No business wants to wait longer than average to get paid for their invoices.

We understand late payments are most annoying for any business. Not only this, it can also affect your cash flow, eventually disturbing your financial planning for the future.

SMEs are estimated to spend 4 hours per week on the task of chasing late payments.

So, what’s the reason behind getting paid late?

“Not adding clear payment terms.”

By not focussing on adding clear terms of payment, you not only receive late payments but also,

- Create confusion and disputes between you and your clients

- Face potential legal issues

- Hamper your business’s professional reputation

- Risk damaging your business relationships

- Become prone to financial instability

Looking at the above pointers, payment terms and conditions in the invoices benefit every business.

Moving forward, in this blog post, we will cover every minor and significant detail about invoice payment terms to help you safeguard your business.

Here’s what we will explore:

- What are payment terms, and how do you add them to invoices?

- Which terms are important to mention?

- Payment terms’ challenges and solutions.

- How to get paid faster by adding payment terms?

Let’s give it a quick read.

What Are Payment Terms?

Picture this: You’ve just delivered a batch of top-notch products to a client. They’re thrilled with your service, and now it’s time to talk about money.

Payment terms are the rules of this money-talk game. They’re the conditions that dictate when and how the money changes hands.

These terms are the backbone of your business transactions.

It includes the due date, preferred payment method, and penalties if the payment is late.

Significance of Payment Terms

So, why are these payment terms so important?

Well, they’re like the GPS of your financial journey. When you and your client or supplier agree on clear payment terms, you set the course for a smooth and predictable process.

This predictability fosters trust and transparency, making your business relationships healthy and solid.

Unclear payment terms can lead to confusion and disputes.

Imagine a scenario where both parties have their interpretation of when the payment is due. Chaos, right? This is why payment terms exist – to prevent such chaos.

Variations Across Industries

Different industries have their unique language of payment terms.

For example, if you’re in the retail game, you might offer “Net 30” terms, giving your customers a generous 30 days to pay.

But if you’re in construction industry, it’s all about progress payments – where money flows in as projects hit key milestones.

Understanding these industry-specific variations is like speaking the language of business fluently. It allows you to tailor your payment terms to your business’s unique needs.

Who Determines Payment Terms?

Now that you know what payment terms are and why they’re vital, you might be wondering: who holds the power in determining these terms?

In most circumstances, two parties – you and your client or supplier – negotiate the payment conditions. It’s a team effort, and the goal is to agree on terms that work for everyone.

Of course, there are norms in the industry and legal laws to consider. In some situations, these factors may influence the outcome of the discussions.

However, the key is open communication and flexibility.

Ultimately, the payment terms that you agree upon will be outlined in your contract or invoice.

These terms become the guiding light for your financial journey, ensuring that you and your business catch the same rhythm regarding payments.

Importance Of Payment Terms

Payment terms are like the silent rules of the business game. They might not grab the spotlight, but they play a crucial role in ensuring the business runs smoothly and everyone involved is on the same page.

Let’s explore why payment terms are so vital in safeguarding your business:

1. Predictable Cash Flow:

Imagine running a business without any clear payment terms. In such a scenario, payments might arrive at unpredictable times, making it nearly impossible to plan your finances.

Payment terms provide the predictability you need for a stable cash flow. They set expectations about when you’ll get paid, allowing you to manage your expenses, investments, and growth more effectively.

2. Relationship Trustworthiness:

In any business, transparent and fair payment terms help build trust with your clients or suppliers.

When everyone knows clearly what to expect and when to expect it, it eliminates the potential for misunderstandings and disputes.

3. Financial Health:

For a business to thrive, it needs to be financially healthy. Unclear payment terms lead to late payments, putting your business at financial risk.

Thus, to remain financially stable, payment terms are necessary.

4. Professional Reputation:

Your business reputation matters!

Clear payment terms project professionalism and reliability. Customers and suppliers are more likely to view your business favorably when you have transparent and well-defined payment terms.

This reputation can open doors to new opportunities and collaborations.

5. Legal Protection:

In some cases, clear payment terms can provide a legal safety net. It helps outline the terms and conditions of the payment agreement, making it easier to resolve disputes and seek legal recourse if necessary.

This added layer of protection can be vital when navigating complex business transactions.

It is essential to know that payment terms are a cornerstone of your business’s financial stability and reputation.

You can run your business smoothly by understanding and using them effectively.

What To Consider When Specifying Payment Terms?

Here’s what you need to consider when specifying payment terms for your business transactions:

Clear Language: Ensure that your payment terms are written in clear and understandable language. Avoid using complex legal terms.

Due Date: Clearly state the due date for the payment. This is the date by which the payment should be received. Use a specific calendar date to avoid any confusion.

Payment Method: Specify the accepted payment methods, whether credit card, bank transfer, check, or online payment platforms.

Late Fees: If applicable, mention any late fees or penalties for overdue payments.

Discounts or Incentives: Consider offering discounts or incentives for early payments. This can motivate clients to settle their invoices ahead of the due date.

Currency and Exchange Rates: If your business deals with international clients, specify the currency in which payment should be made.

Payment Frequency: For ongoing services, clarify whether payments are due on a monthly, quarterly, or yearly basis.

Credit Terms: If you’re extending credit to clients, outline the credit terms, including the credit limit, interest rates (if any), and repayment schedule.

Dispute Resolution: Include a section for dispute resolution procedures in case of disagreements or discrepancies regarding payments or services.

Termination Clauses: In long-term contracts, specify the conditions under which either party can terminate the agreement, including any associated fees or obligations.

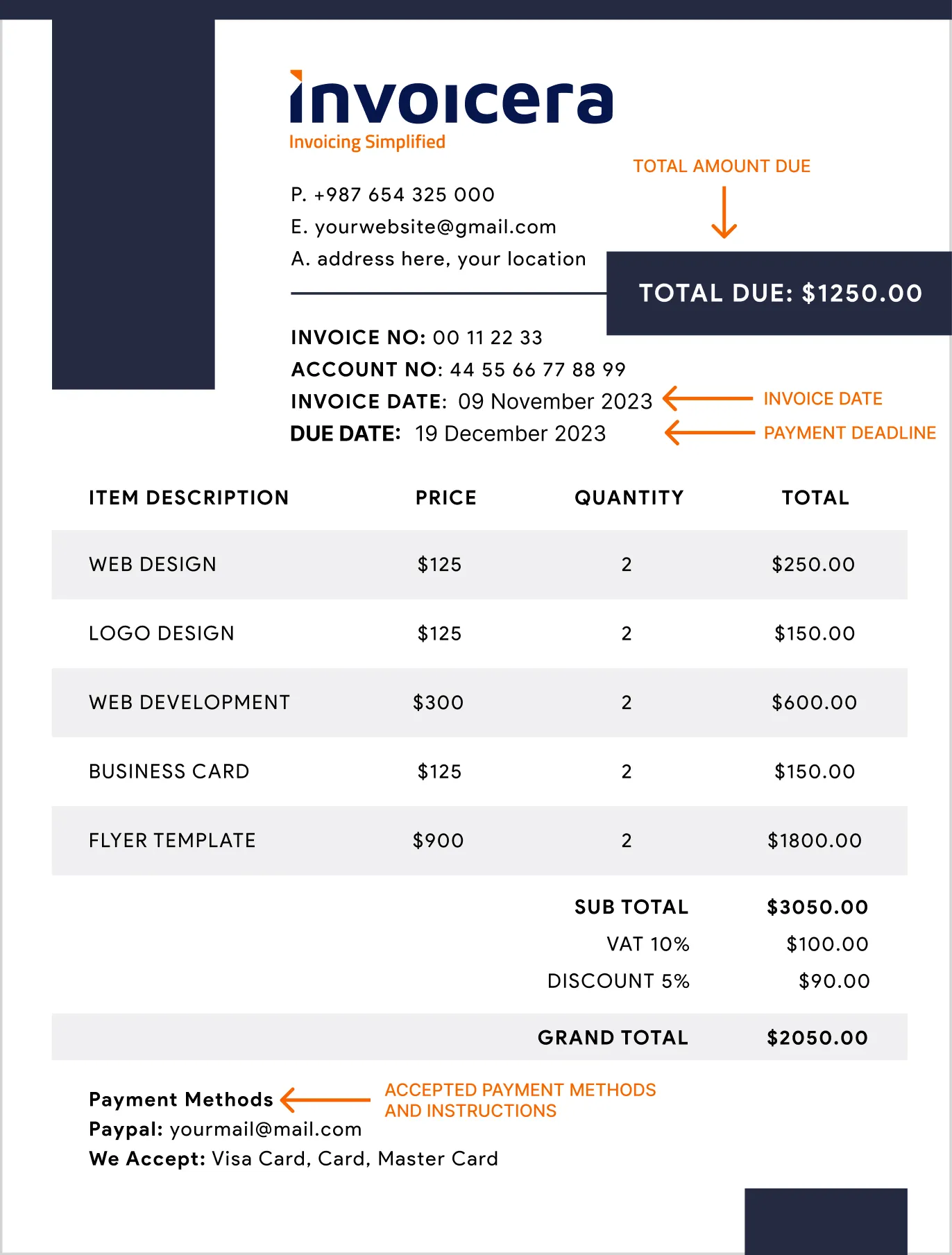

Where To List Payment Terms On Invoice?

After knowing about payment terms, it’s equally important to know where to place them on your invoice. Have a look:

- Invoice Date: Mention the invoice date in the header section.

- Due Date: Boldly highlight the due date so it stands out on the invoice and captures the recipient’s attention.

- Invoice Total: Mention the total invoice amount due to your customer.

- Late Fees: If late fees apply, indicate this prominently to encourage timely payments.

- Payment Method: State the accepted payment methods and provide any relevant account or contact information for each method.

Payment Terms and Cash Flow Management

Payment terms play a pivotal role in maintaining a healthy cash flow. Have a look at the important aspects:

Impact of Payment Terms on a Business’s Cash Flow

Payment terms aren’t just about when you get paid; they’re about how and when to help you efficiently use that money to run your business. Here’s how it works:

- Positive Cash Flow: By receiving early payments, you have more money at your disposal sooner. It helps cover your immediate expenses, invest in growth, and seize opportunities as they arise.

- Negative Cash Flow: Delayed payments can lead to cash flow bottlenecks. You might find it challenging to meet your operational costs, which could stall your growth plans.

- Unpredictable Cash Flow: Irregular or unpredictable payment patterns can make it difficult to budget and plan for your business’s future. This unpredictability can hinder your ability to manage your finances effectively.

Cash Flow Strategies With Different Payment Terms

Now, let’s explore cash flow strategies tailored to different payment terms. Here are a few tips to help you stay on top of your finances:

- Short Payment Terms (e.g., Net 15): Enjoy the advantage of quick payments by offering discounts for early payments. This can incentivize clients to pay promptly, improving your cash flow.

- Longer Payment Terms (e.g., Net 60): While waiting for payments, consider establishing a line of credit with your bank to bridge any gaps in cash flow. This can help you manage your operational expenses smoothly.

- Progress Payments: In industries where progress payments are standard, closely monitor project milestones. Efficiently managing these milestones ensures you receive funds as work advances, reducing cash flow interruptions.

- Diversify Your Payment Methods: Accept various payment methods, including credit cards or online payment platforms. This can speed up the payment process and enhance cash flow.

- Implement Effective Invoicing And Follow-Up: Send invoices promptly and follow up on payments as per the agreed terms. Consistent communication can encourage timely payments.

Challenges & Solutions Related to Payment Terms

We have listed a few challenges & solutions businesses face while dealing with payment terms and solutions.

Challenge 1: Payment Security

Challenge: One of the foremost concerns in business transactions is payment security.

How do you ensure that the payment you’re expecting will be made securely and without risk?

- Encrypted payment gateways that protect your transactions from unauthorized access.

- Secure and compliant data storage that safeguards your sensitive financial information.

Challenge 2: International Payment Terms

As businesses expand globally, they often encounter the complexity of international payment terms, currency conversions, and differing regulations.

Solution: Invoicera simplifies international transactions with:

- Multi-currency invoicing, allowing you to invoice in your client’s preferred currency.

- Automated currency conversion, eliminating the headache of manual calculations.

- Compliance with international tax and legal requirements.

Challenge 3: Inconsistent Payment Methods

Dealing with multiple payment methods, from credit cards to bank transfers, can be overwhelming and time-consuming.

Solution: Invoicera streamlines payment methods by:

- Accepting a wide range of payment options accommodating your client’s preferences.

- Centralizing payment data, making it easy to track and manage.

- Providing a user-friendly interface for clients to make payments conveniently.

Challenge 4: Payment Tracking

Keeping track of due dates, payment statuses, and outstanding invoices can become a daunting task as your business grows.

Invoicera simplifies payment tracking with the following:

- Real-time dashboard insights, allowing you to monitor the progress of invoices.

- Automated reminders for upcoming due dates, reducing the risk of overdue payments.

- Easy access to detailed payment histories.

Challenge 5: Legal and Compliance Issues

Payment terms often have legal and compliance implications that should be navigated carefully to avoid potential issues.

Solution: Invoicera ensures legal and compliance adherence by:

- Generating legally compliant invoices that can be customized to meet specific regional requirements.

- Maintaining thorough records for tax and audit purposes, keeping your business in good legal standing.

Make Invoicera your business partner and tackle every challenge related to payment terms.

Get Faster Payments With Payment Terms

Let’s explore some practical strategies to help you receive payments faster.

1. Use Polite Language

Polite language in your payment communications can go a long way in maintaining positive client or supplier relationships.

2. Establish Clear Deadlines

Be sure to outline due dates that are easy to understand, and make sure they align with your business needs.

This clarity reduces confusion and increases the chances of timely payments.

3. Reduce Payment Periods

One effective way to speed up payments is by shortening your payment periods.

If you usually give your clients 60 days to pay, consider whether 30 days would work just as well.

Shorter payment terms often mean less time for procrastination.

4. Add Late Fees

Implementing late fees within your payment terms can encourage clients to prioritize timely payments.

Be sure to communicate this policy upfront clearly.

5. Provide Multiple Payment Options

People have their preferred payment methods.

To accommodate various preferences and speed up payments, offer multiple payment options.

Whether it’s credit cards, electronic transfers, or even old-school checks, the more options you provide, the easier it is for your clients to pay you promptly.

Reward Early Payments

Offer incentives, such as discounts or other perks. Your clients or suppliers may appreciate the extra motivation to settle their invoices before the due date.

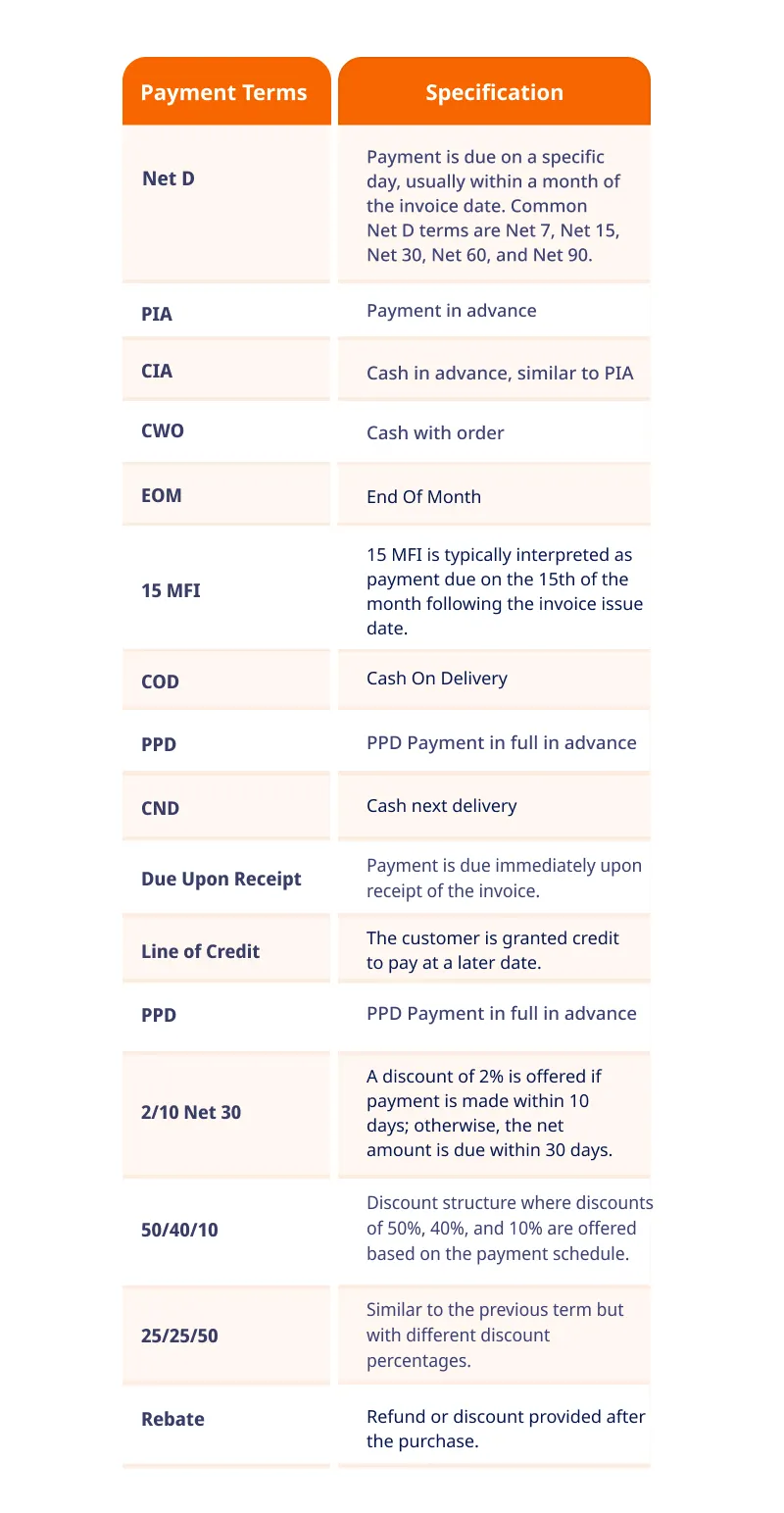

| EARLY PAYMENT DISCOUNT TERMS | MEANING |

| 2/10, Net 30 | 2% off if paid in 10 days, the net amount due in 30 days |

| 1/15, Net 45 | 1% off if paid in 15 days, the net amount due in 45 days |

| 3/5, Net 60 | 3% off if paid in 5 days, the net amount due in 60 days |

| 2/20, Net 90 | 2% off if paid in 20 days, the net amount due in 90 days |

| 5/10, Net 15 | 5% off if paid in 10 days, the net amount due in 15 days |

| 1/5, EOM | 1% off if paid within 5 days after the end of the month. For example: If the month ends on 31 July, you will get 1% off if paid till 5 August. |

| 1/2, Prox 10 | 1% off if paid in 2 days after delivery, net amount due in 10 days |

Final Thoughts

Time is money!

Remember, it’s not just about getting paid; it’s about getting paid on time.

By adding payment terms with care and precision, you can ensure your business’s financial stability.

Key Takeaways:

- Payment terms are the backbone of your financial health in business.

- You must mention payment terms precisely for smooth financial operations.

- Use an automated invoice software like Invoicera and add payment terms automatically in every invoice.

FAQs

What are the most common payment terms used in business transactions?

Common payment terms include Net 30, Net 60, Cash on Delivery (COD), and progress payments. These terms determine the due date and the conditions to make the payment.

What if a client refuses to agree to payment terms?

If a payment is late or not in accordance with the agreed-upon terms, it is critical to follow up as soon as possible. You can issue reminders, charge late fees, and, as a last option, think about legal action. Open communication is essential for solving challenges.

Can I change my payment terms?

Yes, you may modify your payment terms, but you have to discuss it with the other party. Inform them in advance of the changes, and be ready to talk and negotiate if required. It is critical to retain transparency and fairness when making changes to your payment conditions.