Introduction

“Beyond transactions, subscriptions build relationships with every renewal, shaping sustained success.”

Subscription-based businesses might face issues while maintaining continuous revenue due to multiple subscriptions.

If you are also struggling to manage your financial flow perfectly, this blog post is for you as it will take you through every aspect of recurring billing.

So, if you are looking for a tool for recurring billing, your search will probably end here.

This blog sets the stage for the Top 5 Recurring Billing Software tools in 2024, and one of them might become your trusted companion in managing your world of subscriptions.

Let’s kick things off by quickly grasping what recurring billing is all about.

What Is Recurring Billing?

Recurring billing is helpful for subscription service businesses and their customers. In this, a customer has to pay for a product or a service regularly, usually monthly or annually.

It is like having a magazine delivered to your home each month; you pay a few dollars regularly rather than buying every issue individually.

Recurring billing allows companies to keep their finances uniform and predictable.

This system benefits both businesses and customers. Businesses can plan better, knowing they have a reliable income, while customers enjoy the convenience of not having to worry about making individual payments all the time.

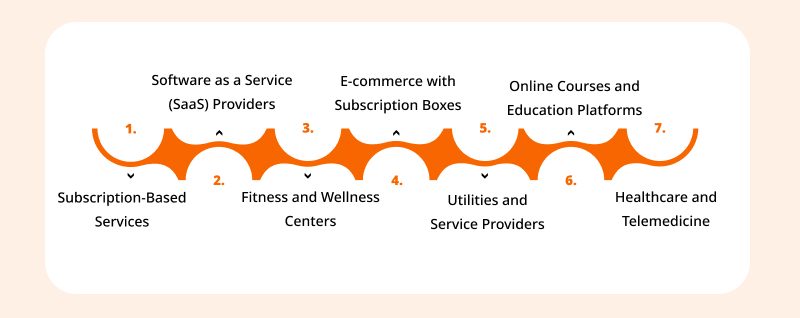

Types Of Businesses Benefit From Recurring Billing

Subscription-Based Services:

Example: Streaming Platforms

Subscription-based businesses like streaming services or online publications enjoy automatic billing through recurrence. Consumers are charged a regular fee for accessing these services. Thus, the business gets a guaranteed a steady income.

Software as a Service (SaaS) Providers:

Example: Cloud-Based Software

SaaS firms, in turn, impose a reoccurring fee on their users for accessing the software. This model permits businesses to consistently provide updates and support and engages brand viewers with a systematic revenue plan.

Fitness and Wellness Centers:

Example: Gym Memberships

Gym and wellness centers typically bill membership on a monthly basis. This not only provides the facility with a stable revenue stream but also empowers members to develop a habit of healthy fitness.

E-commerce with Subscription Boxes:

Example: Monthly Product Boxes

E-commerce enterprises that provide subscription boxes and customers receive curated products monthly use an automatic payment method. This way, the business will be able to retain the customers, and hence the demand for the inventory will be regular.

Utilities and Service Providers:

Example: Internet and Phone Services

Commonly, essential service providers like internet, phone, or utilities are using recurring billing. It makes the payment process easy for customers and guarantees timely payments for the work already done.

Online Courses and Education Platforms:

Example: E-learning Platforms

Platforms offering online courses or educational content typically use recurring billing. This model ensures that learners have continuous access to course materials and updates.

Healthcare and Telemedicine:

Example: Telehealth Subscriptions

Telemedicine healthcare agencies working on a subscription basis may simplify billing and facilitate patients’ continuum of virtual healthcare.

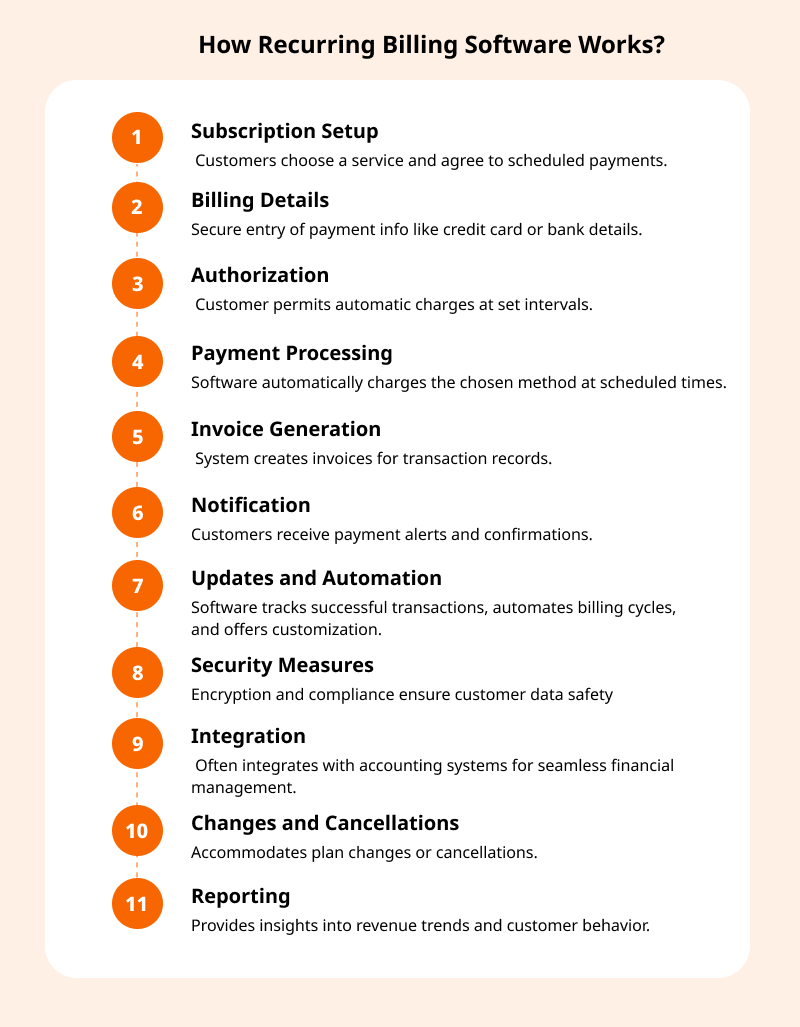

How Recurring Billing Software Works?

Advantages of Recurring Billing Software

Let’s look into some advantages of recurring billing software that might help your business succeed more.

- Remain Financially Stable With Sustainable Cash Flow: For any business, maintaining financial stability requires a steady and reliable income. Recurring billing software allows you to automate regular payments. It facilitates the financial forecast and the steady cash flow.

- Build Customer Loyalty Through Easy Transactions: When a customer is satisfied, he comes back for repeat business. For this, recurring billing software increases customer satisfaction by integrating an easy and convenient payment experience. Through self-service transactions and timely alerts, companies can cultivate trust, and their customers will never switch elsewhere.

- Streamline Administrative Processes and Improve Efficiency: Recurring billing software in automation saves teams a lot of time, which the businesses can allocate to strategic business ventures. This prevents human error and guarantees consistent billing workflows.

- Improve Transparency With Accurate Financial Record-Keeping: Finance is all about accuracy. The recurring billing feature of our system not only prepares the accurate invoices and receipts but also provides you with the clear financial transactions record. This builds customers’ confidence and helps businesses to achieve an accurate and up-to-date financial record, which is indispensable for compliance and business decision-making.

- Scale Your Business and Drive Growth: Recurring billing software scales along with your business and offers the flexibility to change plans and make adjustments as per customer requirements. It seamlessly scales to accommodate increased transaction volumes and can easily help when your business expands.

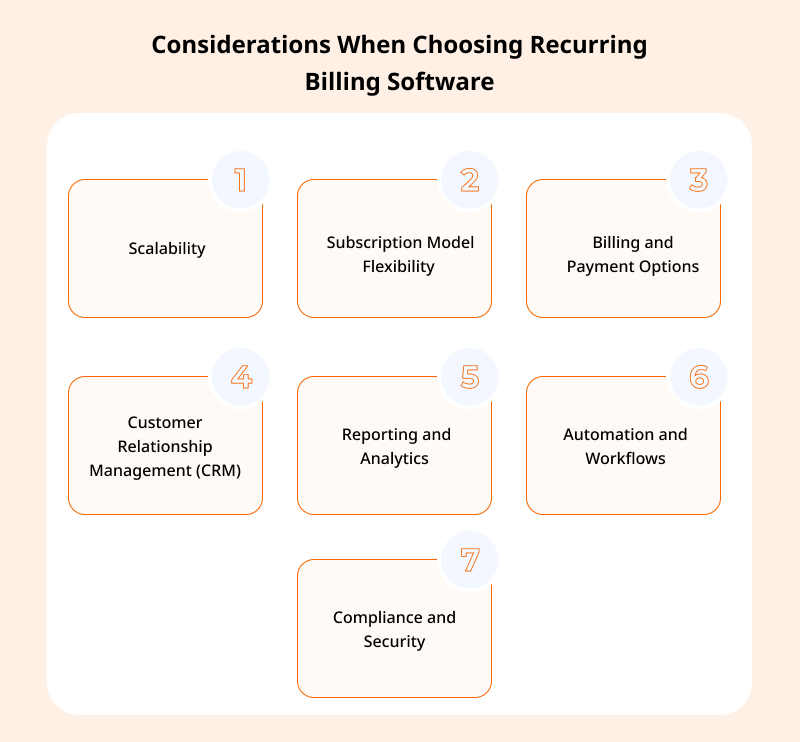

Considerations When Choosing Recurring Billing Software

These criteria encompass various facets that are crucial for CEOs and Founders to consider when making this decision:

1. Scalability

The subscription tool must be capable of accommodating your company’s growth. You must evaluate how well each tool can scale with your business, ensuring it can handle increasing subscriptions and customers without compromising performance.

2. Subscription Model Flexibility

Businesses may opt for various subscription models, including SaaS, e-commerce, or content subscription. The adaptability of each tool to the different subscription types and the customization choices that will allow you to install the tool to your unique business needs are worth considering.

3. Billing and Payment Options

Efficient billing and payment processing are a crucial component of any subscription-based business. Evaluate the tools for their billing automation capability, ability to handle different payment methods, and accuracy and efficiency in managing recurring revenue streams.

4. Customer Relationship Management (CRM)

A seamless customer experience is essential for retaining subscribers. Check out how each tool manages customer data, communication, and retention strategies. This includes features for tracking customer interactions, resolving issues, and providing excellent customer support.

5. Reporting and Analytics

The smart decisions are vital when it comes to the subscription business. Take a look at each tool’s reporting and analytics capabilities, ensuring that they help with tracking subscriber behavior, revenue trends, and churn rates. Comprehensive data analysis is the pillar that supports all strategic decisions.

6. Automation and Workflows

Time and resource efficiency are paramount. Consider how each tool streamlines your subscription management processes through automation and customizable workflows, reducing manual tasks and minimizing errors.

7. Compliance and Security

Your subscription management application must conform to security and data protection laws. Check out the security features of each tool and evaluate how well it can protect customer data integrity and privacy.

Top 5 Popular Recurring Billing Software Options

Here we go with the list of 5 most popular and

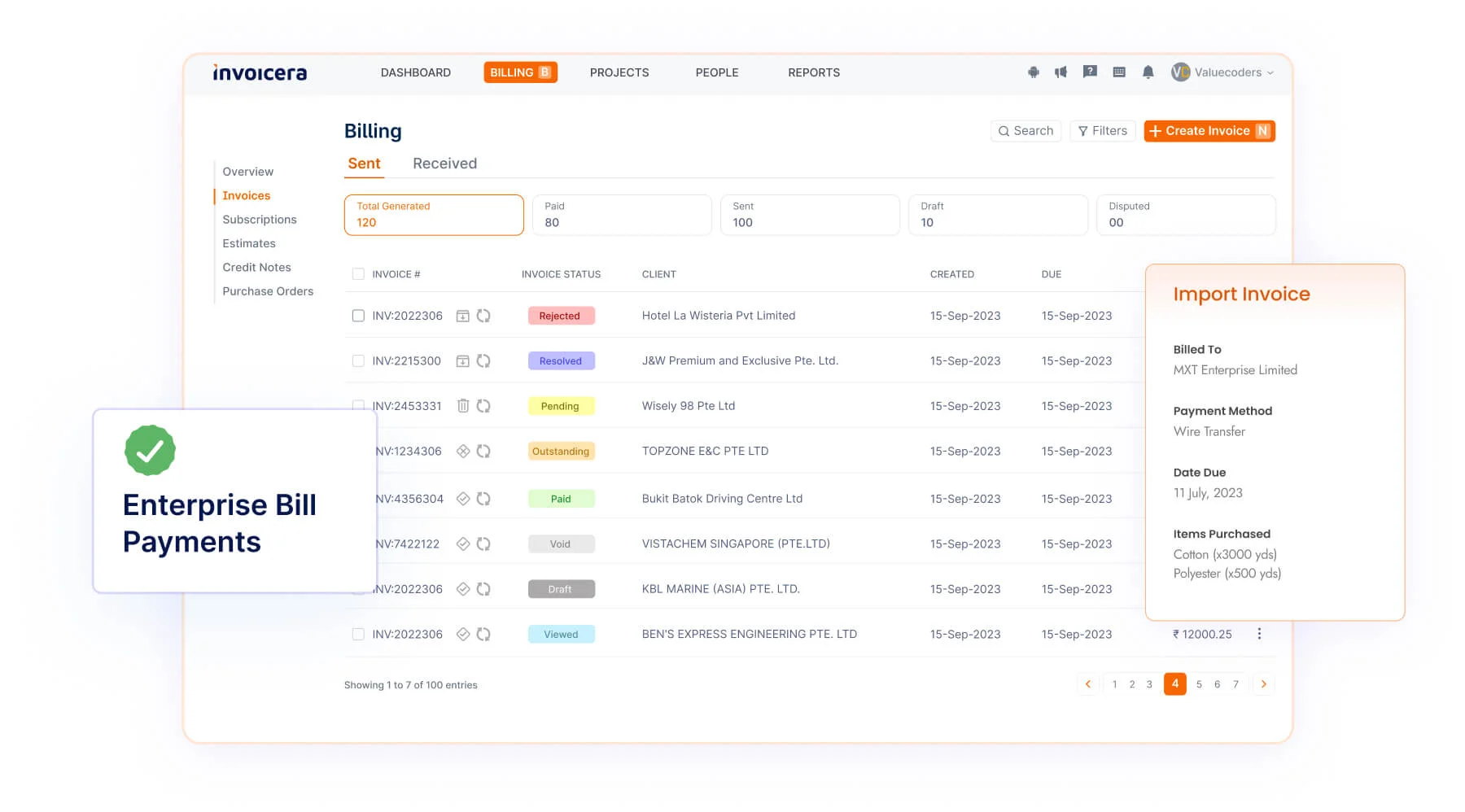

1. Invoicera

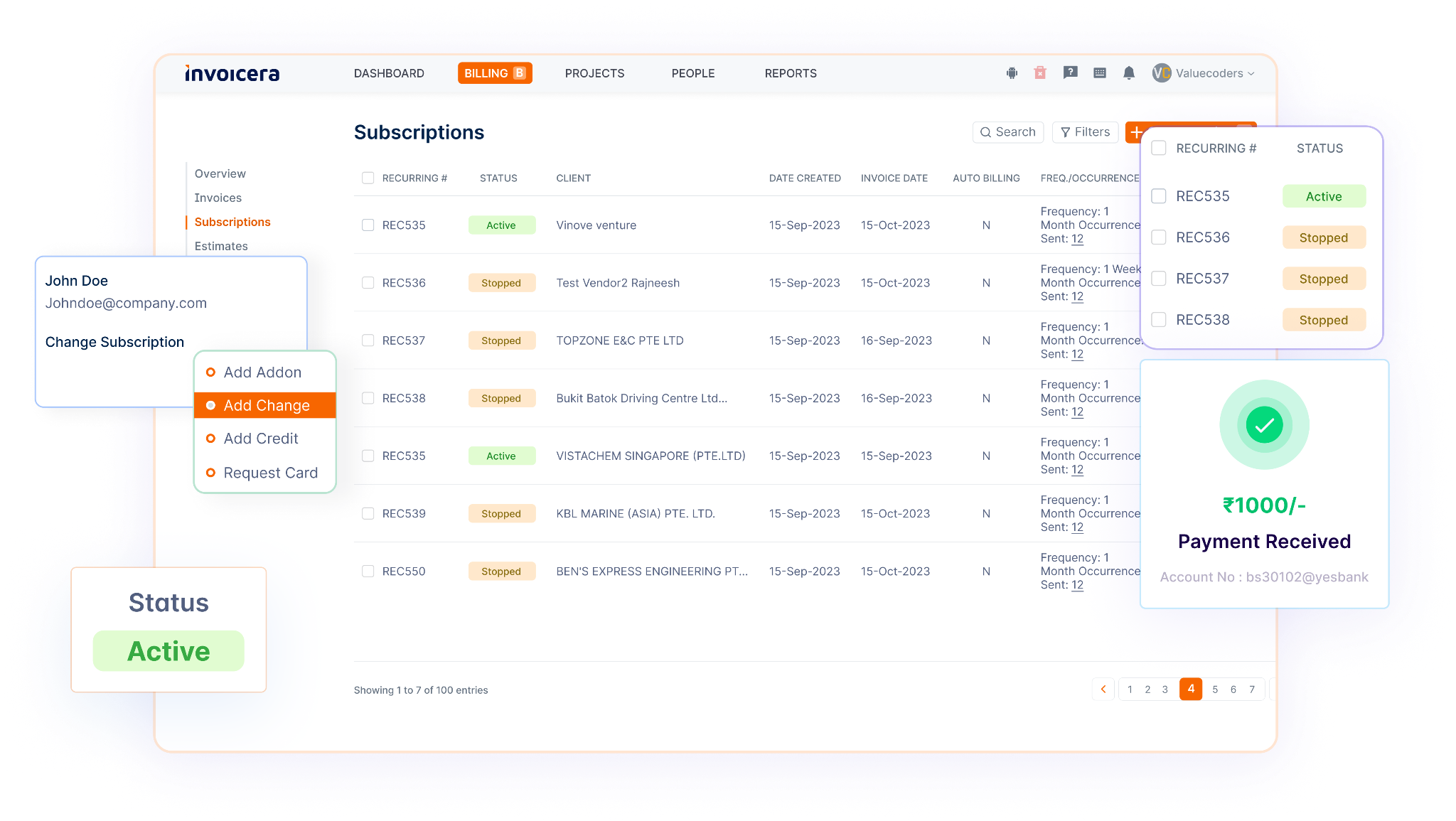

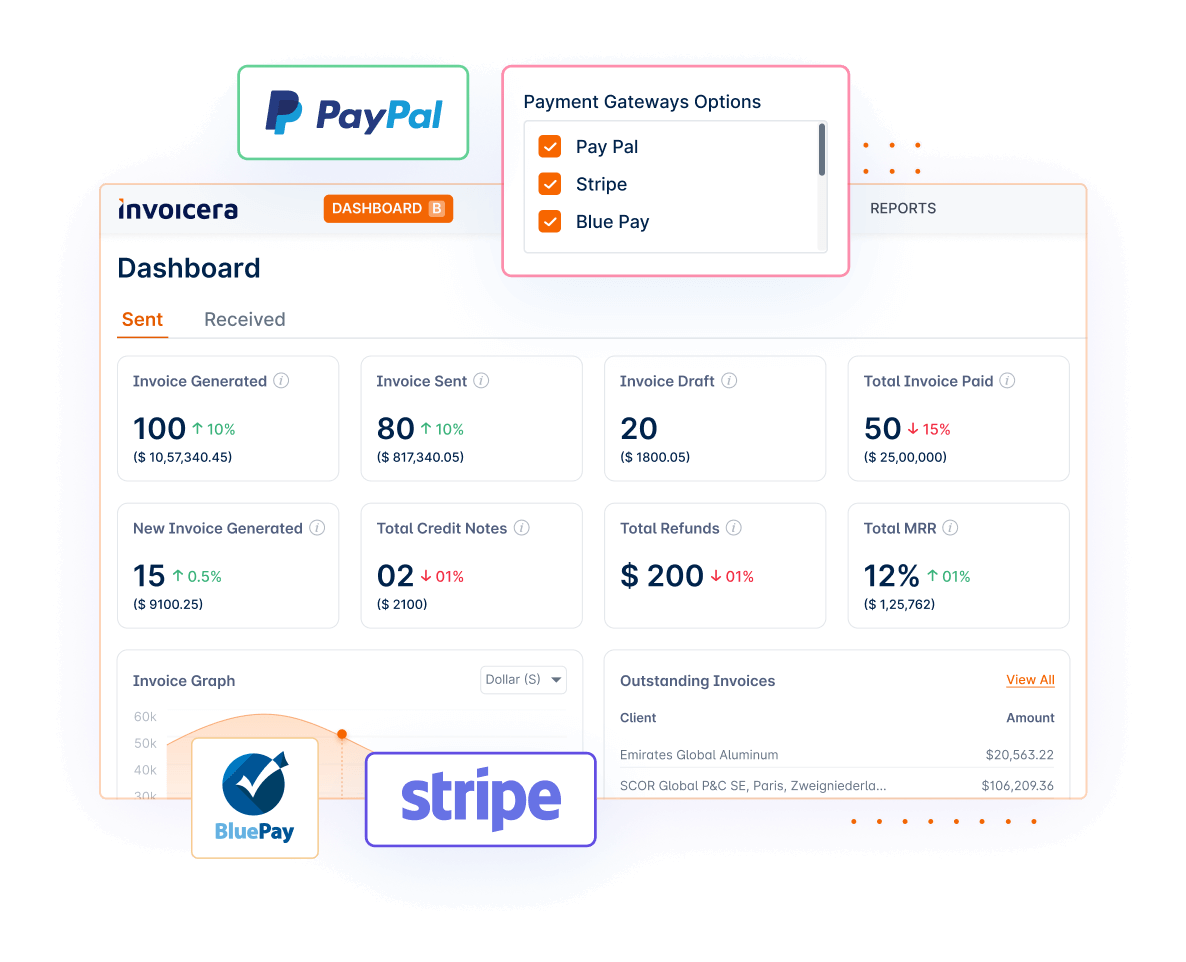

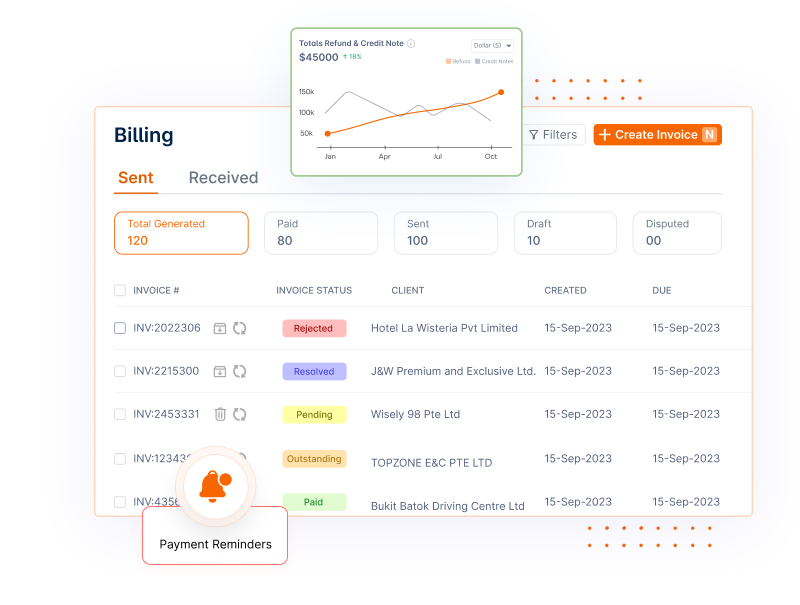

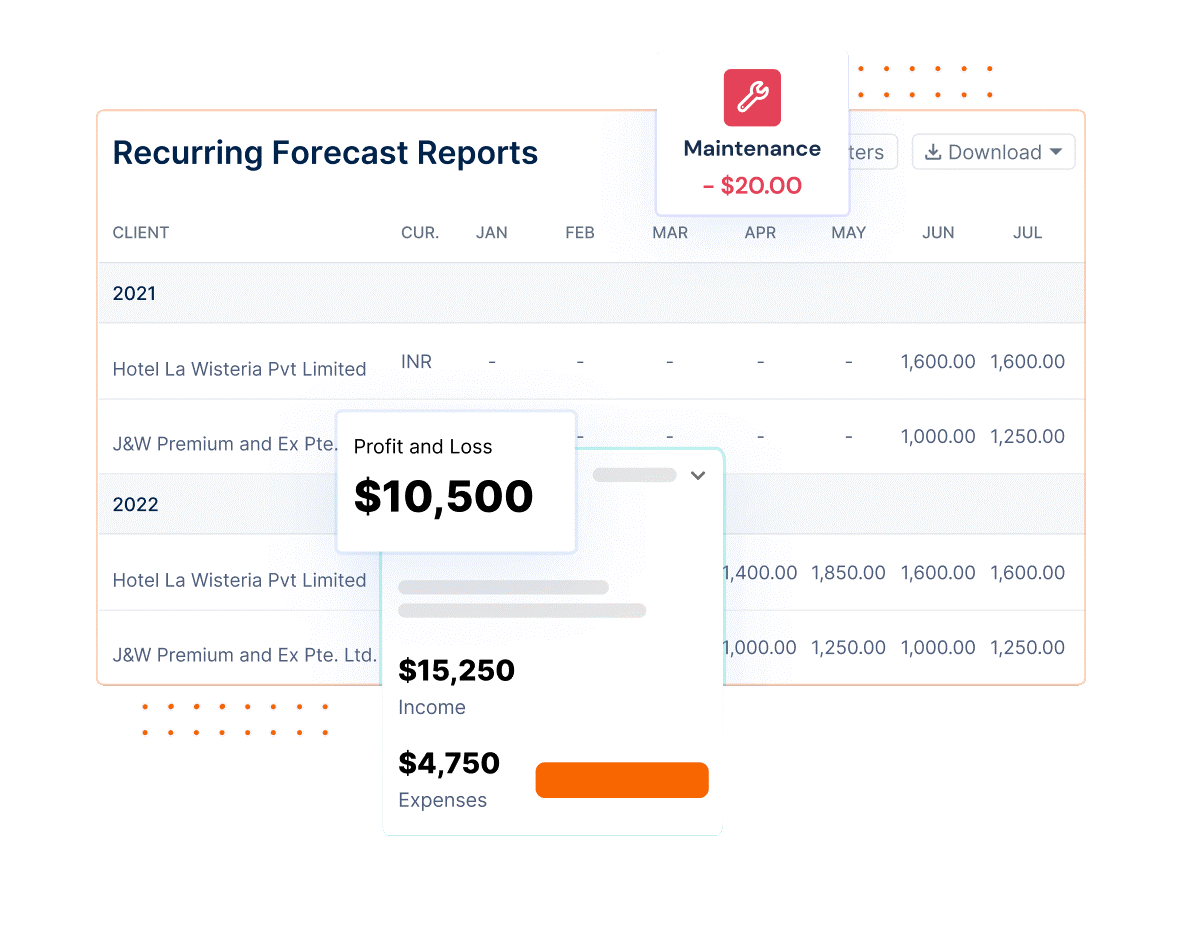

Dealing with easy connection bills and payment requests? Invoicera is the one you should go to. It facilitates the whole process much easier, hence making invoice preparation, transmission, and handling easy.

Even if you are a big or small company, Invoicera is an easy-to-use tool for you to manage your subscription billing.

Features

- Easy Billing: You can create and send professional invoices effortlessly, saving you time and ensuring prompt payments.

- Subscription Management: Handle your subscription-based services seamlessly by easily managing renewals and modifications for a hassle-free experience.

- Payment Gateway Integration: The available integration with 14+ payment portals allows for the provision of a stable and smooth transaction process that addresses a wider audience.

- Automated Reminders: Create automatic reminders to ensure that the due payments for each invoice is always an issue you attend to instantly, without having to constantly worry about them.

- Financial Reports: Create smart financial reports that will monitor your business’s health and provide managerial insights to help you make the right decisions.

2. Zoho Subscriptions

Zoho Subscriptions is a very easy-to-use tool that can suit businesses of any size. It simplifies account sorting and provides a more efficient way to manage recurring bills and subscriptions. This platform is able to manage customer subscription billing for you, which in turn keeps customers loyal and boosts revenue.

Features

- Flexible Pricing Plans: Offer customers subscription plans containing different categories and allow easy management.

- Customer Self-Service Portal: Give customers a chance to manage their subscriptions.

- Automated Recurring Payments: Streamline the workflow for recurring billing and payments.

- Multi-Currency Support: Cater to multilingual clients with multiple currencies.

- Subscription Metrics: Evaluate and analyze metrics and data that relate to subscriptions and see the growth.

3. Freshbooks

FreshBooks is just the right thing for all businesses. It has access to a lot of features, namely billing, user management, and accounting.

Freshbook’s easy-to-use interface will help you handle finances and manage your subscriptions flawlessly.

Features

- User-Friendly Invoicing: Easily create and modify invoices and other documents with a user-friendly interface.

- Time Tracking: Track billable hours and effectively set up your team projects’ tasks.

- Expense Management: From tracking expenses to organizing receipts hassle-free, the application could be your go-to.

- Subscription Tracking: Automatically keep your subscriptions up-to-date and manage them with minimal effort.

- Mobile Accessibility: Get access to your subscription data from anywhere using the mobile app.

4. Recurly

Recurly is suitable for business models that work on the basis of subscriptions, as it is specifically designed for them.

It facilitates intelligent billing and revenue optimization, covering all aspects of your subscription-based business so that you can grow your business intelligently.

Features

- Subscription Billing Automation: Automate billing processes for recurring revenues.

- Revenue Recognition: Identify the possible sources of revenue for the business and make the revenue recognition process fully accurate.

- Subscription Analytics: Get easy-to-read, detailed information on all aspects of your subscription business performance.

- Subscription Changes: Effortlessly manage payments and countdowns anytime you want.

- Payment Gateways: Process payments through the integration of multiple payment gateways to prevent disruptions.

5. Chargebee

Chargebee is a comprehensive platform that addresses all subscription management issues. From billing to revenue recognition, it manages complex processes.

Chargebee automates billing processes, manages subscribers, and furnishes analytics enabling the growth of a business. This makes it an integral tool for flourishing companies.

Features

- Subscription Billing: Manage billing for many subscription services (monthly, quarterly, and yearly).

- Revenue Recognition: Automate revenue recognition to meet the criteria of the accounting principle.

- Dunning Management: Manage failed payments and churn efficiently.

- Analytics and Insights: Get grips with insights into subscription performance.

- Integration Hub: Connect to numerous third-party apps and services.

6. Stripe

Stripe is a widely known payment processor in the internet world, and it is the best tool for subscription management.

It provides a secure and convenient channel for handling subscriptions by offering different features that help both you and your customers manage recurring payments and subscriptions.

Features

- Seamless Payments: Process online transactions securely and conveniently.

- Subscription Billing: Follow up on, update, and personalize subscription plans.

- Smart Recovery: Automate the dunning process and recover the failed payments.

- Real-time Insights: Get real-time data insights that you can use to make informed decisions.

- Developer-Friendly: Easy to integrate Stripe into your website or app.

7. Square Invoices

Square Payments stands out as a top-tier subscription billing platform, delivering an unparalleled checkout experience that is both comprehensive and effortlessly user-friendly. Enjoy stress-free payment processing at all times, coupled with a range of options for your customers, such as Paypal, ApplePay, and more.

Features

- Effortless Setup: Start smoothly with Square Payments, ensuring an easy onboarding experience for users of all levels.

- Credit Card Processing: Seamlessly handle payments, allowing your customers the convenience of using credit cards for transactions.

- Payment Variety: Provide flexibility with multiple payment options, including popular choices like Paypal and ApplePay, ensuring a seamless checkout experience.

- POS Integration:Unify your business management by seamlessly integrating Square Payments with your windows Point of Sale (POS) system.

- Subscription Support: Streamline subscription services effortlessly with Square Payments, simplifying the management of renewals and modifications.

8. Zuora

Zuora is a key player in the subscription economy. It’s a comprehensive subscription management system that empowers businesses to thrive in a subscription-centric world. With Zuora, you can manage subscriptions, pricing, and billing, making it a strategic asset for businesses embracing subscription models.

Features

- Subscription Pricing Strategies: Implement flexible pricing and packaging strategies.

- Subscription Metrics: Track key subscription metrics for informed decisions.

- Billing Automation: Automate complex billing processes.

- Revenue Forecasting: Predict future revenue based on subscription data.

- Subscription Order Management: Streamline order management for subscriptions.

Steps To Implement Recurring Billing Software

Implementing recurring billing software can be a transformative journey for your business, streamlining financial processes and ensuring a steady income flow. Let’s break down the key steps to seamlessly integrate this game-changing tool into your operations.

Strategic Planning and Needs Assessment:

The journey begins with a thorough understanding of your business requirements. Identify the specific needs and objectives for implementing recurring billing software.

Consider factors such as billing frequency, customization requirements, and integration with existing systems. A clear roadmap sets the foundation for a successful implementation.

Software Selection Process:

With your business requirements in focus, embark on the quest to find the right recurring billing software. Explore reputable providers in the market, considering factors such as scalability, security features, and compatibility with your industry.

Look for solutions that align with your business goals and provide the flexibility needed for future growth.

Implementation and Integration:

Once you’ve selected the ideal software, it’s time to implement and integrate it into your existing systems.

Collaborate closely with your IT and finance teams to ensure a seamless transition.

The goal is to have the software working harmoniously with your current infrastructure, minimizing disruptions to day-to-day operations.

Training and On-boarding:

Empower your team with the knowledge and skills needed to maximize the benefits of the new system. Conduct training sessions to familiarize staff with the recurring billing software’s functionalities.

A well-trained team not only ensures smooth operations but also minimizes the learning curve, allowing your business to reap the rewards of the software more quickly.

Regular Monitoring and Optimization:

Implementation doesn’t mark the end of the journey but rather the beginning of a continuous improvement process. Regularly monitor the performance of the recurring billing software, keeping an eye on transaction success rates, customer feedback, and any potential issues.

Optimize processes based on feedback and evolving business needs, ensuring that the software continues to align with your strategic objectives.

Elevate Success through Recurring Billing

This blog has guided you through everything about recurring billing, spotlighting its advantages, popular software options, and implementation steps.

Recurring billing software benefits you a lot, from ensuring a steady cash flow to building customer loyalty and scaling for growth. Considerations for choosing the right software include scalability, efficient billing processes, and robust customer relationship management.

Explore popular options like Invoicera, Zoho Subscriptions, Freshbooks, Recurly, and Chargebee for your recurring billing needs. Implementing recurring billing software involves strategic planning, seamless integration, and continuous optimization.

As you embark on this transformative journey, may your subscriptions become success stories. Here’s to the future of billing – efficient, customer-centric, and geared for lasting success!

FAQs

What are some common features to look for in subscription management tools?

Common features include automated billing, subscription analytics, customer management, invoicing, dunning management, and integration options. The right mix depends on your business needs.

Can these tools help me with customer retention and churn management?

Many subscription management tools offer features to monitor customer behavior, reduce churn, and implement strategies to retain customers. They provide insights and tools to improve customer retention rates.

Do these tools integrate with popular payment gateways and accounting software?

Yes, most top subscription management tools offer integrations with widely used payment gateways and accounting software. This ensures a smooth financial workflow.