Keeping track of international taxes is complex as it requires dealing with multiple rules, changing rates, and loads of paperwork.

Businesses that operate in different countries must overcome major challenges with global invoicing to ensure compliance and efficient invoice management.

That’s where a global invoicing calculator steps in.

The invoicing calculator is an innovative blend of simplicity and tax compliance automation. It gives one-stop access to tax calculation automation and multi-currency invoicing.

Using this solution will simplify your international billing procedures while enabling your business to develop without distraction. It can also work alongside tools like an invoice price calculator or an invoice finance calculator for better financial planning and forecasting.

This blog shows how the advanced software functions to handle complex international deals while keeping your operations in compliance.

Let’s get into it!

Common Challenges in International Taxation

It’s no secret that expanding globally comes with a unique set of tax-related challenges. Here’s a look at some of the most common ones:

1. Varying Tax Laws

Every country has a different tax regulation system. A business needs to stay updated about the laws and ensure they stay compliant to international tax regulations.

2. VAT/GST Complexity

Countries implement substantially dissimilar methods of VAT with GST systems. All companies need to master tax systems by understanding how registration functions alongside collection procedures as well as remittance protocols. A reliable GST billing software is essential to manage such diversity effectively.

3. Changing Tax Rates

Tax rates are subject to change, and staying up-to-date with these changes across multiple jurisdictions is a continuous challenge.

4. Currency Conversion Issues

Fluctuating exchange rates can impact the accuracy of your invoices and tax calculations. This adds another layer of complexity to financial management, making tools like a global invoicing calculator and invoice interest calculator indispensable.

5. Localization Barriers

Tax regulations often require localizing invoices and financial documents, including language and formatting requirements.

6. Double Taxation Risk

Without proper tax planning, businesses may be taxed on the same income in multiple countries, significantly impacting profitability.

7. Tax Documentation Gaps

Maintaining accurate and compliant tax documentation is essential. Using an invoice factoring calculator can assist in keeping financial records in sync when dealing with advances on receivables.

Businesses need an effective system to tackle their international tax requirements based on the current obstacles encountered.

The Role of a Global Invoicing Calculator

Tax compliance transforms into a complex process during international business transactions, which involves clients and vendors from around the world. Compliance becomes such an extensive challenge that it requires full-time dedication when each country maintains its distinct taxation systems and compulsory requirements.

Businesses struggle to maintain compliance due to the mandatory implementation of currency conversion and accurate reporting along with correct tax rate applications.

A global invoicing calculator automates the process by:

- Identifying the correct tax type (VAT, GST, sales tax) based on client location and service/product type

- Applying the latest tax rules for accurate calculations.

- Automatically calculate and apply the applicable tax amount to invoices.

- Ensuring tax data aligns with current compliance standards.

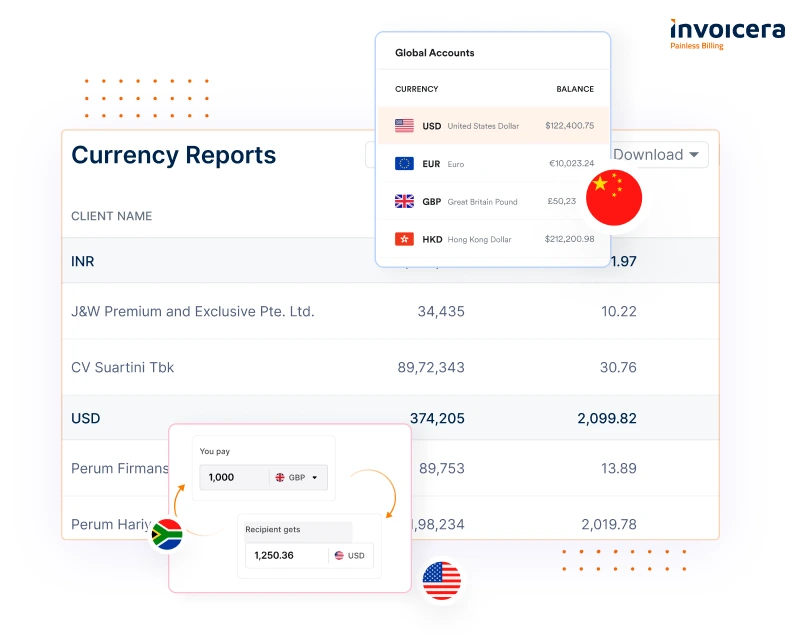

It also supports multi-currency invoicing by:

- Converting currencies using real-time exchange rates.

- Calculating tax in the client’s local currency.

- Maintaining consistency in cross-border invoicing and reconciliation.

This approach helps reduce manual efforts and ensures transactional accuracy across regions. You may also benefit from additional tools like an invoice financing calculator or invoice factoring calculator for enhanced decision-making and cash flow management.

Why Use a Global Invoicing Calculator?

Businesses require automation because the modern economy demands it. The addition of a global invoicing calculator provides benefits like:

1. Automates Tax Calculations

No more manual computations. The calculator ensures every invoice is accurate by applying current tax rules. Use an invoice price calculator to complement this feature when quoting clients.

2. Reduces Human Error

Mistakes in manual entry can be costly. A calculator reduces these risks and maintains clean financial records. An invoice factoring calculator can help track receivables more precisely.

3. Supports Multi-Currency Invoicing

Converts currencies at real-time exchange rates for hassle-free billing. This is especially helpful when paired with GST billing software for accurate tax application.

4. Ensures Global Tax Compliance

Helps meet tax regulations in various jurisdictions. If you’re forecasting financial outcomes, consider using an invoice finance calculator alongside it.

5. Saves Time and Resources

Automates labor-intensive tasks, freeing teams to focus on operations. For further accuracy, an invoice interest calculator ensures financial statements reflect realistic costs.

6. Scales with Business Growth

As operations expand, your invoicing system needs to keep up. That’s where a global invoicing calculator plays a vital role in scaling efficiently.

Thus, a global invoicing calculator functions as a strategic asset that helps businesses approach international trade operations with assurance despite cross-border complexities.

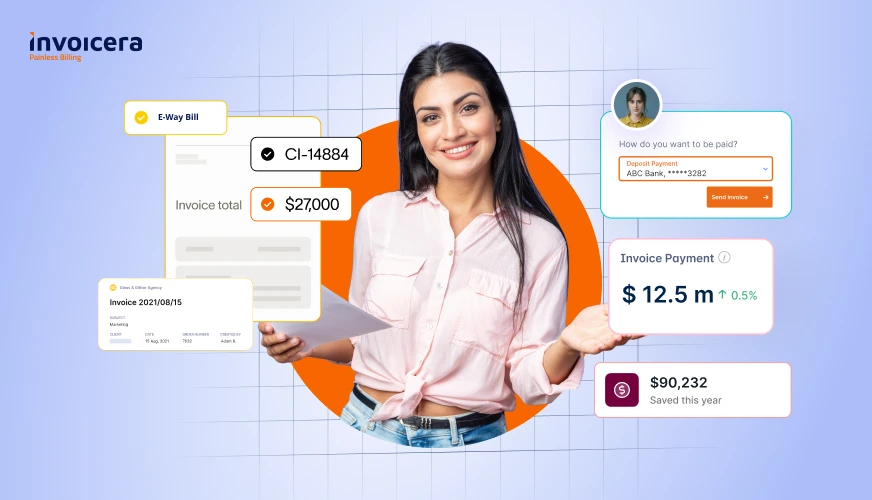

How Invoicera Simplifies Global Taxation

Invoicera provides businesses of all sizes with a complete online solution that optimizes financial procedures through its comprehensive features.

The software platform addresses global tax requirements through features that optimize financial operations and tax compliance.

It also doubles as a global invoicing software, bringing together compliance, invoicing, and currency management under one platform.

Here are the key features to consider:

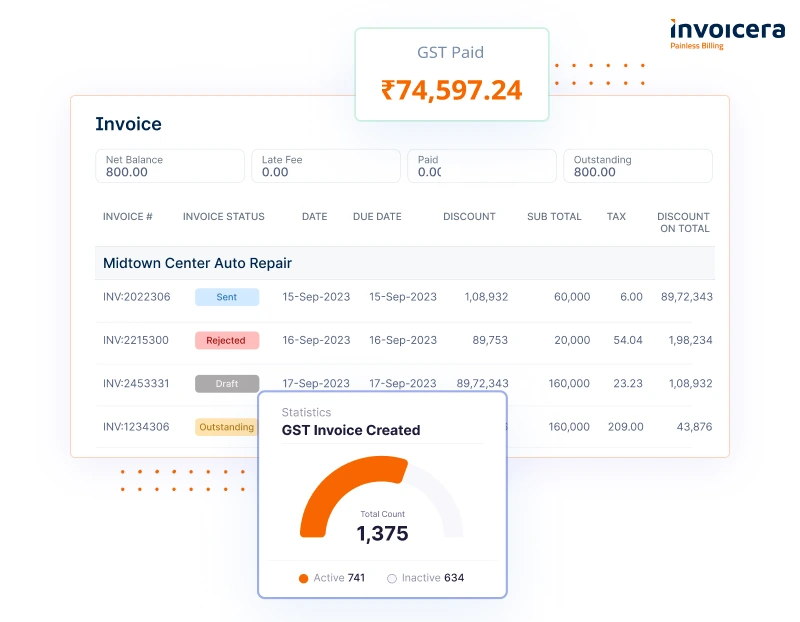

1. Automated Tax Calculations

- Automatically identifies and applies the appropriate tax rates based on the client’s country, region, and type of service or product.

- Removes the need for manual calculations, minimizing human error in tax computation.

- Ensures each invoice reflects accurate and compliant tax information.

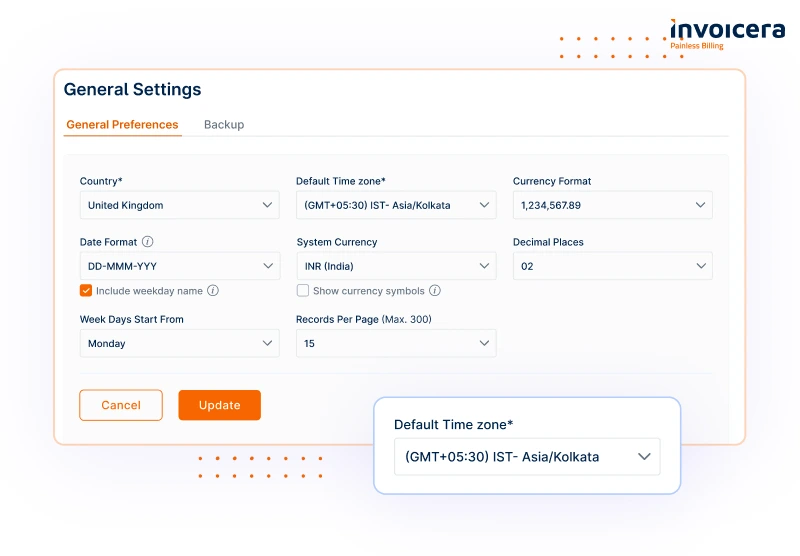

2. Multi-Currency and Multi-Language Support

- Features a system to make invoices in multiple world currencies that adjusts rates through real-time exchange rates.

- Supports a broad range of languages to serve clients from different geographical areas, thus improving understanding between all parties.

- Simplifies cross-border billing through its ability to transform billing standards into local preferred options.

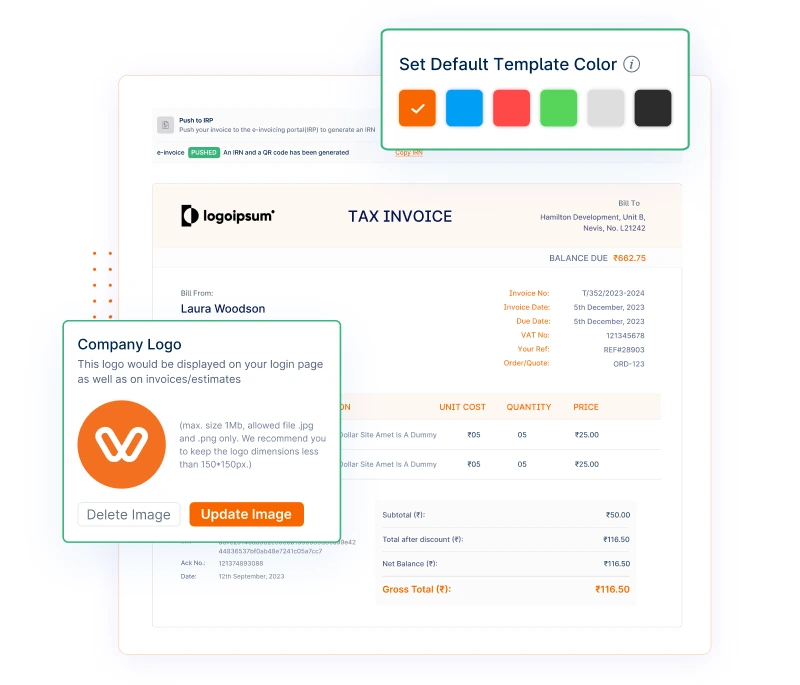

3. Customizable Tax Settings

- Allows full customization of tax rates, rules, and types, including VAT, GST, and sales tax.

- Supports applying different tax settings per client, project, service, or region.

- Accommodates unique business needs or industry-specific tax regulations.

4. Integrated Compliance Tools

- Provides built-in tools to align invoicing practices with local and international tax laws.

- Tracks change in regulations and update the system accordingly to stay compliant.

- Reduces legal risks by helping businesses meet evolving tax obligations.

5. Real-Time Tax Updates

- Keeps tax rates, rules, and compliance guidelines current through automated updates.

- Reflects the latest tax laws directly in invoices without requiring manual intervention.

- Prevents calculation errors due to outdated or incorrect tax information.

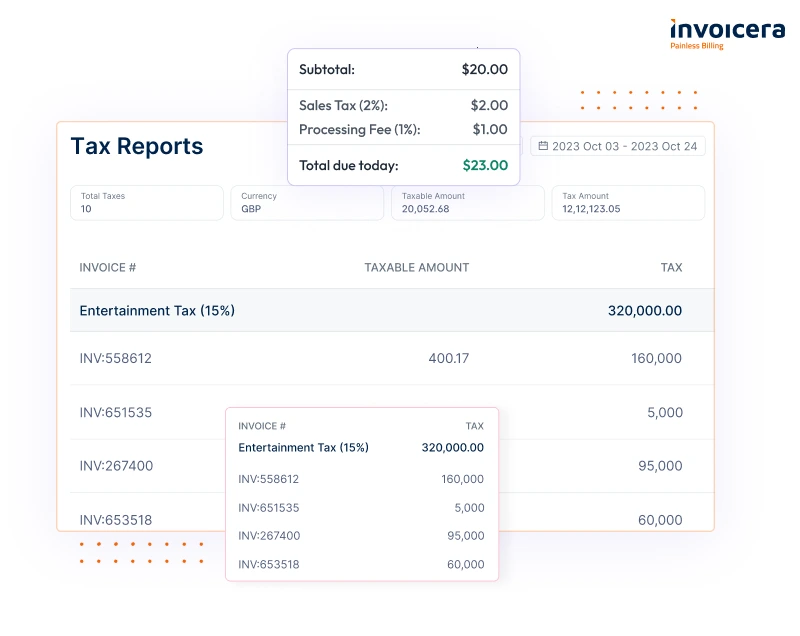

6. Detailed Tax Reports and Audit Trails

- Offers comprehensive, time-stamped tax reports for financial analysis and submission.

- Maintains detailed audit trails of all tax-related changes and activities for accountability.

- Streamlines audit processes and simplifies compliance reporting for regulatory bodies.

Invoicera turns the complex process of worldwide tax management into an easy-to-manage system through its integrated features.

Businesses get all essential features through which they can manage international tax complexities while maintaining focused growth plans.

Strategic Benefits for Financial Managers

Closing Thoughts

In conclusion, managing taxes across borders doesn’t have to be complicated. A global invoicing calculator simplifies every aspect; from conversions to compliance, so businesses can focus on growth.

Tools like Invoicera stand out by combining invoicing with multi-currency, multi-language support and continuous updates. This makes it a reliable invoicing software for international operations.

When paired with a trusted GST billing software, you can achieve complete tax compliance and billing accuracy.

FAQs

Ques: What is the global invoicing calculator?

Ans: Businesses can use the global invoicing calculator to estimate international invoice-related taxes and currency conversions, as well as compliance responsibilities.

Ques: Can I use the calculator for multiple currencies?

Ans: Yes, the calculator allows users to conduct invoicing across multiple currencies by updating their rates through live data systems.

Ques: Is the global invoicing calculator compliant with international tax laws?

Ans: Customers need to consult with professional tax advisors to achieve law compliance after using the tool for estimation purposes based on common regulations.

Ques: Can I include different tax types (VAT, GST, sales tax) in one invoice?

Ans: Absolutely. Invoices can be customized by the calculator to include various tax types according to buyer location and provided goods or services.