Running any business comes with a lot of responsibilities. Besides strategy, execution, P&L, you need to pay attention to taxes and compliance.

Furthermore, in order to maintain good financial health, you must have an eye for detail when making tax and compliance-related decisions.

In this blog post, we’ll discuss the types of business taxes, their impact, benefits, what to think about while filing business taxes, and more.

Let’s get started!

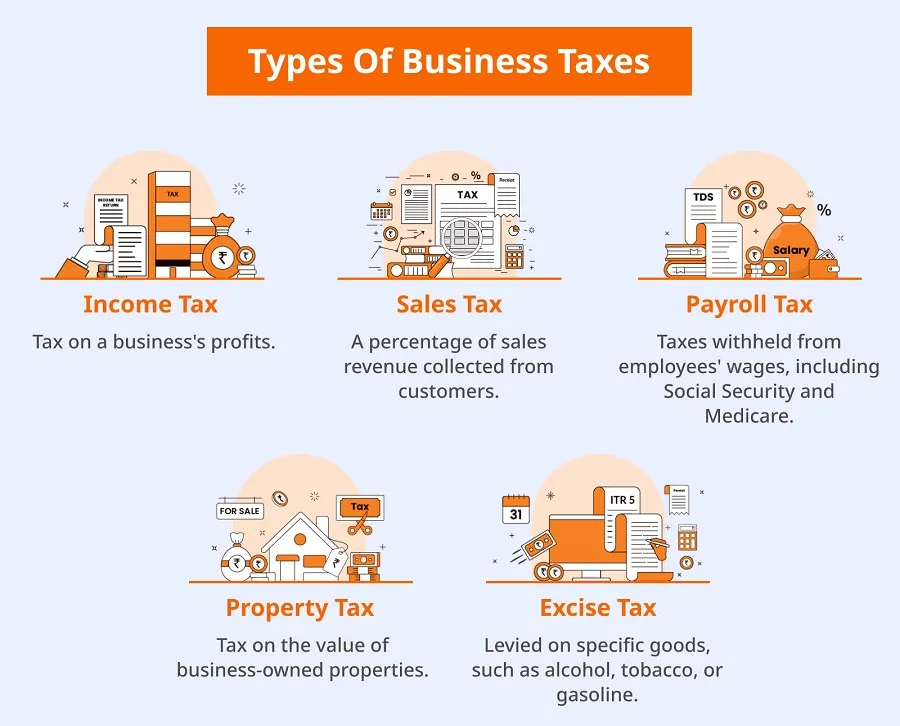

Types of Business Taxes and Their Impact on Business

Income tax is a significant tax, where businesses are taxed on their profits (revenues minus allowable expenses). The impact depends on the tax rate, deductions, credits, and the business structure.

Impact on Business: Higher income tax rates can reduce the after-tax profits available for reinvestment, expansion, and shareholder returns. Businesses may strategically manage their expenses and deductions to minimize their taxable income. To effectively manage tax liabilities, businesses should also focus on understanding quarterly tax obligations. Navigating these payments efficiently can prevent incurring penalties. Utilizing resources like simple quarterly tax calculations, which offers features to accurately assess estimated taxes, can lead to improved financial planning.

1. Sales Tax

Sales tax is collected on goods and services at the point of sale. The rate varies by jurisdiction. If you’re looking to calculate sales tax, you can use an online sales tax calculator for accurate and convenient results

Impact on Business: Businesses are responsible for collecting and remitting sales tax to the government. Higher sales tax can affect consumer spending and demand for products/services.

2. Payroll Tax

Payroll tax is based on employee wages and is used to fund social programs like Social Security and Medicare.

Impact on Business: Payroll tax adds to the cost of employment, potentially affecting hiring decisions and wage structures.

3. Property Tax

Property tax is put on real estate and sometimes personal property owned by businesses.

Impact on Business: Higher property taxes increase operational costs, especially for businesses with significant property holdings.

4. Excise Tax

Excise taxes levy on specific goods like alcohol, tobacco, gasoline, and certain luxury items.

Impact on Business: Businesses involved in producing or selling excisable goods face increased costs, which can influence pricing and demand.

Key Considerations When Filing Business Taxes

Deadlines and Extensions

Timeliness is vital when it comes to tax filing. Discover essential deadlines for various tax types and learn about extension options if you need more time to prepare.

Record Keeping

Accurate record-keeping is the foundation of successful tax filing. Accurate and organized financial records provide evidence of income, expenses, and transactions, ensuring compliance with tax laws and enabling proper calculation of tax liabilities.

Deductible Expenses

Maximizing deductions can help lower your tax liability. Learn about common deductible business expenses and how to ensure you’re taking advantage of every opportunity.

Working with Tax Professionals

Collaborating with tax professionals, like accountants or tax advisors, can provide invaluable guidance.

Compliance Essentials for Businesses

Operating a business comes with its share of regulatory responsibilities. Here are some crucial areas to focus on:

Business Licenses and Permits

Before you even open your business doors, obtaining the necessary licenses and permits is vital. These documents vary based on your location, industry, and the nature of your business. They ensure that your operations meet local regulations and standards.

Start by researching the permits and licenses required by your local government or relevant industry bodies.

Common examples include health permits for restaurants, building permits for construction, and professional licenses for specific services.

Employment Laws and Regulations

As a business, you must have a good knowledge about employment rules and regulations including OIG Exclusions. Factors that come under this are minimum wage, overtime compensation, workplace safety, anti-discrimination regulations, and more. Observing these regulations is essential to preserving a just and courteous workplace culture.

You should produce an employee handbook that details your organization’s policies and procedures so that everyone is aware of them. Regularly review and update this handbook to reflect any changes in regulations.

Intellectual Property and Trademark Compliance

It is essential to safeguard your intellectual property (IP) such as trade secrets, patents, trademarks, and copyrights to maintain reliability and uniqueness of the business. Understanding how to register and enforce your IP rights can prevent potential legal battles down the road.

Consult legal experts to assess your IP needs and options and ensure that your branding, content, and innovations are legally protected.

Environmental Regulations

Environmental compliance is crucial, especially if your business involves manufacturing or handling potentially hazardous materials. Adhering to environmental regulations helps minimize your environmental footprint and potential liability.

Conduct an environmental audit to identify non-compliance areas and implement corrective actions. This not only ensures legal compliance but also demonstrates your commitment to sustainability.

Navigating International Taxation

Expanding your business internationally brings a new set of tax and legal considerations. Here’s what you need to know:

Tax Implications Of International Business Operations

Operating in different countries means dealing with diverse tax systems. Understand the tax implications of international sales, profits, and operations. Double taxation treaties and transfer pricing rules may also apply. Effective financial management strategies for international operations should also consider personal tax implications for expatriates. Tools like Expatfile offer specialized support, ensuring expats manage their U.S. taxes with ease while automating FBAR filings

Consult international tax specialists to optimize your tax strategy while remaining compliant in each jurisdiction.

Reporting Foreign Accounts And Assets

Many countries require individuals and businesses to report foreign accounts and assets. Failure to do so could result in heavy penalties. Research and understand the reporting requirements in each country where you operate.

Keep accurate foreign accounts and assets records and work with tax professionals to ensure proper reporting.

VAT And Customs Duties For International Sales

Value Added Tax (VAT) and customs duties can significantly impact your international sales. Research the VAT rates and customs duties of the countries you do business with. You might need to register for VAT in some jurisdictions.

Partner with logistics experts to manage customs procedures efficiently and minimize potential delays.

Hiring International Employees: Tax And Legal Considerations

If you hire workers abroad, you need to be mindful of the tax and legal implications. Income tax rates, social security contributions, and employment laws can all be very different.

Consult legal and HR experts to ensure you comply with employment laws and tax regulations in each location.

Steps to Maintain Smooth Tax and Compliance Processes

1. Establishing a Robust Record-Keeping System

Effective record-keeping forms the cornerstone of a seamless tax and compliance journey. Leveraging cutting-edge platforms like Invoicera can revolutionize your record-keeping efforts. Invoicera’s user-friendly interface and dedicated features enable you to effortlessly organize invoices, receipts, and financial transactions, streamlining expenses and income tracking.

2. Regular Internal Audits and Reviews

Internal audits proactively identify and rectify potential compliance issues. Invoicera aids in this process by providing customizable reporting options, allowing you to assess your financial data and transactions regularly. This feature helps you pinpoint and address inconsistencies promptly, minimizing compliance risks.

3. Staying Updated on Changing Tax Laws and Regulations

Tax laws and regulations are ever-evolving. It is crucial to always stay informed about these changes to avoid penalties and maintain compliance. Dedicate time to research and subscribe to relevant updates from reputable sources. By understanding new tax codes, you can adjust your strategies accordingly.

4. Building a Relationship with Tax Professionals and Consultants

Collaborating with tax professionals and consultants adds invaluable expertise to your tax and compliance endeavors. These professionals can provide insights tailored to your industry and business structure, ensuring accurate reporting and adherence to regulations.

The Role of Technology in Tax and Compliance

Introduction to Invoicera

Invoicera simplifies invoicing and billing, offering a centralized platform for managing financial transactions. Its intuitive interface enables users to generate invoices, track payments, and manage clients efficiently.

Its features, such as automated invoicing, customizable templates, and secure payment gateways, empower business owners to manage their financial operations seamlessly.

Invoicera’s Role in Ensuring Tax Compliance

- Automated Tax Calculation and Invoicing: Invoicera’s automated tax calculation ensures accurate tax rates are applied to invoices, reducing errors and ensuring compliance with regional tax laws.

- Generating Accurate Financial Reports: The ability to generate detailed financial reports using Invoicera allows you to have a clear overview of your financial health, making tax filing and compliance reporting more accurate.

Streamlining Compliance with Invoicera

- Tracking Business Expenses: The expense tracking feature enables you to categorize and monitor business expenses, simplifying the process of deduction claims during tax filing.

- Storing and Organizing Relevant Documents: With Invoicera’s document management capabilities, storing and organizing essential tax-related documents becomes hassle-free, ensuring you have easy access to records when needed.

Concluding Thoughts

Understanding and navigating taxes and compliance are non-negotiable aspects that can significantly impact your company’s success.

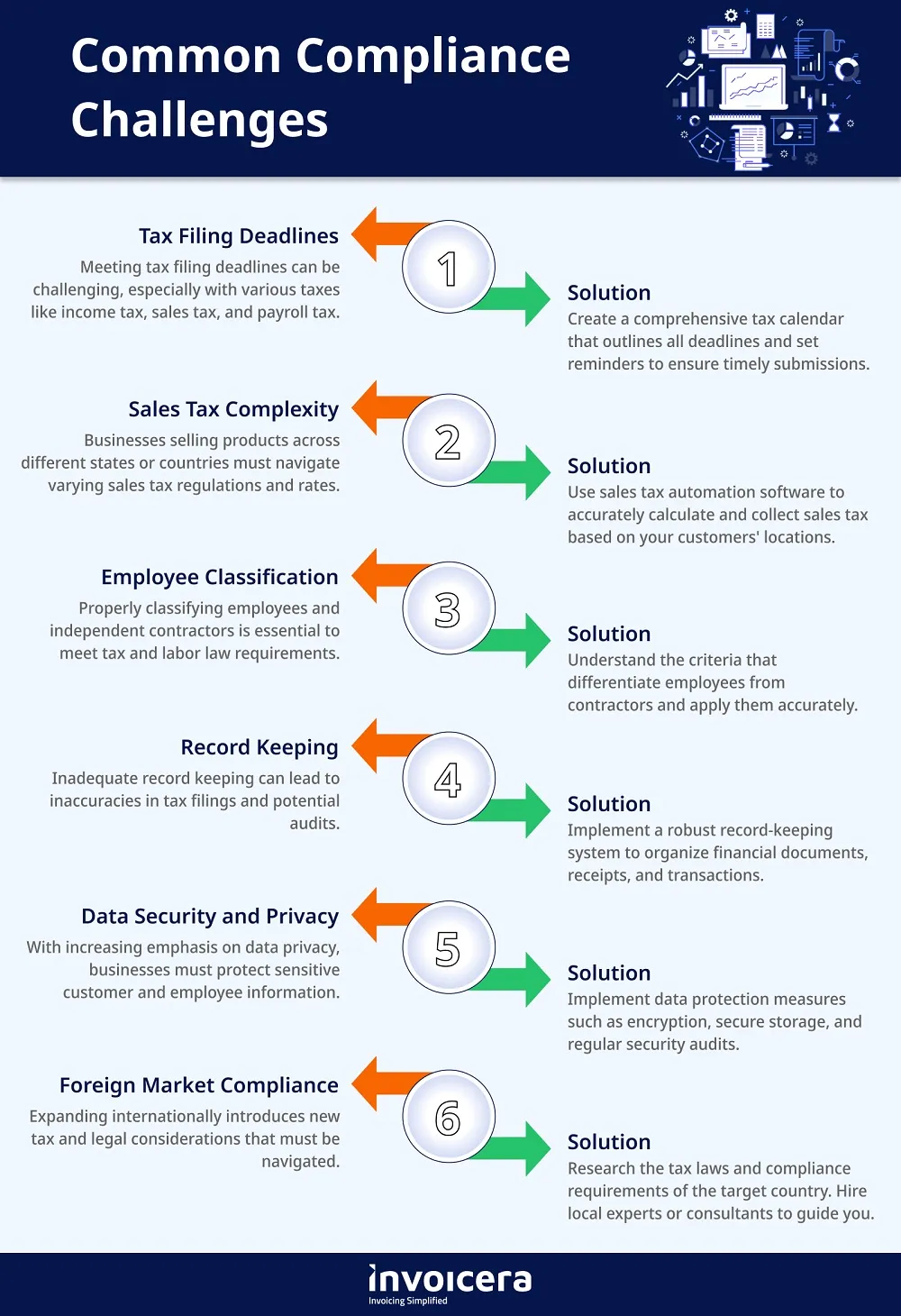

By proactively addressing common compliance challenges such as tax deadlines, employee classification, and data security, you can ensure legal standing, avoid penalties, and foster a secure operating environment.

Staying informed, using technology, seeking professional advice, and maintaining a commitment to compliance will empower you to confidently steer your business towards sustained growth.

FAQs

What should I do if tax regulations change after I’ve started my business?

Staying updated on regulatory changes is essential. Subscribe to industry newsletters, attend seminars, and work with legal advisors to adapt your business practices accordingly.

Can Invoicera assist me in calculating and managing sales tax for different regions?

Absolutely, Invoicera’s software supports automated sales tax calculations based on customer locations, making it easier to stay compliant with varying tax rates.

Is Invoicera suitable for businesses expanding into foreign markets?

Yes, Invoicera’s international invoicing features and multi-currency support make it an ideal solution for businesses entering global markets while adhering to compliance requirements.