Introduction

Imagine a customer comes to you and asks for your services, but you are not able to provide the payment option of their choice.

This will eventually make the customer unhappy, and they can take back their decision of choosing you.

But don’t worry! Bill Gates once said, “Your most unhappy customers are your greatest source of learning.”

Give a chance to payment solution software and grow your small business.

Payment processing solutions are expected to grow to $120 billion by 2025.

Source: Markets and Markets

But the question is, “How to choose and set up the solution?”

This digital age comes with convenience but also with a lot of challenges while setting up software solutions.

We have compiled a list of popular options, such as Square, PayPal, Stripe, etc., with their features, security, and integration capabilities while spotlighting a comprehensive invoicing solution, Invoicera.

All the payment options are so easy to set up and offer good customer support if you have any doubts.

Let’s get started with the guide.

What Is A Payment Solution Software?

Payment solution software helps businesses to securely handle and process financial transactions digitally. Think of it as a virtual cashier—customers can use it to pay for products or services online or in-store, and businesses can easily track their earnings.

This software comes with various features, such as processing credit card payments, managing invoices, and even handling different currencies. It acts as a bridge between a customer’s payment and a business’s bank account, ensuring a smooth and efficient money exchange.

How Payment Software Help Growing Small Businesses?

Adopting payment solution software can be a game-changer for small businesses aiming to expand.

Here’s how:

Streamlined Transactions:

Payment software simplifies the payment process, reducing the time customers spend at the checkout. This efficiency not only enhances the overall customer experience but also allows businesses to serve more customers in a shorter time, fostering growth.

Diverse Payment Options:

Modern payment software accommodates various payment methods, from credit cards to digital wallets. This versatility attracts a broader customer base, as people have the flexibility to pay using their preferred method, ultimately boosting sales.

Efficient Invoicing:

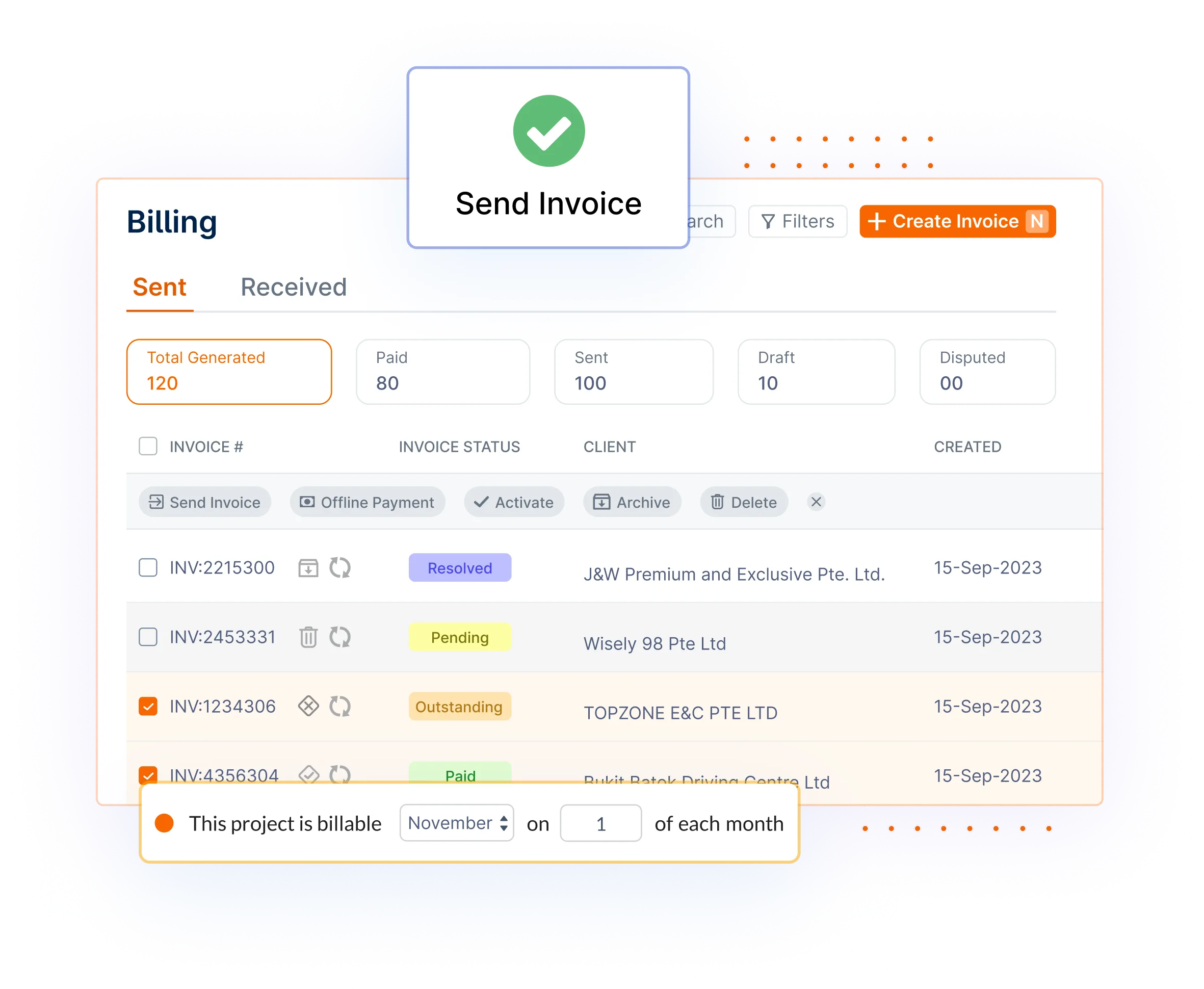

Many payment solutions, including Invoicera, offer robust invoicing features. This means businesses can easily generate and send professional invoices to clients, keeping track of transactions and ensuring timely payments. This streamlined invoicing process contributes to better financial management.

Global Reach:

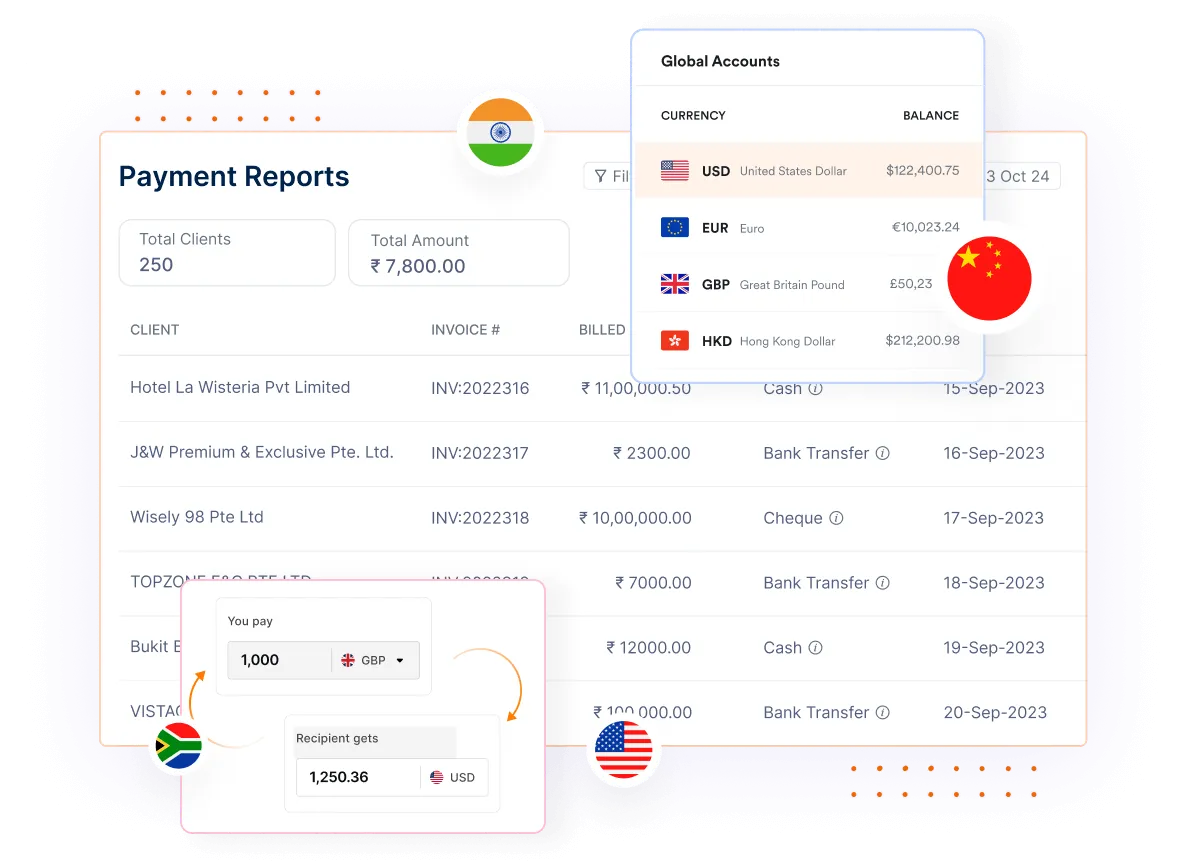

As businesses grow, they may expand beyond local borders. Payment software often supports multiple currencies and global transactions, which helps in managing international business and opening new avenues for revenue.

Data Insights:

Payment solution software provides valuable insights into transaction data. Small businesses can analyze customer spending, and identify popular items, and after analyzing they can improve offerings and marketing strategies.

Enhanced Security:

Security is a top priority in the digital age, and payment software ensures secure transactions. Features like encryption and compliance with industry standards protect both businesses and customers from potential fraud, building trust in the brand. For companies with elevated transaction risks, utilizing a high risk payment gateway can offer additional layers of fraud detection and security to ensure seamless and safe payment handling.

8 Popular Payment Solution Software

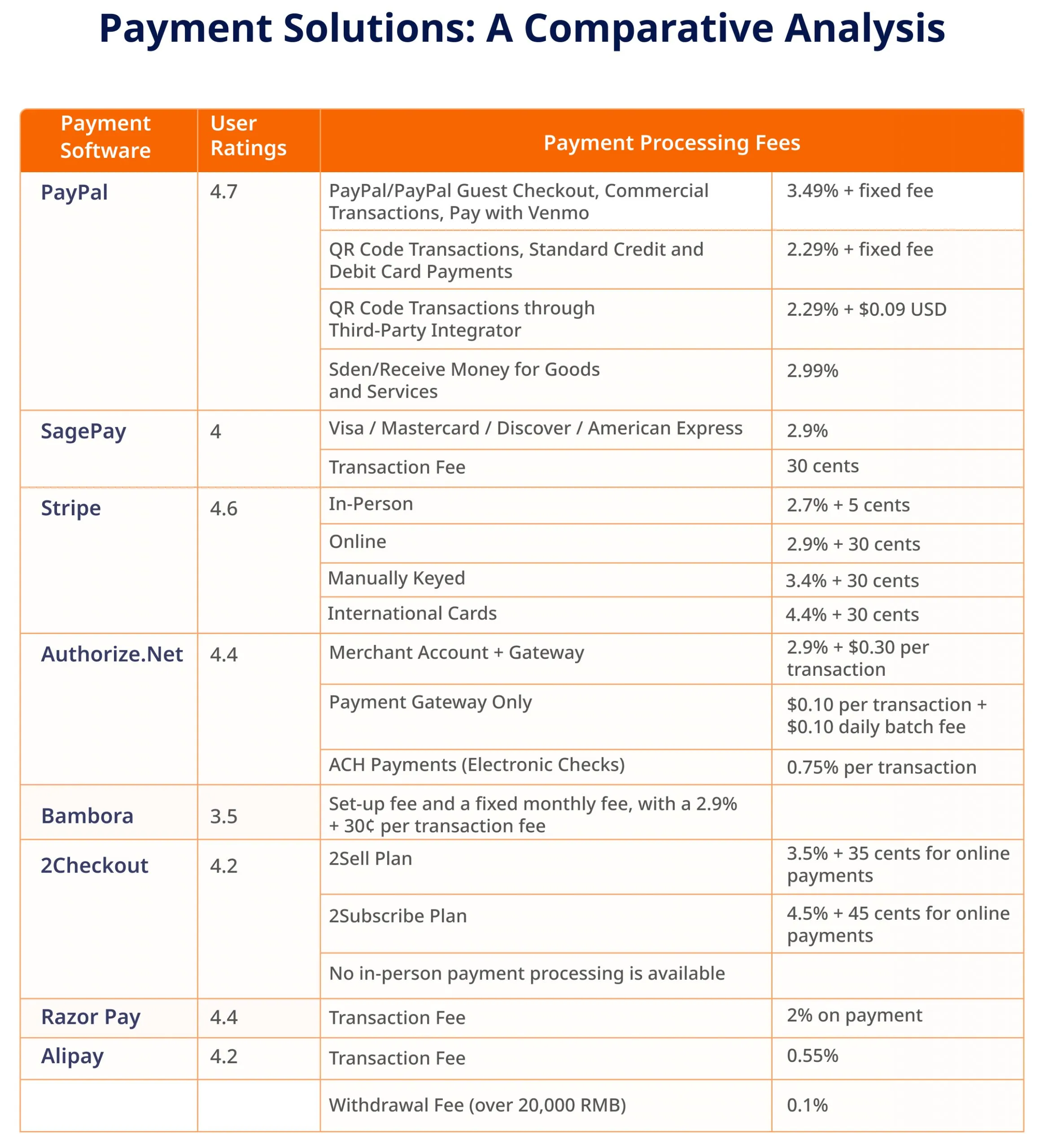

1. PayPal

PayPal, founded in 1998 and originally part of eBay, is a widely-used online payments platform that enables easy money transfers between individuals, businesses, and retailers.

Since its spin-off in 2015, PayPal remains a separate, publicly traded company, offering free account setup and convenient linking to bank accounts, debit cards, or credit cards for seamless transactions.

Features and Benefits

- Versatile Transactions: PayPal allows users to send and receive money effortlessly, whether it’s to friends, family, or businesses.

- Acquisition of Venmo: Through its acquisition of Venmo in 2013, PayPal expanded its reach, providing users with additional options for peer-to-peer payments.

- PayPal Credit: It offers a revolving credit line, letting users make purchases at any PayPal-accepting merchant, with billing and interest like regular credit cards.

- PayPal Cash: Launched in 2019, PayPal Cash allows users to manage their PayPal balance separately for easy external transfers or direct purchases.

- Business Solutions: PayPal supports both personal and business transactions, providing fraud protection, enhanced security, and encryption for all types of accounts.

Security features

- Fraud Prevention: PayPal offers an extra layer of security and fraud prevention, assisting users in recovering funds in case of fraudulent transactions.

- Encryption: The platform encrypts bank and credit card information.

- Business Account Security: PayPal Business accounts come equipped with advanced security measures, ensuring secure transactions and protecting businesses from potential threats.

Integration capabilities

- Seamless linking to bank accounts, debit cards, or credit cards

- Compatibility with Google Pay and Samsung Pay

- Integration with the Rocket Money app for better spending management

2. SagePay

SagePay, a leading payment gateway, provides fast and secure services for online transactions. Trusted for millions of secure transactions monthly, SagePay ensures a seamless payment experience for businesses of all sizes.

Features:

- 3D Secure Enhancement: Boost customer trust by enabling 3D secure for an added layer of transaction security.

- CVV Verification Control: Easily toggle CVV verification on or off with a single click, providing flexibility in payment processing.

- Magento Vault Integration: Allow customers to use previously saved credit card information through Magento Vault for convenient checkouts.

- Order Total Customization: Set maximum or minimum order totals according to your business requirements.

- User-Friendly Configuration: With an intuitive UI, MageDelight Sage Pay extension ensures a hassle-free setup process.

Security Features:

- PCI Compliance: SagePay Payment extension prioritizes PCI compliance for securing customer data.

- SagePay js API Integration: Utilizing SagePay js API, the extension securely transfers card details to the SagePay server and receives encrypted tokens for subsequent payments.

- SAQ Level A-EP: Meeting SAQ level A-EP standards, customer information is not stored on the Magento server, enhancing security.

Integration Capabilities:

Seamless integration of Sage Pay with Magento using login credentials.

Magento Vault support for utilizing saved credit card information.

Two distinct drop-in interfaces (modal and inline) for flexible payment page integration.

3. Stripe

Stripe is a top payment provider for online merchants, emphasizing credit and debit card payments.

Features:

- Diverse Payment Acceptance: Stripe accepts various payment options such as Visa, American Express, Mastercard, Discover, JCB, Diners Club, etc.

- Global Currency Support: Businesses can accept payments in various currencies, facilitating international transactions.

- Stripe Terminal: For in-person transactions, Stripe offers a point-of-sale system called Stripe Terminal.

- Additional Services: Beyond payment processing, Stripe provides services like billing, invoicing, and automated sales tax management.

- Online Sales Optimization: Stripe Payments is tailored for businesses with a significant online sales presence, offering features specifically designed for the digital marketplace.

Security Features:

- PCI Compliance Level 1: Stripe ensures strong security as a Level 1 PCI-compliant provider with yearly audits and regular scans.

- Encryption: Stripe encrypts customers’ credit card numbers and stores decryption information separately, ensuring added security.

- HTTPS Network: All online transactions on Stripe must occur over the secure HTTPS network, enhancing the overall safety of the payment process.

Integration Capabilities:

Compatibility with Stripe Terminal for in-person sales

Robust API for easy integration into existing business systems

4. Authorize.Net

Authorize.net, a payment gateway owned by Visa, facilitates credit card and electronic payment acceptance for businesses through its comprehensive plans.

The platform offers both an all-in-one solution, including a merchant account and payment gateway, and a gateway-only option, with transparent pricing and comparable transaction fees to competitors.

Features:

- Transparent, Flat-Rate Pricing: Authorize.net provides clear and straightforward pricing without hidden fees, offering businesses a predictable cost structure.

- No Contracts or Early Termination Fees: The platform allows flexibility for businesses by eliminating the need for contracts or early termination fees, providing financial freedom.

- Customer Information Manager: The platform includes a customer information manager, allowing users to securely save payment and shipping details for convenient future transactions.

- Recurring Payments and Invoicing: Authorize.net enables businesses to set up recurring payments for installment plans and offers an invoicing feature to send custom digital invoices through email.

Security Features:

- Advanced Fraud Detection: Authorize.net has a tool that spots suspicious transactions and potentially fake IP addresses, adjustable to suit your business.

- Secure Customer Information: The platform prioritizes the security of customer information, providing a safe environment for saving payment and shipping details.

- PCI DSS Compliance: It is PCI DSS compliant and ensures strong security for online transactions.

Integration Capabilities:

- Seamless integration with all major credit and debit cards

- Easy integration with third-party merchant accounts

5. Bambora

Bambora is a versatile online payment processing software facilitating billing, transfers, and online payments, particularly beneficial for sectors like food, non-profit, and education.

Features:

- Invoice Payment: Seamlessly manage and process invoices for efficient transactions.

- PoS Transactions: Enable point-of-sale transactions for convenient and swift payments.

- Multiple Currency Processing: Conduct transactions in various currencies to cater to a global audience.

- Recurring Billing: Streamline recurring payments for subscription-based services effortlessly.

- Website Payments: Facilitate secure online payments directly through your website.

Security Features:

Advanced Encryption: Employ state-of-the-art encryption protocols for secure data transmission.

Fraud Management Tools: Beyond basic measures, Bambora have strong fraud management tools.

Regulatory Compliance: Ensure compliance with regular security standards to safeguard transactions.

Integration Capabilities:

- Supports 1000 ISVs

- Processes $330k per minute

- 99.99% Uptime Rate

6. 2Checkout

2Checkout is a versatile digital commerce platform catering to businesses selling physical or digital products globally.

While renowned for its extensive payment options and subscription billing features, businesses should be mindful of potentially higher processing rates compared to domestic alternatives.

Features:

- Global payments: Facilitate transactions seamlessly across international borders.

- Digital commerce: Tailored for businesses engaged in online sales of both physical and digital goods.

- Subscription billing: Advanced tools for managing and optimizing subscription-based services.

- Reporting and analytics: In-depth insights to track and enhance business performance.

- Global tax and financial services: Offers solutions to manage tax on an international scale.

Security Features:

- Encrypted Transactions: Ensures the safety of sensitive data through encrypted payment transactions.

- Fraud Prevention Measures: Robust risk management tools to identify and prevent fraudulent activities.

- Compliance Standards: Adherence to industry compliance standards for secure and reliable transactions.

Integration Capabilities:

- Shopping cart integrations

7. Razor Pay

Razorpay is a robust payment gateway renowned for its versatile features, secure transactions, and seamless integration capabilities, as validated by a multitude of user reviews.

Features:

- Coupons and Discounts: Accept coupons, discounts, promotions, and gift cards effortlessly.

- Recurring Billing: Charge customers on a recurring basis for subscription-based purchases.

- Instant Payment: Securely store customer data for hassle-free transactions.

- Accepted Cards: Ability to accept various credit and debit cards.

- ACH Payments: Process eChecks and ACH payments with ease.

Security Features:

- PCI Compliance: Keeps your network secure, protects cardholder data, and controls access.

- Fraud Protection Tools: Utilize filters for high-risk elements, preventing fraudulent activities.

- 2-Factor Authentication: Add extra security to stop unauthorized access.

Integration Capabilities:

- Customization (Fields, Objects, and Layouts)

- APIs (Application Programming Interface)

- Accounting Software Integration

- E-Commerce Software Integration

- PCI Regulation Compliance

8. Alipay

Alipay, a leading payment app and digital wallet, simplifies cashless transactions, enabling users to effortlessly send and receive money.

As a super app with over a billion users, Alipay extends its functionality beyond payments, offering features like taxi hailing, credit card services, and insurance purchases, making it a versatile choice for international payments.

Features:

- Card Integration: Users can securely save and utilize debit or credit card details within the app for convenient mobile payments.

- Diverse Partnerships: Alipay, as part of the Alibaba group, collaborates with various financial institutions, primarily associated with Chinese credit and debit cards, including global providers like Mastercard and Visa.

- User-Friendly Interface: Alipay offers an intuitive interface that ensures a seamless and user-friendly experience for both new and experienced users.

- Multi-Functionality: Beyond payments, Alipay serves as a super app, offering services such as taxi bookings, credit card issuance, and insurance acquisition, consolidating various functions in one platform.

- Global Reach: With over a billion users, Alipay facilitates international payments, making it a natural and widely accepted choice for cross-border transactions.

Security Features:

- Advanced Encryption: Alipay uses strong encryption to protect your private information, making sure your data and payments are safe and secure.

- Real-Time Monitoring: Through real-time risk monitoring, Alipay continually assesses user data to detect and address potential risks, enhancing overall transaction security.

- Risk Management Framework: Alipay utilizes a comprehensive risk management framework, actively countering fraud and contributing to the prevention of money laundering, reinforcing the platform’s commitment to secure financial transactions.

Integration Capabilities:

- Seamless card integration for mobile payments

- Broad partnerships with global financial institutions

- Global acceptance for international transactions

Invoicera: A Comprehensive Invoicing Solution

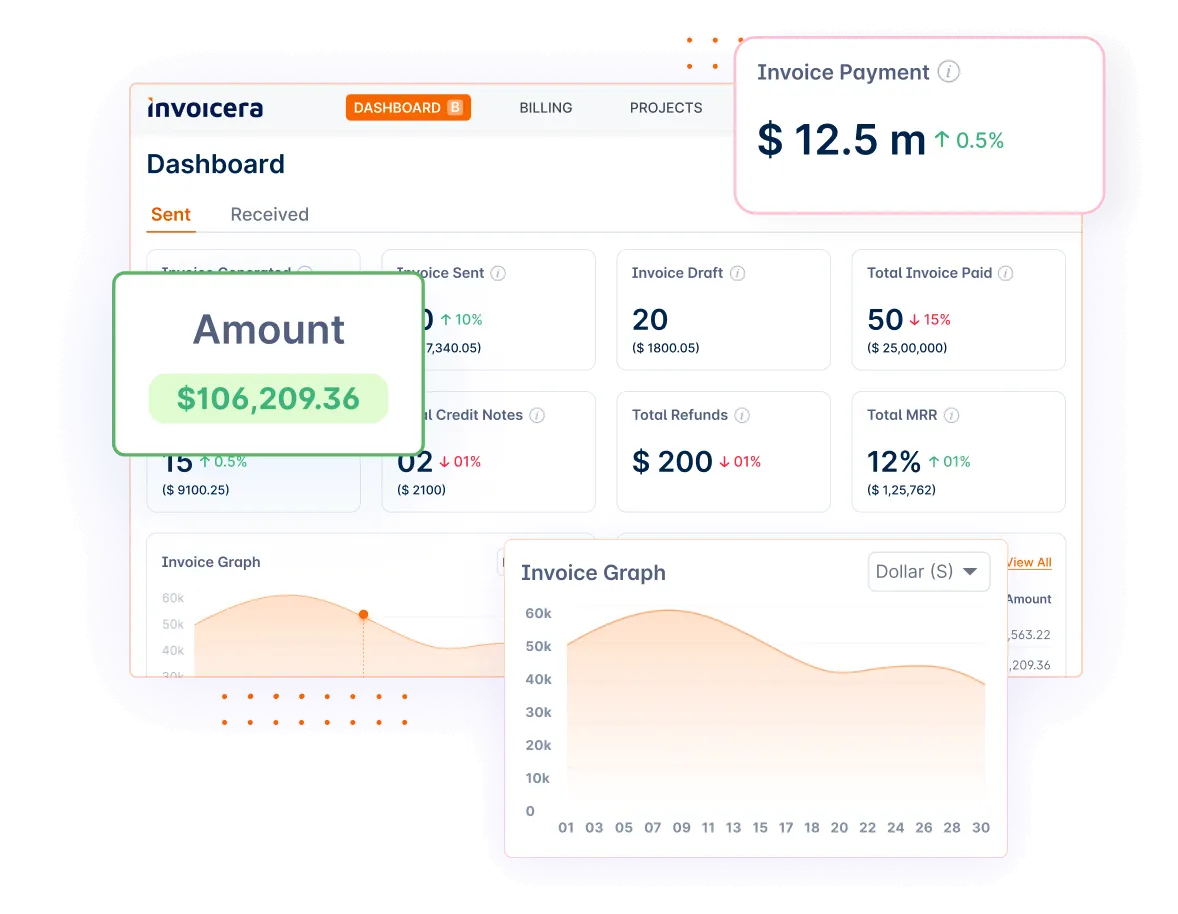

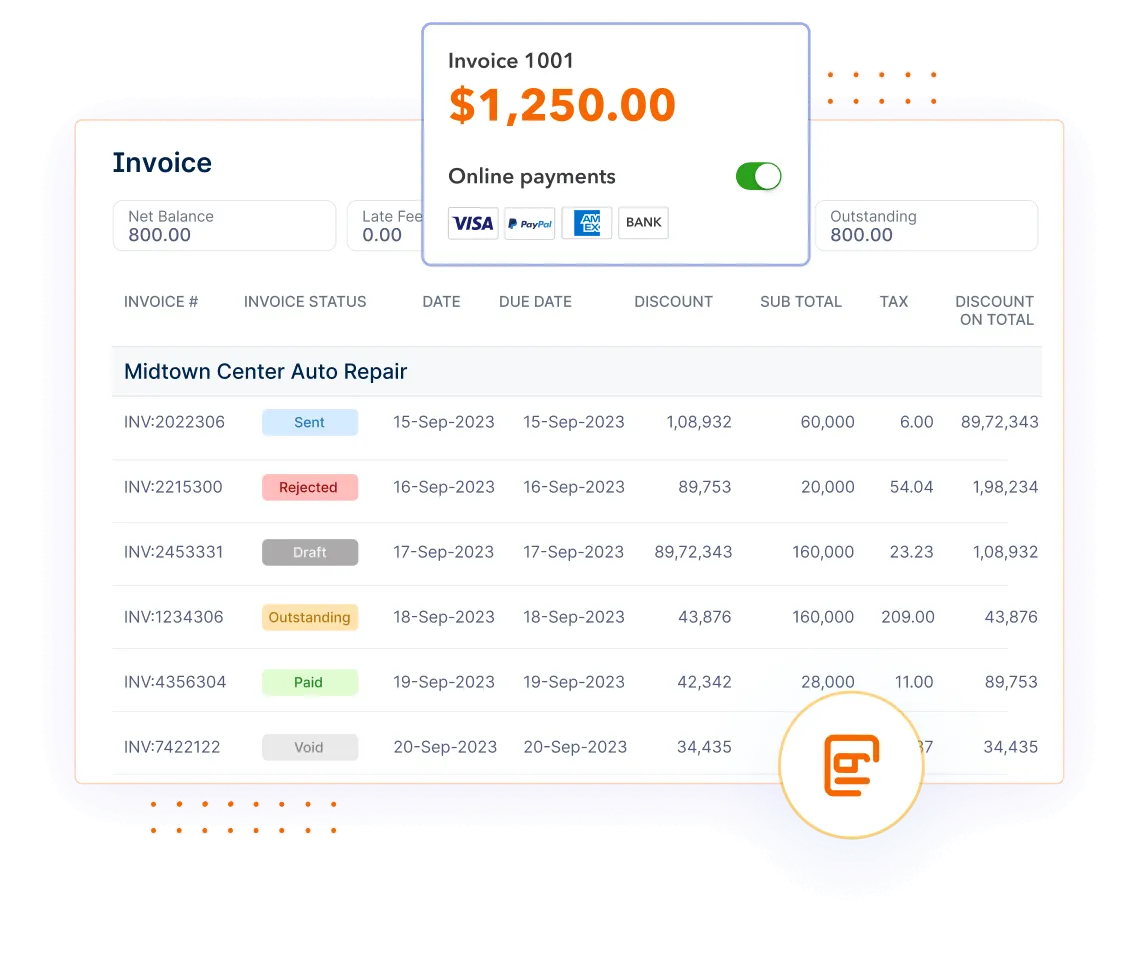

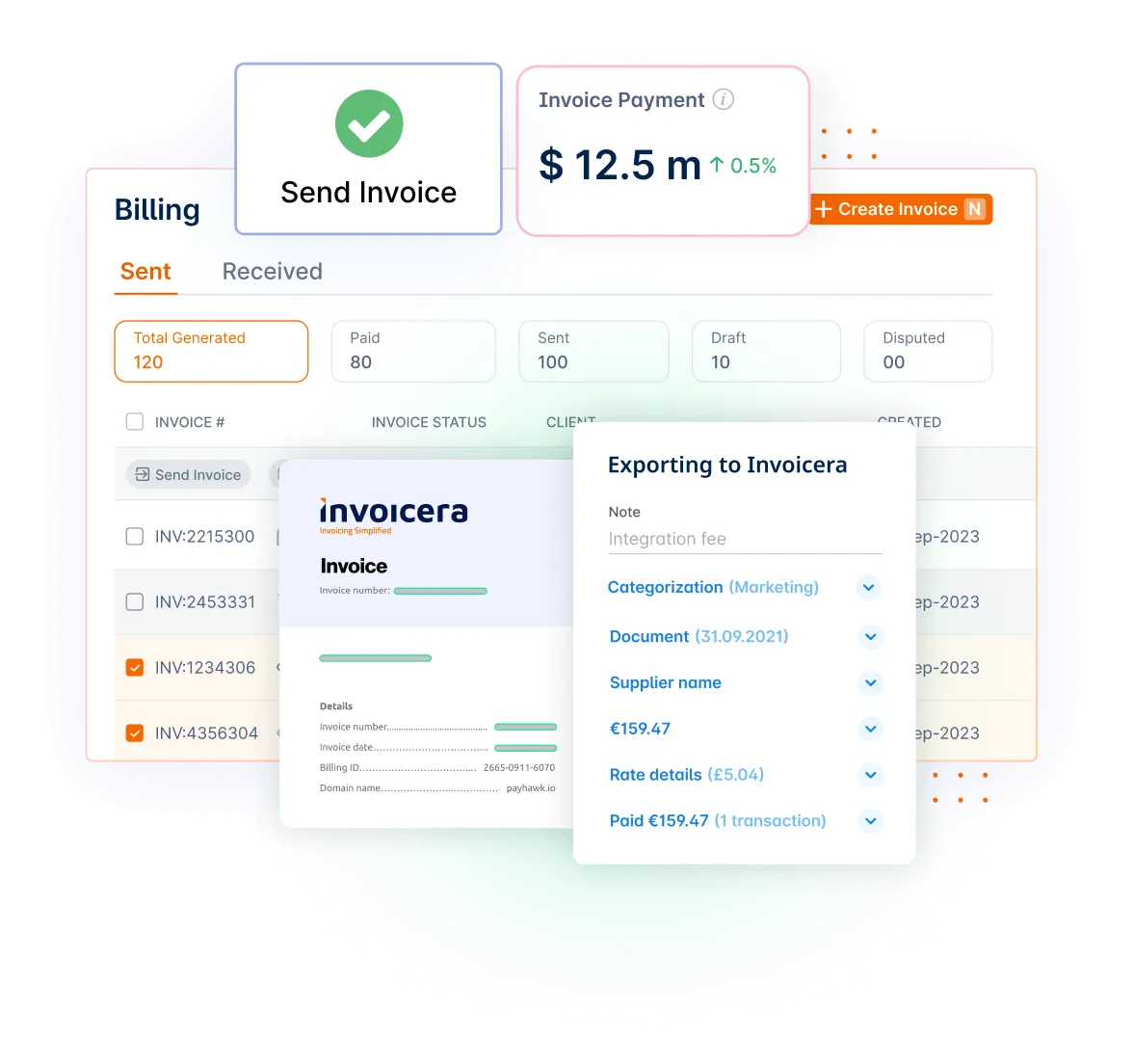

Invoicera is more than just an invoicing tool – it’s a comprehensive solution designed to simplify your small business’s financial processes.

Let’s explore some key aspects that make Invoicera stand out:

Core features

User-Friendly Interface: Invoicera offers a user-friendly interface for small business owners, freelancers, and entrepreneurs, ensuring easy platform navigation. You don’t need to be a financial expert to create professional invoices and manage your billing efficiently.

Invoice Creation and Management: With Invoicera, creating and managing invoices becomes a breeze. The platform allows you to generate customized and professional-looking invoices with just a few clicks. Keep track of your billing history, making it simpler to monitor payments and outstanding balances.

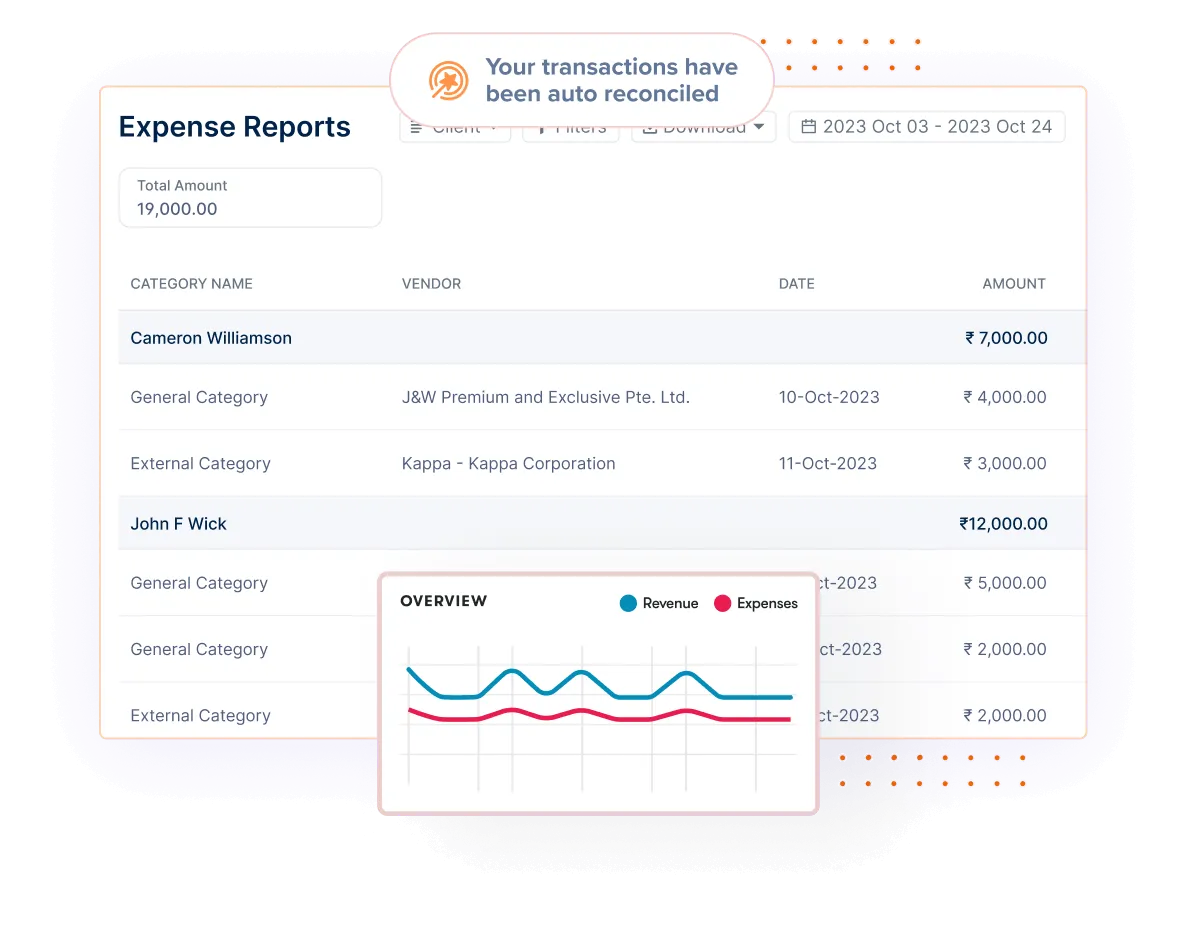

Expense Tracking: In addition to invoicing, Invoicera helps you keep tabs on your business expenses. Record and categorize expenditures effortlessly, gaining a clear overview of your financial health.

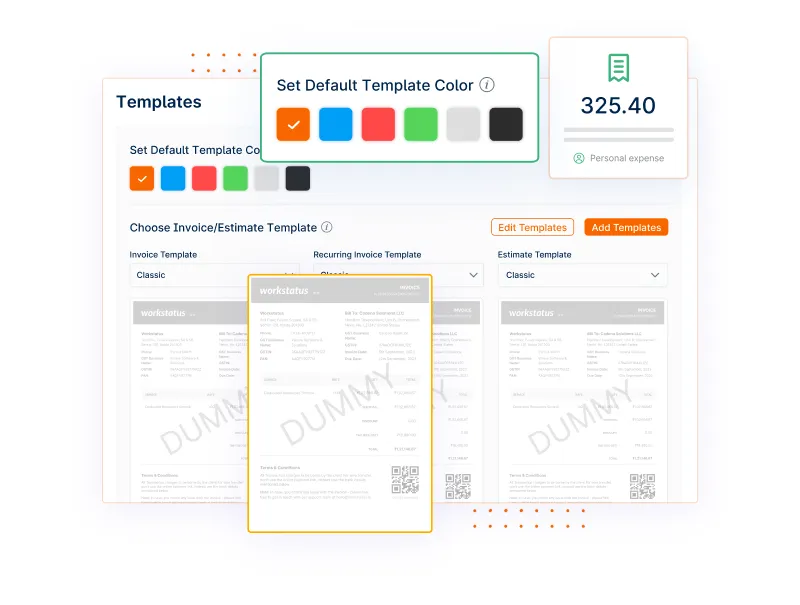

Customization options

Branding Your Invoices: Invoicera understands the importance of branding for your business. Customize your invoices with your logo, color schemes, and personalized messaging to leave a lasting impression on your clients.

Invoice Templates: Tailor your invoices to match your business identity. Invoicera provides a range of professionally designed templates, allowing you to choose the one that suits your brand aesthetic.

Flexible Payment Terms: Customize payment terms based on your specific business needs. Whether you like paying in 30 days, 60 days, or any other way, Invoicera lets you choose when your payments are due.

Payment Integrations

Secure Online Payments: Invoicera smoothly integrates with over 14 popular payment gateways, making sure your clients can easily and safely pay online. This feature accelerates the payment process and enhances overall transaction efficiency.

Multi-Currency Support: For businesses with international clients, Invoicera offers multi-currency support. Invoice clients in their preferred currency, facilitating transparent transactions and reducing confusion.

Integration with Multiple Platforms: Invoicera understands the importance of a connected business ecosystem. It integrates smoothly with various platforms, enabling a seamless flow of information between your invoicing software and other business tools.

How To Choose Best Payment Solution Software?

Choose a scalable payment solution for your future needs.

Ensure security with SSL encryption and PCI DSS compliance.

Check API availability for seamless workflow integration.

Prioritize intuitive design for accessibility in your business.

Choosing the right payment solution software is like picking the perfect tool for the job. Here are four key factors to consider when making this crucial decision:

A. Scalability

Small businesses have big dreams, and your payment solution should grow with you. Scalability means the ability of the software to handle your increasing transaction volumes and adapt to your expanding business. Look for a solution that can seamlessly accommodate your growth without causing headaches or requiring constant upgrades.

Tip: Consider your future needs and opt for a payment solution that can scale alongside your business ambitions.

B. Security

Protecting your business and customer data is non-negotiable. The best payment solution software prioritizes security, using robust encryption and complying with industry standards. Ensure that your chosen software provides a secure environment for transactions, safeguarding both your business and the trust of your customers.

Tip: Make sure the payment tool has SSL encryption and follows PCI DSS rules for a safe payment process.

C. Integration

In the digital age, collaboration is key. Your payment solution should play well with others, integrating seamlessly with your existing systems and third-party applications. Whether you’re using accounting software, customer relationship management (CRM) tools, or e-commerce platforms, compatibility ensures a smooth and efficient operation.

Tip: Check for API availability and compatibility with your current tools to enhance workflow integration.

D. User-Friendly Interface

Keep it simple with payment software. An easy-to-use interface saves time on training and troubleshooting, letting you concentrate on running your business. Pick software that’s intuitive, simple to navigate, and reduces the learning curve for you and your whole team.

Tip: Prioritize software with a clean and intuitive design, making it accessible for everyone in your business.

Conclusion

Finding the right payment solution for your small business is essential in adapting to changing consumer needs. Whether you opt for Square, PayPal, Stripe, or Invoicera, each choice offers unique benefits.

Consider factors like scalability, security, integration, and user-friendliness when making your decision.

Looking forward, with the payment processing industry expected to reach $120 billion by 2025, staying informed about emerging trends is crucial.

Pick a solution that fits your business, helping you meet and go beyond customer expectations in the changing digital world.

Embrace the opportunities presented by modern payment technologies, empowering your small business for ongoing success.

FAQs

Will I need technical expertise to integrate payment solution software?

Most providers offer user-friendly interfaces and support for easy integration. Check compatibility and consult customer support if needed.

Can I use payment solution software for both online and in-person transactions?

Yes, many payment solutions, like Square and PayPal, offer versatility for both online and in-person transactions. Ensure the chosen solution aligns with your business’s specific needs.

Can I switch between different payment solution providers if my business needs to change?

In most cases, yes. However, it’s crucial to review any contractual agreements and potential costs associated with switching providers.