Introduction

Crowdfunding is not just about collecting funds; it’s about building a community, telling a compelling story, and transforming dreams into reality.

It has become a game-changer for turning ideas into reality.

In 2020 alone, the global crowdfunding volumes soared past $34 billion, highlighting its massive appeal and effectiveness, as per Statista.

But behind these impressive figures lie real challenges.

Are you someone with a startup idea craving financial support? Or an artist itching to make your vision a reality?

Crowdfunding seems like the golden ticket, but is not an easy journey.

You might be thinking:

- What are the types of crowdfunding?

- Which are the best crowdfunding platforms?

- What tax implications come with the success of a crowdfunding initiative?

- What challenges might arise in engaging the audience to support a campaign?

Well! This guide has answers to all your questions.

Whether you’re an aspiring creator with a big idea or a business looking to grow, crowdfunding offers a way to make those dreams real.

Let’s explore this world together and discover how to turn ambitions into accomplishments.

What Is Crowdfunding?

Crowdfunding is a modern method that harnesses the collective support of many individuals, often through online platforms, to finance a project, business, or creative endeavor.

Instead of relying on traditional avenues like bank loans or venture capitalists, crowdfunding allows individuals or businesses to raise funds by attracting contributions from a wide audience, typically in smaller amounts.

How Does Crowdfunding Work?

Crowdfunding works on the principle of collective participation, where project creators or entrepreneurs pitch their ideas or initiatives on crowdfunding platforms.

These platforms serve as digital marketplaces, allowing creators to showcase their projects, set funding goals, and outline various incentives or rewards for backers who support their campaigns.

The Impact of Crowdfunding

It lets regular folks and small businesses get money from lots of people all over the world. It helps those with cool ideas or little money get support from a big audience.

It fosters a sense of community engagement, allowing backers to feel emotionally invested in the success of a project and creating opportunities for collaboration and support beyond financial contributions.

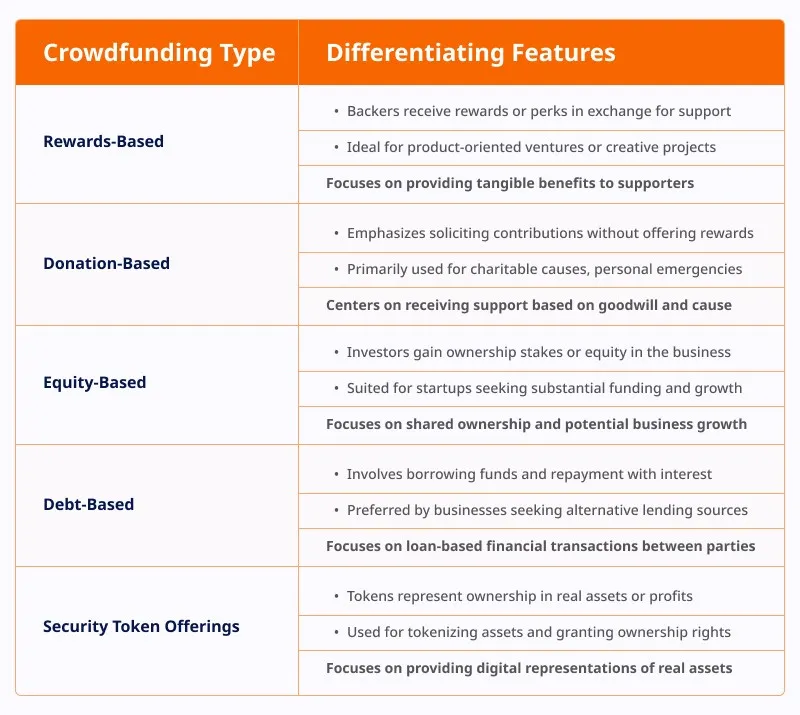

Exploring The 5 Types Of Crowdfunding

Crowdfunding isn’t a one-size-fits-all solution; it comes in various forms, each with its unique way and purpose. Understanding these types can significantly impact the success of your campaign.

Let’s dive into the five primary categories:

1. Rewards-Based Crowdfunding:

This type involves offering backers rewards or perks in return for their support. These rewards range from early access to products, exclusive custom merchandise, or personalized experiences.

Suitable for: Startups, artists, or product-oriented ventures aiming to engage their audience and incentivize support through tangible benefits.

2. Donation-Based Crowdfunding:

Donation-based crowdfunding revolves around soliciting contributions without offering material rewards. It’s often utilized for charitable causes, personal emergencies, or community projects.

Suitable for: Philanthropic endeavors, medical expenses, or social initiatives that rely on the goodwill of contributors.

3. Equity-Based Crowdfunding:

This model involves investors receiving a stake in the business in exchange for their financial support. It’s akin to traditional investing but through crowdfunding platforms.

Suitable for: Startups or businesses seeking substantial funding and willing to share ownership in return.

4. Debt-Based Crowdfunding:

Also known as peer-to-peer lending, this type involves individuals or businesses borrowing funds directly from investors who expect repayment with interest.

Suitable for: Businesses in need of loans but preferring an alternative to traditional banking often turn to debt-based crowdfunding.

5. Security Token Offerings (STOs):

STOs involve issuing digital tokens backed by real assets like shares, profits, or tangible assets, giving investors ownership rights.

Suitable for: Businesses aiming to tokenize assets and provide investors with fractional ownership.

Advantages Of Crowdfunding

Crowdfunding isn’t just a means of raising capital; it’s a dynamic tool with several advantages that extend beyond financial support.

Here are key benefits:

1. Access to Capital:

- Diverse Funding Sources: Crowdfunding opens doors to various backers, from individual contributors to institutional investors, expanding funding possibilities.

- Seed Funding for Startups: Particularly beneficial for startups and early-stage ventures that might struggle to secure traditional financing.

2. Market Validation and Customer Engagement:

- Test Product Appeal: Launching a campaign helps gauge market interest and validate the appeal of a product or service before investing heavily.

- Direct Customer Feedback: Engaging with backers fosters a direct line of communication, allowing creators to refine offerings based on real-time feedback.

3. Building a Community and Brand Advocacy:

- Engagement and Loyalty: Crowdfunding creates a community around a project, fostering a loyal supporter base passionate about the idea.

- Brand Exposure: Increased visibility on crowdfunding platforms can lead to broader brand recognition and advocacy.

4. Cost-Effective Marketing and Promotion:

- Platform Exposure: Campaigns on crowdfunding platforms offer exposure, acting as a marketing avenue without the need for significant upfront costs.

- Storytelling Opportunity: Crafting a compelling campaign narrative not only attracts backers but also serves as free marketing.

5. Flexible Funding Models:

- Various Funding Structures: Different types of crowdfunding—rewards-based, equity-based, donation-based—provide flexibility to suit diverse project needs.

- Tailored Financing: Allows creators to choose a funding model aligned with their goals and offerings.

6. Potential for Early Adoption and Partnerships:

- Early Adopters and Supporters: Attracting early adopters who can become brand ambassadors, creating momentum post-campaign.

- Networking Opportunities: Crowdfunding campaigns often catch the eye of potential partners or collaborators, fostering future business relationships.

Top 5 Crowdfunding Platforms For Each Type

1. Kickstarter for Rewards-Based Crowdfunding

A pioneer in the crowdfunding website, Kickstarter has a strong reputation for supporting creative projects across various categories like art, technology, design, and gaming.

It follows an all-or-nothing funding approach, where projects need to reach their funding targets to receive any pledged funds from supporters.

With its large user base and established track record, Kickstarter offers creators a platform to showcase their projects and gain significant visibility within a community of backers passionate about innovation.

Pricing: Kickstarter applies a 5% platform fee when your fundraising goal is met. Additionally, for each transaction, there’s a 3% + $0.20 fee (or 5% + $0.05 for donations under $10).

2. GoFundMe for Donation-Based Crowdfunding

Leading the charge in donation-based crowdfunding, GoFundMe has become synonymous with personal causes, emergencies, medical needs, and charitable endeavors.

Its user-friendly interface and wide reach make it a go-to platform for individuals and communities seeking immediate financial support.

GoFundMe’s success stories often revolve around individuals rallying support for personal challenges, community projects, or charitable initiatives, leveraging social connections to make a meaningful impact.

Pricing: On GoFundMe, users are prompted to request a platform tip from donors, and there isn’t an option for donors to cover the 2.9% + $0.30 payment processing fee.

3. SeedInvest for Equity-Based Crowdfunding

Focused on equity-based crowdfunding, SeedInvest stands out for its emphasis on startups and early-stage companies seeking investors. The platform curates investment opportunities, providing accredited investors access to a range of high-potential ventures.

With a rigorous vetting process for listing companies, SeedInvest offers a secure environment for both investors and entrepreneurs, facilitating connections between promising startups and interested backers seeking equity stakes.

Pricing: SeedInvest applies different charges, encompassing a 7.5% placement fee calculated on the entire raised amount, a 5% fee on convertible note or equity, and potentially up to $10,000 for covering administrative and legal expenses.

4. LendingClub for Debt-Based Crowdfunding

LendingClub facilitates connections between business owners and a network of investors for funding business ventures. Applicants can request business loans up to $500,000. After undergoing the screening process, LendingClub links borrowers to potential investors.

This enables business owners to receive their funds upfront and repay them similar to a conventional loan structure.

LendingClub imposes stringent criteria for loan eligibility, necessitating applicants to be U.S.-based, operating for at least a year, and generating a minimum of $50,000 in annual sales.

Pricing: The platform also applies several fees, such as an origination fee ranging from 3.49% to 7.49%, alongside a monthly payment per $10,000 borrowed, which varies between $227 and $1,781.

5. Polymath for Security Token Offerings (STOs)

At the forefront of security token offerings (STOs), Polymath specializes in facilitating the creation and management of security tokens for businesses.

Leveraging blockchain technology, Polymath provides a platform for companies to issue regulatory-compliant security tokens, enabling fractional ownership of assets while ensuring compliance with securities laws.

With a focus on tokenization, Polymath aims to reshape traditional finance by making assets more liquid and accessible to a wider investor base.

Each platform represents a niche within the crowdfunding landscape, catering to specific funding models and offering distinct opportunities for creators, investors, and businesses seeking financial backing or investment avenues.

Strategies For Crowdfunding Success

Making a crowdfunding campaign successful isn’t just about sharing your idea. It’s about telling a great story and getting people excited about it.

Here are some ways to make your campaign a success:

- Tell Your Story

- Craft a compelling and authentic story around your project. Share the ‘why’ behind your idea, your passion, and the impact it could have.

-

Use visuals—photos, videos, infographics, even videos streamed through a live transcoder—to reinforce your narrative and create an emotional connection with potential backers.

- Set Clear Goals

- Define specific and achievable goals for your campaign. Clearly outline what you aim to accomplish and how the funds will be utilized.

- Break down your funding target into smaller, attainable milestones to create momentum throughout the campaign.

- Build a Strong Online Presence

- Leverage social media platforms, your website, and relevant online communities to create awareness and buzz around your campaign. Leverage social media platforms, your website, and relevant online communities to create awareness and buzz around your campaign. “For channels like Instagram consider getting some followers to share your brand content to boost visibility.”

- Engage with your audience consistently. Respond to comments, share updates, and involve your backers in the journey.

- Offer Compelling Rewards

- Create different levels of rewards that are appealing and diverse based on how much someone contributes. Make sure the rewards match what your target audience likes.

- Consider limited-edition perks or exclusive experiences to incentivize higher contributions.

- Plan a Robust Marketing Strategy

- Develop a detailed marketing plan well before the launch. Consider email newsletters, influencer partnerships, and PR efforts to expand your reach.

- Implement a pre-launch strategy to generate excitement and gather initial support.

Learnings from Successful Campaigns

Studying successful crowdfunding campaigns can provide invaluable insights and inspiration. Some key takeaways include:

- Community Engagement: Successful campaigns prioritize building and engaging a community early on. They involve backers in the journey, fostering a sense of ownership.

- Transparency and Communication: Clear communication and transparency regarding project updates, challenges faced, and how funds are utilized instill trust and credibility.

- Adaptability: Flexibility and adaptability to unforeseen circumstances or feedback during the campaign are crucial for making necessary adjustments.

Tax Considerations For Crowdfunded Income

Regarding crowdfunding, it’s essential to understand that the funds you raise might have tax implications. The way these funds are taxed can vary based on the type of crowdfunding and the nature of the income received.

Understanding Tax Obligations:

- Income Classification: The IRS categorizes crowdfunded income as either gifts, business income, or taxable donations, depending on the nature of the crowdfunding campaign. For instance, if backers simply donate without expecting anything in return, it might be considered a gift. However, it might be classified differently if backers receive rewards or equity.

- Taxable vs. Nontaxable Income: Income received through crowdfunding campaigns could be taxable or nontaxable.

Gifts or donations without exchange might be nontaxable, while income from selling products or providing services could be taxable as business income.

Advice on Managing Tax Implications

- Keep Detailed Records: Maintain records of all transactions, including funds received and expenses incurred during the crowdfunding campaign. This documentation is vital for accurately reporting income and deductions at tax time.

- Consult a Tax Professional: Given the complexities of tax laws surrounding crowdfunding, seeking advice from a tax professional or accountant is highly recommended. They can provide tailored guidance based on your situation, ensuring compliance with tax regulations.

- Fulfill Reporting Obligations: Depending on the nature of the income, you may need to report it on different tax forms. For example, if the money received is classified as business earnings, it may be necessary to declare them on Schedule C of Form 1040 for individuals who are sole proprietors.

- Be Aware of Deductions: Expenses directly related to the crowdfunding campaign, such as marketing costs or fees charged by the crowdfunding platform, might be deductible. Understanding what can be deducted can help lower the taxable income.

- Stay Updated on Tax Regulations: Tax laws can change, and crowdfunding tax rules might evolve. Staying informed about updates or regulations ensures compliance and helps plan future campaigns.

Choosing The Right Crowdfunding Type

Selecting the right crowdfunding type isn’t just about picking a platform; it’s about finding the perfect match for your project’s needs and overarching business objectives.

Here’s how to navigate this crucial decision-making process:

Factors to Consider:

- Nature of Your Project: Assess the nature and scope of your project. Are you offering a tangible product, seeking investment in your business, or raising funds for a charitable cause? Different crowdfunding types cater to varying project objectives.

- Target Funding Amount: Determine the amount you need to raise. Some platforms are more suitable for smaller, fixed goals, while others accommodate larger funding requirements.

- Audience Engagement: Understand your audience and their preferences. Are they more inclined towards rewards for their contributions, or are they interested in equity or donations?

- Timeframe: Consider the timeline for your campaign. Certain crowdfunding models may have time constraints or better suit short-term versus long-term projects.

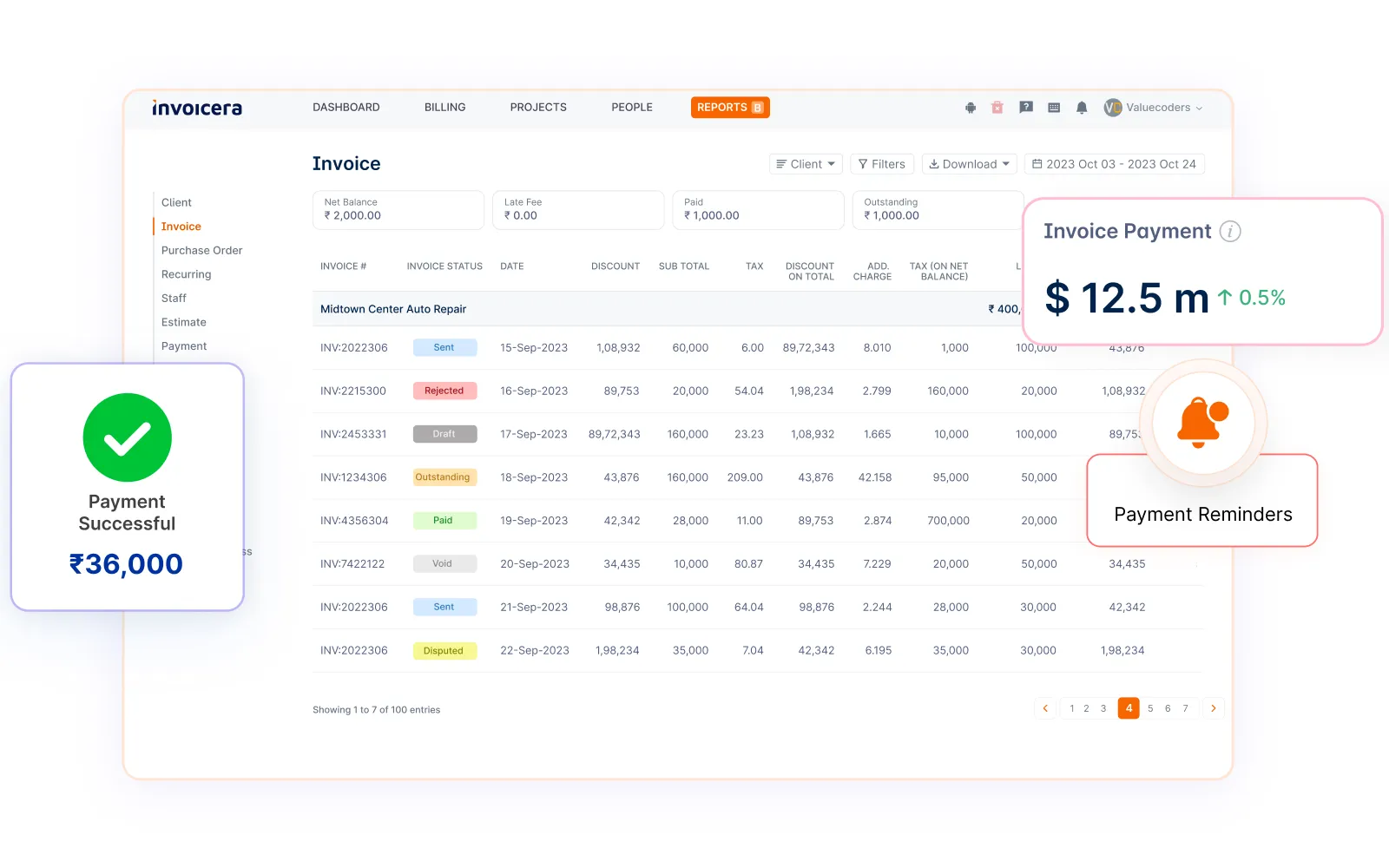

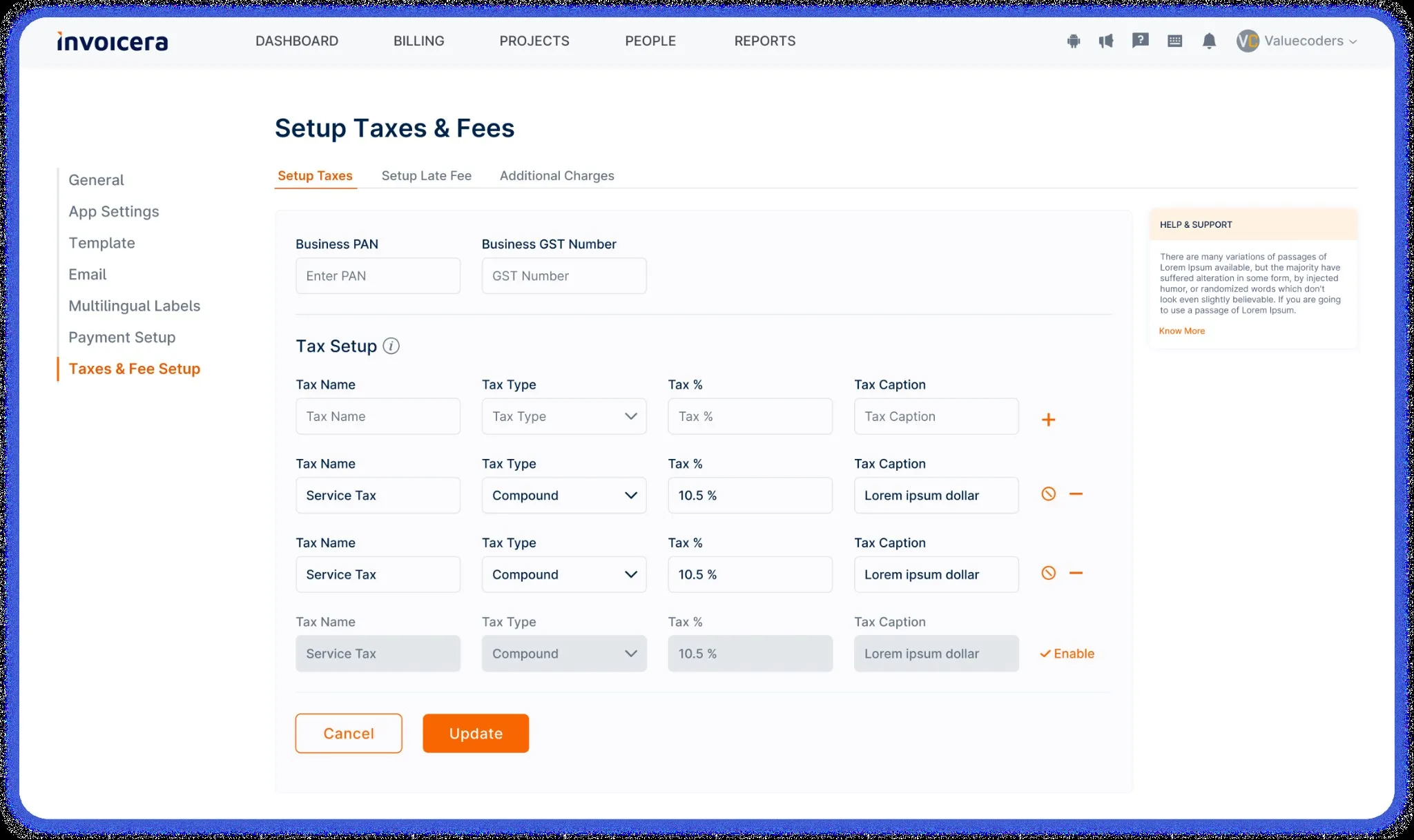

How Invoicera helps in Crowdfunding?

Efficient management of finances lies at the heart of any successful crowdfunding campaign. As funds pour in from backers or investors across various channels, maintaining transparency, accuracy, and organization becomes paramount.

This is where specialized platforms like Invoicera step in to streamline and optimize the financial aspects of your crowdfunding endeavor.

1. Transparency and Accountability:

Invoicera provides a centralized system that meticulously records every financial transaction associated with your crowdfunding campaign. This transparency not only instills confidence in backers but also ensures accountability in the utilization of funds.

From incoming contributions to outgoing expenses, every financial movement is tracked and documented, offering a clear trail of where the money comes from and how it’s utilized.

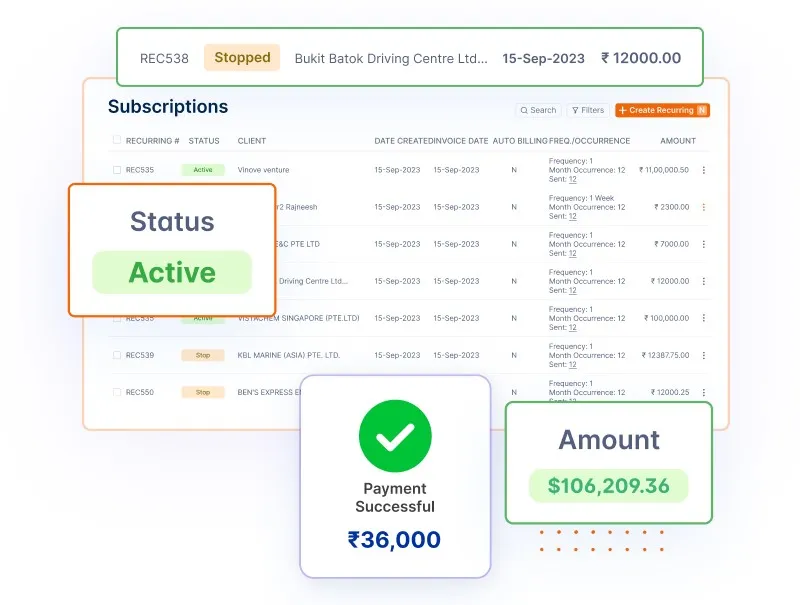

2. Efficient Fund Management:

Managing incoming funds from diverse sources can be daunting without a structured system in place. Invoicera’s platform offers tools to categorize, organize, and manage these funds efficiently.

Through customizable invoicing, it allows for easy differentiation between various types of contributions—be it donations, investments, or pre-orders—streamlining the tracking of each financial stream associated with your campaign.

3. Automated Processes:

Handling numerous transactions manually can be time-consuming and prone to errors. Invoicera automates financial processes, reducing the margin for human error and enabling smooth, error-free transactions.

Automated invoicing and payment reminders ensure that backers receive timely and accurate information about their contributions, fostering trust and reliability throughout the campaign.

4. Regulatory Compliance:

Crowdfunding involves financial regulations and compliance requirements. Invoicera assists in maintaining compliance by generating reports and documentation necessary for regulatory purposes.

This helps in adhering to legal obligations, ensuring that your crowdfunding campaign operates within the established financial frameworks.

5. Real-Time Financial Insights:

Understanding the financial health of your campaign in real time is crucial for making informed decisions. Invoicera provides comprehensive dashboards and analytics that offer insights into the campaign’s financial performance.

These insights empower campaign managers to assess the effectiveness of their strategies and make necessary adjustments for better outcomes.

Key Takeaways

- Crowdfunding Variety: Explore diverse funding models—from rewards to equity-based—to find the right fit for your project’s needs.

- Pros and Cons Awareness: Understand the benefits and challenges of crowdfunding to navigate it effectively.

- Platform Alignment: Choose a platform aligned with your project’s nature and goals for better success.

- Compelling Storytelling: Craft a compelling narrative to engage backers and enhance campaign success.

- Financial Awareness: Be mindful of tax implications and manage finances wisely during and after the campaign.

- Tailored Approach: Customize your strategy to match your project’s uniqueness and audience preferences.

- Community Engagement: Build and nurture a strong connection with your backers for ongoing support.

- Continuous Learning: Learn from both successful and unsuccessful campaigns for invaluable insights.

FAQs

Which type of crowdfunding is best for my project?

The ideal type depends on your project’s nature and goals. Rewards-based suits product launches, while equity-based might befit a startup seeking investment.

What are the key elements of a successful crowdfunding campaign?

Compelling storytelling, clear goals, engaging visuals, and proactive engagement with your audience are crucial.

Can I run multiple crowdfunding campaigns simultaneously?

Yes, but it requires careful management to avoid overwhelming yourself or your backers. Ensure you have the capacity to handle multiple campaigns effectively.