Discounts are an integral part of the entire sales and marketing process. There are two types of discounts in sales and marketing:- purchase discount and the sales discount. These discounts vary in terms of who receives them and why, but they’re also connected in such a way that intelligent marketers can use both to increase revenue and profit.

What is a sales discount in accounting? It is more likely that people will walk into a store if they knew that there was a discount on the products the store sold. A store that sells branded clothing is usually pretty empty until they put up a sign saying that they are offering up to 50% off on their clothes. But, of course, they are not doing this out of the generosity of their hearts; there is something in it for them too, as giving discounts is an integrated marketing strategy for retailers and wholesalers.

Purchase Discount vs. Sales Discount In Accounting Terms

Sales Discount:

Amongst the variety of discounts offered in any market, the one most widely used is the sales discount. It is the kind of discount we are most familiar with. A sales discount refers to reduction in the price of an item or product that a customer buys from a retailer. Imagine walking into a Levis store and finding that the jeans that you wanted to buy were marked down by 30%. That would be a sales discount.

Sales discounts are offered for a variety of reasons. Retailers might want to move new products into their outlets, and thus, will reduce the prices of the old merchandise in order to get customers to buy it. If the season for a particular type of clothing is over (winter clothes, for example), then they are typically put on sale. Bigger brands such as delta 8 brands might want to seem attractive to a wider market and could, therefore, offer big discounts in order to seem more affordable. Some retailers might just offer discounts because they themselves have received purchase discounts. Getting a purchase discount also encourages the retailers to offer sales discounts to their customers.

Purchase Discounts:

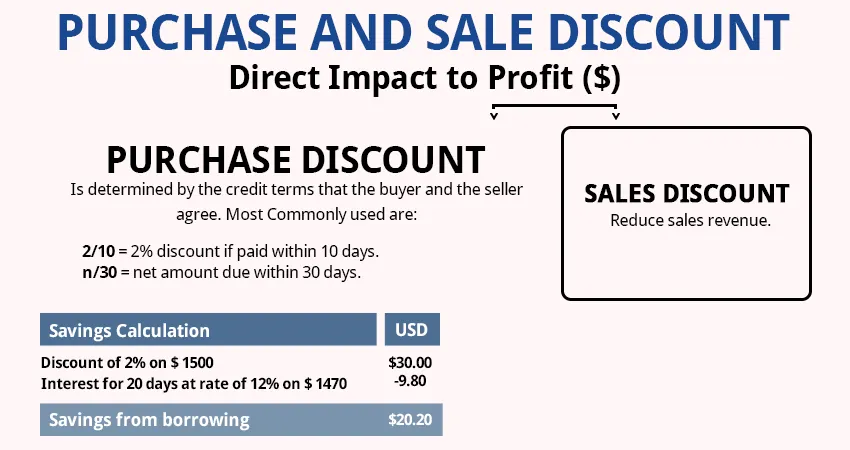

So, what is a purchase discount? Individual customers are not the only ones that get discounts. Purchase discounts are the reductions that retailers and stores get from their wholesalers. Purchase discounts offered to stores can depend on a variety of factors such as the size of the order, a cut in prices of raw material, etc. These supplier discounts are usually offered because the retailer buys products in bulk, or for early payment of an invoice. For example, for a sale worth 100 rupees, a supplier might let the retailer pay 20 rupees less if the retailer agrees to pay within 5 days. If the retailer pays at a later date, the purchase discount gets canceled.

The grander (marketing) scheme of things across Sales Discount and Purchase Discount

As mentioned earlier, in any business offering discounts is an integral part of their marketing and sales scheme. Wholesalers want their goods to be bought in bulk, and to be paid early. Retailers mark down their products when they want to get rid of the old stock and replace them with new inventory. They wanted to attract more customers with their seemingly affordable prices. One of the most important reasons that discounts are offered is to generate consumer surplus. Additionally, discounts can drive impulse purchases, leading to increased sales volume. Platforms like Earthweb make it easier for businesses to list their coupons and discounts, reaching a broader audience.

Simply put, consumer surplus is the difference between what customers are willing to pay for goods or services, and what they do pay (i.e. the market price). Occasional customer surplus is a positive business growth strategy as it makes them think a great bargain

Getting purchase discounts allows retailers to offer sales discounts and thus, keep their customers satisfied.

CONCLUSION

Finding a way to increase sales revenue and further decreasing costs to churn out more profits from a business is important for any business. One can use an Online Invoicing tool to improve business productivity by managing tasks and efficiency. The ability to calculate financial reports with the help of an online invoicing tool like Invoicera helps a business to take relevant finance-related decisions on time and even allows it to forecast finances well before time.

Choose a tool like Invoicera to automate your business process and manage clients more efficiently. The invoicing platform consists of supported features from project/task management, purchase order, estimate management, expense management, financial reports, time tracking, Credit Notes, staff management to Custom workflow management and more.