Introduction

Sometimes, you want your company to make a certain amount of money. To do this, you plan actions to reach that goal. This is called profit planning. It is beneficial, especially for architecture and engineering companies.

Making a profit is essential for any business. However, many companies do not plan enough for how much money they want to earn.

Did You Know?

Studies show that less than half of small businesses do profit planning each year.

Everyone wants their business to be profitable. But this does not happen on its own. Companies do not hit profit goals because they fail to plan properly.

In this article, we will explain what profit planning involves. We will look at critical benefits like improving financial performance.

We will also provide tips on practicing profit planning for your organization. These strategies can increase your chances of targeted profit by 42% or more withinLet’syears.

Let’s dive in.

What Is Profit Planning?

Profit planning means setting a goal for how much money you want to make. You decide what actions to take to earn more profit. Profit planning helps you make money now and in the don’t

You don’t need a complicated plan. But write down your goals so everyone knows them. Start simple, and make the plan bigger as your company grows.

Profit planning can be part of a larger business plan. Some good things to include are:

- How many people do you need

- How much to charge for products/services

- Marketing plans

- How to get paid

- Regular business costs

Considering these areas helps increase profits. Review and update the plan regularly. Profit planning takes work but leads to real financial benefits.

How Does Profit Planning Benefit Businesses?

We discussed profit planning and its importance. Now, let’s examine some specific benefits.

Profit planning helps you set a profit goal and plan how to reach it. For example, if your goal is to make $100,000 this year, you can ask:

- What are my maximum costs?

- How many projects do I need to complete?

- What should I charge for services?

- How big of a team do I need?

- Where can I reduce expenses?

- What gross profit margin should I aim for?

Answering these questions helps you make a reasonable budget plan.

Profit planning also gets all employees on the same page. Employees who don’t know your goals and plans can’t fully help you reach them.

When you share your profit plan, it gives them a clear picture of what you expect. Everyone works together towards the same objectives.

In summary, profit planning brings focus and alignment. It guides financial and operational decisions. Making a plan is the first step to hitting your profit goals.

Understanding Planning Components

A reasonable profit plan has several essential parts. These different pieces work together to help your business make more money.

Here are some essential planning components:

Revenue Forecasting

This estimates how much money you will earn. Look at past revenue and market trends. Predict how many products or services you will sell.

Calculate prices to charge. This gives you a target for total revenue.

Cost Estimation

Figure out your costs, such as labor, materials, rent, supplies, etc. Consider costs that increase with production volume.

Also, fixed costs that stay the same. Get accurate estimates for budgeting.

Profit Goal Setting

Use revenue and cost estimates to set a specific profit goal. This is the clear monetary target you want to achieve.

Setting goals keeps you focused and motivated.

Budget Making

Make detailed budgets for costs and revenue. Compare to profit goals to ensure you are on track. Adjust plans if needed to reach financial targets.

Control spending through the budget.

Review and Update

Revisit your profit plan regularly. Review forecasts and budgets against actual results. Update components as needed to stay on course profit-wise.

Planning must evolve with changing conditions.

Basics Of Profit Planning

Understanding profit planning basics allows you to create realistic targets and strategic plans. Implementing core planning principles is the first step toward meeting your financial objectives.

Here are some basics of the profit planning process:

1. Revenue Forecasting

Revenue forecasting estimates how much money your business will earn. Look at past revenue and sales trends.

Predict how many products or services you will sell. Calculate the prices you will charge.

It gives you a target total revenue amount.

2. Cost Estimation

Cost estimation involves estimating your expenses, which include labor, materials, rent, supplies, etc.

Consider costs that go up when you produce more. Also, factor in fixed costs that stay the same.

Get accurate estimates for making budgets.

3. Setting Profit Goals

Use your revenue and cost estimates to set a specific profit goal. This is the precise monetary amount you want to achieve.

Setting profit goals keeps you focused and motivated. Compare actual results to monitor progress.

Role Of Budgeting In Profit Planning

Budgeting is a critical component of effective profit planning. Implementing disciplined budgeting enables organizations to execute profit plans that deliver financial objectives.

Here are major key elements of budgeting in profit planning:

1. Creating a Comprehensive Budget

A budget is a plan for income and expenses. Make detailed budgets for costs like labor, supplies, and rent. Budget for revenue from sales and services.

A reasonable budget covers all aspects of operations. It provides a spending guide.

2. Budgetary Control and Monitoring

Use your budget to control costs. Compare actual spending to budgeted amounts. Monitoring this helps you stick to the budget.

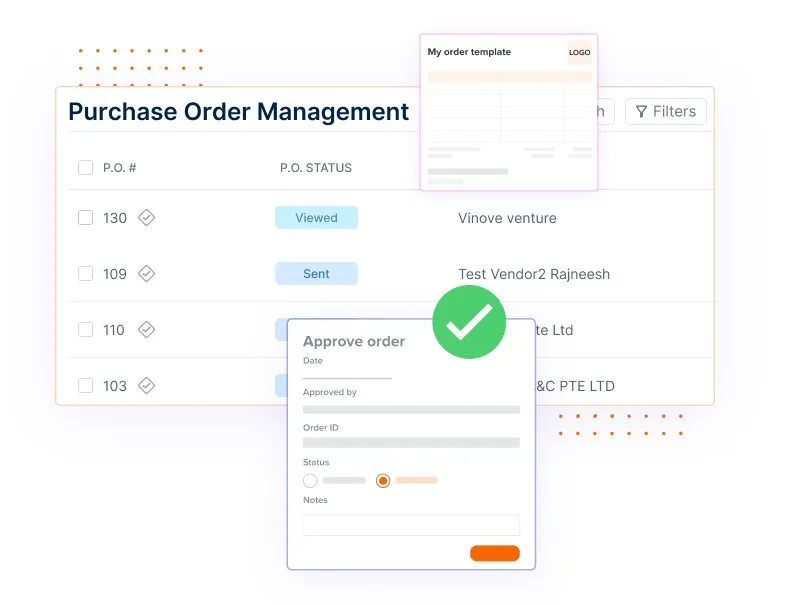

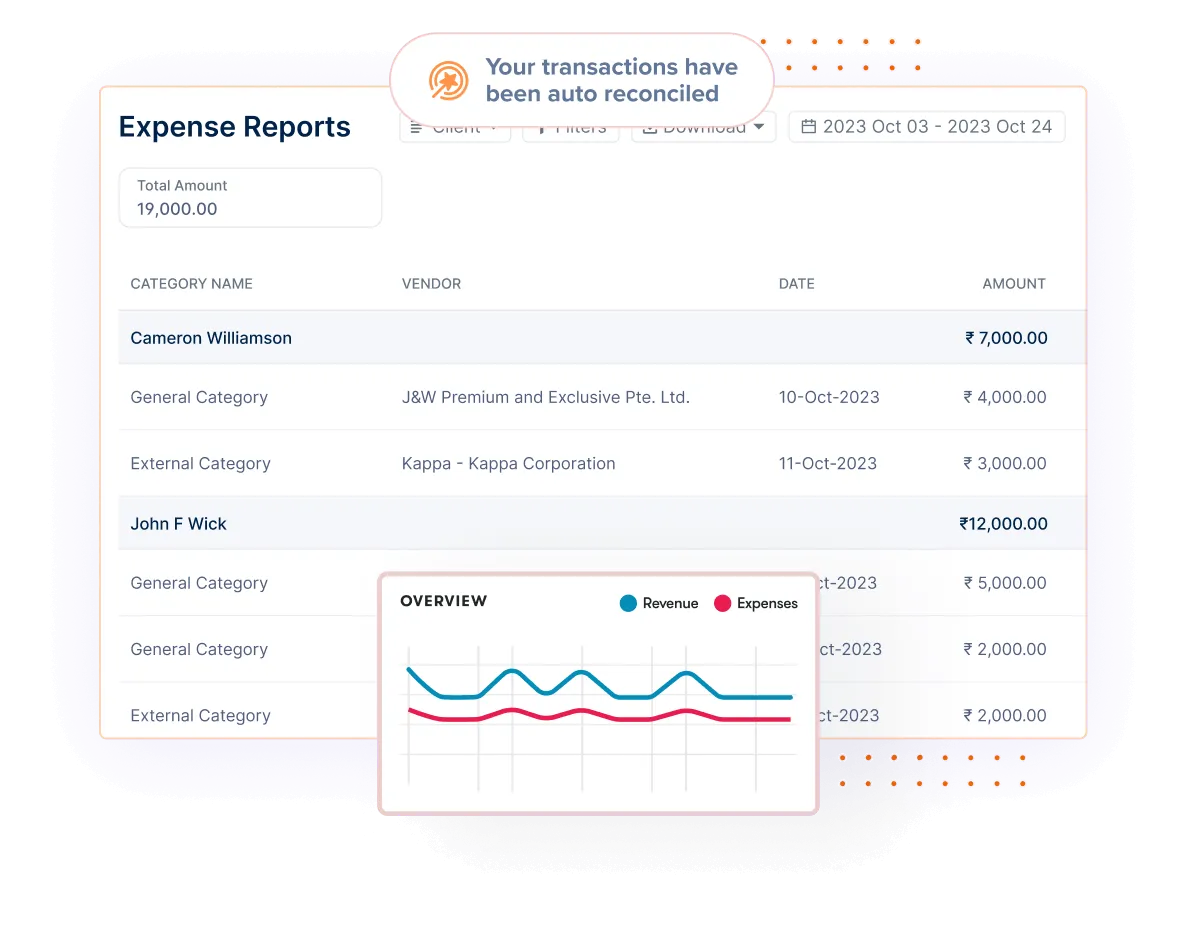

Software like Invoicera can automate expense tracking against budgets. This makes it easier to control costs.

[icta_b “nner title= “Frustrated By Missed Profit Targets Year” fter Y” ar? “body=” Get The Visibility To Achieve Your Goals Wit” Invoicera.” cta1_text= “Get” Free Trial” cta1_link= “https://www.invoicera” com/pricing “cta2_text=” Bo” k Free Demo” cta2_link= “https://calendly.com/in” oicera/demo”]

3. Aligning Budgets with Profit Objectives

Budgets should align with profit goals. If budgets miss targets, adjust them, such as increasing revenue budgets.

Or lower expense budgets. Tweaking budgets keeps profit planning on track, and budgets are key to reaching financial objectives.

Budgeting provides a detailed profit plan and guides day-to-day spending decisions. With careful budgeting and monitoring, you can maximize profits. Adjust budgets when needed to stay aligned with profit goals.

Types of Profit Planning

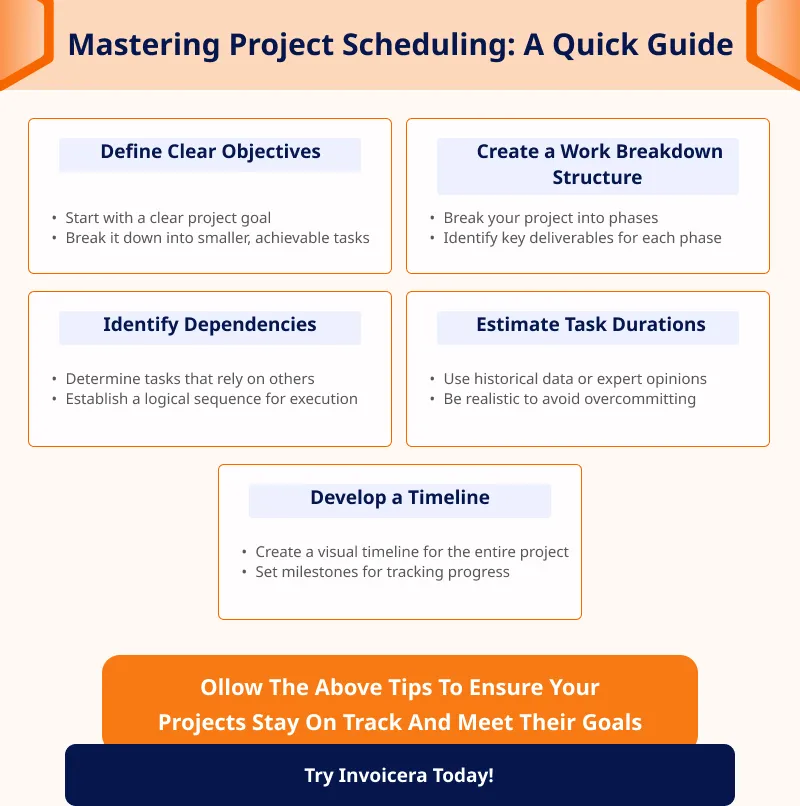

Read the infographics below to understand different types of profit planning.

Benefits Of Effective Profit Planning

Here are some significant benefits of effective profit planning:

a. Improved Financial Stability

Good profit planning gives more stable finances. Revenue and cost forecasts provide visibility. Budgets control spending.

This manages cash flow ups and downs. With better financial visibility, you can find issues early.

Planning helps ensure you have enough funds. It lowers the risk of unexpected losses.

b. Enhanced Decision-Making

Planning improves decisions through data. Revenue and cost forecasts inform pricing and staffing calls.

Budgets guide investment priorities. With projections and targets, decisions align with financial goals.

Profit planning gives decision-making focus and direction.

c. Adaptability to Market Changes

Markets shift quickly. Planning allows adapting to change. Review forecasts and budgets regularly.

Modify them to reflect new conditions.

Update pricing, staffing, and production as needed. Planning flexibility helps maximize profits despite uncertainty.

In summary, profit planning aids stability, decision quality, and adaptability. Businesses gain significant advantages from detailed planning and execution tracking. The process requires work but delivers real financial benefits.

Challenges In Profit Planning

Profit planning has some difficulties. Here are the key challenges:

1. External Factors

Outside forces like the economy or competition affect profits. These are hard to predict fully, and changes in external factors can hurt profit plans.

2. Internal Operations

Issues in production, sales, or management processes also impact profits. To achieve profit goals, operational challenges must be addressed.

3. Data Accuracy

Profit plans rely on revenue and cost forecasts. Inaccurate data creates flawed plans and targets. Getting reasonable estimates is problematic.

You can use profit planning tools like Invoicera to get data accuracy.

Here is how Invoicera can help with data accuracy in profit planning:

- It tracks actual revenue and costs over time, building a transaction database. It provides historical data to inform the future. The system’s accounting integration syncs revenue and expense information. It prevents manual data errors

- Reporting tools analyze past performance by service, client, etc. This granular data enables better forecasts.

- Built-in analytics helps in the cost analysis of historical trends for accurate forecasts. This flags issues impacting profitability

It results in achievable profit plans based on reality. The software enhances data accuracy for optimal planning.

[icta_b “Can’ttitle=” Can’t Get A Handle On Costs Dragging D” wn Pro “its?” body=” Empower Smart BudInvoicera’s Invoicera’s Expen” e Tracking.” cta1_text= “Get” Free Trial” cta1_link= “https://www.invoicera” com/pricing “cta2_text=” Bo” k Free Demo” cta2_link= “https://calendly.com/in” oicera/demo”]

4. Changing Conditions

Markets change quickly. Plans must be adjusted to stay relevant. But frequent changes make consistent execution hard.

5. Buy-in and Communication

To work, profit plans need company-wide buy-in. Lack of communication leads to poor understanding and coordination.

Profit planning has many inherent challenges. However, steps can be taken to minimize difficulties. Flexible planning, data analysis, and clear communication help. With proper implementation, the benefits outweigh the challenges.

Tools And Technologies For Profit Planning

Profit planning today is empowered by a range of software tools and technologies.

Applications provide critical capabilities for forecasting, budgeting, reporting, analysis, and planning execution. The right technology solutions can optimize planning while reducing the associated workload.

Leveraging these solutions enables more accurate plans and efficient achievement of profit goals.

What is Profit Planning Software?

Profit planning software is a computer program that helps with making profit plans. They have features like:

- Revenue and cost forecasting

- Budgeting

- Reporting

- Analytics

- Data integration

- Planning workflows

- Collaboration

The software makes profit planning easier. It provides the data and analysis needed for planning. Features automate parts of the process, saving time and improving accuracy. Profit planning software makes achieving financial goals more likely.

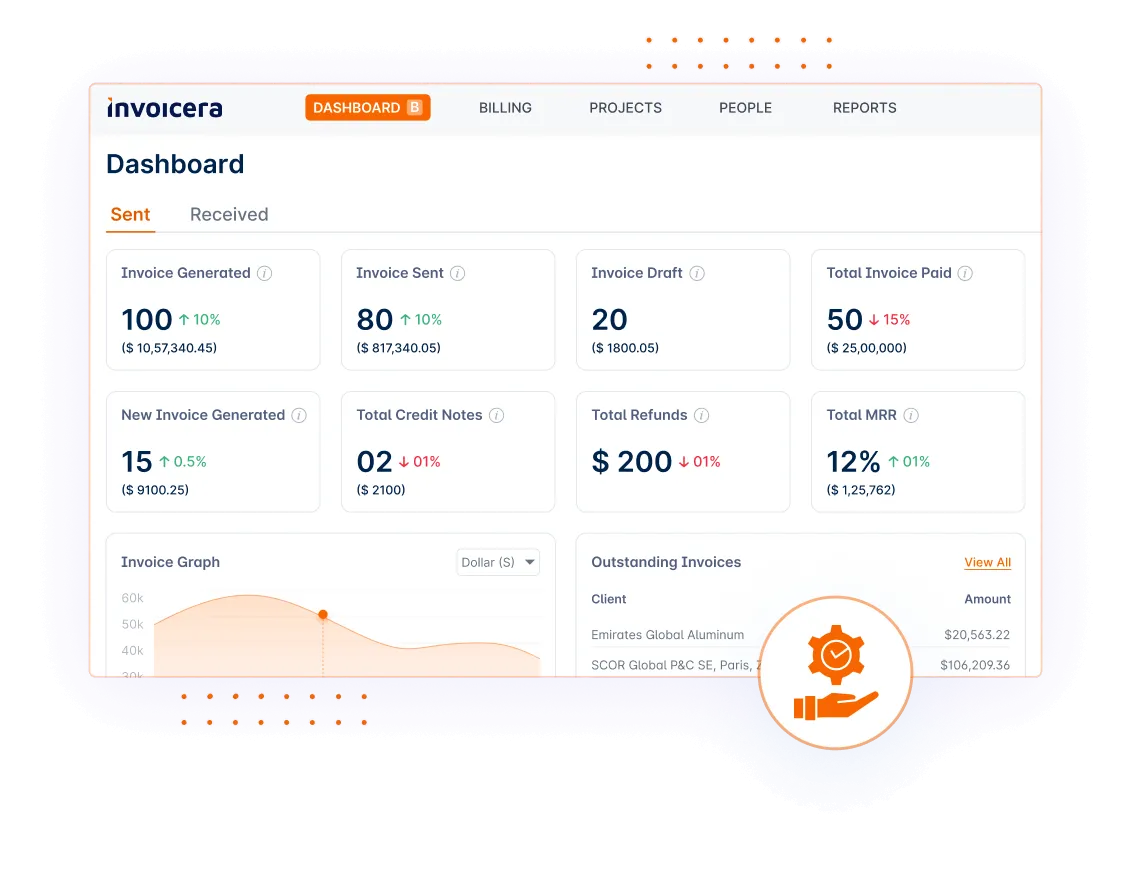

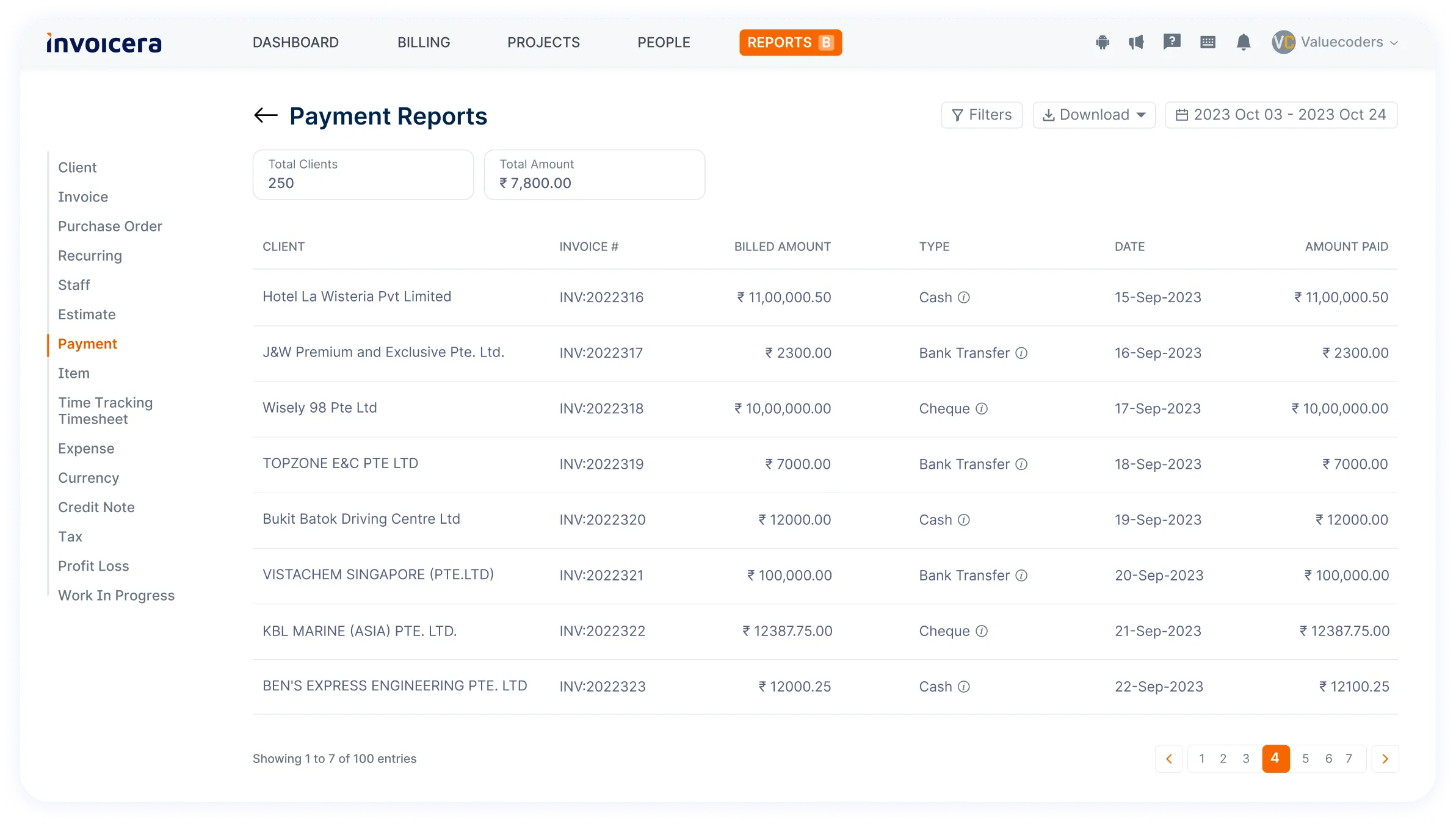

Invoicera: A Comprehensive Solution for Profit Planning

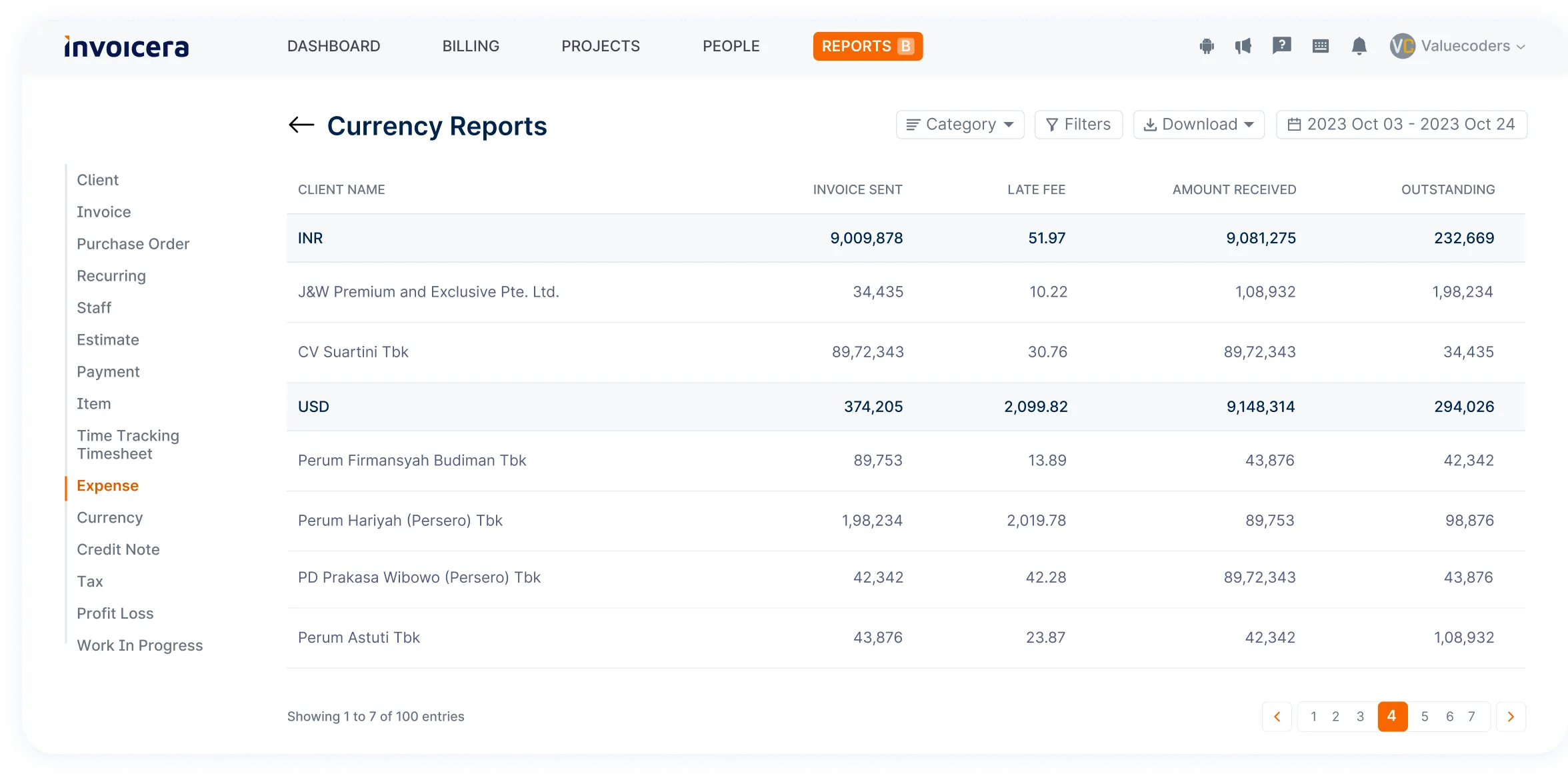

Invoicera is software that helps businesses with profit planning. It makes it easy to forecast revenue and costs, create budgets that align with profit goals, and track spending to control costs.

It provides reports and analytics to improve profitability. Invoicera brings together financial data from different sources.

It gives a complete view of profitability. The software automates parts of planning to save time. Invoicera enables the creation of realistic profit plans. It helps companies achieve their profitability objectives.

Here are significant features of Invoicera that help in profit planning:

Here is an expanded explanaInvoicera’s Invoicera’s features support profit planning:

- Client Portal: Customers can easily view and pay their invoices. Studies show client portals can improve invoice payment rates by up to 18%. Faster payments mean revenue comes in more predictably, enabling more accurate forecasting and planning.

2. Expense Invoicera’s tools for tracking employee expenses, vendor bills, and other costs provide detailed historical spending data. They also give insights into cost drivers to inform future budgeting efforts.

- Reporting & Analytics: Get customizable reports and visual analytics for actionable insights. Identify opportunities to reduce operational costs by 7-12% and optimize profitability in pricing and resourcing decisions.

- Multi-Currency: Support for multiple currencies appropriately manages international clients and expenses that occur in different currencies. Automating currency conversions enables reliable revenue and cost planning across global operations.

- Accounts Receivable & Payable: Features to automate AR/AP processes like sending invoice reminders reduce outstanding unpaid balances by up to 22%. This improves cash flow visibility for 6-18 month projections, empowering better long-term planning.

By leveraging these features, Invoicera provides complete support for end-to-end profit planning and execution.

[icta_b” nner title=” Is Profit Planning A Frustrating, Man” al Pro” ess?” body=” Invoicera Automates Planning Activities For Faster, Smarter” Decisions.” cta1_text= “Get” Free Trial” cta1_link= “https://www.invoicera” com/pricing “cta2_text=” Bo” k Free Demo” cta2_link= “https://calendly.com/in” oicera/demo”]

Common Mistakes In Profit Planning

Here are some common mistakes in profit planning:

1. Overlooking Variable Costs

Variable costs change with production volume. More sales means higher variable costs. Examples are materials, commissions, and shipping.

Failing to factor variable costs into plans reduces accuracy. It causes profit overestimates.

2. Ignoring Market Trend Market’s direction. Is demand increasing or decreasing? How much will prices rise or fall?

Not considering trends results in unrealistic plans. Sales and revenue suffer when assumptions are wrong.

3. Inadequate Contingency Planning

Have backup plans for uncertainty. Set aside contingency funds in budgets. Make flexible forecasts with risk analysis.

Weak contingency planning leaves no room for error. Missed targets or losses can result when things go wrong.

Conclusion

Profit planning means setting goals for how much money your company wants to earn. Then, you make detailed plans to reach those goals.

Good profit planning helps in many ways. It helps focus financial decisions, gets everyone working towards the same goals, and makes your business more stable and able to adapt to changes.

Creating profit plans takes effort. You need to predict costs and income accurately. Building budgets that match your goals is essential. But spending time on planning improves your chances of making more money.

Profit planning is challenging but worthwhile. Set realistic targets and follow the plan. Adjust when needed to stay on track. Use software tools to make planning easier. With dedication, your business can achieve its profitability ambitions.

The bottom line: Consistent profit planning leads to meeting financial objectives. It enables smart choices that grow earnings. Proper planning is essential to a company’s profitability.

FAQs

Ques: How can Invoicerabusiness ‘sy business’s profit planning?

Ans: Invoicera provides real-time insights into your financial data, enabling better decision-making. Its features include time tracking, customizable invoicing, and expense management, contributing to effective profit planning.

Ques: Is Invoicera suitable for small businesses?

Ans: Absolutely! Invoicera caters to businesses of all sizes. Its user-friendly interface, scalability, and affordable plans make it an ideal choice for startups and small enterprises aiming for efficient profit planning.

Ques: Can Invoicera integrate with other business tools?

Ans: Yes, Invoicera offers seamless integration with various popular business tools, including CRM systems, project management platforms, and payment gateways. This ensures a unified approach to profit planning within your business ecosystem.