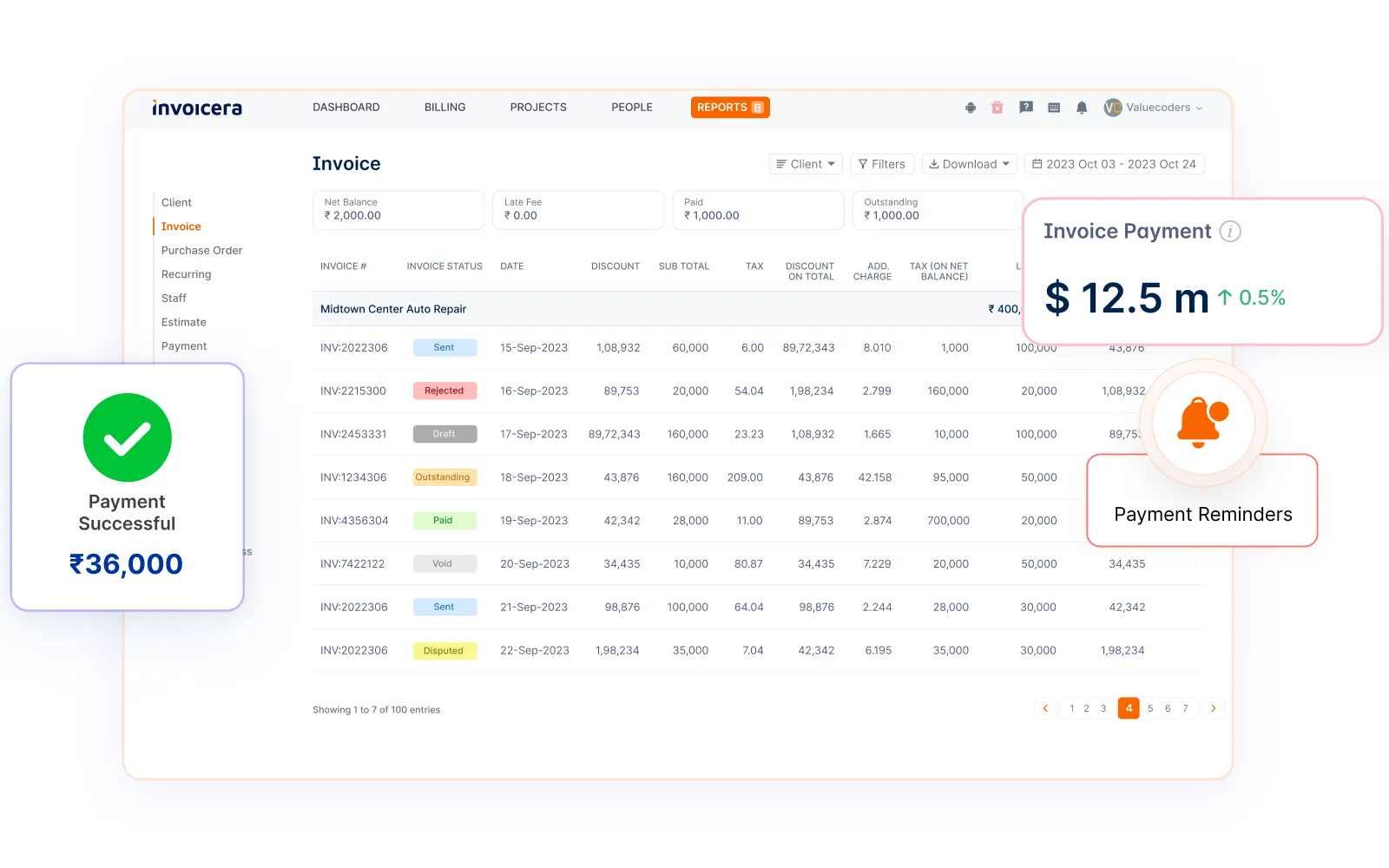

- Automated Invoicing and Payments: Simplify your invoicing process by utilizing Invoicera’s automated tools. Craft customized invoices tailored to each income stream effortlessly, with templates designed for clarity and professionalism. Schedule automated sending to ensure prompt billing, reducing manual errors and saving valuable time.

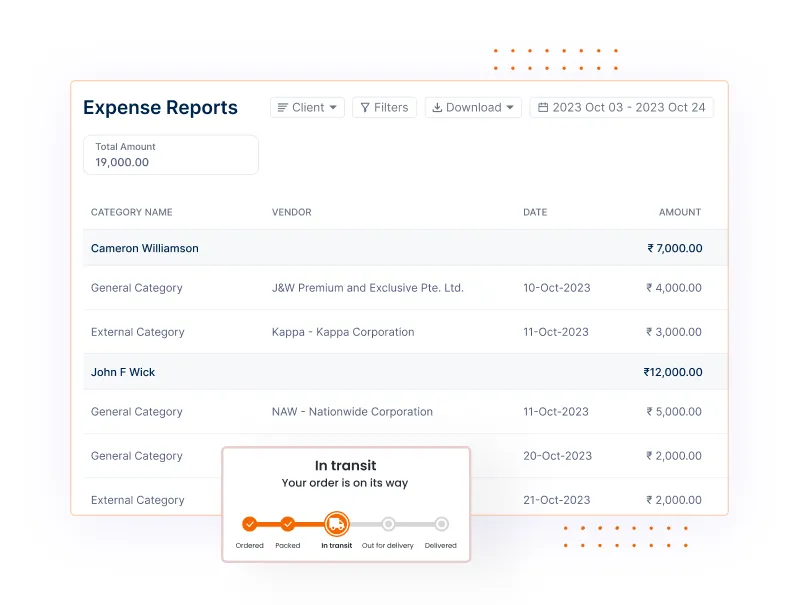

Expense Tracking and Categorization: Effectively monitor expenses associated with each income stream using Invoicera’s expense tracking feature.

Categorize expenses accordingly, offering a comprehensive understanding of the financial dynamics for each revenue source. This capability aids in evaluating the net earnings from each stream accurately.

Reporting and Analytics: Leverage Invoicera’s robust reporting and analytics tools to get valuable insights into the performance of your income streams.

Generate detailed reports showcasing revenue trends, outstanding payments, and expenses linked to each revenue source.

These analytics empower informed decision-making, enabling the optimization of financial strategies for improved outcomes.

4. Optimize Your Tracking System

As a financial manager handling multiple income streams, optimizing your tracking system is pivotal for maintaining financial health and growth.

- Set financial goals: Start by setting clear financial goals. Define specific, achievable targets for each income stream. Whether increasing revenue, minimizing expenses, or diversifying sources, having tangible objectives keeps you focused and motivated.

- Schedule regular reviews: Block out time—weekly, monthly, or quarterly—to assess how each income stream is performing against your goals. Reviewing allows you to spot trends, identify potential issues, and make informed decisions promptly.

- Adapt and refine: Adaptability is key. The financial landscape is dynamic, and income streams can evolve. Prepare yourself to adjust and improve your strategies. If a certain stream underperforms, consider reevaluating or reallocating resources. Likewise, if a particular avenue shows promise, explore ways to amplify its potential.

Remember, optimizing your tracking system isn’t a one-time task—it’s an ongoing process. By consistently setting goals, reviewing performance, and adapting strategies, you’ll not only manage but thrive amidst your array of income streams.

Best Practices For Efficiently Tracking Income Streams

-

Consistent Categorization and Labeling

Maintain a standardized system for categorizing and labeling your income streams. Consistency is critical here. Whether using software or manual methods, assign clear labels to each income source.

This practice streamlines tracking and allows easy identification and analysis of different revenue streams.

-

Regular Reconciliation and Review

Schedule regular check-ins to reconcile your income data. Match your records against bank statements or financial reports to ensure accuracy.

This routine review helps catch discrepancies early on, allowing for timely corrections and preventing potential financial headaches down the road.

-

Automating Processes Where Possible

Explore automation tools to streamline your tracking efforts. Many financial management platforms offer automation features that can fetch data from various sources and categorize it for you.

Automating repetitive tasks not only saves time but also reduces the chances of errors in your records.

-

Seeking Professional Advice or Consultation

Consider seeking advice from financial experts or consultants. They can provide valuable insights into optimizing your income-tracking strategies.

Professionals can offer tailored guidance based on your specific financial situation and goals, helping you make informed decisions to maximize your income potential.

Conclusion

Tracking multiple income streams independently isn’t just about staying organized; it’s vital for gaining financial clarity and fostering growth. By understanding and effectively managing diverse sources of income, you pave the way for better decision-making and financial stability.

Remember, don’t just rely on a single income source. Diversification is important for financial resilience. Tracking your various revenue streams empowers you to capitalize on strengths, identify weaknesses, and adapt your strategies accordingly.

Consider leveraging tools like Invoicera for streamlined and efficient income tracking. Its user-friendly interface and robust features can simplify the process, allowing you to focus more on growing your income and less on managing the details.

Begin your path toward financial empowerment today by embracing independent income tracking—it’s a cornerstone of your financial success.

FAQs

Is it necessary to use specialized software for tracking income streams?

It’s not mandatory, but using dedicated software or tools designed for financial management can significantly streamline the process and reduce errors, especially as the number of income sources increases.

How can I simplify the process of income tracking if I’m not tech-savvy?

You can use basic spreadsheets or manual methods to organize your income streams even without specialized software. Start by listing and categorizing your sources of income clearly and systematically.

How often should I review and update my income tracking system?

Regular reviews, preferably monthly, are recommended to ensure accuracy and catch any discrepancies early. However, the frequency may vary based on the variability of your income sources.