Introduction

Managing money well is crucial for a business, and invoices are most helpful in this regard. An invoice is more than a charge; it is formal documentation of a commercial deal in which both the payer and the payee agree. Every individual and organization must be aware of invoices and all associated concerns.

Did You Know?

42% of automated invoices are paid on time, compared to manual invoices.

Financial managers looking for reliable invoicing software can opt for Invoicera to automate invoicing, reduce manual errors, and ensure invoices are sent promptly.

This blog covers what an invoice is and its relevance, its essential parts, its benefits, and how to create and use invoices. For an experienced entrepreneur and a small business owner, there is always something to learn about invoices that can simplify your business, help you manage your stakeholders’ expectations, teach you how to save money, and increase efficiency.

Understanding an invoice bill is essential, and identifying how one can benefit from it in various business ventures is vital. Let’s get into it!

Understanding Invoice & Its Purpose

An invoice is one of the most essential forms of documentation used in commercial transactions. It is a documented statement that lists the quantity and details of goods or services a vendor has sold and the amount still owed by the customer. Invoices’ functions include their influence over all transaction-related company operations and their essential role in the financial reporting system. Now that you know an invoice, it’s time to understand its purpose.

The Purpose Of An Invoice

After knowing what an invoice is, let’s understand its purpose.

Request for Payment: An invoice’s primary function is to demand payment for goods or services from the buyer. It helps organize the amount of money to be paid and makes the payment manageable and timely.

Legal Documentation: An invoice serves the legal purpose of evidence of a contract detailing the conditions of a sales transaction. They can be tendered in cases of disagreement, as they help both parties appreciate the details of the transactions.

Financial Record Keeping: Invoices document financial transactions and are significant in bookkeeping and accounting. They assist firms in monitoring their revenues, controlling their cash, and presenting their financial statements in preparation for tax returns.

Inventory Management: Invoices assist in tracking inventory levels for companies that sell products in tangible form. They keep records of sales, which lets businesses know the amount of stock to order.

Professionalism and Credibility: Providing detailed and accurate invoices in accounting also contributes to a business’s professionalism. It shows clients that the company is well-managed and effective, which promotes trust and client retention.

Why Is It Important To File The Order Invoice?

Managing invoices properly is crucial for the success and stability of any company due to its impact on the financial level. Here are several vital reasons why maintaining an orderly system for filing invoices in accounting is essential:

Financial Record Keeping

The order invoice is another critical financial document that captures the flow of transactions between buyer and seller. The purpose of such documentation is essential to keeping a proper book of accounts. These are the transaction date, the product or service sold, the quantity, the selling price, and tax or discount where applicable. They are essential for auditing, accounting, and taxes.

Legal Compliance

In many jurisdictions, keeping invoices is mandatory for any business. Such regulations help foster transparency and accountability in financial transactions. Failure to meet these requirements may result in sanctions or legal repercussions. Thus, filing invoices assists business operations in meeting regulatory requirements and eliminating legal issues.

Dispute Resolution

This records what has been agreed upon by the buyer and the seller through preparing invoices. Invoices form the basis for proving or denying price, quantity, or delivery terms allegations. Effectively, settling such disputes depends on the availability of proper invoice records to cross-check with actual transaction records.

Inventory Management

Customers record the details of the products or services sold through invoices. This information is helpful in stock management, where organizations can access the level of stocks and market demand and then plan the acquisition of stocks. Invoices help plan and control business processes effectively when integrated with inventory systems.

Customer Relationship Management

Invoices may record information about clients and their data, which can also help communicate with them. They serve as a reminder for further contact or follow-up for additional sales or services such as warranties. Ease of access to the invoices helps provide customers with dedicated and targeted support.

Financial Analysis and Planning

Invoice data can help organizations identify revenues, customers, and financial health trends. This information is essential for determining price changes, sales expectations, and future budgeting. It also aids in strategic planning and business strategy development.

Manual Challenges Of Invoices

Here are a few manual challenges of invoices:

- Accuracy in Calculation: Doing it manually will likely cause mistakes, mainly when working with significant, complicated statements of many items and subtotals.

- Tracking Changes: Making changes such as additions, deletions, or modifications on invoices can be tiresome, mainly if subhead changes are regular.

- Consistency: Maintaining the proper format for different invoices can be tedious while allowing each to assume different subtotals.

- Version Control: There is also the issue of having different versions of invoices, especially when negotiating or amending some of the items. An adequate system to record the various versions might lead to clarity.

- Time Consumption: Processing invoices with subheads can be time-consuming manually or with minimal automation. It may take time to shift focus from other essential duties.

- Audit Trail: It may be challenging to maintain a clear audit trail when the documentation supporting the changes made to the invoices is weak, especially where subheads are involved.

- Human Error: Human errors in data entry, calculation, and categorization are more likely to affect financial records and reports.

Benefits Of Using Invoices

Some of the prominent benefits of using invoices are as follows:

- Legal Protection: An invoice is a legal statement of the business transaction between the buyer and the seller. It gives proof of sale or service that may be valuable in legal matters, investigations, or audits.

- Record Keeping: The generation of invoices assists in keeping proper records of the money transactions. It documents sales or services, payment terms, due dates, and amounts. This is important for accounting and tracking of business financial records and activity.

- Payment Tracking: Invoices contain information such as payment terms, including when payment is expected to be made and accepted modes of payment. This also aids both companies in recording payments, thus helping to avoid delayed or non-payment.

- Professionalism: Issued invoices also show professionalism and reliability. They reveal that a business is organized and cherishes effective communication with clients or consumers.

- Cash Flow Management: Invoices are necessary for understanding and monitoring cash flow. They provide anticipated income over a specific period, which helps companies make appropriate arrangements.

- Tax Compliance: Invoices contain all the information required to generate tax reports and meet tax requirements. They comprise tax amounts crucial in determining and declaring sales or value-added tax.

Critical Parts Of An Invoice

Here are the essential parts of an invoice:

- Header Information: The header usually comprises vital information, such as the buyer’s and seller’s names and addresses. This section defines the buyer’s and sellers’ roles and responsibilities in the transaction.

- Unique Invoice Number: Every invoice has its identification number, making it unique in the system. This unique identifier assists in identifying transactions and serves as a reference to both the buying and selling parties.

- Itemized Description: Other crucial invoice elements include the quantity or description of the goods or services. This entails an item description, quantity, and unit price to enhance transactional transparency.

- Agreed-Upon Prices: The invoice states different prices to indicate the agreed price for each item or service. This provides the necessary clarification on the financial side of the transaction.

- Total Amount Due To conclude the transaction, the buyer must pay the amount stated in the invoice to the seller. This amount includes the projected expenses for the goods or services sold, costs including taxes where necessary, and any possible discounts.

- Payment Terms: This is needed for accounts receivable and details payment conditions, such as the date the invoice must be paid and whether there are any discounts for early payments or penalties for late payment.

- Payment Information: Highlights the exact payment information, such as the seller’s bank account number, to ensure a smooth and efficient transaction process as seen by the buyer.

- Terms and Conditions: This section involves other terms and conditions formally agreed upon between the parties. These can include delivery terms, return policies, or specific contractual provisions.

Types Of Invoices

Here are some common types of invoices:

1. Past-Due Invoice

An invoice paid after a specific timeframe tells the clients what they should spend. Such an invoice typically contains some basic requirements of the first invoice, such as the amount payable, date of payment, and description of goods or services. It may also include other charges like fines for failure to pay the outstanding balance in time. A past-due invoice serves as a reminder to the customer to pay the amount and as a record of unpaid amounts.

2. Pro Forma Invoice

Proforma invoice refers to the initial invoice issued to the buyer before the products are delivered or the services are offered. It is not an invoice but rather a document that the buyer receives to inform him of the full details of the transaction in terms of the price of the products, transportation costs, and any other incidental charges that might be incurred.

3. Interim Invoice

The interim invoice is given at regular intervals during the lifecycle of a large project or when a buyer has placed a large order to claim partial payments. This kind of invoice helps the service provider get paid in phases instead of waiting for the entire project to be completed. Interim invoices may minimize the risks associated with cash flow in controlling payments and receipts within the project concerning the work done and the costs incurred.

4. Recurring Invoice

A recurring invoice is created to accommodate subscribed services or products and will be provided periodically, say, monthly or quarterly. This type of invoice is perfect for recurring service providers such as software subscriptions, members, or maintenance contracts. Recurring invoices effectively manage bills by automatically creating invoices for each period to establish consistent revenues and ease the collection of expected repeated transactions.

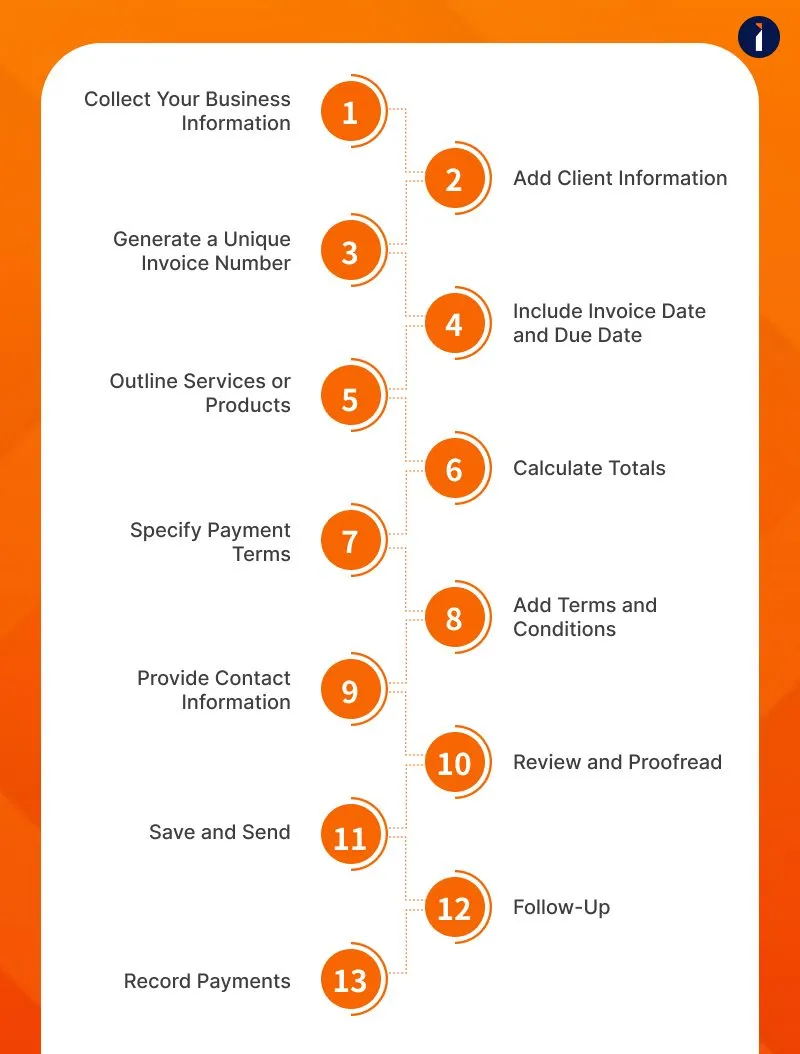

Steps To Create And Track Invoices

Follow these vital steps to create and track invoices:

- Collect Your Business Information: It is recommended to note your business name, address, phone number, e-mail, and business registration or taxpayer-identification numbers, if applicable.

- Add Client Information: Write down the client’s name, address, and contact information. Record any unique details that may need to be filled out in customs on international shipments.

- Generate a Unique Invoice Number: Give the invoice a unique identification number to be tracked. Ensure it is adequately numbered and the numbers used are logical and sequenced appropriately.

- Include Invoice Date and Due Date: Provide when the invoice is prepared and the payment must be made. This will help define the client’s expectations.

- Outline Services or Products: Describe the nature of the goods or services offered. This should present the description, quantity, unit price, and other applicable taxes. However, if there is more than one item, it should be listed neatly in the format of a number list.

- Calculate Totals: Add the price of goods or services and include relevant taxes. If offering discounts, clearly state this. Determine the total costs.

- Specify Payment Terms: Explain the payment terms under which you accept payments, whether you prefer cash, checks, or credit cards, and whether there are discounts for early payments or penalties for delayed payments.

- Add Terms and Conditions: Input any other conditions that may apply in the transaction that have not been captured above. This could include delivery terms, returns policies, or specific contractual terms.

- Provide Contact Information: Leave your contact details beside your work in case the reader has questions or needs further clarification. This ensures that there is an open channel of communication between you and the client.

- Review and Proofread: Finally, every field on the invoice should be checked and reviewed for correctness before the invoice is prepared. Typos and mathematical errors should not be evident; all computations should be accurate.

- Save and Send: Keep one copy for your records and forward the copy of the invoice to the client. You can then forward it via e-mail, send it as a hard copy via post, or use the invoicing service to forward it electronically.

- Follow-Up: Follow up on the due date by contacting the client to recover the money. This step is crucial because it will ensure the organization has enough cash to meet its daily needs.

- Record Payments: A payment received should be entered in the financial books, cleared with open invoices, and marked as such.

Closing Thoughts

Issuing invoices is essential in managing finances because it ensures clarity in the following ways: legal protection, enhanced flow of cash, and professionalism. Understanding an invoice bill and types of invoices like standard, proforma, credit, and debit facilitates proper transaction communication.

Reliable invoicing software like Invoicera is essential for Finance Managers. Some of the critical features of Invoicera include automated billing, the ability to create custom invoices, and real-time tracking of invoices, all of which can help receive timely payments and improve cash flow. Its robust features include rich reporting features, which offer crucial financial information for decision-making.

To conclude, identifying best practices for invoicing and employing an application such as Invoicera can significantly enhance a company’s fiscal and organizational performance.

FAQs

Ques: What are the advantages of using the software for invoicing?

Ans: Solutions such as Invoicera that assist with invoicing can help automate billing, customize templates, and track payments in real-time. This results in fewer mistakes, increased revenue, improved cash flow, and increased crucial financial information with the help of accurate and detailed reporting tools.

Ques: How do you pick the right invoicing software?

Ans: The key points when selecting an invoicing tool include usability, customization, automation, account program integration, generating capabilities, customer service, and pricing. For instance, Invoicera provides a rich feature list to optimize invoicing functionality and improve accounting.

Ques: What is the difference between credit and debit invoices?

Ans: A credit invoice, also known as a credit memo, is created to decrease the amount of money owed by the buyer; this may be as a result of goods being returned, discounts, or even billing mistakes. A debit memo is the kind of invoice that increases the buyer’s amount to be paid due to underbilling, extra services, etc.