Introduction

Are you having trouble managing regional invoicing rules for your business? This guide should be all that you need. In this article, we’ll discuss regional invoicing rules and best practices for businesses to manage internal invoicing.

Businesses can now operate globally, enabling you to work with different companies from anywhere in the world. Still, you should adhere to the invoicing rules of a client’s country of origin. Let’s explore regional invoicing and the laws governing it.

What Are Regional Invoicing Rules?

Regional invoicing rules are the specific legal requirements and guidelines different countries or regions set. These rules cover issuing, formatting, and managing invoices in business transactions with an organization or individual in that region or country. Knowing these rules matters if you want to ensure tax compliance, accurate financial reporting, and legal validity.

Tax systems vary worldwide. Some of those contextual policies include Value Added Tax (VAT), Goods and Services Tax (GST), and sales tax. Since invoicing rules can vary significantly from one region to another, we must adhere to them religiously to protect our businesses.

Why You Should Adhere to Regional Invoicing Rules

Adhering to regional invoicing rules is essential for businesses for many reasons. Here are some of the most critical ones.

1. Legal Compliance and Penalty Avoidance

Failing to comply with invoicing rules can result in large fines, legal issues, and potentially criminal charges for serious violations. Following regional guidelines helps avoid these outcomes.

Moreover, proper invoicing practices are highly crucial during tax audits. Because an invoice serves as the primary document to verify reported income and taxes, you want to ensure it adheres to all policies, including that of the recipient’s country. Discrepancies can trigger further scrutiny, penalties, or audits, which will only cost your business dearly.

2. Facilitating Tax and Financial Reporting

Adhering to invoicing rules is good practice when documenting transactions. You will need this to make tax reporting more straightforward and accurate. Adherence will remove several complexities that will add choke points to your financial systems. In contrast, consistent and compliant invoicing practices help maintain orderly financial records and simplify your accounting processes and financial management.

3. Enhancing Credibility and Professionalism

Being tax and invoicing rule-savvy helps strengthen your trustworthiness in the eyes and hearts of your clients. That’s because following established invoicing protocols demonstrates professionalism and integrity. Additionally, it shows your business is well-organized and mindful of its legal responsibilities, including managing a dedicated LLC bank account.

Furthermore, meeting legal standards can make your business more appealing to partners, investors, and stakeholders. You’ll also attract companies that value corporate responsibility and mutual relationships.

4. Operational Efficiency and Cost Savings

We highly recommend setting up automated invoicing systems and financial management tools that comply with regional rules. Doing so can streamline billing processes, reduce errors, and save time and resources.

Apart from efficiency, a blend of compliance and automation helps you avoid financial discrepancies. Proper invoicing helps prevent payment disputes with clients and vendors.

5. Cross-Border Commerce

Entering and expanding in global markets is nearly impossible if you don’t adhere to other countries’ rules and regulations. Pushing for expansion without compliance is not just irresponsible. It’s also hazardous for you and the clients you will work with. Non-compliance will result in barriers to market entry or expansion.

In addition, correct invoicing is crucial when you’re applying for tax treaties. Your company can and will most likely avoid double taxation, so businesses don’t pay more tax than necessary on international transactions.

6. Keeping Up with Digital Transformation

Staying compliant means keeping pace with technological advances and leveraging them for efficiency and transparency. More regions have adopted electronic invoicing requirements. The e-invoicing space is expected to grow by at least 18% in the next 10 years.

Using the right e-invoicing practices, like adding security features, can lower the risk of fraud and keep financial transactions secure. Additionally, using threat monitoring tools can help spot and address any security issues, further protecting your invoicing process.

5 Key Aspects of Regional Invoicing Rules

Here are the critical aspects of invoicing that companies must master to stay compliant and competitive.

1. Invoice Content Requirements

At the core of every invoice are essential details that validate the transaction and ensure legal and financial clarity. These include:

Basic Information — Every invoice should include the issue date, a unique invoice number, and both the seller’s and buyer’s names and addresses. These details prove the invoice is real and help you and your clients track easily transactions over time.

Tax Information—This includes tax identification numbers for both parties and a detailed breakdown of the taxable amount and the applicable tax rate(s). Preparing all pertinent information will keep you compliant with tax laws and help facilitate accurate tax reporting and reconciliation.

Product or Service Details — Provide a detailed description of the goods or services provided for transparency. That should include the quantity, unit price, and the total amount due. The thoroughness of these details helps both parties understand what is being paid for and aids in dispute resolution and financial management.

2. E-Invoicing

Digital transformation is reshaping business worldwide. To prove this, studies show that 91% of companies are pursuing digital initiatives. As a result, electronic invoicing is now key to enhancing tax reporting and compliance They help reduce fraud and promote operational efficiency.

Many regions now mandate or encourage e-invoices, which must adhere to specific formats, including digital signatures, and follow precise transmission methods. The shift towards e-invoicing is not just about compliance; it’s also about leveraging technology to streamline processes and reduce environmental impact.

3. Tax Reporting and Compliance

Separating the rules governing invoicing and tax reporting requirements is nearly impossible. Businesses must regularly report their sales and the taxes collected to the authorities. That also includes following specific formats and timelines, so urgency is high within that regard.

In some jurisdictions, that will involve real-time or near-real-time invoice data reporting. You might also need a measure to reduce tax evasion and ensure a fair playing field for all businesses.

4. Storage and Record Keeping

Laws worldwide specify the duration for which businesses must retain copies of invoices and the formats in which these records should be kept. That includes paper, electronic, or both versions.

You must know that this is not merely a bureaucratic requirement. It’s a high necessity for financial auditing, legal verification, and historical analysis. Take record keeping seriously at all costs. Invest in good offline and online storage facilities. Consider talking to someone with a data management or library sciences degree to help you figure out your information management.

5. Cross-Border Transactions

Understanding the invoicing rules related to cross-border transactions is essential for businesses engaged in international trade consulting. These rules may involve:

- Specific adjustments for VAT or GST

- Special considerations for handling foreign currencies

- Compliance with international tax treaties

Master these to avoid double taxation, minimize tax liabilities, and streamline global operations.

Guide to Regional Invoicing Rules

If you need guidance on regional invoicing rules, here are some of the most important ones you should know from around some of the most important business regions in the world:

United States

- Unlike many countries, the U.S. hasn’t required e-invoicing for B2B transactions because of tax complexities and the lack of central authority.

- The U.S. lacks a federal VAT/GST system, and its varied state and local taxes make nationwide e-invoicing hard.

- Future e-invoicing rules in the U.S. may target cross-border deals, needing states to work together.

- In addition, the U.S. deals with many e-invoicing formats and standards, making the shift to electronic invoicing challenging.

- Initiatives by groups like the Business Payments Coalition aim to create standard networks and formats.

European Union

Since 2014, the European Parliament has mandated that all EU public sector entities accept e-invoices. These must follow certain standards, including structured data and electronic signatures.

Some critical country-specific rules:

- France: Since 2017, France has required e-invoicing for public administration suppliers, which will expand to all B2B by 2026 and 2027 via the Portail Public de Facturation or approved platforms.

- Italy: Italy made e-invoicing compulsory for public buys in 2015 and most businesses by 2019, using the Sistema di Interscambio for checks and submissions.

- Germany: Germany has required e-invoicing for public procurement since 2020 and plans to mandate it for companies with over €800,000 turnover from January 2027.

- Spain: Plans to mandate e-invoicing for large companies by July 2024 and for all other companies by early 2026, with a submission system similar to France’s.

While an EU member, Ireland has yet to announce a comprehensive mandate for e-invoicing outside business-to-government transactions. In the UK, e-invoicing is mandatory for transactions with public entities but not for B2B payments, subject to certain conditions for authenticity, integrity, and readability.

E-invoicing across the mentioned countries entails specific conditions such as the customer’s consent, the authenticity and integrity of the invoice, readability standards, and compliance with each country’s submission and content requirements.

Despite the overarching EU directive, the adoption, implementation timelines, and specific requirements for e-invoicing vary significantly across European countries.

Asia-Pacific

CTC Models and Mandates:

- Malaysia: Plans to implement a CTC clearance model from August 2024 for companies with over MR100 million in revenue, covering B2B, B2G, and B2C transactions across selected sectors.

- South Korea: Since 2011, has had a mandatory e-invoicing system for all corporations and taxable individuals exceeding certain turnover thresholds, utilizing a CTC reporting model with e-tax invoices reported within one day of issuance.

Adoption Strategies and Tax Incentives:

- Thailand: Developing an e-invoicing system with certified third-party service providers for e-tax issuance, with no current mandatory timeline but extending tax incentives to promote e-invoicing.

- China: Expanded its pilot program for e-invoicing nationwide from December 2023, requiring selected taxpayers to issue digitalized e-invoices (e-fapiao).

International and Regional Efforts:

- Singapore: Joined OpenPEPPOL as the first National Authority outside Europe in 2018, launching the InvoiceNow network for B2B and B2G transactions, with plans to make it the default e-invoicing channel for government vendors.

- Japan: Encourages voluntary adoption of the PEPPOL standard for e-invoicing, with the Qualified Invoice System introduced in October 2023 requiring detailed tax rate information on invoices.

Emerging E-Invoicing Systems:

- Philippines: Introduced the Electronic Invoicing/Receipting System (EIS) for 100 pilot taxpayers in July 2022.

- India: Started the CTC e-invoicing system January 2020, gradually expanding to businesses with Rs. 5 Crore or more turnovers by August 2023, requiring IRN inclusion on invoices.

Indonesia and Vietnam: Both countries implemented mandatory e-invoicing to enhance tax compliance. Indonesia has had the e-Faktur system since 2016, and Vietnam introduced a nationwide mandate in July 2022.

Invoicing the Globe

As globalization creeps up your business door, you want to be careful not to oversimplify growth tactics. Business can have its complexity points, and these intricacies will only grow as you expand your market.

Still, dealing with all these nuances is more than worth it. If you learn to follow invoicing rules, you will significantly grow your customer base and business.

Invoicera – A Global Invoicing Tool

The blog explains how important it is to get this right. Businesses not following invoicing rules can lead to legal trouble and tax issues, which could harm your reputation with clients.

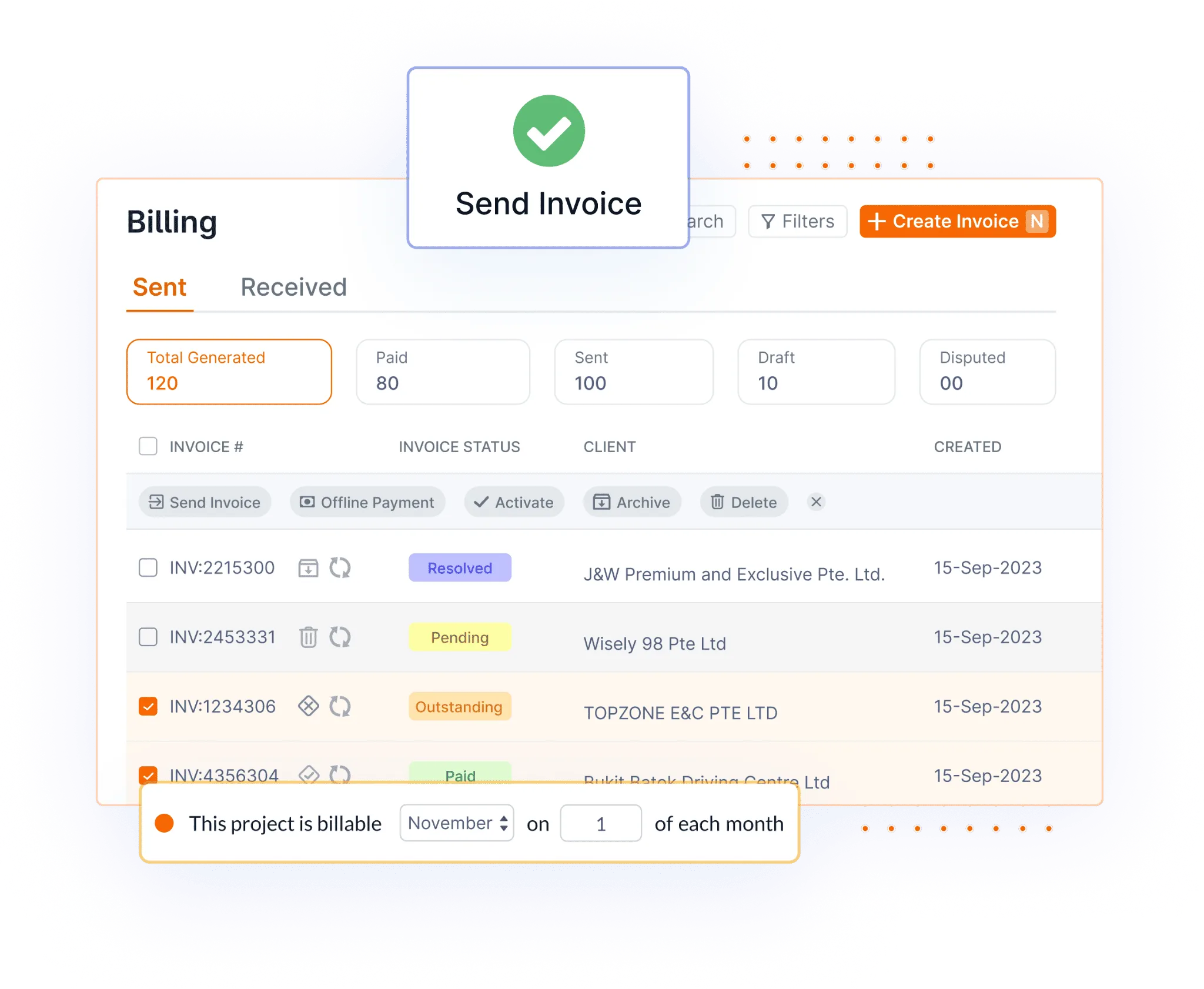

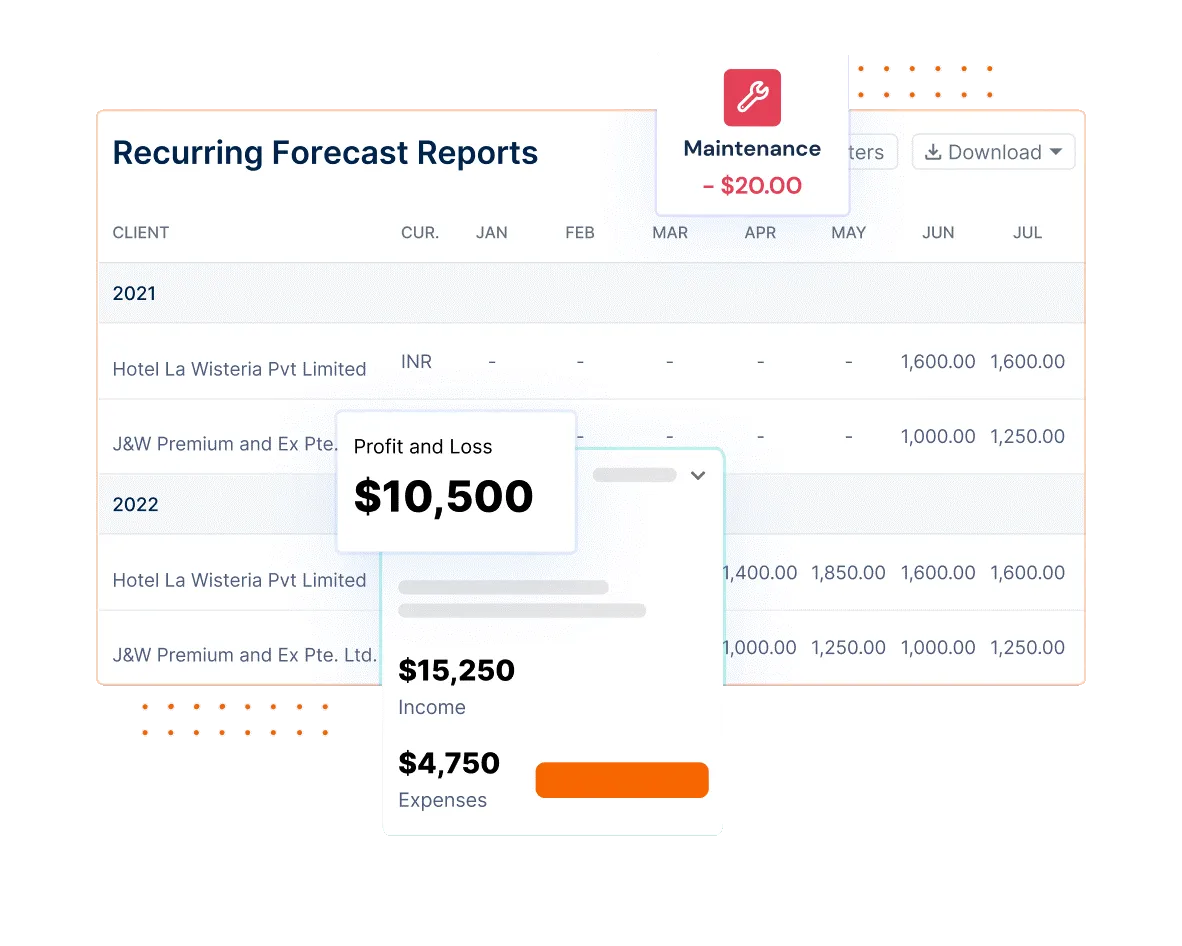

Using an invoicing tool like Invoicera can be a big help in managing your invoicing process more efficiently.

Invoicera lets you customize invoices to match the specific requirements of each region. This includes:

- Adding the right tax details for that area

- Following any rules around e-invoicing (sending invoices electronically)

- Presenting information in the format required by that region

But Invoicera does more than just make sure you comply with the rules. It also:

- Simplifies the whole invoicing process, saving you time

- Reduces mistakes that could lead to costly errors

- Improves efficiency by automating repetitive tasks

Get ready to invoice the globe. International markets are waiting for your expansion!

FAQs

What are the penalties for non-compliance with regional invoicing rules?

If you fail to follow regional invoicing rules, you might have to face severe consequences. You mighty have to pay heavy fines or penalties. It can also lead to legal disputes and even criminal charges in some cases.

How often do regional invoicing rules change?

Regional invoicing rules are continuously evolving. The frequency of these changes can vary depending on the region or country. Some regions may update their invoicing regulations once or twice in a year, while others may introduce changes more frequently, especially in response to technological advancements or shifts in tax policies.

Are there resources available to help businesses understand regional invoicing rules?

Absolutely! Several resources are available to help them understand and comply with these regulations. Government websites and portals often provide detailed information and guidance on invoicing requirements specific to their regions.