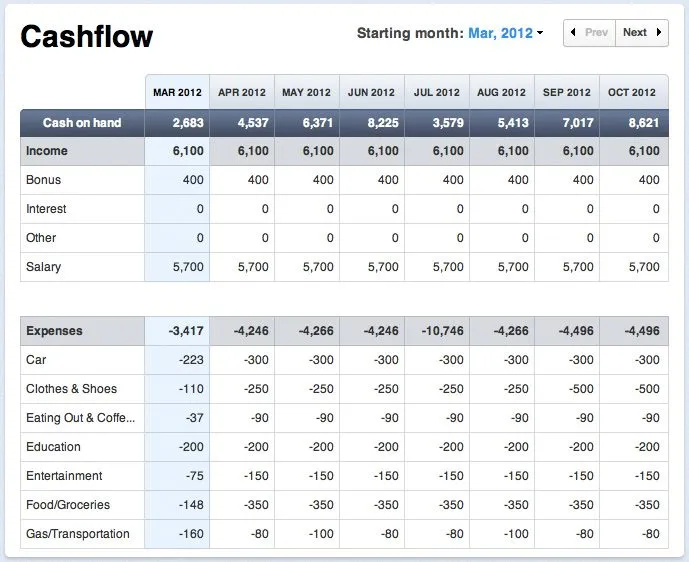

Cash flow Statement CFS meaning business wise functions as the prominent role in financial and business environment. It provides an important and useful information about the performance of a company and business operations. The cash flow monthly statement provides the income statements including Revenue, Expenses and Capital Intensive options. Also, it provides information about account receivable, which can indicate the ability of a company and business to connect their customers.

Learn more: 8 Quick Ways to Improve Cash Flow of Your Business

Monitor the cash situation of any business depending upon the changes in the cash and cash equivalents of any business.

Cash flow categorized in operations, investments, and financial activities.

Cash from operating activities:

It constitutes of activities during an accounting period of any enterprise. The principal revenue generating activities related to garment manufacturing company, procurement of raw material, expenses etc.

Cash from investing activities:

Movement in cash flows owing to the purchase and sales of assets. It constitutes of purchase, long-term assets or fixed assets such as machinery, land, and building etc.

Cash from financing activities:

Familiarizes to long-term funds or capital of any enterprise. It results in changes in the size and composition of the owner’s capital and borrowings of enterprises.

Refer to: [Infographic] The Importance Of Cash Flow Management

The Purpose and Benefits of preparing Cash Flow Statement

The cash flow statements come up as the favorable options out of three financial statements, the Income statement and Balance sheet go hand in hand. The cash flow statement provides useful information and serves various purposes of a business entity than the other two statements.

Cash flow statement helps to identify financial opportunities and ensures the business to be headed in the right direction as well as to grow steady cash which is a good indication of the company’s long-term viability. If you think about your checkbook that accounts for all your cash inflows i.e. Deposits to take part of outflows and checks at the end of each month.

A remaining cash as balance is shown. A cash flow statement works and similarly except in systematic and well-organized manner.

Refer to: Managing Cash Flow For SME’s and Startups

The main purpose and objective of preparing a cash flow statement are to ascertain the reason and the changes in the cash position of a business entity and also provide beneficial information of receipts pay and cash.

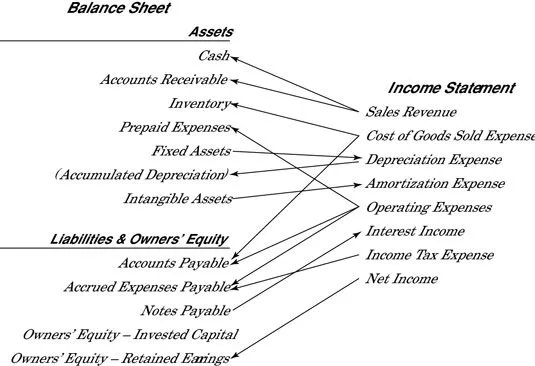

Need of Balance Sheet and Income Statement

Balance sheets are a very important factor for any business. The main purpose of a balance sheet comprises of company’s assets, liability, and owners’ or stockholders’ equity for a given period, while an income statement shows a company’s revenues for a given period. The company needs this information on the regular basis, by the help of this they can able to analyze their company’s worth and income trends. In the business environment, it’s a key factor to remember that a balance sheet has to “balance” at the end of the day.

Income statements can be defined as Profit & Loss (P&L) statements essential for every business. This income statement indicates how much money comes for the sale of goods and services, associated costs, and what income remains (the “bottom line” or net income). Both income statements and balance sheets differ from each other, income statements represent an accounting period, while the balance sheets represent a snapshot of a specific moment.

Also, read how digital agencies keep cash flow pumping.

Conclusion:

A company can use a cash flow statements (CFS) just to predict future cash flow which helps in terms of finance and budgeting. This Cash flow statement can provide the clues to find out and determine if the cash leaks are occurring. It’s a combination with financial matter data derived from income statements and balance sheet.

Negative cash flow results from a company growth strategy in the form of expanding its business.

That’s why analyzing changes in cash flow from one point to the next gives the investor a better idea of how a company and business is performing. “Cash is the lifeblood of all growing business”.

Take advantage of complete cash flow management with Invoicera.