SME’s are the primary growth drivers of the economy and the major contributors to the GDP. In India, almost 3 million SME’s contribute to the 50% of the industrial output and 42% of India’s total export. SME’s have expected to emerge as the leading employment-generating sector providing balanced development across sectors for a developing country like India and its demographic diversity.

Though GST has the overall benefit for SME’s, take a look at the Impact of GST on various sectors in India too!

The new GST regime will benefit the SME’s sector most. It eliminates the cascading effect of the multiple central and state taxes and eases the starting of businesses. The tax reform gives equal options to large enterprises and SME’s and taxes uniformly. Another key feature of the GST rollout is its dual based nature, the Central Government will levy CGST and the state Government will levy SGST respectively. In addition to this, GST will also be levied on import of goods and services into India.

Impact of GST on Small & Medium Enterprises

1. Lower Logistical Overheads:

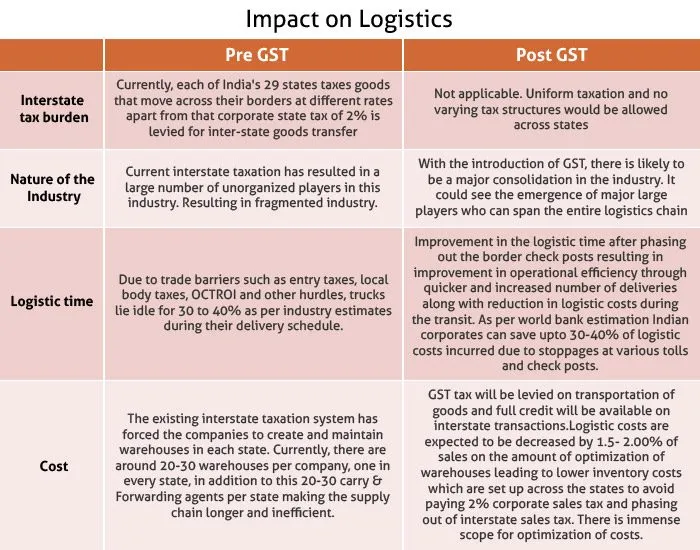

In terms of the logistical costs, India spends much more than any other developed markets. Businesses transporting goods to other states have to be contend with intra-state and border check posts and deal with documentation including road permits, waybills etc.

The impact of GST eliminates time-consuming border tax procedures and toll check posts. Nevertheless, it would lead to logistical efficiency in India’s national supply chains and pave the way for the seamless movement of goods across India.

Note: According to the CRISIL estimation, the logistical cost for the manufacturers of bulk goods will be reduced significantly by about 20%. This is expected to boost e-commerce across the nation.

2. No confusion between Products and Services:

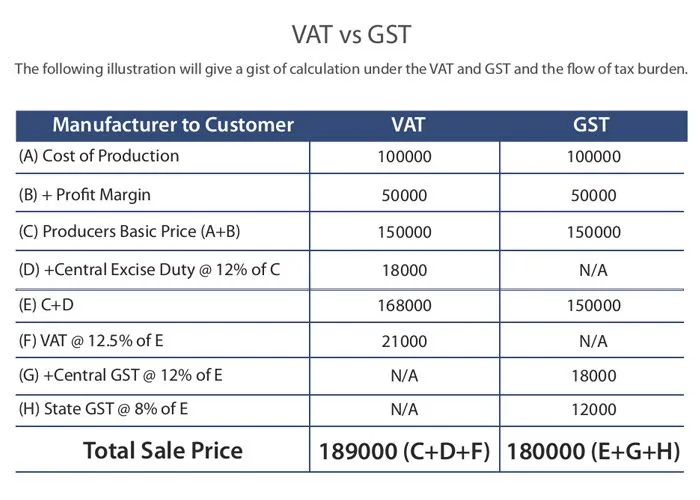

Previously, products and services attract a different tax rate, Goods attract VAT and services attract service tax. The impact of GST spells out a clear design for both, whether product or service. In the GST scenario, there will be no ambiguity between goods and services. Also, it will simplify the legal proceedings related to the packaged products. As a result, there will be no longer distinction between the material and service component that greatly reduces tax evasion.

3. Purchase of Capital Goods:

In the past, only 50% of the input tax credit against the purchase of capital goods is available in the year of purchase and balance amount in subsequent years. Under GST regime, the entire amount of tax credit can be availed in the year of purchase itself. This supports “Make in India” campaign.

4. Unified Market:

The impact of GST will make life easier for SME’s. It would help cut down bureaucracy and the existing layered tax structure. It will allow flexibility in the transfer of goods and give the simpler passage for doing businesses.

5. Easier to Start a New Business:

No need to register for VAT with each state’s sales department in order to carry out business activities. Under GST the registration is centralized and the rules are uniform across the country. The Government mulls the exemption limit under GST to 25 lakhs giving relief to over 60% of small traders and dealers. The new GST regime helps to run a business easier and the consequent expansion that appears an added advantage for SME’s and Startups.

Also know more about GST in India: Impact of working capital on businesses

THE FINAL VERDICT:

The impact of GST on SME’s opens up a mixed opinion and arguments from various stakeholders. It brings in many positives that can easily offset the negatives. However, the revolutionary GST regime makes the system faster, transparent and more efficient. It will enhance the taxpayer base by bringing the simplicity of the taxes like one tax. The new GST regime will create a long lasting impact on the SME’s and Startups due to various factors.

A QUICK RECAP

- – Uniformity in Centralized Registration Process

- – Calculation of tax on total, No distinction between sales and services

- – Boost GDP and reduces the fiscal deficit

- – Attracts New Age Business by extending the limit up to 25 lakhs

- – Eliminates the cascading effects

The impact of GST has the potential to transform not only the tax system but also provides impetus growth to Indian industry and businesses.

Join Invoicera to experience the GST journey now.