How are successful companies assimilating AP cost per transaction, the percentage of invoices received, the cost of invoice processing, the workflows, approval processes, visibility into sending and receiving of invoices, capturing early pay discounts and more?

Has invoice processing system enhances the power and effectiveness of automated controls, reduces the workload for IT, increases employee productivity and gain greater visibility into liabilities?

What does it take to accelerate your workflow?

It’s these types of questions that determine the company’s ability to push through the challenges in setting up effective monitoring of the invoicing system.

Confused, Click Here: 12 Tips For Simplified Invoice Management for businesses

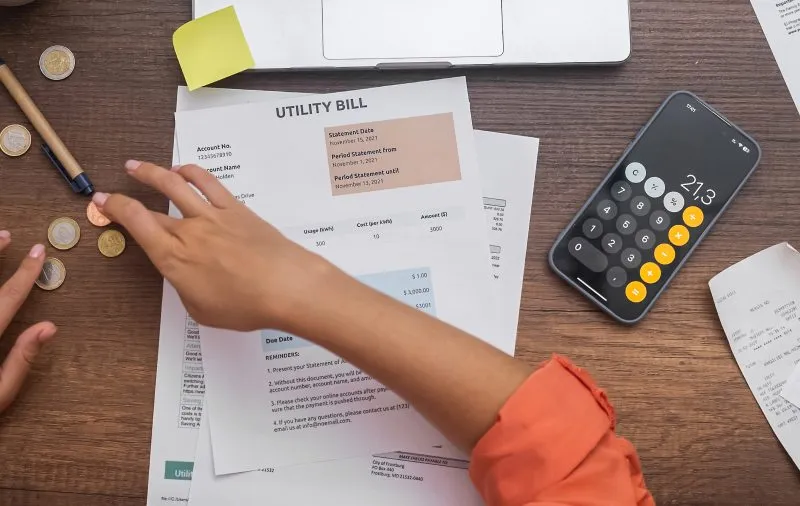

Invoice processing systems generally mean that the software application is capable of working without manual systems. The invoice processing system can manage all documents and papers coming through an account payable department, online. Generally, they are modular in design, can help cut costs and improve efficiency by processing invoices easily.

Learn how your organization can:

- – Minimize the processing hours on invoices

- – Eliminate manual data entry errors

- – Avoid rework from having to rekey or reprocess invoices

- – Invoices don’t match the PO (Purchase orders)

- – Optimize payment terms

- – Increase visibility throughout the A/P process

- – Improve reconciliation, streamline accrual processes, and produce more-accurate financial statements

JUST A FEW OF THE MANY CONSIDERATIONS:

Eliminate unnecessary invoices: Review the invoice stream.

Capture invoices data electronically: Receiving invoices electronically removes manual routing of invoices and manual data entry. Automation decreases processing times, capture early payment discounts, eliminate late payment fees & improves vendor relationships.

Automate invoice matching and Validation: From the moment when the valuable data becomes digital, it is validated with information in your financial system, gain process accuracy that contributes to the overall business success. Each invoice verified can be aligned with the respective purchase order automatically. This approach can lead the AP staff to focus on approving payments and reviewing exceptions rather than data entry and PO lookups.

Leverage web and cloud based solutions: Prioritize the solutions that integrate easily with your existing ERP or system of record. The cloud based online invoicing software keeps better maintenance of invoice records, reduces invoice exception and disputes, improves brand presence, can be accessed anytime anywhere and also helps to get paid faster with the late fee and payment reminders.

Integrate with enterprise resource planning systems: The perfect invoice processing system captures invoices from multi channels, extract information from images, automatically match invoices with purchase orders and integrate the results into enterprise applications and systems of records.

TO THAT END

The online invoicing tool supports the optimization of internal workflows reducing the number of manual steps needed to complete the purchase-to-pay cycle. These include document imaging, data capture workflow, and integration with ERP and other financial systems. The automated invoice processing system boosts accuracy, helping to escape costly errors and minimize risk.

WHAT’S MORE!

The invoice processing system creates value and revenue. It reduces the endless cycle of processing invoices, from initial receipt to final payment. By combining document capture and imaging technology with advanced workflow capabilities i.e. managing unstructured and unpredictable processes in a simple and intuitive way.

WHY INVOICERA?

Invoicera proves to be an effective solution to control how your customers pay and lower costs by replacing a time-consuming AP process. The optimization of invoice processing system enhances company’s profitability, eliminates costly mistakes and reduces transactional costs. It also reduces the operational costs, helps staff to reconcile the purchase orders and generates improved order-to-payment cycles.