Introduction

Ever feel overwhelmed by the puzzling world of Software as a Service (SaaS) billing?

You’re not the only one who is confused!

The global SaaS market is exploding, set to hit a whopping $220 billion by 2024.

But with growth comes complexity, especially when it comes to billing.

Here’s the challenge: How do you navigate through subscription billing, deal with global transactions, and stay compliant?

That’s where our guide comes in.

In this, we’ll break down SaaS billing into bite-sized pieces. From the basics to smart strategies, we’ve discussed everything.

And for a streamlined solution, we’ll introduce you to Invoicera—a billing platform designed to make your SaaS billing woes disappear.

Ready to begin with the guide?

Let’s get started!

What is SaaS Billing?

In the world of tech and software, you’ve probably heard the term “SaaS”.

It stands for Software as a Service, and it’s all about using software without actually owning it. Instead of buying software and installing it on your computer, you access it online.

Now, let’s talk about the billing part. SaaS billing is how these services get paid for. It’s like your monthly Netflix subscription or your favorite gaming app’s in-app purchases. Instead of paying a big lump sum upfront, you pay a regular fee—often monthly or yearly.

So, why does SaaS billing matter?

Well, imagine running a business with different teams needing various software tools. SaaS billing makes it easy to manage because it’s flexible. Need to add or remove users? No problem, and you only pay for what you use.

Here’s the scoop: SaaS billing keeps things smooth and simple, making it a win-win for businesses and users.

One-time vs. Recurring billing

| Aspect | One-Time Billing | Recurring Billing |

| Nature | Single transaction, typically for a product or service. | Ongoing, periodic payments for continuous access. |

| Revenue Stability | Provides a lump sum of revenue at the time of purchase. | Offers a steady, predictable income over time. |

| Customer Commitment | Lower initial commitment from customers. | Establishes a long-term relationship with customers. |

| Customer Retention | Requires efforts to bring back customers for more. | Encourages customer loyalty through continuous use. |

| Flexibility | Limited flexibility for customers in payment choices. | More flexible payment options, often monthly plans. |

| Administration | Simplified billing process for one-time transactions. | Requires ongoing administration for recurring billing. |

| Adaptability | Suited for one-off purchases or specific services. | Ideal for services requiring regular updates/support. |

Importance of flexibility in SaaS billing models

In SaaS, having flexible billing models is like having a secret weapon.

Here’s why:

- Adaptability to Customer Needs: They help you tailor your billing to different needs, adjusting to what your customers want.

- Scalability for Growth: You can easily scale your billing as your business grows, avoiding a billing headache.

- Competitive Edge: They help you stay competitive by offering varied and attractive pricing in a competitive market.

- Customer Satisfaction: They ensure happy customers with flexible billing that meets their needs without fuss.

- Efficient Revenue Management: They can maximize your earnings by efficiently managing revenue streams through adaptable billing.

Challenges In SaaS Billing

As businesses witness exponential growth in the SaaS sector, navigating the intricacies of billing presents several challenges.

1. Scalability Stress:

The boon of business growth brings forth the challenge of scalability stress. A billing system, once well-suited for a modest subscriber base, may encounter difficulties accommodating the complexities associated with an expanding clientele. Managing this transition smoothly is imperative.

2. Subscription Complications:

SaaS billing can get tricky with different plans and billing cycles. The challenge is to keep things organized even with all these varied components.

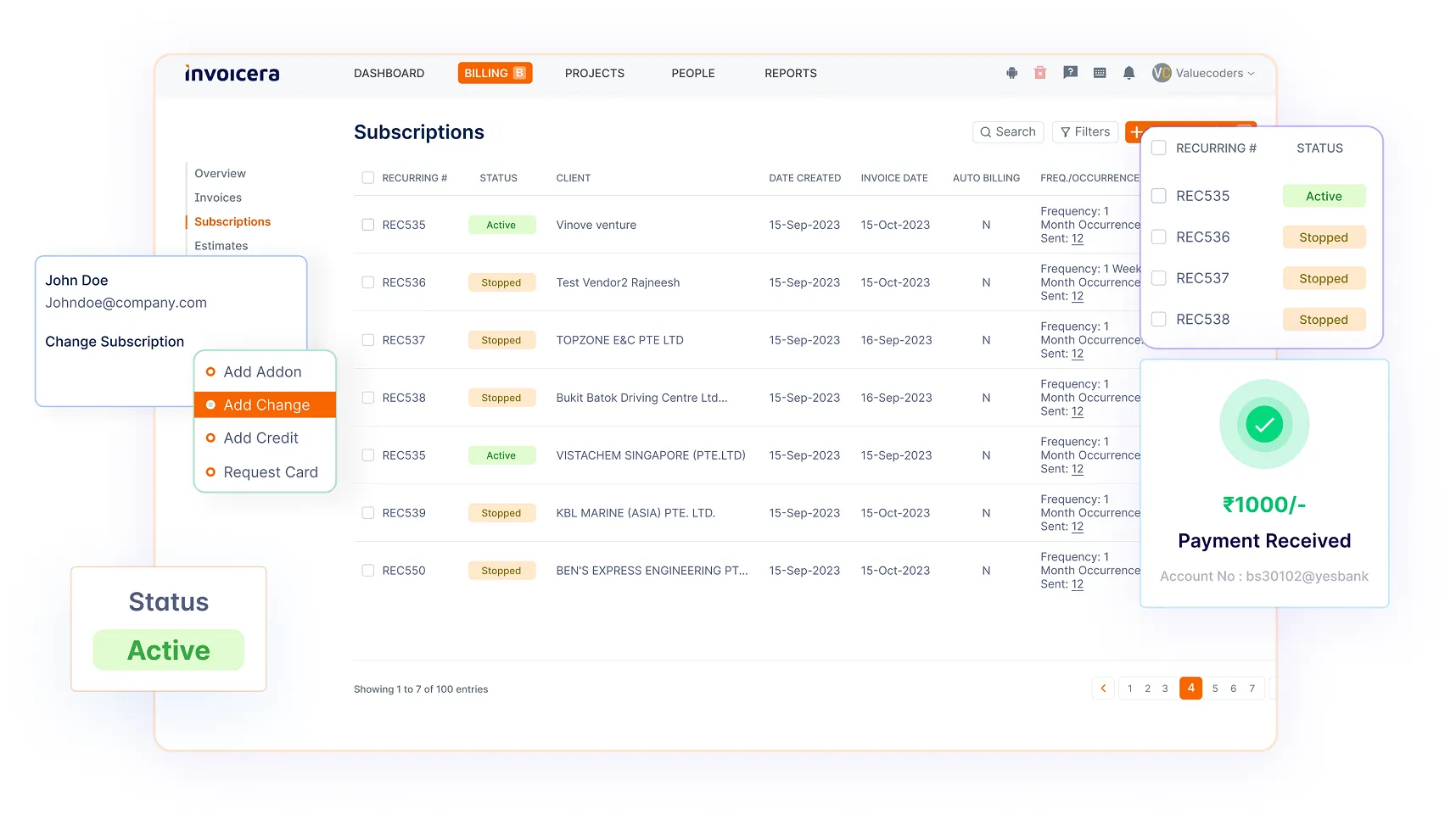

Pro Tip: Navigate the intricacies of subscription management effortlessly with Invoicera’s intuitive platform, streamlining diverse plans and billing components.

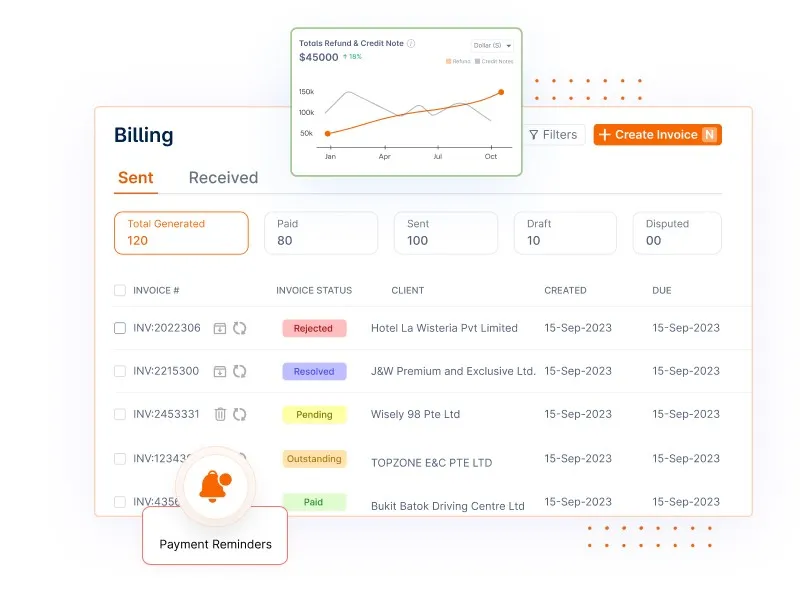

3. Late Payments Dilemma:

The persistent issue of late payments creates an intricate scenario that demands a tactful approach. Navigating through late payments requires tracking mechanisms and diplomatic client communications to ensure a steady and reliable cash flow.

Pro Tip: Bid farewell to late payment headaches – Invoicera automates payment reminders, ensuring a punctual and consistent cash flow for your SaaS venture.

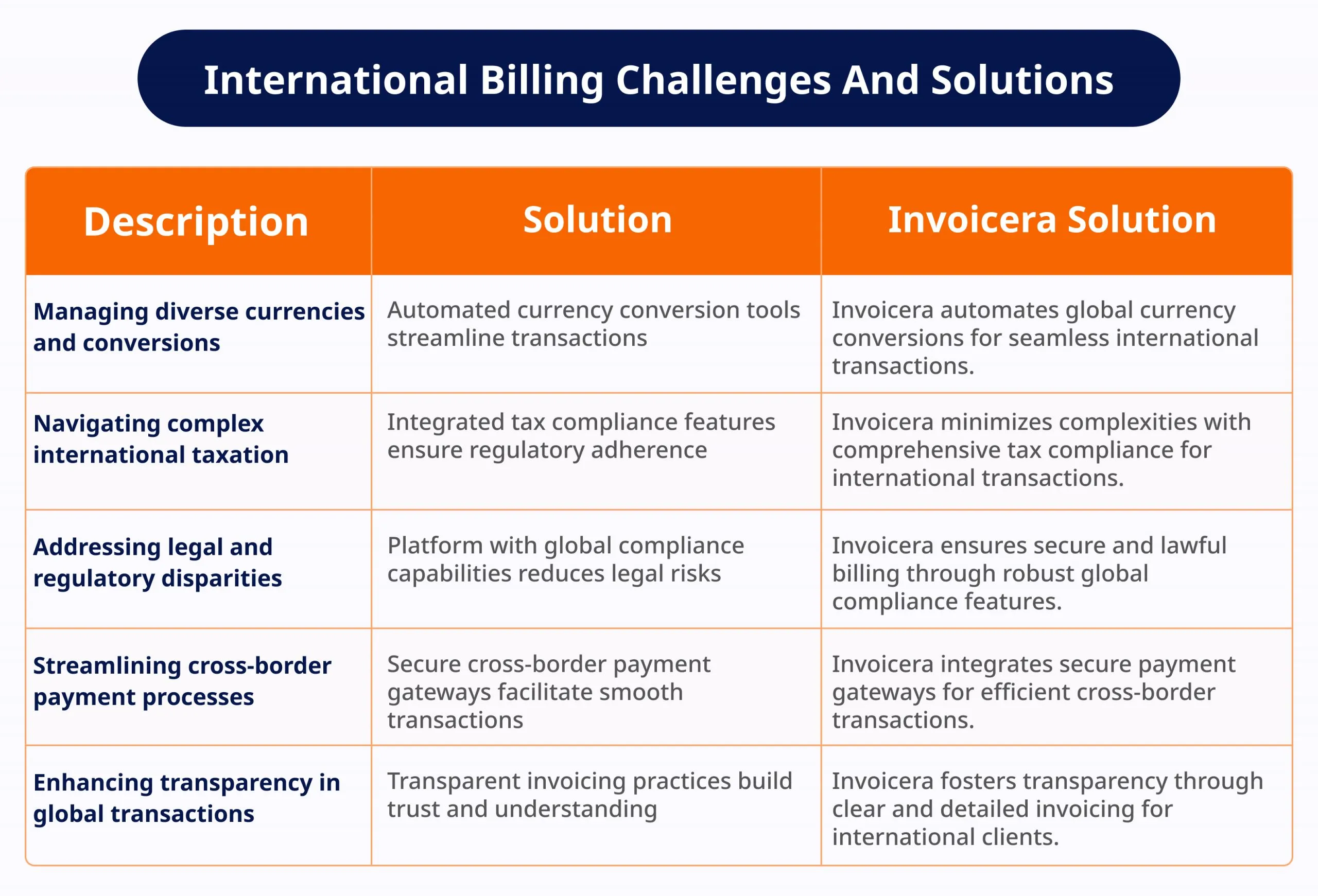

4. Compliance Complexities:

Dealing with rules, taxes, and standards from different countries around the world can be tough. SaaS companies must carefully navigate this compliance conundrum to avoid legal entanglements and maintain a reputable standing in various jurisdictions.

Pro Tip: Address international compliance with confidence – Invoicera incorporates features that facilitate adherence to diverse regulations.

5. Customer Billing Confusion:

Modern billing systems can sometimes confuse customers. The goal is to make sure invoices are clear and not too complicated, finding the right balance for clients to easily understand their bills.

Guide To Overcome SaaS Billing Challenges

We’re here to guide you through the twists and turns of SaaS billing, starting with effective strategies to overcome the challenges.

1. Recurring Billing Strategies

Ever wondered how to keep the cash flowing smoothly in your SaaS business? Recurring billing is the answer! Let’s explore some strategies:

- Tailored Subscription Plans: Customize plans to meet varied customer needs. It keeps them happy and coming back for more.

- Automated Invoicing: Set up automated systems for sending out invoices. It saves time, reduces errors, and keeps your cash flow consistent.

- Trial Periods and Discounts: Provide new users with trial periods and discounts. It’s a win-win – they get to test your service, and you gain loyal customers.

Benefits of Subscription-Based Billing

Now, why go for subscription-based billing? Here’s the lowdown:

- Predictable Revenue: Know what’s coming in each month. Subscription models offer stability in revenue, making it easier to plan and grow.

- Customer Loyalty: Customers who subscribe to a service or product are more likely to remain loyal to it. The steady income encourages you to provide excellent service, fostering customer loyalty.

- Scalability: Easily scale your business with a subscription model. As your customer base grows, so does your revenue.

Tips for Setting Up and Managing Recurring Invoices

Setting up and managing recurring invoices doesn’t have to be a headache. Check out these tips:

- Clear Terms and Conditions: Lay out the rules clearly. Ensure customers understand payment frequencies and terms.

- Flexible Payment Options: Offer multiple payment options for convenience. It boosts customer satisfaction and ensures timely payments.

- Regularly Review and Adjust: Keep an eye on your plans. Regularly review and adjust pricing to stay competitive and reflect your service’s value.

2. Tiered Pricing Models

Tiered pricing is like offering customers a menu – they choose what suits them best. Here’s a quick rundown:

- Defined Tiers: Break down your services into distinct packages or tiers. It allows customers to choose the level that meets their needs.

- Gradual Scalability: Each tier offers more features or resources. Customers can easily upgrade to a higher tier for increased benefits as they grow.

- Value-Based: Customers pay for the value they receive. It’s a fair and flexible approach, catering to various user requirements.

How to Design and Implement Tiered Pricing Structures

Now, let’s design your tiered pricing structure for success:

- Understand Customer Needs: Identify what features matter most to your customers. Tailor your tiers to cater to different user preferences.

- Clear Communication: Clearly outline what each tier includes. Avoid confusion by ensuring customers understand the value they receive at each level.

Test and Iterate: Don’t be afraid to test different pricing structures. Gather feedback, analyze data, and iterate to find the sweet spot for your audience.

This is a visual representation of Invoicera’s Tiered Pricing.

3. Usage-Based Billing

In SaaS billing, one size doesn’t always fit all. That’s where usage-based billing for SaaS comes in, providing a flexible and fair way to charge customers for what they use.

Here’s the breakdown:

- Metered Usage: Usage-based billing involves tracking the actual consumption of your service. Think of it like paying for the electricity you use – you pay for what you consume.

- Customized Pricing: Unlike flat-rate plans, usage-based billing allows you to set prices based on specific actions or features. It’s a personalized approach that aligns costs with value.

- Transparent and Fair: Users appreciate transparency. With usage-based billing, customers can see exactly what they’re paying for, promoting trust and satisfaction.

Implementing and Optimizing Usage-Based Billing

Now, let’s explore how to implement and optimize usage-based billing for maximum efficiency:

- Identify Key Metrics: Pinpoint the critical metrics that define the value of your service. Whether it’s data storage, bandwidth, or transactions, clarity on these metrics is crucial.

- Set Clear Pricing Tiers: Establish transparent pricing tiers based on the identified metrics. This helps customers choose plans that align with their needs and budget.

- Regularly Assess and Adjust: Technology and user behaviors evolve. Regularly check how you charge for what you use, and update prices based on market changes to make sure it’s fair for everyone.

- Provide Usage Analytics: Transparency is key. Give customers access to usage analytics, so that they understand their consumption patterns and make better decisions.

4. Handling Discounts and Promotions

In the bustling world of SaaS, offering discounts and promotions can be a game-changer.

Let’s unravel the importance of these strategies and discover how to wield them effectively without risking your revenue.

Importance of Discounts and Promotions in SaaS

- Customer Acquisition: Discounts attract new customers. It’s like opening your doors to a broader audience, giving them a taste of what you offer.

- Customer Retention: Keep your existing customers happy by rewarding them with promotions. It builds loyalty and ensures they stick around for the long haul.

- Competitive Edge: In a sea of choices, discounts give you an edge. Customers love a good deal, and it can decide when choosing your SaaS over others.

Strategies for Offering Discounts Without Compromising Revenue

Now, the trick is to offer discounts without taking a hit on your bottom line. Here are some savvy strategies:

- Segmented Discounts: Target specific customer segments. This way, you’re offering discounts strategically, ensuring they contribute to overall profitability.

- Bundle Offers: Combine products or services in bundles. It encourages customers to buy more, and you still maintain the overall value of your offerings.

- Limited-Time Offers: Create a sense of urgency. Limited-time discounts drive quick decisions, and customers are more likely to take advantage of the offer.

Tips for Managing Promotional Campaigns Effectively

Launching a promotional campaign isn’t just about slashing prices. It requires finesse. Consider these tips:

- Clear Communication: Clearly communicate the terms of your promotions. Avoid confusion and ensure customers understand the value they’re getting.

- Track and Analyze: Use analytics tools to see how well your promotions are doing. Understand what works and refine your strategy for future campaigns.

- Feedback Loop: Gather feedback from your customers. Learn what they liked or disliked about the promotions. It’s invaluable for refining your future campaigns.

5. Choosing the Right Billing Software

Picking the right billing software is like finding the perfect tool for a job.

Let’s uncover the importance of this choice and the key features you should be looking for:

Importance of Selecting the Right Billing Software for SaaS

- Efficiency Boost: The right billing software streamlines processes, saving time and reducing errors. It lets you focus on what is important – growing your business.

- Adaptability: As your business evolves, so should your billing processes. The right software adapts to your changing needs, ensuring you stay ahead in the dynamic SaaS landscape.

- Customer Satisfaction: A smooth billing experience translates to happy customers. Choose software that makes transactions seamless, boosting customer satisfaction and loyalty.

Key Features to Look for in SaaS Billing Tools

Not all billing tools are created equal. To make an informed decision, watch for these key features:

- Automation Capabilities: Look for tools that automate repetitive tasks like invoicing, reminders, and payment processing. It frees up your time for strategic business initiatives.

- Scalability: Opt for billing software that grows with your business. Whether you’re a startup or an enterprise, scalability ensures your billing processes can handle increasing demands.

- Integration Possibilities: Choose software that integrates seamlessly with other tools you use. This avoids data silos and enhances overall efficiency.

- Security Measures: Protecting sensitive customer data is non-negotiable. Ensure the billing software adheres to robust security standards to safeguard your business and customers.

- Customization Options: Every SaaS business is unique. Look for billing tools that allow you to customize invoices, payment terms, and other features to match your brand and business model.

Invoicera: A Comprehensive Billing Solution

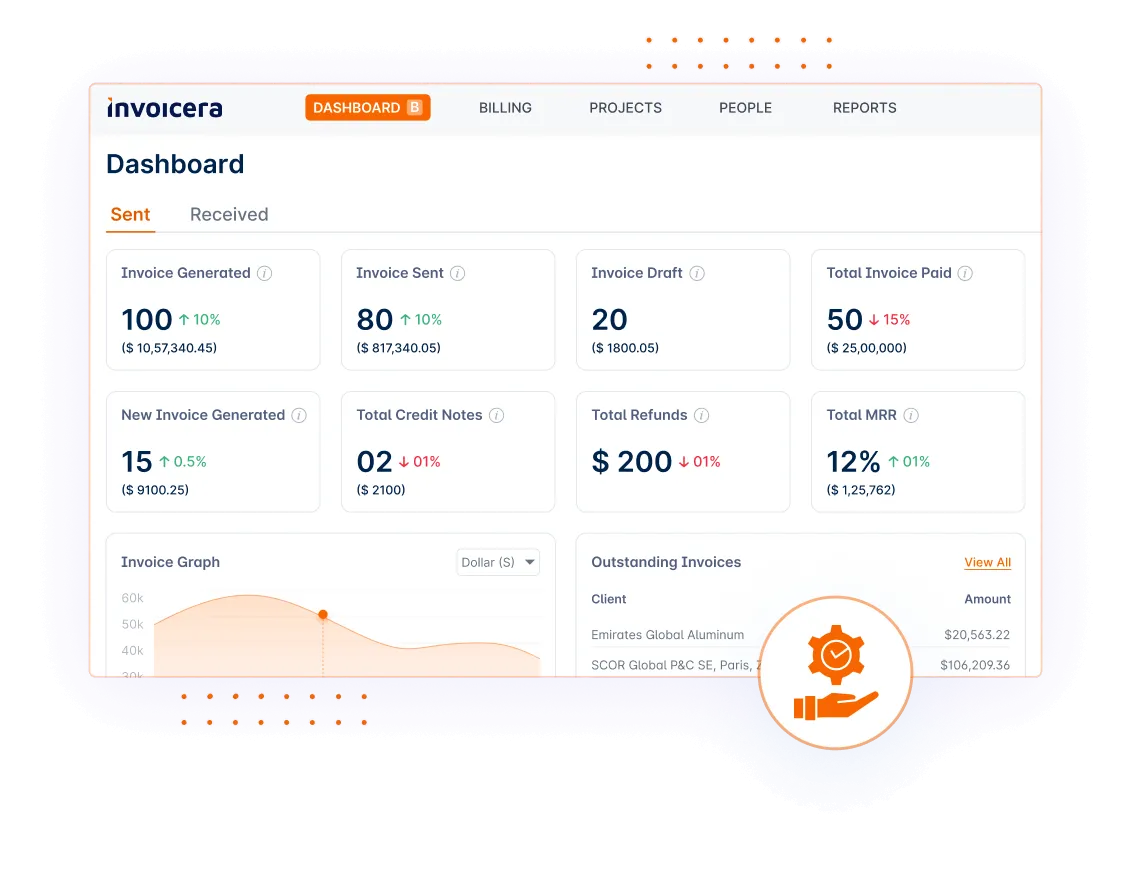

If you’re tired of SaaS billing headaches, it’s time to meet your new ally – Invoicera. This comprehensive billing solution is designed to make your SaaS billing easy.

This user-friendly platform is created to simplify your billing processes, providing a seamless experience for both you and your customers.

Features of Invoicera for SaaS Billing

- Automated Invoicing: Bid farewell to manual invoicing. Invoicera automates the entire process, saving you time and minimizing errors.

- Flexible Billing Models: Whether you prefer monthly subscriptions, tiered pricing, or usage-based models, Invoicera adapts to suit your requirements. It’s as versatile as your business demands.

- Global Currency and Taxation: Dealing with international clients? Invoicera handles global transactions effortlessly, taking care of currency conversions and ensuring compliance with diverse tax regulations.

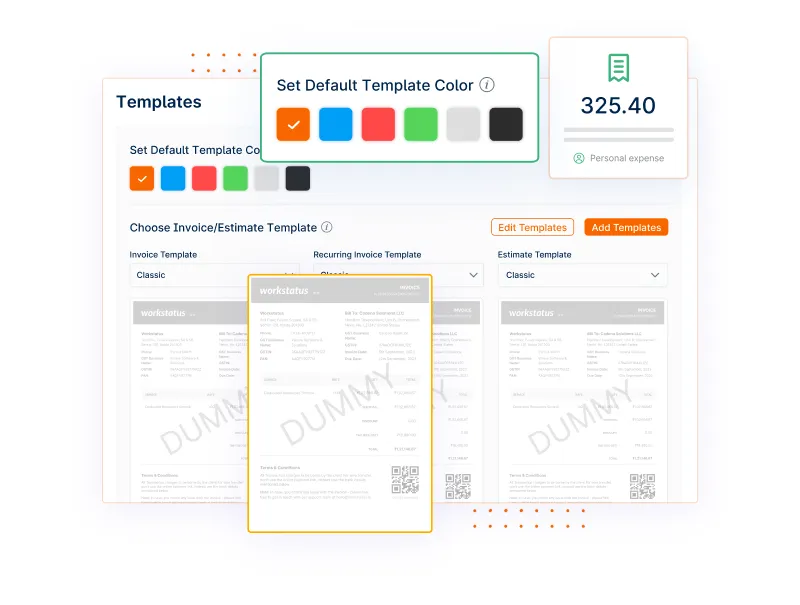

- Customizable Templates: Make your invoices reflect your brand. Invoicera offers customizable templates, giving your invoices a professional and personalized touch.

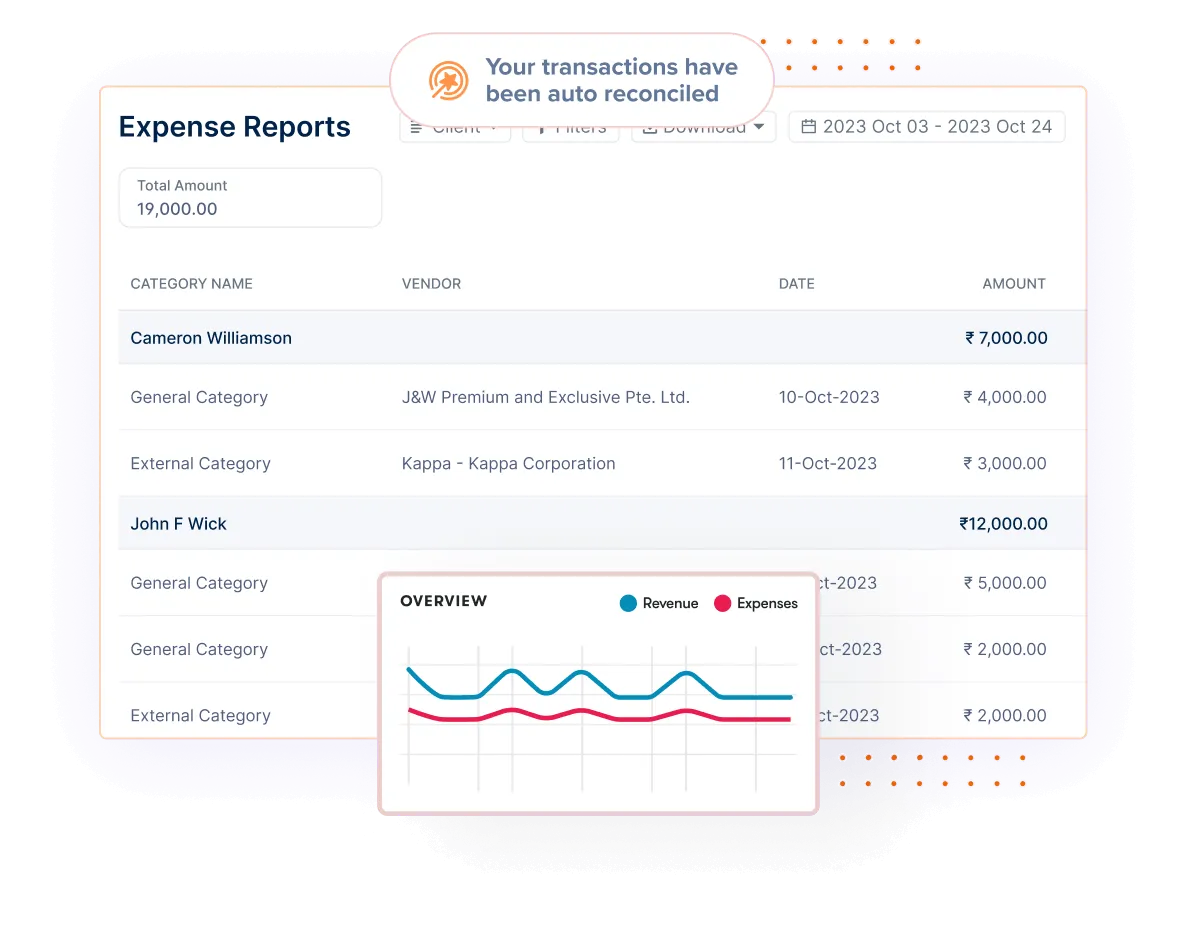

- Real-time Reporting: Stay in the loop with your business finances. Invoicera provides real-time reports and analytics, empowering you with insights for informed decision-making.

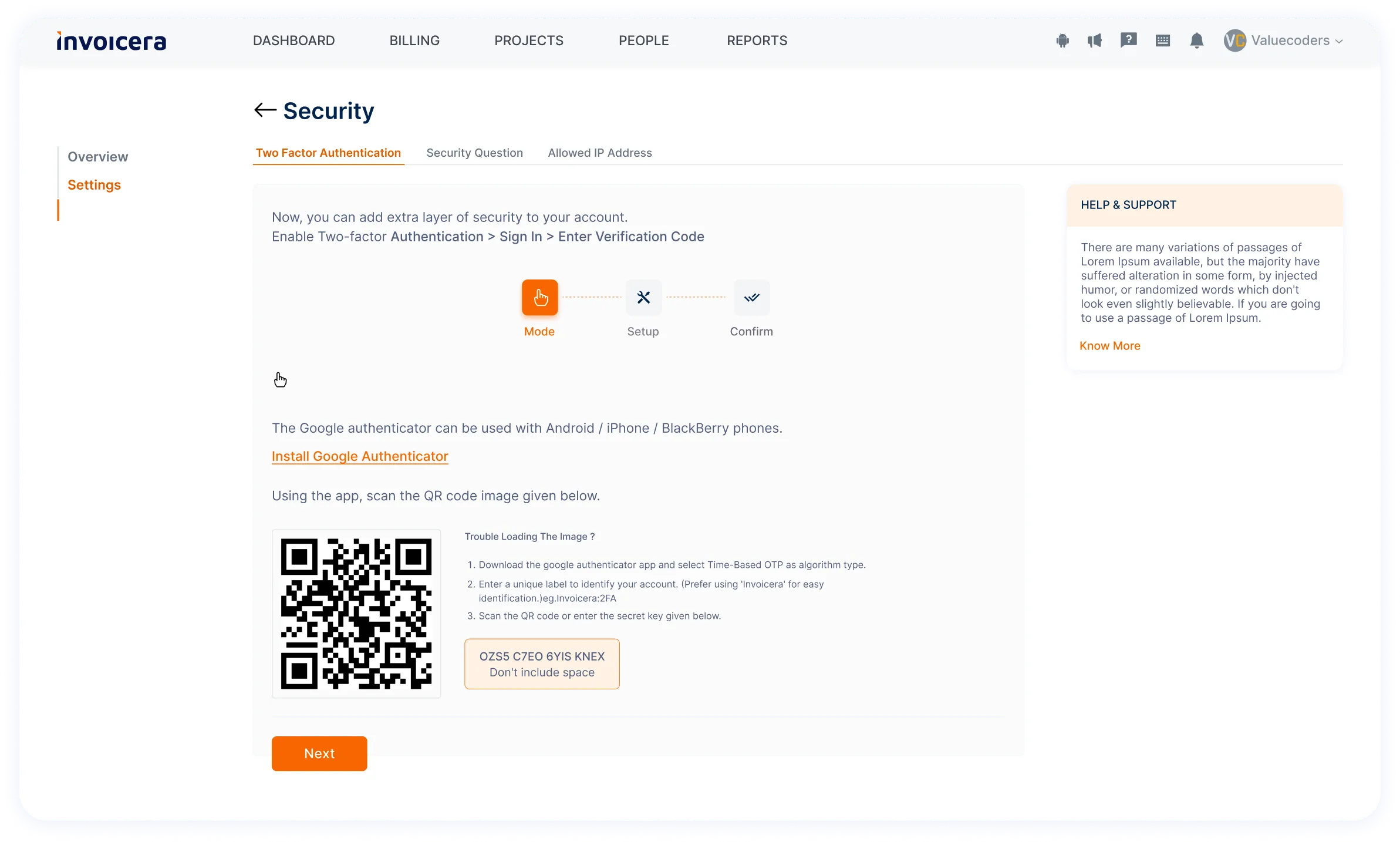

- Secure and Compliant: Security is paramount. Invoicera prioritizes data security, ensuring your sensitive information is protected. Plus, it helps you stay compliant with industry standards.

When it comes to SaaS billing, two critical aspects demand our attention: Compliance with industry standards and the unyielding need for robust data security.

Let’s delve into these vital components to ensure your SaaS billing practices stand strong on solid ground.

Importance of Compliance with Industry Standards

Here’s why compliance matters:

- Legal Safeguard: Adhering to industry standards ensures that your billing practices align with legal requirements, protecting your business from potential legal issues.

- Customer Trust: Compliance instills confidence in your customers. Knowing that you meet industry standards assures them that their data and transactions are in safe hands.

- Market Credibility: Compliance showcases your commitment to excellence. It enhances your market credibility, making your SaaS offering more attractive to potential clients.

Strategies for Ensuring Data Security in SaaS Billing

The below strategies will fortify your SaaS billing system against security threats:

- Encryption Protocols: Implement robust encryption protocols to protect data during transmission. This shields customer information from unauthorized access.

- Access Controls: Limit access to sensitive billing data. Set up strict access controls so only the right people can see or change important information.

Compliance Checklist for SaaS Billing

Ready to ensure your SaaS billing practices meet the highest standards? Here’s a handy compliance checklist:

- Legal Framework: Confirm that your billing practices comply with regional and international legal standards.

- Access Management: Ensure proper access controls are in place, restricting data access to authorized personnel only.

- Regular Audits: Schedule routine security audits to identify and address vulnerabilities promptly.

- Documentation: Maintain comprehensive documentation of your compliance efforts. It serves as evidence of your commitment to industry standards.

Conclusion

As we wrap up our guide on navigating SaaS billing, let’s recap the key takeaways:

- Simplify with Invoicera: Integrate Invoicera for a streamlined SaaS billing experience. Its features can simplify complexities and enhance efficiency.

- Master Recurring Billing: Tailor plans, automate invoicing, and offer trials – the trio that keeps the cash flowing and customers smiling.

- Subscription Power: Embrace subscription models for predictable revenue, customer loyalty, and scalable growth.

- Don’t Ignore Security: Encrypt, control access, and audit on regular basis to protect your billing software against security threats.

- Compliance Matters: Align with industry standards, build trust, and enhance your market credibility.

When we talk about SaaS billing, success lies in these strategies and tools.

Remember, billing excellence is a journey, not a destination. Implement these insights, adapt to changes, and chart your course toward billing success.