Introduction

The IT industry doesn’t struggle with development or providing other tech services; rather, it struggles with financial management.

According to SCORE, “82% of small businesses fail due to issues in managing their cash, and that’s due to the inefficient invoicing process.”

Have you ever thought, what’s the main issue behind this?

Although a lot of reasons are there, the biggest one is invoicing manually.

As you know, every problem itself comes with a solution, so there are many automated invoicing tools in the market that have made the job easy.

This blog is created just to help you learn how you can make your invoicing process better and generate timely revenue.

Let’s move forward with the top 20 invoicing tips for IT companies, along with 5 popular invoicing tools that can help them with faster and more efficient invoicing.

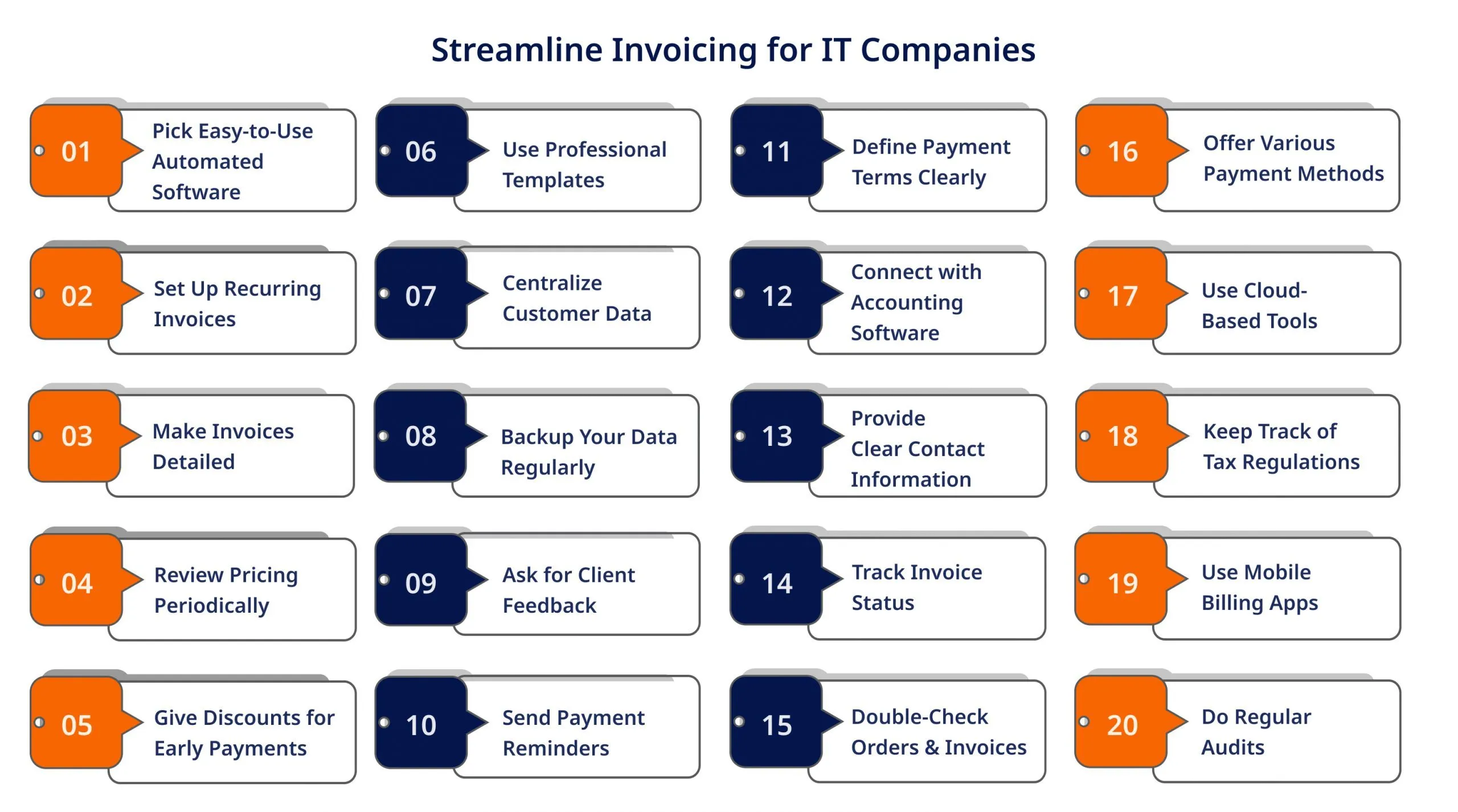

Top 20 Tips to Streamline Invoicing

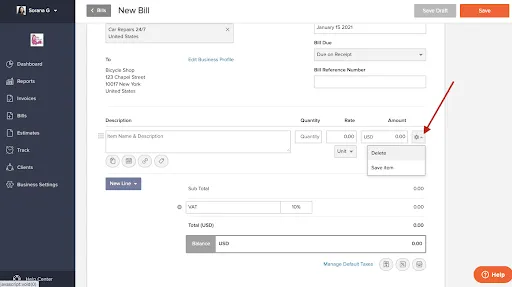

1. Pick Easy-to-Use Automated Software

Firstly, you need user-friendly invoicing software that cuts down hours of manual invoicing. This choice can make a lot of difference in the whole financial management process.

Benefits?

- Easy to learn and saves time

- Avoid the frustration of manual calculations

- A lot of features for proper financial management

- Customizable templates

- Automated reminders

Thus, this step is crucial and should be done by considering multiple options and choosing wisely.

2. Use Professional Templates

The second tip in the list is to use professional and clean templates. But why?

Here’s to know: When you use professional templates that are easy to understand by clients, it makes a good impression and improves your brand identity.

Templates help your invoices look more polished with your business logo and other brand elements. It builds trust and helps you retain your clients. Invoicing tools provide a lot of options to customize an invoice template as per business needs.

You can give a try to our tool for free.

3. Define Payment Terms Clearly

The next tip is to define payment terms clearly.

You must state the payment terms for each invoice like – adding due dates, payment method, penalties if any, late fine if not paid on time, and more.

In this way, you can promote transparency and reduce any future disputes. Also, it helps your business to maintain a positive and good relationship with your clients.

4. Offer Various Payment Methods

Offering multiple payment methods can greatly enhance your chances of getting paid on time. You can provide them with more payment options, such as credit/debit card payments, bank transfers, and digital wallets.

Why this?

- Meet the different needs of clients

- Speed up the payment process

- Boost your revenue

- Provide clients convenience

5. Set Up Recurring Invoices

If you are a business offering services on a subscription basis, you should set up automated recurring invoices.

Again, automated invoicing software plays an important role here.

Below are a few advantages of using this feature:

- You get consistent and timely payments.

- It saves you time generating invoices every month automatically

- You can predict your revenue better

6. Centralize Customer Data

It is obvious that a business has a good number of clients. Thus, managing multiple clients becomes a hectic task when done manually.

If you have one invoicing tool that keeps all your client information in one place, it will avoid confusion. It will be easier to find any client data in seconds.

This centralization will make it easier to

- Track outstanding invoices

- Manage client relationships

- Generate accurate reports

7. Connect with Accounting Software

Integrating your invoicing system with accounting software can significantly enhance your financial management.

The best way to save time and effort is to combine invoicing and accounting software. When integrated with accounting software, billing software syncs all the invoice and client data and bills accurately.

And you know, when you create error-free invoices, it speeds up the task productivity, saving time for other crucial tasks.

8. Use Cloud-Based Tools

Cloud-based invoicing tools offer numerous advantages, including accessibility, flexibility, and real-time updates.

If you want to manage your invoices from anywhere, irrespective of the location, it’s best to choose a cloud-based invoicing software.

With cloud-based tools, you need not worry about updates, backups, and losing data. It does everything automatically.

9. Make Invoices Detailed

You must feed this into your mind that your invoices must include every relevant detail clearly.

This avoids confusion between you and your clients. Add itemized descriptions, quantities, rates, and total amounts. Adding details like tax calculations and payment terms also enhances transparency and helps clients understand exactly what they are being charged for.

Detailed invoices leave no scope for errors and help in a smooth cash flow process.

10. Backup Your Data Regularly

Numerous client’s data and financial information that is important for your business must be protected. So, this is another most important tip to regularly back up your invoicing data. Most invoicing software does this automatically, and a few provide and option to manually do this in a single click.

Manual backup also hardly takes a second to start. Ultimately, you will save time here also.

11. Provide Clear Contact Information

The next tip – Provide clear contact information in your invoices.

You must include every detail about yourself clearly. This will help you resolve issues promptly if any arise. Include phone numbers, email addresses, and physical addresses.

This clarity helps clients reach out easily if they have questions or need to discuss the invoice.

If further, provide your clients satisfaction in trusting your business.

12. Keep Track of Tax Regulations

Here’s another critical aspect of invoicing – “Staying compliant with tax regulations.”

You must regularly update your invoicing system to accommodate any changes in tax regulations and include the necessary tax information on your invoices.

This helps avoid issues with tax authorities and ensures that your invoicing practices are up-to-date.

13. Review Pricing Periodically

For your business to maintain a competitive edge, pricing should be reviewed periodically in order to align with new changes.

These reviews assist in the process of changing price levels depending on the market situation, as well as costs and opportunities to improve services.

When updated with current pricing information, invoicing is accurate and fair. Maintaining current prices also allows you to solve disparities before they become problematic.

14. Ask for Client Feedback

Some clients may be willing to give constructive criticism about the invoice preparation process, and this information can prove helpful.

It serves as a way to learn more about the experiences that your clients have and whether there are any problems that need to be addressed.

Conduct surveys or directly ask for suggestions from employees and other stakeholders to obtain constructive criticism.

But if you act on this feedback, you will be able to better your invoicing process, manage your client’s issues, and improve relations.

15. Track Invoice Status

It is necessary to keep track of the status of the invoices to control the cash flow and avoid delays in payments.

Make sure your invoicing system shows if an invoice has been opened, paid, or unpaid. Such tracking enables you to contact your clients at leisure and manage any contingency.

You can also use automated reminders and notifications to ensure that clients do not lag behind in their payments.

16. Use Mobile Billing Apps

Mobile billing apps provide the advantage of flexibility to handle invoices on the move, a feature that will benefit most of the active IT employees.

In most cases, you can create, send, and track your invoices through your mobile or tablet, so even if you are not at your desk, you will be on top of your billing.

These applications can be accompanied by options such as expenses, payments, and reminders.

17. Give Discounts for Early Payments

It can be beneficial if you offer early payment discounts to your customers. This not only encourages timely payments but also makes you a better financial planner.

Put the discounted amount on your invoices as a note, such as giving a percentage off if the invoice is settled within some weeks.

In this way, the payments made earlier can prevent more significant gaps in cash flow and improve client relations.

18. Send Payment Reminders

To avoid situations when invoices remain unpaid for a long time, you should send payment reminders. Pending invoices can be followed up with automated reminders to keep clients aware of the invoice and to compel him or her to do something about it before the due date.

Incorporate friendly texts on your reminders along with specific information on any invoice in order to elicit a positive response to payment.

Some tools have built-in reminder functionality, allowing you to set up reminders automatically and easily. Thus, making sure you collect the outstanding amount on time and keep your cash flow in check.

19. Double-Check Orders and Invoices

When it comes to invoicing, precision is critical in order to avoid misunderstandings through invoices and to obtain the payments in time.

It is always wise to go over all orders and invoices at least once or twice before forwarding them to clients.

Ensure that all the details provided in the bill include item description, quantity, the amount charged, the total charge, and any other tally with the agreed standard. Such attention to aspects avoids mistakes and misunderstandings.

20. Do Regular Audits

This is also another crucial tip you must follow, i.e., conducting regular audits of your invoicing process.

You must schedule periodic reviews to assess your invoicing practices, check for errors, and ensure compliance with your business policies and regulatory requirements.

Audits can help you find discrepancies and improve the invoicing process for further deals or services.

Top 5 Online Invoicing Tools

Now, it’s time to follow all the above-mentioned tips by using invoicing software. We have mentioned five software for you. It’s up to you which one to choose.

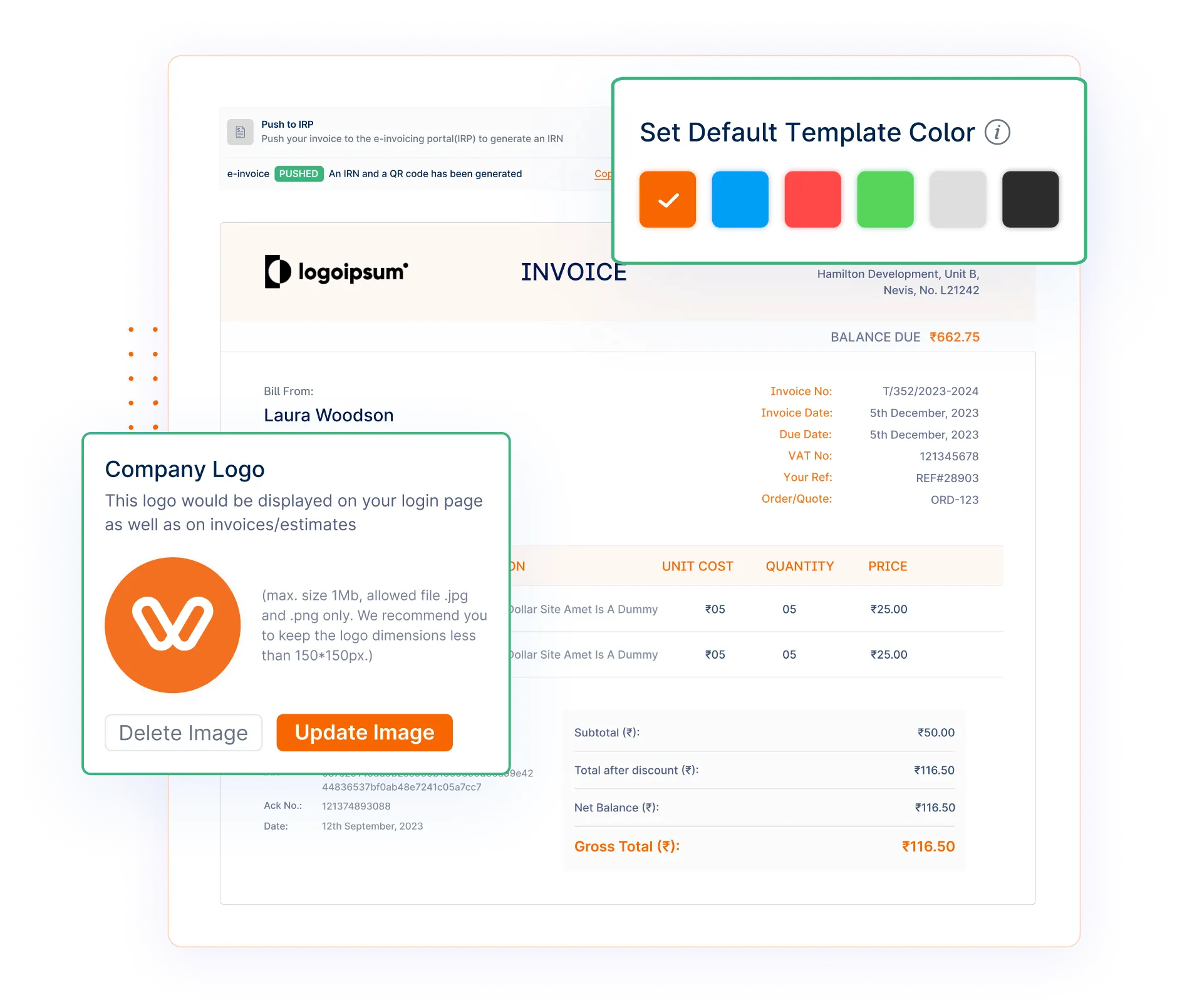

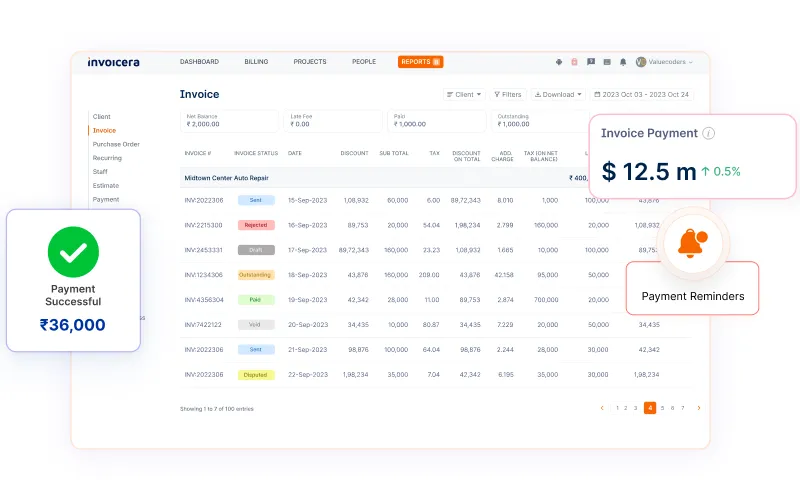

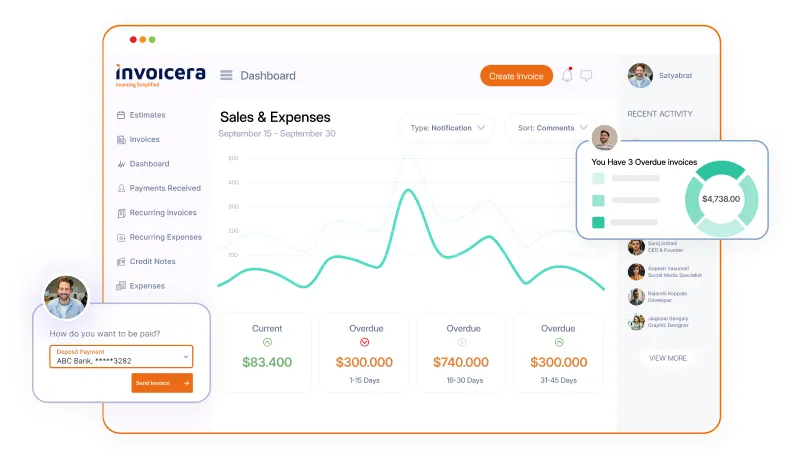

1. Invoicera

Invoicera is a prime invoicing tool with millions of satisfied customers that praise our extensive range of features.

Here’s what we offer:

- E-invoicing

- Customizable templates

- Automated payment reminders

- Recurring billing

- 14+ payment gateways

- Client portal

- Reporting and analytics

- Multi-currency and multi-lingual support

Starting at $15 per month, Invoicera balances affordability with advanced features for effective billing management.

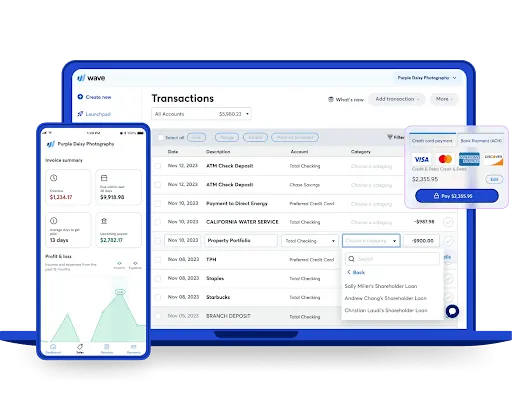

2. Wave

The second one is Wave. It lets you create professional-looking invoices and supports various online payment gateways.

It also comes with many features, like

- Accounting software integration

- Mobile receipt capture

- Financial reports

- Custom templates

The Pro plan with the maximum features starts at $16 per month, offering a cost-effective solution with essential invoicing and accounting features.

3. Sage

Sage has a little bit of an old interface, but don’t underestimate its capabilities with this.

It also has a client base of millions of people. It is fast, efficient, and saves you time. The features it provides are the conversion of quotes into invoices, providing secure payment options, sending automated reminders, integration with third-parties, managing payroll, and more.

These features can completely go with your invoicing needs. But it is a little more expensive than the other mentioned tools. The plans of this tool starts with $60.08 per month

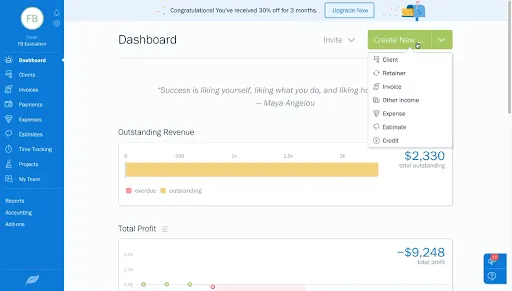

4. FreshBooks

FreshBooks is another all-in-one billing solution.

It offers:

- Customizable invoices

- Automatic payment reminders

- Integrated time tracking

- Expense management

- Tax preparation and reporting

- Project management

Pricing

Its best plan is the premium one that comes with a wide range of features and costs $18 per month.

5. Invoicely

Invoicely is the last tool on the list that offers comprehensive features for improving overall billing productivity.

It allows you to:

- Create professional invoices and estimates

- Choose multiple languages and currencies

- Accept online payments with multiple payment gateways

- Track time, expenses, and mileage

- Handle multiple businesses

Pricing

The Professional plan starts at $19.99 per month, offering essential features for effective and streamlined invoicing.

Conclusion

Overall, if you want to save time and offer your clients more accurate invoicing, you must follow the tips provided above.

Any right tool can effectively help you reduce manual errors, save time, and have a better cash flow.

Choose any tool, follow the tips, and you’re ready toward a streamlined way of billing and growing your business finances.

All the best!

FAQs

How do I choose the best invoicing tool for my IT company?

Consider your specific needs, such as integration with other software, the complexity of your billing models, and your budget. Trial versions or demos can help you make an informed decision.

Can I switch invoicing tools easily without losing data?

Most tools allow you to export data from your current system and import it into a new one, but the ease of this process can vary. Check the support offered by the tool for data migration.

What are the benefits of using cloud-based invoicing software?

Cloud-based tools offer accessibility from anywhere, automatic updates, and enhanced security, making them ideal for remote or distributed teams.

How do invoicing tools handle taxes and compliance?

Many invoicing tools have built-in tax calculators and can be configured to comply with local tax laws. Always verify that the tool meets the tax requirements of your region.

Can invoicing tools be customized for specific industries like IT?

Yes, some invoicing tools offer customization options to cater to specific industry needs, including templates, integrations, and reporting features tailored for IT companies.