Introduction

You might be overwhelmed by a lot of paperwork and hours spent on manual invoicing!

Not only are you struggling!

Inefficient billing processes can be hectic for anyone, be it startups, medium-sized companies, or large enterprises.

But guess what! There is good news.

Bringing automated invoicing into your business can be really helpful and increase your productivity.

Thus, we have listed the top 15 leading automated billing software that are reshaping companies in 2024.

The familiar names are Invoicera, FreshBooks, and QuickBooks.

You will also be introduced to a few real-world examples of companies that have transformed the invoicing process with Invoicera.

Grab a cup of tea and explore this blog post for a better understanding of all popular invoicing software in the market.

Explore Latest Trends In Automated Invoicing

There are various interesting automated invoicing trends you must explore:

1. Artificial Intelligence is on the rise.

Since AI has entered the world of invoicing, data extraction, like names, dates, and amounts, has become automated. It can spot mistakes before they cause problems saving you time. Moreover, it gently reminds them about upcoming payments and more.

2. Industries are adopting automated invoicing.

Most of the large companies have completely adopted automated invoicing. While many freelancers and small businesses still rely on traditional invoicing. But they are also moving toward it and finding it time-saving.

3. Integration with third-party software is saving time.

Many automated billing solutions now integrate with other business tools, such as accounting, CRM, and payment gateways. It helps businesses to boost their productivity and reclaim time for important tasks.

4. There is a growing demand for Mobile Solutions.

Smartphones and tablets are the most convenient to handle; thus, every tool is being available for Android and iOS devices. It is beneficial as it makes it easier for businesses to create, send, and track invoices from anywhere.

5. Security concerns are also rising.

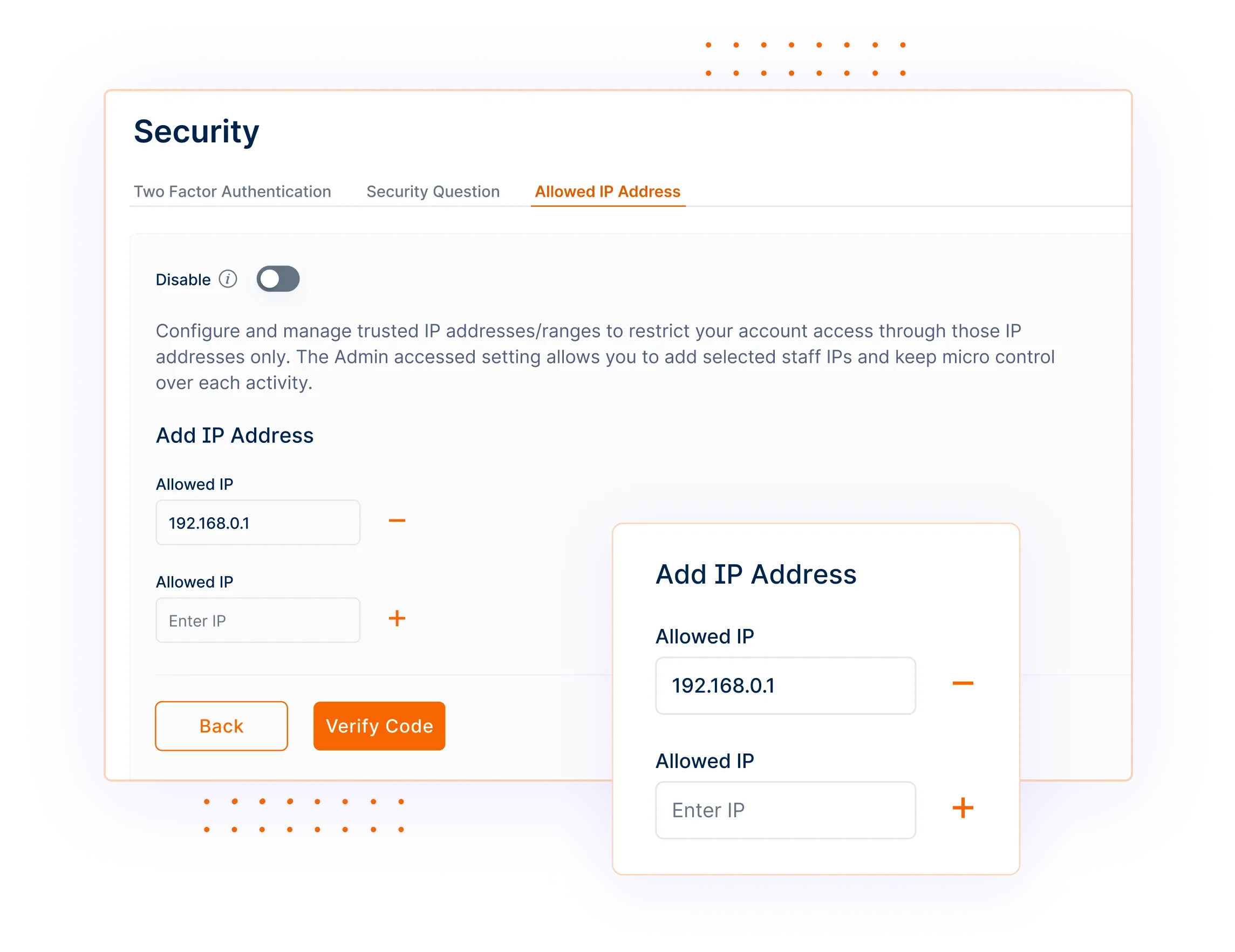

As businesses rely more on digital platforms, data security is a top priority. Leading automated billing software providers are investing heavily in robust security measures to protect sensitive financial information. One of the steps they take is using curl with a proxy to route requests through an intermediary server, which helps to obscure their origin and adds an additional layer of protection against potential security threats. Using ISP proxies can further enhance the security of data transmission.

Impact Of Automation On Business Efficiency

What if?

- You save countless hours currently spent on repetitive invoicing tasks.

- You eliminate manual data errors in calculations.

- You can make workflow easier and free yourself to focus on more crucial tasks.

Do you know you can do all of this with automated billing software?

But how exactly does automation improve your business efficiency? Let’s learn some key benefits:

- It can increase your Productivity: No more wrestling with spreadsheets! Automation handles heavy invoicing tasks like complex calculations. In this way, your staff can spend more time connecting with clients and developing new business opportunities.

- It helps in reducing human errors: Manual data entry is prone to errors, which can lead to delays, complications, and even lost revenue. Automation minimizes these errors, ensuring accuracy and consistency in your invoicing process.

- It improves Time Management: When you automate repetitive tasks, you are left with more time. This time can be valuable in managing other business aspects.

- It gives your customer a better experience: Not only the services but also when invoices are sent on time, it builds up trust in your clients. It showcases your professionalism; hence, resulting in strong relationships with clients.

- It saves your money: When the whole process of invoicing is automated, it saves a lot of time and resources. And fewer resources lead to cutting costs. Moreover, electronic invoices save printing costs and postage expenses.

Overall, automation has a significant impact on business efficiency. It allows you to optimize your resources, work smarter, and ultimately achieve greater success in your business endeavors.

Impact Of Automated Billing Software In Numbers

Have a look at a few statistics related to automated billing:

- 60% of businesses report recovering an average of $600,000 annually in revenue after implementing automated billing software. [Source: staxbill.com]

- Businesses that use automated billing software have reduced 75% of invoice processing time. [Source: Togai.com]

- Automating invoices can reduce human error by up to 80%, leading to more accurate billing and fewer disputes. [Source: Highradius.com]

- Companies implementing automated billing see a 20% increase in on-time payments, leading to improved cash flow. [Source: Vuram.com]

- Automated billing software has helped in boosting 30% of total employees’ productivity. [Source: Togai.com]

These numbers clearly show that automated billing software can significantly improve your financial performance, efficiency, and customer satisfaction.

Top 15 Leading Automated Billing Software

1. Invoicera

Invoicera offers invaluable features like customization of templates, multi-currency support, invoicing workflows with full automation, comprehensive reports and more.

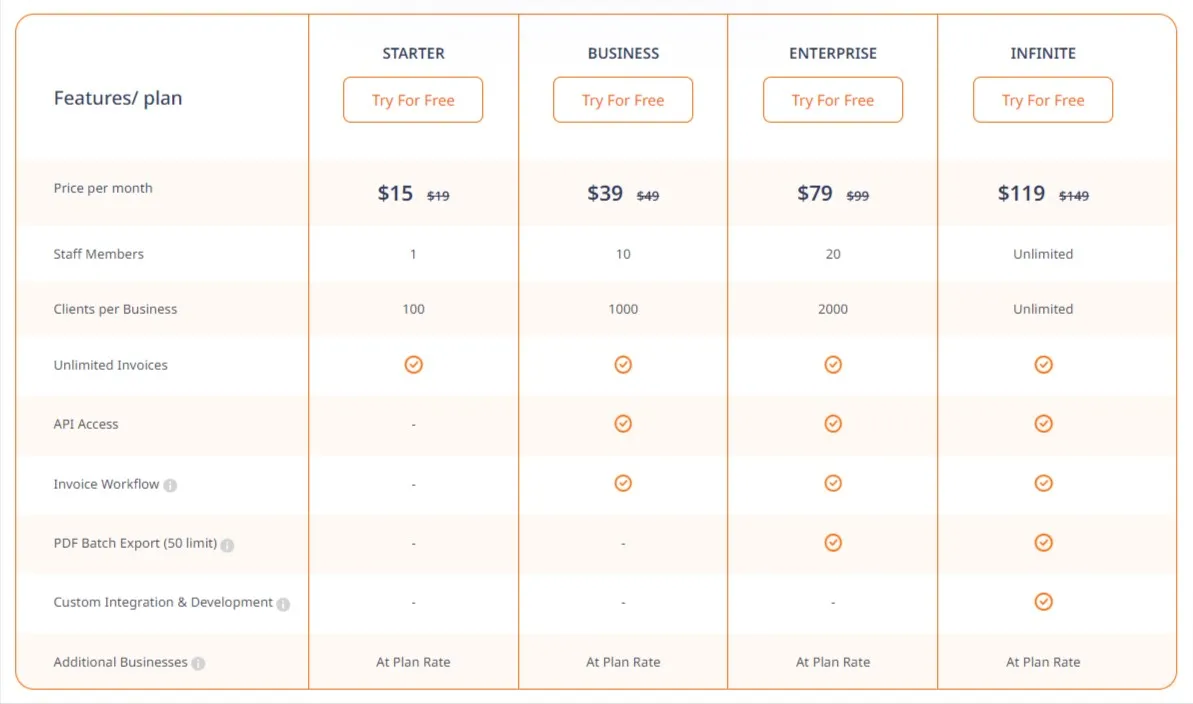

It comes with various plans for unique business needs:

- Starter plan – $19 per month – for solopreneurs and small teams

- Higher tiers like Business – $39/month – for SMEs

- Enterprise – $79/month – for large enterprises with a comprehensive feature set

Invoicera offers:

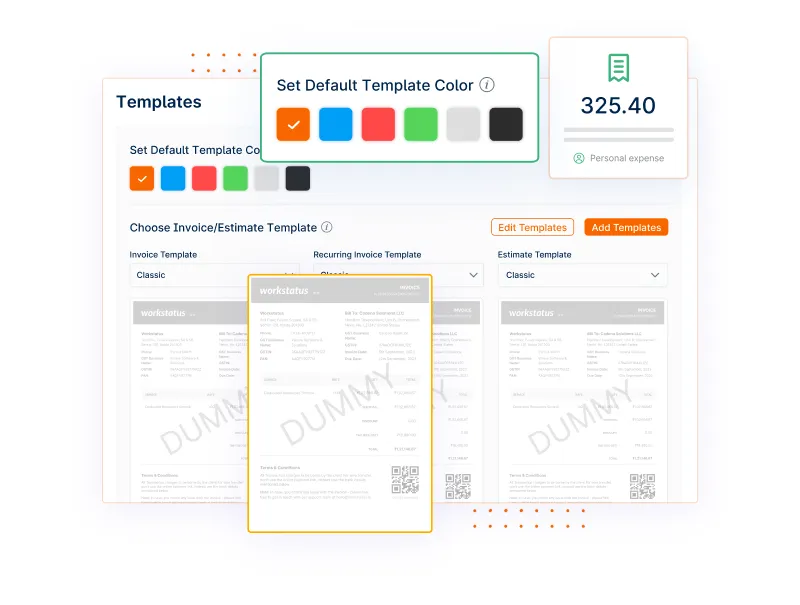

- Customization & Flexibility: You can create invoices that perfectly blend with your company’s identity. No only this, you can also impress your clients with unique and clear invoices.

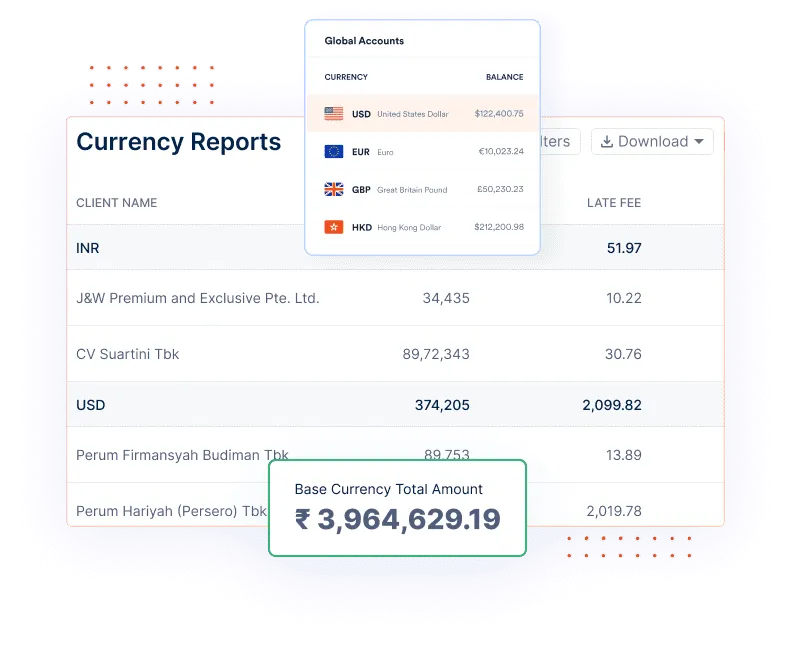

- Multi-Currency & Payments: Global business is not a headache now! You can easily add multiple currencies and payment gateways. Invoicera offers 125+ currencies and 14+ payments gateways to help you expand your business worldwide.

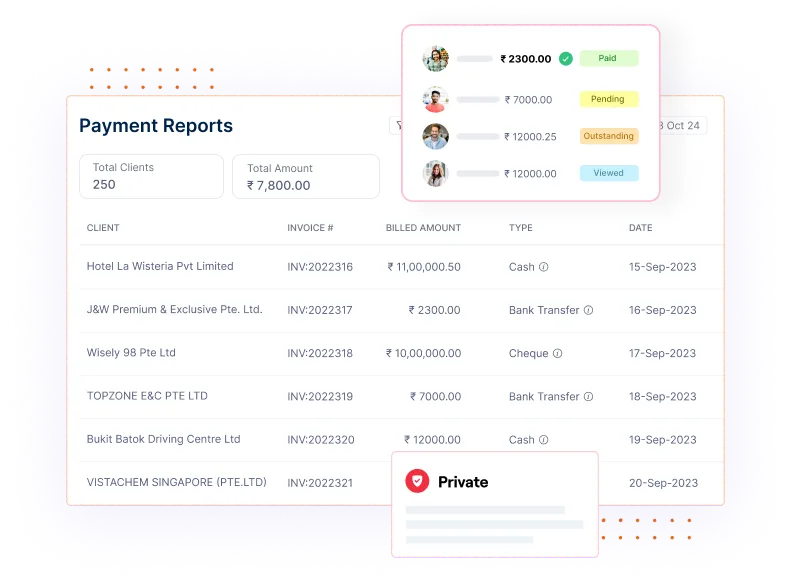

- Advanced Reporting & Analytics: Invoicera lets you generate automated comprehensive financial reports. You can easily identify your accounts payable and receivable through the reports. Thus, you make better financial decisions and grow your business.

- Robust Security & Compliance: Data breaches are everywhere! But Invoicera is here to rescue you. Invoicera protects your sensitive data with 2-factor authentication, access controls, and regular audits.

- Scalability & Collaboration: As your business grows, Invoicera grows with it. It offers a comprehensive feature set for large enterprises and handles a high amount of invoices.

- Integrations & Mobile Access: As mobile and tablets are portable and internet has made everything possible, Invoicera comes for mobile also. With Android and iOS mobile apps, Invoicera makes it easy to access data and generate invoices from anywhere.

2. QuickBooks

A well-known accounting software suite, QuickBooks also offers a comprehensive invoicing solution.

It can integrate with other QuickBooks applications for better management of finances.

The pricing tiers it offers are as follows:

- Simple Start plan: $15/month, suitable for freelancers and solopreneurs

- Essentials plan: $30/month for small businesses with inventory management and team collaboration

- Plus plan: $45/month

- Advanced plan: $100/month

3. FreshBooks

FreshBooks helps you with its user-friendly interface, and this feature makes it a popular choice for all business sizes. It offers the following features:

- Automatic recurring invoices, saving your time

- Expense tracking for keeping your finances organized

- Online payment options for easy transactions and better client experience

With FreshBooks

- You can get started with the Lite plan at $7.60 per month – basic invoicing features to meet your essential needs.

- The Plus plan, at $13.20 per month, adds project management and team collaboration tools.

- For growing businesses, the Premium plan at $24 per month goes with your advanced needs.

4. Zoho Invoice

Part of the Zoho suite of business applications, Zoho Invoice, offers a free plan with limited features. It makes it suitable for freelancers and businesses who are just starting out.

Pricing plans of Zoho:

- The standard plan starts at $15 monthly, offering essential invoicing functionalities.

- Professional plan – $39/month adds features like custom branding and recurring invoices.

- Premium plan – $79/month – caters to growing businesses with multi-currency support and project tracking.

5. Xero

Next comes Xero!

It is a cloud-based invoicing solution that offers features beyond your expectations.

It offers:

- Comprehensive invoicing features

- Customizable templates to design with brand identity

- Real-time financial tracking

- Integration capabilities with third-party tools

It is an invaluable tool that can be really helpful for small businesses.

This platform is committed to keeping your data secure and compliant. It adds an extra security layer to all the data so that businesses are free from theft of sensitive financial information.

Xero offers multiple pricing options:

- Starts at a flat rate of $3.75 per month

- ‘Early’ plan is priced at $3.75 per month

- ‘Growing’ plan is available for $10.50 per month

- ‘Established’ plan costs $19.50 per month

Note: These prices are for the first 3 months as they offer a 75% discount. You can contact their sales team if you require more information.

6. Wave

Wave offers a free invoicing solution with basic features. It can be a good choice for small businesses and freelancers who generate fewer invoices.

However, large companies can also use Wave with paid plans that offer more comprehensive features.

Wave offers pricing at:

- $0 for the starter plan

- $170/year for the pro plan

7. Pabbly

This platform helps you manage subscriptions. It offers billing tools like automatic recurring billing, tools for managing subscriptions, and customer portal access.

It works for businesses with different subscription models, such as SaaS, memberships, and product subscriptions.

Pabbly offers the below pricing plans:

- You can get started with the Basic plan at $47 per month. It has key features for small businesses.

- Higher plans, Pro ($189/month) and Ultimate ($379/month) provide advanced tools and more user limits for larger firms.

8. Scoro

Scoro combines project management and billing software into one solution for you. It makes the workflow easier by bringing together project management, time tracking, invoicing, and reporting in one place.

Scoro offers:

- $26 per user per month for the Essential plan. It suits small teams.

- Higher plans, Pro ($63/user/month)

- Ultimate (custom pricing) offers advanced features and can scale for larger organizations.

9. Tipalti

Tipalti mainly focuses on making global B2B payments easier for you. This solution is ideal for businesses with complex payment needs and international operations.

This software does not pricing plans directly on their website. You need to request for the plans.

It offers custom solutions as per your unique business needs.

10. Bill.com

Bill.com is a cloud-based solution that automates accounts payable and receivable processes. It helps with the following features:

- Easy invoice generation

- Online payments

- Invoice approvals

- Easy communication with vendors and customers

Pricing plans of Bill.com are below:

- You can get started with the Essentials plan at $39 per month, suitable for small businesses.

- Higher tiers, Team ($49/month)

- Enterprise (custom pricing) offers advanced features and greater user capacity for larger organizations.

11. Sage Intacct

This financial management platform offers robust invoicing tools alongside other accounting features:

- General ledger

- Accounts payable/receivable

- Financial reporting

It is best for larger businesses and enterprises with complex accounting needs.

Sage Intacct provides pricing plans on request.

12. Square Invoices

Integrated with the Square ecosystem, Square Invoices offers a free solution for sending and managing invoices.

It’s ideal for businesses already using Square for payment processing, as it simplifies integration and sales and payment flow.

While the free plan offers basic features, paid plans start at $20 per month. Paid plan includes:

- Recurring invoices

- Customer portals

- Inventory management

13. Hiveage

Hiveage is specifically designed for freelancers and independent contractors. It offers solutions:

- Automated billing and invoicing

- Project management

- Time-tracking

- Easy collaboration

Pricing plans by Hiveage:

- The Basic plan comes at $16 per user per month

- The Pro plan ($25/user/month) adds team collaboration tools

- Plus plan ($42/user/month) offers advanced tools for larger teams

14. Bonsai

Bonsai focuses on streamlining the freelance workflow for you. It offers features like time tracking, proposal generation, and invoicing in one platform. This tool makes client communication, project management, and financial management easier for freelancers and solopreneurs.

- Get Bonsai’s Starter plan at $21 per month with basic features for small businesses and individual contractors or freelancers.

- As your business grows, you can upgrade the plan to Professional for $32/month

- The business plan comes for $66/month with advanced tools and increased team capacity.

15. Invoice2go

Invoice2go goes perfectly with small businesses and freelancers. It offers an easy-to-use platform even for the non-tech people. It comes with various features such as customizable templates, online payments, and expense tracking.

Pricing plans:

- They offer a free trial

- You can get started with paid plans at $5.99 per month

- Professional – $9.99/month

- Premium – $39.99/month

16. Refrens

Refrens is a cloud-based billing software designed specifically for the needs of small businesses. It offers a comprehensive suite of features to simplify your financial management, all at a budget-friendly price.

It offers:

- Simplest Dashboard

- Highly professional-looking invoices

- Automated recurring invoices

- Easy document sharing via WhatsApp and Email

- Seamless GST management

- Secure Cloud storage and data backup

Pricing

- Free Plan: free plan for small businesses to create up to 50 documents/year

- Premium Plan: Pricing starts from as low as ₹100/month or $2.5/month depending on the number of users & features

Companies Reshaped Invoicing With Invoicera

The Global Travel Solutions Company, based in London and Marbella, sought an automated invoicing and billing solution to streamline their global travel services.

Operating in over 100 destinations, customization was crucial. Invoicera provided a tailored solution with automatic billing, destination-specific invoices reflecting rates and taxes, recurring billing for corporate clients, and online payment capabilities.

The result: efficient, automated processes and enhanced financial control for the client.

A digital agency overcame challenges in dynamic pricing, automated invoicing, and managing multiple clients with Invoicera.

The solution provided a centralized dashboard for viewing all invoices, streamlined staff management with permissions, and customized AP and AR reports for easy analysis.

Invoicera’s efficiency in accommodating customization requests further enhanced the agency’s invoicing processes.

Invoicera played a pivotal role in transforming the invoicing system for a leading Indian Textile industry with over 50 years of experience.

The industry sought to automate invoicing for both cash and credit transactions, requiring customization to align with their unique business needs.

Invoicera’s hosted solution delivered tailored features, enabling the creation of customized cash and credit invoices, complete with control over prefixes and batch printing.

This customized solution successfully managed over 10 million transactions, demonstrating Invoicera’s capability to streamline intricate invoicing processes and enhance overall operational efficiency.

Future Predictions of Automated Billing Software

Automated billing software has already revolutionized the way businesses handle invoices, but the future promises even more exciting advancements. Here are some predictions for what we can expect:

1. Enhanced Intelligence and Automation:

- AI-powered features: Imagine systems that not only automate tasks but also use artificial intelligence to predict customer payment behavior, suggest personalized payment plans, and even proactively collect late payments.

- Cognitive learning: Billing software will become adept at learning your business’s unique patterns and adapting to optimize workflows and personalize the invoicing experience for both you and your customers.

2. Deeper Integration and Ecosystem:

- Seamless connections: Automated billing software will seamlessly integrate with other business applications like CRM, accounting, and e-commerce platforms, creating a centralized hub for managing your entire financial ecosystem.

- Data-driven insights: By analyzing data from various sources, the software will provide valuable insights into your business performance, helping you make informed decisions about pricing, payment terms, and customer relationships.

3. Advanced Security and Compliance:

- Enhanced security measures: As technology evolves, so will the need for robust security features to safeguard sensitive financial data. Expect advancements in encryption, fraud detection, and access control protocols.

- Global compliance: With the rise of global business interactions, automated billing software will need to adapt to comply with various international tax regulations and reporting requirements.

4. Increased Accessibility and Affordability:

- Cloud-based solutions: More and more billing software will be cloud-based, making them accessible from any device and offering greater scalability for businesses of all sizes.

- Subscription-based pricing: Subscription models will become more prevalent, allowing businesses to access features and functionalities based on their specific needs, making automated billing software more accessible and cost-effective.

Conclusion

Manual invoicing can be a time-consuming and tedious task, hindering your business’s growth.

But by embracing automated billing software, you can unlock a world of efficiency, improved cash flow, and happier customers.

This blog has equipped you with the knowledge you need to understand the benefits, trends, and future prospects of automated billing software. We’ve also showcased the potential of solutions like Invoicera in real-world scenarios.

Ready to change the way you invoice? Take the first step towards smoother operations and financial success.

Explore the features of leading automated billing solutions and find the one that best fits your business needs.

With the power of automation at your fingertips, you’ll be well on your way to streamlining your invoicing and achieving greater business success.

FAQs

Is automated billing software right for my business?

Automated billing software can benefit businesses of all sizes, from freelancers to large enterprises. Whether you’re struggling with manual invoicing or looking to improve efficiency, this software can help you save time, reduce errors, and improve cash flow.

Is it difficult to set up and use automated billing software?

Most automated billing software is user-friendly and offers intuitive interfaces. Many providers also offer comprehensive setup guides, tutorials, and customer support to ensure a smooth transition.

What are the benefits of using Invoicera specifically?

Invoicera offers a comprehensive range of features, including customization options, multi-currency support, automated workflows, and robust security measures. Additionally, their success stories demonstrate their ability to cater to diverse business needs and provide efficient solutions.