In any business, it is very crucial to manage expenses.

Thus, companies are always looking for the right tools or ways to manage cash flow, ultimately leading to better financial decisions.

One of the ways to manage cash flows is by choosing the best employee expense card.

Statistics from a recent survey by ExpenseMate Inc. revealed that 73% of businesses struggle with managing employee expenses effectively, leading to potential financial leakages and administrative headaches.

Thus, this guide will cover the essential factors and considerations that can help your company choose the perfect employee expense card.

From understanding your unique company needs to exploring the latest innovative tools like Invoicera’s expense report feature, let’s navigate the landscape together to empower your company’s financial efficiency.

What Are Employee Expense Cards?

Employee expense cards, also known as corporate expense cards or company cards, are specialized payment cards issued by companies to their employees for business-related spending.

These cards are designed to streamline and simplify managing employee expenses.

They work similarly to debit or credit cards but are specifically intended for business purposes. Employees use these cards to make purchases related to their work, such as buying supplies, paying for travel expenses, or covering client meeting costs.

Expense cards have specific features and controls that help companies monitor and manage spending effectively. These cards offer benefits such as customizable spending limits, real-time tracking of transactions, and seamless integration with accounting software.

A key advantage of these cards is their ability to separate business expenses from personal ones. This makes it easier for employees and the company to accurately track, report, and reconcile costs. when taking into account employee benefit plans.

In essence, employee expense cards are a convenient and efficient way for businesses to enable their employees to make necessary purchases while maintaining oversight and control over company spending.

Why Use Expense Cards?

Expense cards offer a streamlined way to manage employee spending, providing numerous benefits that simplify your company’s financial processes.

- Control and Oversight: Expense cards enable employers to set spending limits for each employee, ensuring expenditures stay within budget. This control helps prevent overspending and allows for better oversight of company finances.

- Ease of Use: These cards make it easy for employees to make purchases without using personal funds. With a dedicated card, they can swiftly cover business expenses without hassle, reducing the need for reimbursement requests.

- Real-time Monitoring: Expense card systems often provide real-time tracking and monitoring features. This means supervisors can instantly view transactions, helping them stay updated on spending and flag any unusual activity promptly.

- Improved Record-Keeping: Using expense cards simplifies record-keeping. Transaction details are typically logged digitally, eliminating the need for manual paperwork. This streamlined process saves time and minimizes errors in expense reporting.

- Expense Reporting and Integration: Many expense card systems integrate with accounting software or dedicated expense management tools. This integration facilitates seamless expense reporting, making generating accurate reports for reimbursement or tax purposes easier.

- Enhanced Security: Most expense cards have security features like spending limits, card deactivation, and fraud protection. These measures safeguard against unauthorized transactions and ensure the safety of company funds.

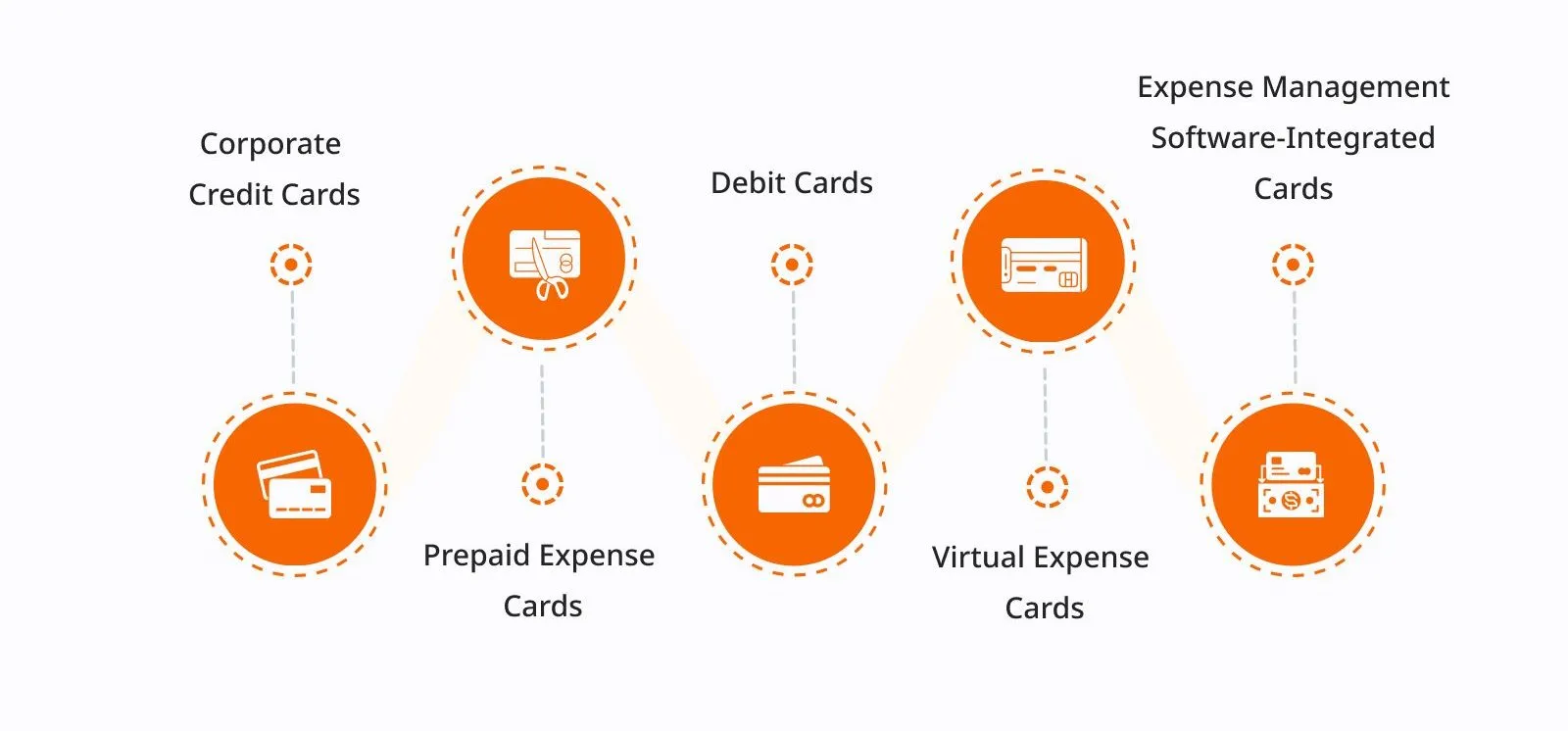

Types Of Employee Expense Cards

A range of employee expense cards is available, each designed to fit various company requirements and the spending patterns of employees. Knowing about these different types can assist you in selecting the most suitable one for your company’s needs.

1. Corporate Credit Cards

These are traditional credit cards issued by banks or financial institutions specifically for business use. Corporate credit cards offer a line of credit and are typically issued under the company’s name.

They offer convenience for large expenses and often come with rewards programs. However, they may require personal guarantees and have higher credit limits, posing potential risks for overspending.

2. Prepaid Expense Cards

Prepaid cards are funded with a particular amount of money upfront, and employees can only spend the available balance.

They don’t require a credit check and are suitable for controlling spending limits. However, they may lack the same perks as credit cards and might not help build credit history.

3. Debit Cards

Similar to prepaid cards, debit cards use the company’s existing funds rather than extending credit. They are directly linked to the company’s bank account, offering real-time spending tracking.

While they limit overspending, they may lack some of the perks and protections offered by credit cards.

4. Virtual Expense Cards

These are digital cards that don’t have a physical form. They are primarily used for online purchases and can be easily created, managed, and deactivated.

Virtual cards offer enhanced security as the card details are often unique for each transaction, reducing the risk of fraud.

5. Expense Management Software-Integrated Cards

Certain expense management software offers integrated cards that work seamlessly within their platform.

These cards streamline expense reporting by automatically syncing transactions with the software.

They provide real-time tracking and detailed insights into spending patterns.

Factors To Consider While Choosing An Expense Card

Factors To Consider While Choosing An Expense Card

Consider these crucial factors before choosing an expense card:

Assess Company Needs

Take a moment to assess your company’s spending patterns and requirements. Consider the frequency and volume of expenses incurred by your employees. Understanding these specifics will guide you toward an expense card that fits seamlessly with your financial flow.

Card Features and Limitations

Each expense card comes with its own set of features and limitations. Pay attention to the details. Look for cards that offer spending controls, easy integration with your accounting systems, and real-time expense monitoring.

Equally important is being aware of limitations like transaction fees, withdrawal limits, and any upfront costs.

Security and Fraud Protection

Keeping your company’s finances secure is paramount. Prioritize expense cards that offer robust security measures and effective fraud protection.

Features like EMV chips, real-time alerts for suspicious activities, and clear liability policies are non-negotiable when safeguarding your company’s funds.

User-Friendly Interface and Accessibility

An expense card is only as good as its usability. Opt for user-friendly cards for your employees, especially those with intuitive mobile apps, for easy access and management. Accessibility for remote workers should also be a factor to consider in today’s flexible work environment.

Integration With Accounting Software

Consider cards that integrate seamlessly with your accounting software.

For instance, Invoicera’s expense report feature can streamline expense tracking and reporting, enhancing the overall efficiency of your expense management process.

These factors are critical to consider when choosing an expense card. Choose the one that perfectly aligns with the needs of your company.

Invoicera’s Expense Reports Can Help You

Invoicera stands out with its user-friendly interface and robust functionalities tailored for expense tracking and reporting. Its expense report feature simplifies the intricate task of monitoring employee spending, offering a comprehensive view of all expenses.

Complementing Expense Card Management

Integrating seamlessly with expense cards, Invoicera adds an extra layer of efficiency to the expense management process. It syncs effortlessly with various card systems, allowing for easy synchronization and categorization of expenses.

Specific Benefits and Functionalities

- Customized Reporting: Generate detailed reports based on specific criteria like time-periods, projects, or categories, providing a clear breakdown of expenditures.

- Real-time Monitoring: Track expenses in real-time, enabling immediate oversight and control over company spending.

- Streamlined Approval Process: Simplify the approval process for expense reports, facilitating quicker employee reimbursements.

- Integration Capabilities: Seamlessly integrates with existing accounting software, ensuring a smooth flow of expense data for accurate financial records.

Invoicera’s expense report feature acts as a reliable companion, addressing the nuances of expense management with simplicity and effectiveness.

This tool’s ability to streamline expense tracking and reporting empowers companies to make informed decisions, optimize spending, and maintain financial transparency effortlessly.

Choosing the right employee expense card is crucial, and coupling it with Invoicera’s expense report feature amplifies its efficiency, making expense management an effortless endeavor for your company.

Conclusion

Selecting the right employee expense card for your company is crucial to streamline your expense management process and enhance financial control. By assessing your company’s specific needs, considering card features, prioritizing security, and ensuring user accessibility, you can make an informed choice that matches your goals.

Remember, there isn’t a one-size-fits-all solution. Each card provider offers unique features and limitations. It’s essential to match these with your company’s spending patterns, employee dynamics, and growth plans.

Consider exploring tools like Invoicera’s expense report feature to complement your expense card choice. Its functionalities can significantly elevate your expense tracking and reporting, simplifying the management process further.

Ultimately, by taking the time to research and analyze available options, you can pave the way for smoother expense management, tighter financial control, and improved operational efficiency within your organization.

FAQs

How do I determine which expense card is best for my company?

Start by evaluating your company’s spending patterns, volume of expenses, required features (such as spending controls and integration with accounting software), security measures, and ease of use for employees. Compare these factors across different card providers to find the best fit.

Are expense cards secure?

Reputable expense card providers offer robust security measures such as EMV chips, real-time alerts, and strong fraud protection policies to ensure the safety of transactions and sensitive financial information.

How important is it to tailor the choice of an expense card to my company’s specific needs?

It’s crucial. Each company has unique spending patterns and employee dynamics. Choosing an expense card that aligns with your company’s requirements ensures optimal functionality, smoother operations, and better financial control.