Managing recurring payments becomes increasingly complex as businesses scale.

From chasing late payments to handling manual processes and preventing errors, these challenges can significantly impact both financial resources and productivity.

Enter automated recurring billing – a transformative solution that streamlines payment collection, time management, and cash flow operations.

This substantial growth reflects businesses’ growing recognition that automated systems reduce errors, eliminate delays, and enhance customer experience.

In this guide, we’ll explore the essential aspects of automated recurring billing, from its core benefits to implementation challenges, and examine how modern invoicing software can help businesses of all sizes – from startups to enterprises – gain a competitive edge in today’s market.

What is Automated Recurring Billing?

“Automated recurring billing is defined as a payment procedure in which a business will automatically charge a customer periodically, such as for services or products.”

Imposing an automated recurring billing eliminates the cumbersome tasks of sending manual invoices and collecting payments, fostering a smooth and hassle-free experience for both your business and its customers.

Automated recurring billing will ensure timely payments and a steady cash flow, whether it’s a monthly subscription, annual membership, or even utility bills.

For instance, imagine owning a gym and charging monthly membership fees.

You don’t want to send out individual invoices to each member month after month. Upon completion of a month, automated recurring billing allows their cards or accounts to be automatically charged on a predetermined date.

This saves your team hours of manual work while reaping the benefit of no missed or late payments.

Example: Netflix and Automated Recurring Billing

- Netflix automatically charges subscribers’ accounts each month.

- Customers enter payment details once at sign-up.

- After that, Netflix deducts the subscription fee without needing any manual action.

- This provides uninterrupted service to customers.

- Netflix enjoys predictable revenue and eliminates manual billing tasks.

The system improves operational efficiency and customer satisfaction by providing a friction-free billing experience. Undoubtedly, any business targeting growth along the loyal customer line will require automated recurring billing in this fast-paced world.

Time-Saving Benefits of Automated Recurring Billing

Automation Speeds Up Billing

With automated recurring billing, valuable time is saved on tedious tasks like manual invoicing. No more creating and sending out invoices individually – it happens automatically.

Consistency in Billing Cycles

Automation guarantees that bills are sent out on time with no human error. Thus, your staff will not have to chase outstanding payments or reschedule.

More Time for Core Tasks

Automation will save your employees from tedious billing tasks and would instead allow them to devote their efforts to higher-value activities such as customer service and product development.

Scalable for Growth

As your customer base increases, it will become impossible for you to go on handling the recurring payments manually. Automated systems become easily scalable, handling thousands of invoices without the added effort and stress.

Fewer Resources Needed

Washing away a long period of trained personnel on recurring assignments for billing would give them a chance to bring some work into an organization instead.

Efficient Payment Management

One makes the collection and reconciliation less time-consuming through automation, streamlining workflows, and minimizing overhead costs.

To summarize, automating recurring billing is an investment to save countless hours of business work while improving efficiency and allowing teams to focus on what really matters.

Reducing Payment Delays and Errors

Less Room for Human Error

Manual billing is prone to errors, wrong amounts, missed deadlines, or duplicate fees. With the intervention of automation, these issues reduce, and efficiency and accuracy increase, with less need for written corrections.

Timely Payments

Automated systems take this a step further by making sure invoices are sent on time so that reminders mean reduced cases of forgotten or delayed payments by customers. This reduces the amount of overdue accounts.

A more Streamlined Cash Flow

Automated billing helps speed things up and the payment process by reducing delays. This gives a business a predictable cash flow, helping to keep the business financially afloat.

Consistency Among All Customers

Automation ensures the same rule for each customer. The processing of the same payments would result in a reduced chance of errors arising.

Integrated Payment Options

Automation usually comes along with an integrated payment gateway for customers to pay easily and fast. Credit cards, bank transfers, or any other means would be made simpler.

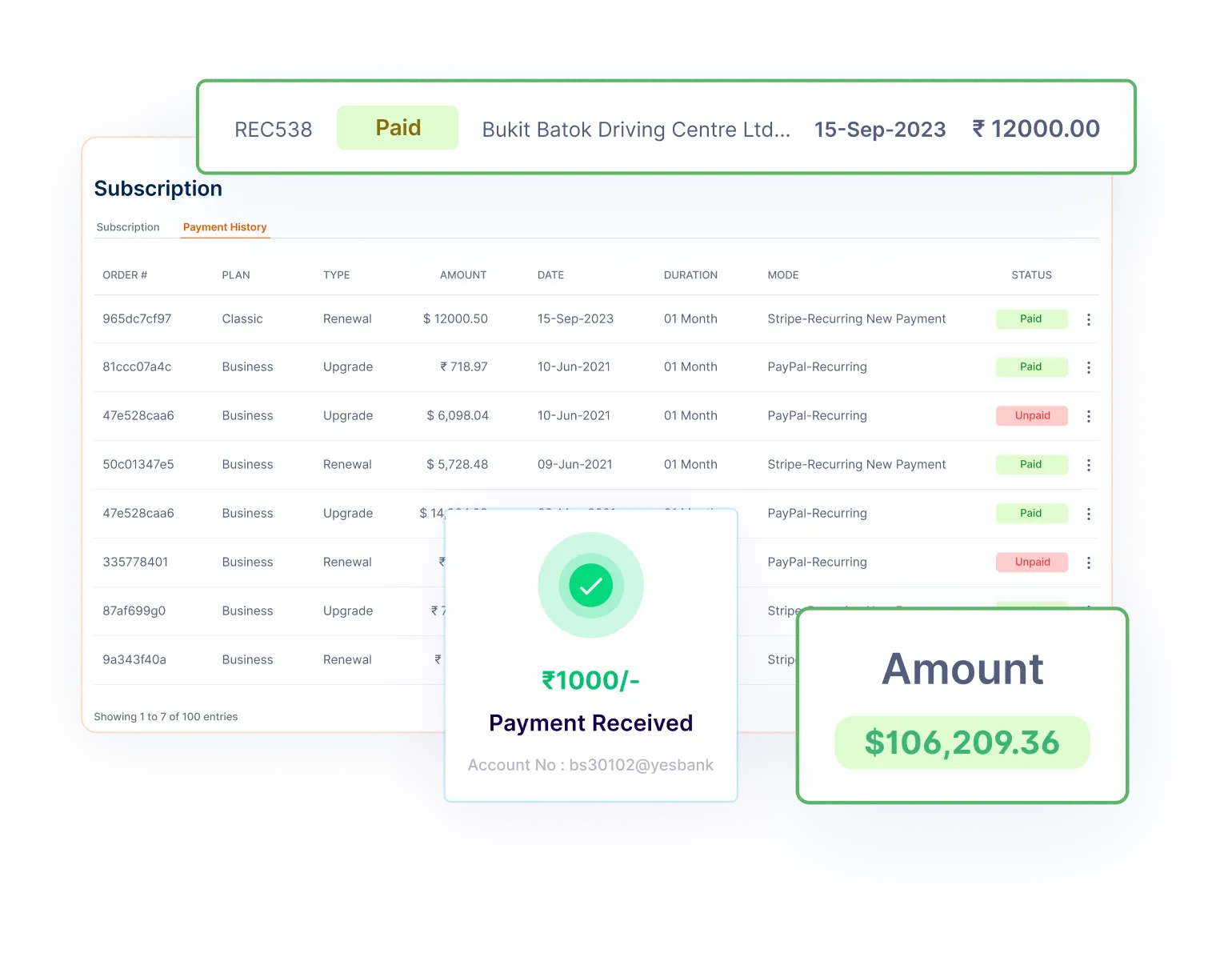

Tracking & Reporting

Automation provides real-time tracking and reporting of payment statuses. This enables businesses to detect and resolve problems early on, and it goes a long way in reducing disputes’ amount or loss on missed payments.

It suggests that reducing errors and timely payment helps put a significant layer of efficiency on the business’s financial handling and regions of client relations.

Implementing Automated Recurring Billing

While beginning automated recurring billing may feel like a big decision, it is, in fact, a straightforward process-specifically beneficial for your business. This is a quick guide to start:

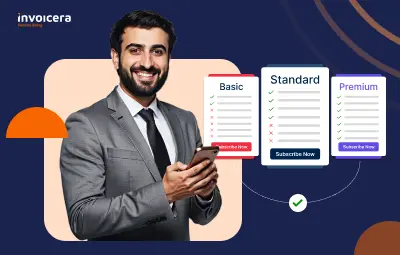

1. Choose Your Option

First, select a platform, such as Invoicera, that is reliable, simple to use, and contains all the features that you want, such as invoicing and flexible billing cycles.

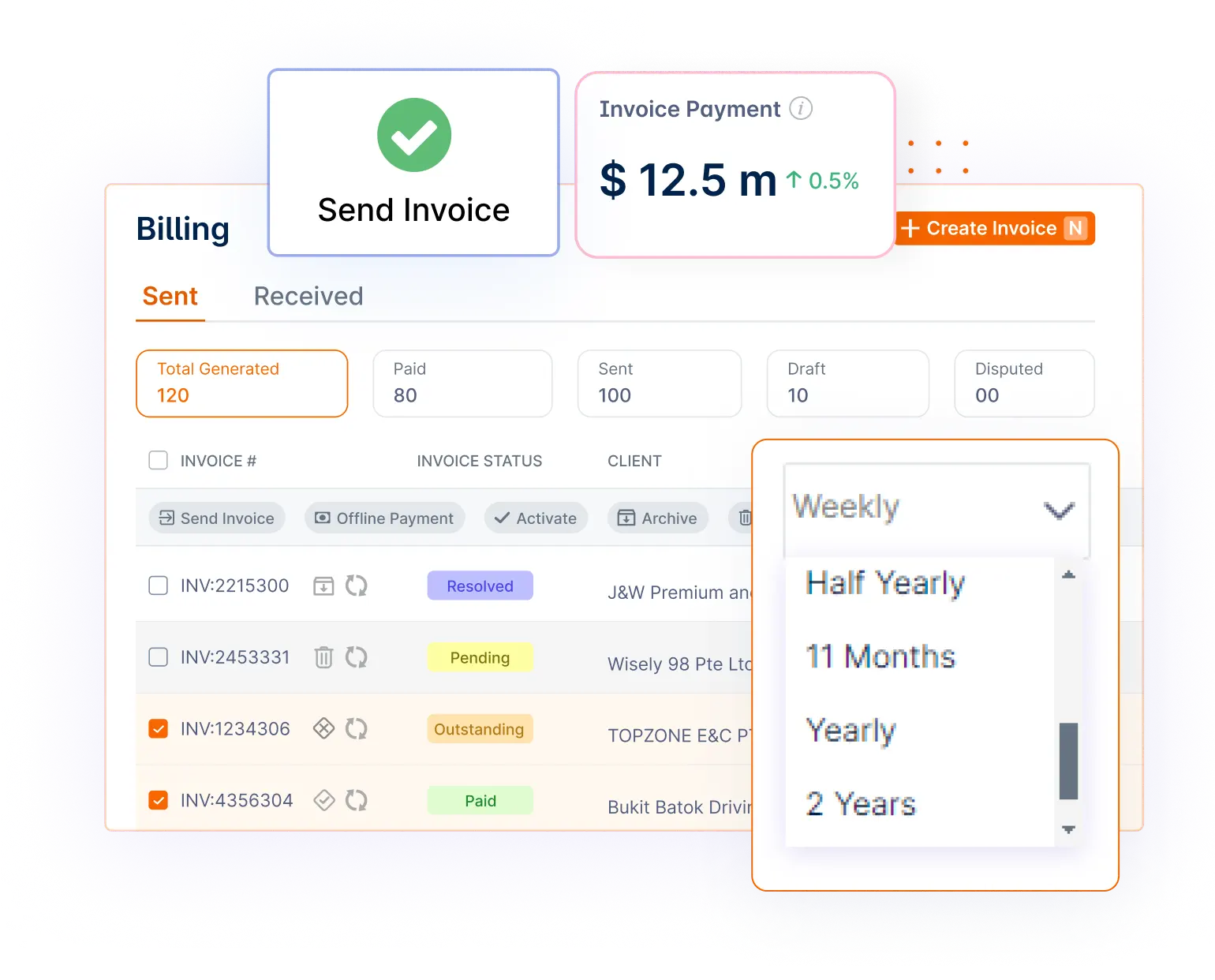

2. Set Up Billing Cycles

Decide when you want to bill your clients: monthly, quarterly, or however you find it suitable to set it up within the system.

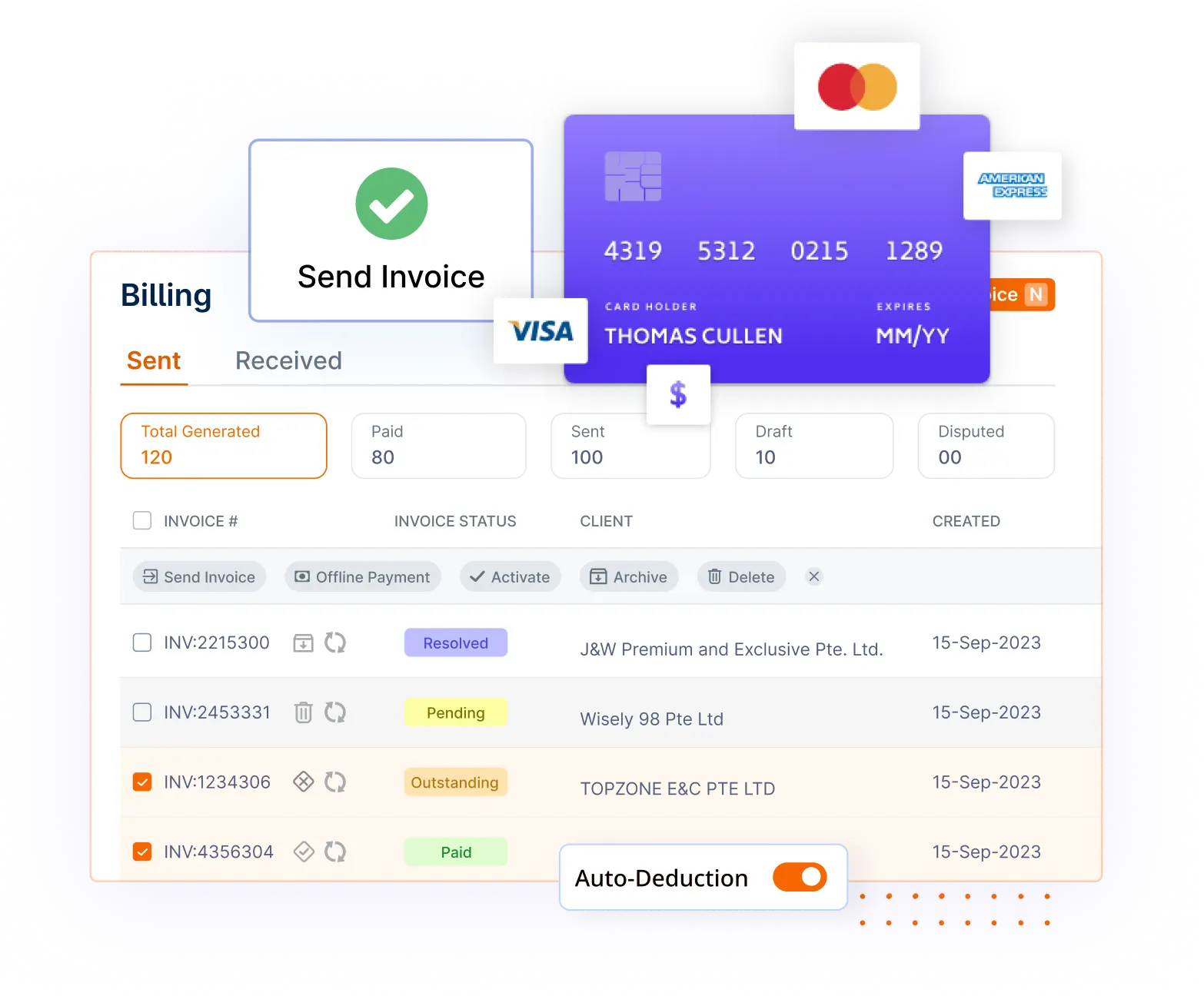

3. Integrate Payment Methods

Activate the payment gateways you want to accept so customers can easily pay you using their preferred method, either via credit card, PayPal, or others.

4. Set Up Invoices

Make fully customizable recurring invoices to include your business details, details of the client, and billing periods so they look professional, consistent, and up-to-date every single time.

5. Set Up Payment Reminders

You can remind customers of their upcoming payments and due dates. This reduces late payments and helps keep everything straight.

6. Monitor Payments

Monitor your recurring billing through real-time reports. This helps you track everything, spot budding problems early, and keep your finances in check.

7. Additional Agency

Give your clients the option to select their favorite method of billing, which contributes to personal touch and customer satisfaction.

With the above-mentioned simple features, automated recurring billing becomes your business’s most important time-saving, stress-relieving element for the payment process between you and your customers.

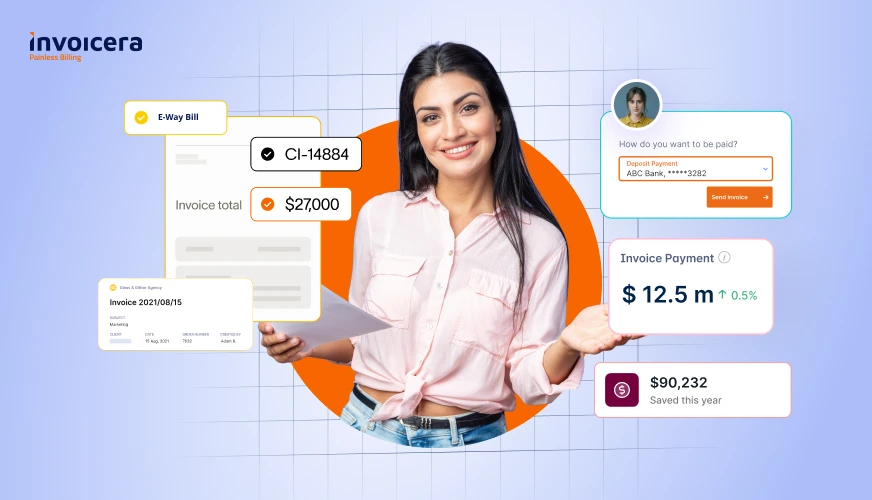

Invoicera’s Recurring Billing Solution

Invoicera is an automated recurring billing software tailored to streamline the recurring billing process by offering robust and straightforward features that automate your invoicing.

Here’s how Invoicera enhances the ease and efficiency of managing recurring billing:

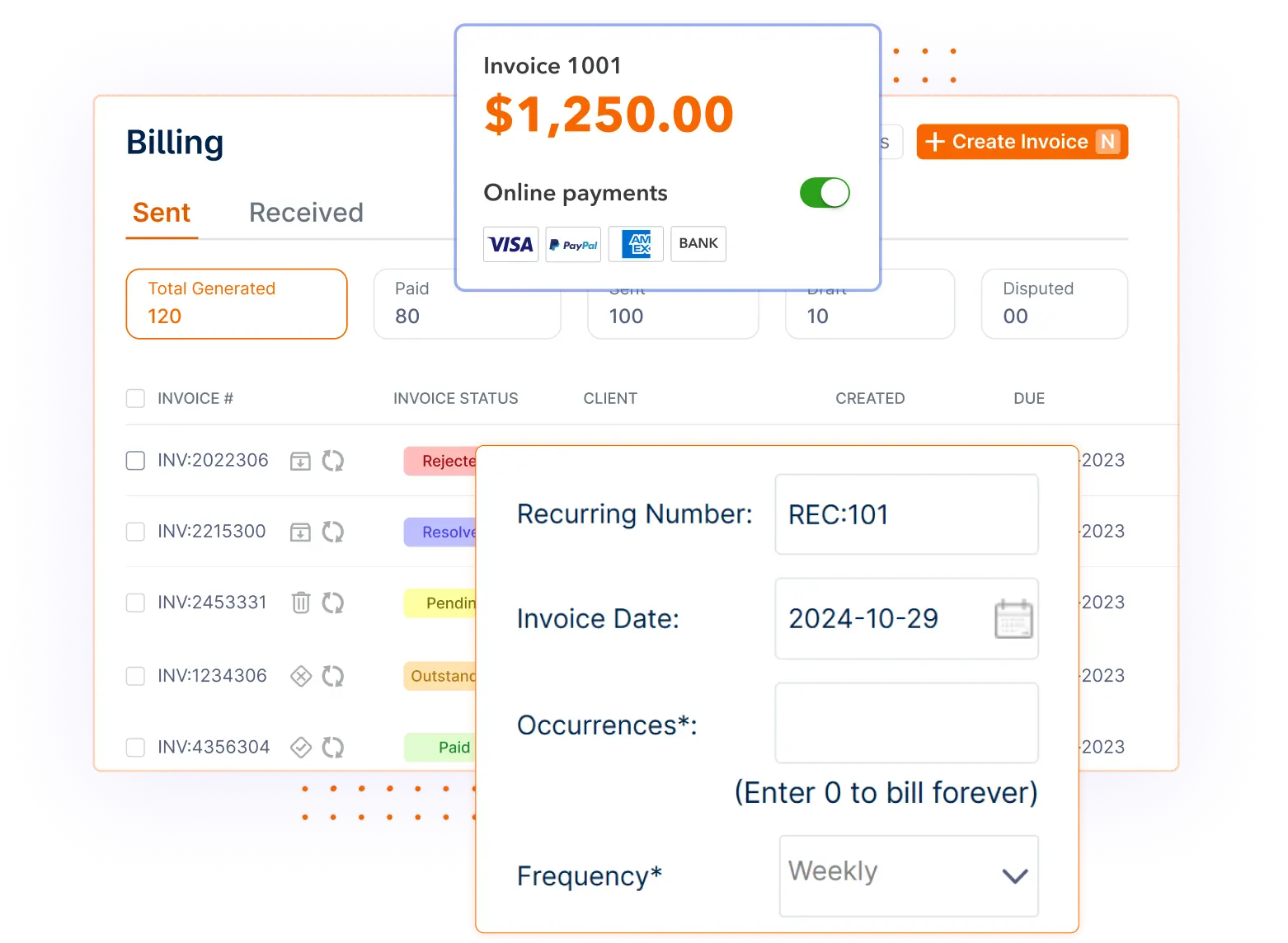

Save Time Through Scheduled Invoices

Payments via 14+ Gateways

Define Your Billing Frequency

Facilitate Payments with Auto-Deduction

Provide Varied Billing Cycles

Accelerate Payments Using Late Fees

Maintain a healthy cash flow management system by enabling late fees on overdue accounts. With Invoicera specifically designed for unpaid invoices combined with automated late fee application capabilities, you have an effective way to expedite outstanding payments.

Automate Invoice Personalization

Forget about manually revising each invoice. Through its functionality, Invoicera ensures your recurring invoices are dynamically customized to automatically reflect the correct month and year—with always precise and current updates.

Conclusion

In the present economic scenario, automated billing not only simplifies operations but also assists in establishing stronger long-term relationships with customers. Use automated recurring billing solutions, like Invoicera, to eliminate payments and run your business more efficiently.

With the automation of invoicing and payment processes, businesses can

- Save time

- Reduce errors

- Receive timely payments

Are you ready to improve your business’s cash flow?

FAQs

Ques. Which industries use recurring billing extensively?

Ans. Generally, recurring billing is used more in industries that follow a subscription-based model, such as SaaS, telecommunications, and media subscriptions-cheers streaming platforms.

Gym and club memberships, insurance, and e-learning platforms are also incorporated in this category.

In general, any kind of business that bills its customers at regular intervals can take advantage of recurrent billing.

Ques. How does recurring billing help to retain customers?

Ans. Customers experience automated, hassle-free payments that provide a pretty seamless experience devoid of any interruption. Therefore, if payment processing flows smoothly and doesn’t create any nicks in the customer’s experience, he/she will be more likely to stick with the service. Flexibility allowing clientele to change invoice frequencies or adapt payment methods will improve customer satisfaction and retention.

Ques. What are the challenges of recurring billing implementation?

Ans. Several challenges come with recurring billing, including:

- Handling failed payments

- Updating customer details

- Making sure of compliance with local tax laws

However, such hurdles can be managed by considering the right software solution in place and determining precise communications and payment processes with the customer.