Introduction

The demand for precision, speed, and efficiency in financial management is more critical than ever. This is where accounting automation comes into the picture.

Accounting automation tools have made a significant place in today’s digital world.

According to a recent report by McKinsey, nearly 50% of finance activities can be automated.

However, with lots of tools available, choosing one of them can be overwhelming.

- Which tool streamlines processes seamlessly?

- Which aligns perfectly with our unique business needs?

If you are an accounting professional, many questions like these can come to your mind.

Accounting professionals often find themselves wrestling with mundane tasks: reconciling transactions, generating reports, or manually inputting data, leaving them little time for value-added activities.

Thus, there is a need to optimize the workflow with automation.

In this blog post, we discuss the top 12 accounting automation tools for 2024 that promise to transform how you handle your accounting processes.

Let’s get started!

Why Need Accounting Automation?

The need for accounting automation has become more than just a convenience — it’s a necessity. Here are some compelling reasons why businesses are embracing these tools:

Enhanced Accuracy

Manual data entry and calculations are prone to human error. One misplaced digit could lead to miscalculations, resulting in financial discrepancies that could harm your business.

Accounting automation ensures precision, minimizes errors, and maintains the integrity of your financial records.

Time Efficiency

Let’s face it—manually handling accounting tasks is time-consuming.

From data entry to reconciliations, the hours spent on these repetitive tasks could be better utilized in more strategic areas of your business.

Automation streamlines these processes, allowing you and your team to focus on higher-value activities that drive growth.

Streamlined Reporting

Generating reports manually involves sifting through heaps of data, compiling information, and formatting it into comprehensive reports.

With accounting automation tools, report generation becomes a breeze.

These tools can extract and analyze data swiftly, providing comprehensive reports at the click of a button.

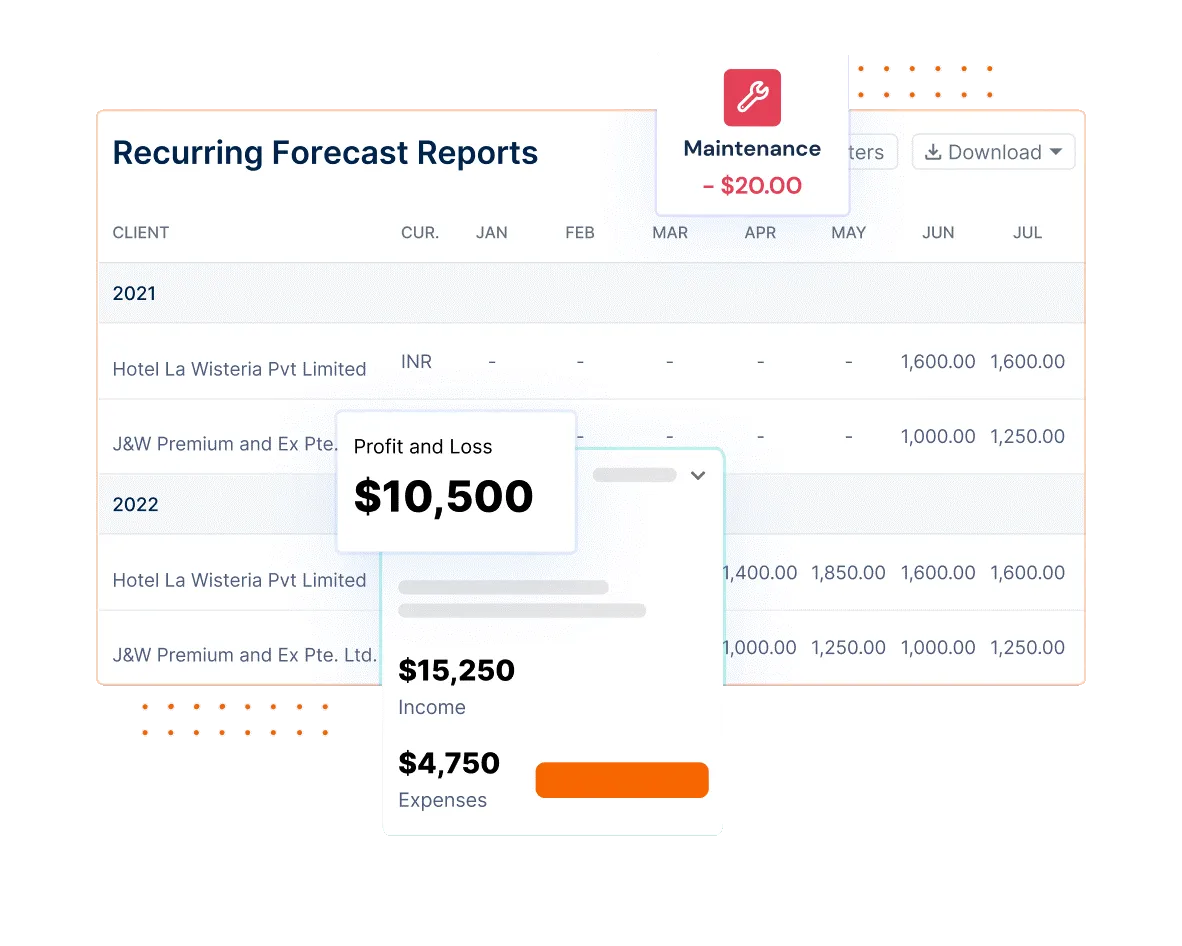

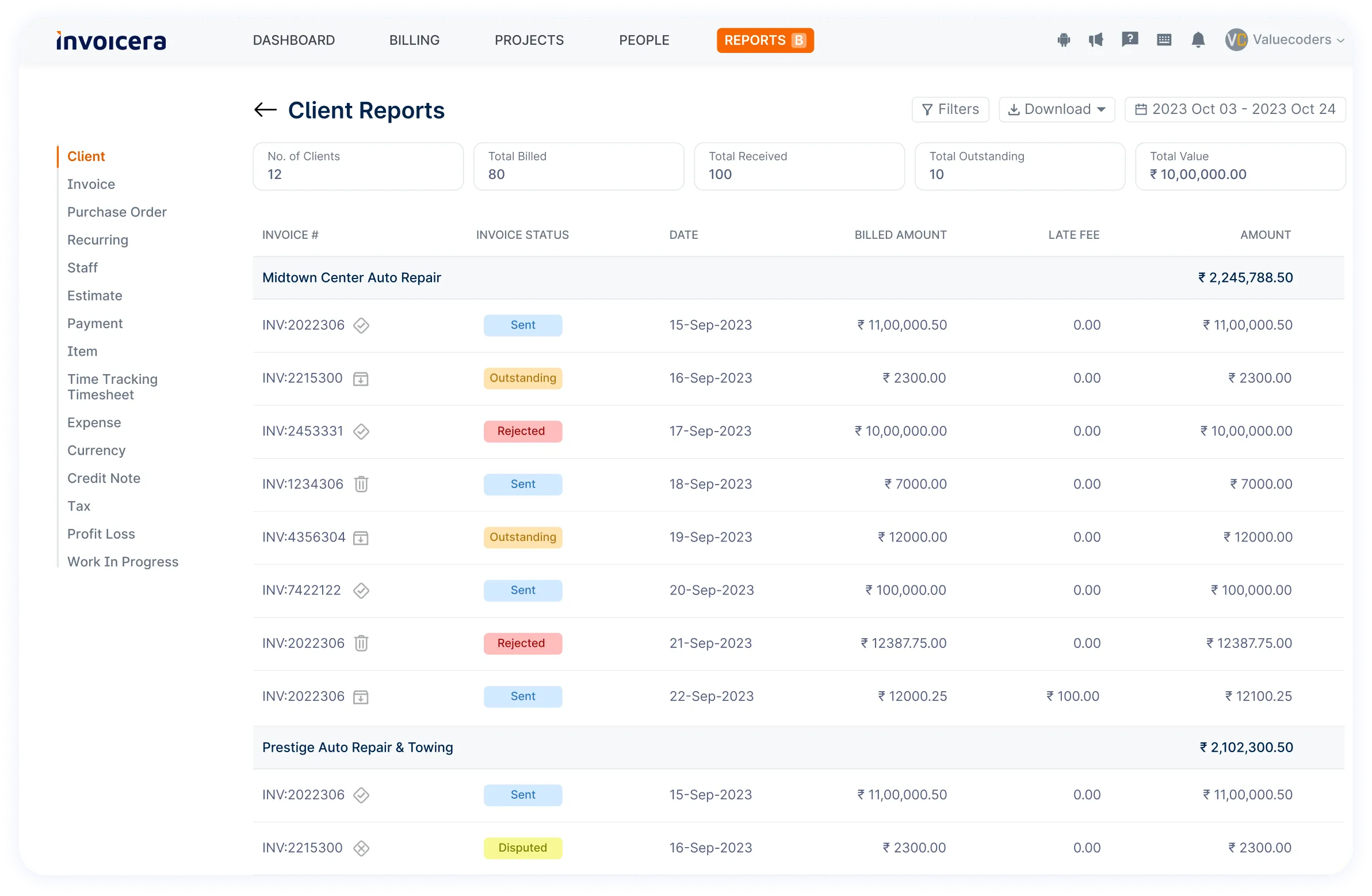

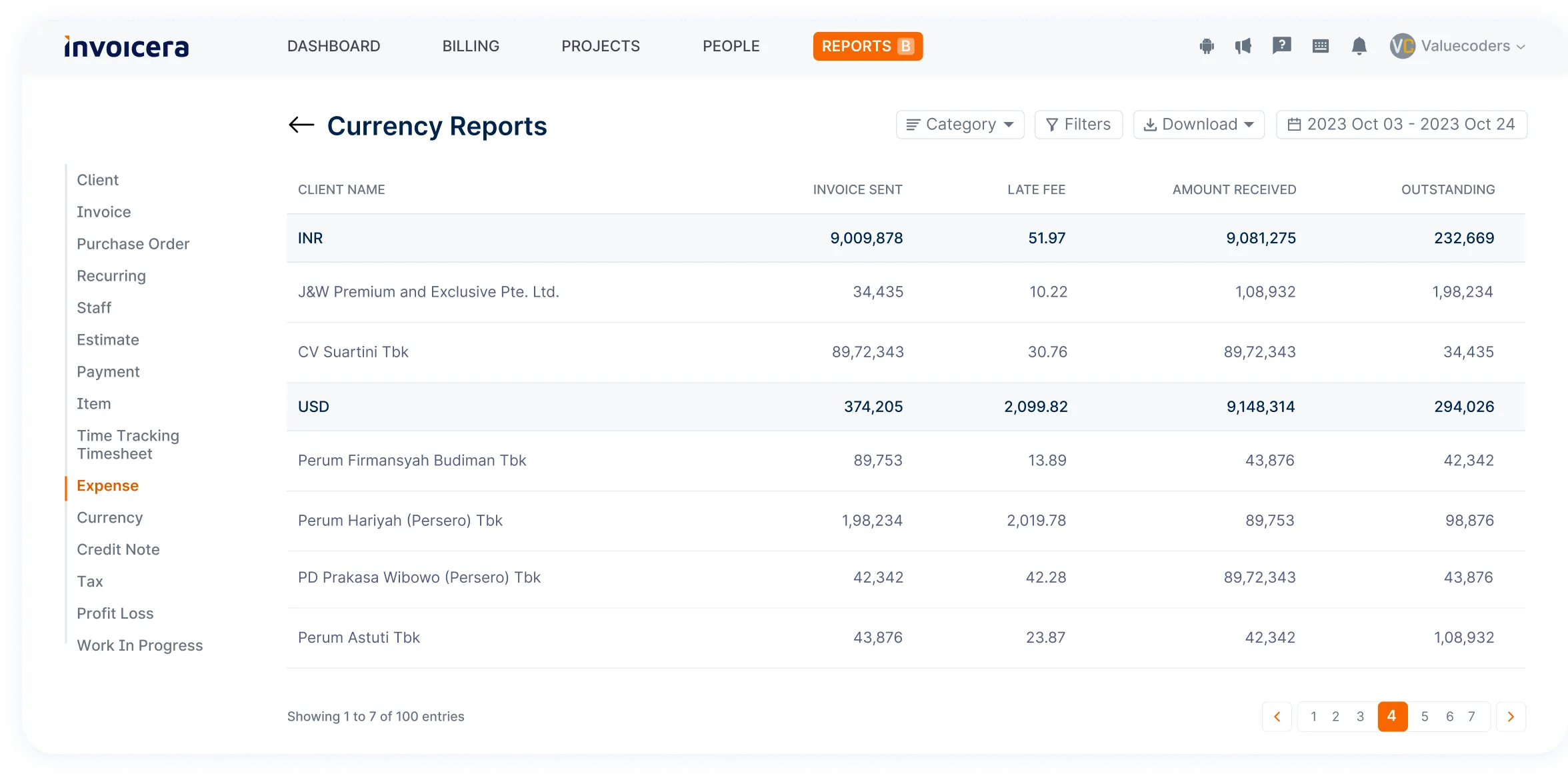

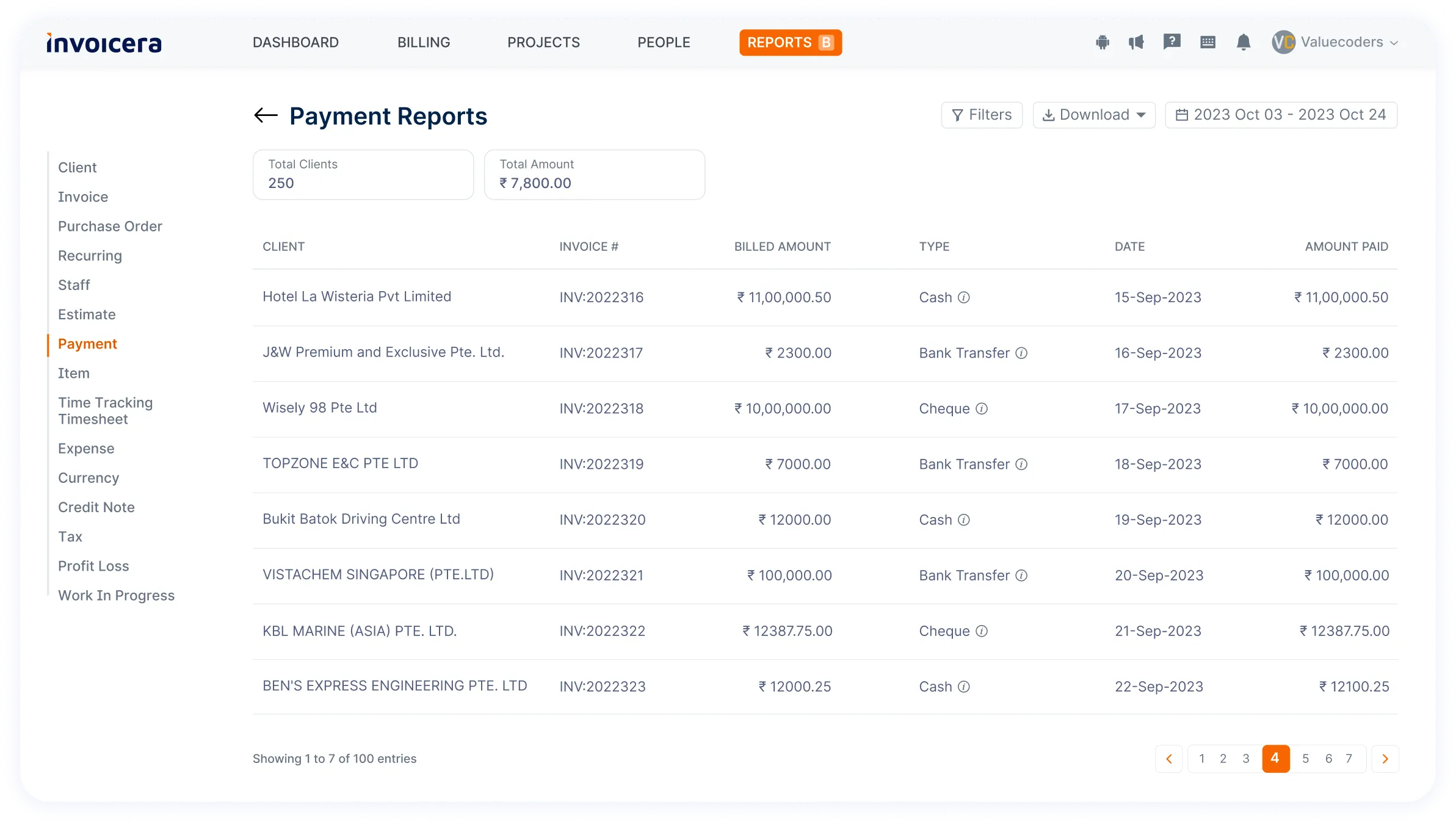

Pro tip: Invoicera offers comprehensive reports that, too are auto-generated. You get a clear picture of your expenses and can make better business decisions based on that.

Regulatory Compliance

Many businesses find it challenging to stay compliant as rules keep changing. Not following them can lead to fines and legal trouble.

Accounting automation tools are made to match these changes, making sure your financial work meets the newest standards and eases your worries.

Improved Workflow

Automation optimizes workflow by creating a seamless process for invoicing, expense tracking, and financial reporting tasks.

It minimizes bottlenecks, facilitates smoother collaboration among team members, and enhances overall productivity.

Cost Savings

Manual accounting processes not only consume time but also money. The resources spent on labor-intensive tasks can be significantly reduced with automation.

Moreover, these tools can save your business from costly mistakes by minimizing errors and improving efficiency.

Accounting Tasks That Can Be Automated

Let’s explore the accounting tasks that automation can easily handle, alleviating pain points and enhancing efficiency.

Read More – Collaborative Accounting: Enhancing CPA-Client Work

1. Data Entry

Gone are the days of mind-numbing data entry tasks!

Automation tools swiftly capture, organize, and input financial data, ensuring accuracy while freeing up precious time once spent deciphering handwritten documents or manually inputting numbers.

2. Invoice Processing

Automation streamlines the invoice processing journey.

These tools rapidly process invoices, cross-referencing them with purchase orders and receipts, significantly reducing processing time and eliminating human error.

3. Recurring Billing

For businesses dealing with recurring payments, automation is a game-changer. It ensures timely billing, reducing the hassle of manual invoicing cycles and minimizing the risk of missed payments.

4. Expense Management

Tracking expenses can be overwhelming, but not with automation. Tools categorize and analyze expenses in real time, simplifying approvals, audits, and compliance checks with ease.

5. Report Generation

Generating comprehensive financial reports used to be an uphill task. Automation tools compile and analyze data swiftly, providing valuable insights critical for informed decision-making.

6. Payroll Processing

Automated payroll systems take the headache out of salary calculations, tax deductions, and direct deposits. They ensure accuracy and timely payments while minimizing the potential for payroll-related errors.

7. Inventory Management

Efficient inventory management is pivotal for businesses.

Invoicera’s feature-rich solution simplifies inventory control, tracking stock levels, optimizing orders, and offering seamless integration, making it a top choice for businesses seeking a comprehensive inventory management solution.

8. Tax And Compliance

Automation ensures adherence to tax regulations by generating accurate reports and flagging potential compliance issues.

It provides peace of mind by minimizing the risk of penalties associated with non-compliance.

9. Audit Trails

Automated audit trails meticulously document financial transactions, creating a transparent and easily accessible history.

These trails prove invaluable during audits and compliance checks.

For businesses searching for a robust inventory management solution, Invoicera stands out with its user-friendly interface and an array of features.

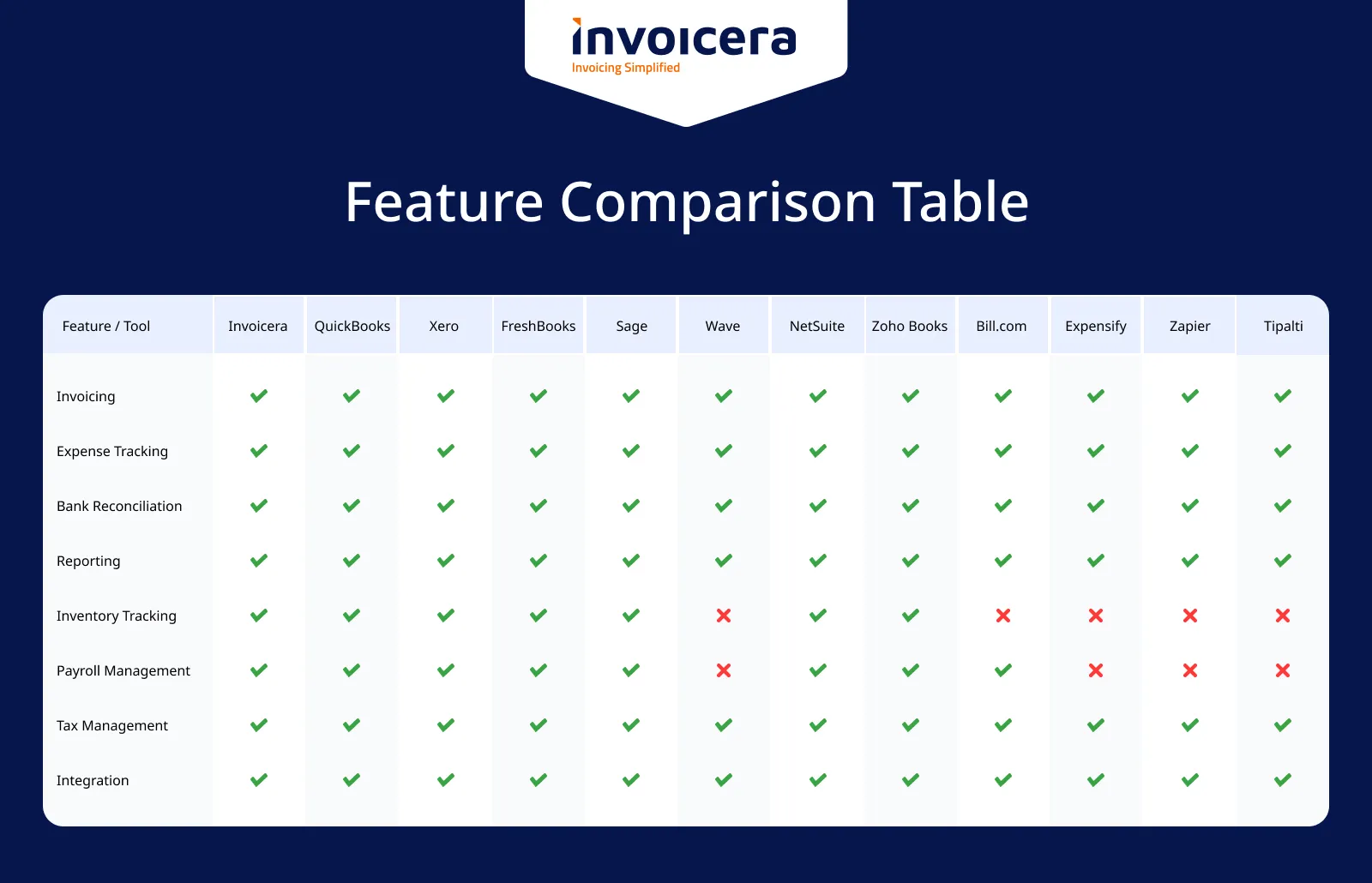

Top 12 Accounting Automation Tools for 2024

Let’s explore the accounting automation tools for 2024.

1. Invoicera

Below are a few features of Invoicera that can streamline the accounting process:

Features

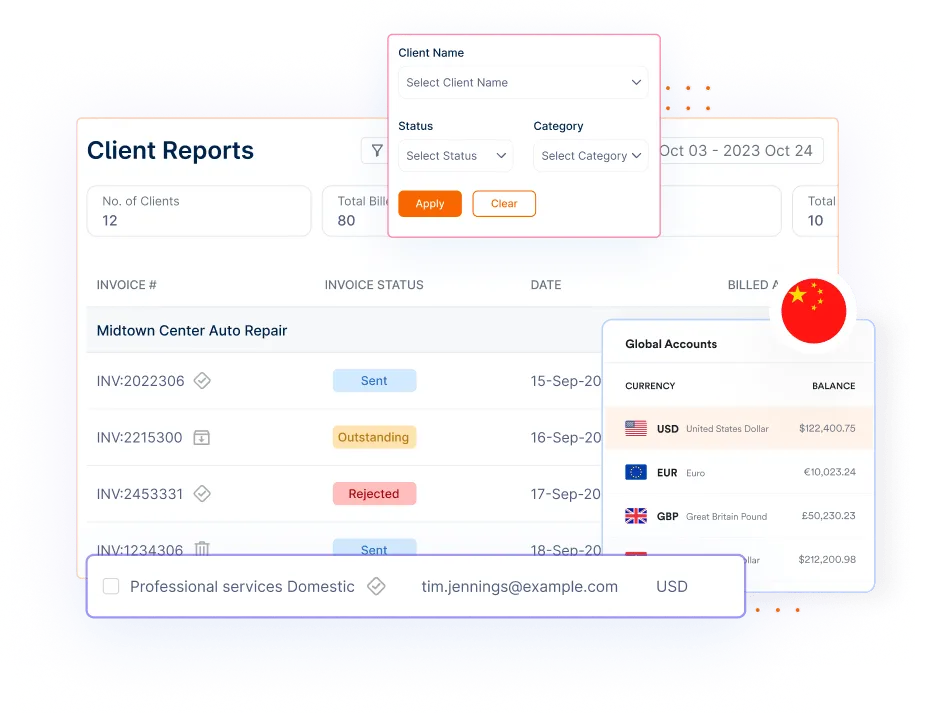

- Online Invoicing: With Invoicera, you can enhance your invoicing style with custom templates reflecting your brand identity and detailed line items for clear billing transparency.

- Recurring Billing: You can automate recurring invoices effortlessly, setting up schedules for convenience while eliminating the hassle of manual generation.

- GST Invoicing: Invoicera ensures GST compliance with accurate tax calculations, making invoicing easy while adhering to GST requirements.

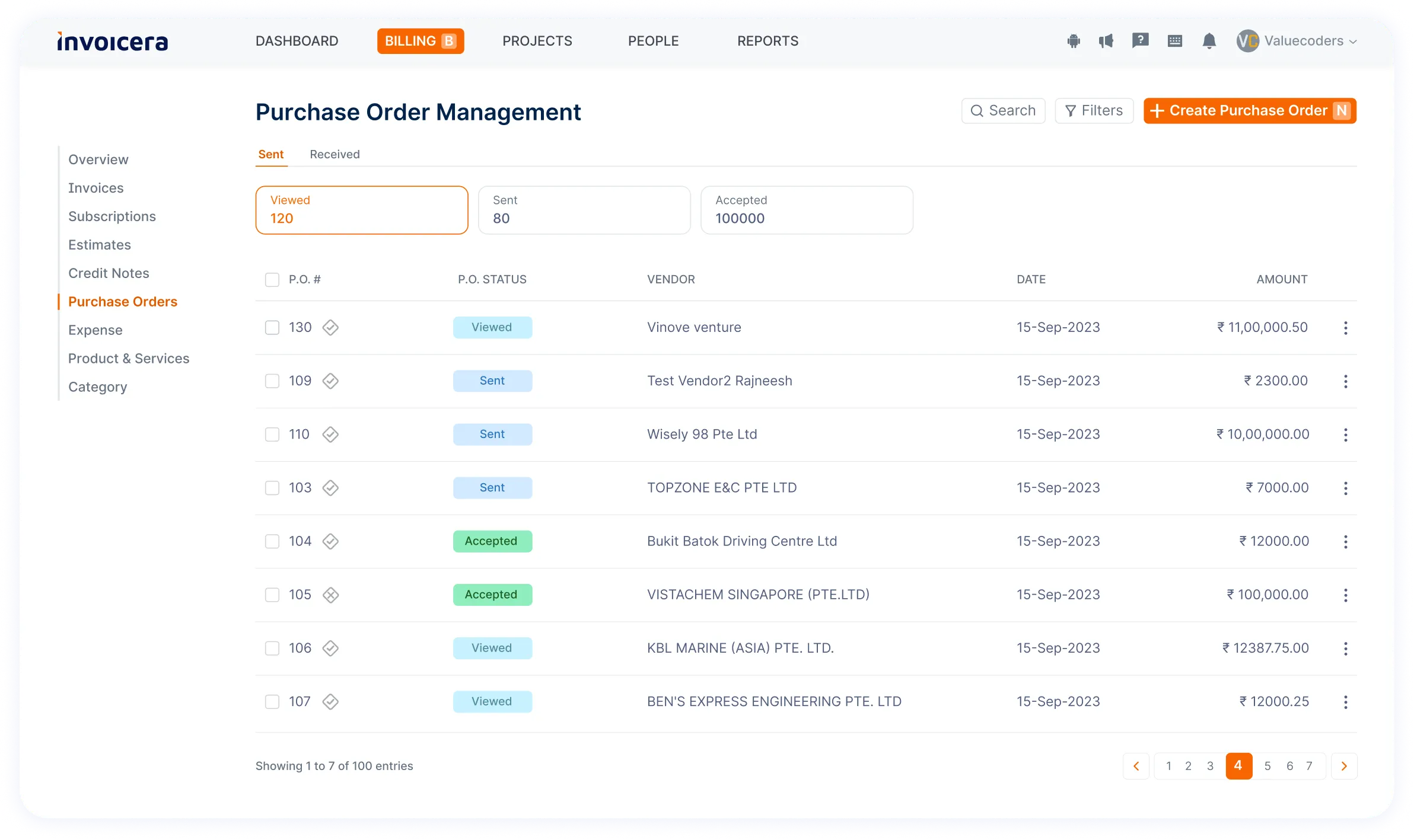

- Estimates & Purchase Orders: Outline project details clearly with estimates and purchase orders, facilitating transparent communication and smoother transactions.

- Integration with 3rd Party Systems: It integrates seamlessly with your favorite apps for streamlined workflows and consistent data across platforms.

- Client Portal: It helps you impress clients with a secure portal for invoice viewing, project details, and direct communication, fostering transparency and professionalism.

- AR & AP Management: You can effortlessly manage accounts receivable and payable, keeping track of outstanding balances and simplifying financial processes.

- Multi-currency & Multi-lingual Support: Go global with the multi-currency and multi-lingual support features of Invoicera, accommodating diverse transactions and effective client communication worldwide.

- Projects & Tasks: You can organize projects efficiently, track progress, and manage tasks to ensure timely completion and successful project delivery.

- Time Tracking: It offers time-tracking features to keep precise records of billable hours seamlessly.

- Online Payments: It offers 14+ secure online payment methods to clients for faster and hassle-free transactions.

- Data Security & Backups: Your data remains secure with Invoicera’s top-notch security measures and regular data protection and reliability backups.

2. QuickBooks

QuickBooks is another accounting automation tool that caters to small business needs, offering similar functionalities.

It aids in bookkeeping, invoicing, expense tracking, payroll management, check printing, receipt organization, and data import from Excel spreadsheets.

You can efficiently perform accounting tasks, automate invoicing, expedite payments with online billing, and maintain precise financial records using QuickBooks, leveraging its bank feeds feature for document management.

Features

- Comprehensive financial tracking and reporting

- Real-time overview of business operations

- Automatic billing

- Compliance management

- Easy transfer of information in and out of the system

- Monitoring and management of expenses

- Handling employee payroll

- Managing and tracking sales tax obligations

- Third-party integrations

3. Xero

Features

- Claim and manage expenses

- Connect your bank for seamless transactions

- Keep track of projects

- Store and access files securely

- Generate comprehensive reports

- Manage inventory seamlessly

- Manage and track purchase orders

- Create and manage quotes

- Handle sales tax calculations

4. FreshBooks

Known for its user-friendly interface, FreshBooks simplifies accounting tasks with features like time tracking, expense management, and client collaboration, making it a go-to choice for freelancers and small teams.

Features

- Customizable and automated recurring invoicing

- Track client interactions with invoices in real-time

- Set automatic late payment reminders and fees

- Seamlessly accept credit card payments online

- Generate and send professional estimates

- Gain business insights through intuitive reports and dashboards

- Access and work on any device – computer, tablet, or mobile

5. Sage

For robust financial planning, consider Sage Accounting—an extensive tool with features like reporting, expense tracking, and inventory management. Sage ensures better financial control, offering ease of use and time-saving automation.

Your data remains secure, backed up to prevent loss, and easily integrates with your bank for transaction imports. This accounting tool elevates your business with professional quotes, invoices, and insightful reports for informed decision-making.

Features

- Easy setup on any device

- Simplified automation for time-saving accuracy

- Professional invoicing with automatic tracking for prompt payments

- Stripe integration for diverse payment options

- Real-time intuitive dashboard for financial oversight

6. Wave

It simplifies digital accounting, offering an invoicing feature for easy creation and sending online invoices using customizable templates.

Features

- Unlimited collaboration with third-party applications

- Manage accounting with multiple businesses

- Manage income and balance sheets

- Generate comprehensive reports

7. NetSuite

NetSuite is a cloud-based platform offering a comprehensive suite of business management tools. Its integrated approach encompasses various functionalities.

Features

- Handles accounting, invoicing, and financial planning

- Manages customer interactions and sales processes

- Provides insights through analytics and reporting capabilities

- Customizable invoicing for specific business needs

- Suits businesses of different sizes

- Third-party integration for better workflow

- Robust data security protocols

8. Zoho Books

Zoho’s invoicing software packs a punch with its comprehensive suite of business applications.

With its intuitive interface and robust functionalities, Zoho allows seamless invoicing, expense tracking, and project management, catering to various business needs.

Zoho Books, an online accounting automation tool, streamlines workflows for businesses of all sizes. It offers robust automation features, encompassing cash flow tracking, invoicing, expense management, and easy accountant collaboration on a free plan for minimal accounting needs.

Features

- Invoicing capabilities for seamless billing

- Creating and managing quotes efficiently

- Customer portal for easy interaction and access

- Tracking and managing expenses effortlessly

- Handling and organizing bills effectively

- Banking integration for financial management

- Project management tools for streamlined workflow

- Inventory tracking and management system

- Managing and tracking sales orders efficiently

- Organizing and managing purchase orders

9. Bill.com

Bill.com is a cloud-based invoicing and payment platform designed to streamline accounts payable and receivable processes.

With features like invoice tracking and seamless integrations, Bill.com is a valuable asset for businesses aiming for efficiency in financial transactions.

Features

- Select between ACH or credit card for quick electronic payments.

- Choose to send invoices electronically through Bill.com or opt for paper invoices via mail.

- Customers can conveniently view and pay invoices online.

- Receive advance email notifications for upcoming payment deadlines.

- Automatic online payments directly deposited into your bank account.

10. ZipBooks

Zipbooks is a user-friendly invoicing software tailored for small businesses and freelancers. Its simple interface and customizable invoice templates make creating and sending invoices hassle-free.

Its focus on user convenience extends to features like automated reminders and expense tracking, ensuring timely payments and financial organization.

Features

- Easily generate customized invoices and estimates according to your business needs.

- Simplify recurring billing with automated invoicing for seamless monthly transactions.

- Set up automatic payment reminders and ensure timely payments.

- Track and analyze project profitability with detailed insights into client finances.

- Access real-time dashboard data, including sent invoices and revenue summaries, for better decision-making.

11. Hiveage

Hiveage is a comprehensive invoicing platform that caters to businesses of all sizes.

Offering a range of customizable invoice templates and payment options, Hiveage empowers users to create invoices tailored to their brand.

Features

- Effortlessly create and dispatch personalized and recurring invoices.

- Embed online payment forms in email templates using clickable payment buttons.

- Subscription-based billing.

- Real-time dashboard to track invoices.

- Automated reminders and receipts for unpaid invoices.

12. Tipalti

Tipalti is designed for global businesses dealing with complex payment processes.

This platform streamlines payment operations, handling everything from supplier onboarding to tax compliance.

Features

- Capture billable events automatically

- Create polished invoices and quotes with custom templates

- Track time and invoices

- Monitor payments

How To Automate Accounting Process?

We have created a step-by-step guide on automating the accounting process:

1. Assess Your Current Workflow

Take a close look at your existing accounting procedures. Identify repetitive tasks that consume a significant amount of time.

This could include data entry, invoice processing, or reconciliation.

2. Choose The Right Accounting Automation Tool

Research and select an accounting automation tool that aligns with your business needs.

Look for software that offers automatic data entry, invoice scanning, expense tracking, and robust reporting capabilities.

3. Integrate Software And Applications

Ensure your chosen accounting tool integrates seamlessly with your existing software and applications.

This integration will allow for smooth data flow between different systems and will reduce manual data entry, minimizing errors.

4. Set Up Automation Workflows

Take advantage of the automation features provided by the tool. Create workflows that automate repetitive tasks.

For instance, set up rules to automatically categorize expenses, schedule recurring invoices, or generate regular financial reports.

5. Train Your Team

Ensure your team is well-trained to use the accounting automation tool.

Offer training sessions or tutorials to familiarize them with the features and functionalities.

Encourage them to explore and make the most out of the software.

6. Regularly Review And Optimize

Periodically review your automated processes. Analyze the efficiency of the automation workflows and identify areas for improvement.

Stay updated with software updates and new features that could further optimize your accounting tasks.

7. Embrace Continuous Improvement

Accounting automation is not a one-time task. Embrace a culture of continuous improvement.

Stay open to new tools, technologies, and methodologies that can further enhance your accounting automation processes.

Conclusion

Time is money! And these automation tools offer invaluable benefits.

From simplifying invoicing and expense tracking to facilitating seamless integration with other business systems, the versatility and functionalities of these tools cater to diverse accounting needs.

As businesses evolve, embracing these technologies becomes an option and a necessity. The competitive edge that automation provides can’t be overstated.

It’s about working smarter, not harder, and these tools illustrate this quality perfectly.

The journey toward automation might seem daunting, but it’s a leap that pays off exponentially.

Embrace the power of these accounting automation tools, tailor them to your business needs, and watch as they elevate your financial processes to new heights.

FAQs

Are these accounting automation tools suitable for small businesses?

Yes, absolutely! Many of the mentioned tools cater to businesses of all sizes. Their scalable solutions make them perfect for startups and small enterprises looking to streamline their accounting processes.

Are these tools user-friendly for someone without a strong accounting background?

Most of these tools come with a user-friendly interface, making it easier for someone from a non-accounting background to navigate features. However, all the tools have tutorials, customer support, and user guides to assist users in accounting.

Are these tools expensive?

These tools’ pricing varies based on features, user count, and additional services. While some may have higher costs, they often offer different pricing plans to accommodate various budgets, including free trials or basic versions with limited functionalities.