The economic trend for all the countries across the world is never the same. The rise and fall of trade as a result of varying demand leads to changing business cycles. Important as they are, they surely need a clear understanding.

Let us draw some light and comprehend what these business cycles are.

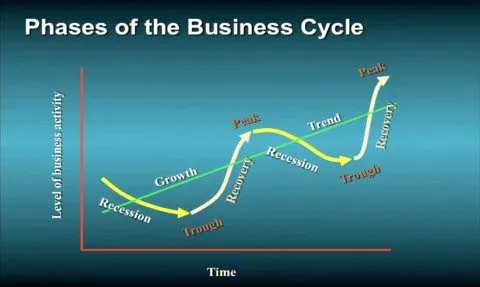

Business cycles are basically defined as the fluctuations in the economic activities which are experienced over a period of time. The economies across the world do not follow a linear graph all the time. They instead follow a crest and trough pattern like a sinusoidal wave indicating the change in the form of recessions and expansions. During the period of expansion, the economy of the country keeps expanding.

One can view this in the graph as the period measured from the trough (or bottom) of the last business cycle till the peak of the current business cycle.

The period is favorable for country’s economic growth as it marks the rise of employment, industrial production, sales and even personal incomes. Recessions, on the other hand, indicate the shrinking of an economy and are measured by checking the instantaneous dip from the peak levels to the bottom most level of the trough.

As per the reports shared by NBER ( National Bureau of Economic Research – a body that provides information on the official dates of business cycles), there have been 11 business cycles from 1945 to 2009 with the average period of a business cycle being roughly 69 months. One interesting thing to know is that out of the 69 months cycle, the average expansion lasts for around 58.4 months and average contraction lasts only 11.1 months.

Extending the discussion on business cycles, we will now understand the causes of these varying cycles –

1. Interest Rates

Interest rates are one of the key factors that regulate the business cycles. A change in the interest rate directly affects the consumer borrowing. Let us take an example: When the interest rates are cut, more people are inclined towards bank borrowing. The disposable income of the consumer’s increases which leads to higher spending. In contrast, when the rates are increased as an attempt to curb inflation, the purchasing power of consumers decreases setting a downturn of economic growth.

2. Changes in House Prices

Consumer spending is also seen to increase and decrease in proportion to the house prices.

Image Source : SlideShareCDN

3. Consumer and Business Confidence

Sometimes the cycles are also a result of the economic sentiments of the nation. If there is an indication of a bad news, it directly influences people discouraging them from spending. In a similar fashion when there is an upward movement of economy recovery, it creates a positive bandwagon effect. Consumer confidence, therefore, has a significant role to play in causing the variations in business cycles.

4. Multiplier Effect

A fall in the monetary injection is also an important factor. If the government of a nation cuts down its public investment, the aggregate demand will fall which will, in turn, lead to the rise in unemployment. Now, those who lose their jobs will also spend less leaving less money in the hands of a government which is collected in the form of taxes.

Likewise, a positive injection in the form of investments leads to a progressive impact on the economy. This is known as Multiplier Effect as the trend (be it positive or negative) multiply based on the monetary decisions which impact the real GDP.

5. Accelerator Effect

This refers to the investment that the firms make based on the changing economic growth trends. Small changes in the economic growth result in the big effect on the investment levels.

To sum Up:-

These business cycles have a direct impact on the economic growth. Every nation in the world falls in either of the business cycles at any point in time. Hence, the decisions made by the government bodies play a key role in shaping the economic growth and turning the business cycles.

The impact of business cycles on an organization includes changing demand that affects profitability, fluctuating staff levels, alter production levels to rationalize operations as necessary. In this case, the cost-cutting ideas for your Account Payable department prove effective in the recessionary economic period. To keep up the business ideas at the manageable level, trust Invoicera for a smooth Account payable process.