Managing invoices in financial services is no walk in the park. Every bill, statement, and report has to be just right—because, in this industry, a minor mistake could mean a major migraine.

It’s not just about sending an invoice; it’s about doing it with precision, ensuring compliance, and, of course, making a good impression on clients who expect absolute professionalism.

And here’s some insight to put things into perspective: the Billing and Invoicing Software Market is expected to boom from $9.85 billion in 2023 to a whopping $18.08 billion by 2032.

So, investing in invoicing software is not only smart but practically necessary in today’s evolving digital landscape. But what exactly makes invoicing software indispensable for financial service providers?

Let’s dive in.

Must-Have Billing Features For Financial Service Providers

If you’re associated with the financial services industry, you need invoicing software that goes beyond basic functions and caters to your industry’s unique requirements. Here’s a rundown of the must-have billing features for financial pros:

1. Automated Invoicing and Recurring Billing

Financial service providers often have clients on retainer or recurring payment plans. Automated invoicing lets you send invoices without lifting a finger each billing cycle, ensuring payments stay consistent.

No more repetitive entries—just set it, forget it, and watch payments come in like clockwork.

2. Multi-Currency and Tax Management

With clients worldwide, invoicing in multiple currencies is essential. Your software should handle various currencies and automatically adjust for exchange rates. What about tax regulations?

You want a system that can easily manage multi-jurisdictional tax requirements, saving you from tax code nightmares and international compliance conundrums.

3. Financial Reporting and Analytics

Generating invoices is the primary job, but insights into cash flow trends, aging receivables, and revenue forecasts are equally essential. A robust invoicing tool will come with built-in analytics to help you track financial health and spot trends.

Financial reporting is your secret weapon for making data-driven decisions, helping you stay proactive rather than reactive.

4. Client Portal with Secure Access

Financial services clients appreciate transparency, so why not let them view their invoices, make payments, or download reports themselves?

A secure client portal saves you time answering invoice-related queries and offers a more professional touch, building client trust and simplifying their experience with you.

5. Expense Tracking

Financial service providers deal with expenses from every corner—whether it’s travel, third-party consulting fees, or software costs.

Expense tracking within your invoicing software lets you monitor and categorize costs, ensuring you don’t undercharge (or overcharge) clients due to missed expenses.

6. Compliance Management

The financial world is built on regulations, and your invoicing software should help you comply. Look for a system that supports industry-specific compliance standards and keeps data secure with encryption.

This way, every invoice you send meets both your standards and those set by financial regulators.

7. Customizable Invoice Templates

First impressions matter. Customizable templates allow you to add your branding and style to invoices, making them not only compliant but also polished and professional.

Showcasing your brand is easy when you can design invoices that reflect the credibility and attention to detail your financial services offer.

Best Invoicing Software for Financial Services

1. Square Invoices

Square Invoices turbo-charges your billing game, getting you paid faster and allowing you to offer flexible payment options that suit your clients.

From instant payments to setting up recurring billing, Square ensures everything runs smoothly for your business.

Features

- You can offer flexible payment options to your clients, making transactions smooth and stress-free while you track every payment in real time.

- Customize your invoices to match your brand—you can choose the layout, add your logo, and even incorporate your brand colors to make it look polished.

- Track your invoices live so you know exactly which ones are paid, unpaid, or overdue.

- With recurring billing, you can set up payments daily, weekly, monthly, or yearly, tailored to your client’s needs and your cash flow goals.

- Secure deposits upfront to lock in client commitments and set separate deadlines for the remaining balance.

- Add custom fields to your invoices to provide essential details, policies, and notes, building transparency and trust.

Pricing

$20/month, with discounted processing rates.

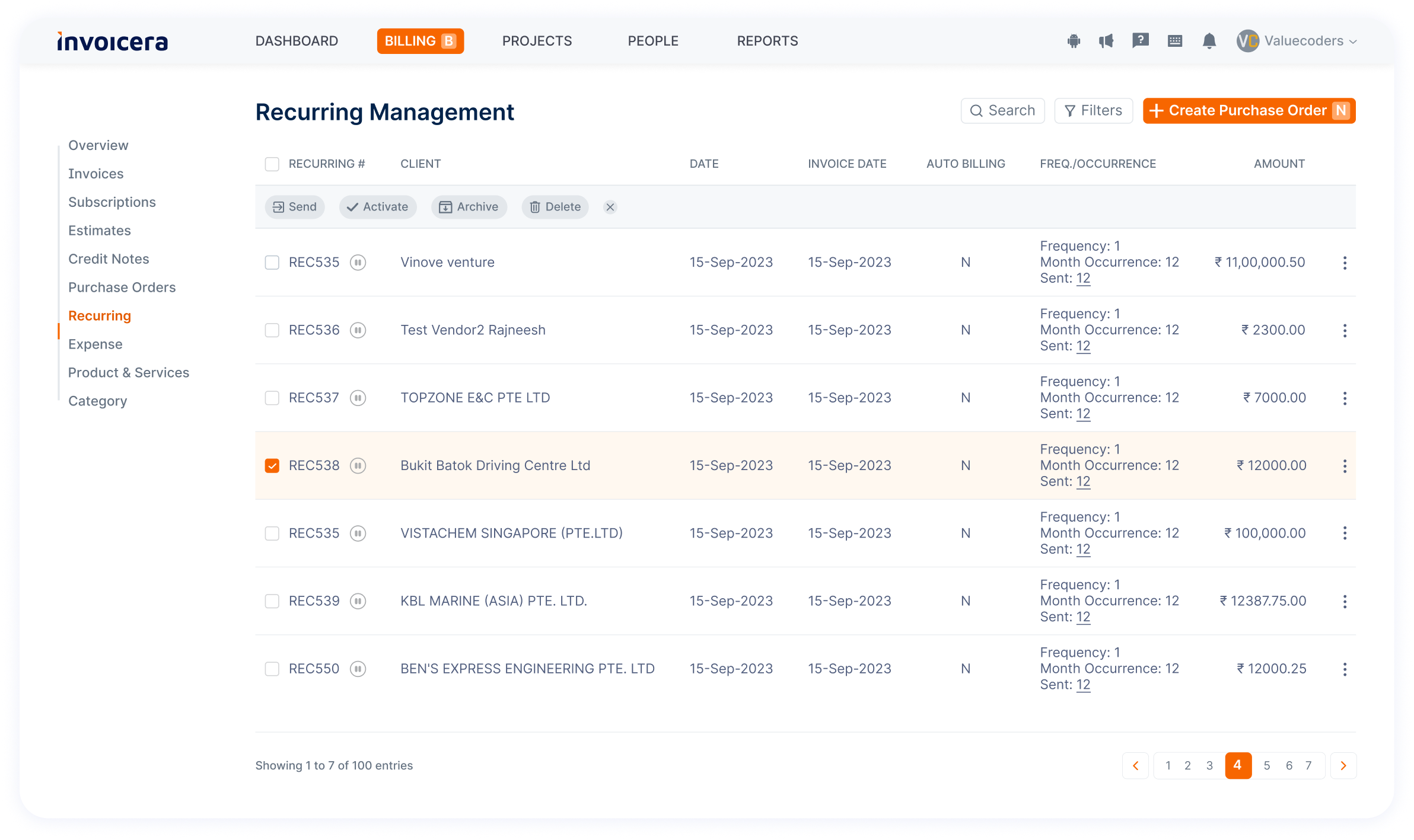

2. Invoicera

This tool is built for professionals who want control without the hassle, from comprehensive financial reports to airtight security.

Features

Automated Recurring Billing & Reminders: Set up automated recurring billing for repeat transactions and send timely reminders to ensure payments are received on time, minimizing manual follow-ups.

Pricing

Pricing

Starts at $15/month

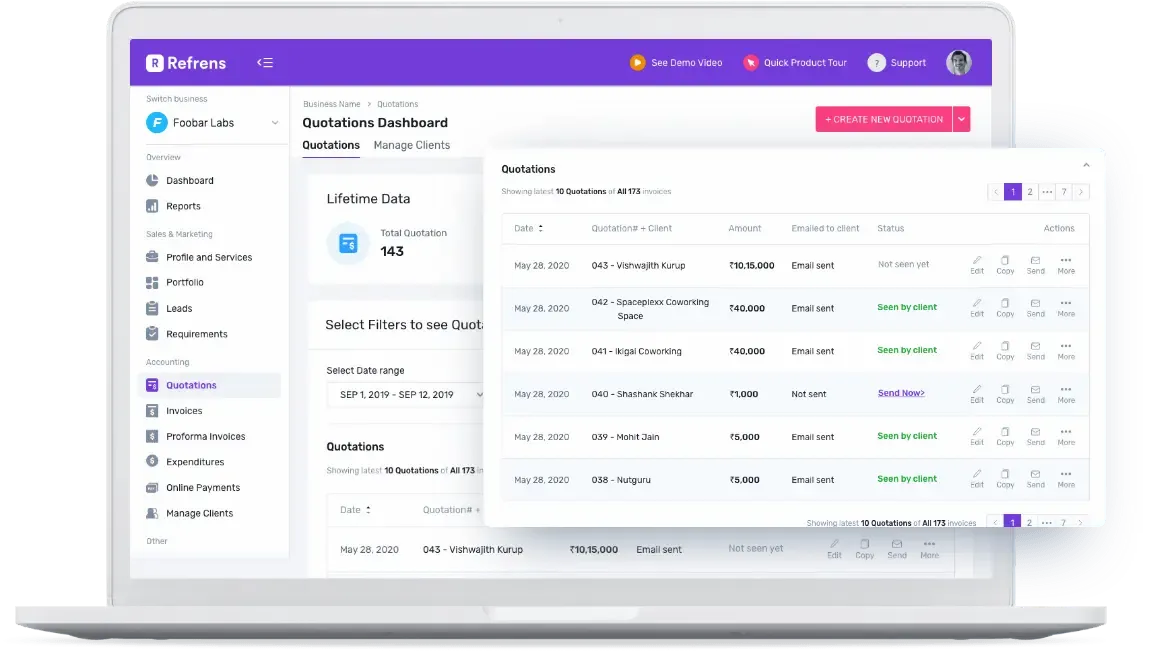

3. Refrens

Refrens offers a supercharged invoicing experience for handling GST, estimates, and expense tracking.

It’s a one-stop solution that keeps you updated and helps your financial operations run quickly.

Features

- Create fully customized GST and non-GST invoices quickly, leveraging automation for accuracy and efficiency.

- Send quotes and estimates to clients within seconds and keep them informed with updates throughout the negotiation process.

- Expense management features let you track all your business expenses, giving you better financial insights to boost profitability.

- Track client interactions with notifications every time an invoice is viewed.

- Accelerate cash flow with automated payment reminders sent through WhatsApp or email, keeping clients on time with gentle prompts.

- Easily correct invoice errors with the credit and debit notes feature, keeping your records error-free.

- Comprehensive reports give you full visibility into invoices, payments, and client transactions with one click.

Pricing

Most value for money at $225/year

4. Freshbooks

FreshBooks is an online accounting solution tailored for financial services, making invoicing and bookkeeping effortless.

Designed to handle all your financial transactions, FreshBooks offers a simple, cloud-based platform that even non-accountants can navigate confidently—no math degree required!

The intuitive dashboard gives you an at-a-glance view of income and expenses, so you’ll always have a pulse on your finances.

Features

- Invite your team to add their hours and track expenses directly on projects, making collaboration a breeze.

- Quickly view detailed expense reports and see exactly where your business is spending.

- Set up automatic reminders for overdue payments, ensuring clients get a polite nudge and you stay informed.

- Apply late payment fees seamlessly—just choose a flat rate or percentage, and FreshBooks does the math.

- Use recurring profiles to automate invoices for regular clients, saving you from manually invoicing each time.

- Integrate with popular apps, customizing FreshBooks to suit your needs.

Pricing

Plus plan at $16.50 USD/month

5. Wave

Wave lets you send sleek, professional invoices in seconds, helping you get paid faster—no hassle.

Whether you’re sending an invoice on the go or managing recurring payments, Wave is designed to streamline your billing, especially for repeat clients.

Features

- For recurring billing, you can set up automated invoices and credit card payments, ensuring payments come in on time.

- Invoices sync directly with Wave’s accounting, so your books are always up to date.

- Access all customer details in one place, making it easy to track who owes what and leave a lasting impression.

- Keep track of payment statuses, from reminders to overdue notices, with a clear history of client interactions.

- With mobile app access, invoice on the go—anytime, anywhere!

- Receive instant notifications for invoice actions like views, due dates, or payments, ensuring you’re always informed.

- Enable online payments and let customers pay through a secure link, boosting your cash flow effortlessly.

Pricing

Pro Plan at $16/user/month

6. AdvicePay

AdvicePay offers a billing solution tailored for financial advisors, ensuring compliance and security while keeping billing stress-free.

Perfect for financial planners and advisors, it supports flexible payment processing and integrates seamlessly with your practice needs.

Features

- Set up various billing options and let clients choose how they pay, giving flexibility and ease of use.

- Get signatures electronically, speeding up the onboarding process and keeping it paperless.

- Designed with RIA compliance in mind, AdvicePay meets regulatory needs, so you stay audit-ready.

- Keep client data secure, reassuring clients that their information is protected.

- Calculate fees easily with an intuitive fee calculator, saving time on manual calculations.

- Access support and tailor the client experience to make billing as smooth and personalized as possible.

Pricing

Professional plan starting at $50/user/month.

7. AvidXchange

AvidXchange simplifies accounts payable for banks and credit unions, turning a traditionally paper-heavy process into a digital, streamlined experience.

With full automation, it integrates into your accounting software and helps cut out repetitive manual tasks.

Features

- Go paperless with end-to-end automation, from invoice capture to payment processing.

- Customize workflows to improve AP processing, so your team spends less time on busy work.

- Use OCR (Optical Character Recognition) for fast and accurate invoice data capture, enhancing accuracy and speed.

- Automate GL (general ledger) coding and workflows, ensuring all entries are consistent and error-free.

- Access files from anywhere with cloud-based storage that lets you manage AP remotely and securely.

Pricing

Available upon request.

Comparison Table

Top Reasons How Invoicing Software Can Streamline Financial Services

A streamlined billing process in financial services is like a solid balance sheet—absolutely essential! Here’s how invoicing software takes the complexity out of billing and leaves your team more time to focus on high-stakes number crunching:

1. Efficiency Overload

No more juggling endless spreadsheets! Invoicing software consolidates client data, invoice tracking, and payment status in one place, reducing the “administrative fatigue” that comes with manual billing.

2. Quick Payments? Check!

In financial services, cash flow is king. Automated invoicing and reminders can process payments faster, boosting cash flow like a well-timed market rally.

3. Compliance & Accuracy

Regulatory errors can be costly, both in fines and reputation. Invoicing software maintains precise records and automates tax calculations, ensuring your bills are as accurate as a top-notch audit.

4. Security First

Sensitive financial data requires iron-clad security. Invoicing software has built-in data encryption, protecting client details like a fortress and maintaining regulatory compliance.

How Invoicing Software Enhances Client Relationships

Good client relationships are all about trust; nothing builds trust like a clear, prompt, and professional billing process.

Here’s how invoicing software helps turn billing into a client-friendly experience:

1. Transparency with Style

Customizable invoices add a personalized touch to your billing, giving clients a clear breakdown of services while keeping your brand front and center. It’s a professional way to say, “We’ve got this covered!”

2. Smooth Communication

Automated reminders ensure that billing updates are timely. Hence, clients never miss a due date, while support features ensure that invoice-related queries are resolved faster than you can say “depreciation.”

3. Builds Financial Trust

Clients know they’re in good hands when their service provider’s billing is as consistent as quarterly dividends. On-time, professional invoices set a standard that reinforces trust in your financial expertise.

Conclusion

Invoicing software for financial services isn’t just about sending a bill—it’s about presenting a flawless financial image that boosts trust, professionalism, and efficiency.

With features like multi-currency support, tax management, and secure client portals, the right invoicing tool keeps your cash flow steady and your records spotless.

With its robust compliance features and in-depth financial reporting, Invoicera makes it easy to manage even the most complex billing requirements.

Whether you’re a financial planner, advisor, or accountant, the right software ensures you can focus less on invoicing headaches and more on what you do best—managing your clients’ financial health.

FAQs

Ques. How secure is invoicing software for handling sensitive client data?

Ans. Top-tier invoicing platforms use encryption and secure data storage to protect sensitive financial information. Look for software with compliance certifications (e.g., SOC 2, GDPR) to ensure regulatory adherence and peace of mind.

Ques. Can I use invoicing software for various payment methods (credit, debit, bank transfer)?

Ans. Absolutely! Invoicing tools often support multiple payment options, allowing clients to pay in the method they prefer. This flexibility can enhance client satisfaction and streamline cash flow.

Ques. What if my business has clients in multiple countries with different tax regulations?

Ans. Many invoicing solutions offer multi-currency and tax management features, automatically adjusting for exchange rates and different tax codes so your global clients receive accurate invoices.